Key Insights

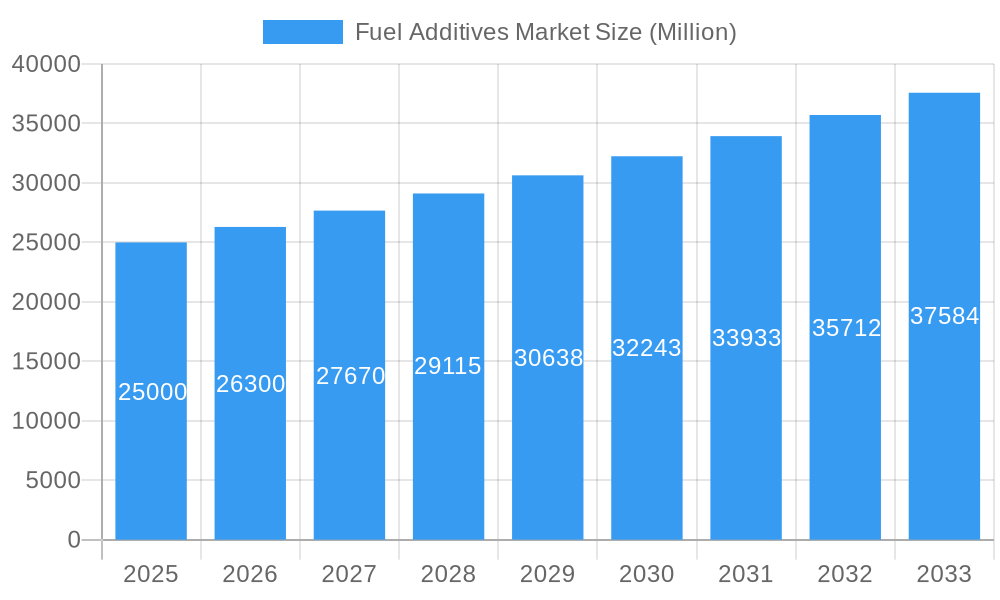

The global Fuel Additives Market is projected to experience robust growth, reaching a significant market size of approximately USD 25,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.09% during the forecast period of 2025-2033. This expansion is primarily driven by an increasing demand for cleaner fuels, stringent emission regulations worldwide, and the continuous need to enhance fuel efficiency and performance. As governments and regulatory bodies implement stricter environmental standards to combat pollution and climate change, the adoption of advanced fuel additives becomes imperative for refiners and fuel distributors. These additives play a crucial role in improving combustion efficiency, reducing harmful emissions like NOx and particulate matter, and preventing deposit formation in engines, thereby extending engine life and reducing maintenance costs. Furthermore, the growing automotive sector, coupled with advancements in engine technology, necessitates the use of high-performance fuels, which in turn fuels the demand for specialized fuel additives.

Fuel Additives Market Market Size (In Billion)

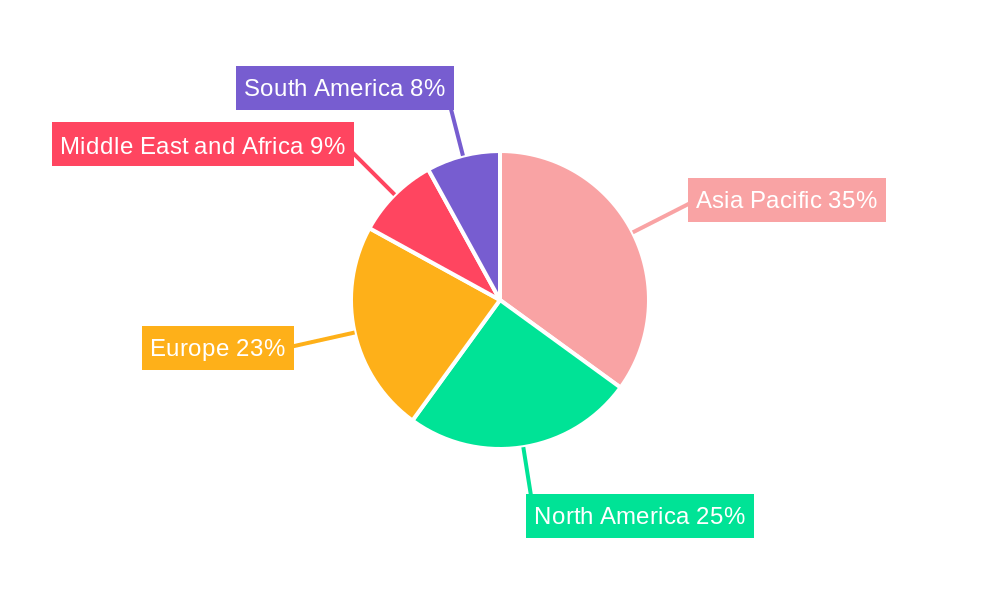

The market is segmented by product type, with Deposit Control additives, Cetane Improvers, and Lubricity Additives expected to witness substantial demand due to their critical roles in maintaining engine health and fuel quality. The growing emphasis on diesel engine efficiency and emissions reduction further propels the demand for these specific additive categories. In terms of applications, Diesel and Gasoline segments are anticipated to dominate the market, reflecting their widespread use in transportation and industrial machinery. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a key growth hub due to rapid industrialization, a burgeoning automotive industry, and increasing fuel consumption. North America and Europe, with their established automotive markets and advanced regulatory frameworks, will also continue to be significant contributors. Key market players are actively engaged in research and development to innovate and introduce new formulations that meet evolving performance and environmental standards, further shaping the competitive landscape of the fuel additives market.

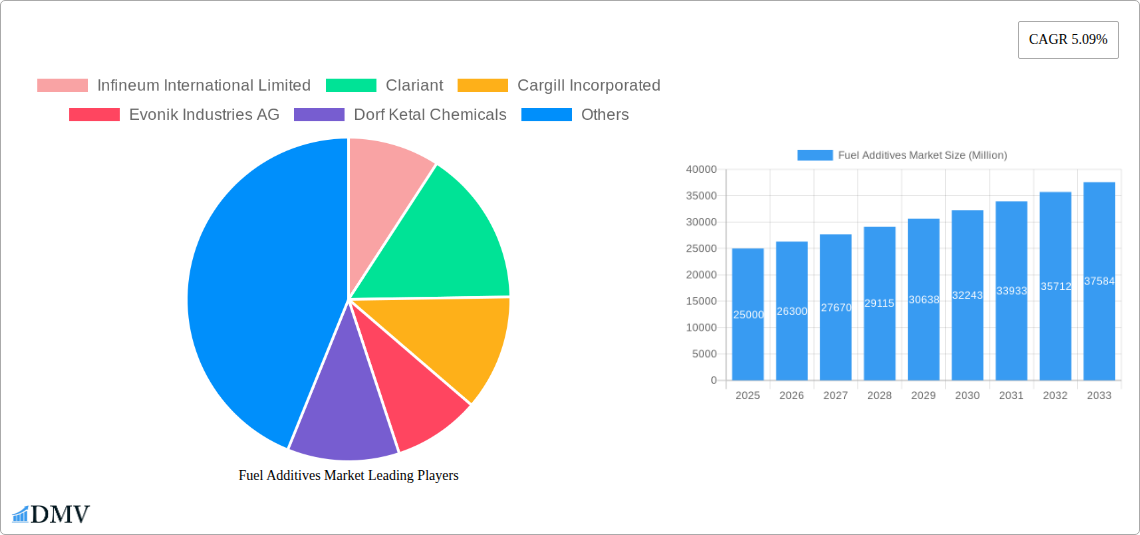

Fuel Additives Market Company Market Share

This in-depth fuel additives market report provides a granular examination of the global landscape, focusing on critical product types like deposit control additives, cetane improvers, lubricity additives, and antioxidants, alongside key applications in diesel, gasoline, and jet fuel. With a comprehensive study period of 2019–2033, including a base year of 2025 and a robust forecast period of 2025–2033, this report offers unparalleled insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging advanced analytics and proprietary data, it empowers stakeholders to make informed strategic decisions in a dynamic and rapidly evolving market. The market is projected to reach an estimated value of XX Million by 2025, driven by increasing demand for enhanced fuel efficiency and emissions reduction.

Fuel Additives Market Market Composition & Trends

The global fuel additives market exhibits a moderately concentrated landscape, with key players like BASF SE, Chevron Corporation, The Lubrizol Corporation, and Exxon Mobil corporation holding significant market share. Innovation catalysts are primarily driven by stringent environmental regulations and the demand for improved engine performance and fuel economy. Regulatory landscapes, particularly in North America and Europe, are pushing for lower emissions and higher quality fuels, directly impacting additive formulation and adoption. Substitute products, while present, often fall short in delivering the comprehensive performance benefits offered by specialized fuel additives. End-user profiles range from large oil corporations and fuel distributors to fleet operators and individual vehicle owners. Mergers and acquisitions (M&A) activities, such as the expansion of Afton Chemical's Singapore facility, signify strategic moves to enhance production capacity and localize supply chains. M&A deal values are estimated to be in the range of XX Million to XX Million, reflecting consolidation and strategic partnerships aimed at market expansion and technological advancement. The market share distribution is characterized by a strong presence of major chemical and petroleum companies, with specialized additive manufacturers carving out niche segments.

- Market Concentration: Moderately concentrated with leading global chemical and petroleum corporations.

- Innovation Catalysts: Stringent emissions standards, demand for fuel efficiency, advanced engine technologies.

- Regulatory Landscapes: Growing influence of environmental regulations (e.g., Euro 7, EPA standards) driving demand for cleaner fuel solutions.

- Substitute Products: Limited direct substitutes offering the same multi-faceted performance enhancements.

- End-User Profiles: Oil majors, fuel distributors, commercial fleet operators, automotive manufacturers, industrial users.

- M&A Activities: Strategic expansions, capacity enhancements, and technology acquisitions to bolster market position.

Fuel Additives Market Industry Evolution

The fuel additives market has witnessed a significant evolution, driven by technological advancements and shifting consumer demands, particularly concerning environmental sustainability and engine performance. Historically, the focus was primarily on octane enhancement and basic detergency. However, the past decade has seen a dramatic shift towards more sophisticated additive packages addressing a broader spectrum of needs. The market trajectory has been consistently upward, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024). Technological advancements have introduced novel chemistries for deposit control, leading to cleaner combustion and reduced emissions. Cetane improvers are increasingly vital for optimizing diesel engine performance and fuel economy, while lubricity additives are crucial for protecting modern, low-sulfur diesel fuel systems from wear. The adoption of advanced engine technologies, including direct injection and exhaust aftertreatment systems, has necessitated the development of highly specialized and compatible fuel additives. Consumer demand has pivoted towards fuels that not only perform efficiently but also contribute to reduced environmental impact. This is evidenced by the growing market share of cold flow improvers in colder climates and the persistent demand for antioxidants and anticorrosion additives to ensure fuel stability and system longevity. The increasing global vehicle parc, particularly in emerging economies, coupled with a growing emphasis on extending the lifespan of existing engines, further propels the industry's growth. Projections indicate a sustained CAGR of XX% from 2025 to 2033, underscoring the enduring relevance and expansion potential of the fuel additives sector. The market size is anticipated to grow from an estimated XX Million in 2025 to XX Million by 2033, reflecting robust underlying demand and continuous innovation.

Leading Regions, Countries, or Segments in Fuel Additives Market

The fuel additives market is dominated by regions and segments that exhibit strong automotive manufacturing presence, stringent environmental regulations, and significant fuel consumption. North America, with its vast automotive industry and evolving emission standards, consistently leads in the demand for advanced fuel additives. The United States, in particular, represents a substantial market share due to its large vehicle parc and the widespread use of both gasoline and diesel fuels. Europe follows closely, driven by the European Union's ambitious environmental directives and a growing consumer preference for fuel-efficient and low-emission vehicles.

Within product types, Deposit Control additives command a significant market share, fueled by the global push for cleaner combustion and improved engine longevity, especially in gasoline and diesel applications. Cetane Improvers are also critically important, particularly in the diesel segment, where they enhance combustion efficiency and reduce particulate matter emissions. Lubricity Additives have gained prominence with the global shift towards low-sulfur diesel fuels, essential for protecting fuel injection systems.

In terms of applications, Diesel fuel additives represent the largest segment. This is attributed to the high consumption of diesel in commercial transportation, industrial machinery, and off-road vehicles, all of which benefit immensely from performance-enhancing additives. The growing adoption of diesel engines in developing economies further bolsters this segment. Gasoline additives follow, driven by the massive global gasoline vehicle fleet and the continuous need for performance optimization and emission control. Jet Fuel additives, while a smaller segment, are crucial for ensuring the safety and performance of aviation, especially in demanding flight conditions.

Dominant Region: North America (primarily the United States)

- Key Drivers: High automotive production, stringent EPA regulations, extensive fuel consumption in transportation and industrial sectors.

- Investment Trends: Significant R&D investment in next-generation additive formulations to meet evolving emission standards.

- Regulatory Support: Favorable regulatory environment encouraging the use of performance-enhancing and emission-reducing fuel additives.

Dominant Product Segment: Deposit Control Additives

- In-depth Analysis: Essential for maintaining engine cleanliness, preventing deposit formation in intake valves, combustion chambers, and fuel injectors, leading to improved fuel efficiency and reduced emissions. Crucial for both gasoline and diesel engines.

- Technological Advancements: Development of multi-functional detergents and dispersants for enhanced performance.

Dominant Application Segment: Diesel Fuel Additives

- In-depth Analysis: Vital for optimizing the performance of diesel engines in heavy-duty vehicles, trucks, buses, and industrial equipment. Addresses issues like cold flow properties, lubricity, and combustion efficiency.

- Market Drivers: Growth in global trade and logistics requiring efficient heavy-duty transportation, increasing adoption of advanced diesel engine technologies.

Fuel Additives Market Product Innovations

Product innovation in the fuel additives market is relentlessly focused on enhancing fuel efficiency, reducing emissions, and extending engine life. Recent advancements include the development of advanced deposit control formulations that offer superior cleaning power, preventing gum and varnish formation in fuel systems, particularly in modern direct-injection engines. New generation cetane improvers are being designed for faster ignition and more complete combustion, leading to reduced NOx emissions and improved fuel economy in diesel engines. Furthermore, the development of bio-compatible lubricity additives is crucial for ensuring the smooth operation of fuel pumps and injectors in engines running on biofuels or blends. Antioxidants are being engineered to provide longer-lasting fuel stability, especially for fuels stored for extended periods. The market is also witnessing the emergence of multifunctional additives that combine several benefits into a single product, offering greater convenience and cost-effectiveness for end-users.

Propelling Factors for Fuel Additives Market Growth

Several key factors are propelling the growth of the fuel additives market. Technological advancements in engine design, necessitating specialized additives for optimal performance and emissions control, are a primary driver. The increasing global demand for cleaner fuels and stricter environmental regulations worldwide are mandating the use of additives that reduce harmful emissions like NOx, SOx, and particulate matter. Furthermore, the growing automotive parc, especially in emerging economies, contributes significantly to the overall fuel consumption and, consequently, the demand for additives. The continuous need to improve fuel efficiency and reduce operational costs for both consumers and commercial fleet operators also fuels the adoption of performance-enhancing additives. Lastly, the focus on extending the lifespan of existing vehicles and machinery through better engine protection drives demand for lubricity additives and anticorrosion agents.

Obstacles in the Fuel Additives Market Market

Despite its robust growth, the fuel additives market faces several obstacles. Stringent and evolving regulatory landscapes can pose challenges, requiring significant R&D investment to reformulate products to meet new standards, particularly concerning biodegradability and toxicity. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of raw materials essential for additive production. Volatile raw material prices also present a significant challenge, affecting profit margins for additive manufacturers. Moreover, the increasing adoption of electric vehicles (EVs), while still a nascent threat to the traditional fuel market, poses a long-term restraint on the demand for fuel additives in the passenger vehicle segment. Intense competitive pressure among established players and emerging manufacturers can also lead to price wars and affect market profitability.

Future Opportunities in Fuel Additives Market

The fuel additives market is ripe with future opportunities, driven by ongoing trends and emerging technologies. The increasing use of renewable fuels and biofuels presents a significant opportunity for developing specialized additives that enhance their stability, performance, and compatibility with existing engine systems. The continuous innovation in heavy-duty diesel engines and their demand for advanced performance and emissions control offers a substantial growth avenue. Furthermore, the exploration of synthetic fuels and alternative fuel sources will require novel additive solutions tailored to their unique chemical properties. The growing focus on performance tuning and engine optimization for both personal and commercial vehicles presents an opportunity for high-performance, specialized additive packages. Emerging markets with rapidly expanding vehicle ownership also offer considerable untapped potential for market penetration.

Major Players in the Fuel Additives Market Ecosystem

- Infineum International Limited

- Clariant

- Cargill Incorporated

- Evonik Industries AG

- Dorf Ketal Chemicals

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Baker Hughes Company

- TotalEnergies SE

- Lanxess

- Innospec

- Afton Chemical

- Exxon Mobil corporation

Key Developments in Fuel Additives Market Industry

- April 2022: Afton Chemical's Greenclean 3, an advancement in diesel fuel detergent technology, was launched in North America. This powerful, creative technology aims to improve the performance of heavy-duty fleets and off-road vehicles equipped with cutting-edge engine technology and pollution control systems.

- March 2022: Afton Chemical Corporation completed the expansion of its phase 3 Singapore Chemical Additive Manufacturing Facility. The objective of this expansion was to incorporate fuel Performance Additives (GPA) blending capabilities, enhancing localized supply chain solutions for its Asian customers.

Strategic Fuel Additives Market Market Forecast

The strategic outlook for the fuel additives market remains highly positive, driven by a confluence of factors. The persistent global demand for enhanced fuel efficiency and reduced environmental impact will continue to be the primary growth catalysts. Ongoing technological advancements in internal combustion engines, coupled with the necessity to comply with ever-stringent emissions regulations, will ensure sustained demand for innovative additive solutions. The projected growth in emerging economies, characterized by an expanding vehicle fleet and industrialization, presents a significant market potential. Furthermore, the increasing integration of renewable and alternative fuels into the existing energy infrastructure will necessitate the development of specialized additives, opening new avenues for market expansion and innovation. The strategic focus on product development, capacity expansion, and regional market penetration by key players will further solidify the market's upward trajectory.

Fuel Additives Market Segmentation

-

1. Product Type

- 1.1. Deposit Control

- 1.2. Cetane Improvers

- 1.3. Lubricity Additives

- 1.4. Antioxidants

- 1.5. Anticorrosion

- 1.6. Cold Flow Improvers

- 1.7. Antiknock Agents

- 1.8. Other Product Types

-

2. Application

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Jet Fuel

- 2.4. Other Applications

Fuel Additives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fuel Additives Market Regional Market Share

Geographic Coverage of Fuel Additives Market

Fuel Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enactment of Stringent Environmental Regulations; Degrading Quality of Crude Oil

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Battery Electric Vehicles (BEVs); High Costs of R&D Activities

- 3.4. Market Trends

- 3.4.1. Gasoline to Dominate the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Deposit Control

- 5.1.2. Cetane Improvers

- 5.1.3. Lubricity Additives

- 5.1.4. Antioxidants

- 5.1.5. Anticorrosion

- 5.1.6. Cold Flow Improvers

- 5.1.7. Antiknock Agents

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Jet Fuel

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Deposit Control

- 6.1.2. Cetane Improvers

- 6.1.3. Lubricity Additives

- 6.1.4. Antioxidants

- 6.1.5. Anticorrosion

- 6.1.6. Cold Flow Improvers

- 6.1.7. Antiknock Agents

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diesel

- 6.2.2. Gasoline

- 6.2.3. Jet Fuel

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Deposit Control

- 7.1.2. Cetane Improvers

- 7.1.3. Lubricity Additives

- 7.1.4. Antioxidants

- 7.1.5. Anticorrosion

- 7.1.6. Cold Flow Improvers

- 7.1.7. Antiknock Agents

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diesel

- 7.2.2. Gasoline

- 7.2.3. Jet Fuel

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Deposit Control

- 8.1.2. Cetane Improvers

- 8.1.3. Lubricity Additives

- 8.1.4. Antioxidants

- 8.1.5. Anticorrosion

- 8.1.6. Cold Flow Improvers

- 8.1.7. Antiknock Agents

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diesel

- 8.2.2. Gasoline

- 8.2.3. Jet Fuel

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Deposit Control

- 9.1.2. Cetane Improvers

- 9.1.3. Lubricity Additives

- 9.1.4. Antioxidants

- 9.1.5. Anticorrosion

- 9.1.6. Cold Flow Improvers

- 9.1.7. Antiknock Agents

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diesel

- 9.2.2. Gasoline

- 9.2.3. Jet Fuel

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Deposit Control

- 10.1.2. Cetane Improvers

- 10.1.3. Lubricity Additives

- 10.1.4. Antioxidants

- 10.1.5. Anticorrosion

- 10.1.6. Cold Flow Improvers

- 10.1.7. Antiknock Agents

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diesel

- 10.2.2. Gasoline

- 10.2.3. Jet Fuel

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineum International Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cargill Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evonik Industries AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dorf Ketal Chemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chevron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Lubrizol Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baker Hughes Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies SE *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lanxess

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Innospec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Afton Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Exxon Mobil corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Infineum International Limited

List of Figures

- Figure 1: Global Fuel Additives Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Fuel Additives Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 5: Asia Pacific Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Asia Pacific Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: Asia Pacific Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: Asia Pacific Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 9: Asia Pacific Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: Asia Pacific Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: North America Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 17: North America Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: North America Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: North America Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: North America Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 21: North America Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 25: North America Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Europe Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 29: Europe Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Europe Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 33: Europe Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 37: Europe Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: South America Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 41: South America Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: South America Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 45: South America Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 49: South America Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: Middle East and Africa Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 57: Middle East and Africa Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Fuel Additives Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Global Fuel Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Fuel Additives Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 11: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: China Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: India Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 27: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 29: United States Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United States Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Canada Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Canada Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 35: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 37: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 39: Germany Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: France Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Italy Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 50: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 51: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 52: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 53: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 54: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 55: Brazil Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Brazil Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Mexico Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Mexico Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Argentina Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Argentina Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 64: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 65: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 66: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 67: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 68: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 71: South Africa Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: South Africa Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fuel Additives Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Fuel Additives Market?

Key companies in the market include Infineum International Limited, Clariant, Cargill Incorporated, Evonik Industries AG, Dorf Ketal Chemicals, BASF SE, Chevron Corporation, The Lubrizol Corporation, Baker Hughes Company, TotalEnergies SE *List Not Exhaustive, Lanxess, Innospec, Afton Chemical, Exxon Mobil corporation.

3. What are the main segments of the Fuel Additives Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Enactment of Stringent Environmental Regulations; Degrading Quality of Crude Oil.

6. What are the notable trends driving market growth?

Gasoline to Dominate the Market Studied.

7. Are there any restraints impacting market growth?

Increasing Demand for Battery Electric Vehicles (BEVs); High Costs of R&D Activities.

8. Can you provide examples of recent developments in the market?

April 2022: Afton Chemical's Greenclean 3 is an advancement in diesel fuel detergent technology launched in North America. This powerful, creative technology will continue to improve the performance of heavy-duty fleets and off-road vehicles equipped with cutting-edge engine technology and pollution control systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fuel Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fuel Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fuel Additives Market?

To stay informed about further developments, trends, and reports in the Fuel Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence