Key Insights

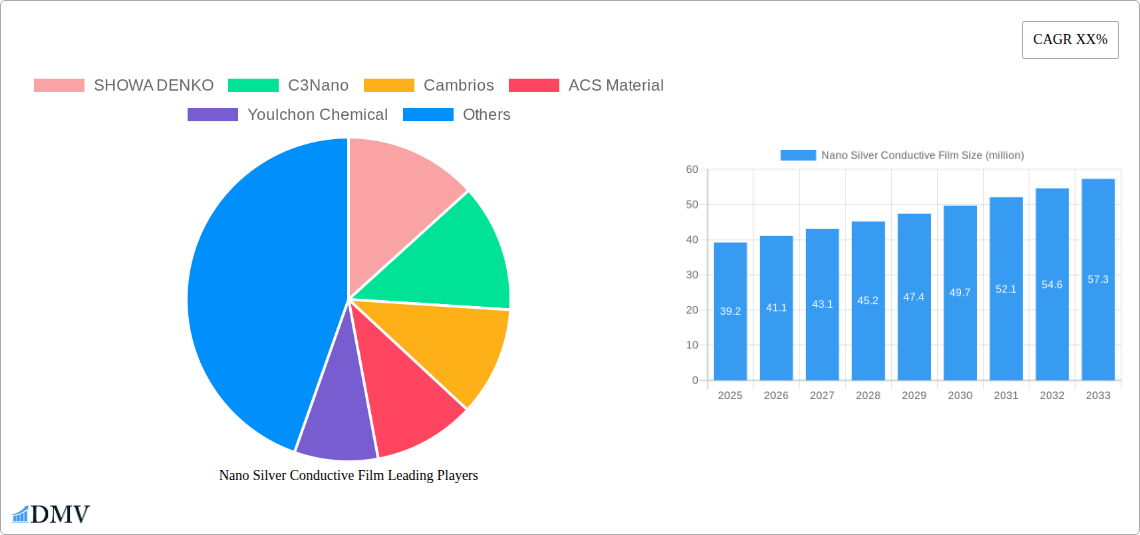

The Nano Silver Conductive Film market is poised for significant expansion, projected to reach approximately $39.2 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.9% over the forecast period. This growth trajectory is primarily driven by the escalating demand for advanced display technologies across a myriad of consumer electronics. The indispensable role of nano silver conductive films in enabling transparent and flexible circuitry for smartphones and tablet computers, which continue to dominate consumer preference, forms a cornerstone of this market's upward trend. Furthermore, the burgeoning adoption of these films in thin-film solar cells, contributing to the global shift towards renewable energy, and the increasing integration into OLED displays for enhanced performance and aesthetics, are significant catalysts. The market is characterized by continuous innovation in material science, leading to the development of films with superior conductivity, flexibility, and durability, thereby opening new avenues for application and fueling market expansion.

Nano Silver Conductive Film Market Size (In Million)

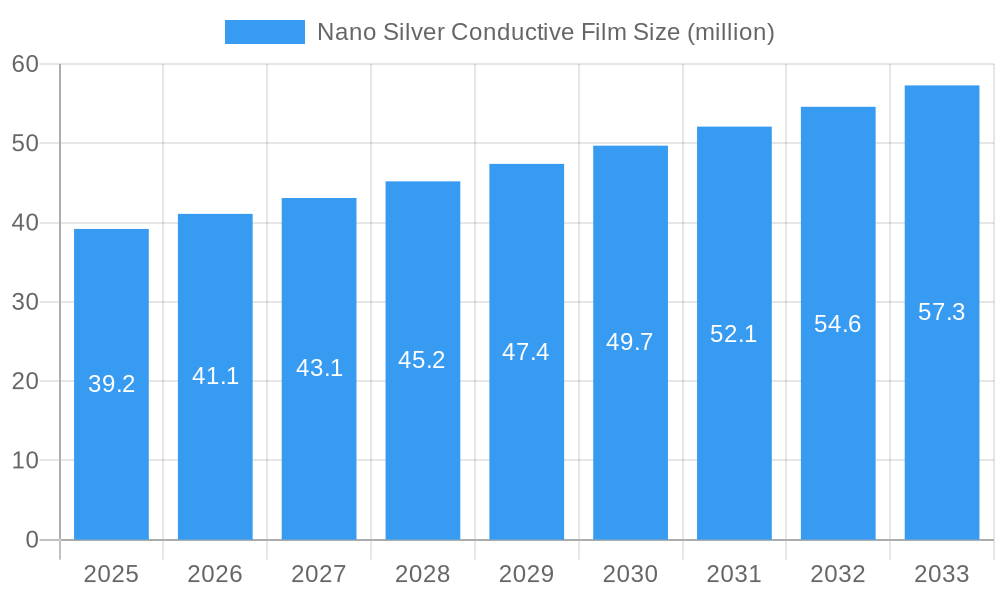

The market is segmented by application and type, reflecting the diverse utility and specialized requirements of nano silver conductive films. Key applications include Smartphones, Tablet Computers, Thin Film Solar Cells, and OLED, alongside a category for 'Others' that encompasses emerging uses. In terms of type, the films are categorized by thickness, with segments such as Below 50µm, 50-100µm, 100-150µm, and 'Others' indicating the precision engineering involved. While the market benefits from strong demand drivers, certain restraints, such as the cost of raw materials and the complexity of manufacturing processes, could influence its pace. However, ongoing research and development efforts by leading companies like SHOWA DENKO, C3Nano, and Cambrios are focused on overcoming these challenges, developing more cost-effective and efficient production methods, and exploring novel applications, thereby solidifying the market's promising future.

Nano Silver Conductive Film Company Market Share

Nano Silver Conductive Film Market Outlook: A Comprehensive Analysis & Strategic Forecast (2019–2033)

This in-depth market research report provides an unparalleled analysis of the global Nano Silver Conductive Film market, offering critical insights for stakeholders navigating this dynamic and rapidly evolving sector. Spanning the historical period of 2019–2024, the base year of 2025, and extending through a comprehensive forecast period from 2025–2033, this report delves into market composition, industry evolution, regional dominance, product innovation, growth drivers, market obstacles, emerging opportunities, key industry players, and significant developments. With a focus on high-ranking keywords such as "nano silver conductive film," "transparent conductive film," "silver nanowire," "OLED," "thin-film solar cells," and "smartphones," this report is optimized for maximum search visibility and stakeholder engagement. We analyze key applications including Smartphones, Tablet Computers, Thin Film Solar Cells, OLED, and Others, alongside critical product types such as Below 50um, 50-100um, 100-150um, and Others.

Nano Silver Conductive Film Market Composition & Trends

The global Nano Silver Conductive Film market, valued at approximately xxx million in the base year of 2025, exhibits a moderate to high level of market concentration. Key innovation catalysts driving this market include ongoing advancements in nanotechnology, increasing demand for flexible and transparent electronics, and a growing emphasis on energy-efficient display technologies. The regulatory landscape, while not overly restrictive, is increasingly focusing on material safety and environmental impact, influencing manufacturing processes and product development. Substitute products, such as Indium Tin Oxide (ITO) and conductive polymers, continue to present competitive challenges, particularly in cost-sensitive applications. End-user profiles are diverse, encompassing consumer electronics manufacturers, renewable energy companies, and automotive suppliers. Mergers and acquisitions (M&A) activities are on the rise, signaling consolidation and strategic partnerships to enhance technological capabilities and market reach. Projected M&A deal values are expected to reach xxx million during the forecast period.

- Market Share Distribution: Dominant players are expected to hold approximately xx% of the market share by 2025, with the remaining xx% distributed among emerging and niche manufacturers.

- Innovation Catalysts:

- Development of enhanced silver nanowire dispersion techniques.

- Improved film flexibility and durability for foldable displays.

- Cost reduction initiatives through optimized manufacturing processes.

- Regulatory Landscape: Focus on REACH compliance and RoHS directives for hazardous substances.

- Substitute Products: ITO film, conductive polymers, metal mesh.

- End-User Segments:

- Consumer Electronics: xx%

- Renewable Energy: xx%

- Automotive: xx%

- M&A Activities: Driven by companies seeking to acquire advanced material technologies and expand their product portfolios.

Nano Silver Conductive Film Industry Evolution

The Nano Silver Conductive Film industry has witnessed a remarkable evolution, transitioning from a nascent technology to a critical component in advanced electronic devices. Over the historical period of 2019–2024, the market experienced robust growth, fueled by the increasing miniaturization of electronics and the demand for higher performance transparent conductive films. The base year of 2025 marks a significant milestone, with the market size projected to reach xxx million, demonstrating an impressive Compound Annual Growth Rate (CAGR) of approximately xx% from 2019. This growth trajectory is intrinsically linked to the rapid advancements in nanotechnology, particularly in the synthesis and application of silver nanowires. The development of highly transparent, electrically conductive films with superior flexibility and durability has been a game-changer, enabling novel applications in areas previously dominated by less adaptable materials like Indium Tin Oxide (ITO).

Consumer demand for immersive and interactive experiences has propelled the adoption of technologies such as OLED displays and flexible touchscreens, where nano silver conductive films excel. The report projects that by 2033, the market size will ascend to xxx million, sustaining a significant CAGR of xx% during the forecast period (2025–2033). This sustained growth is attributed to continued technological innovation, such as the development of patterned silver nanowire films that offer enhanced conductivity and reduced optical haze, as well as the exploration of new material formulations to further improve performance and reduce costs. The increasing integration of these films in thin-film solar cells, driven by the global push for renewable energy solutions, also represents a substantial growth avenue. Furthermore, the evolution of the manufacturing processes, from batch production to more scalable roll-to-roll manufacturing, has significantly contributed to the cost-effectiveness and wider accessibility of nano silver conductive films, further solidifying their market position. Shifting consumer preferences towards more sustainable and energy-efficient electronic devices also play a crucial role, as nano silver conductive films offer a compelling alternative with a potentially lower environmental footprint compared to some traditional materials. The industry's ability to adapt to these evolving demands, coupled with continuous research and development, ensures its continued relevance and expansion in the global electronics landscape.

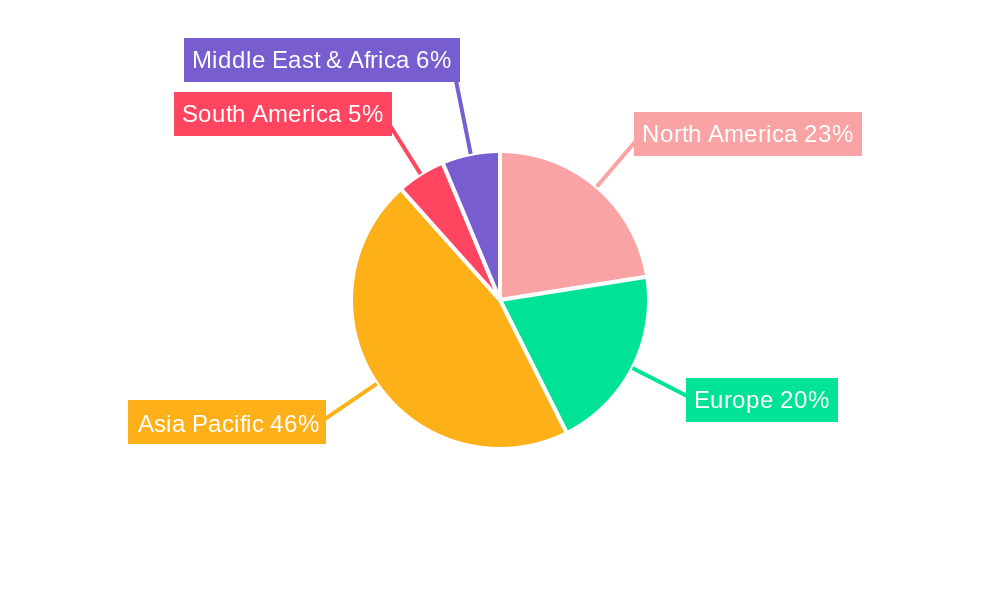

Leading Regions, Countries, or Segments in Nano Silver Conductive Film

The global Nano Silver Conductive Film market is characterized by dynamic regional leadership and segment dominance, driven by a confluence of technological advancements, manufacturing capabilities, and end-user demand. Among the key application segments, Smartphones are currently leading the charge, accounting for an estimated xx% of the market in the base year of 2025. This dominance is directly attributed to the sheer volume of smartphone production worldwide and the increasing demand for higher resolution, brighter, and more energy-efficient displays, where nano silver conductive films offer superior optical clarity and conductivity compared to traditional alternatives. The continuous innovation in smartphone design, particularly the trend towards larger, bezel-less, and foldable displays, further bolsters the demand for flexible and transparent conductive materials.

In terms of product types, films with thicknesses Below 50um are currently the most prevalent, representing approximately xx% of the market. This preference is driven by the need for ultra-thin and lightweight components in portable electronic devices, where space and weight are critical design considerations. The manufacturing processes for producing these thinner films have also matured, leading to better yield and cost-effectiveness.

Regionally, Asia Pacific stands out as the dominant force in the Nano Silver Conductive Film market, projected to hold over xx% of the global market share in 2025. This dominance is underpinned by several key factors:

- Dominant Manufacturing Hubs: Countries like China, South Korea, and Taiwan are home to a significant concentration of electronics manufacturers, including leading smartphone and display producers, creating a substantial local demand for nano silver conductive films.

- Technological Innovation and R&D: These regions are at the forefront of nanotechnology research and development, with numerous companies actively investing in the production and application of silver nanowires and other nano-scale conductive materials.

- Government Support and Investment: Favorable government policies, subsidies, and investments in advanced materials and high-tech industries have fostered a conducive environment for the growth of the nano silver conductive film sector.

- Extensive Supply Chains: The established and robust supply chains for electronic components and materials within Asia Pacific ensure efficient sourcing and integration of nano silver conductive films into finished products.

While Smartphones currently lead in application dominance, other segments like OLED and Thin Film Solar Cells are experiencing rapid growth and are expected to gain significant market share over the forecast period. The increasing adoption of OLED technology in televisions, wearables, and automotive displays, along with the global imperative to transition to renewable energy sources, will drive substantial demand for nano silver conductive films in these applications. The development of specialized films tailored for these specific use cases, offering optimized conductivity and transparency for different lighting conditions and power generation needs, will be crucial for future market expansion.

Nano Silver Conductive Film Product Innovations

Nano Silver Conductive Film innovations are continuously pushing the boundaries of electronic device performance and design. Key advancements include the development of ultra-high transparency films with minimal optical haze, crucial for advanced display technologies like OLED and virtual reality devices. Enhanced flexibility and stretchability are being achieved through novel binder materials and nanowire network architectures, enabling seamless integration into foldable smartphones and wearable electronics. Performance metrics are seeing significant improvements, with conductivity levels rivaling traditional ITO, while offering superior durability and scratch resistance. Applications are expanding beyond touchscreens to include electromagnetic shielding, flexible heaters, and even bio-sensors, showcasing the versatility of this advanced material. The unique selling proposition lies in its combination of transparency, conductivity, and flexibility, offering a compelling alternative for next-generation electronic products.

Propelling Factors for Nano Silver Conductive Film Growth

The rapid growth of the Nano Silver Conductive Film market is propelled by several interconnected factors. Technologically, the continuous improvement in silver nanowire synthesis and dispersion techniques has led to films with superior transparency, conductivity, and uniformity, making them increasingly competitive with established transparent conductive materials like ITO. Economically, the falling cost of silver and advancements in roll-to-roll manufacturing processes are making nano silver conductive films more cost-effective, widening their adoption across various electronic devices. Regulatory support for sustainable and energy-efficient technologies also plays a role, as these films contribute to lighter and more power-efficient devices. The burgeoning demand for flexible displays in smartphones, tablets, and wearables, coupled with the growth of the thin-film solar cell market, are significant market pull factors driving this expansion.

Obstacles in the Nano Silver Conductive Film Market

Despite its promising growth, the Nano Silver Conductive Film market faces several obstacles. Regulatory hurdles related to the long-term environmental impact and potential health concerns of nanomaterials, although evolving, can create uncertainty and necessitate further safety testing. Supply chain disruptions, particularly concerning the availability and price volatility of high-purity silver, can impact production costs and lead times. Competitive pressures from alternative transparent conductive materials, such as metal mesh and conductive polymers, which may offer certain advantages in specific applications or at lower price points, continue to challenge market penetration. Furthermore, achieving consistent, large-scale production of high-performance, defect-free films remains a technical challenge for some manufacturers, potentially impacting yield and overall cost-effectiveness.

Future Opportunities in Nano Silver Conductive Film

The future of the Nano Silver Conductive Film market is rich with opportunities. Emerging markets for flexible and transparent electronics, including smart windows, in-vehicle displays, and advanced medical devices, present significant untapped potential. Advancements in material science are leading to the development of hybrid films that combine the benefits of silver nanowires with other conductive materials, offering enhanced performance characteristics. The growing demand for IoT devices and wearable technology will necessitate lightweight, flexible, and highly conductive components, a niche where nano silver conductive films are ideally positioned. Furthermore, the increasing focus on sustainable energy solutions will drive demand for cost-effective and efficient transparent electrodes in next-generation solar cells and potentially in advanced battery technologies.

Major Players in the Nano Silver Conductive Film Ecosystem

- SHOWA DENKO

- C3Nano

- Cambrios

- ACS Material

- Youlchon Chemical

- iVTouch Co.,Ltd.

- Shantou Wanshun

- Hefei Weijing Material Technology Co.,Ltd.

- Guangdong Nanhai ETEB Technology

- Beijing Nanotop

- Tianjin Baoxingwei Technology Co. Ltd.

- Jiangsu Yilikim

- Ningbo Coating and Optronics

- Suzhou Cold Stone Nano Material

- Nuovo Film Inc

- Chengdu Mogreat Material

Key Developments in Nano Silver Conductive Film Industry

- 2023 Q4: C3Nano announces a new generation of transparent conductive films with improved flexibility and conductivity, targeting foldable display applications.

- 2023 Q3: Cambrios secures significant funding to scale up its silver nanowire production capacity, addressing growing demand from the smartphone sector.

- 2023 Q2: ACS Material launches a new nano silver ink formulation for high-volume printing of conductive patterns on flexible substrates.

- 2023 Q1: Youlchon Chemical expands its R&D efforts into developing nano silver conductive films for advanced solar cell applications, aiming to improve efficiency.

- 2022 Q4: iVTouch Co.,Ltd. introduces an innovative integrated touch sensor using nano silver conductive film, reducing bill of materials for consumer electronics.

- 2022 Q3: Shantou Wanshun showcases a new sputtering-based nano silver conductive film with exceptional scratch resistance.

- 2022 Q2: Hefei Weijing Material Technology Co.,Ltd. patents a novel binder system for nano silver conductive films, enhancing durability and adhesion.

- 2022 Q1: Guangdong Nanhai ETEB Technology announces a strategic partnership to integrate its nano silver conductive films into smart textile applications.

- 2021 Q4: Beijing Nanotop unveils a high-transparency nano silver conductive film with significantly reduced optical haze for next-generation AR/VR headsets.

- 2021 Q3: Tianjin Baoxingwei Technology Co. Ltd. expands its product portfolio to include patterned nano silver conductive films for specialized electronic circuits.

- 2021 Q2: Jiangsu Yilikim focuses on developing eco-friendly manufacturing processes for nano silver conductive films.

- 2021 Q1: Ningbo Coating and Optronics introduces ultra-thin nano silver conductive films for ultra-portable electronic devices.

- 2020 Q4: Suzhou Cold Stone Nano Material achieves breakthroughs in uniform silver nanowire dispersion, leading to enhanced conductivity consistency.

- 2020 Q3: Nuovo Film Inc develops a cost-effective method for producing large-area nano silver conductive films, suitable for industrial applications.

- 2020 Q2: Chengdu Mogreat Material focuses on the development of nano silver conductive films for flexible sensor applications in the automotive industry.

Strategic Nano Silver Conductive Film Market Forecast

The strategic outlook for the Nano Silver Conductive Film market remains exceptionally positive, driven by robust growth catalysts and emerging opportunities. The continued innovation in display technologies, particularly the widespread adoption of OLED and the evolution of foldable and rollable screens, will sustain significant demand. The burgeoning renewable energy sector, with its increasing reliance on efficient thin-film solar cells, presents a substantial growth avenue. Furthermore, the expanding landscape of IoT devices, wearable technology, and advanced automotive electronics will necessitate the unique properties of nano silver conductive films. As manufacturing processes become more efficient and cost-effective, market penetration will accelerate, solidifying its position as a critical material in the global electronics industry. The market is poised for sustained expansion, driven by technological advancements and evolving consumer demands for more advanced, flexible, and energy-efficient electronic devices.

Nano Silver Conductive Film Segmentation

-

1. Application

- 1.1. Smartphones

- 1.2. Tablet Computer

- 1.3. Thin Film Solar Cells

- 1.4. OLED

- 1.5. Others

-

2. Types

- 2.1. Below 50um

- 2.2. 50-100um

- 2.3. 100-150um

- 2.4. Others

Nano Silver Conductive Film Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nano Silver Conductive Film Regional Market Share

Geographic Coverage of Nano Silver Conductive Film

Nano Silver Conductive Film REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Smartphones

- 5.1.2. Tablet Computer

- 5.1.3. Thin Film Solar Cells

- 5.1.4. OLED

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 50um

- 5.2.2. 50-100um

- 5.2.3. 100-150um

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Smartphones

- 6.1.2. Tablet Computer

- 6.1.3. Thin Film Solar Cells

- 6.1.4. OLED

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 50um

- 6.2.2. 50-100um

- 6.2.3. 100-150um

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Smartphones

- 7.1.2. Tablet Computer

- 7.1.3. Thin Film Solar Cells

- 7.1.4. OLED

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 50um

- 7.2.2. 50-100um

- 7.2.3. 100-150um

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Smartphones

- 8.1.2. Tablet Computer

- 8.1.3. Thin Film Solar Cells

- 8.1.4. OLED

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 50um

- 8.2.2. 50-100um

- 8.2.3. 100-150um

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Smartphones

- 9.1.2. Tablet Computer

- 9.1.3. Thin Film Solar Cells

- 9.1.4. OLED

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 50um

- 9.2.2. 50-100um

- 9.2.3. 100-150um

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nano Silver Conductive Film Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Smartphones

- 10.1.2. Tablet Computer

- 10.1.3. Thin Film Solar Cells

- 10.1.4. OLED

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 50um

- 10.2.2. 50-100um

- 10.2.3. 100-150um

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SHOWA DENKO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 C3Nano

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cambrios

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ACS Material

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Youlchon Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 iVTouch Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shantou Wanshun

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hefei Weijing Material Technology Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Guangdong Nanhai ETEB Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Beijing Nanotop

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tianjin Baoxingwei Technology Co. Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Jiangsu Yilikim

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ningbo Coating and Optronics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Suzhou Cold Stone Nano Material

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nuovo Film Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Chengdu Mogreat Material

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 SHOWA DENKO

List of Figures

- Figure 1: Global Nano Silver Conductive Film Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Nano Silver Conductive Film Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Nano Silver Conductive Film Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Nano Silver Conductive Film Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Nano Silver Conductive Film Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Nano Silver Conductive Film Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Nano Silver Conductive Film Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Nano Silver Conductive Film Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Nano Silver Conductive Film Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Nano Silver Conductive Film Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Nano Silver Conductive Film Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Nano Silver Conductive Film Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Nano Silver Conductive Film Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Nano Silver Conductive Film Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Nano Silver Conductive Film Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Nano Silver Conductive Film Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Nano Silver Conductive Film Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Nano Silver Conductive Film Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Nano Silver Conductive Film Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Nano Silver Conductive Film Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Nano Silver Conductive Film Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Nano Silver Conductive Film Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Nano Silver Conductive Film Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Nano Silver Conductive Film Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Nano Silver Conductive Film Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Nano Silver Conductive Film Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Nano Silver Conductive Film Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Nano Silver Conductive Film Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Nano Silver Conductive Film Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Nano Silver Conductive Film Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Nano Silver Conductive Film Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Nano Silver Conductive Film Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Nano Silver Conductive Film Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Nano Silver Conductive Film Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Nano Silver Conductive Film Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Nano Silver Conductive Film Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Nano Silver Conductive Film Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Nano Silver Conductive Film Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Nano Silver Conductive Film Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Nano Silver Conductive Film Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nano Silver Conductive Film?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Nano Silver Conductive Film?

Key companies in the market include SHOWA DENKO, C3Nano, Cambrios, ACS Material, Youlchon Chemical, iVTouch Co., Ltd., Shantou Wanshun, Hefei Weijing Material Technology Co., Ltd., Guangdong Nanhai ETEB Technology, Beijing Nanotop, Tianjin Baoxingwei Technology Co. Ltd., Jiangsu Yilikim, Ningbo Coating and Optronics, Suzhou Cold Stone Nano Material, Nuovo Film Inc, Chengdu Mogreat Material.

3. What are the main segments of the Nano Silver Conductive Film?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nano Silver Conductive Film," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nano Silver Conductive Film report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nano Silver Conductive Film?

To stay informed about further developments, trends, and reports in the Nano Silver Conductive Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence