Key Insights

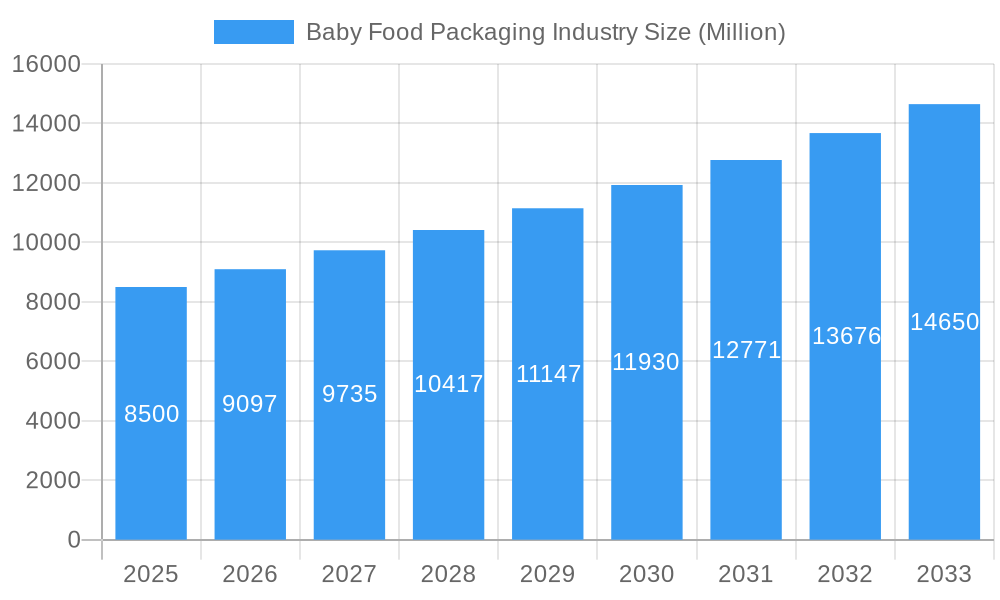

The global Baby Food Packaging market is poised for robust expansion, projected to reach a substantial XX million by the end of the forecast period. Driven by an estimated CAGR of 6.95% from 2025 to 2033, this dynamic industry is fueled by a confluence of factors. Increasing parental awareness regarding the importance of nutrition and safety for infants and toddlers is a primary catalyst. Furthermore, rising disposable incomes in developing economies, coupled with a growing preference for convenient and ready-to-consume baby food options, are significantly contributing to market growth. The burgeoning demand for premium and specialized baby food products, including organic and allergen-free variants, further propels the need for advanced and high-quality packaging solutions that ensure product integrity and shelf appeal. Technological advancements in packaging materials and designs, focusing on sustainability, safety, and user-friendliness, are also playing a pivotal role in shaping market trends.

Baby Food Packaging Industry Market Size (In Billion)

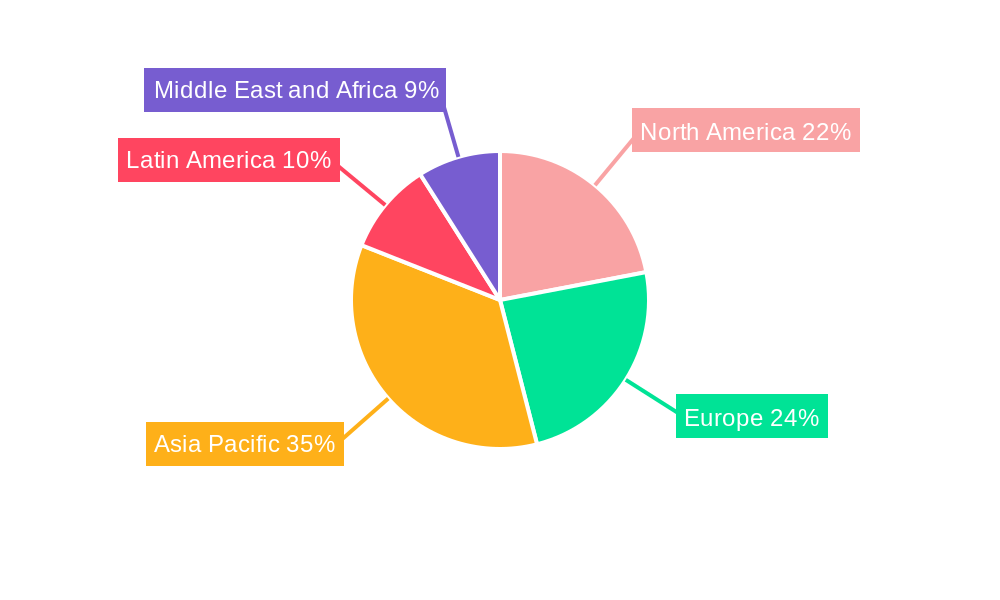

The market landscape is characterized by diverse packaging materials and types catering to different product formulations and consumer needs. Plastic dominates due to its versatility, cost-effectiveness, and excellent barrier properties, with bottles and pouches being prominent package types for liquid milk formula and prepared baby food. Paperboard, particularly for cartons, is gaining traction due to its eco-friendly profile and suitability for dried baby food. Metal cans continue to be a reliable choice for certain product formats, while glass jars offer a premium perception for specific niche segments. The competitive environment features key players like Amcor PLC, Tetra Laval, and Mondi Group, who are actively investing in research and development to innovate sustainable and safer packaging solutions. Regional dynamics are also crucial, with Asia Pacific expected to witness the highest growth owing to its large infant population and rapidly developing economies, while North America and Europe remain significant markets with a strong emphasis on premiumization and sustainable packaging.

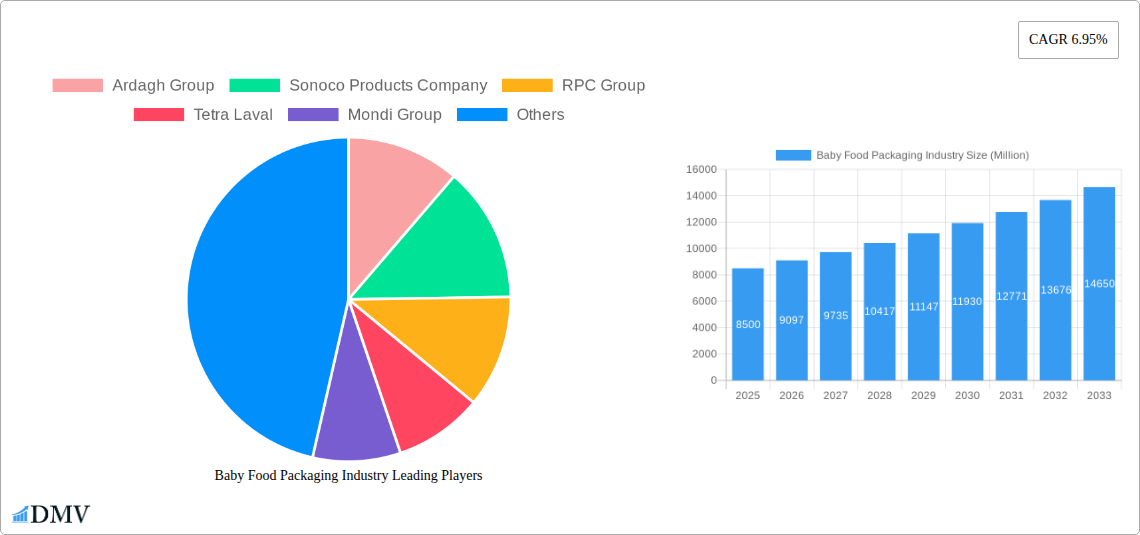

Baby Food Packaging Industry Company Market Share

Baby Food Packaging Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Baby Food Packaging market, encompassing a historical review (2019-2024), a detailed market assessment for the base year (2025), and a robust forecast period (2025-2033). Delve into market dynamics, emerging trends, technological advancements, and strategic opportunities within this rapidly evolving sector. With an estimated market size of over XX Million in 2025, this report is essential for stakeholders seeking to understand and capitalize on the baby food packaging solutions landscape.

Baby Food Packaging Industry Market Composition & Trends

The Baby Food Packaging industry exhibits a moderately consolidated market structure, with key players like Ardagh Group, Sonoco Products Company, RPC Group, Tetra Laval, Mondi Group, Winpak Ltd, Amcor PLC, Silgan Holdings Inc, and DS Smith PLC dominating significant market shares. Innovation is a primary catalyst, driven by the increasing demand for sustainable baby food packaging, eco-friendly baby food containers, and child-safe baby food packaging. Regulatory landscapes, particularly concerning food safety and environmental impact, are continuously shaping industry practices. Substitute products, such as reusable containers and homemade baby food, pose a mild threat, though convenience and shelf-life advantages of packaged options remain strong. End-user profiles are primarily focused on health-conscious parents and caregivers prioritizing nutrition, safety, and convenience. Mergers and Acquisitions (M&A) activities are anticipated to continue, with estimated M&A deal values in the range of XX Million to XX Million annually, further consolidating the market and fostering technological integration. The overall market share distribution shows Plastic accounting for approximately XX%, followed by Paperboard at XX%, Metal at XX%, and Glass at XX%.

Baby Food Packaging Industry Industry Evolution

The baby food packaging market size has witnessed consistent growth trajectories, fueled by a confluence of escalating birth rates in emerging economies and a significant rise in dual-income households globally, leading to a greater reliance on convenient and ready-to-eat baby food options. Technological advancements have been pivotal, with the introduction of innovative materials and designs that enhance product shelf-life, safety, and ease of use. For instance, the adoption of advanced barrier technologies in pouches has dramatically reduced spoilage rates for prepared baby food, extending its market reach. The shift towards sustainable baby food packaging represents a major evolutionary phase. Consumers are increasingly demanding packaging that is recyclable, compostable, or made from recycled content, compelling manufacturers to invest in greener solutions. This trend is evident in the growing market share of pouches and cartons made from paperboard with innovative plastic coatings. The average annual growth rate for the baby food packaging industry is projected to be around XX% over the forecast period. Furthermore, the demand for organic baby food packaging and BPA-free baby food containers has surged, reflecting heightened parental awareness regarding ingredient safety and environmental impact. The penetration of smart packaging technologies, while still nascent, is also expected to grow, offering benefits like temperature monitoring and authenticity verification, further enhancing consumer confidence.

Leading Regions, Countries, or Segments in Baby Food Packaging Industry

The Plastic segment, particularly for pouches and bottles, is the dominant force within the Baby Food Packaging industry, driven by its versatility, cost-effectiveness, and excellent barrier properties. In 2025, the global market share for plastic packaging in this sector is estimated to be XX%. North America and Europe currently lead in terms of market value, with a combined share of approximately XX%. However, the Asia Pacific region is experiencing the fastest growth, projected at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period, owing to rapidly expanding middle-class populations and increasing disposable incomes.

- Dominant Material Segment: Plastic

- Drivers: High demand for lightweight, durable, and safe packaging; innovation in recyclable and biodegradable plastics; cost-effectiveness.

- Applications: Ideal for powder milk formula, dried baby food, and prepared baby food due to excellent moisture and oxygen barrier properties.

- Key Products: Pouches (especially stand-up pouches) and bottles are the most popular formats.

- Dominant Package Type: Pouches

- Drivers: Convenience for consumers (easy to open, consume, and discard), portability, extended shelf life, and suitability for purees and semi-solid foods.

- Market Share: Estimated to capture XX% of the overall package type market in 2025.

- Innovation: Introduction of reclosable features and spoon attachments.

- Leading Region: Asia Pacific

- Drivers: High birth rates, increasing urbanization, rising disposable incomes, and growing awareness of infant nutrition.

- Investment Trends: Significant investments in local manufacturing facilities and R&D for sustainable baby food packaging.

- Regulatory Support: Government initiatives promoting food safety standards and the adoption of environmentally friendly packaging.

- Dominant Product Type: Powder Milk Formula

- Drivers: Sustained global demand, perceived nutritional completeness, and longer shelf life compared to liquid alternatives.

- Packaging Needs: Requires robust, airtight packaging to maintain product integrity and prevent contamination.

Baby Food Packaging Industry Product Innovations

Product innovations in the Baby Food Packaging industry are revolutionizing how parents feed their infants. The development of BPA-free baby food containers, advanced multi-layer films for pouches offering superior barrier protection, and tamper-evident seals are paramount for ensuring consumer safety and product integrity. For instance, the introduction of integrated spouts on pouches for spill-free feeding and the use of inks and adhesives compliant with stringent food contact regulations represent significant advancements. Performance metrics are focused on maintaining optimal freshness, preventing oxidation, and ensuring ease of use for both parents and babies. Unique selling propositions include enhanced portability, portion control features, and aesthetically pleasing designs that appeal to modern consumers.

Propelling Factors for Baby Food Packaging Industry Growth

Several factors are propelling the growth of the Baby Food Packaging industry. The sustained increase in global birth rates, coupled with a rising trend of working parents, amplifies the demand for convenient and ready-to-use baby food solutions. Growing parental consciousness regarding infant health and nutrition is a significant driver, pushing demand for organic baby food packaging and BPA-free baby food containers. Technological advancements in material science have enabled the development of more sustainable and efficient packaging formats, such as recyclable pouches and lightweight paperboard cartons. Furthermore, supportive government regulations promoting food safety standards and initiatives encouraging the adoption of eco-friendly packaging materials are creating a favorable market environment. The increasing availability of diverse baby food products, from liquid milk formula to prepared baby food, further broadens the packaging requirements.

Obstacles in the Baby Food Packaging Industry Market

Despite robust growth, the Baby Food Packaging industry faces several obstacles. Stringent regulatory compliances regarding food contact materials and safety standards, particularly in developed nations, can increase manufacturing costs and slow down product innovation. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production volumes and lead to increased costs. The growing consumer preference for sustainable baby food packaging also presents a challenge, as transitioning to eco-friendly materials often involves significant investment in new technologies and infrastructure. Competitive pressures from both established players and emerging niche brands can lead to price wars and necessitate continuous product differentiation. Furthermore, the perceived environmental impact of single-use plastics, though being addressed by industry innovations, continues to be a point of concern for some consumer segments.

Future Opportunities in Baby Food Packaging Industry

The Baby Food Packaging industry is ripe with future opportunities. The burgeoning demand for plant-based baby food packaging and biodegradable alternatives presents a significant avenue for innovation and market penetration. Expansion into emerging economies with rapidly growing infant populations and increasing disposable incomes offers substantial growth potential. The development and adoption of smart packaging technologies, such as those with integrated sensors for temperature monitoring or QR codes for product traceability and nutritional information, can enhance consumer trust and engagement. Furthermore, the increasing popularity of subscription-based baby food services creates opportunities for customized and optimized packaging solutions. Collaborations between packaging manufacturers and baby food brands to develop closed-loop recycling systems and promote a circular economy are also a promising area for future development.

Major Players in the Baby Food Packaging Industry Ecosystem

- Ardagh Group

- Sonoco Products Company

- RPC Group

- Tetra Laval

- Mondi Group

- Winpak Ltd

- Amcor PLC

- Silgan Holdings Inc

- DS Smith PLC

Key Developments in Baby Food Packaging Industry Industry

- June 2021: Plasmon, an Italian baby food company owned by Kraft-Heinz, relaunched its "Squeezer and Taste" product in a new, fully recyclable fruit snack pack designed specifically for children, emphasizing sustainable baby food packaging.

- March 2021: Amcor announced its membership in the Alliance to End Plastic Waste, reinforcing its commitment to developing all its packaging to be recyclable or reusable by 2025, aligning with its sustainability pledge and its partnership with McKinsey.org on recycling solutions.

Strategic Baby Food Packaging Industry Market Forecast

The strategic forecast for the Baby Food Packaging industry is overwhelmingly positive, driven by a powerful synergy of evolving consumer demands and technological advancements. The persistent global trend towards smaller family sizes coupled with increased awareness of infant nutrition will continue to fuel the demand for safe, convenient, and healthy baby food options, inherently boosting the need for specialized packaging. The relentless pursuit of sustainability by both manufacturers and consumers will unlock significant opportunities for innovative materials and circular economy models, further solidifying the market's growth trajectory. Investments in advanced barrier technologies and smart packaging solutions are poised to enhance product integrity and consumer engagement, ensuring a robust market outlook for the foreseeable future.

Baby Food Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paperboard

- 1.3. Metal

- 1.4. Glass

-

2. Package Type

- 2.1. Bottles

- 2.2. Metal Cans

- 2.3. Cartons

- 2.4. Jars

- 2.5. Pouches

-

3. Product

- 3.1. Liquid Milk Formula

- 3.2. Dried Baby Food

- 3.3. Powder Milk Formula

- 3.4. Prepared Baby Food

Baby Food Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Baby Food Packaging Industry Regional Market Share

Geographic Coverage of Baby Food Packaging Industry

Baby Food Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization Coupled with Busy Lifestyle

- 3.3. Market Restrains

- 3.3.1. Rising Concerns over Eco-friendly Products

- 3.4. Market Trends

- 3.4.1. Plastic is Expected to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paperboard

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Package Type

- 5.2.1. Bottles

- 5.2.2. Metal Cans

- 5.2.3. Cartons

- 5.2.4. Jars

- 5.2.5. Pouches

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Liquid Milk Formula

- 5.3.2. Dried Baby Food

- 5.3.3. Powder Milk Formula

- 5.3.4. Prepared Baby Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paperboard

- 6.1.3. Metal

- 6.1.4. Glass

- 6.2. Market Analysis, Insights and Forecast - by Package Type

- 6.2.1. Bottles

- 6.2.2. Metal Cans

- 6.2.3. Cartons

- 6.2.4. Jars

- 6.2.5. Pouches

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Liquid Milk Formula

- 6.3.2. Dried Baby Food

- 6.3.3. Powder Milk Formula

- 6.3.4. Prepared Baby Food

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paperboard

- 7.1.3. Metal

- 7.1.4. Glass

- 7.2. Market Analysis, Insights and Forecast - by Package Type

- 7.2.1. Bottles

- 7.2.2. Metal Cans

- 7.2.3. Cartons

- 7.2.4. Jars

- 7.2.5. Pouches

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Liquid Milk Formula

- 7.3.2. Dried Baby Food

- 7.3.3. Powder Milk Formula

- 7.3.4. Prepared Baby Food

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paperboard

- 8.1.3. Metal

- 8.1.4. Glass

- 8.2. Market Analysis, Insights and Forecast - by Package Type

- 8.2.1. Bottles

- 8.2.2. Metal Cans

- 8.2.3. Cartons

- 8.2.4. Jars

- 8.2.5. Pouches

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Liquid Milk Formula

- 8.3.2. Dried Baby Food

- 8.3.3. Powder Milk Formula

- 8.3.4. Prepared Baby Food

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paperboard

- 9.1.3. Metal

- 9.1.4. Glass

- 9.2. Market Analysis, Insights and Forecast - by Package Type

- 9.2.1. Bottles

- 9.2.2. Metal Cans

- 9.2.3. Cartons

- 9.2.4. Jars

- 9.2.5. Pouches

- 9.3. Market Analysis, Insights and Forecast - by Product

- 9.3.1. Liquid Milk Formula

- 9.3.2. Dried Baby Food

- 9.3.3. Powder Milk Formula

- 9.3.4. Prepared Baby Food

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paperboard

- 10.1.3. Metal

- 10.1.4. Glass

- 10.2. Market Analysis, Insights and Forecast - by Package Type

- 10.2.1. Bottles

- 10.2.2. Metal Cans

- 10.2.3. Cartons

- 10.2.4. Jars

- 10.2.5. Pouches

- 10.3. Market Analysis, Insights and Forecast - by Product

- 10.3.1. Liquid Milk Formula

- 10.3.2. Dried Baby Food

- 10.3.3. Powder Milk Formula

- 10.3.4. Prepared Baby Food

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ardagh Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RPC Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tetra Laval

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mondi Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Winpak Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Silgan Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DS Smith PLC*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ardagh Group

List of Figures

- Figure 1: Global Baby Food Packaging Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Baby Food Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Baby Food Packaging Industry Revenue (undefined), by Package Type 2025 & 2033

- Figure 5: North America Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 6: North America Baby Food Packaging Industry Revenue (undefined), by Product 2025 & 2033

- Figure 7: North America Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 8: North America Baby Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Baby Food Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 11: Europe Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Baby Food Packaging Industry Revenue (undefined), by Package Type 2025 & 2033

- Figure 13: Europe Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 14: Europe Baby Food Packaging Industry Revenue (undefined), by Product 2025 & 2033

- Figure 15: Europe Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Baby Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Baby Food Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 19: Asia Pacific Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Baby Food Packaging Industry Revenue (undefined), by Package Type 2025 & 2033

- Figure 21: Asia Pacific Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 22: Asia Pacific Baby Food Packaging Industry Revenue (undefined), by Product 2025 & 2033

- Figure 23: Asia Pacific Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Asia Pacific Baby Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Baby Food Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 27: Latin America Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Baby Food Packaging Industry Revenue (undefined), by Package Type 2025 & 2033

- Figure 29: Latin America Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 30: Latin America Baby Food Packaging Industry Revenue (undefined), by Product 2025 & 2033

- Figure 31: Latin America Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 32: Latin America Baby Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Baby Food Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 35: Middle East and Africa Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Baby Food Packaging Industry Revenue (undefined), by Package Type 2025 & 2033

- Figure 37: Middle East and Africa Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 38: Middle East and Africa Baby Food Packaging Industry Revenue (undefined), by Product 2025 & 2033

- Figure 39: Middle East and Africa Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 40: Middle East and Africa Baby Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 3: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 4: Global Baby Food Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 7: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Global Baby Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 10: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 11: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 12: Global Baby Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 14: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 15: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 16: Global Baby Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 18: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 19: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Baby Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Baby Food Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 22: Global Baby Food Packaging Industry Revenue undefined Forecast, by Package Type 2020 & 2033

- Table 23: Global Baby Food Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Baby Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Food Packaging Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Baby Food Packaging Industry?

Key companies in the market include Ardagh Group, Sonoco Products Company, RPC Group, Tetra Laval, Mondi Group, Winpak Ltd, Amcor PLC, Silgan Holdings Inc, DS Smith PLC*List Not Exhaustive.

3. What are the main segments of the Baby Food Packaging Industry?

The market segments include Material, Package Type, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization Coupled with Busy Lifestyle.

6. What are the notable trends driving market growth?

Plastic is Expected to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Rising Concerns over Eco-friendly Products.

8. Can you provide examples of recent developments in the market?

June 2021 - Plasmon, the Italian baby food company owned by Kraft-Heinz, relaunched its "Squeezer and Taste" in a new fully recyclable pack. The Plasmon 100 percent fruit snack pack is designed specifically for children.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Food Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Food Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Food Packaging Industry?

To stay informed about further developments, trends, and reports in the Baby Food Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence