Key Insights

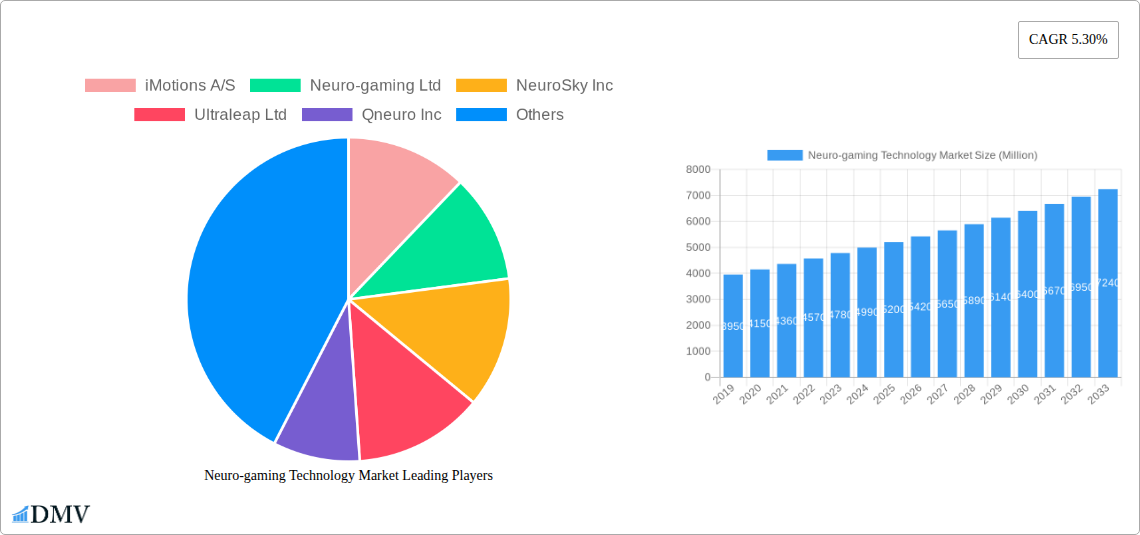

The global Neuro-gaming Technology Market is poised for significant expansion, projected to reach an estimated market size of $5,200 million by 2025. This growth is propelled by a Compound Annual Growth Rate (CAGR) of 5.30%, indicating a robust upward trajectory. The market is driven by an increasing demand for immersive and personalized gaming experiences, the growing integration of neuroscience in entertainment, and the rising adoption of brain-computer interfaces (BCIs) across various sectors. Key growth drivers include advancements in EEG and fNIRS technologies, enabling more sophisticated BCI integration, and the burgeoning interest in using neuro-gaming for cognitive training and therapeutic applications within healthcare. The entertainment sector continues to be a primary catalyst, with developers actively exploring novel ways to leverage brainwave data to enhance player engagement and adapt game difficulty in real-time. Furthermore, the educational segment is observing growing adoption for its potential in personalized learning and attention monitoring.

Neuro-gaming Technology Market Market Size (In Billion)

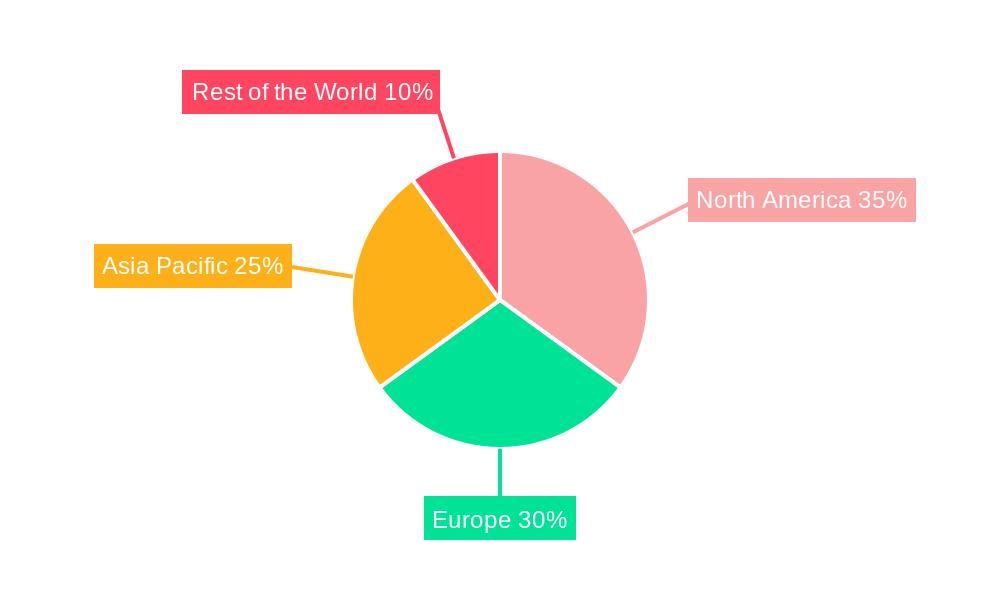

The market landscape is characterized by dynamic trends such as the convergence of AI and neuro-gaming, leading to more adaptive and intelligent gaming environments. The development of sophisticated algorithms for analyzing brain signals allows for deeper insights into player emotions and cognitive states, enabling hyper-personalized gameplay. However, the market also faces certain restraints, including the high cost of advanced neuro-gaming hardware, concerns surrounding data privacy and security related to sensitive brainwave information, and the need for greater consumer awareness and understanding of the technology. Despite these challenges, companies like iMotions A/S, Neuro-gaming Ltd, and Emotiv Inc. are at the forefront, innovating and expanding the applications of neuro-gaming technology. The Asia Pacific region is emerging as a significant growth hub, fueled by a large gaming population and increasing investment in research and development. North America and Europe continue to lead in adoption due to established technological infrastructure and a strong gaming culture.

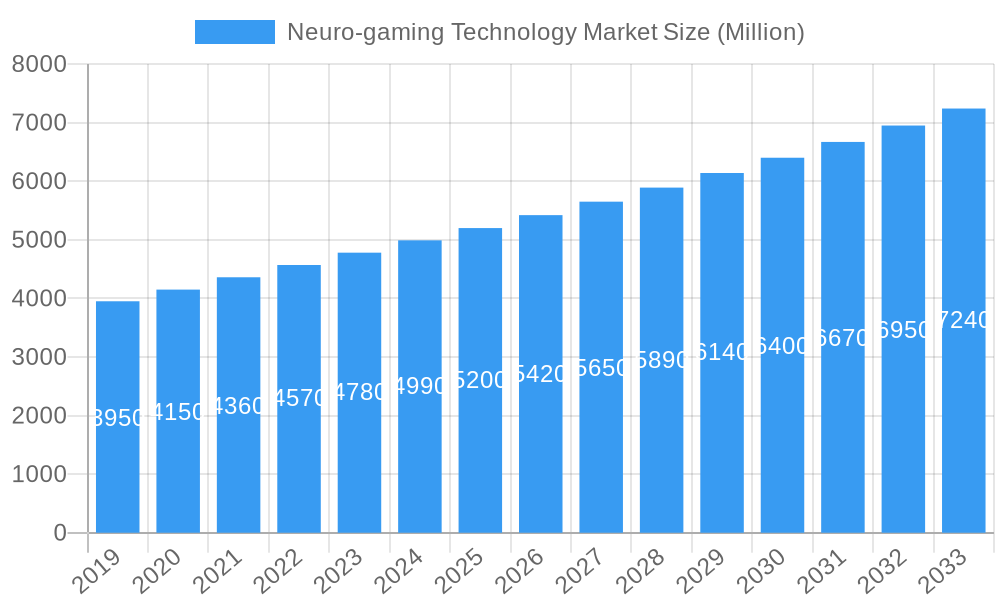

Neuro-gaming Technology Market Company Market Share

This in-depth report provides an exhaustive analysis of the global Neuro-gaming Technology Market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033. Leveraging advanced neurotechnology and brain-computer interfaces (BCI), the neuro-gaming market is poised for substantial growth, driven by advancements in hardware, software, and their integration into diverse end-user segments such as healthcare, education, and entertainment.

Neuro-gaming Technology Market Market Composition & Trends

The neuro-gaming technology market exhibits a moderate level of concentration, with key players like iMotions A/S, Neuro-gaming Ltd, NeuroSky Inc, Ultraleap Ltd, Qneuro Inc, Emotiv Inc, and Affectiva Inc (Acquired by Smart Eye AB) investing heavily in research and development. Innovation is primarily catalyzed by the increasing demand for personalized and immersive gaming experiences, alongside the burgeoning applications of BCI in therapeutic and educational settings. The regulatory landscape is still evolving, with a focus on data privacy and ethical considerations surrounding brain-interface technologies. Substitute products, such as traditional gaming peripherals, are being challenged by the unique interactive capabilities offered by neuro-gaming. End-user profiles are expanding from early adopters in research to mainstream consumers seeking enhanced cognitive engagement and wellness benefits. Merger and acquisition (M&A) activities are significant, with strategic investments aimed at consolidating market share and accelerating technological integration. For instance, the acquisition of NextMind by Snap Inc. for an undisclosed sum in March 2022 underscores the strategic importance of BCI technology in the AR/VR space. The market share distribution, while dynamic, shows a steady increase in BCI-enabled hardware and sophisticated neurofeedback software solutions.

Neuro-gaming Technology Market Industry Evolution

The evolution of the Neuro-gaming Technology Market is characterized by a steep growth trajectory fueled by groundbreaking technological advancements and a paradigm shift in consumer demand towards more interactive and personalized experiences. Over the historical period from 2019 to 2024, the market has witnessed an average annual growth rate (AAGR) of approximately 15%, driven by initial research and development in BCI and a gradual increase in adoption. The base year, 2025, sees the market poised for accelerated expansion, with projections indicating a CAGR of over 20% during the forecast period of 2025–2033. This surge is attributed to the increasing sophistication of neurotechnology, including non-invasive EEG sensors and advanced AI algorithms capable of interpreting neural signals with higher accuracy. Consumer demand is shifting from passive entertainment to active engagement, with users seeking games that not only challenge their reflexes but also their cognitive abilities and emotional states. The integration of neuro-gaming into healthcare for rehabilitation, cognitive training, and mental wellness is a significant growth driver, expanding the market beyond traditional gaming demographics. Educational applications, such as personalized learning experiences and cognitive skill development, are also gaining traction, further diversifying the market's reach. The market's evolution is further marked by a continuous push for more seamless and intuitive BCI integration, reducing latency and improving the overall user experience. This has led to innovations in both hardware components, like advanced headgear and sensors, and software platforms that translate complex neural data into actionable game mechanics and feedback. The increasing availability of accessible BCI devices, coupled with growing public awareness of the potential benefits of neuro-enhancement, is creating a fertile ground for sustained market expansion and innovation. The industry is actively moving towards making neuro-gaming a mainstream phenomenon, transitioning from niche applications to widespread consumer adoption.

Leading Regions, Countries, or Segments in Neuro-gaming Technology Market

The Neuro-gaming Technology Market is experiencing significant dominance and growth across various regions and segments, with North America currently leading the charge. This leadership is propelled by robust investment in research and development, a highly tech-savvy consumer base, and a supportive ecosystem for emerging technologies. The component segment, Hardware, particularly advanced EEG headsets and neurofeedback devices, is a primary driver of this dominance, with a projected market share of over 55% in 2025.

- North America's Dominance Factors:

- High R&D Investment: Significant funding from both private ventures and government grants fuels innovation in BCI and neuro-gaming technologies.

- Early Adoption Rate: Consumers in North America are quick to embrace new technologies, driving demand for sophisticated neuro-gaming hardware and software.

- Presence of Key Companies: Major neurotech players, including iMotions A/S and NeuroSky Inc, have a strong presence and influence in the region, fostering market growth.

- Vibrant Gaming Culture: The deeply ingrained gaming culture in North America provides a ready market for innovative gaming experiences.

Within the end-user segment, Healthcare is emerging as a critical area of growth, demonstrating a substantial projected market share of over 30% in 2025. The application of neuro-gaming in mental health, rehabilitation, and cognitive therapy is gaining significant traction, attracting substantial investment and research focus.

- Healthcare Segment Growth Drivers:

- Therapeutic Applications: Use of neuro-gaming for treating conditions like ADHD, PTSD, depression, and for stroke rehabilitation is increasing.

- Cognitive Enhancement: Growing awareness of neuro-gaming's potential for cognitive training and age-related cognitive decline prevention.

- Personalized Medicine: BCI allows for highly personalized therapeutic interventions tailored to individual neural responses.

- Insurance Reimbursement: As research solidifies efficacy, increasing possibilities for insurance coverage for neuro-gaming therapies.

The Education segment is also witnessing rapid expansion, driven by the demand for engaging and effective learning tools that cater to diverse learning styles. The Entertainment segment continues to be a foundational pillar, with developers exploring novel ways to enhance player immersion and interaction through BCI.

- Education Segment Expansion:

- Gamified Learning: Developing interactive games that improve focus, memory, and problem-solving skills.

- Special Education: Tailored neuro-gaming solutions for students with learning disabilities.

- Skill Development: Immersive platforms for developing complex skills through neurofeedback.

The Software component, crucial for interpreting neural data and creating interactive experiences, is expected to grow at a CAGR of approximately 22% during the forecast period, closely following hardware advancements. The interplay between these segments and regions is creating a dynamic and rapidly evolving market landscape.

Neuro-gaming Technology Market Product Innovations

Product innovations in the neuro-gaming technology market are revolutionizing user interaction and engagement. The development of non-invasive BCI headwear, such as the Varjo Aero with its Galea platform integrating EEG, heart rate, and muscle sensors, represents a significant leap in comprehensive biometric data collection for XR experiences. Furthermore, the advent of BCI technology enabling hands-free interaction with devices, as demonstrated by Snap Inc.'s acquisition of NextMind, is paving the way for more intuitive and seamless control mechanisms in AR/VR and other electronic devices. These innovations focus on enhancing immersion, providing personalized feedback, and unlocking new possibilities for human-computer interaction, promising greater user control and deeper engagement in both gaming and other applications.

Propelling Factors for Neuro-gaming Technology Market Growth

The neuro-gaming technology market is propelled by a confluence of transformative factors. Technological advancements in BCI, AI, and sensor technology are making neuro-gaming more accessible, accurate, and sophisticated. The increasing demand for immersive and personalized entertainment experiences is driving consumer interest and investment. Furthermore, the growing applications in healthcare and education, particularly for cognitive enhancement, rehabilitation, and mental wellness, are opening up significant new markets. Economic factors like increasing disposable incomes and growing venture capital funding for neurotech startups are also critical growth catalysts. The expanding research into brain plasticity and cognitive function further validates and supports the development and adoption of neuro-gaming solutions.

Obstacles in the Neuro-gaming Technology Market Market

Despite its promising trajectory, the neuro-gaming technology market faces several obstacles. High development costs and the complexity of BCI technology can hinder widespread adoption and affordability. Regulatory hurdles and data privacy concerns regarding the collection and use of sensitive neural data are significant barriers that require careful navigation. User adoption challenges, including the need for calibration and potential discomfort with head-mounted devices, still exist. Ethical considerations surrounding cognitive enhancement and potential misuse of neurotechnology also pose societal questions that need addressing. Furthermore, supply chain disruptions for specialized hardware components can impact production and availability, while intense competition from established gaming technologies necessitates continuous innovation.

Future Opportunities in Neuro-gaming Technology Market

The neuro-gaming technology market is ripe with future opportunities. The expansion of BCI applications into mainstream consumer electronics, beyond gaming, presents a vast untapped market. The development of more intuitive and user-friendly BCI interfaces will lower adoption barriers and attract a broader audience. Partnerships between neurotech companies and established gaming giants can accelerate market penetration and product development. The increasing integration of neuro-gaming with virtual and augmented reality promises hyper-realistic and deeply engaging experiences. Furthermore, the growing focus on mental wellness and cognitive health creates significant opportunities for therapeutic and preventative neuro-gaming solutions.

Major Players in the Neuro-gaming Technology Market Ecosystem

- iMotions A/S

- Neuro-gaming Ltd

- NeuroSky Inc

- Ultraleap Ltd

- Qneuro Inc

- Emotiv Inc

- Affectiva Inc (Acquired by Smart Eye AB)

Key Developments in Neuro-gaming Technology Market Industry

- July 2022: Mindpeers launched a new game focused on mental clarity, worry expression, and empowerment, utilizing journaling and self-exploration to activate neocortical functioning.

- June 2022: Varjo Aero, a professional-grade VR/XR headgear, claimed to be the first device to concurrently measure heart, skin, muscles, eyes, and brain activity using the Galea platform, which integrates BCI hardware and software.

- March 2022: Snap Inc. acquired Paris-based neurotech company NextMind, which developed non-invasive BCI technology enabling hands-free interaction with electronic devices, to bolster Snap's AR research plans.

Strategic Neuro-gaming Technology Market Market Forecast

The strategic forecast for the Neuro-gaming Technology Market indicates robust growth fueled by continuous innovation and expanding applications. The market is expected to witness significant expansion driven by advancements in BCI hardware and software, leading to more immersive and intuitive user experiences. The increasing adoption of neuro-gaming in healthcare for therapeutic purposes and in education for enhanced learning will be key growth catalysts. Strategic partnerships and investments in R&D will further accelerate market penetration. The development of more accessible and user-friendly neuro-gaming solutions will broaden the consumer base, solidifying its position as a significant future technology market with substantial growth potential.

Neuro-gaming Technology Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. End User

- 2.1. Healthcare

- 2.2. Education

- 2.3. Entertainment

- 2.4. Other End Users

Neuro-gaming Technology Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Neuro-gaming Technology Market Regional Market Share

Geographic Coverage of Neuro-gaming Technology Market

Neuro-gaming Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Development of Brain Computer Interfaces (BCIs); Increasing Adoption of Smart Devices

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Limited Actions Included in Games

- 3.4. Market Trends

- 3.4.1. Education Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare

- 5.2.2. Education

- 5.2.3. Entertainment

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Healthcare

- 6.2.2. Education

- 6.2.3. Entertainment

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Healthcare

- 7.2.2. Education

- 7.2.3. Entertainment

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Healthcare

- 8.2.2. Education

- 8.2.3. Entertainment

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Healthcare

- 9.2.2. Education

- 9.2.3. Entertainment

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 iMotions A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Neuro-gaming Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NeuroSky Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ultraleap Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qneuro Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Emotiv Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Affectiva Inc (Acquired by Smart Eye AB)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 iMotions A/S

List of Figures

- Figure 1: Global Neuro-gaming Technology Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 21: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 11: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neuro-gaming Technology Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Neuro-gaming Technology Market?

Key companies in the market include iMotions A/S, Neuro-gaming Ltd, NeuroSky Inc, Ultraleap Ltd, Qneuro Inc, Emotiv Inc, Affectiva Inc (Acquired by Smart Eye AB).

3. What are the main segments of the Neuro-gaming Technology Market?

The market segments include Component, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Development of Brain Computer Interfaces (BCIs); Increasing Adoption of Smart Devices.

6. What are the notable trends driving market growth?

Education Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness and Limited Actions Included in Games.

8. Can you provide examples of recent developments in the market?

July 2022: The new game from Mindpeers is a ground-breaking development in health technology. It claims to give its users mental clarity, the ability to express their worries, and a sense of empowerment. As the name implies, the game's intriguing two-step journaling and self-exploration portion aid in clearing the skies or thoughts. According to research, when users express their feelings or thoughts, they can articulate, activating neocortical functioning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Neuro-gaming Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Neuro-gaming Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Neuro-gaming Technology Market?

To stay informed about further developments, trends, and reports in the Neuro-gaming Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence