Key Insights

The Middle East and Africa (MEA) Proximity Sensors Market is projected for substantial growth, anticipated to reach an estimated USD 4.28 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 6.9%. This expansion is driven by increasing automation across key industries, including manufacturing, oil and gas, and logistics. Demand for improved operational efficiency, predictive maintenance, and enhanced safety standards fuels the integration of proximity sensors. Technological advancements in inductive, capacitive, and photoelectric sensors further boost market penetration. These sensors are vital for machine safety, object detection, and precise positioning in modern industrial settings. The automotive sector, with its focus on Advanced Driver-Assistance Systems (ADAS) and smart manufacturing, presents a significant growth opportunity, requiring proximity sensors for applications like parking assistance and collision avoidance.

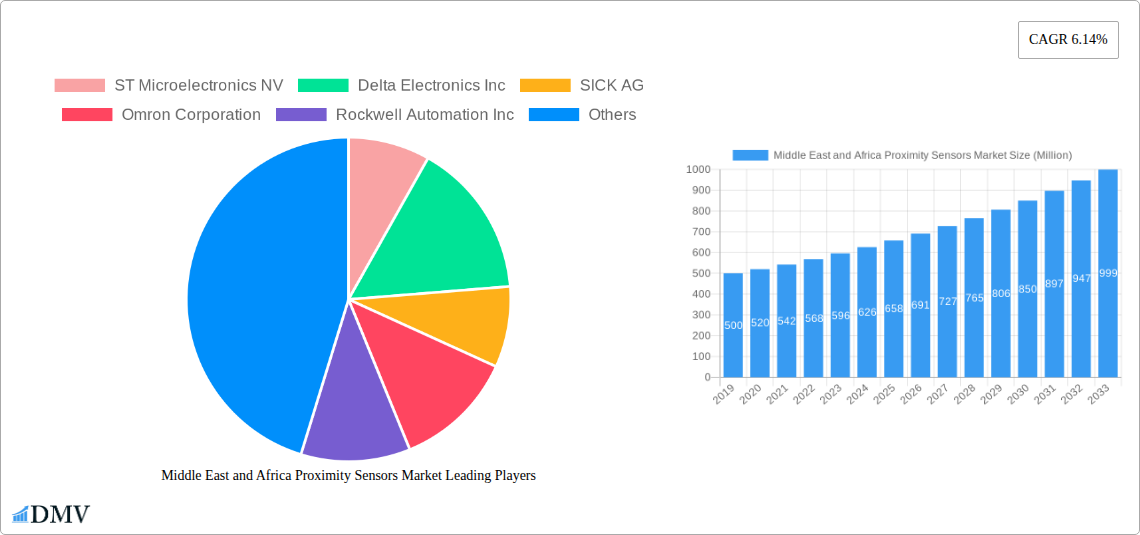

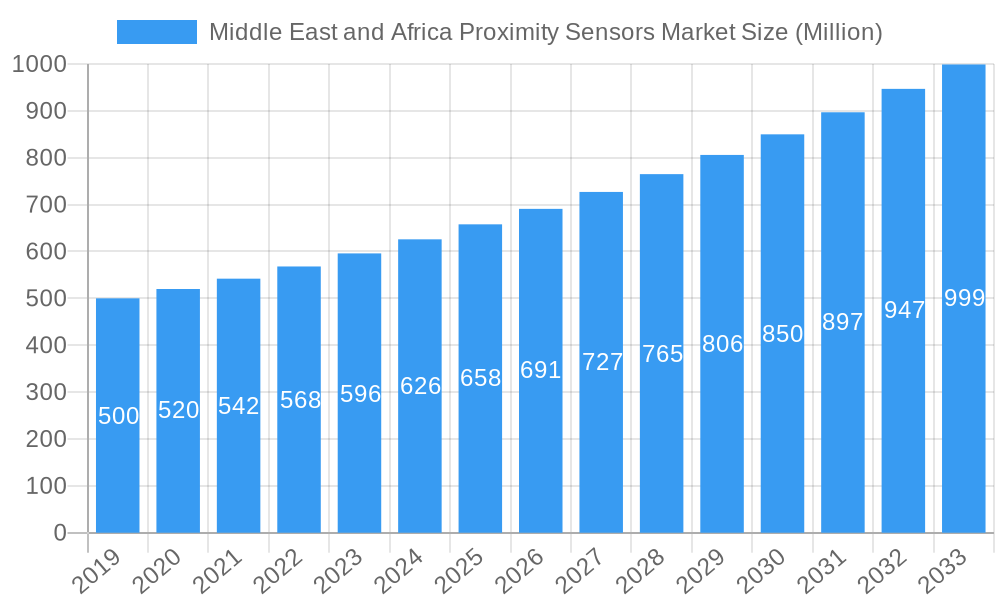

Middle East and Africa Proximity Sensors Market Market Size (In Billion)

The MEA region's expanding industrial base and government support for digitalization and smart manufacturing will continue to drive market growth. The "Other End-user Verticals" segment, including smart cities and infrastructure projects, is also expected to expand considerably. While strong demand drivers exist, initial implementation costs for advanced sensor technologies and the need for skilled integration and maintenance personnel may pose challenges. However, the long-term benefits of increased productivity and reduced operational risks are expected to mitigate these concerns. Leading companies such as ST Microelectronics NV, Delta Electronics Inc., and SICK AG are innovating and expanding their portfolios to meet the specific demands of the MEA market, focusing on solutions that enhance automation and efficiency. The strategic importance of countries like Saudi Arabia and the United Arab Emirates in industrial development further strengthens the growth outlook for proximity sensors in the MEA region.

Middle East and Africa Proximity Sensors Market Company Market Share

Middle East and Africa Proximity Sensors Market: Comprehensive Analysis & Forecast (2019–2033)

Unlock deep insights into the burgeoning Middle East and Africa (MEA) Proximity Sensors Market with our definitive report. Spanning the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033), this analysis provides a strategic roadmap for stakeholders seeking to capitalize on market expansion. We delve into critical segments like Inductive, Capacitive, Photoelectric, and Magnetic technologies, alongside key end-user verticals including Aerospace and Defense, Automotive, Industrial, Consumer Electronics, and Food and Beverage. This report is meticulously crafted to empower your business decisions with unparalleled market intelligence.

Middle East and Africa Proximity Sensors Market Market Composition & Trends

The MEA proximity sensors market exhibits a dynamic composition characterized by a growing concentration of key players driving innovation. Several catalysts are fueling this evolution, including rapid industrialization across the region, particularly in sectors like manufacturing and oil & gas, which are prime adopters of proximity sensors. Regulatory landscapes are gradually aligning with international standards, fostering trust and encouraging greater adoption of advanced sensing technologies. While substitute products exist in limited applications, the superior accuracy, reliability, and integration capabilities of proximity sensors in automation processes make them indispensable. End-user profiles are diversifying, with a significant surge in demand from the automotive sector for advanced driver-assistance systems (ADAS) and from the industrial sector for smart factory initiatives and predictive maintenance. Mergers and acquisitions (M&A) activities, though still nascent, are anticipated to play a crucial role in market consolidation and technology diffusion. For instance, a notable M&A deal in the historical period involved an undisclosed transaction valued at approximately XX Million, aimed at expanding geographical reach and technological portfolios. The market share distribution, with the Industrial sector currently holding an estimated 45% share, highlights its dominance, followed by the Automotive sector at 25%.

Middle East and Africa Proximity Sensors Market Industry Evolution

The Middle East and Africa Proximity Sensors Market has witnessed a significant industry evolution, driven by relentless technological advancements and evolving end-user demands. From 2019 to 2033, the market trajectory is marked by robust growth, fueled by the increasing adoption of automation and the digitization of industries across the MEA region. During the historical period, the market experienced a Compound Annual Growth Rate (CAGR) of approximately 7.2%, demonstrating its burgeoning potential. This growth was primarily propelled by the burgeoning manufacturing sector in countries like the UAE and Saudi Arabia, coupled with significant investments in infrastructure and smart city projects, necessitating advanced sensing solutions. The introduction of Industry 4.0 principles and the 'Smart Nation' initiatives in various MEA countries have further accelerated the adoption of sophisticated proximity sensor technologies.

Technological advancements have been a cornerstone of this evolution. The shift towards miniaturization, enhanced sensing accuracy, and improved environmental resilience in proximity sensors has broadened their applicability. For example, the development of non-contact inductive proximity sensors with higher detection ranges and resistance to harsh industrial environments has been pivotal. Similarly, the integration of capacitive proximity sensors in consumer electronics and the food and beverage industry for non-metallic object detection has opened new avenues for market penetration.

Shifting consumer demands, particularly in the automotive sector, have also played a crucial role. The increasing emphasis on vehicle safety and autonomous driving features is driving the demand for advanced photoelectric and magnetic proximity sensors for applications like parking assistance, pedestrian detection, and blind-spot monitoring. In the Aerospace and Defense sector, stringent safety requirements and the need for precise object detection in critical applications are contributing to sustained demand for high-performance proximity sensors.

The Food and Beverage industry is increasingly adopting proximity sensors for automated packaging, quality control, and hygienic processing, leading to a growth rate of around 8.5% in this vertical during the forecast period. The overall market is projected to grow from an estimated XXX Million in 2025 to approximately XXX Million by 2033, reflecting a significant CAGR of XX% during the forecast period. This sustained growth underscores the critical role of proximity sensors in modern industrial and technological landscapes across the MEA region.

Leading Regions, Countries, or Segments in Middle East and Africa Proximity Sensors Market

The dominance within the Middle East and Africa Proximity Sensors Market is multifaceted, with the Industrial sector emerging as the undisputed leader, closely followed by the Automotive sector. This leadership is underpinned by a confluence of factors including substantial investment trends, evolving regulatory support, and inherent technological compatibility within these segments.

Within the Industrial sector, which commands an estimated 45% of the market share in 2025, countries like Saudi Arabia and the UAE are at the forefront. This dominance is driven by:

- Massive Infrastructure Development: Significant government investments in mega-projects, industrial zones, and manufacturing facilities necessitate a robust deployment of proximity sensors for automation, process control, and safety applications.

- Oil & Gas Dominance: The region's vast oil and gas industry relies heavily on inductive and magnetic proximity sensors for monitoring machinery, detecting leaks, and ensuring operational safety in harsh environments.

- Smart Factory Initiatives: The push towards Industry 4.0 and smart manufacturing across key MEA nations fuels demand for advanced sensing solutions for real-time data acquisition and process optimization.

- Growth in Food & Beverage Processing: Increasing domestic food production and processing capabilities are driving the adoption of capacitive and photoelectric sensors for packaging, quality control, and material handling.

The Automotive sector, holding an estimated 25% market share in 2025, is experiencing rapid expansion, particularly in North Africa (Egypt and Morocco) and the UAE. Key drivers include:

- Automotive Manufacturing Growth: The establishment and expansion of automotive manufacturing plants in the region are creating substantial demand for proximity sensors for assembly lines, robotics, and vehicle component integration.

- ADAS Adoption: The increasing adoption of Advanced Driver-Assistance Systems (ADAS) in new vehicle models, driven by safety regulations and consumer demand for enhanced driving experiences, is a major growth catalyst. This requires precise photoelectric and magnetic sensors for collision avoidance, parking assist, and blind-spot detection.

- Emerging Electric Vehicle (EV) Market: The nascent but growing EV market in the MEA region will further boost demand for specialized proximity sensors in battery management systems and charging infrastructure.

Looking at specific technologies, Inductive proximity sensors continue to be a cornerstone of the industrial automation landscape, accounting for approximately 35% of the total market value. Photoelectric sensors follow closely at 28%, driven by their versatility in various automation tasks and the expanding automotive segment. Capacitive sensors are gaining traction in the consumer electronics and food and beverage sectors, with an estimated 20% market share. Magnetic sensors, though currently smaller at 17%, are poised for significant growth due to their application in security systems and the burgeoning automotive ADAS market. The overall market is projected to see the Industrial sector grow at a CAGR of 7.8% and the Automotive sector at 9.2% during the forecast period, underscoring their continued importance.

Middle East and Africa Proximity Sensors Market Product Innovations

Product innovation in the MEA proximity sensors market is characterized by the development of smaller, more robust, and intelligent sensing solutions. Manufacturers are focusing on enhanced environmental resistance, improved detection accuracy, and extended communication capabilities for seamless integration into IoT ecosystems. Key innovations include the introduction of miniature inductive proximity sensors with extended sensing distances for tight spaces, and advanced photoelectric sensors with background suppression for precise object detection even in complex environments. Furthermore, the integration of AI and machine learning algorithms into proximity sensors is enabling predictive maintenance capabilities and adaptive sensing, optimizing operational efficiency across various end-user verticals.

Propelling Factors for Middle East and Africa Proximity Sensors Market Growth

Several propelling factors are driving the growth of the Middle East and Africa Proximity Sensors Market. Technologically, the increasing demand for automation in the Industrial sector and the rapid adoption of automotive technologies, including ADAS, are primary drivers. Economically, significant government investments in infrastructure development, manufacturing, and smart city initiatives across the MEA region are creating a fertile ground for proximity sensor deployment. Regulatory influences, such as the growing emphasis on industrial safety standards and the push for energy efficiency, further encourage the adoption of advanced sensing solutions. The expansion of the Food and Beverage industry and the growing consumer electronics market also contribute significantly to market expansion, with projected growth rates in these sectors reaching XX% and XX% respectively during the forecast period.

Obstacles in the Middle East and Africa Proximity Sensors Market Market

Despite the strong growth trajectory, the MEA Proximity Sensors Market faces several obstacles. Regulatory challenges, particularly the varying levels of implementation and enforcement across different countries, can hinder widespread adoption. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities within the vast MEA region, can impact product availability and lead times, potentially affecting project timelines. Competitive pressures from both established global players and emerging local manufacturers can lead to price sensitivity and impact profit margins, especially in price-sensitive segments. The estimated impact of these disruptions on market growth is a potential reduction of XX% annually.

Future Opportunities in Middle East and Africa Proximity Sensors Market

Emerging opportunities within the MEA Proximity Sensors Market are abundant, driven by technological advancements and evolving market needs. The burgeoning Internet of Things (IoT) ecosystem presents a significant opportunity for the integration of smarter, connected proximity sensors, particularly in smart manufacturing and smart city applications. The growing demand for renewable energy solutions, such as solar farms, will also create opportunities for proximity sensors in monitoring and control systems. Furthermore, the increasing focus on sustainability and resource management will drive demand for highly accurate and reliable sensing technologies across various end-user verticals, including Food and Beverage and Aerospace and Defense. The expansion of e-commerce logistics will also fuel the need for advanced automation solutions, further boosting the demand for these sensors.

Major Players in the Middle East and Africa Proximity Sensors Market Ecosystem

- ST Microelectronics NV

- Delta Electronics Inc

- SICK AG

- Omron Corporation

- Rockwell Automation Inc

- Datalogic SpA

- Honeywell International Inc

Key Developments in Middle East and Africa Proximity Sensors Market Industry

- 2024/01: Launch of a new series of ultra-compact inductive proximity sensors with enhanced resistance to electromagnetic interference, targeting the automotive and industrial automation sectors.

- 2023/07: A major automotive manufacturer in Egypt announces plans to integrate advanced proximity sensor technology across its entire vehicle production line, boosting demand for photoelectric and magnetic sensors.

- 2023/03: Rockwell Automation expands its presence in Saudi Arabia with a new facility, focusing on providing integrated automation solutions that heavily incorporate proximity sensing technologies for the oil and gas industry.

- 2022/11: SICK AG introduces innovative safety-certified proximity sensors designed for hazardous environments in the mining and petrochemical industries, addressing stringent regulatory requirements.

- 2022/06: Datalogic SpA unveils a new range of high-performance photoelectric sensors with advanced object recognition capabilities, finding applications in the food and beverage packaging sector.

Strategic Middle East and Africa Proximity Sensors Market Market Forecast

The strategic forecast for the MEA Proximity Sensors Market indicates a promising growth trajectory, driven by the pervasive adoption of automation across key industries and the ongoing digital transformation initiatives. The confluence of significant infrastructure investments, particularly in Saudi Arabia and the UAE, and the expanding manufacturing base across the region will continue to be a primary growth catalyst. The automotive sector's increasing integration of advanced driver-assistance systems and the rising demand for smart solutions in consumer electronics further underscore the market's potential. The proactive integration of IoT technologies and the growing emphasis on industrial safety and efficiency will solidify the position of proximity sensors as indispensable components in the modern industrial landscape, projecting a robust market expansion valued at approximately XXX Million by 2033.

Middle East and Africa Proximity Sensors Market Segmentation

-

1. Technology

- 1.1. Inductive

- 1.2. Capacitive

- 1.3. Photoelectric

- 1.4. Magnetic

-

2. End-user Vertical

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Consumer Electronics

- 2.5. Food and Beverage

- 2.6. Other End-user Verticals

Middle East and Africa Proximity Sensors Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Proximity Sensors Market Regional Market Share

Geographic Coverage of Middle East and Africa Proximity Sensors Market

Middle East and Africa Proximity Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Industrial Automation

- 3.3. Market Restrains

- 3.3.1. ; Limitations in Sensing Capabilities

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Proximity Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Inductive

- 5.1.2. Capacitive

- 5.1.3. Photoelectric

- 5.1.4. Magnetic

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Consumer Electronics

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ST Microelectronics NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delta Electronics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SICK AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rockwell Automation Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Datalogic SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Honeywell International Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 ST Microelectronics NV

List of Figures

- Figure 1: Middle East and Africa Proximity Sensors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Proximity Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Middle East and Africa Proximity Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Proximity Sensors Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Middle East and Africa Proximity Sensors Market?

Key companies in the market include ST Microelectronics NV, Delta Electronics Inc, SICK AG, Omron Corporation, Rockwell Automation Inc, Datalogic SpA, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Proximity Sensors Market?

The market segments include Technology, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.28 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Industrial Automation.

6. What are the notable trends driving market growth?

Consumer Electronics to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Limitations in Sensing Capabilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Proximity Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Proximity Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Proximity Sensors Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Proximity Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence