Key Insights

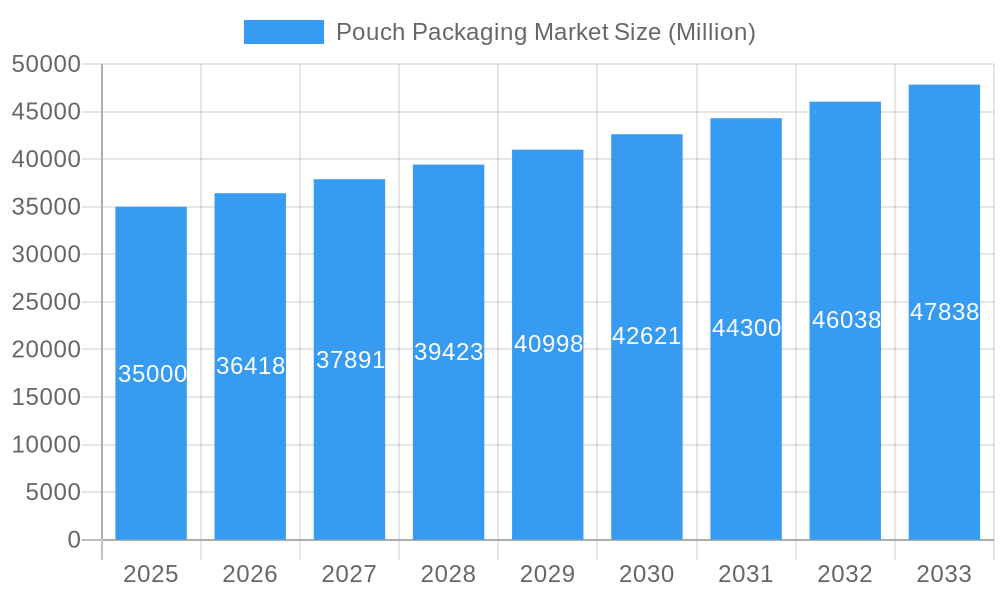

The global Pouch Packaging Market is experiencing robust expansion, projected to reach a significant market size of approximately $35,000 million by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.03%, indicating sustained demand and innovation within the sector. The market's dynamism is fueled by several key drivers, including the escalating consumer preference for convenient, portable, and single-serving packaging solutions, particularly in the food and beverage sectors. The rising demand for premium and aesthetically pleasing packaging, coupled with advancements in material science leading to more sustainable and high-barrier pouches, further propels market growth. Furthermore, the increasing adoption of pouch packaging in the medical and pharmaceutical industries for sterile and safe delivery of drugs and devices, as well as in the personal care segment for its hygiene and portability benefits, contributes significantly to this upward trajectory.

Pouch Packaging Market Market Size (In Billion)

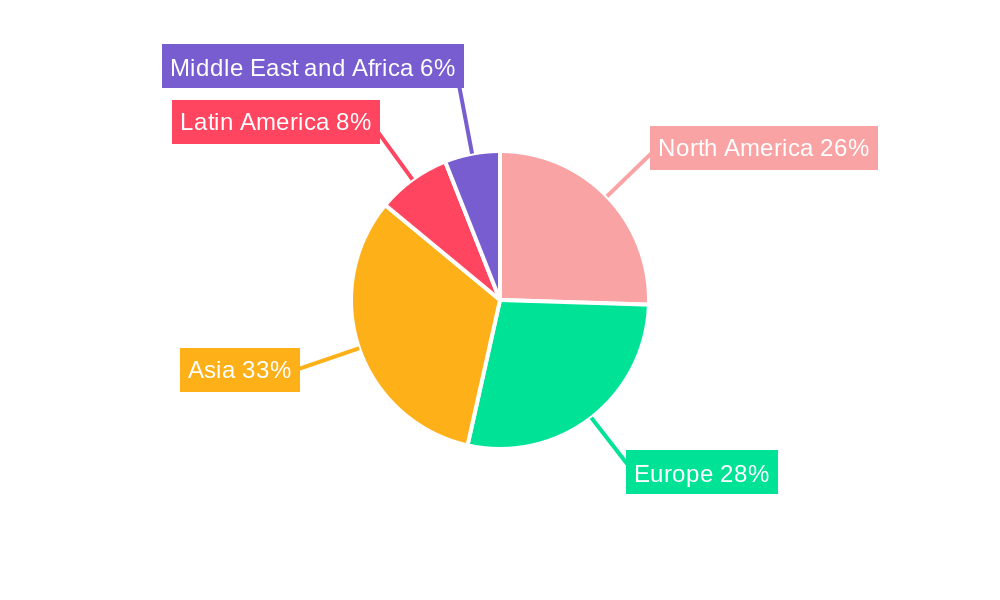

The Pouch Packaging Market is characterized by a diverse range of materials and product types catering to a broad spectrum of end-user industries. The material segment is dominated by plastics, with polyethylene (PE), polypropylene (PP), and PET leading the pack due to their versatility, cost-effectiveness, and excellent barrier properties. Paper and aluminum also hold significant shares, offering specialized benefits like enhanced rigidity and superior barrier protection, respectively. In terms of product types, flat pouches (pillow and side-seal) and stand-up pouches are the most prevalent, offering optimal product display and convenience. The food industry, in particular, is a major consumer of pouch packaging, utilizing it for a wide array of products ranging from confectionery and frozen foods to dairy, dry goods, and pet food. The beverage, medical and pharmaceutical, and personal care and household care sectors also represent substantial end-user segments. Geographically, Asia, particularly China and India, is emerging as a key growth region due to its large population, rising disposable incomes, and rapid industrialization. North America and Europe continue to be dominant markets, driven by established consumer preferences and strong manufacturing bases. However, emerging economies in Latin America and the Middle East & Africa are also showing promising growth potential.

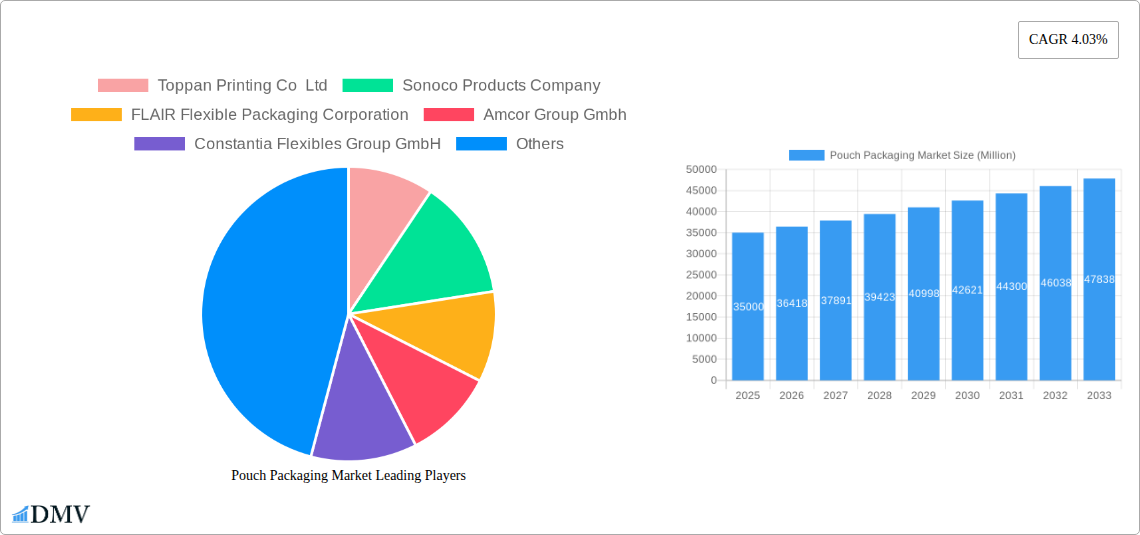

Pouch Packaging Market Company Market Share

Dive deep into the dynamic Pouch Packaging Market with this insightful report, meticulously crafted to equip stakeholders with critical intelligence for strategic decision-making. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report offers a granular view of market composition, industry evolution, regional dominance, product innovation, growth drivers, obstacles, and future opportunities. Leveraging high-ranking keywords such as flexible packaging solutions, sustainable pouches, food packaging innovation, medical packaging, and beverage pouches, this analysis ensures maximum visibility for key stakeholders seeking to capitalize on the rapidly expanding global pouch packaging sector. The report provides in-depth analysis of market trends, technological advancements, and competitive landscapes, presenting actionable insights for manufacturers, suppliers, and end-users across diverse industries.

Pouch Packaging Market Market Composition & Trends

The Pouch Packaging Market is characterized by a moderate concentration of leading players, with significant innovation catalysts driving its expansion. The market composition reveals a complex interplay of material advancements, evolving regulatory landscapes, and intense M&A activities. Key trends include a strong push towards sustainable packaging solutions, driven by consumer demand and government initiatives aimed at reducing plastic waste. Regulatory frameworks are increasingly emphasizing recyclability and the use of post-consumer recycled (PCR) materials, directly impacting product development and material choices. Substitute products, primarily rigid packaging, are facing stiff competition from the superior flexibility, lightweight nature, and extended shelf-life offered by pouches. End-user profiles are diverse, with the food and beverage industries dominating consumption, followed by the burgeoning medical and pharmaceutical, and personal care and household care sectors. Mergers and acquisitions are playing a pivotal role in market consolidation and expansion, with deal values indicative of strategic investments in expanding manufacturing capabilities and market reach. For instance, recent acquisitions aim to bolster companies' positions in specialized pouch formats and sustainable material offerings, reflecting a strategic intent to capture growing market segments.

- Market Share Distribution: Leading players hold substantial, yet fragmented, market shares, indicating room for both growth and consolidation.

- M&A Deal Values: Acquisitions in the sector are often substantial, reflecting the strategic importance of securing technological expertise and market access in the flexible packaging industry.

- Innovation Catalysts: The demand for convenience, shelf-life extension, and sustainable alternatives are key drivers of product and material innovation.

- Regulatory Landscape: Evolving environmental regulations are a significant factor, pushing for increased use of recyclable and biodegradable materials in pouch manufacturing.

Pouch Packaging Market Industry Evolution

The Pouch Packaging Market has witnessed a remarkable evolution, driven by a confluence of technological advancements, shifting consumer demands for convenience and sustainability, and expanding applications across various end-user industries. From its early iterations, the market has transformed into a sophisticated ecosystem offering diverse functionalities and aesthetic appeal. The historical period (2019-2024) laid the groundwork for significant growth, with an increasing adoption of pouches in the food and beverage sectors due to their lightweight nature, ease of use, and enhanced product protection, which extends shelf life and reduces spoilage. This period saw a notable increase in the utilization of stand-up pouches and flat pouches, catering to a wide range of products from dry goods and snacks to liquids and semi-liquids.

The base year of 2025 marks a pivotal point, with the market projected to continue its upward trajectory. The forecast period (2025-2033) is expected to be characterized by accelerated innovation in material science, particularly the development and widespread adoption of advanced plastic materials like Polyethylene (PE), Polypropylene (PP), and PET, alongside barrier layers such as EVOH to enhance product integrity and shelf life. The increasing demand for eco-friendly packaging is a critical evolution, pushing manufacturers towards recyclable pouches and those incorporating post-consumer recycled (PCR) content, as exemplified by ProAmpac's ProActive PCR retort pouches. Technological advancements in printing, sealing, and dispensing mechanisms have further enhanced the functionality and consumer appeal of pouches, making them ideal for a broader array of applications, including medical packaging and pharmaceutical packaging. The growth rate is expected to remain robust, with adoption metrics for sustainable options showing a significant upward trend. The integration of smart technologies for traceability and product authentication also represents a key evolutionary step, offering added value to both brands and consumers within the flexible packaging solutions market.

Leading Regions, Countries, or Segments in Pouch Packaging Market

The Pouch Packaging Market exhibits distinct leadership across various regions and segments, driven by a complex interplay of economic factors, consumer preferences, and regulatory support. North America and Europe currently lead in terms of market value and adoption rates, primarily due to a well-established food and beverage industry, a high disposable income, and a strong consumer preference for convenient and premium packaging solutions. The dominance of Plastic materials, particularly Polyethylene (PE) and Polypropylene (PP), is a defining characteristic of these leading regions, owing to their versatility, cost-effectiveness, and excellent barrier properties essential for food preservation.

Among the product types, Stand-up Pouches are experiencing unparalleled growth, driven by their superior on-shelf presence, ease of handling, and resealability, making them a preferred choice for snacks, pet food, and ready-to-eat meals. The Food industry remains the largest end-user segment, with significant demand from Candy & Confectionery, Dry Foods, Frozen Foods, and Meat, Poultry, and Seafood categories. The increasing consumer focus on health and wellness is also driving demand for pouches in the Beverage sector, particularly for single-serve drinks and functional beverages.

- Dominant Region - North America: High adoption rates for convenience foods and a strong emphasis on sustainable packaging initiatives are key drivers. Investment trends show significant capital infusion into advanced manufacturing facilities and R&D for eco-friendly materials.

- Leading Material - Plastic:

- Polyethylene (PE): Widely used for its flexibility and cost-effectiveness in various pouch constructions.

- Polypropylene (PP): Offers superior heat resistance and stiffness, ideal for retort pouches and hot-fill applications.

- PET: Provides excellent clarity and barrier properties, often used in laminate structures.

- EVOH: Acts as a critical oxygen barrier, extending shelf life for sensitive products.

- Dominant Product - Stand-up Pouches: Their ergonomic design and re-closable features make them highly favored across consumer segments. Investment in pouch-making machinery capable of producing high-quality stand-up pouches is on the rise.

- Key End-User Industry - Food:

- Candy & Confectionery: Pouches offer excellent product protection and visual appeal for impulse purchases.

- Dry Foods: Enable extended shelf life and easy portioning for products like pasta, rice, and cereals.

- Pet Food: The shift towards premium and specialized pet nutrition has fueled the demand for sophisticated pouch packaging.

- Regulatory Support: Government mandates and incentives promoting recyclable packaging and waste reduction are fostering growth, particularly for brands investing in sustainable flexible packaging solutions.

Pouch Packaging Market Product Innovations

Product innovations within the Pouch Packaging Market are rapidly transforming consumer experience and product performance. The development of advanced barrier technologies, such as multi-layer laminates incorporating specialized films like EVOH, significantly enhances shelf life for sensitive food and pharmaceutical products by preventing oxygen and moisture ingress. Novel printing techniques offer vibrant graphics and high-definition imagery, elevating brand appeal and consumer engagement. Furthermore, innovations in dispensing mechanisms, including spouts, zippers, and press-to-close seals, enhance convenience and resealability, a critical factor for on-the-go consumers. The emergence of sustainable pouches, crafted from mono-materials or incorporating high percentages of post-consumer recycled (PCR) content, represents a significant leap, addressing environmental concerns without compromising functionality. These innovations collectively drive higher adoption rates for flexible packaging solutions across a multitude of applications.

Propelling Factors for Pouch Packaging Market Growth

The Pouch Packaging Market is experiencing robust growth fueled by several propelling factors. The increasing global demand for convenience and portability drives the adoption of lightweight and easy-to-use pouch formats, especially in the food and beverage sectors. Technological advancements in materials science and manufacturing processes enable the creation of high-barrier pouches that significantly extend product shelf life, reducing food waste and enhancing value. The growing consumer preference for sustainable packaging solutions is a major catalyst, pushing manufacturers to develop recyclable and compostable pouches made from materials like Polyethylene and Polypropylene, alongside the incorporation of post-consumer recycled (PCR) content. Favorable regulatory initiatives promoting waste reduction and environmental responsibility further encourage the transition towards flexible packaging. The expanding e-commerce sector also benefits from pouch packaging's lightweight and durable nature, making it ideal for shipping.

Obstacles in the Pouch Packaging Market Market

Despite its strong growth, the Pouch Packaging Market faces several obstacles. The complex multi-layer structures of some traditional pouches can pose challenges for recycling, leading to concerns about their environmental impact and contributing to landfill waste, prompting a shift towards mono-material designs. Fluctuations in raw material prices, particularly for petroleum-based plastics like Polyethylene and Polypropylene, can impact manufacturing costs and profitability. Stringent regulatory requirements in certain regions regarding food contact materials and recyclability can necessitate costly product reformulation and re-qualification. Supply chain disruptions, global economic uncertainties, and geopolitical events can also affect the availability and cost of essential components and finished products. Furthermore, intense competition among existing players and the emergence of new entrants can lead to price pressures, limiting profit margins for manufacturers of flexible packaging solutions.

Future Opportunities in Pouch Packaging Market

The Pouch Packaging Market is ripe with future opportunities, driven by emerging trends and unmet demands. The escalating global demand for sustainable and recyclable pouches presents a significant opportunity for innovation in materials and design, with a focus on mono-material structures and the increased use of post-consumer recycled (PCR) content. The expanding medical and pharmaceutical sectors offer substantial growth potential for specialized, high-barrier pouches designed for sterile packaging and drug delivery systems. The rise of e-commerce continues to create demand for durable, lightweight, and tamper-evident pouch solutions. Furthermore, the exploration of smart packaging technologies, incorporating features like QR codes for traceability and augmented reality experiences, can unlock new value propositions for brands. Emerging markets in Asia Pacific and Latin America, with their growing middle class and increasing consumption of packaged goods, represent untapped potential for flexible packaging solutions.

Major Players in the Pouch Packaging Market Ecosystem

- Toppan Printing Co Ltd

- Sonoco Products Company

- FLAIR Flexible Packaging Corporation

- Amcor Group Gmbh

- Constantia Flexibles Group GmbH

- Gualapack SpA

- Bischof + Klein SE & Co KG

- Hood Packaging Corporation

- Coveris Management GmbH

- Mondi Group

- Scholle IPN

- Aluflexpack Group

- Huhtamaki Oy

- Toyo Seikan Co Ltd

- ProAmpac Intermediate Inc

- Sealed Air Corporation

Key Developments in Pouch Packaging Market Industry

- February 2024: Brook + Whittle, a United States-based packaging company, announced the acquisition of Pouchlt, a United States-based flexible packaging manufacturer. The company specializes in manufacturing pouches and roll stock films. The strategic acquisition is likely to expand the printing and manufacturing capabilities of Brook + Whittle which will allow them to rapidly grow in the flexible packaging industry.

- November 2023: ProAmpac Intermediate Inc. launched its ProActive PCR retort pouches, a sustainable alternative to conventional retort options. ProActive PCR Retort pouches are designed to reduce virgin plastics usage and contain up to 30% post-consumer recycled (PCR) material by mass.

Strategic Pouch Packaging Market Market Forecast

The strategic forecast for the Pouch Packaging Market is overwhelmingly positive, driven by an accelerating global shift towards sustainable flexible packaging solutions. The increasing consumer and regulatory demand for eco-friendly alternatives, such as recyclable pouches and those incorporating post-consumer recycled (PCR) materials, will continue to be a primary growth catalyst. Innovations in barrier technologies for plastic materials like Polyethylene and Polypropylene will further enhance product protection and extend shelf life, particularly in the food and beverage sectors. The expanding applications in the medical, pharmaceutical, and personal care industries, coupled with the convenience offered by formats like stand-up pouches, will fuel consistent market expansion. Strategic investments in advanced manufacturing capabilities and research and development for novel materials are expected to shape the competitive landscape and unlock new market opportunities. The market is poised for sustained, robust growth throughout the forecast period.

Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Pouch Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. United Kingdom

- 2.5. Spain

- 2.6. Poland

- 2.7. Nordic

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Thailand

- 3.5. Australia and New Zealand

- 3.6. Indonesia

- 3.7. Vietnam

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. South Africa

- 5.5. Nigeria

- 5.6. Morocco

Pouch Packaging Market Regional Market Share

Geographic Coverage of Pouch Packaging Market

Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirements for Cost-effective Packaging Solutions and Brand Enhancement; Increasing Demand for Convenience and Ready-to-eat Food

- 3.3. Market Restrains

- 3.3.1. Increasing Environmental Concerns and Recycling

- 3.4. Market Trends

- 3.4.1. The Candy and Snack Foods Segment is Expected to Drive the Demand for Pouch Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.1.1. Polyethylene

- 6.1.1.2. Polypropylene

- 6.1.1.3. PET

- 6.1.1.4. PVC

- 6.1.1.5. EVOH

- 6.1.1.6. Other Resins

- 6.1.2. Paper

- 6.1.3. Aluminum

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Flat (Pillow & Side-Seal)

- 6.2.2. Stand-up

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Food

- 6.3.1.1. Candy & Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Fo

- 6.3.2. Beverage

- 6.3.3. Medical and Pharmaceutical

- 6.3.4. Personal Care and Household Care

- 6.3.5. Other En

- 6.3.1. Food

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.1.1. Polyethylene

- 7.1.1.2. Polypropylene

- 7.1.1.3. PET

- 7.1.1.4. PVC

- 7.1.1.5. EVOH

- 7.1.1.6. Other Resins

- 7.1.2. Paper

- 7.1.3. Aluminum

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Flat (Pillow & Side-Seal)

- 7.2.2. Stand-up

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Food

- 7.3.1.1. Candy & Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Fo

- 7.3.2. Beverage

- 7.3.3. Medical and Pharmaceutical

- 7.3.4. Personal Care and Household Care

- 7.3.5. Other En

- 7.3.1. Food

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.1.1. Polyethylene

- 8.1.1.2. Polypropylene

- 8.1.1.3. PET

- 8.1.1.4. PVC

- 8.1.1.5. EVOH

- 8.1.1.6. Other Resins

- 8.1.2. Paper

- 8.1.3. Aluminum

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Flat (Pillow & Side-Seal)

- 8.2.2. Stand-up

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Food

- 8.3.1.1. Candy & Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Fo

- 8.3.2. Beverage

- 8.3.3. Medical and Pharmaceutical

- 8.3.4. Personal Care and Household Care

- 8.3.5. Other En

- 8.3.1. Food

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.1.1. Polyethylene

- 9.1.1.2. Polypropylene

- 9.1.1.3. PET

- 9.1.1.4. PVC

- 9.1.1.5. EVOH

- 9.1.1.6. Other Resins

- 9.1.2. Paper

- 9.1.3. Aluminum

- 9.1.1. Plastic

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Flat (Pillow & Side-Seal)

- 9.2.2. Stand-up

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Food

- 9.3.1.1. Candy & Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Fo

- 9.3.2. Beverage

- 9.3.3. Medical and Pharmaceutical

- 9.3.4. Personal Care and Household Care

- 9.3.5. Other En

- 9.3.1. Food

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.1.1. Polyethylene

- 10.1.1.2. Polypropylene

- 10.1.1.3. PET

- 10.1.1.4. PVC

- 10.1.1.5. EVOH

- 10.1.1.6. Other Resins

- 10.1.2. Paper

- 10.1.3. Aluminum

- 10.1.1. Plastic

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Flat (Pillow & Side-Seal)

- 10.2.2. Stand-up

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Food

- 10.3.1.1. Candy & Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Fo

- 10.3.2. Beverage

- 10.3.3. Medical and Pharmaceutical

- 10.3.4. Personal Care and Household Care

- 10.3.5. Other En

- 10.3.1. Food

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toppan Printing Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FLAIR Flexible Packaging Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor Group Gmbh

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Constantia Flexibles Group GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gualapack SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bischof + Klein SE & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hood Packaging Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coveris Management GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondi Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Scholle IPN

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aluflexpack Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huhtamaki Oy

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Toyo Seikan Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ProAmpac Intermediate Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sealed Air Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Toppan Printing Co Ltd

List of Figures

- Figure 1: Global Pouch Packaging Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Pouch Packaging Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Pouch Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 4: North America Pouch Packaging Market Volume (Billion), by Material 2025 & 2033

- Figure 5: North America Pouch Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Pouch Packaging Market Volume Share (%), by Material 2025 & 2033

- Figure 7: North America Pouch Packaging Market Revenue (undefined), by Product 2025 & 2033

- Figure 8: North America Pouch Packaging Market Volume (Billion), by Product 2025 & 2033

- Figure 9: North America Pouch Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America Pouch Packaging Market Volume Share (%), by Product 2025 & 2033

- Figure 11: North America Pouch Packaging Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 12: North America Pouch Packaging Market Volume (Billion), by End-User Industry 2025 & 2033

- Figure 13: North America Pouch Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 14: North America Pouch Packaging Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 15: North America Pouch Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Pouch Packaging Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Pouch Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Pouch Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Pouch Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 20: Europe Pouch Packaging Market Volume (Billion), by Material 2025 & 2033

- Figure 21: Europe Pouch Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Pouch Packaging Market Volume Share (%), by Material 2025 & 2033

- Figure 23: Europe Pouch Packaging Market Revenue (undefined), by Product 2025 & 2033

- Figure 24: Europe Pouch Packaging Market Volume (Billion), by Product 2025 & 2033

- Figure 25: Europe Pouch Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 26: Europe Pouch Packaging Market Volume Share (%), by Product 2025 & 2033

- Figure 27: Europe Pouch Packaging Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 28: Europe Pouch Packaging Market Volume (Billion), by End-User Industry 2025 & 2033

- Figure 29: Europe Pouch Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Europe Pouch Packaging Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 31: Europe Pouch Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Pouch Packaging Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Pouch Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Pouch Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pouch Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 36: Asia Pouch Packaging Market Volume (Billion), by Material 2025 & 2033

- Figure 37: Asia Pouch Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pouch Packaging Market Volume Share (%), by Material 2025 & 2033

- Figure 39: Asia Pouch Packaging Market Revenue (undefined), by Product 2025 & 2033

- Figure 40: Asia Pouch Packaging Market Volume (Billion), by Product 2025 & 2033

- Figure 41: Asia Pouch Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 42: Asia Pouch Packaging Market Volume Share (%), by Product 2025 & 2033

- Figure 43: Asia Pouch Packaging Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 44: Asia Pouch Packaging Market Volume (Billion), by End-User Industry 2025 & 2033

- Figure 45: Asia Pouch Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: Asia Pouch Packaging Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: Asia Pouch Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pouch Packaging Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pouch Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pouch Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Pouch Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 52: Latin America Pouch Packaging Market Volume (Billion), by Material 2025 & 2033

- Figure 53: Latin America Pouch Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 54: Latin America Pouch Packaging Market Volume Share (%), by Material 2025 & 2033

- Figure 55: Latin America Pouch Packaging Market Revenue (undefined), by Product 2025 & 2033

- Figure 56: Latin America Pouch Packaging Market Volume (Billion), by Product 2025 & 2033

- Figure 57: Latin America Pouch Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 58: Latin America Pouch Packaging Market Volume Share (%), by Product 2025 & 2033

- Figure 59: Latin America Pouch Packaging Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 60: Latin America Pouch Packaging Market Volume (Billion), by End-User Industry 2025 & 2033

- Figure 61: Latin America Pouch Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 62: Latin America Pouch Packaging Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 63: Latin America Pouch Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: Latin America Pouch Packaging Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Latin America Pouch Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Pouch Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Pouch Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 68: Middle East and Africa Pouch Packaging Market Volume (Billion), by Material 2025 & 2033

- Figure 69: Middle East and Africa Pouch Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 70: Middle East and Africa Pouch Packaging Market Volume Share (%), by Material 2025 & 2033

- Figure 71: Middle East and Africa Pouch Packaging Market Revenue (undefined), by Product 2025 & 2033

- Figure 72: Middle East and Africa Pouch Packaging Market Volume (Billion), by Product 2025 & 2033

- Figure 73: Middle East and Africa Pouch Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 74: Middle East and Africa Pouch Packaging Market Volume Share (%), by Product 2025 & 2033

- Figure 75: Middle East and Africa Pouch Packaging Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 76: Middle East and Africa Pouch Packaging Market Volume (Billion), by End-User Industry 2025 & 2033

- Figure 77: Middle East and Africa Pouch Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 78: Middle East and Africa Pouch Packaging Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 79: Middle East and Africa Pouch Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa Pouch Packaging Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Pouch Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Pouch Packaging Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 4: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Global Pouch Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 10: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 12: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Pouch Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 22: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 23: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 25: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 26: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 27: Global Pouch Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: France Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Italy Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Spain Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Spain Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Poland Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Poland Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Nordic Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Nordic Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 44: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 45: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 46: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 47: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 48: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 49: Global Pouch Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: China Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: India Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: India Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Japan Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Japan Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Thailand Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Thailand Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Australia and New Zealand Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Australia and New Zealand Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Indonesia Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Indonesia Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Vietnam Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Vietnam Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 66: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 67: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 68: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 69: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 70: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 71: Global Pouch Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Mexico Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Mexico Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Colombia Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Colombia Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Global Pouch Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 80: Global Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 81: Global Pouch Packaging Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 82: Global Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 83: Global Pouch Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 84: Global Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 85: Global Pouch Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 86: Global Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 87: United Arab Emirates Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: United Arab Emirates Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Saudi Arabia Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Saudi Arabia Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Egypt Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Egypt Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: South Africa Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: South Africa Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Nigeria Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: Nigeria Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: Morocco Pouch Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: Morocco Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pouch Packaging Market?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the Pouch Packaging Market?

Key companies in the market include Toppan Printing Co Ltd, Sonoco Products Company, FLAIR Flexible Packaging Corporation, Amcor Group Gmbh, Constantia Flexibles Group GmbH, Gualapack SpA, Bischof + Klein SE & Co KG, Hood Packaging Corporation, Coveris Management GmbH, Mondi Group, Scholle IPN, Aluflexpack Group, Huhtamaki Oy, Toyo Seikan Co Ltd, ProAmpac Intermediate Inc, Sealed Air Corporation.

3. What are the main segments of the Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirements for Cost-effective Packaging Solutions and Brand Enhancement; Increasing Demand for Convenience and Ready-to-eat Food.

6. What are the notable trends driving market growth?

The Candy and Snack Foods Segment is Expected to Drive the Demand for Pouch Packaging.

7. Are there any restraints impacting market growth?

Increasing Environmental Concerns and Recycling.

8. Can you provide examples of recent developments in the market?

February 2024: Brook + Whittle, a United States-based packaging company, announced the acquisition of Pouchlt, a United States-based flexible packaging manufacturer. The company specializes in manufacturing pouches and roll stock films. The strategic acquisition is likely to expand the printing and manufacturing capabilities of Brook + Whittle which will allow them to rapidly grow in the flexible packaging industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence