Key Insights

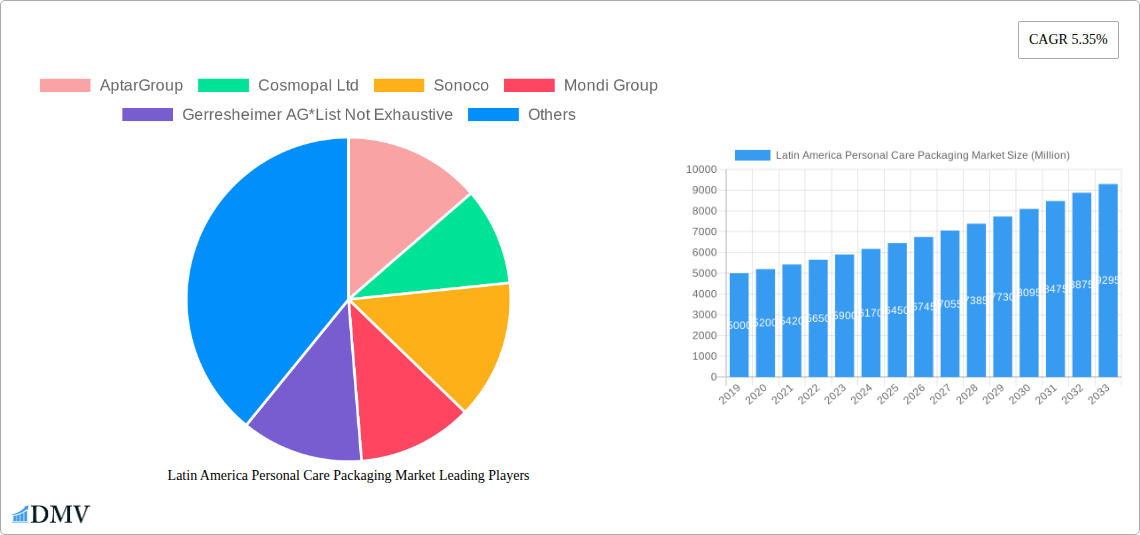

The Latin America personal care packaging market is projected to reach $38.85 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is driven by a growing middle class, increasing disposable incomes, and heightened consumer focus on personal grooming and aesthetics. Key factors include rising demand for premium and specialized cosmetic and skincare products, particularly in Brazil and Mexico. Advanced packaging solutions offering convenience and functionality, such as pumps and dispensers, are also gaining traction. Furthermore, evolving consumer preferences for sustainable packaging, including recycled plastics and biodegradable alternatives, present significant opportunities.

Latin America Personal Care Packaging Market Market Size (In Billion)

The market is segmented by material, with plastics leading due to their versatility and cost-effectiveness. Glass and metal are also utilized in premium and specific product categories, respectively. Dominant packaging types include plastic bottles, containers, and flexible packaging, alongside folding cartons and corrugated boxes. Caps, closures, pumps, and dispensers are key areas of innovation. Skincare and color cosmetics lead product segmentation, followed by hair care and oral care. Major industry players are actively investing in research, development, and strategic collaborations. Potential challenges include fluctuating raw material prices and regulatory frameworks, yet the inherent growth potential and ongoing demographic and economic shifts in Latin America ensure a positive trajectory for the personal care packaging sector.

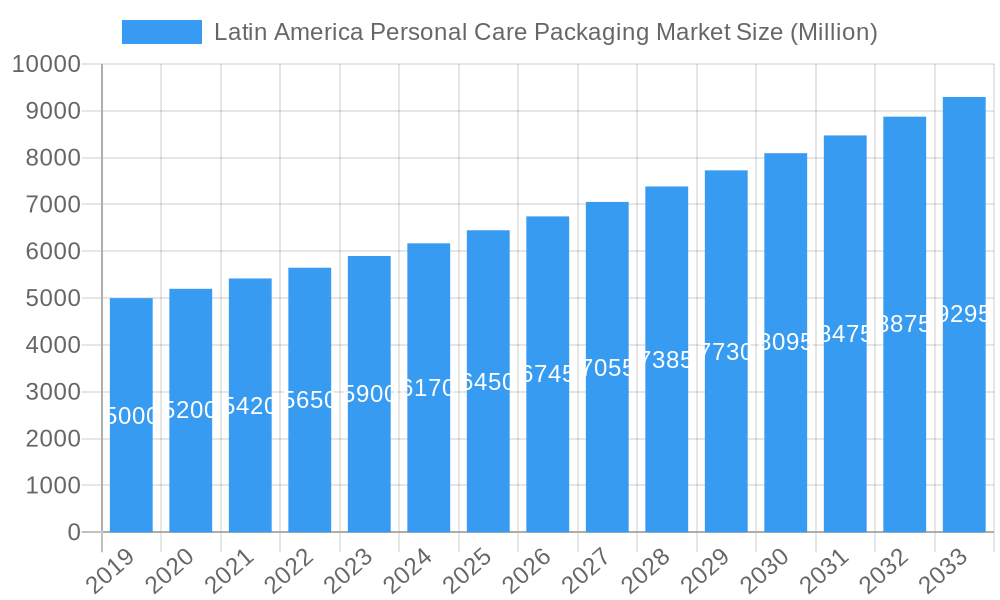

Latin America Personal Care Packaging Market Company Market Share

This report offers an in-depth analysis of the Latin America Personal Care Packaging Market, covering the historical period 2019-2024 and projecting to 2033, with a base and estimated year of 2025. It provides critical insights into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, future opportunities, and the competitive landscape. Understand key trends in plastic bottles, flexible packaging, skincare, and haircare packaging solutions to gain a strategic advantage in this dynamic region.

Latin America Personal Care Packaging Market Market Composition & Trends

The Latin America Personal Care Packaging Market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation is a key catalyst for growth, driven by increasing consumer demand for sustainable, aesthetically pleasing, and functional packaging solutions. The regulatory landscape is evolving, with a growing emphasis on recyclability and reduced environmental impact influencing packaging material choices and designs. Substitute products, particularly in the realm of sustainable materials like paper-based options, are gaining traction and challenging traditional plastic dominance. End-user profiles are diverse, ranging from large multinational corporations to emerging local brands, each with unique packaging requirements. Merger and acquisition (M&A) activities are on the rise as companies seek to consolidate market presence, expand their product portfolios, and integrate new technologies. The market share distribution reveals a substantial portion attributed to plastic packaging, followed by paper and glass. M&A deal values are projected to increase as companies strategically acquire smaller competitors or invest in innovative startups to enhance their competitive edge. XXX

Latin America Personal Care Packaging Market Industry Evolution

The Latin America Personal Care Packaging Market has witnessed a remarkable evolution, driven by a confluence of factors including robust market growth trajectories, significant technological advancements, and a profound shift in consumer demands. Over the historical period (2019-2024), the market has experienced consistent expansion, fueled by increasing disposable incomes and a growing middle class across the region. This has translated into a higher propensity for consumers to spend on personal care products, consequently boosting the demand for sophisticated and appealing packaging. Technological advancements have played a pivotal role in shaping the industry. The adoption of advanced printing techniques, material science innovations, and automated filling and sealing machinery has not only enhanced production efficiency but also enabled the creation of more intricate and user-friendly packaging designs. For instance, the development of high-barrier flexible plastic packaging has extended product shelf-life and improved product integrity for a wide array of personal care items, from skincare creams to hair treatments. Furthermore, the increasing focus on sustainability has spurred innovation in eco-friendly materials and packaging designs. The industry has seen a significant uptake in the use of recycled plastics, biodegradable materials, and paper-based packaging solutions as companies strive to meet environmental regulations and consumer expectations. Consumer demands have also undergone a significant transformation. There is a discernible preference for packaging that is not only aesthetically pleasing but also convenient and portable. This has led to the proliferation of single-serve sachets, travel-sized containers, and innovative dispensing mechanisms like pumps and sprayers. The rising consciousness regarding health and wellness has also influenced packaging choices, with a demand for transparent packaging that showcases product quality and ingredients. Moreover, the burgeoning e-commerce sector has necessitated the development of robust and protective packaging capable of withstanding the rigments of shipping and handling, leading to advancements in corrugated boxes and specialized mailer bags. The projected Compound Annual Growth Rate (CAGR) for the forecast period is expected to remain strong, driven by these ongoing trends and the inherent potential of the Latin American market. XXX

Leading Regions, Countries, or Segments in Latin America Personal Care Packaging Market

The Latin America Personal Care Packaging Market is led by Brazil, which commands a significant market share due to its large population, robust economy, and a highly developed personal care industry. The dominance of Brazil is underpinned by several key drivers, including substantial consumer spending on beauty and personal care products, a receptive market for new product launches, and a well-established manufacturing base for packaging solutions.

Material Type Dominance:

- Plastic: Plastic remains the leading material type, accounting for a substantial market share. This is driven by its versatility, cost-effectiveness, and ability to be molded into various shapes and sizes for different product categories. The demand for flexible plastic packaging, in particular, is on the rise due to its convenience and lighter weight.

- Paper: Paper-based packaging, especially folding cartons and corrugated boxes, is experiencing significant growth due to increasing environmental consciousness and a push towards sustainable alternatives. Its recyclability and biodegradability are attractive features.

Packaging Type Dominance:

- Plastic Bottles and Containers: These are ubiquitous across a wide range of personal care products, from shampoos and conditioners to lotions and creams. Their lightweight, durability, and design flexibility make them a preferred choice.

- Caps and Closures: Essential components that enhance product safety and user experience, these are in high demand across all personal care segments.

- Flexible Plastic Packaging: Growing rapidly, especially for single-use sachets, pouches, and stand-up bags, catering to convenience and affordability.

Product Type Dominance:

- Hair Care: This segment consistently drives demand for a variety of packaging types, including bottles, tubes, and pouches, reflecting the diverse product offerings and consumer preferences.

- Skin Care: Experiencing robust growth, this segment demands sophisticated and often premium packaging, including jars, tubes, and airless dispensers, to convey product quality and efficacy.

Key Drivers of Dominance in Brazil:

- High Consumer Spending: A large and growing middle class with increasing disposable income readily invests in personal care products.

- E-commerce Growth: The burgeoning e-commerce sector in Brazil fuels the demand for robust and attractive packaging, particularly corrugated boxes and flexible mailers.

- Brand Presence: The strong presence of both multinational and local personal care brands stimulates continuous innovation and demand for diverse packaging solutions.

- Regulatory Support for Sustainability: Increasing government initiatives and consumer demand for eco-friendly packaging are driving the adoption of sustainable materials.

The intricate interplay of these factors solidifies Brazil's position as the leading region in the Latin America Personal Care Packaging Market, influencing trends and driving demand across various material, packaging, and product segments.

Latin America Personal Care Packaging Market Product Innovations

Product innovation in the Latin America Personal Care Packaging Market is increasingly focused on enhancing user experience and sustainability. Brands are adopting advanced dispensing technologies, such as airless pumps and precision applicators for skincare products, ensuring optimal product usage and minimizing waste. For hair care, innovative trigger sprayers and foaming dispensers are gaining traction. The integration of smart packaging features, including QR codes for product traceability and ingredient information, is also on the rise. Furthermore, there's a significant push towards novel material compositions, including the incorporation of post-consumer recycled (PCR) plastics in bottles and tubes, and the development of plant-based or biodegradable flexible packaging. These innovations not only aim to reduce environmental impact but also to offer consumers premium, convenient, and safe packaging solutions. Performance metrics such as barrier properties, material strength, and recyclability are key considerations in these advancements, ensuring product integrity and brand appeal in a competitive market.

Propelling Factors for Latin America Personal Care Packaging Market Growth

The Latin America Personal Care Packaging Market is propelled by several key factors. A rapidly growing middle class with increasing disposable incomes fuels higher consumption of personal care products, directly translating into greater demand for packaging. Technological advancements in material science and manufacturing processes allow for more cost-effective, sustainable, and visually appealing packaging solutions. The burgeoning e-commerce sector necessitates robust and protective packaging, driving innovation in corrugated boxes and flexible mailers. Moreover, a growing consumer awareness and preference for sustainable and eco-friendly packaging solutions are encouraging the adoption of recycled materials, biodegradable options, and innovative designs that minimize environmental impact. Regulatory support for sustainability initiatives also plays a crucial role in shaping market trends and encouraging the adoption of greener packaging alternatives.

Obstacles in the Latin America Personal Care Packaging Market Market

Despite its growth potential, the Latin America Personal Care Packaging Market faces several obstacles. Fluctuations in raw material prices, particularly for plastics and metals, can impact production costs and profitability. Supply chain disruptions, exacerbated by logistical challenges and geopolitical instability, can lead to delays and increased expenses. Stringent and evolving regulatory landscapes regarding packaging waste and recyclability can pose compliance challenges for manufacturers. Intense competition among numerous players, both local and international, can lead to price pressures and necessitate continuous investment in innovation to maintain market share. Furthermore, the cost associated with implementing sustainable packaging solutions can be a barrier for smaller enterprises.

Future Opportunities in Latin America Personal Care Packaging Market

Emerging opportunities in the Latin America Personal Care Packaging Market lie in the expanding demand for sustainable packaging solutions, including biodegradable plastics and paper-based alternatives, driven by increasing consumer and regulatory pressure. The growth of the e-commerce sector presents a significant opportunity for innovative and protective shipping packaging. Furthermore, the rising popularity of niche and premium personal care products creates demand for specialized and aesthetically appealing packaging. Untapped rural markets and a growing middle class in several Latin American countries represent new frontiers for market penetration. The adoption of smart packaging technologies, offering enhanced consumer engagement and traceability, also presents a significant avenue for future growth.

Major Players in the Latin America Personal Care Packaging Market Ecosystem

- AptarGroup

- Cosmopal Ltd

- Sonoco

- Mondi Group

- Gerresheimer AG

- Silgan Holdings

- RPC Group Plc (Berry Global Group INC)

- Amcor Ltd

Key Developments in Latin America Personal Care Packaging Market Industry

- March 2022: Univar Solutions is expanding its distribution agreement with Dow to distribute Dow Organics' personal care and beauty brands in Brazil, a major global marketplace for these products. This wider distribution covers brands like Versene, Aculyn, and Ecosense.

- January 2022: Mondi is increasing its paper-based MailerBAG series capacity for e-commerce. This recyclable solution, built from socially sourced renewable resources, offers three forms, including a flat-bottom version that complements existing pinch and folding bottom bags, providing user-friendly packaging.

Strategic Latin America Personal Care Packaging Market Market Forecast

The strategic forecast for the Latin America Personal Care Packaging Market indicates sustained and robust growth, propelled by an intensifying focus on sustainability, evolving consumer preferences, and the rapid expansion of e-commerce. Key growth catalysts include the increasing adoption of recycled and biodegradable materials, the innovation of user-friendly and aesthetically pleasing designs for skincare and haircare products, and the demand for robust packaging solutions to support online retail channels. The market's potential is further amplified by growing disposable incomes and a heightened awareness of personal grooming across the region, creating a fertile ground for investment and expansion. Manufacturers who can adeptly navigate regulatory changes and capitalize on emerging trends in eco-conscious packaging will be well-positioned for success.

Latin America Personal Care Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper

-

2. Packaging Type

- 2.1. Plastic Bottles and Containers

- 2.2. Glass Bottles and Containers

- 2.3. Metal Containers

- 2.4. Folding Cartons

- 2.5. Corrugated Boxes

- 2.6. Tube and Stick

- 2.7. Caps and Closures

- 2.8. Pump and Dispenser

- 2.9. Flexible Plastic Packaging

- 2.10. Other Packaging Types

-

3. Product Type

- 3.1. Oral Care

- 3.2. Hair Care

- 3.3. Color Cosmetics

- 3.4. Skin Care

- 3.5. Men's Grooming

- 3.6. Deodorants

- 3.7. Other Products Types

Latin America Personal Care Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Personal Care Packaging Market Regional Market Share

Geographic Coverage of Latin America Personal Care Packaging Market

Latin America Personal Care Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Personal Care Products With Growing Disposable Income; Growing Focus on Innovative and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. High Costs of R&D and Manufacturing of New Packaging Solution

- 3.4. Market Trends

- 3.4.1. Skin Care Expected to Witness Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Plastic Bottles and Containers

- 5.2.2. Glass Bottles and Containers

- 5.2.3. Metal Containers

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated Boxes

- 5.2.6. Tube and Stick

- 5.2.7. Caps and Closures

- 5.2.8. Pump and Dispenser

- 5.2.9. Flexible Plastic Packaging

- 5.2.10. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Oral Care

- 5.3.2. Hair Care

- 5.3.3. Color Cosmetics

- 5.3.4. Skin Care

- 5.3.5. Men's Grooming

- 5.3.6. Deodorants

- 5.3.7. Other Products Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AptarGroup

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cosmopal Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gerresheimer AG*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silgan Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RPC Group Plc (Berry Global Group INC )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AptarGroup

List of Figures

- Figure 1: Latin America Personal Care Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Personal Care Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Personal Care Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Latin America Personal Care Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Latin America Personal Care Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Latin America Personal Care Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Personal Care Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Latin America Personal Care Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Latin America Personal Care Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Latin America Personal Care Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Personal Care Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Personal Care Packaging Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Latin America Personal Care Packaging Market?

Key companies in the market include AptarGroup, Cosmopal Ltd, Sonoco, Mondi Group, Gerresheimer AG*List Not Exhaustive, Silgan Holdings, RPC Group Plc (Berry Global Group INC ), Amcor Ltd.

3. What are the main segments of the Latin America Personal Care Packaging Market?

The market segments include Material Type, Packaging Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Personal Care Products With Growing Disposable Income; Growing Focus on Innovative and Attractive Packaging.

6. What are the notable trends driving market growth?

Skin Care Expected to Witness Significant Growth in the Market.

7. Are there any restraints impacting market growth?

High Costs of R&D and Manufacturing of New Packaging Solution.

8. Can you provide examples of recent developments in the market?

March 2022 - To distribute Dow Organics' personal care and beauty brands in Brazil, one of the largest marketplaces for these products in the world, Univar Solutions, a chemical and ingredients firm, is increasing its distribution agreement with Dow. The wider distribution is available for brands including Versene, Aculyn, and Ecosense from Dow Organics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Personal Care Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Personal Care Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Personal Care Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Personal Care Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence