Key Insights

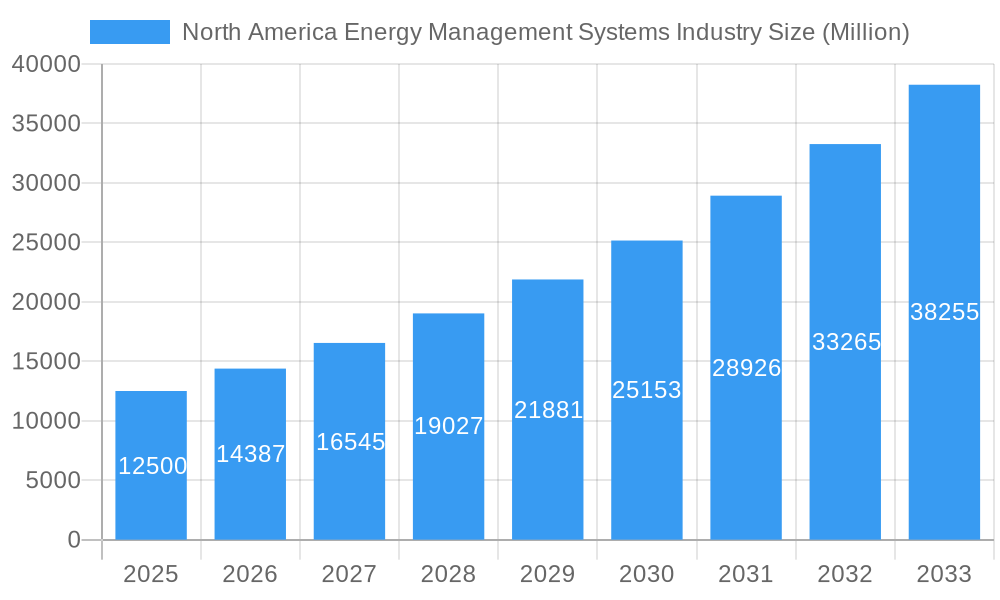

The North America Energy Management Systems (EMS) market is projected for substantial growth, reaching an estimated $60.61 billion by 2033. With a Compound Annual Growth Rate (CAGR) of 12.7% from 2025 to 2033, this expansion is driven by increasing demand for smart grid technologies, stringent energy efficiency regulations, and the widespread adoption of IoT-enabled solutions in commercial and industrial sectors. In the base year of 2025, the market was valued at a significant figure, demonstrating strong foundational demand. Key growth drivers include rising energy costs, the imperative to reduce carbon footprints, and the pursuit of operational cost optimization through intelligent energy consumption. The market is experiencing a surge in Building Energy Management Systems (BEMS) and Home Energy Management Systems (HEMS), as consumer awareness of energy conservation intensifies.

North America Energy Management Systems Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained momentum, with energy management solutions playing a vital role in achieving sustainability goals and enhancing grid reliability. Segments such as BEMS for commercial, industrial, and educational institutions are expected to lead growth, supported by advancements in cloud-based platforms and AI-driven analytics for predictive maintenance and optimized energy distribution. Initial high implementation costs and the need for skilled labor for integration and maintenance are being addressed by scalable, subscription-based models and government incentives for energy-efficient technologies. Leading companies such as Honeywell, Siemens, Schneider Electric, and Johnson Controls are actively investing in R&D, introducing innovative solutions to meet evolving market demands.

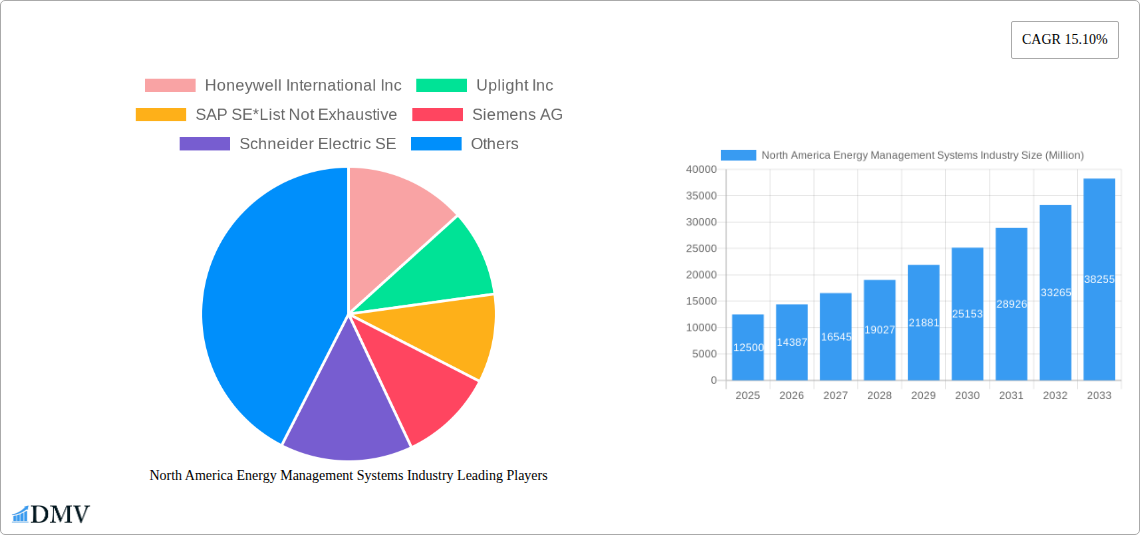

North America Energy Management Systems Industry Company Market Share

Here is an SEO-optimized and insightful report description for the North America Energy Management Systems Industry, incorporating your specified requirements:

North America Energy Management Systems Industry Market Composition & Trends

The North America energy management systems (EMS) market is characterized by a dynamic and evolving landscape, driven by increasing energy costs, growing environmental consciousness, and stringent regulatory mandates. Market concentration is moderately high, with key players like Honeywell International Inc., Siemens AG, and Schneider Electric SE holding significant market share. Innovation catalysts include advancements in IoT, AI, and cloud computing, enabling smarter and more efficient energy consumption. The regulatory landscape is robust, with initiatives promoting energy efficiency and emissions reduction across all sectors. Substitute products, such as manual energy conservation efforts, are increasingly being supplanted by sophisticated EMS solutions. End-user profiles span a wide spectrum, from large industrial facilities and commercial buildings seeking to optimize operational costs and sustainability to homeowners aiming for reduced utility bills and enhanced comfort. Mergers and acquisitions (M&A) activity is a significant trend, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, recent M&A deals in the sector have collectively surpassed $500 Million in value, reflecting the industry's drive for scale and technological integration.

- Market Share Distribution: Dominant players collectively hold over 60% of the market.

- M&A Deal Values: Aggregated deal values exceeding $500 Million within the historical period.

- Innovation Focus: IoT integration, AI-driven analytics, and cloud-based platforms.

- Regulatory Drivers: Government incentives for energy efficiency, carbon pricing mechanisms.

North America Energy Management Systems Industry Industry Evolution

The North America energy management systems industry has witnessed a transformative evolution over the historical period of 2019–2024, with a projected sustained growth trajectory through the forecast period of 2025–2033. The market's growth trajectory has been significantly influenced by a confluence of technological advancements and a pronounced shift in consumer and enterprise demand towards sustainable and cost-effective energy solutions. During the historical period, the adoption of Building Energy Management Systems (BEMS) and Home Energy Management Systems (HEMS) saw a compound annual growth rate (CAGR) of approximately 7.5%. This growth was fueled by increasing awareness of the financial and environmental benefits of optimized energy usage. Technological advancements have been pivotal, with the integration of the Internet of Things (IoT) enabling real-time data collection and analysis, allowing for unprecedented control and efficiency. Artificial intelligence (AI) and machine learning algorithms are now central to predicting energy demand, identifying inefficiencies, and automating energy-saving actions, thereby pushing the boundaries of what EMS can achieve. Furthermore, the increasing accessibility and affordability of smart devices and sensors have democratized access to energy management capabilities, moving beyond large industrial applications to smaller commercial spaces and residential homes. Shifting consumer demands have also played a crucial role; individuals and businesses are no longer solely focused on minimizing costs but are increasingly prioritizing environmental responsibility and contributing to a greener future. This has led to a surge in demand for EMS solutions that not only reduce energy consumption but also provide transparent reporting on carbon footprints and sustainability metrics. The base year, 2025, stands as a pivotal point, with market projections indicating a continued upward trend, with the EMS market expected to reach an estimated $35 Billion by 2033. The industry has successfully navigated challenges, adapting to evolving energy grids and embracing renewable energy integration, further solidifying its importance in the North American energy ecosystem.

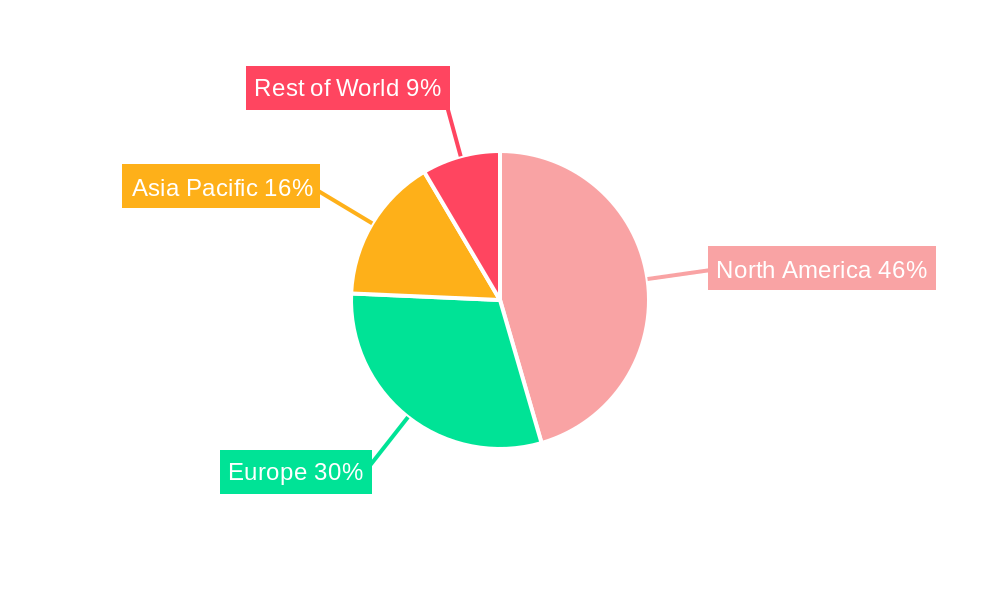

Leading Regions, Countries, or Segments in North America Energy Management Systems Industry

Within the North America energy management systems industry, Building Energy Management Systems (BEMS) emerge as the dominant segment, exhibiting robust growth and widespread adoption across various end-user verticals. The United States spearheads this dominance, driven by a combination of aggressive energy efficiency targets, substantial investments in smart grid infrastructure, and a highly developed commercial and industrial sector. The country's proactive regulatory framework, including incentives for green building certifications and energy performance standards, further bolsters the adoption of advanced BEMS solutions. Canada and Mexico also contribute significantly, with increasing awareness and policy support contributing to market expansion.

Key Drivers for BEMS Dominance:

- Commercial Sector Dominance: Large office buildings, retail complexes, and hospitality establishments are primary adopters, seeking to reduce operational expenses and meet corporate sustainability goals. The commercial segment alone accounts for an estimated 45% of the total BEMS market.

- Industrial Sector Integration: Manufacturing plants and industrial facilities leverage BEMS for optimizing energy-intensive processes, improving operational efficiency, and ensuring compliance with environmental regulations. This segment represents approximately 30% of the BEMS market share.

- Healthcare and Education Expansion: Hospitals and educational institutions are increasingly investing in BEMS to manage their vast energy consumption, driven by the need for cost savings and the imperative to maintain stable environments for patient care and learning. These sectors contribute around 15% and 10% respectively to the BEMS market.

- Technological Advancements: The proliferation of IoT sensors, cloud-based analytics, and AI-powered control systems in BEMS enhances their capabilities, providing granular insights into energy usage and enabling predictive maintenance.

- Regulatory Support and Incentives: Government initiatives such as tax credits, rebates, and energy performance mandates in both the US and Canada encourage the retrofitting of existing buildings and the construction of energy-efficient new ones, directly fueling BEMS market growth.

While Home Energy Management Systems (HEMS) are also experiencing significant growth, particularly with the rise of smart home technology, BEMS continues to hold the larger market share due to the scale of energy consumption in commercial and industrial settings and the more substantial return on investment potential offered by comprehensive building management solutions. The services component within BEMS, including installation, integration, and ongoing maintenance, is also a significant contributor to its overall market leadership, ensuring sustained value for end-users.

North America Energy Management Systems Industry Product Innovations

Product innovations in the North America energy management systems industry are increasingly focused on enhanced connectivity, intelligent automation, and predictive capabilities. Companies are integrating advanced AI and machine learning algorithms to offer sophisticated energy analytics, enabling users to identify anomalies, predict consumption patterns, and optimize energy usage in real-time. The development of interoperable hardware and software solutions that seamlessly integrate with existing building infrastructure and diverse energy sources, including renewables, is a key trend. Furthermore, user-friendly interfaces and mobile accessibility are being prioritized to empower a wider range of users to effectively monitor and control their energy consumption, driving greater adoption and engagement with EMS.

Propelling Factors for North America Energy Management Systems Industry Growth

Several key factors are propelling the North America energy management systems industry forward. The escalating cost of conventional energy sources mandates efficiency. Governments are actively promoting energy conservation and emission reduction through favorable policies and incentives. Technological advancements, particularly in IoT and AI, are enabling more sophisticated and automated energy management solutions. Furthermore, a growing corporate and public emphasis on sustainability and environmental responsibility is driving demand for EMS as a means to achieve ESG (Environmental, Social, and Governance) goals and reduce carbon footprints. The demand for smart grid integration and the increasing adoption of distributed energy resources also necessitate advanced EMS for efficient management.

Obstacles in the North America Energy Management Systems Industry Market

Despite robust growth, the North America energy management systems industry faces several obstacles. High upfront installation costs for comprehensive systems can be a barrier for small and medium-sized enterprises and individual homeowners. The complexity of integrating diverse legacy systems with new EMS technologies can lead to compatibility issues and implementation challenges. Evolving cybersecurity threats pose a significant concern, requiring robust security measures to protect sensitive energy data. Furthermore, a lack of skilled professionals for installation, maintenance, and data analysis can hinder widespread adoption and optimal system performance. Regulatory fragmentation across different states and provinces can also create complexities for widespread deployment.

Future Opportunities in North America Energy Management Systems Industry

Emerging opportunities in the North America energy management systems industry are abundant. The integration of EMS with electric vehicle (EV) charging infrastructure presents a significant growth avenue, enabling optimized charging based on grid load and electricity prices. The expanding smart home market, coupled with increasing consumer demand for energy efficiency and cost savings, offers substantial potential for HEMS solutions. The growing focus on grid modernization and the increasing deployment of renewable energy sources create opportunities for EMS to facilitate demand response and grid stability. Furthermore, the development of advanced analytics platforms that provide deeper insights into energy consumption patterns and offer personalized energy-saving recommendations will drive future market expansion.

Major Players in the North America Energy Management Systems Industry Ecosystem

- Honeywell International Inc.

- Uplight Inc.

- SAP SE

- Siemens AG

- Schneider Electric SE

- Elster Group GmbH

- Oracle Corporation

- Johnson Control International PLC

- Greenwave Systems Inc.

- Panasonic Corporation

Key Developments in North America Energy Management Systems Industry Industry

- 2023: Honeywell International Inc. launched its Forge Energy Optimization platform, leveraging AI to predict and manage energy consumption in commercial buildings, enhancing operational efficiency by up to 20%.

- 2023: Uplight Inc. acquired a leading energy efficiency software provider, expanding its digital energy management solutions portfolio and strengthening its market position.

- 2022: Siemens AG introduced new IoT-enabled sensors and cloud services for its Desigo building management system, enabling advanced data analytics for energy performance.

- 2022: Schneider Electric SE announced significant investments in its EcoStruxure platform, focusing on integrating AI and machine learning for predictive energy management across industrial and commercial sectors.

- 2021: Johnson Controls International PLC expanded its smart building technologies with enhanced cybersecurity features and greater interoperability for its Metasys EMS.

Strategic North America Energy Management Systems Industry Market Forecast

The North America energy management systems industry is poised for significant strategic growth, driven by an intensified focus on decarbonization and operational cost reduction. The forecast period (2025–2033) will witness an accelerated adoption of intelligent EMS solutions as businesses and governments prioritize sustainability and energy independence. The increasing integration of AI and IoT will unlock new levels of efficiency and predictive capabilities, making EMS indispensable for managing complex energy landscapes. Opportunities in grid modernization, EV integration, and smart building technologies will create substantial market potential. The market is projected to reach an estimated value of $35 Billion by 2033, reflecting the enduring importance of effective energy management in shaping a sustainable future.

North America Energy Management Systems Industry Segmentation

-

1. Type of EMS

-

1.1. Building Energy Management Systems (BEMS)

- 1.1.1. Hardware

- 1.1.2. Software

- 1.1.3. Services

- 1.2. Home Energy Management Systems (HEMS)

-

1.1. Building Energy Management Systems (BEMS)

-

2. BEMS End User

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Healthcare

- 2.4. Education

North America Energy Management Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Energy Management Systems Industry Regional Market Share

Geographic Coverage of North America Energy Management Systems Industry

North America Energy Management Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Trend of Electricity Prices and Commitment Towards Sustainability; Energy Efficiency Regulations

- 3.3. Market Restrains

- 3.3.1. ; High Installation Costs Coupled with Maintenance Costs

- 3.4. Market Trends

- 3.4.1. BEMS is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of EMS

- 5.1.1. Building Energy Management Systems (BEMS)

- 5.1.1.1. Hardware

- 5.1.1.2. Software

- 5.1.1.3. Services

- 5.1.2. Home Energy Management Systems (HEMS)

- 5.1.1. Building Energy Management Systems (BEMS)

- 5.2. Market Analysis, Insights and Forecast - by BEMS End User

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Healthcare

- 5.2.4. Education

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of EMS

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uplight Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SAP SE*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elster Group GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson Control International PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Greenwave Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Energy Management Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Energy Management Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Energy Management Systems Industry Revenue billion Forecast, by Type of EMS 2020 & 2033

- Table 2: North America Energy Management Systems Industry Revenue billion Forecast, by BEMS End User 2020 & 2033

- Table 3: North America Energy Management Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Energy Management Systems Industry Revenue billion Forecast, by Type of EMS 2020 & 2033

- Table 5: North America Energy Management Systems Industry Revenue billion Forecast, by BEMS End User 2020 & 2033

- Table 6: North America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Energy Management Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Energy Management Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Energy Management Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Energy Management Systems Industry?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the North America Energy Management Systems Industry?

Key companies in the market include Honeywell International Inc, Uplight Inc, SAP SE*List Not Exhaustive, Siemens AG, Schneider Electric SE, Elster Group GmbH, Oracle Corporation, Johnson Control International PLC, Greenwave Systems Inc, Panasonic Corporation.

3. What are the main segments of the North America Energy Management Systems Industry?

The market segments include Type of EMS, BEMS End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.61 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Trend of Electricity Prices and Commitment Towards Sustainability; Energy Efficiency Regulations.

6. What are the notable trends driving market growth?

BEMS is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

; High Installation Costs Coupled with Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Energy Management Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Energy Management Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Energy Management Systems Industry?

To stay informed about further developments, trends, and reports in the North America Energy Management Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence