Key Insights

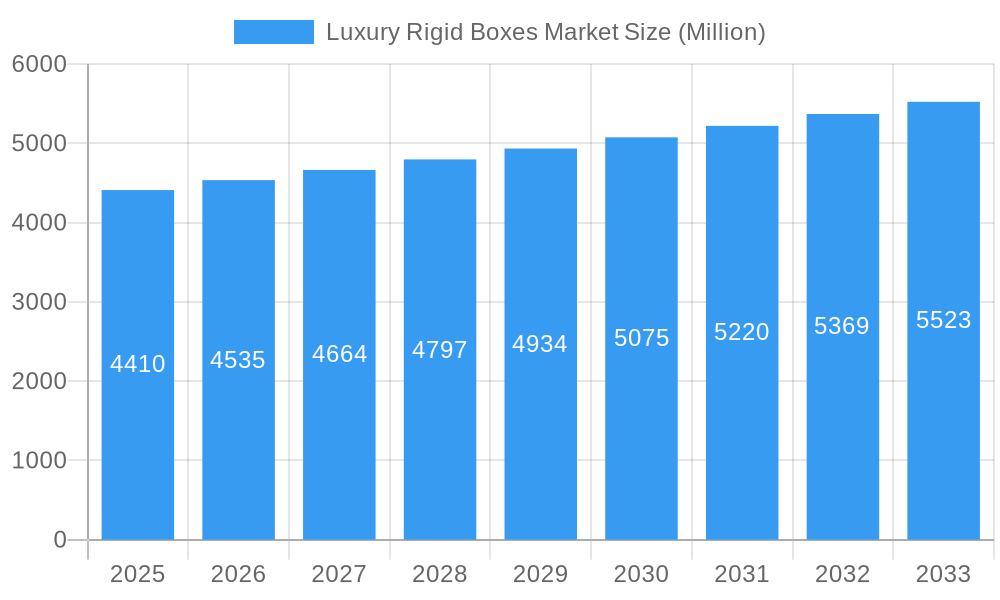

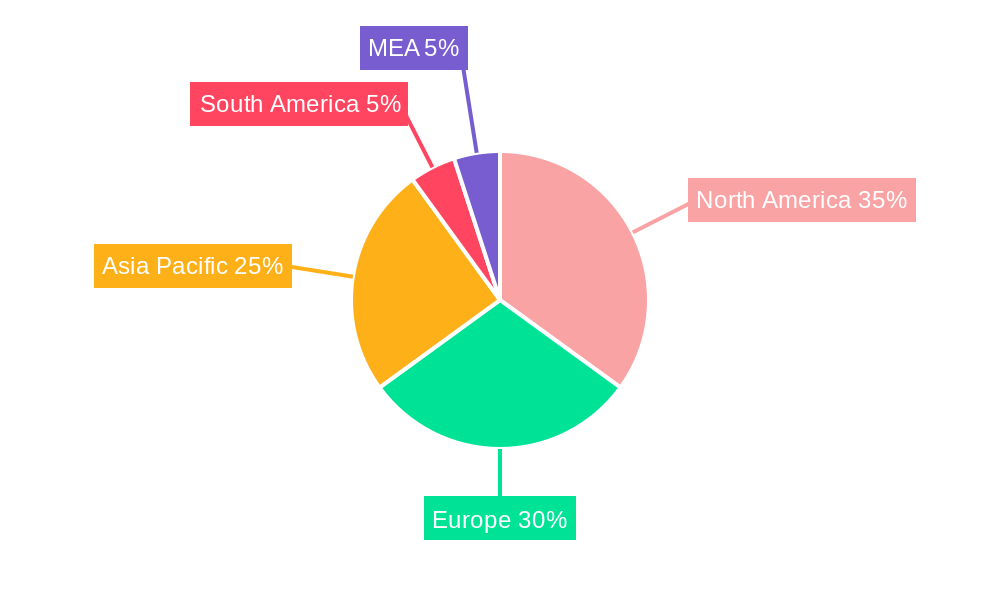

The luxury rigid boxes market, valued at $4.41 billion in 2025, is projected to experience steady growth, driven by increasing demand for premium packaging across diverse sectors. The Compound Annual Growth Rate (CAGR) of 2.85% from 2025 to 2033 reflects a consistent upward trajectory, fueled by several key factors. The rising preference for sustainable and eco-friendly packaging materials is reshaping the market, with a notable shift towards paperboard and recycled options. Furthermore, the growing e-commerce sector contributes significantly to market expansion, as luxury brands seek sophisticated packaging to enhance the unboxing experience and elevate brand perception. The fashion and apparel industry remains a dominant end-user, followed by the food and beverage and consumer electronics sectors. Regional growth is expected to be diverse; North America and Europe will maintain substantial market share, while the Asia-Pacific region is poised for significant expansion due to increasing disposable incomes and a burgeoning middle class with a growing appetite for luxury goods. Competitive dynamics are marked by established players like WestRock Company and DS Smith Plc, along with specialized packaging companies catering to niche luxury brands.

Luxury Rigid Boxes Market Market Size (In Billion)

Product segmentation reveals strong demand for hinged lid boxes and rigid sleeve boxes, reflecting the need for secure and visually appealing packaging. The market's growth, however, faces certain challenges. Fluctuations in raw material prices, particularly for metals and plastics, can impact profitability. Additionally, maintaining consistent quality while adapting to evolving consumer preferences and environmental regulations presents ongoing challenges for manufacturers. The market's future hinges on innovation in sustainable materials, advanced printing techniques, and personalized packaging solutions to enhance the customer experience and justify premium pricing. Growth strategies will likely focus on collaborations with luxury brands, expansion into emerging markets, and the adoption of digital printing technologies for customized packaging solutions. This balanced approach will allow companies to capitalize on growth opportunities while addressing market limitations.

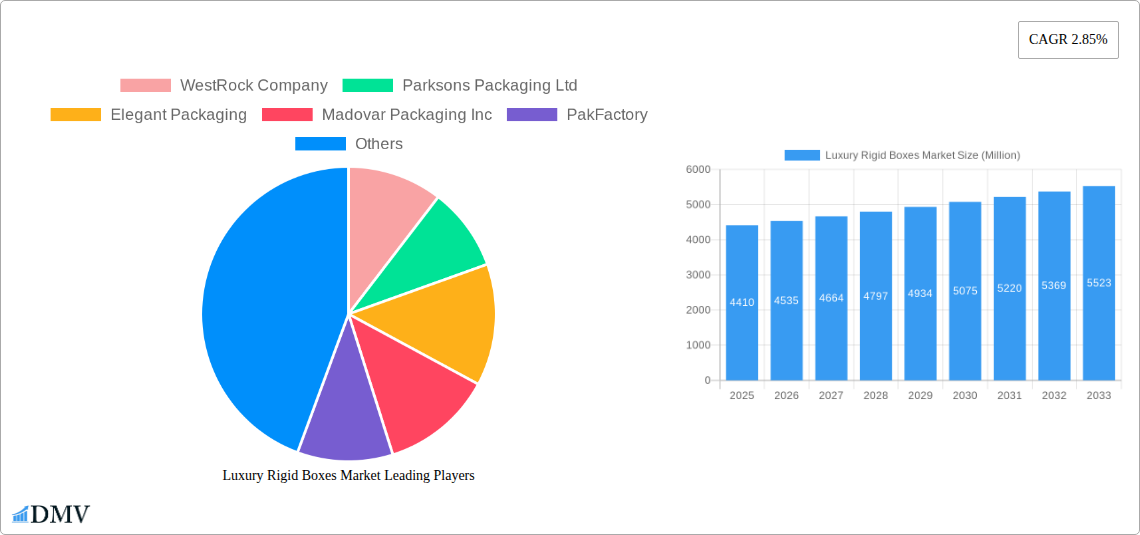

Luxury Rigid Boxes Market Company Market Share

Luxury Rigid Boxes Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Luxury Rigid Boxes Market, offering a detailed examination of market dynamics, trends, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this lucrative market segment. The market is estimated to be worth xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period.

Luxury Rigid Boxes Market Composition & Trends

The Luxury Rigid Boxes Market is characterized by a moderately consolidated landscape, with key players such as WestRock Company, Parksons Packaging Ltd, Elegant Packaging, and DS Smith Plc holding significant market share. Market share distribution is dynamic, influenced by innovation, strategic acquisitions, and evolving consumer preferences. The report delves into the competitive intensity, analyzing M&A activities, including deal values (estimated at xx Million annually in recent years). Regulatory landscapes impacting material sourcing and sustainability are also examined. The increasing demand for eco-friendly packaging solutions is driving innovation in sustainable materials like recycled paperboard and biodegradable plastics. Substitute products, such as premium flexible packaging, pose a competitive challenge, while end-user profiles vary widely across fashion, food & beverage, and consumer electronics sectors.

- Market Concentration: Moderately Consolidated

- Innovation Catalysts: Sustainable materials, enhanced designs, personalization options.

- Regulatory Landscape: Focus on sustainability and eco-friendly materials.

- Substitute Products: Premium flexible packaging, reusable containers.

- End-User Profiles: Diverse, spanning luxury goods, cosmetics, and electronics.

- M&A Activity: Annual deal value estimated at xx Million, driving consolidation.

Luxury Rigid Boxes Market Industry Evolution

The Luxury Rigid Boxes Market has experienced significant growth over the historical period (2019-2024), driven by rising disposable incomes, increasing demand for premium packaging, and a growing emphasis on brand differentiation. Technological advancements, including advancements in printing techniques (e.g., digital printing for personalized boxes) and automation in manufacturing processes, have enhanced production efficiency and product customization. Shifting consumer demands toward sustainable and aesthetically pleasing packaging are shaping the industry's trajectory. The market witnessed a growth rate of xx% from 2021 to 2022, fueled primarily by growth in the e-commerce sector and increased demand for luxurious packaging in the fashion accessories and apparel segment. Adoption of sustainable materials such as recycled paperboard is increasing rapidly, driven by consumer preference and stringent environmental regulations.

Leading Regions, Countries, or Segments in Luxury Rigid Boxes Market

North America currently holds the largest market share in the luxury rigid boxes market, driven by robust consumer spending and a strong presence of key players. Within product types, Hinged Lid Boxes and Rigid Sleeve Boxes account for a significant portion of the market due to their versatility and upscale appeal. The Fashion Accessories and Apparel end-user industry demonstrates the highest growth potential.

- Key Drivers (North America): High disposable incomes, strong brand presence, early adoption of sustainable practices.

- Key Drivers (Hinged Lid Boxes): Versatile design, premium appeal.

- Key Drivers (Fashion Accessories & Apparel): Increased demand for luxury packaging to enhance brand perception.

- Key Drivers (Paper and Paperboard): Readily available, cost-effective, and environmentally preferable (when sustainably sourced).

In-depth Analysis: The dominance of North America is attributed to several factors. High per capita income levels enable consumers to purchase luxury products, creating a significant demand for premium packaging. The region also hosts many major players in the luxury goods industry, further boosting the demand for luxury rigid boxes. Furthermore, stringent regulations on packaging materials promote the use of eco-friendly solutions, driving innovation within the region. Within product segments, Hinged Lid Boxes and Rigid Sleeve Boxes command high market shares due to their versatility and ability to enhance the product's visual appeal. The Fashion Accessories and Apparel sector drives the strongest demand due to the increasing importance of luxury branding and presentation within the industry.

Luxury Rigid Boxes Market Product Innovations

Recent innovations focus on sustainable materials, such as recycled paperboard and biodegradable plastics, to meet growing environmental concerns. Advanced printing techniques, including digital printing, enable greater customization and personalization of boxes, enhancing brand identity. Enhanced structural designs, offering greater protection and improved aesthetics, are also gaining traction. These innovations deliver unique selling propositions by improving sustainability, offering personalized designs, and ensuring higher product protection. Performance metrics are improving with lighter weight designs and improved material strength.

Propelling Factors for Luxury Rigid Boxes Market Growth

Several factors drive market expansion. Firstly, escalating demand for premium and luxurious packaging, driven by rising disposable incomes and brand differentiation strategies, significantly boosts sales. Secondly, technological advancements, like digital printing and automation, enhance production efficiency and customization options. Finally, supportive government regulations that promote the use of sustainable packaging materials, further accelerate growth. For example, increasing consumer preference for eco-friendly packaging influences material choices by brands seeking to enhance their sustainability credentials.

Obstacles in the Luxury Rigid Boxes Market

Challenges include fluctuations in raw material prices, particularly for paperboard and metals, impacting profitability. Supply chain disruptions, caused by geopolitical instability and natural disasters, can lead to production delays. Intense competition from established players and new entrants creates price pressures. Regulatory compliance concerning material usage and environmental standards adds complexity and potential costs for businesses. The estimated impact of these combined factors is a potential xx% reduction in profit margins in the coming years.

Future Opportunities in Luxury Rigid Boxes Market

Emerging opportunities include expanding into new markets in developing economies with growing middle classes. The integration of smart packaging technologies, like RFID tagging for tracking and authentication, offers value-added services. The focus on sustainable packaging solutions using innovative materials and production methods present considerable opportunities for environmentally conscious businesses. Tailored packaging solutions for niche markets and personalized branding will further enhance the market outlook.

Major Players in the Luxury Rigid Boxes Market Ecosystem

- WestRock Company (WestRock Company)

- Parksons Packaging Ltd

- Elegant Packaging

- Madovar Packaging Inc

- PakFactory

- McLaren Packaging Ltd

- Elite Marking Systems

- DS Smith Plc (DS Smith Plc)

- Robinson plc (Robinson plc)

- Sunrise Packaging Inc

- List Not Exhaustive

Key Developments in Luxury Rigid Boxes Market Industry

- November 2023: Metsä Board launches its Micro-Fluted Corrugated Board Gift Box, a lightweight and eco-friendly option. This development reflects the industry’s increasing focus on sustainability.

- September 2023: Anaïk, a French packaging manufacturer, expands its luxury packaging offerings with new collaterals, gift boxes, and calendars. This illustrates the ongoing trend of innovation and enhanced product offerings within the luxury segment.

Strategic Luxury Rigid Boxes Market Forecast

The Luxury Rigid Boxes Market is poised for sustained growth, driven by factors like the increasing adoption of sustainable packaging, technological advancements in printing and automation, and rising demand for premium packaging solutions. The market's expansion will be fueled by innovations in materials, customization options, and expansion into new markets. The continued focus on luxury branding and premium product presentation will drive strong demand for innovative, high-quality rigid boxes throughout the forecast period.

Luxury Rigid Boxes Market Segmentation

-

1. Material

- 1.1. Metals

- 1.2. Plastics

- 1.3. Paper and Paper board

- 1.4. Other Material

-

2. Product Type

- 2.1. Hinged Lid Box

- 2.2. Collapsible Box

- 2.3. Rigid Sleeve Box

- 2.4. Shoulder Neck Box

- 2.5. Other Products

-

3. End-user Industry

- 3.1. Fashion Accessories and Apparels

- 3.2. Food and Beverages

- 3.3. Consumer Goods

- 3.4. Consumer Electronics

- 3.5. Other End-user Industries

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Luxury Rigid Boxes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Italy

- 2.4. United Kingdom

-

3. Asia Pacific

- 3.1. Japan

- 3.2. India

- 3.3. China

- 3.4. Australia and New Zealand

Luxury Rigid Boxes Market Regional Market Share

Geographic Coverage of Luxury Rigid Boxes Market

Luxury Rigid Boxes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising demand for the Presentation and Display4.; Growing Demand for the Packaging of Food Products

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment and Substitute Channels with Affordable Price

- 3.4. Market Trends

- 3.4.1. Luxury Fashion Accessories Boxes are Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Rigid Boxes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Metals

- 5.1.2. Plastics

- 5.1.3. Paper and Paper board

- 5.1.4. Other Material

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Hinged Lid Box

- 5.2.2. Collapsible Box

- 5.2.3. Rigid Sleeve Box

- 5.2.4. Shoulder Neck Box

- 5.2.5. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Fashion Accessories and Apparels

- 5.3.2. Food and Beverages

- 5.3.3. Consumer Goods

- 5.3.4. Consumer Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Rest of the World

- 5.4.1. Latin America

- 5.4.2. Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Luxury Rigid Boxes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Metals

- 6.1.2. Plastics

- 6.1.3. Paper and Paper board

- 6.1.4. Other Material

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Hinged Lid Box

- 6.2.2. Collapsible Box

- 6.2.3. Rigid Sleeve Box

- 6.2.4. Shoulder Neck Box

- 6.2.5. Other Products

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Fashion Accessories and Apparels

- 6.3.2. Food and Beverages

- 6.3.3. Consumer Goods

- 6.3.4. Consumer Electronics

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Rest of the World

- 6.4.1. Latin America

- 6.4.2. Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Luxury Rigid Boxes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Metals

- 7.1.2. Plastics

- 7.1.3. Paper and Paper board

- 7.1.4. Other Material

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Hinged Lid Box

- 7.2.2. Collapsible Box

- 7.2.3. Rigid Sleeve Box

- 7.2.4. Shoulder Neck Box

- 7.2.5. Other Products

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Fashion Accessories and Apparels

- 7.3.2. Food and Beverages

- 7.3.3. Consumer Goods

- 7.3.4. Consumer Electronics

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Rest of the World

- 7.4.1. Latin America

- 7.4.2. Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Luxury Rigid Boxes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Metals

- 8.1.2. Plastics

- 8.1.3. Paper and Paper board

- 8.1.4. Other Material

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Hinged Lid Box

- 8.2.2. Collapsible Box

- 8.2.3. Rigid Sleeve Box

- 8.2.4. Shoulder Neck Box

- 8.2.5. Other Products

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Fashion Accessories and Apparels

- 8.3.2. Food and Beverages

- 8.3.3. Consumer Goods

- 8.3.4. Consumer Electronics

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Rest of the World

- 8.4.1. Latin America

- 8.4.2. Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 WestRock Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Parksons Packaging Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elegant Packaging

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Madovar Packaging Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 PakFactory

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 McLaren Packaging Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Elite Marking Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 DS Smith Plc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Robinson plc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Sunrise Packaging Inc *List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 WestRock Company

List of Figures

- Figure 1: Global Luxury Rigid Boxes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Rigid Boxes Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Luxury Rigid Boxes Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Luxury Rigid Boxes Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Luxury Rigid Boxes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Luxury Rigid Boxes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Luxury Rigid Boxes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Luxury Rigid Boxes Market Revenue (Million), by Rest of the World 2025 & 2033

- Figure 9: North America Luxury Rigid Boxes Market Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 10: North America Luxury Rigid Boxes Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Luxury Rigid Boxes Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Luxury Rigid Boxes Market Revenue (Million), by Material 2025 & 2033

- Figure 13: Europe Luxury Rigid Boxes Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: Europe Luxury Rigid Boxes Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Luxury Rigid Boxes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Luxury Rigid Boxes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Luxury Rigid Boxes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Luxury Rigid Boxes Market Revenue (Million), by Rest of the World 2025 & 2033

- Figure 19: Europe Luxury Rigid Boxes Market Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 20: Europe Luxury Rigid Boxes Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Luxury Rigid Boxes Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Luxury Rigid Boxes Market Revenue (Million), by Material 2025 & 2033

- Figure 23: Asia Pacific Luxury Rigid Boxes Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Luxury Rigid Boxes Market Revenue (Million), by Product Type 2025 & 2033

- Figure 25: Asia Pacific Luxury Rigid Boxes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Asia Pacific Luxury Rigid Boxes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific Luxury Rigid Boxes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific Luxury Rigid Boxes Market Revenue (Million), by Rest of the World 2025 & 2033

- Figure 29: Asia Pacific Luxury Rigid Boxes Market Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 30: Asia Pacific Luxury Rigid Boxes Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Luxury Rigid Boxes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Luxury Rigid Boxes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 5: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Luxury Rigid Boxes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 10: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Luxury Rigid Boxes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 17: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Germany Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 23: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Luxury Rigid Boxes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 26: Global Luxury Rigid Boxes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Japan Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: China Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia and New Zealand Luxury Rigid Boxes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Rigid Boxes Market?

The projected CAGR is approximately 2.85%.

2. Which companies are prominent players in the Luxury Rigid Boxes Market?

Key companies in the market include WestRock Company, Parksons Packaging Ltd, Elegant Packaging, Madovar Packaging Inc, PakFactory, McLaren Packaging Ltd, Elite Marking Systems, DS Smith Plc, Robinson plc, Sunrise Packaging Inc *List Not Exhaustive.

3. What are the main segments of the Luxury Rigid Boxes Market?

The market segments include Material, Product Type, End-user Industry, Rest of the World.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising demand for the Presentation and Display4.; Growing Demand for the Packaging of Food Products.

6. What are the notable trends driving market growth?

Luxury Fashion Accessories Boxes are Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment and Substitute Channels with Affordable Price.

8. Can you provide examples of recent developments in the market?

November 2023 - The Metsä Board Micro-Fluted Corrugated Board Gift Box is a new lightweight gift box for premium products that uses less material and reduces carbon footprint compared to traditional rigid boxes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Rigid Boxes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Rigid Boxes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Rigid Boxes Market?

To stay informed about further developments, trends, and reports in the Luxury Rigid Boxes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence