Key Insights

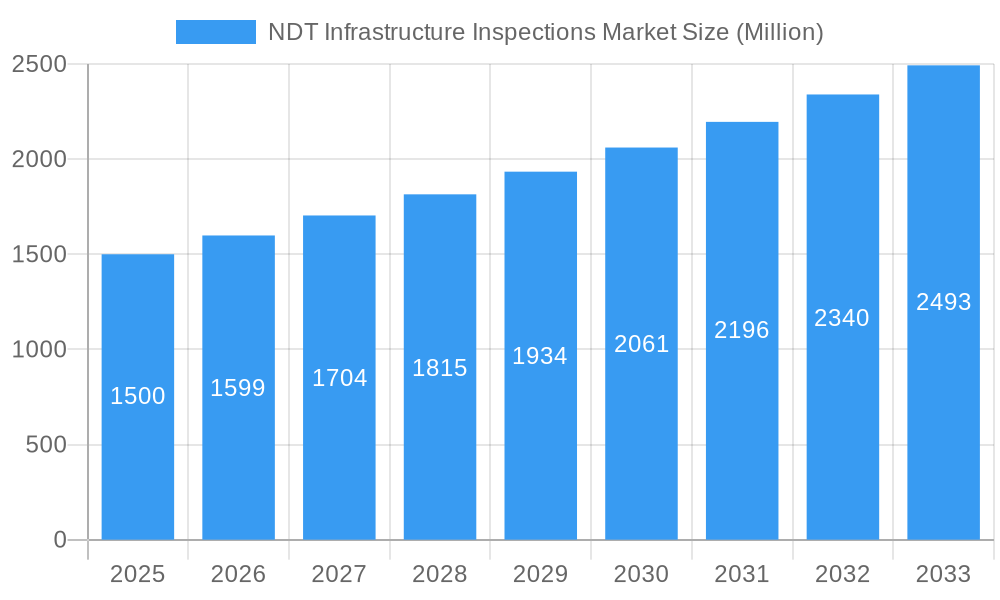

The Non-Destructive Testing (NDT) infrastructure inspections market is poised for significant expansion, driven by aging global infrastructure, stringent safety mandates, and the increasing adoption of advanced NDT solutions. The market, valued at $10.36 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% through 2033. Key catalysts include robust growth in the construction and industrial sectors, particularly in emerging economies, and the critical need for preventative maintenance to safeguard and prolong the life of vital assets such as bridges, pipelines, and buildings. The market is segmented by end-user industry (construction, industrial, real estate, and others), testing type (equipment, services), and technology (radiographic, ultrasonic, magnetic particle, liquid penetrant, visual, acoustic emission, thermography, laser scanning, and others). Innovations like laser scanning and thermography are enhancing accuracy and efficiency, fueling market adoption. However, substantial initial investment costs and a scarcity of skilled professionals present market challenges. While North America and Europe currently dominate, the Asia-Pacific region is expected to lead growth due to accelerated infrastructure development and increased government investment. Leading players like Intertek, Applus, SGS, and Mistras Group are focusing on technological innovation and strategic alliances to maintain a competitive edge.

NDT Infrastructure Inspections Market Market Size (In Billion)

Future market trajectory is contingent on sustained investment in NDT technology R&D and concerted efforts to bridge the industry's skills gap. Mandated infrastructure inspections and a growing emphasis on sustainability are expected to further stimulate market growth. Opportunities abound for specialized providers and technology vendors across diverse market segments. The integration of digitalization and data analytics will elevate operational efficiency and decision-making, leading to optimized maintenance strategies and improved infrastructure safety. This market's expansion is shaped by a confluence of technological advancements, regulatory imperatives, economic dynamics, and the overarching concern for infrastructure integrity and public safety.

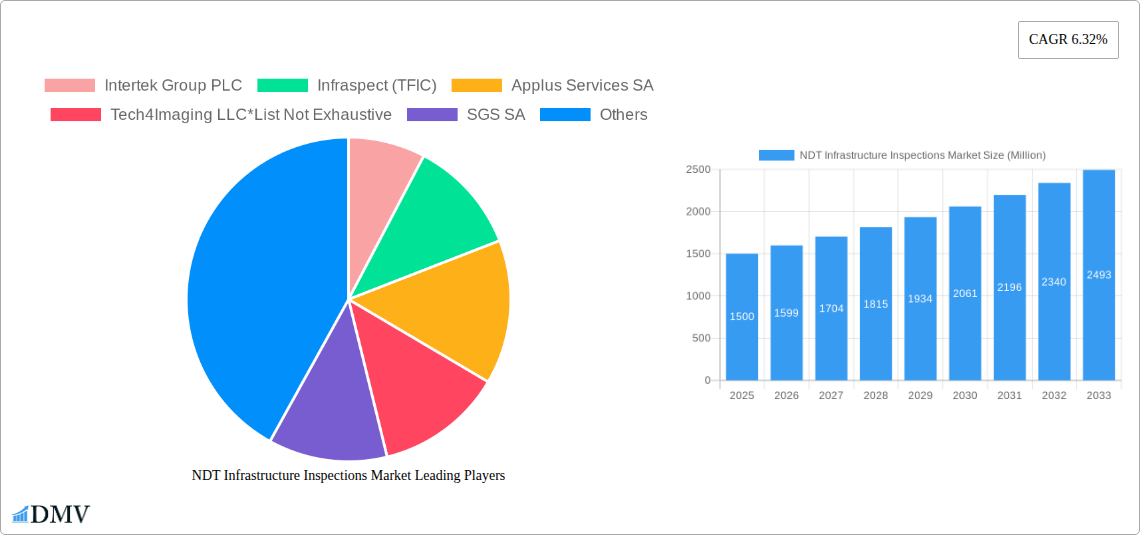

NDT Infrastructure Inspections Market Company Market Share

NDT Infrastructure Inspections Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the NDT Infrastructure Inspections Market, offering a comprehensive analysis of market trends, leading players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the market dynamics and capitalize on emerging opportunities within this rapidly evolving sector. The market size is projected to reach xx Million by 2033.

NDT Infrastructure Inspections Market Composition & Trends

The NDT Infrastructure Inspections Market exhibits a moderately concentrated landscape, with key players like Intertek Group PLC, Applus Services SA, and SGS SA holding significant market share. However, the market is also characterized by the presence of numerous smaller, specialized firms. The market share distribution is as follows (2024): Intertek Group PLC (15%), Applus Services SA (12%), SGS SA (10%), Others (63%). Innovation in NDT technologies, driven by the need for improved accuracy, speed, and safety, is a key catalyst for market growth. Stringent regulatory frameworks emphasizing infrastructure safety and maintenance across various regions further propel market expansion. Substitute products, primarily visual inspections and limited destructive testing, are gradually losing ground due to the increasing demand for precise, non-destructive assessment capabilities. End-user profiles are diverse, encompassing construction, industrial, and real estate sectors, each with specific NDT requirements. M&A activity has been moderate, with deal values averaging xx Million in recent years, reflecting the ongoing consolidation within the sector.

- Market Concentration: Moderately concentrated, with a few major players holding significant share.

- Innovation Catalysts: Advancements in ultrasonic, radiographic, and laser scanning technologies.

- Regulatory Landscape: Stringent regulations driving demand for NDT inspections.

- Substitute Products: Visual inspections and limited destructive testing.

- End-User Profiles: Construction, industrial, real estate, and other sectors.

- M&A Activity: Moderate, with deal values averaging xx Million.

NDT Infrastructure Inspections Market Industry Evolution

The NDT Infrastructure Inspections Market has experienced steady growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to the increasing focus on infrastructure maintenance and rehabilitation globally, coupled with advancements in NDT technologies. The market is witnessing a shift towards more sophisticated and automated solutions, driven by the need for enhanced efficiency and accuracy. This includes the integration of AI and machine learning in data analysis and the development of advanced sensors. Demand for services is rising faster than equipment, reflecting the preference for outsourcing specialized expertise. Adoption of advanced technologies like laser scanning and thermography is gradually increasing, though ultrasonic and radiographic testing remain dominant due to their maturity and reliability. Consumer demand is shifting towards faster turnaround times, higher accuracy, and minimized disruption during inspections. The market is also seeing increased demand for reporting and data management tools for seamless integration with infrastructure management systems.

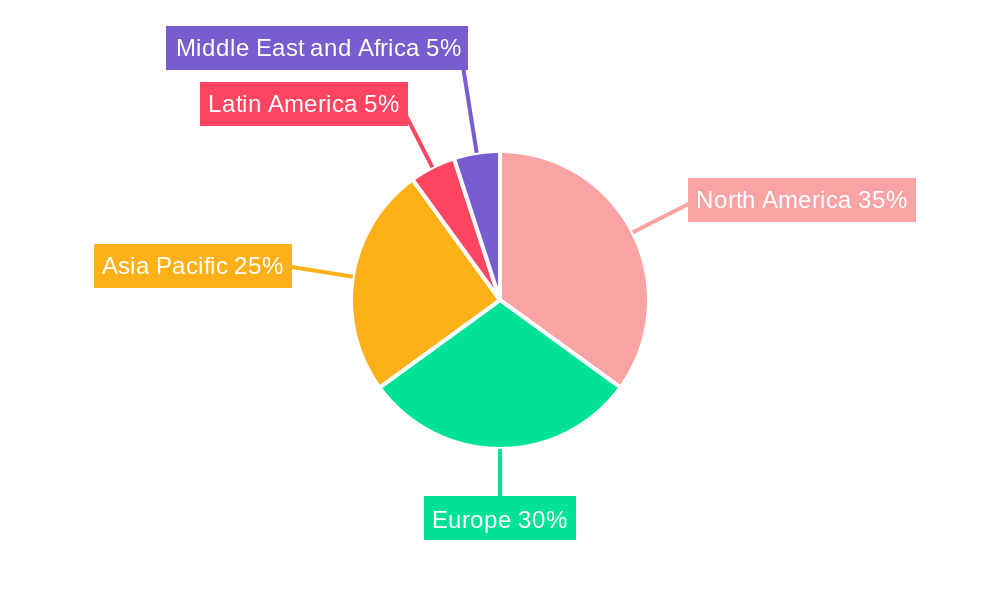

Leading Regions, Countries, or Segments in NDT Infrastructure Inspections Market

The North American region currently dominates the NDT Infrastructure Inspections Market, driven by extensive infrastructure investment, stringent safety regulations, and technological advancements. Within North America, the United States holds the largest market share.

- Dominant Regions/Countries: North America (particularly the US), followed by Europe and Asia-Pacific.

- Dominant End-user Industries: Construction and Industrial sectors currently dominate, followed by Real Estate.

- Dominant Types: Services segment is experiencing faster growth than equipment due to outsourcing preference.

- Dominant Technologies: Ultrasonic and Radiographic testing continue to hold the largest market share.

Key Drivers:

- High Infrastructure Spending: Significant investments in infrastructure projects across major economies.

- Stringent Safety Regulations: Government mandates for regular infrastructure inspections.

- Technological Advancements: Development of faster, more accurate, and portable NDT equipment.

The dominance of North America stems from factors such as high levels of infrastructure spending, stringent safety regulations, and the presence of major players in the NDT equipment and services industry. The construction and industrial sectors are major drivers due to the critical need for regular inspections of bridges, pipelines, and other critical infrastructure.

NDT Infrastructure Inspections Market Product Innovations

Recent innovations have focused on enhancing the speed, accuracy, and portability of NDT equipment. The introduction of advanced imaging software, coupled with AI-powered data analysis, has significantly improved the efficiency of defect detection and reporting. The development of robotic inspection systems and drone-based technologies is streamlining inspection processes for hard-to-reach areas. Unique selling propositions (USPs) include improved resolution, faster scanning speeds, reduced operational costs, and user-friendly interfaces. These advancements cater to the evolving needs for enhanced accuracy, efficiency, and safety in infrastructure inspections.

Propelling Factors for NDT Infrastructure Inspections Market Growth

Several factors are driving market growth. Technological advancements like improved sensors and data analytics are boosting efficiency and accuracy. Government regulations mandating infrastructure inspections are creating consistent demand. Economic factors like increased infrastructure investment in developing economies are further contributing to market expansion. For instance, the increasing focus on aging infrastructure rehabilitation in both developed and developing countries is significantly impacting the growth of this market.

Obstacles in the NDT Infrastructure Inspections Market

Challenges include regulatory hurdles in certain regions, supply chain disruptions impacting the availability of critical components, and intense competition from established and emerging players. These factors can lead to increased costs, project delays, and reduced profit margins for companies operating in this space. Supply chain disruptions have caused significant price fluctuations in certain NDT equipment and materials, affecting the profitability of service providers.

Future Opportunities in NDT Infrastructure Inspections Market

Emerging opportunities lie in the application of advanced technologies like AI and machine learning for predictive maintenance and automated defect detection. Expanding into new markets, especially in developing countries with growing infrastructure needs, presents significant potential. The development of specialized NDT solutions for specific infrastructure types (e.g., wind turbines, high-speed rail) will also create new market segments.

Major Players in the NDT Infrastructure Inspections Market Ecosystem

- Intertek Group PLC

- Infraspect (TFIC)

- Applus Services SA

- Tech4Imaging LLC

- SGS SA

- Mistras Group Inc

- Acuren Group Inc

- ROSEN Group

- Bureau Veritas SA

- Olympus Corporation

- Teledyne FLIR LLC

Key Developments in NDT Infrastructure Inspections Market Industry

- November 2022: Toshiba Corporation developed the SSLM for ultrasonic NDT, eliminating the need for liquid couplants and improving performance. This innovation significantly enhances the efficiency and practicality of ultrasonic testing, potentially boosting market adoption.

- September 2022: JME Ltd.'s partnership with DÜRR NDT for improved infrastructural testing, specifically weld inspection, highlights the ongoing collaboration and innovation within the NDT sector, which should lead to more effective and efficient inspection methods.

Strategic NDT Infrastructure Inspections Market Forecast

The NDT Infrastructure Inspections Market is poised for continued growth, driven by factors such as increasing infrastructure investment, stringent safety regulations, and technological advancements. The market is expected to witness significant expansion in emerging economies, as well as increased adoption of advanced NDT technologies. The focus on predictive maintenance and digitalization will further drive market growth and create new opportunities for market participants. The market's future trajectory is strongly tied to global infrastructure development initiatives and the ongoing evolution of NDT technologies.

NDT Infrastructure Inspections Market Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Technology

- 2.1. Radiographic Testing

- 2.2. Ultrasonic Testing

- 2.3. Magnetic Particle Testing

- 2.4. Liquid Penetrant Testing

- 2.5. Visual Testing

- 2.6. Acoustic Emission Testing

- 2.7. Thermography Testing

- 2.8. Laser Scanning Testing

- 2.9. Other Technologies

-

3. End-user Industry

- 3.1. Construction Industry

- 3.2. Industrial Sector

- 3.3. Real Estate Industry

- 3.4. Other End-user Industries

NDT Infrastructure Inspections Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

NDT Infrastructure Inspections Market Regional Market Share

Geographic Coverage of NDT Infrastructure Inspections Market

NDT Infrastructure Inspections Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations Mandating Safety Standard in the Infrastructure Industry; Growth in Infrastructure Maintenance Services

- 3.3. Market Restrains

- 3.3.1. NDT Services In Other Industries Restraining the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Investment in Construction Sector to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radiographic Testing

- 5.2.2. Ultrasonic Testing

- 5.2.3. Magnetic Particle Testing

- 5.2.4. Liquid Penetrant Testing

- 5.2.5. Visual Testing

- 5.2.6. Acoustic Emission Testing

- 5.2.7. Thermography Testing

- 5.2.8. Laser Scanning Testing

- 5.2.9. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Construction Industry

- 5.3.2. Industrial Sector

- 5.3.3. Real Estate Industry

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Equipment

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Radiographic Testing

- 6.2.2. Ultrasonic Testing

- 6.2.3. Magnetic Particle Testing

- 6.2.4. Liquid Penetrant Testing

- 6.2.5. Visual Testing

- 6.2.6. Acoustic Emission Testing

- 6.2.7. Thermography Testing

- 6.2.8. Laser Scanning Testing

- 6.2.9. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Construction Industry

- 6.3.2. Industrial Sector

- 6.3.3. Real Estate Industry

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Equipment

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Radiographic Testing

- 7.2.2. Ultrasonic Testing

- 7.2.3. Magnetic Particle Testing

- 7.2.4. Liquid Penetrant Testing

- 7.2.5. Visual Testing

- 7.2.6. Acoustic Emission Testing

- 7.2.7. Thermography Testing

- 7.2.8. Laser Scanning Testing

- 7.2.9. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Construction Industry

- 7.3.2. Industrial Sector

- 7.3.3. Real Estate Industry

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Equipment

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Radiographic Testing

- 8.2.2. Ultrasonic Testing

- 8.2.3. Magnetic Particle Testing

- 8.2.4. Liquid Penetrant Testing

- 8.2.5. Visual Testing

- 8.2.6. Acoustic Emission Testing

- 8.2.7. Thermography Testing

- 8.2.8. Laser Scanning Testing

- 8.2.9. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Construction Industry

- 8.3.2. Industrial Sector

- 8.3.3. Real Estate Industry

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Equipment

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Radiographic Testing

- 9.2.2. Ultrasonic Testing

- 9.2.3. Magnetic Particle Testing

- 9.2.4. Liquid Penetrant Testing

- 9.2.5. Visual Testing

- 9.2.6. Acoustic Emission Testing

- 9.2.7. Thermography Testing

- 9.2.8. Laser Scanning Testing

- 9.2.9. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Construction Industry

- 9.3.2. Industrial Sector

- 9.3.3. Real Estate Industry

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa NDT Infrastructure Inspections Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Equipment

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Radiographic Testing

- 10.2.2. Ultrasonic Testing

- 10.2.3. Magnetic Particle Testing

- 10.2.4. Liquid Penetrant Testing

- 10.2.5. Visual Testing

- 10.2.6. Acoustic Emission Testing

- 10.2.7. Thermography Testing

- 10.2.8. Laser Scanning Testing

- 10.2.9. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Construction Industry

- 10.3.2. Industrial Sector

- 10.3.3. Real Estate Industry

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infraspect (TFIC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Applus Services SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tech4Imaging LLC*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SGS SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mistras Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Acuren Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ROSEN Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Olympus Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne FLIR LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global NDT Infrastructure Inspections Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America NDT Infrastructure Inspections Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America NDT Infrastructure Inspections Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America NDT Infrastructure Inspections Market Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America NDT Infrastructure Inspections Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America NDT Infrastructure Inspections Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America NDT Infrastructure Inspections Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America NDT Infrastructure Inspections Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America NDT Infrastructure Inspections Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe NDT Infrastructure Inspections Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe NDT Infrastructure Inspections Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe NDT Infrastructure Inspections Market Revenue (billion), by Technology 2025 & 2033

- Figure 13: Europe NDT Infrastructure Inspections Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe NDT Infrastructure Inspections Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe NDT Infrastructure Inspections Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe NDT Infrastructure Inspections Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe NDT Infrastructure Inspections Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific NDT Infrastructure Inspections Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific NDT Infrastructure Inspections Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific NDT Infrastructure Inspections Market Revenue (billion), by Technology 2025 & 2033

- Figure 21: Asia Pacific NDT Infrastructure Inspections Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific NDT Infrastructure Inspections Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific NDT Infrastructure Inspections Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific NDT Infrastructure Inspections Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific NDT Infrastructure Inspections Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America NDT Infrastructure Inspections Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin America NDT Infrastructure Inspections Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America NDT Infrastructure Inspections Market Revenue (billion), by Technology 2025 & 2033

- Figure 29: Latin America NDT Infrastructure Inspections Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America NDT Infrastructure Inspections Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Latin America NDT Infrastructure Inspections Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America NDT Infrastructure Inspections Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America NDT Infrastructure Inspections Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa NDT Infrastructure Inspections Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East and Africa NDT Infrastructure Inspections Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa NDT Infrastructure Inspections Market Revenue (billion), by Technology 2025 & 2033

- Figure 37: Middle East and Africa NDT Infrastructure Inspections Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa NDT Infrastructure Inspections Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa NDT Infrastructure Inspections Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa NDT Infrastructure Inspections Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa NDT Infrastructure Inspections Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 15: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global NDT Infrastructure Inspections Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NDT Infrastructure Inspections Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the NDT Infrastructure Inspections Market?

Key companies in the market include Intertek Group PLC, Infraspect (TFIC), Applus Services SA, Tech4Imaging LLC*List Not Exhaustive, SGS SA, Mistras Group Inc, Acuren Group Inc, ROSEN Group, Bureau Veritas SA, Olympus Corporation, Teledyne FLIR LLC.

3. What are the main segments of the NDT Infrastructure Inspections Market?

The market segments include Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations Mandating Safety Standard in the Infrastructure Industry; Growth in Infrastructure Maintenance Services.

6. What are the notable trends driving market growth?

Growing Investment in Construction Sector to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

NDT Services In Other Industries Restraining the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2022: Toshiba Corporation developed a Sliding Sheet-Lattice Matrix (SSLM) for ultrasonic nondestructive testing in infrastructure maintenance and inspections. SSLM does not require the application of a liquid couplant, such as liquid gel, and combines high performance for passing ultrasonic waves with smooth device operability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NDT Infrastructure Inspections Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NDT Infrastructure Inspections Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NDT Infrastructure Inspections Market?

To stay informed about further developments, trends, and reports in the NDT Infrastructure Inspections Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence