Key Insights

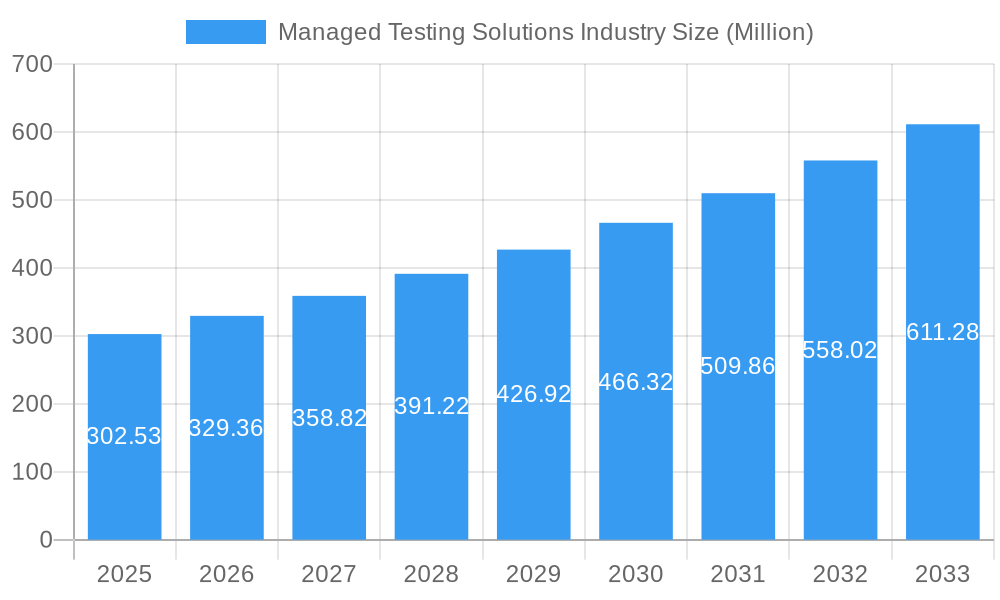

The Managed Testing Solutions market, valued at $302.53 million in 2025, is projected to experience robust growth, driven by the increasing adoption of digital technologies and the rising need for ensuring software quality across diverse industries. The market's Compound Annual Growth Rate (CAGR) of 8.70% from 2025 to 2033 signifies a significant expansion opportunity. Key growth drivers include the escalating complexity of software applications, the surge in demand for agile and DevOps methodologies that necessitate continuous testing, and the growing adoption of cloud-based testing solutions. Furthermore, the increasing prevalence of cybersecurity threats is compelling organizations to invest heavily in rigorous testing processes to mitigate risks. The market is segmented by organization size (SMEs and large enterprises), end-user vertical (healthcare, BFSI, telecom and IT, retail, government, and others), and delivery model (onshore and offshore). Large enterprises, given their complex IT infrastructure and higher budgets, are anticipated to drive a substantial portion of market growth. The healthcare and BFSI sectors are expected to witness significant demand for managed testing solutions due to stringent regulatory compliance requirements and the critical nature of their applications. The offshore delivery model is likely to gain traction due to cost advantages and access to a larger talent pool. While competitive intensity from established players like Infosys, Accenture, and Wipro is high, market expansion is likely to create opportunities for smaller, specialized firms.

Managed Testing Solutions Industry Market Size (In Million)

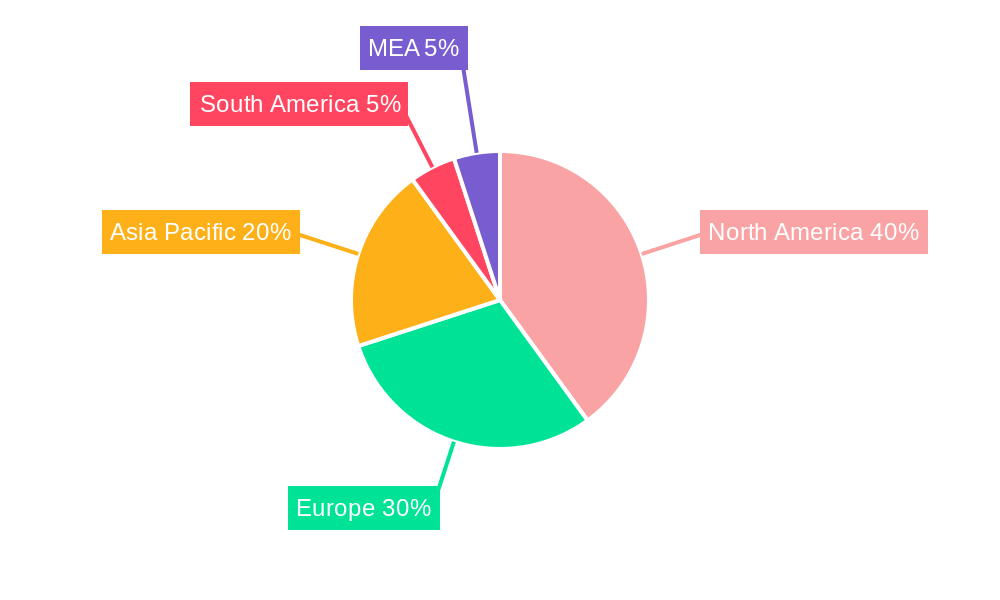

The geographical distribution of the market reveals a strong presence in North America and Europe, driven by early adoption of advanced technologies and robust IT infrastructure. However, the Asia-Pacific region is expected to witness significant growth during the forecast period, fueled by rising digitalization and a growing number of tech-savvy businesses in countries like India and China. Challenges to market growth include the high cost of implementing and maintaining comprehensive testing solutions, the shortage of skilled testing professionals, and the need for continuous upskilling to stay abreast of evolving technologies. Despite these challenges, the overall outlook for the Managed Testing Solutions market remains highly positive, indicating substantial growth prospects over the next decade.

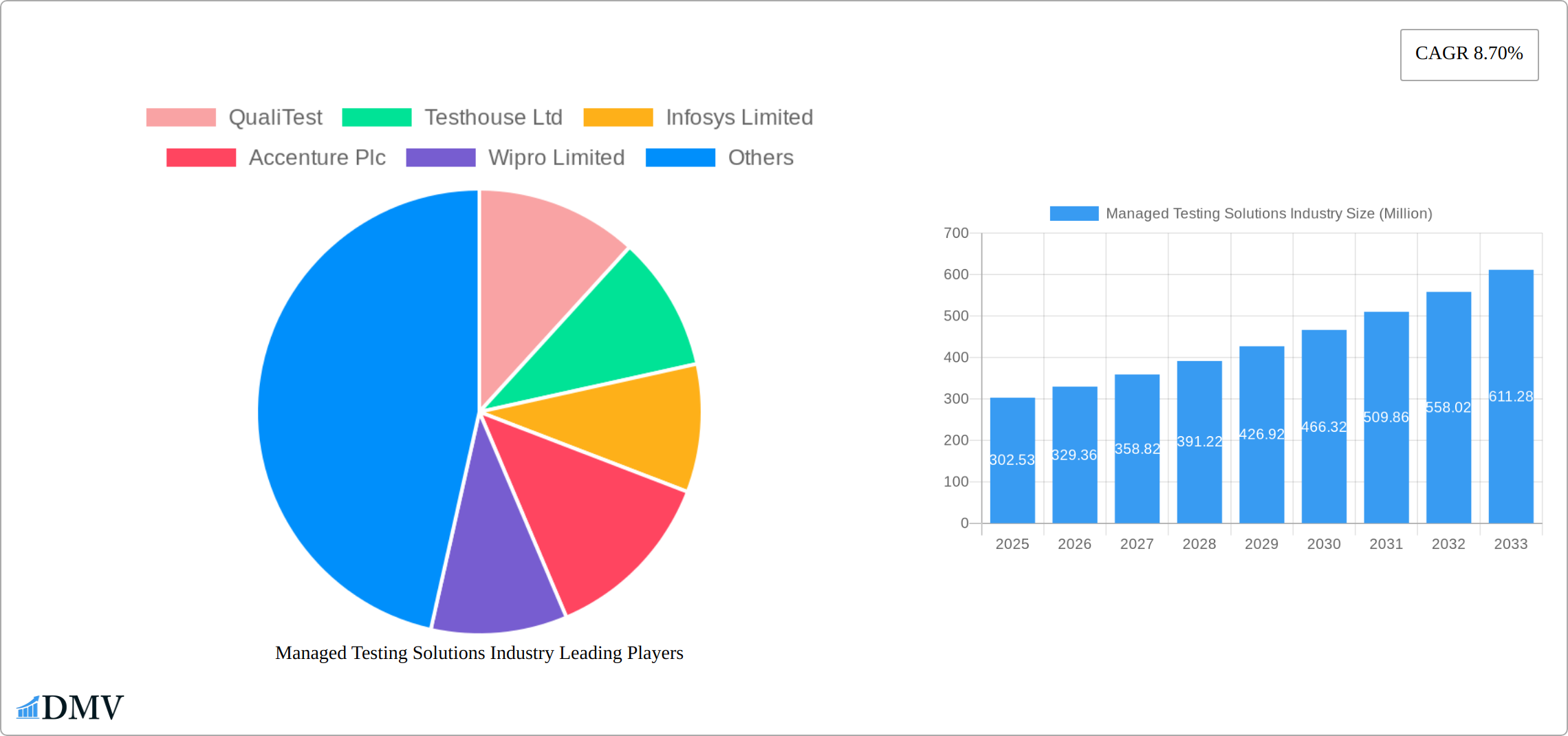

Managed Testing Solutions Industry Company Market Share

Managed Testing Solutions Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Managed Testing Solutions industry, projecting a market value of $XX Million by 2033. It covers market composition, leading players, technological advancements, and future growth opportunities, offering invaluable insights for stakeholders across the industry. The study period spans 2019-2033, with 2025 as the base and estimated year.

Managed Testing Solutions Industry Market Composition & Trends

The global Managed Testing Solutions market, a critical component of modern software development and deployment, is projected to reach a significant valuation of $XX Million in 2024. This robust expansion is fueled by several intertwined forces, including the escalating complexity of contemporary software architectures, the pervasive adoption of digital transformation initiatives across all business sectors, and an unwavering demand for impeccably high-quality software applications. The market exhibits a moderate concentration, with established stalwarts like QualiTest, Testhouse Ltd, Infosys Limited, Accenture Plc, and Wipro Limited commanding substantial portions of the market share, though precise segmentation is still evolving. The industry's dynamic nature is underscored by a consistent stream of mergers and acquisitions (M&A), a testament to ongoing consolidation and strategic expansion. The cumulative value of M&A transactions over the past five years is estimated at an impressive $XX Million, highlighting a vibrant ecosystem of growth and integration.

- Market Concentration: Moderate, with top players collectively holding approximately XX% of the market share, indicating a healthy competitive landscape with room for specialized players.

- Innovation Catalysts: The driving forces behind market advancement are predominantly Automation, the transformative power of Artificial Intelligence (AI), and the flexibility and scalability offered by cloud-based testing solutions.

- Regulatory Landscape: A complex and region-specific regulatory environment significantly influences the industry, particularly concerning stringent data privacy and security standards that managed testing services must rigorously adhere to.

- Substitute Products: The unique and specialized nature of managed testing services presents a limited availability of direct substitutes, as clients often seek outsourced expertise for complex quality assurance needs.

- M&A Activities: The industry is characterized by high M&A activity, reflecting a strategic imperative for consolidation, talent acquisition, and market expansion. The total M&A deal value from 2019 to 2024 is estimated at $XX Million, showcasing significant investment and restructuring.

- End-User Profiles: The client base is remarkably diverse, spanning both small and medium-sized enterprises (SMEs) and large-scale corporations across a multitude of industry verticals, each with unique testing requirements.

Managed Testing Solutions Industry Industry Evolution

The Managed Testing Solutions market has witnessed consistent growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of XX%. This growth is fueled by several factors: the increasing adoption of agile and DevOps methodologies, the expanding use of cloud-based testing platforms, and the rising demand for specialized testing services such as AI-powered testing and cybersecurity testing. Technological advancements, particularly in automation and Artificial Intelligence (AI), have significantly enhanced testing efficiency and accuracy, driving further market expansion. The demand for higher software quality and reduced time-to-market is pushing businesses to outsource their testing needs, fueling the growth of managed testing services. The market is also witnessing a shift towards outcome-based pricing models, further encouraging the adoption of managed testing solutions.

Leading Regions, Countries, or Segments in Managed Testing Solutions Industry

The North American market currently dominates the Managed Testing Solutions industry, fueled by high technological adoption rates and a robust software development ecosystem. However, the Asia-Pacific region is showing significant growth potential.

- Size of Organization: Large enterprises are the primary drivers, accounting for XX% of the market due to their higher budgets and complex testing requirements. SMEs contribute XX%.

- End-user Vertical: The BFSI (Banking, Financial Services, and Insurance) sector leads, followed by Telecom and IT, Healthcare, and Retail. Government and other end-user verticals are also contributing significantly.

- Type of Delivery Model: Offshore delivery models are dominant due to cost-effectiveness, followed by onshore and hybrid models.

Key drivers for regional dominance include:

- North America: High software development activity, high adoption of advanced technologies.

- Asia-Pacific: Rapid technological advancements, cost-effective labor.

Managed Testing Solutions Industry Product Innovations

The cutting edge of the Managed Testing Solutions industry is defined by pioneering innovations that enhance efficiency, coverage, and cost-effectiveness. Foremost among these are advancements in AI-powered test automation, which allows for more intelligent and adaptive testing processes. Furthermore, the widespread adoption of cloud-based testing platforms offers unparalleled scalability and accessibility. Crucially, the seamless integration of testing into DevOps pipelines is revolutionizing development cycles, enabling continuous testing and faster feedback loops. These innovations collectively contribute to significantly improved test coverage, drastically reduced turnaround times, and substantial cost savings for clients. Key differentiators and unique selling propositions often revolve around specialized expertise in niche testing domains, such as sophisticated security testing or intricate performance testing, coupled with highly flexible and tailored pricing models designed to meet diverse client needs.

Propelling Factors for Managed Testing Solutions Industry Growth

The sustained growth trajectory of the Managed Testing Solutions industry is propelled by a confluence of powerful drivers. Primarily, the ever-increasing complexity of modern software applications mandates more sophisticated and comprehensive testing methodologies. Secondly, the global imperative for digital transformation across all business domains inherently requires robust, reliable, and efficient quality assurance solutions to ensure successful implementation. Thirdly, the evolving and often stringent regulatory compliance requirements across various industries necessitate rigorous testing protocols and adherence to specific standards. Finally, continuous advancements in automation and AI technologies are not only enhancing the efficiency and effectiveness of testing processes but also opening new avenues for innovative service delivery.

Obstacles in the Managed Testing Solutions Industry Market

Despite its growth, the Managed Testing Solutions industry navigates several significant hurdles. A persistent challenge is the scarcity of highly skilled and specialized testing professionals, a demand-driven bottleneck. Maintaining the utmost levels of security and data privacy for client information is paramount and presents ongoing operational complexities. Furthermore, there is continuous pressure to maintain competitive pricing while delivering high-quality services, impacting profit margins. The potential for supply chain disruptions, though less direct than in manufacturing, can still impact the seamless delivery of testing services. Finally, the landscape is marked by increasing competition from both agile new entrants and established industry giants, creating a dynamic environment that necessitates constant adaptation and strategic differentiation.

Future Opportunities in Managed Testing Solutions Industry

The future outlook for the Managed Testing Solutions industry is brimming with promising opportunities. A key avenue for growth lies in expanding service offerings into emerging markets, capitalizing on the burgeoning digital economies. Developing highly specialized testing services tailored for nascent technologies, such as the Internet of Things (IoT), blockchain, and extended reality (XR), presents a significant untapped potential. Leveraging the advanced capabilities of AI and machine learning for predictive testing, anomaly detection, and proactive quality assurance promises to redefine industry standards. The escalating demand for robust cybersecurity testing, driven by an increasingly threat-prone digital landscape, and the ongoing need for continuous testing within agile DevOps environments, further solidify the industry's growth trajectory and innovative potential.

Major Players in the Managed Testing Solutions Industry Ecosystem

Key Developments in Managed Testing Solutions Industry Industry

- July 2023: TestingXperts expands into Canada.

- June 2023: TestingXperts partners with an AI-based candidate screening services provider, adopting an offshore delivery model.

Strategic Managed Testing Solutions Industry Market Forecast

The Managed Testing Solutions market is poised for significant growth over the forecast period (2025-2033), driven by technological advancements, increasing demand for higher quality software, and the continued adoption of agile and DevOps methodologies. The market's expansion will be shaped by the increasing integration of AI and machine learning into testing processes, the growing adoption of cloud-based testing platforms, and the rising demand for specialized testing services across various industry verticals. The market is projected to reach $XX Million by 2033, representing a substantial increase from its 2024 value.

Managed Testing Solutions Industry Segmentation

-

1. Type of Delivery Model

- 1.1. Onshore

- 1.2. Offshore

-

2. Size of Organization

- 2.1. Small & Medium Enterprises

- 2.2. Large Enterprises

-

3. End-user Vertical

- 3.1. Healthcare

- 3.2. BFSI

- 3.3. Telecom and IT

- 3.4. Retail

- 3.5. Government

- 3.6. Other End-user Verticals

Managed Testing Solutions Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Managed Testing Solutions Industry Regional Market Share

Geographic Coverage of Managed Testing Solutions Industry

Managed Testing Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adopting artificial intelligence (AI) and cloud management is eventually helping organizations meet various functional business requirements while driving business process optimization.; The growing preference for outsourcing management functions to cloud service providers and managed service providers is expected to drive market growth.

- 3.3. Market Restrains

- 3.3.1. The market's need for more skilled labor is a significant challenge. Understanding customer requirements and selecting the best testing method required specialized knowledge.

- 3.4. Market Trends

- 3.4.1. Healthcare to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Size of Organization

- 5.2.1. Small & Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Healthcare

- 5.3.2. BFSI

- 5.3.3. Telecom and IT

- 5.3.4. Retail

- 5.3.5. Government

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 6. North America Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Size of Organization

- 6.2.1. Small & Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Healthcare

- 6.3.2. BFSI

- 6.3.3. Telecom and IT

- 6.3.4. Retail

- 6.3.5. Government

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 7. Europe Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Size of Organization

- 7.2.1. Small & Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Healthcare

- 7.3.2. BFSI

- 7.3.3. Telecom and IT

- 7.3.4. Retail

- 7.3.5. Government

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 8. Asia Pacific Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Size of Organization

- 8.2.1. Small & Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Healthcare

- 8.3.2. BFSI

- 8.3.3. Telecom and IT

- 8.3.4. Retail

- 8.3.5. Government

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 9. South America Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Size of Organization

- 9.2.1. Small & Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Healthcare

- 9.3.2. BFSI

- 9.3.3. Telecom and IT

- 9.3.4. Retail

- 9.3.5. Government

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 10. Middle East Managed Testing Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Size of Organization

- 10.2.1. Small & Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Healthcare

- 10.3.2. BFSI

- 10.3.3. Telecom and IT

- 10.3.4. Retail

- 10.3.5. Government

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type of Delivery Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 QualiTest

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Testhouse Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infosys Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accenture Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wipro Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cognizant

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TATA Consultancy Services Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexaware Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Capgemini SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Business Machines Corporation (IBM)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 QualiTest

List of Figures

- Figure 1: Global Managed Testing Solutions Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Managed Testing Solutions Industry Revenue (Million), by Type of Delivery Model 2025 & 2033

- Figure 3: North America Managed Testing Solutions Industry Revenue Share (%), by Type of Delivery Model 2025 & 2033

- Figure 4: North America Managed Testing Solutions Industry Revenue (Million), by Size of Organization 2025 & 2033

- Figure 5: North America Managed Testing Solutions Industry Revenue Share (%), by Size of Organization 2025 & 2033

- Figure 6: North America Managed Testing Solutions Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Managed Testing Solutions Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Managed Testing Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Managed Testing Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Managed Testing Solutions Industry Revenue (Million), by Type of Delivery Model 2025 & 2033

- Figure 11: Europe Managed Testing Solutions Industry Revenue Share (%), by Type of Delivery Model 2025 & 2033

- Figure 12: Europe Managed Testing Solutions Industry Revenue (Million), by Size of Organization 2025 & 2033

- Figure 13: Europe Managed Testing Solutions Industry Revenue Share (%), by Size of Organization 2025 & 2033

- Figure 14: Europe Managed Testing Solutions Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Managed Testing Solutions Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Managed Testing Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Managed Testing Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Managed Testing Solutions Industry Revenue (Million), by Type of Delivery Model 2025 & 2033

- Figure 19: Asia Pacific Managed Testing Solutions Industry Revenue Share (%), by Type of Delivery Model 2025 & 2033

- Figure 20: Asia Pacific Managed Testing Solutions Industry Revenue (Million), by Size of Organization 2025 & 2033

- Figure 21: Asia Pacific Managed Testing Solutions Industry Revenue Share (%), by Size of Organization 2025 & 2033

- Figure 22: Asia Pacific Managed Testing Solutions Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Managed Testing Solutions Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Managed Testing Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Managed Testing Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Managed Testing Solutions Industry Revenue (Million), by Type of Delivery Model 2025 & 2033

- Figure 27: South America Managed Testing Solutions Industry Revenue Share (%), by Type of Delivery Model 2025 & 2033

- Figure 28: South America Managed Testing Solutions Industry Revenue (Million), by Size of Organization 2025 & 2033

- Figure 29: South America Managed Testing Solutions Industry Revenue Share (%), by Size of Organization 2025 & 2033

- Figure 30: South America Managed Testing Solutions Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: South America Managed Testing Solutions Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: South America Managed Testing Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Managed Testing Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Managed Testing Solutions Industry Revenue (Million), by Type of Delivery Model 2025 & 2033

- Figure 35: Middle East Managed Testing Solutions Industry Revenue Share (%), by Type of Delivery Model 2025 & 2033

- Figure 36: Middle East Managed Testing Solutions Industry Revenue (Million), by Size of Organization 2025 & 2033

- Figure 37: Middle East Managed Testing Solutions Industry Revenue Share (%), by Size of Organization 2025 & 2033

- Figure 38: Middle East Managed Testing Solutions Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East Managed Testing Solutions Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East Managed Testing Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Managed Testing Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 2: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 3: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Managed Testing Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 6: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 7: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Managed Testing Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 10: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 11: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Managed Testing Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 14: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 15: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Managed Testing Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 18: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 19: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Managed Testing Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Managed Testing Solutions Industry Revenue Million Forecast, by Type of Delivery Model 2020 & 2033

- Table 22: Global Managed Testing Solutions Industry Revenue Million Forecast, by Size of Organization 2020 & 2033

- Table 23: Global Managed Testing Solutions Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Managed Testing Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed Testing Solutions Industry?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the Managed Testing Solutions Industry?

Key companies in the market include QualiTest, Testhouse Ltd, Infosys Limited, Accenture Plc, Wipro Limited, Cognizant, TATA Consultancy Services Limited, Hexaware Technologies, Capgemini SE, International Business Machines Corporation (IBM).

3. What are the main segments of the Managed Testing Solutions Industry?

The market segments include Type of Delivery Model, Size of Organization, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 302.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Adopting artificial intelligence (AI) and cloud management is eventually helping organizations meet various functional business requirements while driving business process optimization.; The growing preference for outsourcing management functions to cloud service providers and managed service providers is expected to drive market growth..

6. What are the notable trends driving market growth?

Healthcare to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

The market's need for more skilled labor is a significant challenge. Understanding customer requirements and selecting the best testing method required specialized knowledge..

8. Can you provide examples of recent developments in the market?

July 2023 - TestingXperts, a software testing and quality assurance company, is pleased to announce its further expansion into Canada, strengthening its presence in the North American market. The decision to expand into Canada aligns with the company's strategic vision to cater to the region's growing demand for Quality Engineering and software testing services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed Testing Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed Testing Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed Testing Solutions Industry?

To stay informed about further developments, trends, and reports in the Managed Testing Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence