Key Insights

The North America Eye Tracking Solutions Market is projected for substantial growth, driven by an increasing demand for enhanced user experiences and the integration of AI and machine learning. Key applications include driver monitoring in automotive and shopper behavior analysis in retail. Advancements in hardware and software are enabling more precise and intuitive eye-tracking capabilities across sectors like Media & Entertainment, Automotive & Transportation, and Consumer Electronics, fostering personalized interactions and content engagement.

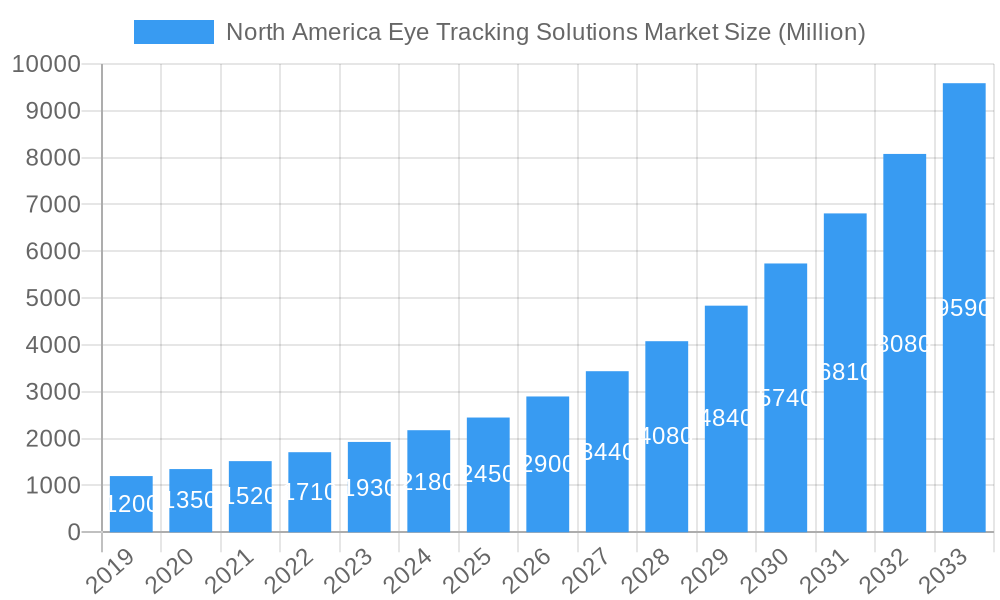

North America Eye Tracking Solutions Market Market Size (In Billion)

Emerging trends such as non-intrusive wearable devices and their application in VR/AR environments are shaping the market's future. Innovations in gaze analysis and emotion detection algorithms are critical growth enablers. While initial implementation costs and data privacy concerns present challenges, ongoing technological progress and rising awareness of benefits are expected to drive market expansion. Leading companies are actively innovating and expanding the market across the United States, Canada, and Mexico.

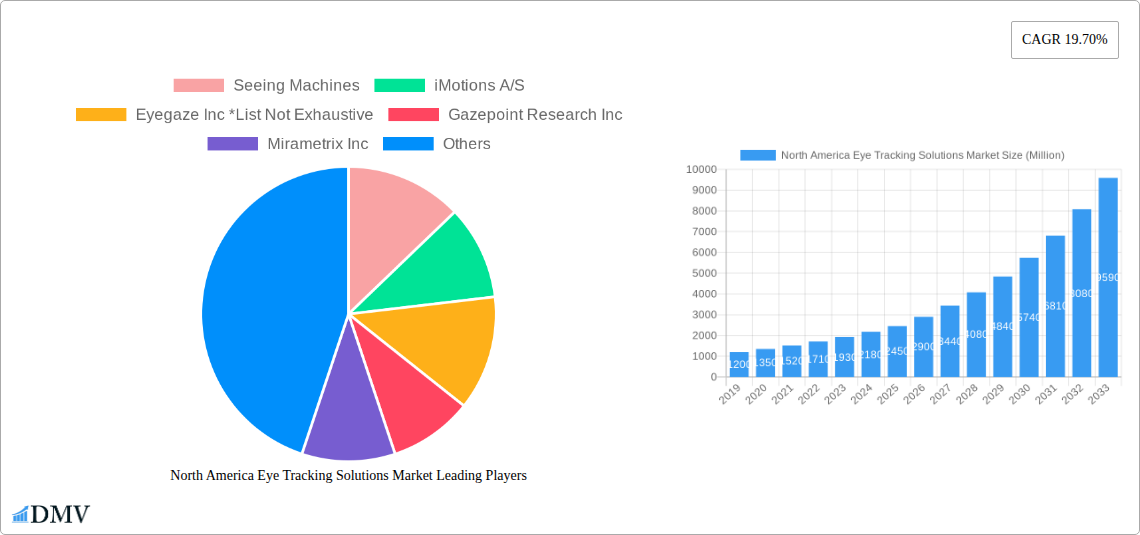

North America Eye Tracking Solutions Market Company Market Share

This report, "North America Eye Tracking Solutions Market," offers a comprehensive analysis of this dynamic industry. Covering the historical period of 2019-2024, with a base year of 2025 and a forecast period through 2033, the study provides actionable insights into market composition, evolution, segmentation, innovations, drivers, challenges, and future opportunities. Leveraging advanced analytical tools and extensive research, this report details the current state and projected trajectory of the North America eye tracking solutions market, with an estimated market size of 1708.8 million and a CAGR of 21.64%. Key segments include Solution Type (Hardware, Software) and End-User Industry (Retail & Advertisement, Automotive & Transportation, Media & Entertainment, Aerospace & Defense, Consumer Electronics, and others).

North America Eye Tracking Solutions Market Market Composition & Trends

The North America eye tracking solutions market exhibits a dynamic composition characterized by a moderate to high concentration of key players, with a few dominant entities holding substantial market share. Innovation catalysts, including advancements in sensor technology, AI-powered analytics, and miniaturization, are continuously reshaping the landscape. The regulatory landscape, particularly concerning data privacy and the ethical use of eye-tracking data, is an emerging factor influencing adoption rates across various sectors. Substitute products, such as advanced gesture recognition and voice control systems, present a competitive challenge, though the unique depth of behavioral insights offered by eye tracking continues to differentiate it. End-user profiles are increasingly sophisticated, with a growing demand for real-time, actionable data for personalization and optimization. Mergers and acquisitions (M&A) activities are a key trend, driven by the pursuit of synergistic technologies and market consolidation. The aggregate value of M&A deals within the historical period is estimated at USD XXX Million.

- Market Concentration: Moderate to High

- Innovation Catalysts: Sensor Technology, AI Analytics, Miniaturization

- Regulatory Landscape: Data Privacy, Ethical Use Policies

- Substitute Products: Gesture Recognition, Voice Control

- End-User Profiles: Sophisticated, Data-Driven

- M&A Activity: Strategic acquisitions for technology and market expansion, estimated deal value of USD XXX Million.

North America Eye Tracking Solutions Market Industry Evolution

The North America eye tracking solutions market has witnessed a remarkable evolution, transitioning from niche academic research applications to widespread commercial adoption across diverse industries. The study period of 2019-2033 encapsulates this transformative journey, showcasing consistent market growth trajectories fueled by technological advancements and shifting consumer demands. In the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately XX%, driven by early adopters in research and healthcare. The base year of 2025 sees the market poised for accelerated expansion, with projections indicating a CAGR of XX% during the forecast period (2025-2033). This surge is attributed to the increasing integration of eye tracking into consumer electronics, the burgeoning automotive sector's focus on driver monitoring systems, and the demand for enhanced user experience in media and entertainment. Technological breakthroughs in areas such as infrared illumination, eye-movement prediction algorithms, and compact, high-resolution sensors have significantly improved accuracy, reduced costs, and expanded the practical applications of eye tracking. Consumer demand for personalized experiences, intuitive interfaces, and safer, more engaging digital interactions is a pivotal factor, compelling businesses to invest in solutions that offer deeper insights into user behavior. For instance, advancements in foveated rendering in VR/AR headsets, as exemplified by HTC's Vive Focus 3 expansion, demonstrate a direct response to the need for optimized performance and enhanced user immersion, directly translating into increased adoption of eye tracking hardware and software. Similarly, the metaverse's rise has spurred demand for more expressive and authentic avatars, a trend actively addressed by collaborations like Tobii's with Ready Player and LIV. These industry-wide developments underscore a market not just growing, but fundamentally transforming how humans interact with technology.

Leading Regions, Countries, or Segments in North America Eye Tracking Solutions Market

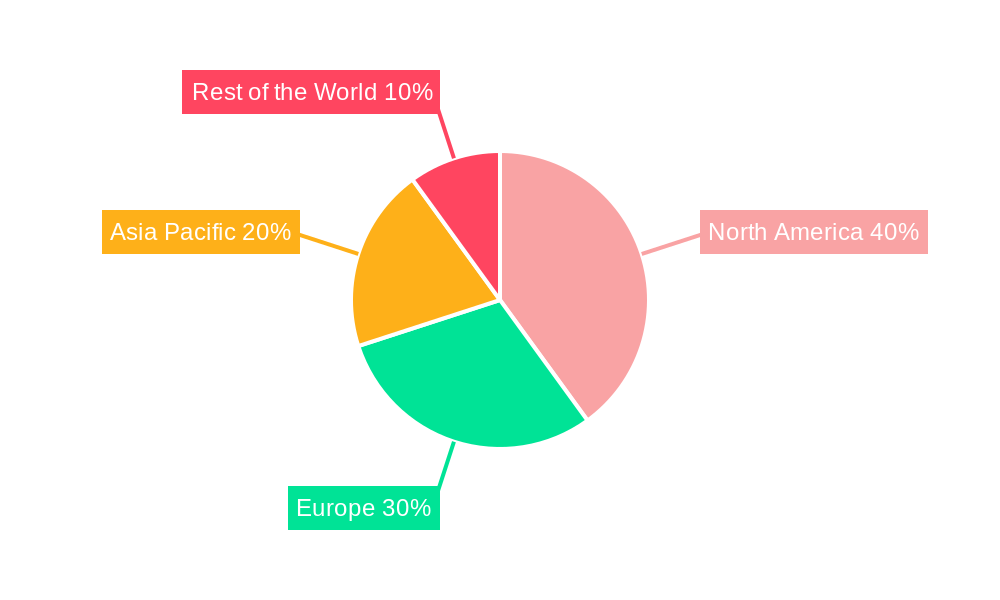

Within the North America eye tracking solutions market, the United States consistently emerges as the dominant country, driven by its robust technological innovation ecosystem, significant R&D investments, and a large consumer base actively adopting new technologies. The Automotive & Transportation sector, alongside Consumer Electronics, stands out as a leading end-user industry, demonstrating substantial growth and investment in eye tracking solutions.

- Dominant Country: United States

- Key Drivers:

- High R&D Investment: Significant funding allocated to developing advanced eye tracking hardware and software.

- Technological Hubs: Presence of leading tech companies and research institutions fostering innovation.

- Early Adoption Rates: Consumers and businesses readily embrace new technological solutions.

- Stringent Safety Regulations: Driving demand for driver monitoring systems in the automotive sector.

- Key Drivers:

- Leading End-User Industry Segments:

- Automotive & Transportation:

- Dominance Factors: Critical for driver attention monitoring, advanced driver-assistance systems (ADAS), and in-car infotainment personalization. Regulatory push for enhanced vehicle safety significantly boosts adoption. Estimated market penetration in new vehicles is projected to reach XX% by 2033.

- Investment Trends: Increased OEM investments in integrating eye tracking for safety and user experience improvements.

- Regulatory Support: Government mandates and safety standards for driver monitoring systems.

- Consumer Electronics:

- Dominance Factors: Integration into smartphones, tablets, gaming consoles, and VR/AR headsets for personalized user experiences, intuitive controls, and immersive gaming. The growing metaverse and XR markets are significant growth catalysts. Estimated market penetration in high-end consumer electronics is projected to reach XX% by 2033.

- Consumer Demand: Growing consumer preference for personalized and interactive digital experiences.

- Product Innovation: Continuous integration of eye tracking in next-generation devices.

- Automotive & Transportation:

- Dominant Solution Type Segment:

- Hardware:

- Dominance Factors: The foundational component for eye tracking systems. Advancements in miniaturization, accuracy, and cost-effectiveness of cameras, infrared illuminators, and sensors are key drivers. The increasing demand for integrated hardware solutions in vehicles and consumer devices fuels its dominance. Estimated market share of hardware solutions is projected to be around XX% in 2025.

- Technological Advancements: Development of compact, high-resolution, and low-power consumption eye tracking sensors.

- Manufacturing Scale: Economies of scale in production contribute to cost reduction and wider accessibility.

- Hardware:

North America Eye Tracking Solutions Market Product Innovations

Product innovations in the North America eye tracking solutions market are transforming user interaction and data analysis. Key advancements include the development of higher-resolution cameras and more sophisticated algorithms capable of accurately tracking gaze in diverse lighting conditions and with varying eye types. Miniaturization of hardware components is enabling seamless integration into smaller devices, from wearables to automotive dashboards. Software innovations are focused on advanced AI-driven analytics, providing deeper insights into user attention, cognitive load, and emotional responses. These innovations are driving new applications in areas like personalized advertising, driver fatigue detection, and enhanced accessibility tools. The performance metrics are continuously improving, with accuracy rates exceeding XX% and latency decreasing to below XX milliseconds.

Propelling Factors for North America Eye Tracking Solutions Market Growth

The growth of the North America eye tracking solutions market is propelled by a confluence of technological advancements, economic drivers, and supportive regulatory frameworks. The increasing demand for personalized user experiences across all digital platforms, from e-commerce to entertainment, is a primary economic driver. Technologically, the miniaturization of hardware, coupled with sophisticated AI and machine learning algorithms, is making eye tracking more accessible and accurate than ever before. The automotive industry's focus on enhancing driver safety through advanced driver-assistance systems (ADAS) and in-cabin monitoring is a significant regulatory and economic catalyst. Furthermore, the burgeoning virtual and augmented reality markets are heavily reliant on eye tracking for immersive experiences and efficient rendering. The growing emphasis on user research and behavioral analytics within the retail and advertisement sector also fuels adoption.

Obstacles in the North America Eye Tracking Solutions Market Market

Despite its promising growth, the North America eye tracking solutions market faces several obstacles. Regulatory challenges, particularly concerning data privacy and the ethical implications of collecting granular user behavioral data, can slow down adoption in sensitive sectors. The high initial cost of some advanced eye tracking systems can be a barrier for smaller businesses and certain consumer segments. Supply chain disruptions, especially for specialized electronic components, can impact manufacturing and lead times, potentially affecting market availability and pricing. Furthermore, intense competitive pressures from alternative interaction technologies like advanced gesture and voice recognition, although offering different functionalities, can present a challenge for market penetration in specific use cases. Overcoming these hurdles requires continued innovation in cost-effectiveness and clear communication regarding data security and ethical practices.

Future Opportunities in North America Eye Tracking Solutions Market

The future of the North America eye tracking solutions market is ripe with emerging opportunities. The expanding metaverse and extended reality (XR) ecosystems present a significant avenue for growth, as eye tracking is crucial for realistic avatar creation, interactive environments, and foveated rendering. The increasing adoption of autonomous vehicles will further necessitate sophisticated driver monitoring systems, where eye tracking plays a vital role. Furthermore, advancements in healthcare applications, including assistive technologies for individuals with disabilities and advanced diagnostics for neurological conditions, offer substantial untapped potential. The integration of eye tracking into smart home devices for intuitive control and personalized environments also represents a growing consumer market.

Major Players in the North America Eye Tracking Solutions Market Ecosystem

- Seeing Machines

- iMotions A/S

- Eyegaze Inc

- Gazepoint Research Inc

- Mirametrix Inc

- Smart Eye Group

- Tobii Technology Inc

- EyeTech Digital Systems Inc

- SR Research Ltd

Key Developments in North America Eye Tracking Solutions Market Industry

- September 2022: HTC announced an expansion to the Vive Focus 3 ecosystem with new retrofitted add-ons allowing eye and face tracking. This move is expected to provide users with 'insightful data' for deeper user behavior analysis, and specifically aids in design reviews and viewing CAD models through foveated rendering.

- March 2022: Tobii collaborated with Ready Player and LIV to enhance avatar authenticity and expressiveness within the Metaverse, enabling more lifelike digital representations through their eye-tracking technology.

Strategic North America Eye Tracking Solutions Market Market Forecast

The strategic forecast for the North America eye tracking solutions market is overwhelmingly positive, driven by continuous technological innovation and expanding application horizons. The projected market growth, estimated to reach USD XXX Million by 2033, is underpinned by the increasing demand for enhanced user experience, safety-critical applications in the automotive sector, and the burgeoning XR and metaverse industries. The integration of advanced AI for deeper behavioral insights and the ongoing miniaturization of hardware will further democratize access to eye tracking solutions. Key growth catalysts include supportive regulatory environments, significant R&D investments from major players, and a growing consumer awareness and acceptance of eye tracking's benefits. The market is poised to witness substantial expansion as businesses across diverse sectors leverage eye tracking to gain a competitive edge and deliver more personalized, efficient, and engaging products and services.

North America Eye Tracking Solutions Market Segmentation

-

1. Solution Type

- 1.1. Hardware

- 1.2. Software

-

2. End-User Industry

- 2.1. Retail & Advertisement sector

- 2.2. Automotive & Transportation

- 2.3. Media & Entertainment

- 2.4. Aerospace & Defense

- 2.5. Consumer Electronics

- 2.6. Other End-user Industries

North America Eye Tracking Solutions Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Eye Tracking Solutions Market Regional Market Share

Geographic Coverage of North America Eye Tracking Solutions Market

North America Eye Tracking Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased adoption of Artificial Intelligence

- 3.2.2 Virtual Reality

- 3.2.3 and Augmented Reality; Increasing adoption of eye tracking technology in commercial spaces

- 3.3. Market Restrains

- 3.3.1 Contact lenses

- 3.3.2 spectacles

- 3.3.3 and pupil color can all have an effect on the capabilities of an eye-tracking camera

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Eye Tracking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail & Advertisement sector

- 5.2.2. Automotive & Transportation

- 5.2.3. Media & Entertainment

- 5.2.4. Aerospace & Defense

- 5.2.5. Consumer Electronics

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Seeing Machines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 iMotions A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eyegaze Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gazepoint Research Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mirametrix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smart Eye Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tobii Technology Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EyeTechDigital Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SR Research Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Seeing Machines

List of Figures

- Figure 1: North America Eye Tracking Solutions Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Eye Tracking Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: North America Eye Tracking Solutions Market Revenue million Forecast, by Solution Type 2020 & 2033

- Table 2: North America Eye Tracking Solutions Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Eye Tracking Solutions Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Eye Tracking Solutions Market Revenue million Forecast, by Solution Type 2020 & 2033

- Table 5: North America Eye Tracking Solutions Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Eye Tracking Solutions Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States North America Eye Tracking Solutions Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Eye Tracking Solutions Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Eye Tracking Solutions Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Eye Tracking Solutions Market?

The projected CAGR is approximately 21.64%.

2. Which companies are prominent players in the North America Eye Tracking Solutions Market?

Key companies in the market include Seeing Machines, iMotions A/S, Eyegaze Inc *List Not Exhaustive, Gazepoint Research Inc, Mirametrix Inc, Smart Eye Group, Tobii Technology Inc, EyeTechDigital Systems Inc, SR Research Ltd.

3. What are the main segments of the North America Eye Tracking Solutions Market?

The market segments include Solution Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1708.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of Artificial Intelligence. Virtual Reality. and Augmented Reality; Increasing adoption of eye tracking technology in commercial spaces.

6. What are the notable trends driving market growth?

Consumer Electronics to Account for Significant Market Share.

7. Are there any restraints impacting market growth?

Contact lenses. spectacles. and pupil color can all have an effect on the capabilities of an eye-tracking camera.

8. Can you provide examples of recent developments in the market?

September 2022: HTC announced an expansion to the Vive Focus 3 ecosystem with new retrofitted add-ons allowing eye and face tracking when using its pro-focussed Vive Focus 3 headset. HTC expects that the trackers will help provide users with 'insightful data' by tracking and analyzing eye movement, attention, and focus for deeper user behavior analysis, however the greater use for those looking to use the HMD for design reviews and viewing CAD models, eye tracking also helps with GPU workloads, as foveated rendering prioritizes areas where the user is actually focused.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Eye Tracking Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Eye Tracking Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Eye Tracking Solutions Market?

To stay informed about further developments, trends, and reports in the North America Eye Tracking Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence