Key Insights

The Qatar automotive lubricants market is forecast for robust expansion. With a projected market size of $298.33 million by the base year 2025, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 3.72%. This growth trajectory is propelled by escalating demand for high-performance lubricants that optimize fuel efficiency and enhance engine longevity across the expanding commercial and passenger vehicle sectors. Qatar's ongoing infrastructure development and its hosting of international events further stimulate automotive fleet growth, creating sustained demand for premium lubricants.

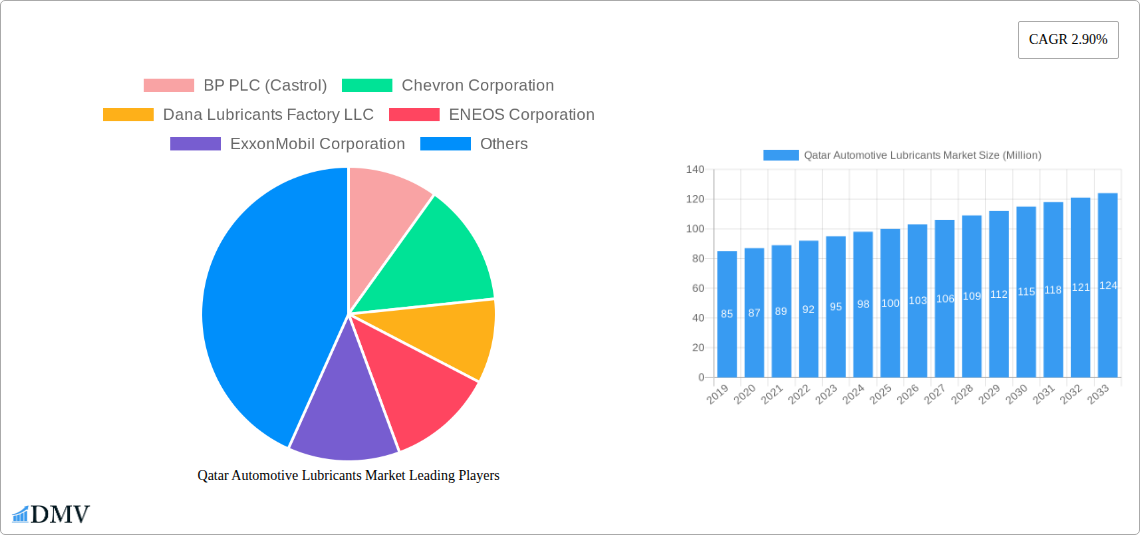

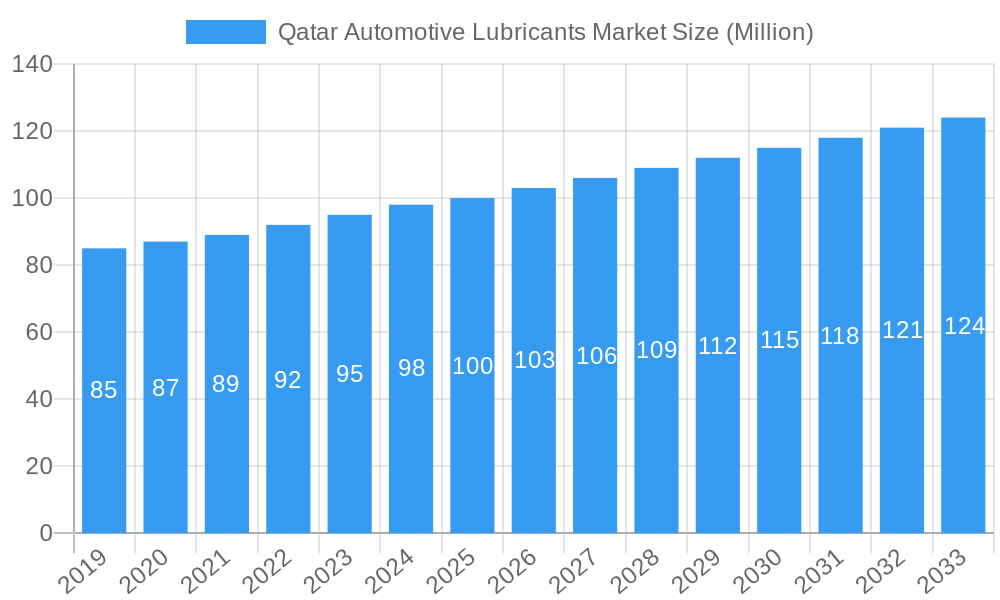

Qatar Automotive Lubricants Market Market Size (In Million)

Key market trends include a notable shift towards synthetic and semi-synthetic lubricants, favored for their advanced performance and environmental advantages. Specialized greases and hydraulic fluids are also gaining traction, aligning with advancements in automotive technology. Challenges such as crude oil price volatility, the primary feedstock for lubricants, may influence market dynamics. Additionally, the gradual adoption of electric vehicles presents a long-term consideration for traditional lubricant demand. Nonetheless, established industry leaders including ExxonMobil, Royal Dutch Shell, and Chevron are anticipated to maintain significant market positions. The market is segmented by product type, with engine oils expected to lead demand due to their broad application. The commercial vehicle segment is also poised for substantial growth, driven by the nation's extensive industrial and infrastructure initiatives.

Qatar Automotive Lubricants Market Company Market Share

Qatar Automotive Lubricants Market Market Composition & Trends

This comprehensive report delves into the intricate composition and evolving trends of the Qatar Automotive Lubricants Market, offering unparalleled insights for stakeholders. We meticulously analyze market concentration, identifying key players and their respective market share distributions. Innovation catalysts, including advancements in lubricant technology and increasing demand for high-performance products, are thoroughly examined. The report navigates the complex regulatory landscapes impacting product development and market entry. We assess the threat of substitute products, such as biodegradable lubricants and advanced material coatings, and define the diverse end-user profiles, ranging from individual car owners to large commercial fleet operators. Merger and acquisition (M&A) activities are detailed, providing insights into deal values and strategic implications for market consolidation. The report is structured to equip businesses with actionable intelligence to navigate this dynamic market successfully.

- Market Concentration: Analysis of market share distribution among leading lubricant manufacturers.

- Innovation Catalysts: Identification of technological advancements driving product development.

- Regulatory Landscapes: Overview of regulations affecting lubricant quality and environmental impact.

- Substitute Products: Evaluation of emerging alternatives to traditional lubricants.

- End-User Profiles: Detailed segmentation of consumer and commercial user groups.

- M&A Activities: Insights into recent and historical mergers and acquisitions.

Qatar Automotive Lubricants Market Industry Evolution

The Qatar Automotive Lubricants Market is undergoing a significant industry evolution, driven by a confluence of technological advancements, shifting consumer demands, and economic development. Our in-depth analysis, covering the historical period from 2019 to 2024 and projecting through 2033, with a base year of 2025, reveals distinct market growth trajectories. The surge in vehicle ownership in Qatar, fueled by economic prosperity and infrastructure development, has been a primary growth driver. This has directly translated into an increased demand for automotive lubricants across all vehicle segments, including passenger vehicles, commercial vehicles, and motorcycles.

Technological advancements in engine design and the increasing adoption of electric vehicles (EVs) are fundamentally reshaping the lubricant landscape. While traditional internal combustion engine (ICE) lubricants remain dominant, there is a noticeable trend towards synthetic and semi-synthetic formulations offering enhanced performance, fuel efficiency, and extended drain intervals. The report quantifies these trends, projecting a compound annual growth rate (CAGR) of approximately 5.2% for the overall market during the forecast period. Adoption metrics for synthetic lubricants are expected to rise significantly, reaching over 60% of the market share by 2033.

Furthermore, growing environmental consciousness and stricter emission regulations are pushing manufacturers to develop and market eco-friendly and sustainable lubricant solutions. This includes lubricants with lower viscosity, improved biodegradability, and reduced harmful additives. The increasing sophistication of vehicle technology, such as advanced transmission systems and complex hydraulic components, also necessitates specialized lubricant formulations, driving innovation in areas like transmission fluids and hydraulic oils. The market’s evolution is not just about volume but also about the sophistication and specialization of lubricant products catering to a more discerning and environmentally aware consumer base. The industry’s trajectory is clearly marked by a move towards higher-value, performance-driven, and sustainable lubricant solutions, directly impacting product development strategies and market competition.

Leading Regions, Countries, or Segments in Qatar Automotive Lubricants Market

Within the Qatar Automotive Lubricants Market, the dominance of specific segments is shaped by several compelling factors, including economic activity, vehicle parc, and technological adoption.

Dominant Vehicle Type: Commercial Vehicles

Commercial vehicles, encompassing trucks, buses, and construction equipment, represent a significant and consistently high-demand segment for automotive lubricants in Qatar. This dominance is driven by several key factors:

- Robust Economic Activity: Qatar's ongoing infrastructure development projects and its status as a global hub for business and tourism necessitate a large and active commercial vehicle fleet. This constant operation of heavy-duty vehicles requires frequent lubrication and maintenance, creating sustained demand for engine oils, hydraulic fluids, and greases.

- Higher Lubricant Consumption: Commercial vehicles, due to their larger engine capacities and prolonged operating hours, inherently consume more lubricant per vehicle compared to passenger cars. This volume-driven demand significantly bolsters the market share of lubricants catering to this segment.

- Specialized Lubricant Requirements: The rigorous operating conditions and advanced engineering of commercial vehicle engines and machinery necessitate the use of high-performance, specialized lubricants. This includes heavy-duty diesel engine oils formulated to withstand extreme temperatures and pressures, as well as robust hydraulic fluids essential for the operation of specialized equipment.

- Fleet Maintenance Strategies: Large commercial fleet operators often adhere to strict maintenance schedules, ensuring regular oil changes and fluid replacements. This proactive approach guarantees a steady and predictable demand for lubricants from this sector.

Dominant Product Type: Engine Oils

Engine oils remain the cornerstone of the Qatar Automotive Lubricants Market, exhibiting the highest demand across all vehicle types, with a particular emphasis on commercial vehicles.

- Universal Application: Engine oils are fundamental to the operation of all internal combustion engines, whether in passenger cars, commercial vehicles, or motorcycles. Their essential role in reducing friction, dissipating heat, and preventing wear makes them indispensable.

- High Replacement Frequency: Engine oil is a consumable product with a defined service life, requiring regular replacement as per manufacturer recommendations. This inherent characteristic leads to a high volume of sales and a dominant market share.

- Technological Advancements: The evolution of engine technology, including advancements in turbocharging, direct injection, and emissions control systems, has spurred the demand for sophisticated engine oils. Synthetic and semi-synthetic engine oils, offering superior protection and performance, are increasingly preferred by consumers and fleet operators alike.

- Aftermarket Dominance: The aftermarket segment for engine oils is particularly strong in Qatar, driven by independent repair shops and vehicle owners opting for regular maintenance. This accessibility and choice further solidify the dominance of engine oils.

- Growth in Passenger Vehicles: While commercial vehicles drive significant volume, the steadily growing passenger vehicle parc in Qatar, fueled by a young population and rising disposable incomes, also contributes substantially to the demand for passenger car engine oils.

The interplay between the robust commercial vehicle segment and the universal necessity of engine oils creates a powerful synergistic effect, cementing these as the leading segments within the Qatar Automotive Lubricants Market.

Qatar Automotive Lubricants Market Product Innovations

Product innovations in the Qatar Automotive Lubricants Market are increasingly focused on enhancing performance, extending equipment lifespan, and addressing environmental concerns. A key trend is the development of advanced synthetic and semi-synthetic formulations offering superior protection against wear, heat, and oxidation, leading to extended drain intervals and improved fuel efficiency. Specialized lubricants for electric vehicles (EVs), such as Castrol's e-fluid range, are gaining traction, designed to manage thermal challenges and electrical insulation requirements unique to EV powertrains. Furthermore, biodegradable and low-emission lubricants are emerging as important product categories, catering to growing environmental awareness and regulatory pressures. These innovations are driven by cutting-edge research and development aimed at meeting the evolving demands of modern automotive technology.

Propelling Factors for Qatar Automotive Lubricants Market Growth

Several key factors are propelling the growth of the Qatar Automotive Lubricants Market. The expanding vehicle parc, driven by economic diversification and a growing population, is a primary contributor, increasing the overall demand for lubricants. Furthermore, ongoing infrastructure development projects necessitate a robust commercial vehicle fleet, sustaining high lubricant consumption. Technological advancements in vehicles, leading to more sophisticated engine designs and the increasing adoption of synthetic and high-performance lubricants, are also driving market value. Finally, a growing awareness of the importance of regular vehicle maintenance and the use of quality lubricants to ensure longevity and optimal performance further bolsters the market.

Obstacles in the Qatar Automotive Lubricants Market Market

Despite significant growth potential, the Qatar Automotive Lubricants Market faces several obstacles. Intense price competition among a multitude of local and international brands can erode profit margins. The increasing adoption of electric vehicles poses a long-term challenge to the demand for traditional internal combustion engine lubricants, although this transition is still in its nascent stages in Qatar. Fluctuations in crude oil prices can impact the cost of raw materials for lubricant production, leading to price volatility. Additionally, the presence of counterfeit and sub-standard lubricants in the market can harm brand reputation and consumer trust, posing a significant threat to legitimate players.

Future Opportunities in Qatar Automotive Lubricants Market

The Qatar Automotive Lubricants Market presents several promising future opportunities. The burgeoning electric vehicle segment, while a long-term challenge for ICE lubricants, opens avenues for specialized EV fluids, including coolants, gear oils, and greases. The continued economic growth and infrastructure development will sustain the demand for heavy-duty lubricants. Furthermore, there is an increasing opportunity for manufacturers to introduce and promote high-performance synthetic and premium lubricants, catering to consumers seeking enhanced vehicle protection and fuel efficiency. The growing emphasis on sustainability also presents opportunities for eco-friendly and biodegradable lubricant formulations.

Major Players in the Qatar Automotive Lubricants Market Ecosystem

- BP PLC (Castrol)

- Chevron Corporation

- Dana Lubricants Factory LLC

- ENEOS Corporation

- ExxonMobil Corporation

- Gulf Continental Oil and Grease Factory (GulfCon)

- Indian Oil Corporation Limited

- Lucas Oil Products Inc

- Qatar Lubricants Company (QALCO)

- Royal Dutch Shell PLC

- TotalEnergies

- Valvoline Inc

Key Developments in Qatar Automotive Lubricants Market Industry

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.

- March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.

Strategic Qatar Automotive Lubricants Market Market Forecast

The strategic Qatar Automotive Lubricants Market forecast indicates a steady upward trajectory, driven by sustained economic growth and an expanding vehicle population. The increasing demand for higher-performance synthetic and semi-synthetic lubricants, coupled with the growing adoption of advanced vehicle technologies, will contribute significantly to market value. While the transition to electric vehicles presents a long-term shift, the immediate future will see continued strong demand for traditional lubricants, particularly in the commercial vehicle segment. The focus on product innovation, environmental sustainability, and expanding distribution networks will be crucial for players to capitalize on the market’s potential.

Qatar Automotive Lubricants Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Qatar Automotive Lubricants Market Segmentation By Geography

- 1. Qatar

Qatar Automotive Lubricants Market Regional Market Share

Geographic Coverage of Qatar Automotive Lubricants Market

Qatar Automotive Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Automotive Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dana Lubricants Factory LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENEOS Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gulf Continental Oil and Grease Factory (GulfCon)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lucas Oil Products Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qatar Lubricants Company (QALCO)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Dutch Shell PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Valvoline Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Qatar Automotive Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Qatar Automotive Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Automotive Lubricants Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Qatar Automotive Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Qatar Automotive Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Qatar Automotive Lubricants Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Qatar Automotive Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Qatar Automotive Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Automotive Lubricants Market?

The projected CAGR is approximately 3.72%.

2. Which companies are prominent players in the Qatar Automotive Lubricants Market?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, Dana Lubricants Factory LLC, ENEOS Corporation, ExxonMobil Corporation, Gulf Continental Oil and Grease Factory (GulfCon), Indian Oil Corporation Limited, Lucas Oil Products Inc, Qatar Lubricants Company (QALCO), Royal Dutch Shell PLC, TotalEnergies, Valvoline Inc.

3. What are the main segments of the Qatar Automotive Lubricants Market?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 298.33 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Commercial Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Automotive Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Automotive Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Automotive Lubricants Market?

To stay informed about further developments, trends, and reports in the Qatar Automotive Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence