Key Insights

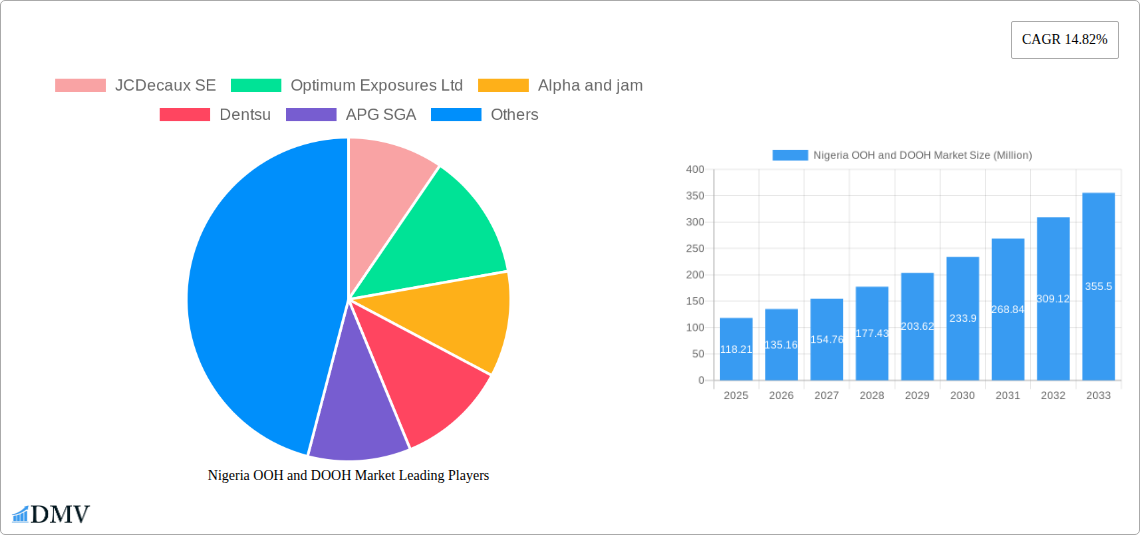

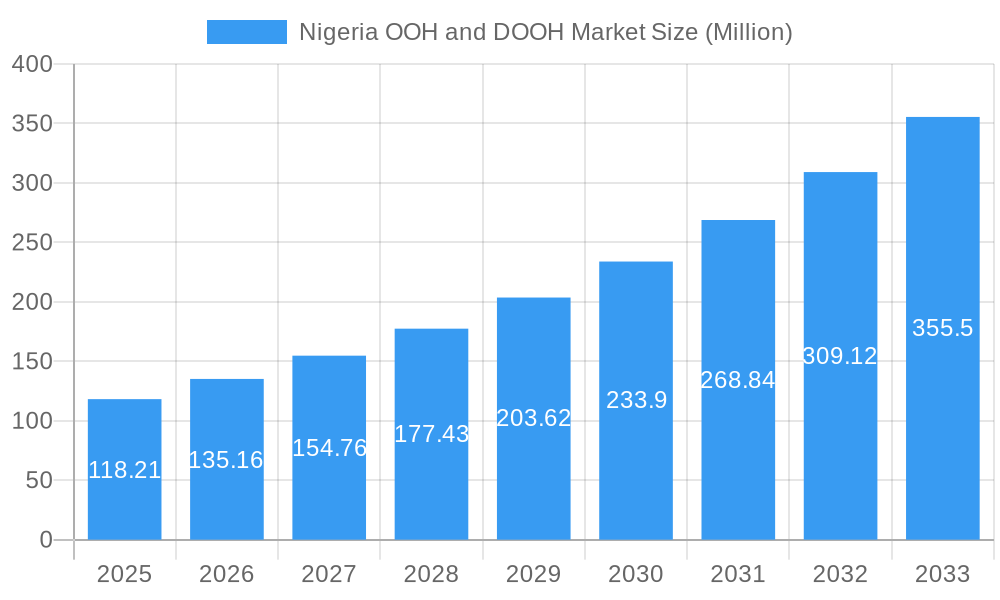

The Nigerian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market presents a compelling investment opportunity, exhibiting robust growth potential. With a 2025 market size of $118.21 million and a projected Compound Annual Growth Rate (CAGR) of 14.82% from 2025 to 2033, the market is poised for significant expansion. This growth is fueled by increasing urbanization, rising disposable incomes, and a burgeoning young population increasingly receptive to digitally-driven advertising formats. The proliferation of smartphones and increased internet penetration further enhances DOOH's effectiveness, attracting brands seeking innovative and impactful advertising strategies. Key market segments include billboards, transit advertising, street furniture, and digital displays in high-traffic locations like shopping malls and airports. Leading players like JCDecaux SE, Optimum Exposures Ltd, and Dentsu are actively shaping the market landscape, leveraging technological advancements and strategic partnerships to enhance their offerings and capture market share. Challenges include regulatory hurdles, infrastructure limitations in certain regions, and the need for robust measurement and reporting solutions to track campaign effectiveness. However, the overall outlook remains positive, with considerable scope for further market penetration and diversification of advertising formats.

Nigeria OOH and DOOH Market Market Size (In Million)

The strategic focus on data-driven insights and programmatic DOOH buying is expected to further accelerate market growth. Improved measurement techniques will provide advertisers with more accurate and transparent data on campaign ROI, boosting investor confidence. Furthermore, collaborations between OOH and DOOH providers, along with integration with other media channels, will create a more holistic and integrated advertising ecosystem. While competition is intensifying, opportunities exist for both established players and new entrants who can offer innovative solutions and cater to the evolving demands of advertisers seeking targeted and engaging campaigns. The market is ripe for innovation in creative formats, programmatic advertising adoption, and a stronger emphasis on delivering measurable results. This combination of factors positions the Nigerian OOH and DOOH market for sustained growth and substantial returns in the coming years.

Nigeria OOH and DOOH Market Company Market Share

Nigeria OOH and DOOH Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Nigeria Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, encompassing historical data (2019-2024), current estimations (2025), and a robust forecast spanning 2025-2033. Uncover key trends, leading players, and lucrative opportunities in this rapidly evolving sector. This report is crucial for stakeholders seeking to understand market composition, investment potential, and future growth trajectories in the Nigerian OOH and DOOH landscape.

Nigeria OOH and DOOH Market Composition & Trends

This section delves into the competitive landscape of the Nigerian OOH and DOOH market, evaluating market concentration, innovative drivers, regulatory frameworks, substitute advertising mediums, and end-user profiles. We analyze mergers and acquisitions (M&A) activity, providing insights into deal values and their impact on market share distribution.

- Market Concentration: The Nigerian OOH market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share (estimated at 60% in 2025). Smaller, independent agencies comprise the remaining market share.

- Innovation Catalysts: Technological advancements like programmatic DOOH and data-driven targeting are major innovation catalysts. The increasing adoption of smart city initiatives also fuels growth.

- Regulatory Landscape: The regulatory environment is evolving, with new guidelines focusing on advertising standards and permit processes. This section will analyze the implications of these regulations on market operations.

- Substitute Products: Digital advertising channels like social media and online video present competition. However, the unique reach and impact of OOH advertising provide a compelling alternative.

- End-User Profiles: The report profiles key end-users, including FMCG companies, telecommunication firms, financial institutions, and the rapidly growing entertainment sector.

- M&A Activity: We analyze significant M&A transactions in the historical period (2019-2024), estimating the total deal value at approximately $xx Million. This section will detail the impact of these activities on market consolidation.

Nigeria OOH and DOOH Market Industry Evolution

This section examines the trajectory of the Nigerian OOH and DOOH market, analyzing growth patterns, technological progress, and the influence of changing consumer preferences. We provide detailed data points on growth rates, technological adoption, and evolving consumer behavior, providing a robust understanding of market dynamics from 2019 to 2033. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increased digital adoption and infrastructural development. Specific factors contributing to this growth include the rise of programmatic DOOH, increasing smartphone penetration, and a growing middle class with higher disposable income. Technological advancements are enabling targeted advertising campaigns and improved measurement capabilities, further enhancing the attractiveness of OOH and DOOH to advertisers. Evolving consumer behaviour, with increased time spent outdoors in urban centers, also contributes to this market expansion.

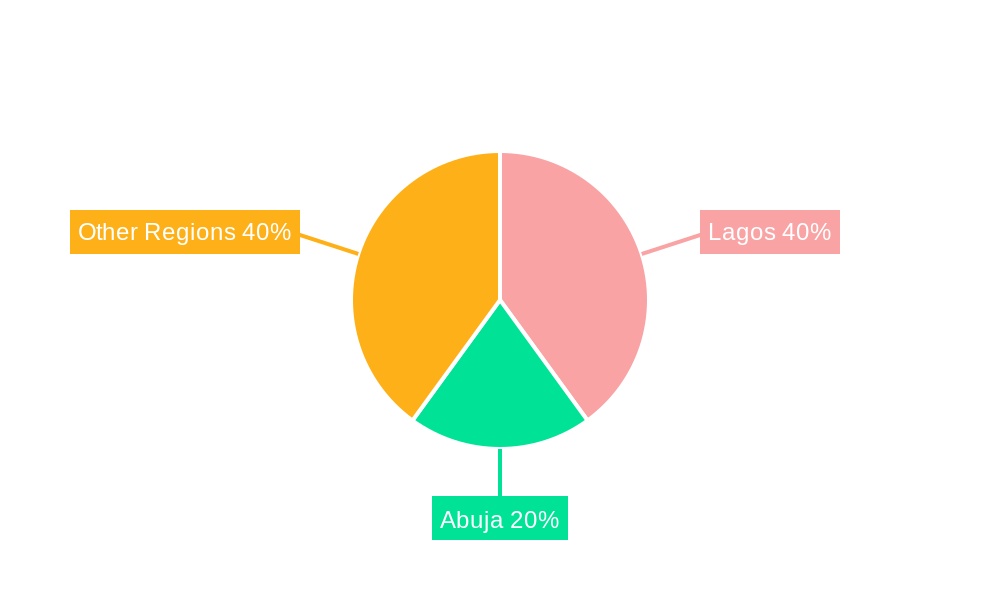

Leading Regions, Countries, or Segments in Nigeria OOH and DOOH Market

This section identifies the leading regions or segments within the Nigerian OOH and DOOH market. Lagos, the commercial capital, consistently demonstrates the highest market share due to its high population density and commercial activity.

- Key Drivers for Lagos Dominance:

- High Population Density: Lagos houses a significant portion of Nigeria's population, resulting in high visibility and audience reach for OOH/DOOH advertisements.

- High Commercial Activity: As Nigeria's economic hub, Lagos boasts robust commercial activity, making it an attractive location for businesses to invest in OOH/DOOH advertising.

- Infrastructure Development: Investments in improved infrastructure, including transportation and urban development, create opportunities for more impactful OOH/DOOH campaigns.

- Government Support: Government initiatives promoting urban renewal and tourism further boost the attractiveness of OOH/DOOH in Lagos.

Nigeria OOH and DOOH Market Product Innovations

Recent innovations include the integration of interactive elements in DOOH screens, leveraging augmented reality (AR) and location-based targeting to create engaging experiences. Advanced analytics platforms provide marketers with precise measurement and optimization capabilities, enhancing ROI. These technological advancements are transforming the OOH landscape and boosting effectiveness. The use of programmatic buying platforms allows for greater efficiency and precision in media buying, while the implementation of dynamic content features enables campaigns to be tailored to specific audiences and real-time events.

Propelling Factors for Nigeria OOH and DOOH Market Growth

Several factors contribute to the growth of the Nigerian OOH and DOOH market. Firstly, rising smartphone penetration enables location-based advertising and targeted campaigns. Secondly, increasing urbanization concentrates populations in areas ideal for OOH/DOOH. Finally, economic growth boosts advertising expenditure.

Obstacles in the Nigeria OOH and DOOH Market Market

Challenges include limited access to reliable power supply in certain regions impacting DOOH operations. Also, obtaining advertising permits and navigating regulatory frameworks can be complex and time-consuming, hindering timely campaign execution. Furthermore, competition from other digital advertising channels can exert pressure on market share.

Future Opportunities in Nigeria OOH and DOOH Market

Future opportunities lie in expanding into less-penetrated regions through strategic partnerships and infrastructure investment. Leveraging new technologies like AI-powered audience targeting and incorporating immersive experiences will create greater engagement. Furthermore, developing innovative campaign formats that align with evolving consumer preferences can attract more investment in the OOH/DOOH sector.

Major Players in the Nigeria OOH and DOOH Market Ecosystem

- JCDecaux SE

- Optimum Exposures Ltd

- Alpha and jam

- Dentsu

- APG SGA

- Invent Media Limited

- NIMBUS MEDIA

- Plural Media

- Moving Media

- Alliance Medi

Key Developments in Nigeria OOH and DOOH Market Industry

- June 2024: Polygon's expansion into the Nigerian DOOH market signals increased competition and investment in the sector. This move provides advertisers with access to a larger, more unified network across Africa.

- May 2024: The launch of LMX's revenue management suite enables OOH media owners to optimize inventory utilization, improving revenue generation and potentially boosting market efficiency.

Strategic Nigeria OOH and DOOH Market Forecast

The Nigerian OOH and DOOH market is poised for significant growth, driven by technological advancements, increasing urbanization, and a burgeoning digital economy. Opportunities abound in expanding into less-penetrated regions, leveraging data-driven targeting, and creating innovative campaign formats. The market's potential is considerable, promising robust returns for investors and advertisers alike.

Nigeria OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Types

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Nigeria OOH and DOOH Market Segmentation By Geography

- 1. Niger

Nigeria OOH and DOOH Market Regional Market Share

Geographic Coverage of Nigeria OOH and DOOH Market

Nigeria OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Technological Innovations in Display Technologies

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Technological Innovations in Display Technologies

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising is Expected to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Optimum Exposures Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpha and jam

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsu

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 APG SGA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Invent Media Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NIMBUS MEDIA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Plural Media

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moving Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alliance Medi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Nigeria OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Nigeria OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Nigeria OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Nigeria OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Nigeria OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Nigeria OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Nigeria OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Nigeria OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Nigeria OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Nigeria OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Nigeria OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Nigeria OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 13: Nigeria OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Nigeria OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Nigeria OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Nigeria OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria OOH and DOOH Market?

The projected CAGR is approximately 14.82%.

2. Which companies are prominent players in the Nigeria OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Optimum Exposures Ltd, Alpha and jam, Dentsu, APG SGA, Invent Media Limited, NIMBUS MEDIA, Plural Media, Moving Media, Alliance Medi.

3. What are the main segments of the Nigeria OOH and DOOH Market?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Technological Innovations in Display Technologies.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising is Expected to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Technological Innovations in Display Technologies.

8. Can you provide examples of recent developments in the market?

June 2024: Polygon, South Africa's premier programmatic digital out-of-home (DOOH) publisher, unveiled plans to extend its reach throughout Africa. This strategic move underscores its commitment to providing marketers with a unified gateway to the continent's most extensive DOOH inventory. By August 2024, advertisers can tap into Polygon's offerings in Mauritius, Ghana, and Kenya. As the year progresses, Polygon's network will further expand, introducing screens in Nigeria, Uganda, Zimbabwe, Mozambique, and Angola.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Nigeria OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence