Key Insights

The High Temperature Sealants market is projected for robust growth, with an estimated market size of $12.27 billion by 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 10.34% from the 2025 base year. Key demand drivers include the Electrical & Electronics, Automotive & Transportation, and Building & Construction sectors. Increasing device complexity and the need for high-temperature insulation in electronics, alongside advancements in automotive engine performance and electric vehicle battery thermal management, are significant catalysts. Furthermore, the construction industry's focus on energy efficiency and high-performance materials in infrastructure development also fuels demand.

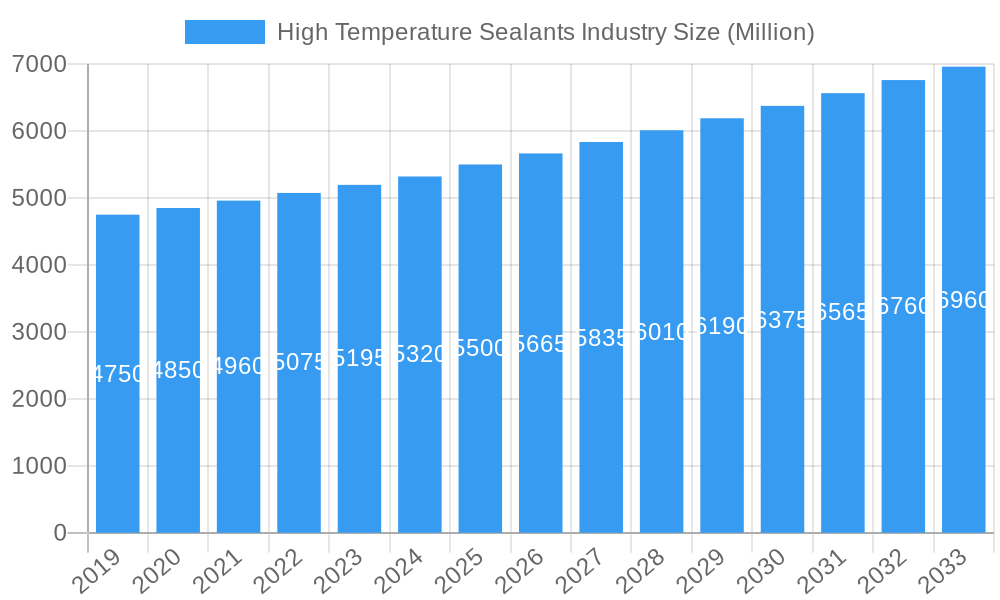

High Temperature Sealants Industry Market Size (In Billion)

Market dynamics are shaped by innovations in advanced silicone and epoxy formulations, offering enhanced thermal resistance and durability. Developments in application technologies are improving ease of use and market penetration. Challenges include raw material price volatility and stringent environmental regulations concerning VOCs, necessitating continuous product innovation. Geographically, the Asia Pacific region, led by industrial growth in China and India, is expected to dominate. North America and Europe, with their established industrial bases and focus on technological progress, will remain key markets. Leading companies such as Henkel AG & Co KGaA, 3M, and Dow are driving innovation in high-performance sealant solutions.

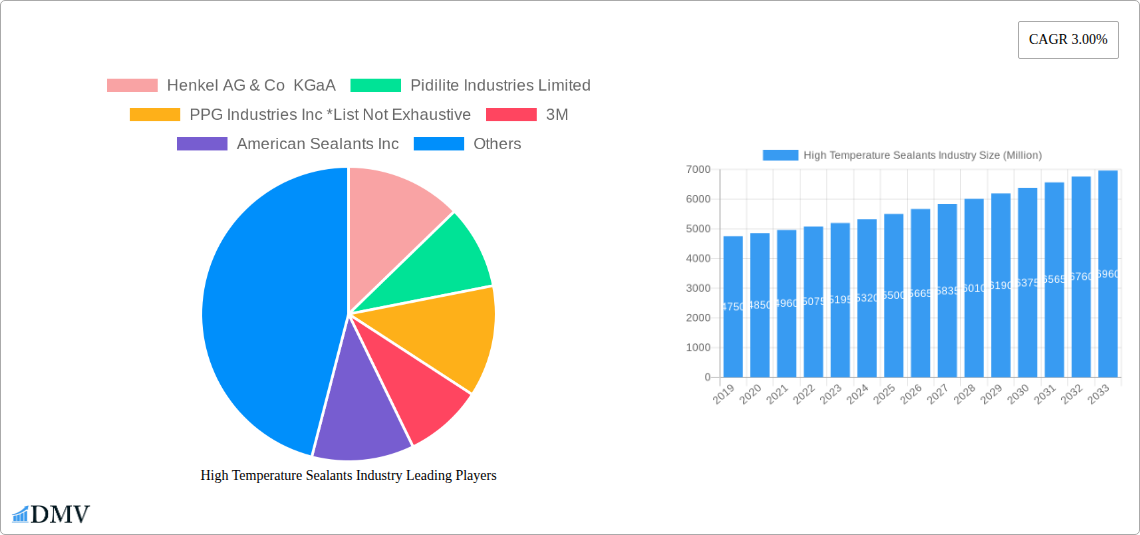

High Temperature Sealants Industry Company Market Share

High Temperature Sealants Industry Market Composition & Trends

The high temperature sealants market exhibits a dynamic and evolving composition, driven by relentless innovation and a complex web of influencing factors. Market concentration is moderate, with key players like Henkel AG & Co KGaA, PPG Industries Inc, and 3M holding significant shares, but with ample room for specialized manufacturers and emerging companies to carve out niches. The industry's growth is catalyzed by an increasing demand for durable, high-performance sealing solutions in extreme environments across sectors like automotive, aerospace, and electronics. Regulatory landscapes are becoming more stringent, particularly concerning environmental impact and VOC emissions, pushing manufacturers towards greener formulations and sustainable practices. Substitute products, while present, often fall short of the performance benchmarks set by specialized high-temperature sealants, particularly in applications demanding resilience against extreme heat, chemical exposure, and mechanical stress. End-user profiles are diverse, ranging from intricate electronic component assembly requiring precision and thermal stability to heavy-duty industrial applications demanding robust adhesion and sealing integrity. Mergers and acquisitions (M&A) activity is a notable trend, with strategic consolidations aimed at expanding product portfolios, acquiring advanced technologies, and gaining broader market access. Recent M&A deals have seen valuations in the hundreds of millions of dollars, reflecting the strategic importance and growth potential of this sector.

- Market Share Distribution: Dominated by a few key players but with significant contribution from mid-sized and specialized manufacturers.

- Innovation Catalysts: Rising performance demands, miniaturization in electronics, electrification of vehicles, and stringent environmental regulations.

- Regulatory Landscape: Increasing focus on VOC content reduction, eco-friendly formulations, and compliance with industry-specific standards.

- Substitute Products: Primarily lower-temperature sealants, adhesives with limited heat resistance, and mechanical fastening methods that may compromise sealing integrity.

- End-User Profiles: From niche applications in aerospace and defense to mass-market needs in automotive and consumer electronics.

- M&A Activities: Strategic acquisitions focusing on technology integration, market expansion, and portfolio diversification.

High Temperature Sealants Industry Industry Evolution

The high temperature sealants industry has witnessed a significant evolution characterized by robust market growth trajectories, transformative technological advancements, and a discernible shift in consumer and industrial demands. Over the historical period of 2019–2024, the market demonstrated a steady upward trend, fueled by the increasing adoption of advanced materials and processes across various end-user industries. The base year of 2025 marks a pivotal point, with an estimated market size poised for continued expansion throughout the forecast period of 2025–2033. This growth is intrinsically linked to the relentless pursuit of higher performance and reliability in challenging operating conditions.

Technological advancements have been a primary engine of this evolution. The development of novel chemistries, including sophisticated epoxy formulations with enhanced thermal stability and advanced silicone-based sealants offering superior flexibility at extreme temperatures, has been crucial. The "Others" chemistry segment is also seeing innovation, with advancements in ceramic-based and hybrid polymer sealants catering to highly specialized applications. These innovations are not merely incremental; they represent leaps in material science, enabling sealants to withstand temperatures exceeding 1000°C while maintaining their structural integrity and sealing capabilities.

Shifting consumer and industrial demands have played an equally vital role. The automotive and transportation sector, driven by the transition to electric vehicles (EVs) and the increasing complexity of under-the-hood components, requires sealants that can manage battery pack heat dissipation and protect sensitive electronics from extreme temperatures and vibrations. Similarly, the electrical and electronics industry's push for miniaturization and higher power densities necessitates sealants that offer superior thermal conductivity and electrical insulation. The chemical and pharmaceutical industries continue to rely on high-temperature sealants for their robust chemical resistance and ability to maintain sterile environments at elevated temperatures. Even the building and construction sector is increasingly leveraging these advanced materials for specialized applications requiring fire resistance and long-term durability in harsh climates. Adoption metrics for high-temperature sealants in these sectors have seen year-on-year growth rates averaging between 5% and 8% during the historical period, with projections indicating sustained double-digit growth in specific high-demand segments during the forecast period. This consistent demand, coupled with ongoing technological breakthroughs, underscores the dynamic and expanding nature of the high-temperature sealants industry.

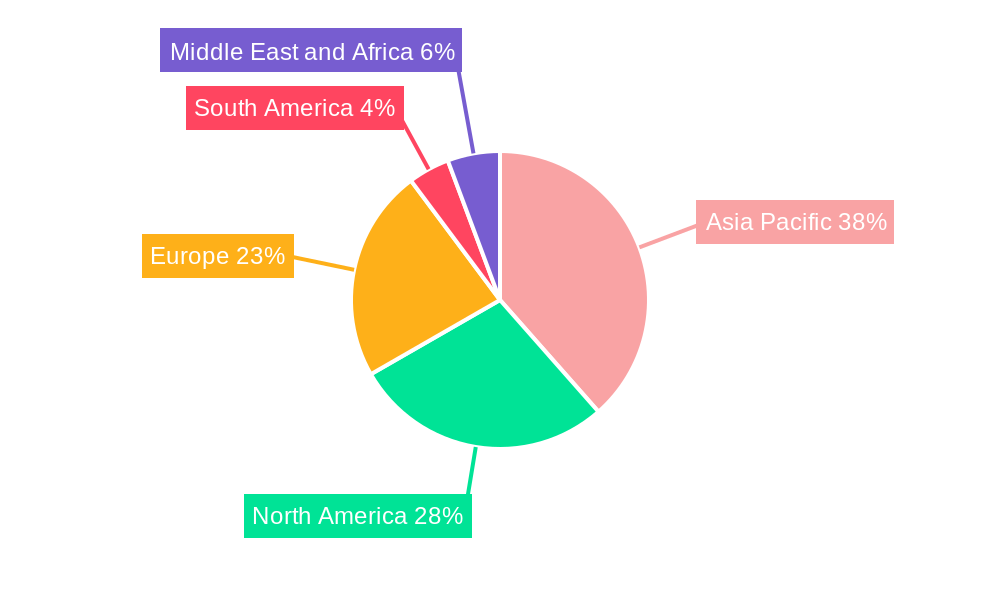

Leading Regions, Countries, or Segments in High Temperature Sealants Industry

The global high temperature sealants market is a complex ecosystem, with distinct regions, countries, and specific segments exhibiting leadership due to a confluence of factors including investment trends, regulatory support, and end-user industry dominance.

Dominant Segment: Chemistry - Silicone

The Silicone chemistry segment stands out as a leading force within the high temperature sealants industry. This dominance is attributable to silicone's inherent properties, which make it exceptionally well-suited for a wide array of high-temperature applications.

- Key Drivers for Silicone's Dominance:

- Exceptional Thermal Stability: Silicone sealants can withstand a broad temperature range, often from -60°C to over 300°C, with specialized grades performing even higher. This makes them indispensable in applications exposed to extreme heat fluctuations.

- Flexibility and Durability: Unlike many other sealant types, silicones retain their flexibility even at high temperatures, preventing cracking and ensuring a long-lasting seal. Their resistance to UV radiation, ozone, and moisture further enhances their durability.

- Chemical Inertness: Silicones exhibit excellent resistance to a wide range of chemicals, acids, and bases, making them ideal for use in chemical processing, pharmaceutical manufacturing, and automotive environments.

- Electrical Insulation Properties: Their inherent dielectric strength makes them crucial for sealing electrical components in high-temperature applications, preventing short circuits and ensuring operational safety.

- Versatile Adhesion: Silicones can adhere to a multitude of substrates, including metals, plastics, glass, and ceramics, contributing to their widespread applicability.

- Regulatory Compliance and Innovation: Ongoing research and development in silicone chemistry have led to formulations that meet increasingly stringent environmental regulations and offer enhanced performance characteristics, such as low outgassing and improved adhesion to challenging substrates.

The Automotive and Transportation end-user industry also plays a pivotal role in driving the demand for high-temperature sealants, particularly silicone-based ones. The rapid growth of the electric vehicle (EV) market has created a substantial demand for thermal management solutions, including sealants for battery packs, power electronics, and charging infrastructure. These applications require materials that can effectively dissipate heat while maintaining a robust seal against environmental contaminants. Furthermore, traditional internal combustion engine vehicles continue to demand high-temperature sealants for gaskets, exhaust systems, and engine components where extreme heat and aggressive fluids are prevalent.

In terms of Regional Leadership, North America and Europe currently hold significant market share due to the established presence of advanced manufacturing industries, particularly in automotive, aerospace, and electronics. These regions benefit from strong research and development capabilities, significant investments in industrial automation, and stringent quality and performance standards that favor high-temperature sealants. Asia Pacific, however, is emerging as the fastest-growing region, driven by the burgeoning manufacturing sector, particularly in China and Southeast Asia, and the increasing adoption of advanced technologies across all end-user industries.

High Temperature Sealants Industry Product Innovations

Product innovations in the high-temperature sealants industry are constantly pushing the boundaries of material science. Recent advancements include the development of self-healing sealants that can autonomously repair minor cracks and punctures, significantly extending product lifespan and reducing maintenance needs. Novel formulations are achieving unprecedented thermal resistance, with some ceramic-based sealants now capable of withstanding temperatures exceeding 1200°C, crucial for aerospace and advanced industrial applications. Furthermore, advancements in adhesion technologies are enabling sealants to bond effectively to a wider range of challenging substrates, including exotic alloys and advanced composite materials, at extreme temperatures. These innovations are characterized by their unique selling propositions of enhanced durability, superior performance under extreme conditions, and reduced environmental impact, often with significantly improved application characteristics and cure times.

Propelling Factors for High Temperature Sealants Industry Growth

The growth of the high temperature sealants industry is propelled by several key factors. Technological advancements are paramount, with continuous innovation in material science leading to sealants with higher thermal stability, improved chemical resistance, and enhanced adhesion properties. The electrification of vehicles, demanding robust thermal management and protection for sensitive battery and electronic components, is a significant driver. Furthermore, the expanding aerospace and defense sectors, requiring reliable sealing solutions for aircraft engines, spacecraft, and defense equipment operating under extreme conditions, contribute substantially. Stringent regulations mandating improved safety and performance in various industries also push for the adoption of advanced, high-temperature sealing solutions.

Obstacles in the High Temperature Sealants Industry Market

Despite robust growth, the high temperature sealants industry faces several obstacles. Regulatory challenges, particularly concerning the development and approval of new, environmentally friendly formulations, can slow down innovation and market entry. Supply chain disruptions for raw materials, exacerbated by geopolitical factors and increased demand, can lead to price volatility and availability issues. Intense competitive pressures from both established global players and emerging regional manufacturers necessitate continuous investment in R&D and cost optimization. Furthermore, the specialized nature of some high-temperature sealant applications requires extensive testing and qualification processes, adding to development timelines and costs, potentially impacting market penetration in niche sectors.

Future Opportunities in High Temperature Sealants Industry

The high temperature sealants industry is poised for significant future opportunities. The burgeoning renewable energy sector, particularly solar thermal and advanced geothermal applications, will demand specialized sealants capable of withstanding extreme temperatures and corrosive environments. The ongoing miniaturization and increased power density in consumer electronics and industrial automation will create a growing need for high-performance, thermally conductive, and electrically insulating sealants. Emerging markets in Asia and Latin America, with their rapidly developing industrial bases and infrastructure projects, represent substantial untapped potential. Furthermore, the development of bio-based or sustainable high-temperature sealants could open new avenues, catering to the growing demand for eco-friendly industrial solutions.

Major Players in the High Temperature Sealants Industry Ecosystem

- Henkel AG & Co KGaA

- Pidilite Industries Limited

- PPG Industries Inc

- 3M

- American Sealants Inc

- Arkema Group

- Dow

- H B Fuller Company

- Bond It

- MAPEI S p A

Key Developments in High Temperature Sealants Industry Industry

- 2023 March: Launch of a new line of high-temperature silicone sealants by Dow, offering enhanced UV resistance and thermal stability for automotive applications.

- 2023 July: 3M announces a strategic partnership with a leading aerospace manufacturer to develop advanced sealants for next-generation aircraft engines.

- 2024 January: Arkema Group acquires a specialty chemicals company, expanding its portfolio in high-performance polymers and sealants for extreme environments.

- 2024 April: Henkel AG & Co KGaA introduces a novel epoxy sealant with superior chemical resistance for the pharmaceutical industry, meeting stringent regulatory standards.

- 2024 August: PPG Industries Inc. unveils an innovative ceramic-based sealant for industrial applications, achieving record-breaking temperature resistance.

Strategic High Temperature Sealants Industry Market Forecast

The strategic outlook for the high temperature sealants industry is exceptionally positive, driven by a confluence of technological innovation and sustained demand from critical growth sectors. The forecast period of 2025–2033 anticipates continued robust expansion, with an estimated market size projected to reach several billion dollars. Key growth catalysts include the accelerating adoption of electric vehicles, requiring advanced thermal management solutions, and the persistent needs of the aerospace, defense, and renewable energy sectors for high-performance sealing materials. Emerging markets and the ongoing trend towards miniaturization in electronics will further fuel demand. Strategic investments in R&D, focusing on sustainable formulations and ultra-high temperature resistance, will be crucial for capturing future market share and solidifying competitive advantages.

High Temperature Sealants Industry Segmentation

-

1. Chemistry

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Others

-

2. End-user Industry

- 2.1. Electrical and Electronics

- 2.2. Automotive and Transportation

- 2.3. Chemical and Pharmaceutical

- 2.4. Building and Construction

- 2.5. Other End-user Industries

High Temperature Sealants Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

High Temperature Sealants Industry Regional Market Share

Geographic Coverage of High Temperature Sealants Industry

High Temperature Sealants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Electrical and Electronics Industry; Growing Demand owing to its Wide Range of Applications

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Electrical & Electronics Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electrical and Electronics

- 5.2.2. Automotive and Transportation

- 5.2.3. Chemical and Pharmaceutical

- 5.2.4. Building and Construction

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 6. Asia Pacific High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electrical and Electronics

- 6.2.2. Automotive and Transportation

- 6.2.3. Chemical and Pharmaceutical

- 6.2.4. Building and Construction

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 7. North America High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electrical and Electronics

- 7.2.2. Automotive and Transportation

- 7.2.3. Chemical and Pharmaceutical

- 7.2.4. Building and Construction

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 8. Europe High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electrical and Electronics

- 8.2.2. Automotive and Transportation

- 8.2.3. Chemical and Pharmaceutical

- 8.2.4. Building and Construction

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 9. South America High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electrical and Electronics

- 9.2.2. Automotive and Transportation

- 9.2.3. Chemical and Pharmaceutical

- 9.2.4. Building and Construction

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 10. Middle East and Africa High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Electrical and Electronics

- 10.2.2. Automotive and Transportation

- 10.2.3. Chemical and Pharmaceutical

- 10.2.4. Building and Construction

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pidilite Industries Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PPG Industries Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Sealants Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dow

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 H B Fuller Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bond It

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MAPEI S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global High Temperature Sealants Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 3: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 4: Asia Pacific High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 9: North America High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 10: North America High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 15: Europe High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 16: Europe High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 21: South America High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 22: South America High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 27: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 28: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 2: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global High Temperature Sealants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 5: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 13: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 19: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 27: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 33: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Temperature Sealants Industry?

The projected CAGR is approximately 10.34%.

2. Which companies are prominent players in the High Temperature Sealants Industry?

Key companies in the market include Henkel AG & Co KGaA, Pidilite Industries Limited, PPG Industries Inc *List Not Exhaustive, 3M, American Sealants Inc, Arkema Group, Dow, H B Fuller Company, Bond It, MAPEI S p A.

3. What are the main segments of the High Temperature Sealants Industry?

The market segments include Chemistry, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.27 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Electrical and Electronics Industry; Growing Demand owing to its Wide Range of Applications.

6. What are the notable trends driving market growth?

Increasing Demand from Electrical & Electronics Industry.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Temperature Sealants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Temperature Sealants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Temperature Sealants Industry?

To stay informed about further developments, trends, and reports in the High Temperature Sealants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence