Key Insights

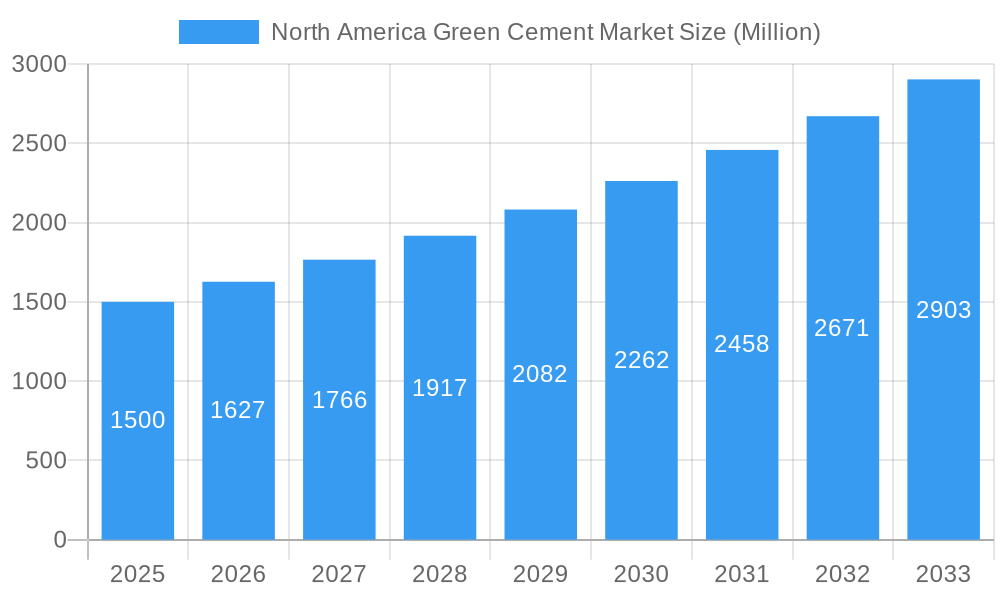

The North American green cement market is projected for significant growth, expected to reach a market size of $15.22 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period. This expansion is driven by increasing demand for sustainable building materials, reinforced by stringent environmental regulations and a global focus on reducing the construction sector's carbon footprint. Key growth catalysts include government incentives for eco-friendly construction, rising investments in green building technologies, and the superior cost-effectiveness and performance of green cement alternatives over traditional Portland cement. Innovation is a critical factor, with companies developing advanced formulations that substantially reduce CO2 emissions in production.

North America Green Cement Market Market Size (In Billion)

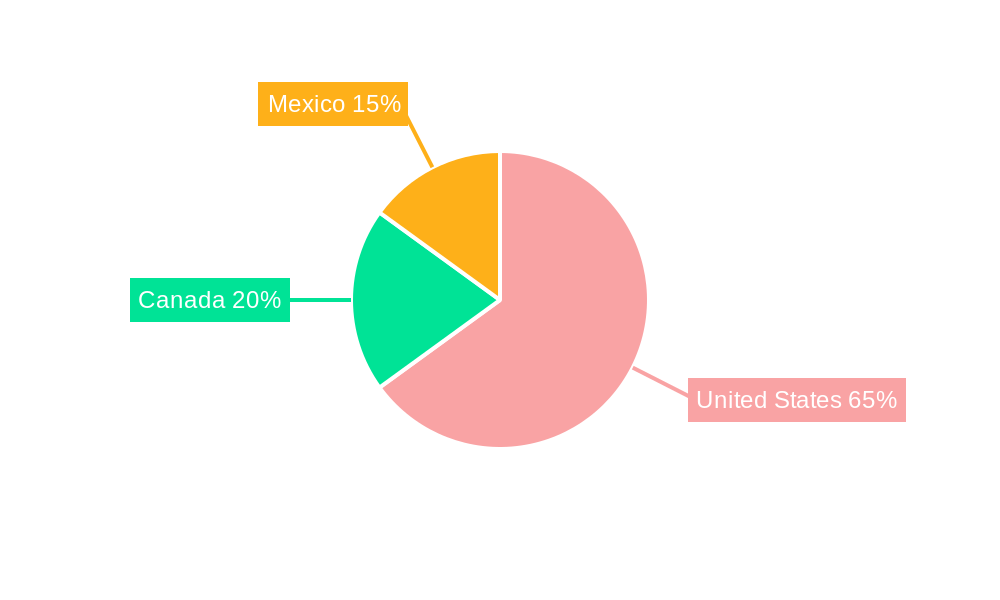

The market is shifting towards alternative raw materials, with Fly Ash-based and Slag-based cements leading product segmentation due to their availability and proven performance. Limestone-based and Silica Fume-based cements are also gaining traction for specific applications. The construction sector, encompassing both residential and non-residential segments, is a primary end-user, with a growing preference for sustainable solutions. The United States dominates the market, followed by Canada and Mexico, with regional policies and market maturity influencing growth. Challenges include the initial higher cost of some green cement variants and the need for increased industry and consumer awareness. Despite these hurdles, the strong trend towards decarbonization in construction ensures a positive outlook for the North American green cement market.

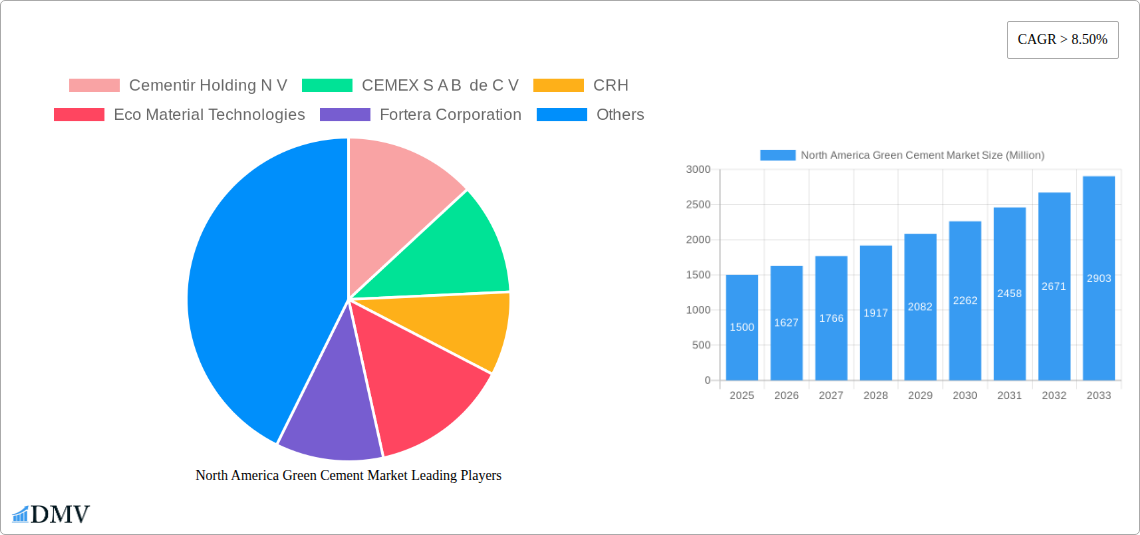

North America Green Cement Market Company Market Share

North America Green Cement Market: Sustainable Construction Solutions & Future Outlook (2019-2033)

Unlock critical insights into the burgeoning North America green cement market with our comprehensive report. This in-depth analysis, covering the 2019-2033 study period, with 2025 as the base and estimated year, and a 2025-2033 forecast period, delves into the driving forces behind the shift towards sustainable building materials. From fly ash-based cement to slag-based and limestone-based alternatives, explore innovations revolutionizing the residential and non-residential construction sectors across the United States, Canada, and Mexico. Understand market dynamics, key players, and future growth trajectories in this essential market report, tailored for stakeholders seeking to navigate the evolving landscape of low-carbon cement solutions.

North America Green Cement Market Market Composition & Trends

The North America green cement market is characterized by a moderate to high degree of concentration, with a few dominant players actively shaping its trajectory. Innovation is a key catalyst, driven by mounting environmental regulations and a growing demand for sustainable construction materials. The regulatory landscape, while evolving, is increasingly favorable towards low-carbon cement alternatives, incentivizing producers to invest in greener technologies. Substitute products, primarily traditional Portland cement, still hold a significant market share, but their dominance is being challenged by the superior environmental performance of green cement. End-user profiles are diverse, encompassing large-scale construction firms, government projects, and increasingly, environmentally conscious developers in both residential and non-residential construction. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate their market position and acquire innovative technologies. For instance, CRH's USD 2.1 billion acquisition of assets from Martin Marietta in November 2023 signifies a major consolidation trend. The market share distribution is dynamic, with established cement giants investing heavily in green cement production capacity and innovative startups emerging with novel formulations.

North America Green Cement Market Industry Evolution

The North America green cement industry has witnessed a transformative evolution, driven by an unwavering commitment to sustainability and technological breakthroughs. The historical period (2019-2024) saw initial investments and a gradual increase in awareness regarding the environmental impact of traditional cement production. As the base year 2025 approaches, the market is poised for significant expansion. Market growth trajectories are increasingly steep, fueled by governmental mandates and corporate sustainability goals. Technological advancements have been pivotal, enabling the development of green cement products with reduced carbon footprints without compromising performance. For example, the June 2023 unveiling of the first 3D-printed homes using almost zero carbon cement by Eco Material Technologies, in partnership with Hive 3D, showcases a significant leap in application. Shifting consumer demands, particularly from environmentally conscious developers and end-users, are compelling manufacturers to adopt greener alternatives. The adoption metrics for green cement are steadily rising, with forecasts indicating a substantial increase in market penetration over the 2025-2033 forecast period. This evolution is not merely about incremental improvements; it represents a paradigm shift in the construction materials industry, moving towards a more circular and environmentally responsible future.

Leading Regions, Countries, or Segments in North America Green Cement Market

The United States stands as the preeminent leader within the North America green cement market. This dominance is fueled by a confluence of factors, including robust governmental initiatives promoting sustainable construction, significant investments in green infrastructure projects, and a highly developed construction sector receptive to technological advancements. The sheer size of the construction market, encompassing both residential and non-residential sectors, translates to immense demand for innovative building materials.

- Dominant Geography: United States

- Investment Trends: The US government's commitment to climate action and infrastructure development, through initiatives like the Bipartisan Infrastructure Law, is a major driver for the adoption of low-carbon materials. This translates to substantial investment flowing into green cement production and research.

- Regulatory Support: Stringent environmental regulations and building codes are increasingly favoring materials with lower embodied carbon. State and local governments are also setting ambitious sustainability targets, further pushing the adoption of green cement.

- Industry Adoption: Major construction firms and developers in the US are actively seeking out and specifying green cement to meet their corporate sustainability goals and comply with evolving project requirements.

- Innovation Hubs: The US hosts numerous research institutions and companies at the forefront of developing and commercializing green cement technologies, fostering a dynamic innovation ecosystem.

Within the Product Type segmentation, Slag-based and Limestone-based green cements are emerging as particularly strong contenders, owing to their widespread availability of raw materials and established production methodologies. These types offer a viable and scalable alternative to traditional Portland cement.

- Key Drivers for Slag-based and Limestone-based Cement:

- Abundant Raw Materials: Industrial by-products like fly ash and ground granulated blast furnace slag (GGBS) are readily available from various industries, making slag-based cement an economically attractive option. Limestone, a fundamental component of Portland-limestone cement (PLC), is also widely accessible.

- Proven Performance: These cement types have demonstrated comparable, and in some cases superior, performance characteristics to ordinary Portland cement in various construction applications.

- Cost-Effectiveness: The utilization of industrial by-products or optimized clinker-to-limestone ratios often leads to a more cost-effective production process compared to traditional methods, making them competitive.

- Regulatory Acceptance: Many green cement types, including PLC, have gained acceptance in building codes and standards across North America, facilitating their wider adoption.

The Non-residential construction sector is a significant driver of demand for green cement due to the scale of projects and the increasing emphasis on the environmental performance of large-scale infrastructure and commercial buildings.

- Dominant Segment: Non-residential Construction

- Large-Scale Projects: Infrastructure projects, commercial buildings, and industrial facilities represent substantial volumes of cement usage, making them prime targets for green cement adoption.

- ESG (Environmental, Social, and Governance) Focus: Corporations are increasingly incorporating ESG principles into their development strategies, driving the demand for sustainable building materials in their non-residential projects.

- Life Cycle Costing: A growing understanding of life cycle costing, which considers long-term environmental and operational impacts, favors green cement due to its reduced carbon footprint and potential for enhanced durability.

North America Green Cement Market Product Innovations

Product innovation in the North America green cement market is rapidly advancing, focusing on reducing embodied carbon while maintaining or enhancing performance. Companies like Hoffmann Green Cement Technologies are developing novel low-carbon cement formulations that significantly cut CO2 emissions during production. Eco Material Technologies' PozzCEM Vite, used in 3D-printed homes, exemplifies innovation by replacing 100% of Portland cement, showcasing its potential for nearly zero-carbon construction. Holcim Mexico's Fuerte Más cement, with 50% reduced CO2 emissions and 10% higher physical performance, demonstrates the integration of locally sourced minerals to achieve superior, sustainable outcomes. These innovations are not only about environmental benefits but also about creating stronger, more durable, and cost-effective building materials for diverse applications.

Propelling Factors for North America Green Cement Market Growth

The North America green cement market is experiencing robust growth, propelled by several key factors. Growing environmental consciousness and stringent government regulations mandating reduced carbon emissions are significant drivers. Technological advancements in developing low-carbon cement alternatives like slag-based and fly ash-based cements are making these products increasingly viable and cost-effective. Furthermore, the increasing demand from the construction sector for sustainable building materials, driven by corporate sustainability goals and consumer preference, is a critical catalyst. The financial sector's growing emphasis on ESG investments also channels capital towards green building solutions.

Obstacles in the North America Green Cement Market Market

Despite its promising growth, the North America green cement market faces several obstacles. The high initial cost of green cement production facilities and R&D investments can be a barrier for some manufacturers. The established infrastructure and widespread familiarity with traditional Portland cement create inertia, requiring significant education and marketing efforts. Supply chain disruptions for raw materials like fly ash and slag, if not managed effectively, can impact production consistency. Furthermore, the need for standardized testing and certification of new green cement products to ensure performance and build market confidence is an ongoing challenge.

Future Opportunities in North America Green Cement Market

The future for the North America green cement market is brimming with opportunities. The continuous development of innovative low-carbon cement technologies, including those utilizing captured carbon or advanced supplementary cementitious materials, presents significant potential. The expansion of 3D printing in construction with green cement offers new avenues for efficient and sustainable building. Growing demand for resilient and low-embodied carbon infrastructure projects, particularly in response to climate change impacts, will further drive the adoption of green cement. Opportunities also lie in developing specialized green cement blends for niche applications and in expanding into emerging markets within North America with supportive policy frameworks.

Major Players in the North America Green Cement Market Ecosystem

- Cementir Holding N V

- CEMEX S A B de C V

- CRH

- Eco Material Technologies

- Fortera Corporation

- HOLCIM

- Hoffmann Green Cement Technologies

- Heidelberg Materials

- Titan America LLC

- Votorantim Cimentos

Key Developments in North America Green Cement Market Industry

- November 2023: CRH agreed on a major deal in Texas, buying assets from Martin Marietta for USD 2.1 billion, signaling significant consolidation and investment in the sector.

- September 2023: Fortera Corporation secured USD 1 billion in financing to aggressively expand, aiming to establish seven commercial plants within five years, highlighting rapid growth ambitions.

- June 2023: Eco Material Technologies, in partnership with Hive 3D, unveiled the first 3D-printed homes utilizing almost zero carbon cement (PozzCEM Vite), replacing 100% of Portland cement.

- March 2023: Holcim Mexico began producing Fuerte Más reduced-CO2 cement, offering 50% less CO2 emissions and 10% higher performance, utilizing locally sourced minerals.

- November 2022: Titan America LLC fully converted its cement plants to Type IL portland-limestone cement, a low-carbon material, championing its adoption across multiple US states.

- September 2022: HeidelbergCement rebranded to Heidelberg Materials, reflecting a strategic shift towards more sustainable building solutions.

- February 2022: Holcim and Eni announced a collaboration to develop innovative technology for producing green cement from captured carbon, including a demonstration plant to test CO2 footprint reduction.

Strategic North America Green Cement Market Market Forecast

The strategic North America green cement market forecast indicates substantial growth driven by an undeniable shift towards decarbonization in the construction industry. Emerging technologies for carbon capture and utilization, coupled with the increasing efficacy and cost-competitiveness of alternative cementitious materials, are poised to accelerate adoption. The growing emphasis on circular economy principles and the demand for green building certifications will further bolster the market. Proactive governmental policies, including carbon pricing and green procurement mandates, are expected to create a highly favorable environment for sustainable cement solutions. The market is anticipated to witness significant investment and innovation, leading to widespread integration of green cement across diverse construction applications.

North America Green Cement Market Segmentation

-

1. Product Type

- 1.1. Fly Ash-based

- 1.2. Slag-based

- 1.3. Limestone-based

- 1.4. Silica fume-based

- 1.5. Other Pr

-

2. Construction Sector

- 2.1. Residential

- 2.2. Non-residential

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Green Cement Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Green Cement Market Regional Market Share

Geographic Coverage of North America Green Cement Market

North America Green Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fly Ash-based

- 5.1.2. Slag-based

- 5.1.3. Limestone-based

- 5.1.4. Silica fume-based

- 5.1.5. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Construction Sector

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fly Ash-based

- 6.1.2. Slag-based

- 6.1.3. Limestone-based

- 6.1.4. Silica fume-based

- 6.1.5. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Construction Sector

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fly Ash-based

- 7.1.2. Slag-based

- 7.1.3. Limestone-based

- 7.1.4. Silica fume-based

- 7.1.5. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Construction Sector

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fly Ash-based

- 8.1.2. Slag-based

- 8.1.3. Limestone-based

- 8.1.4. Silica fume-based

- 8.1.5. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Construction Sector

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cementir Holding N V

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 CEMEX S A B de C V

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CRH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eco Material Technologies

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fortera Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 HOLCIM

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hoffmann Green Cement Technologies

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Heidelberg Materials

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Titan America LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Votorantim Cimentos*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cementir Holding N V

List of Figures

- Figure 1: Global North America Green Cement Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United States North America Green Cement Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: United States North America Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: United States North America Green Cement Market Revenue (billion), by Construction Sector 2025 & 2033

- Figure 5: United States North America Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 6: United States North America Green Cement Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: United States North America Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Green Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 9: United States North America Green Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Green Cement Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Canada North America Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Canada North America Green Cement Market Revenue (billion), by Construction Sector 2025 & 2033

- Figure 13: Canada North America Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 14: Canada North America Green Cement Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Canada North America Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Green Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Canada North America Green Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Green Cement Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Mexico North America Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Mexico North America Green Cement Market Revenue (billion), by Construction Sector 2025 & 2033

- Figure 21: Mexico North America Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 22: Mexico North America Green Cement Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Mexico North America Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Green Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Mexico North America Green Cement Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Green Cement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global North America Green Cement Market Revenue billion Forecast, by Construction Sector 2020 & 2033

- Table 3: Global North America Green Cement Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global North America Green Cement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global North America Green Cement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global North America Green Cement Market Revenue billion Forecast, by Construction Sector 2020 & 2033

- Table 7: Global North America Green Cement Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global North America Green Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global North America Green Cement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global North America Green Cement Market Revenue billion Forecast, by Construction Sector 2020 & 2033

- Table 11: Global North America Green Cement Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global North America Green Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global North America Green Cement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global North America Green Cement Market Revenue billion Forecast, by Construction Sector 2020 & 2033

- Table 15: Global North America Green Cement Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global North America Green Cement Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Cement Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Green Cement Market?

Key companies in the market include Cementir Holding N V, CEMEX S A B de C V, CRH, Eco Material Technologies, Fortera Corporation, HOLCIM, Hoffmann Green Cement Technologies, Heidelberg Materials, Titan America LLC, Votorantim Cimentos*List Not Exhaustive.

3. What are the main segments of the North America Green Cement Market?

The market segments include Product Type, Construction Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

6. What are the notable trends driving market growth?

Residential Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

November 2023: CRH agreed on a major deal in Texas two months after moving its primary listing from London to New York. It announced that it bought assets from Martin Marietta for USD 2.1 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Cement Market?

To stay informed about further developments, trends, and reports in the North America Green Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence