Key Insights

The European flexible beverage packaging market is projected to reach 52.96 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.75%. This growth is propelled by consumer demand for convenient, portable, and sustainable packaging. The increasing popularity of plant-based beverages further fuels market expansion. While plastics remain prevalent for their versatility, a significant shift towards recyclable and biodegradable alternatives is observed, driven by environmental consciousness. Metal cans and paperboard packaging are also gaining traction for beer and juices, valued for recyclability and premium perception. Pouches continue to dominate for on-the-go consumption, particularly for energy drinks and juices.

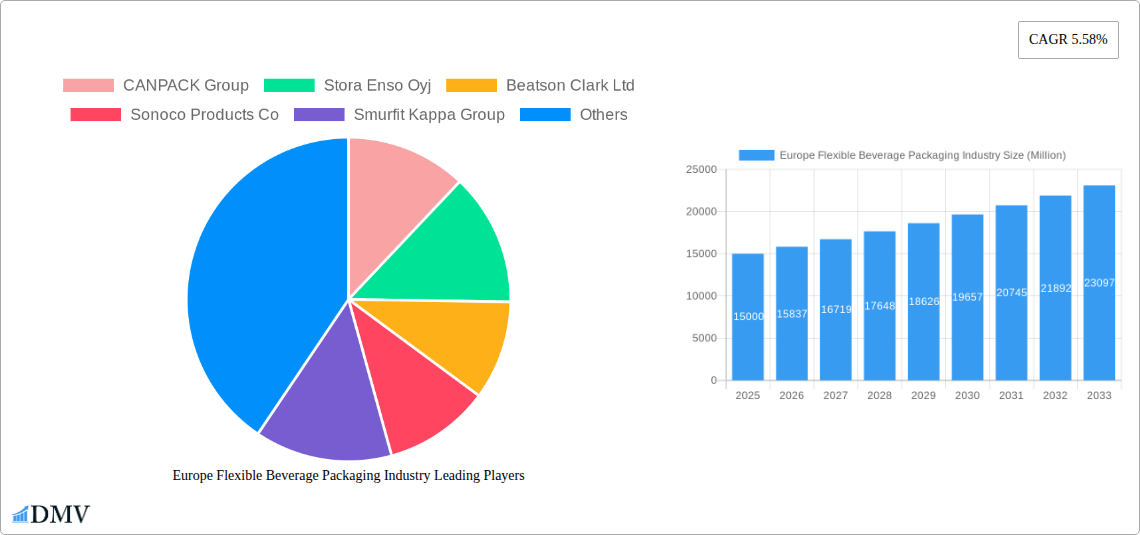

Europe Flexible Beverage Packaging Industry Market Size (In Billion)

Key industry players are investing in innovative materials and advanced manufacturing to meet evolving demands. However, challenges such as raw material price volatility, plastic waste regulations, and the cost of transitioning to new technologies may restrain growth. The growing emphasis on a circular economy and heightened consumer environmental awareness are expected to drive the market forward. Strategic collaborations and M&A activities will likely shape the competitive landscape as companies aim to enhance product portfolios and expand within key European markets including the United Kingdom, Germany, and France.

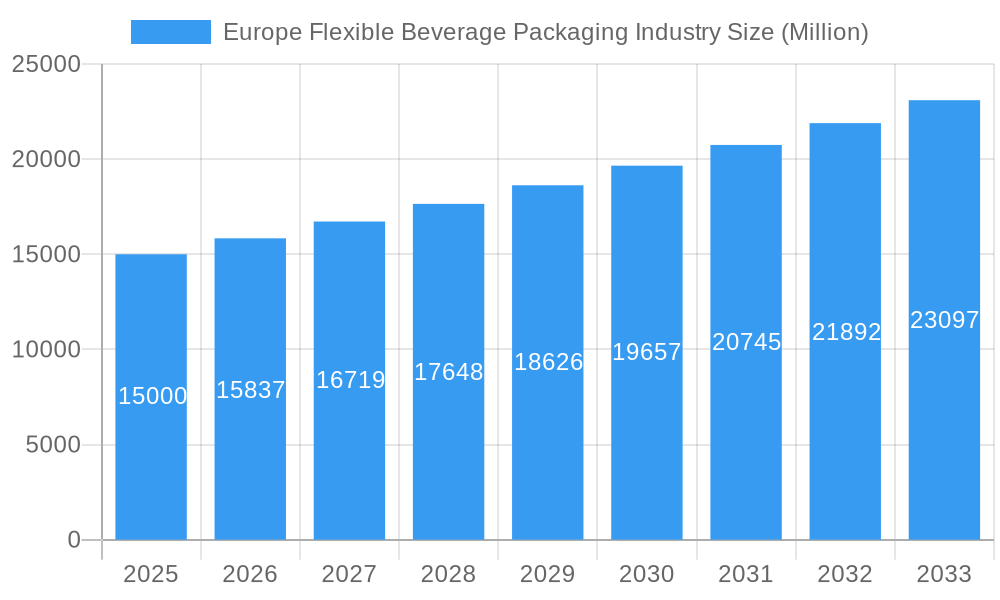

Europe Flexible Beverage Packaging Industry Company Market Share

Europe Flexible Beverage Packaging Industry Market Composition & Trends

The Europe Flexible Beverage Packaging Industry is a dynamic and competitive landscape characterized by a mix of established multinational corporations and specialized regional players. Market concentration is moderate, with key entities like Amcor Plc, Smurfit Kappa Group, and Ball Corp holding significant market shares. However, the presence of companies like CANPACK Group, Stora Enso Oyj, Mondi Group Plc, and Ardagh Group SA, alongside specialists in specific materials such as Beatson Clark Ltd (Glass) and Vidrala SA (Glass), ensures a robust competitive environment. Innovation is a critical catalyst, driven by the relentless pursuit of sustainability, enhanced product protection, and cost-efficiency. This includes advancements in lightweighting, barrier properties, and the integration of smart packaging technologies. The regulatory landscape is increasingly focused on recyclability, recycled content mandates, and the reduction of single-use plastics, significantly shaping material choices and design strategies. Substitute products, particularly from paperboard and advanced plastic alternatives, are gaining traction, posing a challenge to traditional materials. End-user profiles are diverse, spanning major beverage producers such as Danone SA and Tetra Pak International SA, as well as a burgeoning segment of craft breweries and independent bottlers. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion, with deal values often reaching into the hundreds of millions of Euros as companies seek to acquire new technologies or expand their geographical reach. For instance, significant M&A activities in recent years have reshaped the competitive fabric, with reported deal values in the range of €50 Million to €500 Million, impacting market share distribution and driving further industry consolidation. The market is responding to these shifts with an estimated market share distribution where plastic packaging leads, followed closely by paperboard and metal, reflecting evolving consumer preferences and regulatory pressures.

Europe Flexible Beverage Packaging Industry Industry Evolution

The Europe Flexible Beverage Packaging Industry has undergone a significant transformation over the study period (2019–2033), evolving from a market primarily focused on functionality and cost to one increasingly driven by sustainability, consumer convenience, and technological innovation. The historical period (2019–2024) witnessed steady growth, fueled by consistent demand from established beverage categories like carbonated drinks and bottled water. However, this period also laid the groundwork for the seismic shifts that would follow. The base year (2025) marks a critical juncture, where the industry is consolidating lessons learned and actively pivoting towards future trends. The forecast period (2025–2033) is projected to be characterized by accelerated innovation and significant market expansion, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5%. This growth will be propelled by a confluence of factors, including rising consumer awareness regarding environmental impact, stringent government regulations promoting circular economy principles, and advancements in material science and processing technologies. Technological advancements are at the forefront of this evolution. We are seeing a pronounced trend towards the development of high-barrier flexible packaging solutions that extend shelf life, reduce food waste, and enable the use of thinner, lighter materials. Innovations in barrier coatings, multilayer film structures, and advanced printing technologies are enhancing product protection and brand appeal. Furthermore, the digitalization of the packaging value chain, including track-and-trace capabilities and smart packaging solutions, is becoming increasingly important for supply chain efficiency and consumer engagement. Shifting consumer demands are also playing a pivotal role. Consumers are actively seeking products with reduced environmental footprints, leading to a surge in demand for recyclable, compostable, and bio-based packaging alternatives. The rise of plant-based drinks, functional beverages, and ready-to-drink (RTD) cocktails has created new opportunities for specialized packaging formats that offer convenience, portion control, and enhanced portability. The industry is adapting by investing heavily in research and development to meet these evolving preferences, with significant R&D investments in sustainable materials and smart packaging solutions estimated to be in the range of €100 Million to €300 Million annually. Adoption metrics for sustainable packaging solutions are showing an upward trend, with an estimated increase of 15-20% year-on-year, underscoring the industry's responsiveness to both regulatory mandates and market desires.

Leading Regions, Countries, or Segments in Europe Flexible Beverage Packaging Industry

The European flexible beverage packaging market exhibits distinct regional strengths and segment dominance, driven by a combination of economic factors, consumer preferences, and regulatory landscapes. Germany, the United Kingdom, and France consistently emerge as leading countries, owing to their large consumer bases, robust beverage industries, and proactive approaches to environmental regulations. The Plastic segment, despite increasing scrutiny, remains a dominant material type due to its versatility, cost-effectiveness, and superior barrier properties for many applications. However, the Paperboard segment is experiencing rapid growth, fueled by sustainability initiatives and the demand for cartons and pouches for beverages like milk, juices, and plant-based drinks. Within product types, Bottles and Cans continue to hold substantial market share, particularly for carbonated drinks and alcoholic beverages. However, Pouches are witnessing significant expansion, especially in the convenience and single-serve segments, and for emerging markets like plant-based drinks. In terms of applications, Carbonated Drinks, Alcoholic Beverages, and Bottled Water represent mature but consistently high-demand segments. The Plant-based Drinks (Emerging Market) segment, however, is poised for exceptional growth, driven by changing dietary habits and health consciousness.

Key drivers for dominance include:

- Investment Trends: Significant investments by major players like Amcor Plc and Smurfit Kappa Group in state-of-the-art manufacturing facilities and R&D for sustainable packaging in these leading regions. For example, investments in recycling infrastructure in Germany are estimated to be in the range of €50 Million to €100 Million annually.

- Regulatory Support: Proactive environmental policies and Extended Producer Responsibility (EPR) schemes in countries like the UK and France encourage the adoption of recyclable and reusable packaging solutions, particularly benefiting paperboard and certain plastic innovations.

- Consumer Preferences: A strong consumer demand for convenient, single-serve, and environmentally friendly packaging options in urban centers across Western Europe drives innovation in pouches and lightweight bottles.

- Technological Advancements: The presence of advanced material science and manufacturing capabilities in countries like Germany and the Netherlands fosters the development of high-performance and sustainable packaging solutions.

The dominance of certain segments is further amplified by strategic partnerships and market penetration efforts. For instance, the increasing popularity of energy drinks and the expansion of RTD beverages are boosting demand for both cans and specialized plastic bottles in this application segment. The forecast period (2025–2033) is expected to see a continued rise in paperboard and pouch adoption, alongside ongoing innovation within the plastic segment to improve its environmental credentials. The estimated market share for plastic is projected to be around 40-45%, paperboard 30-35%, metal 20-25%, and glass 5-10%, with significant growth anticipated in the plant-based drink application, potentially capturing 15-20% of the flexible packaging market by 2033.

Europe Flexible Beverage Packaging Industry Product Innovations

Europe is at the vanguard of flexible beverage packaging innovation, with a focus on enhanced sustainability and functionality. Companies are introducing novel multi-material solutions that optimize barrier properties while reducing virgin plastic usage, such as advanced co-extrusion films incorporating recycled content or bio-based polymers. Innovations in printable technologies are enabling brands to achieve vibrant aesthetics and enhanced shelf appeal with eco-friendly inks and coatings. Unique selling propositions often revolve around increased recyclability, compostability, and the integration of features that extend product shelf life, thereby reducing food waste. For example, new stand-up pouches with integrated resealing mechanisms and advanced oxygen barriers are significantly improving product integrity for juices and dairy alternatives. Performance metrics are continually being enhanced; for instance, lightweighting initiatives have reduced material usage by up to 15% in some bottle designs, and improved barrier technologies are extending the shelf life of sensitive beverages by an additional 20%.

Propelling Factors for Europe Flexible Beverage Packaging Industry Growth

The Europe Flexible Beverage Packaging Industry's growth is propelled by a powerful synergy of factors. Firstly, increasing consumer awareness and demand for sustainable packaging solutions are driving innovation in recyclable, compostable, and bio-based materials. Secondly, stringent government regulations, such as the EU's Circular Economy Action Plan and national targets for recycled content, are creating a favorable environment for eco-friendly packaging adoption. Thirdly, technological advancements in material science and manufacturing processes are enabling the development of more efficient, lighter, and higher-performing packaging. Economic growth and rising disposable incomes in key European markets also contribute by increasing overall beverage consumption. Finally, the burgeoning market for plant-based drinks, functional beverages, and ready-to-drink (RTD) cocktails presents significant new avenues for growth, requiring specialized and convenient packaging formats.

Obstacles in the Europe Flexible Beverage Packaging Industry Market

Despite robust growth potential, the Europe Flexible Beverage Packaging Industry faces several obstacles. The complexity of recycling infrastructure across different European nations poses a significant challenge for achieving high recycling rates for certain mixed materials. Fluctuations in raw material prices, particularly for plastics and paper pulp, can impact profitability and production costs, with price volatility sometimes exceeding 20%. Stringent and evolving regulatory landscapes, while driving sustainability, can also create compliance hurdles and increase operational expenses. Furthermore, intense competitive pressure from both established players and new entrants necessitates continuous investment in R&D and cost optimization, potentially limiting profitability for smaller companies. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can also lead to delays and increased costs, impacting the timely delivery of packaging materials.

Future Opportunities in Europe Flexible Beverage Packaging Industry

The Europe Flexible Beverage Packaging Industry is ripe with future opportunities. The ongoing expansion of the plant-based beverage sector presents a substantial growth avenue for innovative and sustainable packaging solutions. The increasing demand for convenient, on-the-go consumption fuels opportunities in single-serve pouches and lightweight bottles with easy-open features. The integration of smart packaging technologies, such as RFID tags and QR codes, offers opportunities for enhanced traceability, brand engagement, and product authentication. Furthermore, the drive towards a circular economy opens avenues for advanced recycling technologies and the development of novel packaging materials made from recycled or renewable resources. The growing popularity of functional beverages and fortified drinks also creates demand for packaging that can preserve ingredient integrity and communicate product benefits effectively.

Major Players in the Europe Flexible Beverage Packaging Industry Ecosystem

- CANPACK Group

- Stora Enso Oyj

- Beatson Clark Ltd

- Sonoco Products Co

- Smurfit Kappa Group

- Ball Corp

- Mondi Group Plc

- Ardagh Group SA

- Amcor Plc

- Danone SA

- Tetra Pak International SA

- Gerresheimer AG

- Vidrala SA

Key Developments in Europe Flexible Beverage Packaging Industry Industry

- 2023/08: Amcor Plc launches a new range of recyclable polyethylene-based pouches designed for a variety of beverage applications, enhancing sustainability credentials and reducing carbon footprint by an estimated 10-15%.

- 2023/05: Smurfit Kappa Group invests €50 Million in expanding its corrugated packaging production capacity in Poland to meet growing demand for sustainable beverage solutions.

- 2022/11: Stora Enso Oyj develops a new barrier coating for paperboard packaging, significantly improving its suitability for liquid beverages and reducing reliance on plastic liners.

- 2022/07: Ball Corp announces advancements in its sustainable aluminum can technology, aiming for a 15% reduction in material usage by 2025.

- 2021/09: Mondi Group Plc acquires a flexible packaging producer in Eastern Europe, expanding its market reach and product portfolio for beverage packaging.

Strategic Europe Flexible Beverage Packaging Industry Market Forecast

The strategic outlook for the Europe Flexible Beverage Packaging Industry is overwhelmingly positive, driven by a powerful confluence of accelerating demand for sustainable solutions and continued innovation. The forecast period (2025–2033) will witness a pronounced shift towards circular economy principles, with an estimated 30-40% increase in the use of recycled content across various packaging materials. The burgeoning plant-based beverage market, projected to grow at a CAGR of over 7%, will be a significant catalyst for new packaging formats. Furthermore, advancements in material science and processing will lead to lighter, stronger, and more functional packaging, reducing waste and enhancing product appeal. Government mandates and consumer preferences will continue to shape the market, pushing for greater recyclability and reduced environmental impact. Investments in advanced recycling technologies and bio-based materials are expected to reach an aggregate of €500 Million to €700 Million over the forecast period, underscoring the industry's commitment to a sustainable future and positioning it for robust and sustained growth.

Europe Flexible Beverage Packaging Industry Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paperboard

-

2. Product Type

- 2.1. Bottles

- 2.2. Cans

- 2.3. Pouches

- 2.4. Cartons

- 2.5. Beer Kegs

-

3. Application

- 3.1. Carbonated Drinks

- 3.2. Alcoholic Beverages

- 3.3. Bottled Water

- 3.4. Milk

- 3.5. Fruit and Vegetable Juices

- 3.6. Energy Drinks

- 3.7. Plant-based Drinks (Emerging Market)

- 3.8. Other Applications

Europe Flexible Beverage Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Flexible Beverage Packaging Industry Regional Market Share

Geographic Coverage of Europe Flexible Beverage Packaging Industry

Europe Flexible Beverage Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Technology Offering Better Solutions

- 3.3. Market Restrains

- 3.3.1. Operation and Logistical Concerns

- 3.4. Market Trends

- 3.4.1. Plastic Packaging Significance in Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flexible Beverage Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Cans

- 5.2.3. Pouches

- 5.2.4. Cartons

- 5.2.5. Beer Kegs

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Carbonated Drinks

- 5.3.2. Alcoholic Beverages

- 5.3.3. Bottled Water

- 5.3.4. Milk

- 5.3.5. Fruit and Vegetable Juices

- 5.3.6. Energy Drinks

- 5.3.7. Plant-based Drinks (Emerging Market)

- 5.3.8. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CANPACK Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stora Enso Oyj

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Beatson Clark Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smurfit Kappa Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ball Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Group Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ardagh Group SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danone SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tetra Pak International SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gerresheimer AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Vidrala SA*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CANPACK Group

List of Figures

- Figure 1: Europe Flexible Beverage Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Flexible Beverage Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flexible Beverage Packaging Industry?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Europe Flexible Beverage Packaging Industry?

Key companies in the market include CANPACK Group, Stora Enso Oyj, Beatson Clark Ltd, Sonoco Products Co, Smurfit Kappa Group, Ball Corp, Mondi Group Plc, Ardagh Group SA, Amcor Plc, Danone SA, Tetra Pak International SA, Gerresheimer AG, Vidrala SA*List Not Exhaustive.

3. What are the main segments of the Europe Flexible Beverage Packaging Industry?

The market segments include Material Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Technology Offering Better Solutions.

6. What are the notable trends driving market growth?

Plastic Packaging Significance in Beverage Industry.

7. Are there any restraints impacting market growth?

Operation and Logistical Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flexible Beverage Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flexible Beverage Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flexible Beverage Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Flexible Beverage Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence