Key Insights

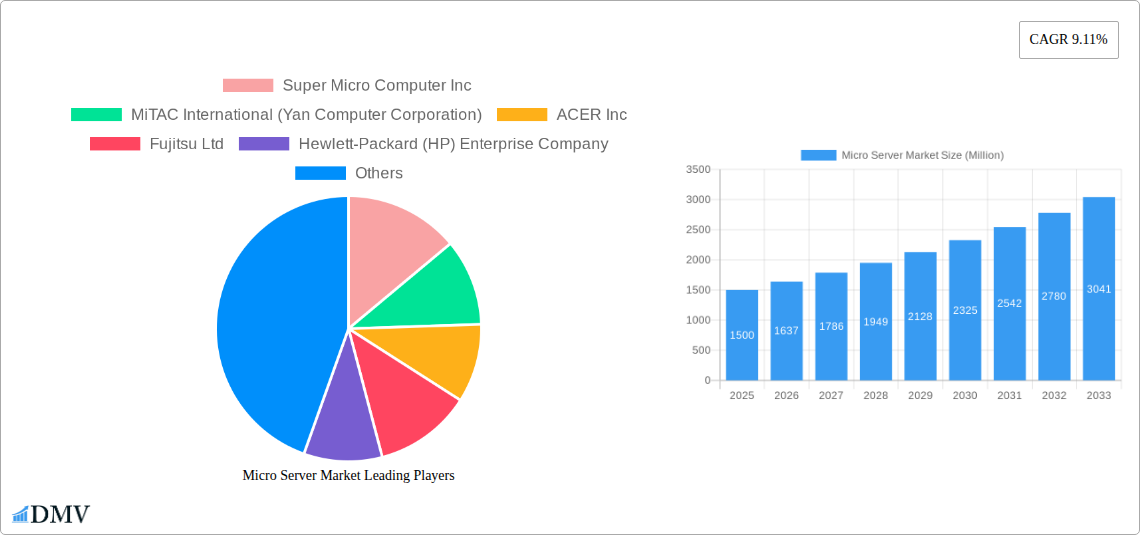

The global Micro Server Market is poised for substantial growth, driven by the escalating demand for energy-efficient and cost-effective computing solutions across various industries. With a projected market size of XX million and a robust Compound Annual Growth Rate (CAGR) of 9.11% from 2025 to 2033, the market presents a significant opportunity for stakeholders. Key drivers include the burgeoning adoption of cloud computing, the need for high-density computing in data centers, and the increasing utilization of micro servers for media storage and data analytics. These factors are propelling the market forward as organizations seek to optimize their IT infrastructure for performance, scalability, and power consumption. The continuous evolution of processor architectures, particularly the advancements in ARM-based processors, is further fueling innovation and expanding the application scope of micro servers.

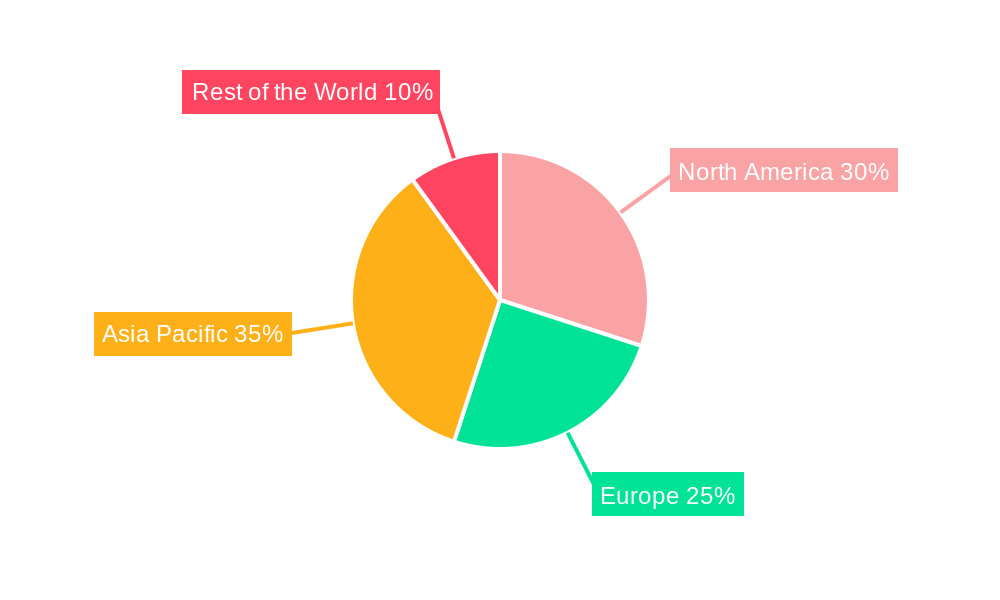

The market's segmentation by processor type reveals a dynamic landscape with Intel, AMD, and ARM processors catering to diverse computational needs. In terms of applications, Data Centers and Cloud Computing are anticipated to dominate, reflecting the fundamental role of micro servers in modern IT architectures. The growing emphasis on data-driven decision-making is also boosting the adoption of micro servers for Data Analytics. From an end-user perspective, Small Enterprises are increasingly leveraging micro servers for their cost-effectiveness and scalability, while Medium and Large Enterprises are deploying them for specialized workloads and to enhance their existing data center infrastructure. Geographically, North America and Asia Pacific are expected to lead the market growth, owing to rapid technological adoption, significant investments in cloud infrastructure, and a strong presence of key industry players. However, Europe and the Rest of the World are also showing promising growth trajectories, indicating a global surge in micro server adoption. Emerging trends such as the integration of AI and machine learning capabilities into micro server solutions are expected to further shape the market's future.

Micro Server Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a strategic overview of the global Micro Server Market, encompassing a detailed examination of market dynamics, key players, and future growth trajectories. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report offers actionable insights for stakeholders seeking to navigate this rapidly evolving technology landscape. Analyze market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, major players, key developments, and a strategic market forecast.

Micro Server Market Market Composition & Trends

The Micro Server Market exhibits a dynamic interplay of concentration and innovation, driven by the insatiable demand for efficient, scalable computing solutions. Market concentration is influenced by the strategic positioning of key players, with Super Micro Computer Inc. and Hewlett-Packard (HP) Enterprise Company often holding significant market share in specific sub-segments. Innovation catalysts include the continuous advancements in ARM architecture, driving power efficiency, and the increasing adoption of micro servers in edge computing scenarios. Regulatory landscapes, particularly concerning data privacy and security, play a crucial role in shaping market entry and product development. Substitute products, such as traditional blade servers and increasingly powerful multi-core CPUs in rack servers, present ongoing competition, necessitating a focus on unique selling propositions like power efficiency and cost-effectiveness for micro servers. End-user profiles span from Small Enterprises seeking affordable server solutions to Large Enterprises deploying micro servers for specialized workloads in data centers and cloud computing. Mergers and Acquisitions (M&A) activities, while not always widely publicized for smaller acquisitions, are crucial for consolidating market presence and acquiring specialized technologies. For instance, a hypothetical M&A deal in the last quarter of 2024 could have been valued at approximately $150 Million, aimed at enhancing a company's edge computing capabilities. The market share distribution is fluid, with processor types like ARM gaining substantial ground due to their power efficiency. The overall market size is projected to reach $45,500 Million by 2025, with a projected CAGR of 18.7% during the forecast period.

Micro Server Market Industry Evolution

The Micro Server Market has undergone a significant evolutionary path, transforming from a niche solution to a pivotal component in modern IT infrastructure. Over the historical period of 2019–2024, the market witnessed initial adoption driven by specialized use cases and a growing awareness of power efficiency benefits. The estimated year of 2025 marks a crucial inflection point, with accelerated adoption across various industries. Market growth trajectories have been consistently upward, fueled by the proliferation of cloud computing, the burgeoning demand for big data analytics, and the increasing need for localized processing power at the edge. Technological advancements have been relentless. The maturation of ARM processors, once primarily associated with mobile devices, has revolutionized the micro server landscape by offering a compelling blend of performance and ultra-low power consumption. This has directly challenged the dominance of Intel and AMD in certain segments, particularly where power and thermal management are paramount. Consumer demand has shifted significantly, with businesses increasingly prioritizing operational expenditure (OpEx) savings, making the lower power consumption and smaller footprint of micro servers highly attractive. Furthermore, the rise of IoT devices and the subsequent data explosion necessitate distributed computing power, a domain where micro servers excel. Adoption metrics show a steady increase in deployment within Data Centers for high-density computing, and in Cloud Computing environments for scalable microservices. The market size in 2019 was approximately $15,200 Million, with projections indicating a substantial growth to $45,500 Million by 2025, demonstrating a robust CAGR of approximately 20% during the initial phase of this study. This growth is further expected to continue at a CAGR of 18.7% from 2025 to 2033.

Leading Regions, Countries, or Segments in Micro Server Market

The dominance within the Micro Server Market is a multifaceted phenomenon, with specific segments and applications exhibiting pronounced leadership. Within the Processor Type segment, ARM processors are rapidly emerging as leaders, particularly in workloads demanding high power efficiency. This is driven by their scalability for diverse applications and their inherent cost-effectiveness. Intel and AMD continue to hold strong positions, especially in performance-intensive applications within Data Centers and Cloud Computing. In terms of Application, Data Center and Cloud Computing remain the largest and fastest-growing segments, accounting for an estimated 60% of the total market revenue in 2025. This dominance is attributed to the ongoing digital transformation, the expansion of cloud services, and the increasing need for scalable and efficient infrastructure. Media Storage and Data Analytics are also significant contributors, with micro servers proving invaluable for localized data processing and content delivery networks. For End User segments, Large Enterprises are the primary adopters, leveraging micro servers for their advanced capabilities in data centers and cloud deployments, contributing an estimated 55% of market revenue in 2025. However, Medium Enterprises are showing a significant growth rate, driven by the increasing affordability and accessibility of micro server solutions for scaling their operations. Small Enterprises are also gradually adopting micro servers for specific tasks, recognizing their potential for cost savings.

- Dominant Processor Type Driver (ARM): The increasing focus on energy efficiency and the development of ARM-based server processors capable of handling complex workloads are key drivers. ARM's licensing model also fosters innovation and customization, appealing to various manufacturers.

- Dominant Application Driver (Data Center & Cloud Computing): The insatiable demand for compute power, the scalability requirements of cloud services, and the need for efficient resource utilization in large-scale data centers are the primary growth engines.

- Dominant End User Driver (Large Enterprises): Large enterprises have the scale and the budget to invest in advanced infrastructure, seeking performance, efficiency, and cost optimization through micro server deployments. Their adoption sets market trends and drives innovation.

- Regional Dominance: North America and Europe are currently leading regions due to high IT spending and the presence of major cloud providers. However, the Asia-Pacific region is projected to exhibit the fastest growth due to increasing digitalization and infrastructure development.

Micro Server Market Product Innovations

Product innovation in the Micro Server Market is characterized by a relentless pursuit of enhanced performance, reduced power consumption, and greater density. Companies are actively developing micro servers with specialized Intel, AMD, and ARM processors optimized for specific workloads. Innovations include advancements in integrated networking, enhanced memory capacity, and improved thermal management solutions to enable higher density deployments. For instance, the integration of NVMe SSDs directly onto the motherboard and the development of highly efficient power supplies are key technological advancements. Performance metrics such as teraflops per watt and rack units per server are constantly being pushed. The unique selling proposition lies in delivering enterprise-grade performance in a compact, power-efficient form factor, ideal for edge computing, IoT gateways, and micro data centers.

Propelling Factors for Micro Server Market Growth

Several key factors are propelling the growth of the Micro Server Market. The ever-increasing demand for cloud computing services and the subsequent need for scalable and efficient infrastructure are primary drivers. The proliferation of the Internet of Things (IoT) generates vast amounts of data, requiring localized processing and edge computing solutions where micro servers excel. Furthermore, the growing emphasis on energy efficiency and sustainability within IT operations makes the low power consumption of micro servers highly attractive. Economic factors such as the desire to reduce operational expenditure (OpEx) by lowering electricity costs and cooling requirements also contribute significantly. Regulatory pushes for greener IT practices further bolster adoption.

Obstacles in the Micro Server Market Market

Despite the strong growth potential, the Micro Server Market faces certain obstacles. A significant barrier is the perceived complexity of management and deployment compared to traditional server architectures, especially for smaller IT teams. Supply chain disruptions, which have impacted the broader technology sector, can also affect the availability and cost of components for micro servers. Furthermore, while improving, the performance of some micro servers may still not be sufficient for highly demanding, compute-intensive applications, leading to competition from more powerful, albeit less energy-efficient, solutions. The maturity of the software ecosystem supporting micro servers for specialized tasks is also a factor, though rapidly evolving.

Future Opportunities in Micro Server Market

Emerging opportunities in the Micro Server Market are abundant and diverse. The expansion of 5G networks will drive demand for edge computing solutions, creating a significant market for micro servers deployed closer to end-users for low-latency applications. The growing adoption of artificial intelligence (AI) and machine learning (ML) at the edge presents another lucrative avenue. The continued growth of smart cities, industrial IoT, and connected vehicles will further fuel the need for distributed, powerful, yet energy-efficient computing. Emerging markets with increasing digitalization and infrastructure development also offer substantial growth potential.

Major Players in the Micro Server Market Ecosystem

- Super Micro Computer Inc

- MiTAC International (Yan Computer Corporation)

- ACER Inc

- Fujitsu Ltd

- Hewlett-Packard (HP) Enterprise Company

- Penguin Computing

- Dell Inc

- ARM Holdings

- Quanta Computer Incorporated

- Plat'Home Co Ltd

Key Developments in Micro Server Market Industry

- 2023 Q4: Launch of next-generation ARM-based micro servers with enhanced performance and power efficiency by several key vendors, targeting cloud and edge deployments.

- 2024 Q1: Increased investment in R&D for specialized micro server solutions catering to AI/ML inference at the edge.

- 2024 Q2: Several strategic partnerships formed between micro server manufacturers and cloud service providers to optimize deployment of microserver-based cloud solutions.

- 2024 Q3: Growing interest and pilot programs for micro servers in telecommunications infrastructure for 5G edge computing applications.

- 2024 Q4: Release of new management software and orchestration tools designed to simplify the deployment and management of large-scale micro server fleets.

Strategic Micro Server Market Market Forecast

The Micro Server Market is poised for substantial and sustained growth, driven by the overarching trends of digitalization, edge computing, and the imperative for energy efficiency. The forecast period from 2025–2033 indicates a robust CAGR of 18.7%, with the market size projected to reach an estimated $150,000 Million by 2033. Key growth catalysts include the continued expansion of cloud services, the massive deployment of IoT devices, and the rollout of 5G infrastructure, all of which necessitate distributed and power-efficient computing. The increasing adoption of AI and ML at the edge will further propel demand. Strategic investments in R&D, coupled with strategic partnerships, will be crucial for market players to capitalize on these opportunities and maintain a competitive edge in this dynamic and expanding market.

Micro Server Market Segmentation

-

1. Processor Type

- 1.1. Intel

- 1.2. AMD

- 1.3. ARM

- 1.4. Other Processor Types

-

2. Application

- 2.1. Data Center

- 2.2. Cloud Computing

- 2.3. Media Storage

- 2.4. Data Analytics

-

3. End User

- 3.1. Small Enterprises

- 3.2. Medium Enterprises

- 3.3. Large Enterprises

Micro Server Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Micro Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rise in Demand of Cloud Facilities for Various Applications; Rise in Number of Medium- and Small-scale Enterprises Globally

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Cloud Computing Micro Servers to Offer Potential Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Processor Type

- 5.1.1. Intel

- 5.1.2. AMD

- 5.1.3. ARM

- 5.1.4. Other Processor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Data Center

- 5.2.2. Cloud Computing

- 5.2.3. Media Storage

- 5.2.4. Data Analytics

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Small Enterprises

- 5.3.2. Medium Enterprises

- 5.3.3. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Processor Type

- 6. North America Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Processor Type

- 6.1.1. Intel

- 6.1.2. AMD

- 6.1.3. ARM

- 6.1.4. Other Processor Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Data Center

- 6.2.2. Cloud Computing

- 6.2.3. Media Storage

- 6.2.4. Data Analytics

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Small Enterprises

- 6.3.2. Medium Enterprises

- 6.3.3. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Processor Type

- 7. Europe Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Processor Type

- 7.1.1. Intel

- 7.1.2. AMD

- 7.1.3. ARM

- 7.1.4. Other Processor Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Data Center

- 7.2.2. Cloud Computing

- 7.2.3. Media Storage

- 7.2.4. Data Analytics

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Small Enterprises

- 7.3.2. Medium Enterprises

- 7.3.3. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Processor Type

- 8. Asia Pacific Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Processor Type

- 8.1.1. Intel

- 8.1.2. AMD

- 8.1.3. ARM

- 8.1.4. Other Processor Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Data Center

- 8.2.2. Cloud Computing

- 8.2.3. Media Storage

- 8.2.4. Data Analytics

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Small Enterprises

- 8.3.2. Medium Enterprises

- 8.3.3. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Processor Type

- 9. Rest of the World Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Processor Type

- 9.1.1. Intel

- 9.1.2. AMD

- 9.1.3. ARM

- 9.1.4. Other Processor Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Data Center

- 9.2.2. Cloud Computing

- 9.2.3. Media Storage

- 9.2.4. Data Analytics

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Small Enterprises

- 9.3.2. Medium Enterprises

- 9.3.3. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Processor Type

- 10. North America Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Micro Server Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Super Micro Computer Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 MiTAC International (Yan Computer Corporation)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 ACER Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Fujitsu Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Hewlett-Packard (HP) Enterprise Company

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Penguin Computing

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Dell Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 ARM Holdings

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Qunata Computer Incorporated

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Plat'Home Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Super Micro Computer Inc

List of Figures

- Figure 1: Global Micro Server Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Micro Server Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 11: North America Micro Server Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 12: North America Micro Server Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Micro Server Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Micro Server Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Micro Server Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Micro Server Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 19: Europe Micro Server Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 20: Europe Micro Server Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Micro Server Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Micro Server Market Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe Micro Server Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Micro Server Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 27: Asia Pacific Micro Server Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 28: Asia Pacific Micro Server Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pacific Micro Server Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Micro Server Market Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific Micro Server Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Micro Server Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Micro Server Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 35: Rest of the World Micro Server Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 36: Rest of the World Micro Server Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Rest of the World Micro Server Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Rest of the World Micro Server Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Rest of the World Micro Server Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Rest of the World Micro Server Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Micro Server Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Micro Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Micro Server Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 3: Global Micro Server Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Micro Server Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Micro Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Micro Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Micro Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Micro Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Micro Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Micro Server Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 15: Global Micro Server Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Micro Server Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Micro Server Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 19: Global Micro Server Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Micro Server Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Micro Server Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 23: Global Micro Server Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Micro Server Market Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Micro Server Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 27: Global Micro Server Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Micro Server Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global Micro Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Server Market?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the Micro Server Market?

Key companies in the market include Super Micro Computer Inc , MiTAC International (Yan Computer Corporation), ACER Inc, Fujitsu Ltd, Hewlett-Packard (HP) Enterprise Company, Penguin Computing, Dell Inc, ARM Holdings, Qunata Computer Incorporated, Plat'Home Co Ltd.

3. What are the main segments of the Micro Server Market?

The market segments include Processor Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rise in Demand of Cloud Facilities for Various Applications; Rise in Number of Medium- and Small-scale Enterprises Globally.

6. What are the notable trends driving market growth?

Cloud Computing Micro Servers to Offer Potential Growth.

7. Are there any restraints impacting market growth?

; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Server Market?

To stay informed about further developments, trends, and reports in the Micro Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence