Key Insights

The Asia Pacific cosmetic packaging market is projected for significant expansion, expected to reach an estimated USD 5.22 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.83% through 2033. This growth is propelled by rising disposable incomes, an expanding middle class, and a strong consumer appetite for premium and innovative beauty products. The proliferation of e-commerce for beauty sales further underscores the need for secure and adaptable packaging, fostering innovation in flexible plastics and specialized containers. A growing commitment to sustainability is a key market driver, encouraging investment in recyclable and biodegradable packaging, particularly in environmentally conscious markets like China and Japan. This trend offers brands opportunities to connect with eco-aware consumers.

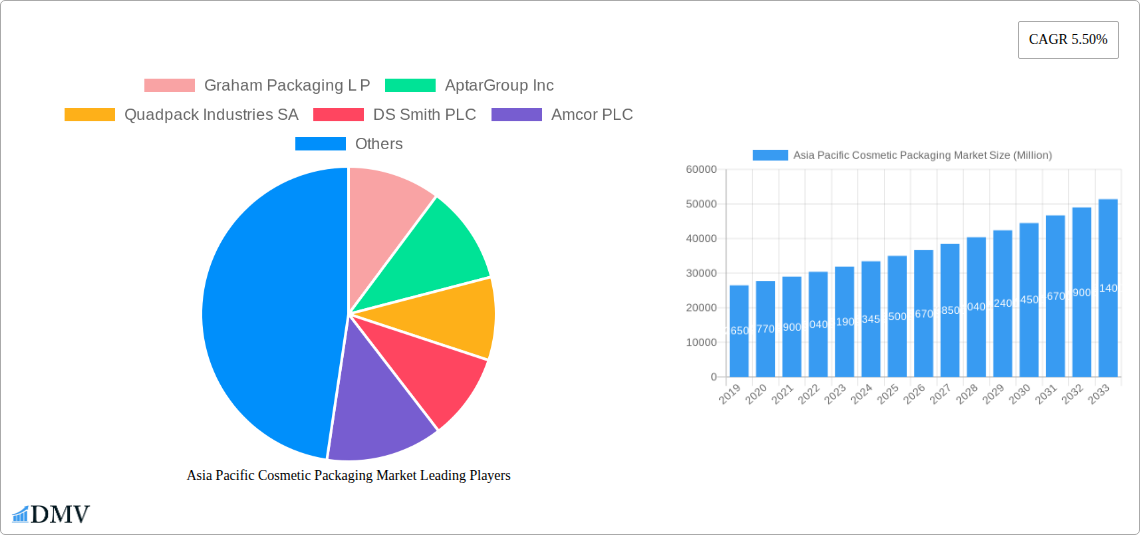

Asia Pacific Cosmetic Packaging Market Market Size (In Billion)

The market is segmented by material. Plastics dominate due to their versatility and cost-effectiveness in applications such as bottles and containers. Glass and metal packaging continue to see demand, especially from luxury brands. Paper-based solutions like folding cartons are gaining traction, supported by sustainability initiatives and secondary packaging needs. In terms of product type, plastic bottles and containers are expected to lead, with significant growth anticipated in tubes, sticks, caps, closures, pumps, and dispensers for skincare and color cosmetics. The rising popularity of men's grooming and deodorants also contributes to the diverse packaging requirements in the region, creating a competitive environment for manufacturers including Amcor PLC and AptarGroup Inc.

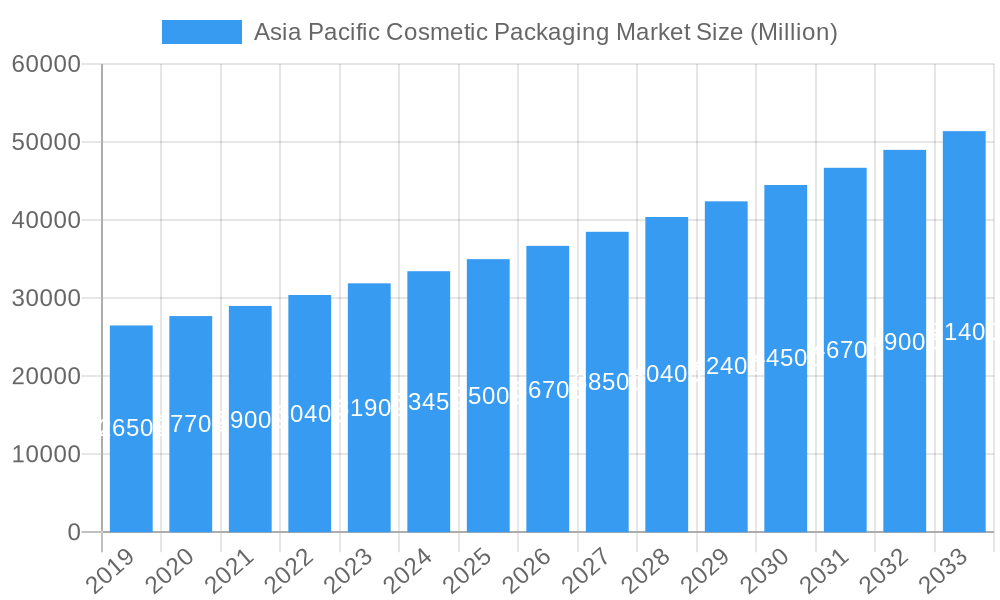

Asia Pacific Cosmetic Packaging Market Company Market Share

This report offers a strategic analysis of the Asia Pacific cosmetic packaging market, characterized by evolving consumer demands, technological advancements, and a focus on sustainability. Covering the period from 2019 to 2024, with 2025 as the base year and projections extending to 2033, this analysis provides critical insights for stakeholders. The report details market segmentation by material type (plastic, glass, metal, paper), product type (plastic bottles and containers, glass bottles and containers, metal containers, folding cartons, corrugated boxes, tubes and sticks, caps and closures, pump and dispenser, droppers, ampoules, flexible plastic packaging), and cosmetic type (color cosmetics, skin care, men's grooming, deodorants, other cosmetics). Key players such as Amcor PLC, AptarGroup Inc., Graham Packaging L.P., DS Smith PLC, and Berry Global Group are profiled.

Asia Pacific Cosmetic Packaging Market Market Composition & Trends

The Asia Pacific cosmetic packaging market exhibits a moderate to high concentration, with a few key players dominating specific product categories. Innovation is a constant catalyst, driven by demand for premium aesthetics, enhanced functionality, and sustainable solutions. The regulatory landscape is evolving, with increasing focus on recyclability, reduced plastic usage, and eco-friendly materials, particularly impacting the plastic bottles and containers and flexible plastic packaging segments. Substitute products, such as bio-plastics and innovative paper-based solutions, are gaining traction, challenging traditional plastic and glass dominance. End-user profiles range from mass-market brands to luxury cosmetic houses, each with distinct packaging requirements for skin care, color cosmetics, and men's grooming products. Merger and acquisition (M&A) activities are a significant trend, with strategic consolidations aimed at expanding market reach and product portfolios. For instance, recent M&A deals in the packaging sector have reached valuations in the hundreds of Millions, signifying robust investor confidence. The market share distribution indicates a strong preference for plastic materials due to their versatility and cost-effectiveness, although there's a discernible shift towards sustainable alternatives.

Asia Pacific Cosmetic Packaging Market Industry Evolution

The Asia Pacific cosmetic packaging industry has undergone significant evolution, marked by consistent growth trajectories fueled by a burgeoning middle class and rising disposable incomes across key economies. From 2019 to 2024, the market witnessed steady expansion, with an estimated compound annual growth rate (CAGR) of XX%. This growth has been propelled by rapid technological advancements in packaging design and manufacturing, enabling the creation of more sophisticated and aesthetically pleasing packaging. Innovations such as advanced printing techniques, sustainable material development, and smart packaging solutions are becoming increasingly prevalent. Consumer demands have also shifted dramatically, with a growing preference for eco-friendly, minimalist, and personalized packaging. The rise of e-commerce has further influenced packaging needs, emphasizing durability, lightweight designs, and branding opportunities during transit. The skin care segment, in particular, has seen substantial growth, driving demand for specialized packaging like droppers, ampoules, and high-barrier flexible plastic packaging. Similarly, the color cosmetics segment continues to innovate with unique applicators and compact designs. The introduction of sustainable packaging initiatives and consumer awareness campaigns have also played a crucial role in shaping market trends, pushing manufacturers towards recycled content and biodegradable materials. The estimated market size for the Asia Pacific cosmetic packaging market in 2025 is valued at XXX Million. This trajectory is projected to continue, with the market expected to reach XXX Million by 2033, demonstrating sustained long-term growth. The adoption rate of advanced, sustainable packaging solutions is expected to accelerate, with an estimated XX% increase in the usage of recycled plastics and paper-based alternatives by 2030.

Leading Regions, Countries, or Segments in Asia Pacific Cosmetic Packaging Market

The Asia Pacific cosmetic packaging market is characterized by significant regional variations in dominance, with Southeast Asia and East Asia emerging as key growth engines. Within Material Type, Plastic packaging continues to hold the largest market share, accounting for an estimated XX% of the total market value in 2025. This dominance is driven by its versatility, cost-effectiveness, and widespread application across various cosmetic products. However, Glass packaging is experiencing a resurgence, particularly in the premium skin care and color cosmetics segments, valued at XX Million in 2025, due to its perceived luxury appeal and excellent barrier properties.

Material Type Dominance:

- Plastic: Expected to represent over XX% of the market value in 2025. Key drivers include its use in plastic bottles and containers, flexible plastic packaging, caps and closures, and tubes and sticks.

- Glass: Strong demand in premium skin care and color cosmetics, with a market value of XX Million in 2025. Drivers include brand perception, sustainability initiatives, and recyclability.

Product Type Significance:

- Plastic Bottles and Containers: Constituting the largest share within product types, driven by widespread use in skin care, color cosmetics, and men's grooming.

- Caps and Closures: Essential components, with high volume demand across all cosmetic categories.

- Flexible Plastic Packaging: Growing rapidly due to its use in sachets, pouches for travel-sized products, and sustainable alternatives.

Cosmetic Type Influence:

- Skin Care: The largest and fastest-growing segment, influencing demand for sophisticated and functional packaging like droppers, airless pumps, and high-barrier glass bottles and containers. Estimated market value for skin care packaging in 2025: XXX Million.

- Color Cosmetics: Robust demand for visually appealing and innovative packaging, driving trends in compacts, lip gloss tubes, and specialized applicators.

- Men's Grooming: A rapidly expanding segment, contributing to demand for durable, masculine-styled packaging, including metal containers and robust plastic bottles and containers.

Regional Dynamics:

- East Asia (China, Japan, South Korea): Leading consumption and production hubs, driven by strong domestic brands, high adoption of beauty trends, and significant investment in R&D. China alone is projected to contribute XX% to the market value in 2025.

- Southeast Asia (Indonesia, Thailand, Vietnam): Experiencing rapid growth due to increasing disposable incomes, urbanization, and a young population with a high propensity to spend on beauty products. Investment trends in this region are focused on scalable manufacturing and efficient distribution networks.

Asia Pacific Cosmetic Packaging Market Product Innovations

Product innovations in the Asia Pacific cosmetic packaging market are rapidly evolving to meet consumer demand for both aesthetic appeal and sustainability. The introduction of advanced airless pump systems for skin care products, ensuring product integrity and reducing preservative needs, is a significant trend, with adoption rates projected to increase by XX% by 2028. Smart packaging solutions, incorporating QR codes for product authentication and ingredient information, are gaining traction, particularly in the color cosmetics segment. Furthermore, the development of novel flexible plastic packaging materials that are compostable or made from post-consumer recycled (PCR) content is a key focus, enhancing the eco-credentials of beauty brands. The use of unique dispensing mechanisms for precise application in products like foundations and serums is also a notable innovation. The performance metrics for these innovations are increasingly measured by factors such as product preservation efficacy, user experience, and environmental impact reduction, with brands actively seeking packaging that aligns with their sustainability goals.

Propelling Factors for Asia Pacific Cosmetic Packaging Market Growth

Several key factors are propelling the growth of the Asia Pacific cosmetic packaging market. The burgeoning middle class across countries like China, India, and Southeast Asian nations, with their increasing disposable incomes and growing interest in beauty and personal care products, is a primary driver. Technological advancements in manufacturing processes, enabling the production of intricate and visually appealing packaging, also contribute significantly. Furthermore, the rising global demand for eco-friendly and sustainable packaging solutions is spurring innovation in materials like recycled plastics and biodegradable alternatives. Government initiatives promoting responsible waste management and circular economy principles are also indirectly fostering the adoption of greener packaging. The expanding e-commerce landscape further fuels demand for durable and brand-enhancing packaging for direct-to-consumer shipments.

Obstacles in the Asia Pacific Cosmetic Packaging Market Market

Despite robust growth, the Asia Pacific cosmetic packaging market faces several obstacles. Stringent and evolving regulatory frameworks regarding plastic usage and recyclability across different countries can create compliance challenges for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact production costs and delivery timelines. The high cost associated with adopting cutting-edge sustainable materials and advanced manufacturing technologies can also be a barrier for smaller players. Intense competition within the market leads to price pressures, and the need for continuous innovation to meet rapidly changing consumer preferences requires significant R&D investment. The significant XX% increase in raw material costs observed in 2023 highlights this challenge.

Future Opportunities in Asia Pacific Cosmetic Packaging Market

Future opportunities in the Asia Pacific cosmetic packaging market lie in the increasing demand for personalized and customizable packaging solutions, particularly for niche beauty segments. The growing trend of sustainability presents a significant opportunity for companies offering innovative biodegradable, compostable, or fully recyclable packaging materials. The expansion of the men's grooming sector is another area ripe for specialized packaging development. Furthermore, the integration of smart technologies, such as NFC tags or embedded sensors for enhanced product tracking and consumer engagement, offers a frontier for innovation. The untapped potential in emerging economies within the Asia Pacific region also presents considerable growth prospects for packaging providers. The projected XX% growth in the adoption of PCR content by 2030 underscores this opportunity.

Major Players in the Asia Pacific Cosmetic Packaging Market Ecosystem

- Graham Packaging L.P.

- AptarGroup Inc.

- Quadpack Industries SA

- DS Smith PLC

- Amcor PLC

- Gerresheimer AG

- Cosmopak Ltd

- HCP Packaging Co Ltd

- Albea SA

- RPC Group PLC (Berry Global Group)

Key Developments in Asia Pacific Cosmetic Packaging Market Industry

- June 2022: Watsons partnered with L'Oréal to roll out the 'Beauty for the Future' recycling campaign to widen its sustainability impact. The company is looking to expand its green credentials, extending the recycling program to Hong Kong. This initiative aims to significantly boost recycling rates for cosmetic packaging.

- June 2022: SGD Pharma, a leader in pharmaceutical-grade molded glass vials, intends to expand globally in the cosmetics and beauty segment. The company's beauty and care division is already the Asia Pacific market leader in this segment, supplying both global and local beauty brands through their factory in Zhanjiang, China-based. This expansion is set to enhance the availability of high-quality glass packaging for beauty products in the region.

Strategic Asia Pacific Cosmetic Packaging Market Market Forecast

The strategic Asia Pacific cosmetic packaging market forecast indicates continued robust growth, driven by a confluence of favorable factors. The burgeoning demand for premium and eco-conscious beauty products will propel innovation in sustainable materials and advanced functional packaging. The increasing disposable incomes and growing middle class across Southeast Asia and other emerging economies will fuel consumption of cosmetics, thereby amplifying the need for diverse packaging solutions. The market will witness significant investment in advanced manufacturing technologies and R&D for recyclable and biodegradable alternatives. Strategic collaborations and M&A activities are expected to shape the competitive landscape, enabling companies to expand their product portfolios and geographic reach. The estimated market size of XXX Million in 2025 is projected to reach XXX Million by 2033, with a CAGR of XX% during the forecast period, highlighting substantial future potential.

Asia Pacific Cosmetic Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper

-

2. Product Type

- 2.1. Plastic Bottles and Containers

- 2.2. Glass Bottles and Containers

- 2.3. Metal Containers

- 2.4. Folding Cartons

- 2.5. Corrugated Boxes

- 2.6. Tubes and Sticks

- 2.7. Caps and Closures

- 2.8. Pump and Dispenser

- 2.9. Droppers

- 2.10. Ampoules

- 2.11. Flexible Plastic Packaging

-

3. Cosmetic Type

- 3.1. Color Cosmetics

- 3.2. Skin Care

- 3.3. Men's Grooming

- 3.4. Deodrants

- 3.5. Other Co

Asia Pacific Cosmetic Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Cosmetic Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Cosmetic Packaging Market

Asia Pacific Cosmetic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Cosmetic Products in the Region; Increasing Focus on Innovation and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. Growing Sustainability Concerns

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Cosmetic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles and Containers

- 5.2.2. Glass Bottles and Containers

- 5.2.3. Metal Containers

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated Boxes

- 5.2.6. Tubes and Sticks

- 5.2.7. Caps and Closures

- 5.2.8. Pump and Dispenser

- 5.2.9. Droppers

- 5.2.10. Ampoules

- 5.2.11. Flexible Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 5.3.1. Color Cosmetics

- 5.3.2. Skin Care

- 5.3.3. Men's Grooming

- 5.3.4. Deodrants

- 5.3.5. Other Co

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Graham Packaging L P

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AptarGroup Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Quadpack Industries SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gerresheimer AG*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cosmopak Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HCP Packaging Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Albea SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RPC Group PLC (Berry Global Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Graham Packaging L P

List of Figures

- Figure 1: Asia Pacific Cosmetic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Cosmetic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 4: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 8: Asia Pacific Cosmetic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Cosmetic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Cosmetic Packaging Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Asia Pacific Cosmetic Packaging Market?

Key companies in the market include Graham Packaging L P, AptarGroup Inc, Quadpack Industries SA, DS Smith PLC, Amcor PLC, Gerresheimer AG*List Not Exhaustive, Cosmopak Ltd, HCP Packaging Co Ltd, Albea SA, RPC Group PLC (Berry Global Group).

3. What are the main segments of the Asia Pacific Cosmetic Packaging Market?

The market segments include Material Type, Product Type, Cosmetic Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Cosmetic Products in the Region; Increasing Focus on Innovation and Attractive Packaging.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Growing Sustainability Concerns.

8. Can you provide examples of recent developments in the market?

June 2022: Watsons partnered with L'Oréal to roll out the 'Beauty for the Future' recycling campaign to widen its sustainability impact. The company is looking to expand its green credentials, extending the recycling program to Hong Kong.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Cosmetic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Cosmetic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Cosmetic Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Cosmetic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence