Key Insights

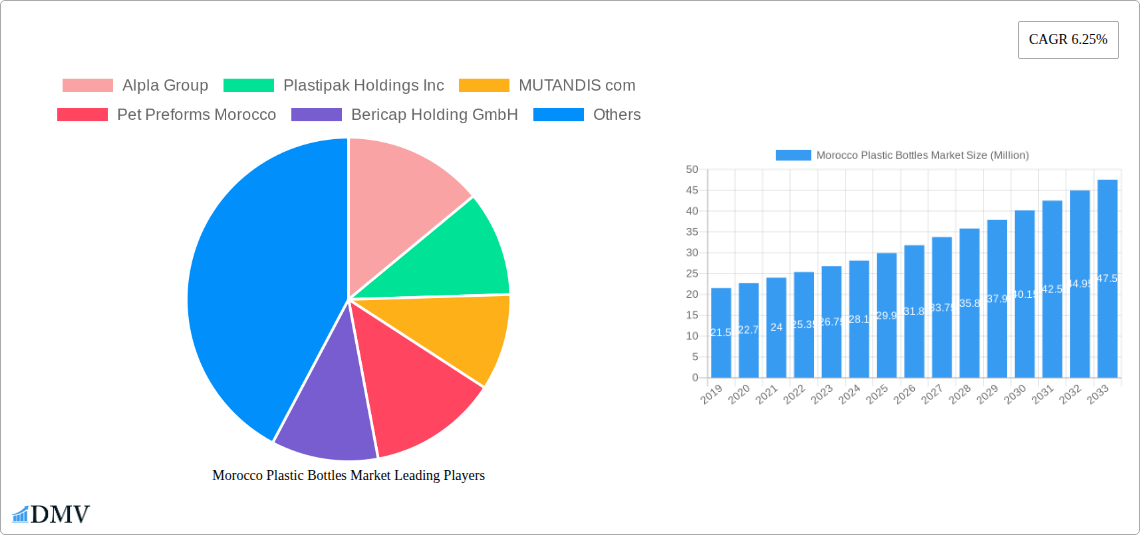

The Morocco Plastic Bottles Market is poised for robust expansion, projected to reach a market size of USD 29.90 million by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.25%, indicating sustained demand and innovation within the sector over the forecast period of 2025-2033. Key drivers fueling this upward trajectory include the escalating demand from crucial end-user industries such as food and beverages, pharmaceuticals, and personal care. The burgeoning middle class, coupled with evolving consumer lifestyles and an increasing preference for convenient packaging solutions, is significantly contributing to the uptake of plastic bottles. Furthermore, advancements in recycling technologies and a growing emphasis on sustainable packaging practices are expected to mitigate some of the environmental concerns associated with plastic, further stimulating market penetration. The market's segmentation by resin type highlights the dominance of Polyethylene (PE) and Polyethylene Terephthalate (PET), owing to their versatility, cost-effectiveness, and wide applicability in packaging various products.

Morocco Plastic Bottles Market Market Size (In Million)

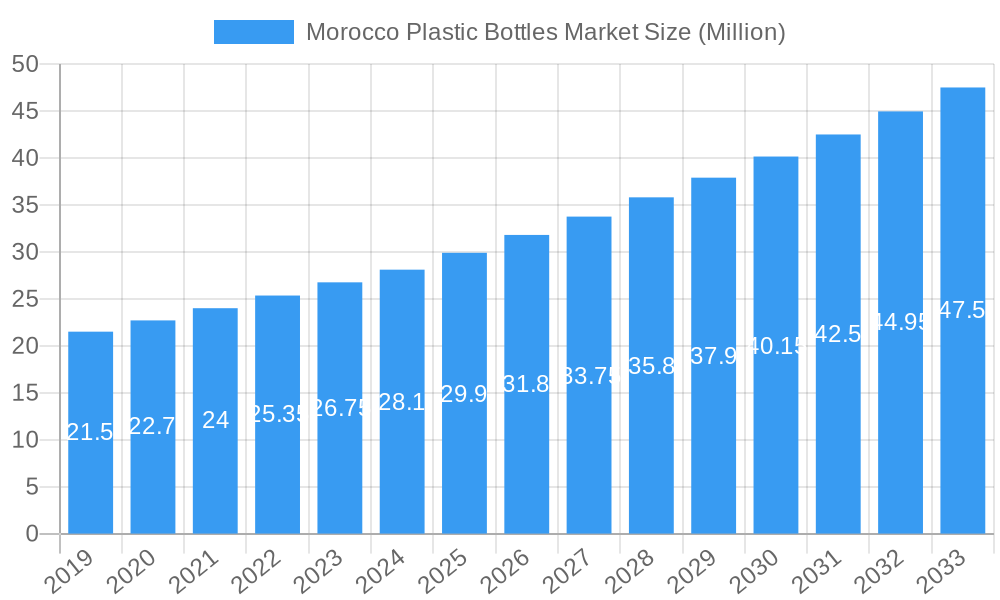

The dynamic landscape of the Morocco Plastic Bottles Market is characterized by a strong focus on innovation and strategic expansion by key players. Companies like Alpla Group and Plastipak Holdings Inc. are actively involved in capitalizing on emerging opportunities within the region. The market's segmentation by end-user industry reveals the critical role of the food and beverage sector, particularly bottled water and carbonated soft drinks, in driving consumption. The pharmaceutical and personal care industries also represent significant segments, demanding high-quality, safe, and reliable plastic packaging. While the market is experiencing strong growth, potential restraints such as increasing regulatory pressures on single-use plastics and fluctuating raw material prices warrant careful strategic planning. However, the persistent demand for lightweight, durable, and cost-effective packaging solutions, coupled with ongoing investments in manufacturing capabilities and product development, are expected to propel the Morocco Plastic Bottles Market to new heights, ensuring its continued vitality and contribution to the national economy.

Morocco Plastic Bottles Market Company Market Share

Report Description:

Unlock the intricacies of the burgeoning Morocco plastic bottles market with this definitive research report. Spanning 2019 to 2033, with a detailed analysis of the base year 2025 and an estimated year 2025, this study offers unparalleled insights into market dynamics, competitive landscapes, and future trajectories. The forecast period 2025-2033 meticulously examines growth opportunities, technological advancements, and evolving consumer preferences that are shaping the plastic packaging solutions in Morocco. Dive deep into market segmentation by crucial resins like Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP), and by diverse end-user industries including Food, Beverage (Bottled Water, Carbonated Soft Drinks, Alcoholic Beverages, Juices and Energy Drinks, Other Beverages), Pharmaceuticals, Personal Care and Toiletries, Industrial, Household Chemicals, Paints and Coatings, and Other End-user Industries. This report is an indispensable tool for stakeholders seeking to understand and capitalize on the Moroccan plastic containers market, PET bottle manufacturing Morocco, and the growth of plastic packaging Morocco.

Morocco Plastic Bottles Market Market Composition & Trends

The Morocco plastic bottles market is characterized by a moderate to high degree of market concentration, with key players actively engaging in strategic expansions and product innovations. The innovation landscape is largely driven by sustainability initiatives and the increasing demand for lightweight, durable, and cost-effective packaging solutions. Regulatory frameworks, particularly concerning environmental impact and recyclability, are becoming more stringent, pushing manufacturers towards adopting eco-friendly practices and materials. Substitute products, such as glass and metal containers, pose a challenge, but the inherent advantages of plastics in terms of cost, weight, and design flexibility continue to fuel market dominance. End-user profiles are diverse, with the food and beverage sector representing the largest consumer base, followed by pharmaceuticals and personal care and toiletries. Mergers and acquisitions (M&A) activity, though not extensively documented with precise values, indicates a trend towards consolidation and the acquisition of innovative technologies to enhance market competitiveness. Market share distribution is influenced by production capacity, technological adoption, and distribution networks within the Moroccan plastic packaging industry.

Morocco Plastic Bottles Market Industry Evolution

The Morocco plastic bottles market has undergone a significant evolution over the historical period 2019-2024 and is poised for substantial growth through 2033. This evolution is primarily propelled by a confluence of factors, including a rapidly expanding population, increasing disposable incomes, and a growing consumer preference for convenience-driven products, particularly in the beverage and personal care sectors. Technological advancements in plastic bottle manufacturing have been instrumental in this growth, leading to improved production efficiency, enhanced product quality, and the development of innovative packaging designs. The adoption of advanced molding techniques and automation has reduced manufacturing costs, making plastic bottles a more attractive option for businesses across various industries. Furthermore, the rising awareness regarding health and hygiene has boosted demand for packaged goods, especially bottled water and pharmaceuticals, thereby directly influencing the plastic bottle demand in Morocco.

A key trend observed during the historical period was the increasing emphasis on lightweighting and material reduction in plastic bottle design. This not only contributes to cost savings for manufacturers but also reduces the environmental footprint associated with transportation and waste. The market has witnessed a steady increase in the adoption of recycled PET (rPET), driven by both consumer demand for sustainable products and evolving regulatory mandates. This shift towards a circular economy is a critical aspect of the industry's evolution, fostering investments in recycling infrastructure and technologies. The Moroccan plastic bottle market growth rate has been consistently positive, with projections indicating continued upward momentum in the coming years. This growth is underpinned by increasing investments in local manufacturing capabilities and a supportive business environment for packaging industries. The penetration of plastic bottles in emerging end-user segments like industrial chemicals and paints and coatings is also on the rise, diversifying the market base and contributing to its overall resilience.

Leading Regions, Countries, or Segments in Morocco Plastic Bottles Market

The Morocco plastic bottles market exhibits distinct regional and segment-wise dominance, driven by varying consumption patterns, industrial infrastructure, and regulatory landscapes. Within the Resin segment, Polyethylene Terephthalate (PET) stands out as the leading material, largely due to its widespread application in the beverage industry, including bottled water and carbonated soft drinks. Its excellent barrier properties, clarity, and recyclability make it the preferred choice for these high-volume applications. Polyethylene (PE), particularly HDPE, holds significant share in the household chemicals and personal care and toiletries segments, owing to its chemical resistance and durability.

In terms of End-user Industry, the Food and Beverage sectors collectively represent the largest and most dynamic segment of the Morocco plastic bottles market. The escalating demand for packaged food products, coupled with the ubiquitous presence of bottled water and other beverages, fuels this dominance. The Bottled Water sub-segment, in particular, is a major growth engine, driven by increasing health consciousness and concerns about water quality.

- Key Drivers for Food & Beverage Dominance:

- Growing Consumer Base: Morocco's increasing population and urbanization lead to higher consumption of packaged goods.

- Convenience Factor: Plastic bottles offer portability and ease of use for on-the-go consumption of beverages and ready-to-eat food items.

- Hygiene and Safety: Sealed plastic packaging ensures product integrity and safety for consumers.

- Economic Affordability: Plastic packaging is generally more cost-effective compared to alternatives, making packaged food and beverages accessible to a wider demographic.

- Investment Trends: Significant investments by major beverage manufacturers in bottling and packaging infrastructure within Morocco directly contribute to the demand for plastic bottles.

The Pharmaceuticals segment, while smaller in volume compared to Food & Beverage, is a high-value segment characterized by stringent quality and safety requirements. The use of specialized plastic bottles for medicines, syrups, and other pharmaceutical preparations is critical, demanding high levels of purity and inertness. The Personal Care and Toiletries segment also presents substantial demand, with plastic bottles being the preferred packaging for a wide array of products including shampoos, lotions, and cleaning agents, owing to their aesthetic appeal, durability, and cost-effectiveness.

While other segments like Industrial, Household Chemicals, and Paints and Coatings contribute to the overall market, their growth is influenced by specific industrial cycles and the availability of specialized plastic formulations. The dominance of PET in the beverage sector and the broad applicability of PE in consumer goods segments solidify their leadership positions within the Morocco plastic bottles market.

Morocco Plastic Bottles Market Product Innovations

Product innovation in the Morocco plastic bottles market is primarily centered on enhancing sustainability, functionality, and consumer appeal. A significant trend is the development of lightweight PET bottles, as exemplified by Alpla Group's recent innovations. These bottles are designed to reduce material usage without compromising structural integrity, leading to significant environmental benefits and cost efficiencies. The focus on fully recyclable PET bottles and the increasing adoption of rPET are transforming the market, aligning with global sustainability goals and consumer demand for eco-conscious packaging. Furthermore, advancements in barrier technologies are leading to extended shelf life for sensitive products, while improved dispensing mechanisms and ergonomic designs enhance user experience across various end-user industries.

Propelling Factors for Morocco Plastic Bottles Market Growth

The Morocco plastic bottles market is experiencing robust growth fueled by several key factors. Economically, rising disposable incomes and an expanding middle class are driving increased consumption of packaged goods, particularly in the food and beverage and personal care sectors. Technologically, advancements in plastic bottle manufacturing processes, including automation and the development of more efficient molding techniques, are leading to cost reductions and improved product quality. This also includes the growing adoption of lightweighting and the use of recycled PET (rPET), responding to global sustainability trends. Regulatory support, such as government initiatives promoting local manufacturing and recycling infrastructure, further bolsters market expansion. The strong demand for convenient and hygienic packaging solutions across various end-user industries, from bottled water to pharmaceuticals, remains a significant propellant.

Obstacles in the Morocco Plastic Bottles Market Market

Despite its growth potential, the Morocco plastic bottles market faces several obstacles. Fluctuations in the prices of raw materials, primarily petrochemicals, can impact manufacturing costs and profitability. Stringent environmental regulations and increasing public scrutiny regarding plastic waste pose significant challenges, necessitating substantial investment in recycling infrastructure and sustainable packaging solutions. Supply chain disruptions, influenced by global economic conditions and geopolitical events, can affect the availability and cost of raw materials and finished goods. Intense competition from both domestic and international players, coupled with the presence of alternative packaging materials like glass, also presents a barrier to market growth. The need for continuous technological upgrades to meet evolving sustainability standards and consumer expectations requires ongoing capital investment, which can be a constraint for smaller manufacturers.

Future Opportunities in Morocco Plastic Bottles Market

The Morocco plastic bottles market presents several promising future opportunities. The growing demand for sustainable and eco-friendly plastic packaging opens avenues for increased use of rPET and bio-based plastics, creating opportunities for manufacturers investing in these technologies. The expansion of the e-commerce sector in Morocco is driving demand for robust and specialized plastic packaging for shipping and delivery. Furthermore, the untapped potential in emerging end-user industries, such as specialized industrial chemicals and new personal care product categories, offers diversification and growth prospects. Government initiatives aimed at boosting local manufacturing and promoting a circular economy, alongside increasing consumer awareness about product safety and hygiene, will continue to drive demand for high-quality plastic bottles. The development of smart packaging solutions with integrated tracking or authentication features also represents a nascent but growing opportunity.

Major Players in the Morocco Plastic Bottles Market Ecosystem

- Alpla Group

- Plastipak Holdings Inc

- MUTANDIS com

- Pet Preforms Morocco

- Bericap Holding GmbH

- Sumilon Eco PET SARL

- Blowtec Morocco

- Intel Plast

Key Developments in Morocco Plastic Bottles Market Industry

- August 2024: Alpla Group, an Austria-based company with operations in Morocco, produced PET bottles for the Polish mineral water brands Staropolanka and Krystynka. Weighing just 32 g, Alpla's fully recyclable PET bottles are one-sixth the weight of traditional glass bottles.

- May 2024: Alpla Group, an Austria-based company with operations in Morocco, unveiled a recyclable wine bottle crafted from PET. This eco-friendly innovation cuts carbon consumption by 38% when stacked against traditional glass bottles. Looking ahead, Alpla aims to produce several million units annually starting in 2025, with a vision for solutions made entirely from rPET.

Strategic Morocco Plastic Bottles Market Market Forecast

The strategic forecast for the Morocco plastic bottles market indicates a trajectory of sustained and robust growth through 2033. This expansion will be primarily driven by the increasing demand for convenient and hygienic packaging across the food, beverage, pharmaceuticals, and personal care sectors. The market's evolution will be significantly shaped by the ongoing global shift towards sustainability, leading to a greater adoption of recycled PET (rPET) and the development of lightweight, eco-friendly plastic bottles. Technological advancements in plastic bottle manufacturing, coupled with investments in recycling infrastructure, will further enhance efficiency and reduce the environmental impact. The growing middle class and increasing urbanization in Morocco will continue to fuel consumer spending on packaged goods, creating a fertile ground for market expansion. Emerging opportunities in e-commerce packaging and niche industrial applications also present significant growth potential, making the Moroccan plastic packaging market an attractive landscape for stakeholders.

Morocco Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Resins

-

2. End-user Industry

- 2.1. Food

-

2.2. Beverage

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices and Energy Drinks

- 2.2.5. Other Be

- 2.3. Pharmaceuticals

- 2.4. Personal Care and Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints and Coatings

- 2.8. Other End-user Industries

Morocco Plastic Bottles Market Segmentation By Geography

- 1. Morocco

Morocco Plastic Bottles Market Regional Market Share

Geographic Coverage of Morocco Plastic Bottles Market

Morocco Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Food and Beverage Sector in Morocco to Propel Market Growth; Increasing Adoption of Lightweight Packaging Solutions by End-user Industries

- 3.3. Market Restrains

- 3.3.1. Rising Food and Beverage Sector in Morocco to Propel Market Growth; Increasing Adoption of Lightweight Packaging Solutions by End-user Industries

- 3.4. Market Trends

- 3.4.1. The Polyethylene Terephthalate (PET) Segment is Estimated to Record the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices and Energy Drinks

- 5.2.2.5. Other Be

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care and Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints and Coatings

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpla Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Plastipak Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MUTANDIS com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pet Preforms Morocco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bericap Holding GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumilon Eco PET SARL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Blowtec Morocco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Plast8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Alpla Group

List of Figures

- Figure 1: Morocco Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Morocco Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Morocco Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Morocco Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Morocco Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Morocco Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Morocco Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Morocco Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Morocco Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Morocco Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Morocco Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Morocco Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Plastic Bottles Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Morocco Plastic Bottles Market?

Key companies in the market include Alpla Group, Plastipak Holdings Inc, MUTANDIS com, Pet Preforms Morocco, Bericap Holding GmbH, Sumilon Eco PET SARL, Blowtec Morocco, Intel Plast8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Morocco Plastic Bottles Market?

The market segments include Resin, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Food and Beverage Sector in Morocco to Propel Market Growth; Increasing Adoption of Lightweight Packaging Solutions by End-user Industries.

6. What are the notable trends driving market growth?

The Polyethylene Terephthalate (PET) Segment is Estimated to Record the Largest Market Share.

7. Are there any restraints impacting market growth?

Rising Food and Beverage Sector in Morocco to Propel Market Growth; Increasing Adoption of Lightweight Packaging Solutions by End-user Industries.

8. Can you provide examples of recent developments in the market?

August 2024: Alpla Group, an Austria-based company with operations in Morocco, produced PET bottles for the Polish mineral water brands Staropolanka and Krystynka. Weighing just 32 g, Alpla's fully recyclable PET bottles are one-sixth the weight of traditional glass bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Morocco Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence