Key Insights

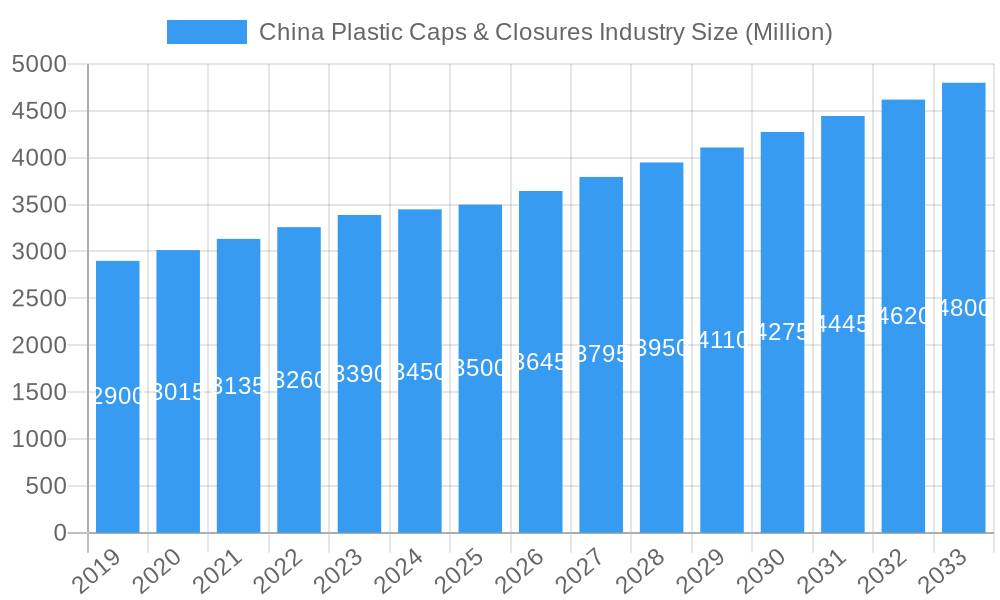

The China Plastic Caps & Closures market is projected for significant expansion, forecast to reach $6.34 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 5.7% through 2033. Key growth drivers include escalating demand from the food and beverage sector, fueled by rising consumer incomes and a preference for convenience and extended shelf-life products. The pharmaceutical industry also contributes significantly, driven by strict packaging regulations and increased healthcare consumption. Innovations in cosmetics and household product segments, coupled with advancements in manufacturing technologies and a focus on sustainable packaging, further propel market growth.

China Plastic Caps & Closures Industry Market Size (In Billion)

Dominant raw materials include Polyethylene Terephthalate (PET) and Polypropylene (PP), valued for their versatility, cost-effectiveness, and barrier properties. High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE) are also utilized for specific applications. Potential restraints include fluctuations in petrochemical-linked raw material prices and evolving regulations on plastic waste management, which may necessitate investment in alternative materials. China's robust manufacturing capacity positions it as a vital global supplier in this sector, with major players like Aptar Group Inc, Amcor Ltd, and Berry Global Inc actively participating.

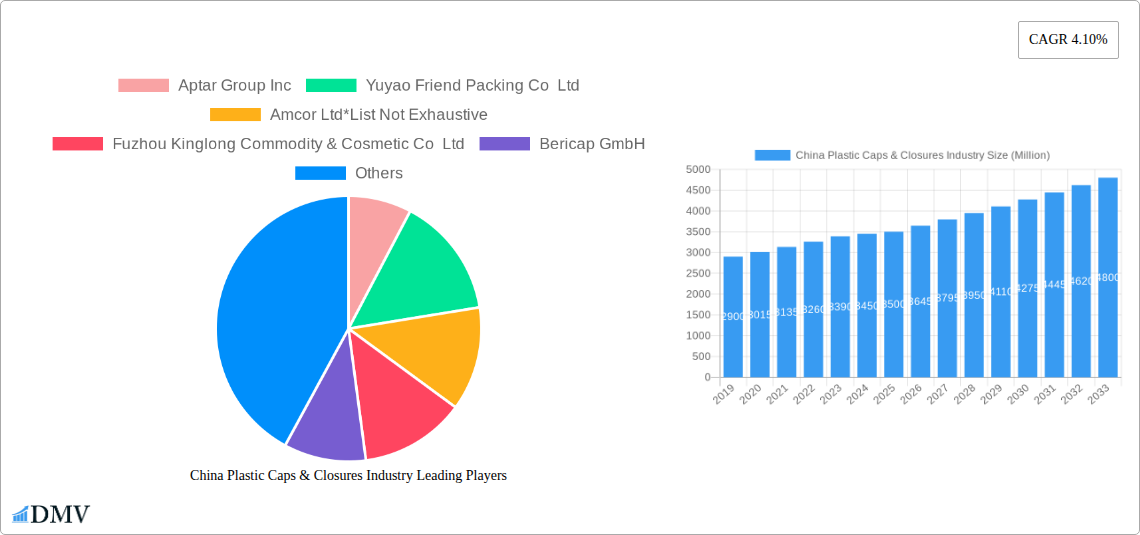

China Plastic Caps & Closures Industry Company Market Share

This report offers an in-depth analysis of the China Plastic Caps & Closures Industry, detailing market size, growth trends, and future forecasts.

China Plastic Caps & Closures Industry Market Composition & Trends

This comprehensive report delves into the intricate landscape of the China plastic caps and closures market, a dynamic sector poised for significant expansion. We meticulously analyze market concentration, identifying key players and their strategic positioning, alongside emerging innovation catalysts that are reshaping product development and manufacturing processes. The report scrutinizes the evolving regulatory landscapes impacting production and distribution, while also evaluating the threat of substitute products and the increasing sophistication of end-user profiles. Furthermore, a deep dive into Mergers & Acquisitions (M&A) activities within the industry reveals strategic consolidations and investment trends, with detailed insights into M&A deal values and their impact on market share distribution. The China plastic caps & closures industry report highlights the competitive intensity and the strategic maneuvers employed by leading entities. With a focus on the plastic closures market China, this section provides a foundational understanding of the forces driving market evolution and competition.

China Plastic Caps & Closures Industry Industry Evolution

The China plastic caps and closures industry has undergone a remarkable transformation over the study period 2019–2033. This in-depth analysis, covering the historical period 2019–2024 and projecting through to 2033 with a base year of 2025, meticulously examines the market's growth trajectories. We explore the pivotal technological advancements that have revolutionized production efficiency and product functionality, from material innovations to advanced molding techniques. Simultaneously, the report addresses the profound shifts in consumer demands, driven by factors such as sustainability concerns, convenience, and enhanced product safety. Specific data points, including compound annual growth rates (CAGRs) and adoption metrics for new technologies and product types, are provided to illustrate the industry's impressive momentum. The plastic caps and closures market China is experiencing robust growth, fueled by increasing consumption across diverse end-use sectors. This section offers a granular view of the factors propelling this evolution, making it an indispensable resource for understanding the industry's past, present, and future trajectory.

Leading Regions, Countries, or Segments in China Plastic Caps & Closures Industry

This section of the China plastic caps and closures market analysis spotlights the dominant forces within this expansive industry. We provide an in-depth examination of the leading regions, countries, and specific segments that are shaping market dynamics. Focusing on Raw Material: Polyethylene Terephthalate (PET), Polypropylene (PP), High-Density Polyethylene (HDPE), and Low-Density Polyethylene (LDPE), along with Other Raw Materials, and Industry Verticals: Food, Beverages, Pharmaceutical, Cosmetics and Household, and Other Industries, this report identifies key drivers of dominance. Bullet points highlight crucial factors such as investment trends, supportive regulatory frameworks, and evolving consumer preferences within these segments. Paragraphs offer a more detailed analysis of the specific factors contributing to the preeminence of certain regions and material types, underscoring their strategic importance. Understanding these leading segments is crucial for stakeholders aiming to capitalize on the opportunities within the China plastic caps and closures industry.

China Plastic Caps & Closures Industry Product Innovations

The China plastic caps and closures industry is a hotbed of innovation, with a continuous stream of new products designed to enhance functionality, sustainability, and consumer appeal. This report details cutting-edge product innovations, including smart closures with integrated QR codes for enhanced traceability and consumer engagement, as seen in Nestle's recent product launches. We explore advancements in tamper-evident designs, child-resistant mechanisms, and sustainable material applications, such as the increasing use of recycled plastics. Performance metrics for these innovations, along with their unique selling propositions, are thoroughly evaluated, providing a clear picture of the technological advancements that are setting new industry benchmarks and driving market growth in the plastic closures China market.

Propelling Factors for China Plastic Caps & Closures Industry Growth

The China plastic caps and closures market is propelled by a confluence of powerful factors. Technological advancements, including the adoption of automation, advanced injection molding techniques, and the development of novel, sustainable materials, are driving efficiency and product quality. Economically, rising disposable incomes and a growing middle class in China are fueling demand across key end-use industries like food & beverage, pharmaceuticals, and cosmetics. Furthermore, supportive government policies and initiatives aimed at promoting domestic manufacturing and innovation further bolster the industry's growth. The increasing demand for convenient and safe packaging solutions also plays a significant role in the expanding plastic caps and closures market China.

Obstacles in the China Plastic Caps & Closures Industry Market

Despite robust growth, the China plastic caps and closures industry faces several obstacles. Stringent and evolving environmental regulations, particularly concerning plastic waste and recyclability, present a significant challenge for manufacturers. Supply chain disruptions, exacerbated by global geopolitical events and raw material price volatility, can impact production costs and delivery timelines. Intense competitive pressures from both domestic and international players, coupled with the need for continuous investment in R&D to stay ahead of technological advancements, also pose considerable hurdles. The plastic closures market China must navigate these challenges to sustain its growth trajectory.

Future Opportunities in China Plastic Caps & Closures Industry

The future of the China plastic caps and closures industry is ripe with opportunities. The burgeoning e-commerce sector presents a growing demand for specialized packaging solutions that ensure product integrity during transit. Furthermore, the increasing global focus on sustainability is creating a substantial market for biodegradable, compostable, and recycled plastic closures, offering significant growth potential for innovative companies. Emerging markets within China and expanding export opportunities for high-quality, cost-effective plastic caps and closures are also key areas for strategic development within the plastic caps and closures China market.

Major Players in the China Plastic Caps & Closures Industry Ecosystem

- Aptar Group Inc

- Yuyao Friend Packing Co Ltd

- Amcor Ltd

- Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- Bericap GmbH

- Albea Group

- Silgan White Cap (Shanghai) Co

- Shandong Haishengyu Plastics Industry Co Ltd

- Crown Asia Pacific Holdings Limited

- Berry Global Inc

Key Developments in China Plastic Caps & Closures Industry Industry

- May 2022: Carlyle plans to acquire China-based cosmetic packaging company HCP. HCP works with more than 250 leading cosmetics, skincare, and fragrance brands, including Estée Lauder, L'Oréal, and Shiseido. Carlyle will work with HCP through strategic acquisitions to strengthen the company's research and development (R&D) capabilities.

- August 2021: After successfully launching its QR code closure solution in China, Nestle launched the products in Vietnam. These closures include QR codes that can be easily scanned and serve as a reward point to be redeemed online via the Vietnamese messaging app Zalo.

Strategic China Plastic Caps & Closures Industry Market Forecast

The China plastic caps and closures market is projected for sustained growth driven by a combination of factors. The increasing demand for convenient and safe packaging solutions across the food, beverage, pharmaceutical, and cosmetic sectors will continue to be a primary growth catalyst. Innovations in sustainable packaging materials and smart closures will open new market avenues and cater to evolving consumer preferences. Strategic investments in research and development, coupled with a favorable regulatory environment for manufacturing, will further fuel market expansion, solidifying China's position as a global leader in the plastic caps and closures industry.

China Plastic Caps & Closures Industry Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate

- 1.2. Polypropylene

- 1.3. HDPE and LDPE

- 1.4. Other Ra

-

2. Industry Vertical

- 2.1. Food

- 2.2. Beverages

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Household

- 2.5. Other In

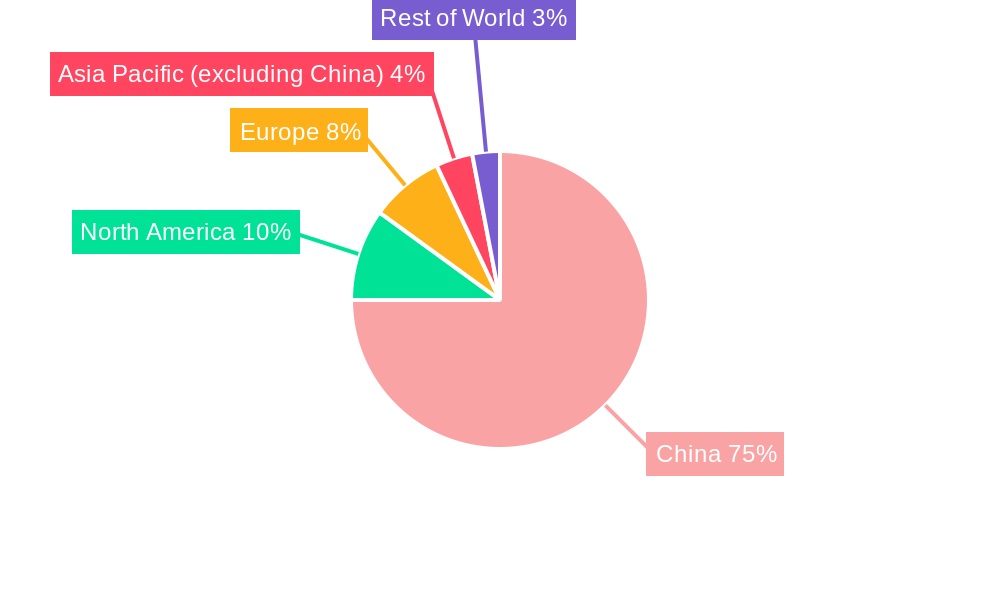

China Plastic Caps & Closures Industry Segmentation By Geography

- 1. China

China Plastic Caps & Closures Industry Regional Market Share

Geographic Coverage of China Plastic Caps & Closures Industry

China Plastic Caps & Closures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry

- 3.3. Market Restrains

- 3.3.1. Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Caps & Closures Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate

- 5.1.2. Polypropylene

- 5.1.3. HDPE and LDPE

- 5.1.4. Other Ra

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Household

- 5.2.5. Other In

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aptar Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yuyao Friend Packing Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bericap GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Albea Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan White Cap (Shanghai) Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Haishengyu Plastics Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Crown Asia Pacific Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berry Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aptar Group Inc

List of Figures

- Figure 1: China Plastic Caps & Closures Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Plastic Caps & Closures Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Caps & Closures Industry Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 2: China Plastic Caps & Closures Industry Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 3: China Plastic Caps & Closures Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Plastic Caps & Closures Industry Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 5: China Plastic Caps & Closures Industry Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 6: China Plastic Caps & Closures Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Caps & Closures Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the China Plastic Caps & Closures Industry?

Key companies in the market include Aptar Group Inc, Yuyao Friend Packing Co Ltd, Amcor Ltd*List Not Exhaustive, Fuzhou Kinglong Commodity & Cosmetic Co Ltd, Bericap GmbH, Albea Group, Silgan White Cap (Shanghai) Co, Shandong Haishengyu Plastics Industry Co Ltd, Crown Asia Pacific Holdings Limited, Berry Global Inc.

3. What are the main segments of the China Plastic Caps & Closures Industry?

The market segments include Raw Material, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry.

6. What are the notable trends driving market growth?

Food and Beverage Industry to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives.

8. Can you provide examples of recent developments in the market?

May 2022: Carlyle plans to acquire China-based cosmetic packaging company HCP. HCP works with more than 250 leading cosmetics, skincare, and fragrance brands, including Estée Lauder, L'Oréal, and Shiseido. Carlyle will work with HCP through strategic acquisitions to strengthen the company's research and development (R&D) capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Caps & Closures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Caps & Closures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Caps & Closures Industry?

To stay informed about further developments, trends, and reports in the China Plastic Caps & Closures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence