Key Insights

The China plastic packaging market is projected for substantial growth, fueled by strong domestic demand and increasing adoption across key industries. With an estimated market size of 432.1 billion by 2025, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.4%. This growth is underpinned by several factors: a growing middle class seeking premium and convenient packaged goods, the rapid expansion of e-commerce requiring efficient and protective packaging, and ongoing innovation in plastic materials driving sustainability and functionality. Government support through manufacturing initiatives and the "Made in China 2025" strategy further bolster the industry's advancement.

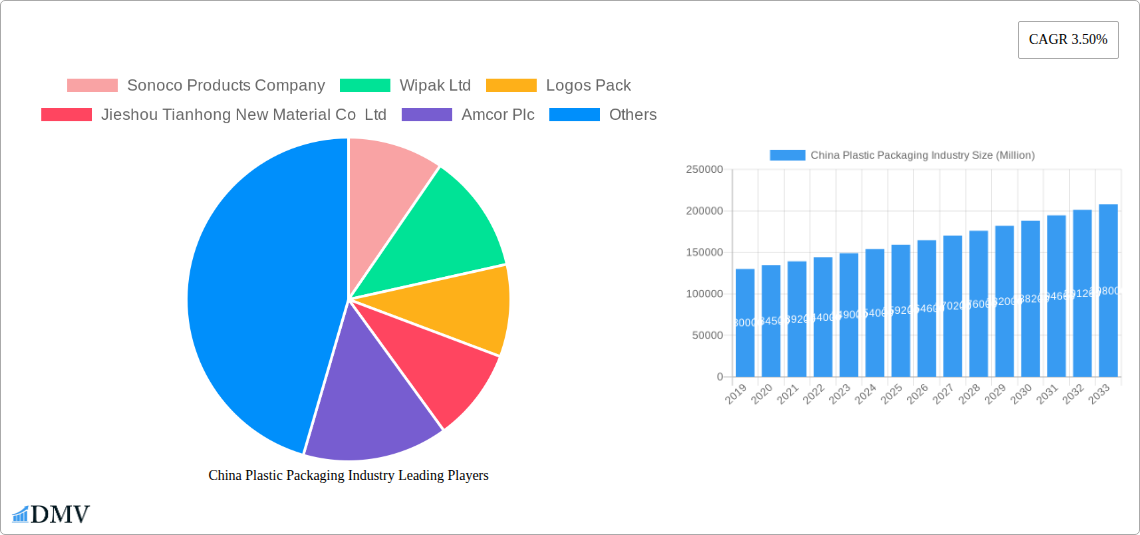

China Plastic Packaging Industry Market Size (In Billion)

Challenges within the China plastic packaging market include environmental regulations and public concern over plastic waste, driving a shift towards sustainable alternatives such as recycled plastics, bioplastics, and reduced packaging. Fluctuations in the prices of petroleum-based raw materials also present cost uncertainties. The industry is responding by investing in R&D for eco-friendly materials and recycling infrastructure. Market segmentation spans food and beverage, pharmaceuticals, personal care, and industrial goods, each offering distinct opportunities. The competitive environment comprises global leaders and emerging domestic players, fostering innovation and price efficiency. China's significant role in global plastic packaging production and consumption makes it a vital hub, influencing regional and international trade dynamics.

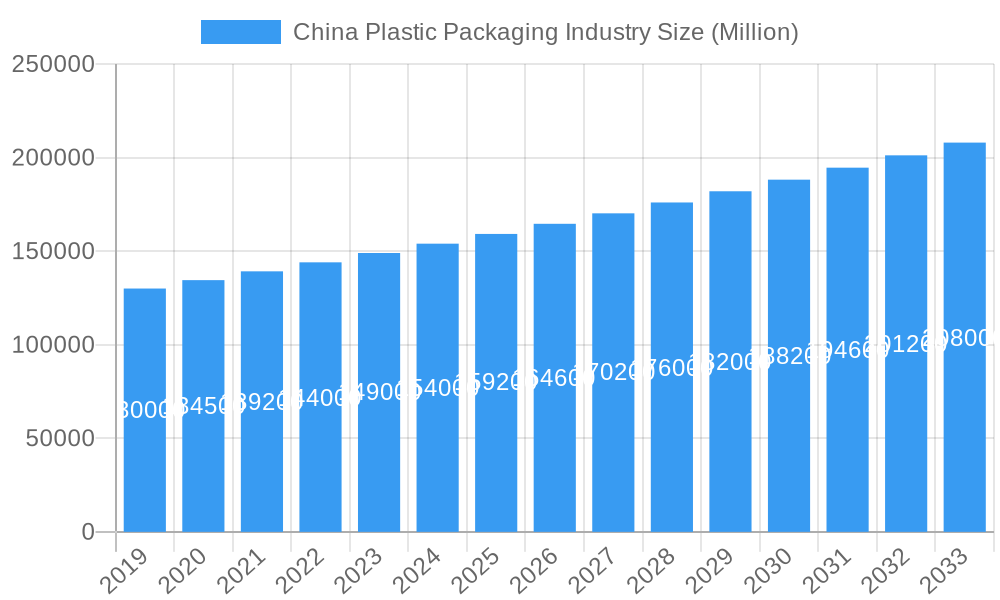

China Plastic Packaging Industry Company Market Share

China Plastic Packaging Industry Market Composition & Trends

This comprehensive report delves into the intricate dynamics of the China plastic packaging market, offering an in-depth analysis of its composition and evolving trends. We meticulously examine market concentration, identifying key players and their respective market share distribution within the vast Chinese landscape. Innovation catalysts, including advancements in sustainable materials and smart packaging solutions, are highlighted as crucial drivers shaping the industry's future. The report scrutinizes the regulatory landscapes governing plastic packaging production and consumption, assessing their impact on market accessibility and compliance. Furthermore, it evaluates the threat posed by substitute products and analyzes the diverse end-user profiles, from food and beverage to pharmaceuticals and personal care. A detailed overview of M&A activities within the sector, including estimated deal values, provides insights into industry consolidation and strategic partnerships. The China plastic packaging market is characterized by a dynamic interplay of these factors, influencing its trajectory and investment potential. The report estimates the total market value to reach XXX Million by 2033, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

- Market Concentration: Dominated by a mix of multinational corporations and robust domestic manufacturers.

- Innovation Catalysts: Focus on biodegradable plastics, advanced barrier films, and smart packaging technologies.

- Regulatory Landscapes: Stringent environmental policies and increasing emphasis on recycling mandates.

- Substitute Products: Competition from glass, metal, paper, and emerging bio-based alternatives.

- End-User Profiles: High demand from the rapidly growing e-commerce, food & beverage, and healthcare sectors.

- M&A Activities: Strategic acquisitions and joint ventures aimed at expanding market reach and technological capabilities. Estimated M&A deal value in the historical period was XXX Million.

China Plastic Packaging Industry Industry Evolution

The China plastic packaging industry has undergone a dramatic transformation, evolving from basic packaging solutions to sophisticated, high-performance materials driven by technological advancements and shifting consumer demands. This evolution is evident in the consistent market growth trajectories observed over the historical period (2019–2024), with the market value standing at an estimated XXX Million in 2024. Technological advancements have been pivotal, with significant investments in research and development leading to the creation of lighter, stronger, and more sustainable plastic packaging options. The adoption of advanced manufacturing techniques, such as sophisticated extrusion, injection molding, and blow molding processes, has enhanced production efficiency and product quality. Shifting consumer demands have played an equally crucial role. As Chinese consumers become more environmentally conscious, there's a growing preference for recyclable, biodegradable, and compostable packaging solutions. This trend is compelling manufacturers to innovate and invest in green technologies. The food and beverage segment, a major consumer of plastic packaging, is witnessing a demand for extended shelf-life solutions, tamper-evident features, and visually appealing packaging that enhances brand recognition. Similarly, the pharmaceutical sector requires stringent barrier properties and child-resistant closures, pushing innovation in specialized plastic films and containers. The e-commerce boom has also fueled the demand for durable, lightweight, and cost-effective packaging that can withstand the rigors of logistics. The report forecasts a robust CAGR of XX% during the forecast period (2025–2033), driven by these interwoven factors. The base year of 2025 holds particular significance as a benchmark for future projections, with the market estimated to reach XXX Million in this year alone.

Leading Regions, Countries, or Segments in China Plastic Packaging Industry

The China plastic packaging industry exhibits distinct regional dominance and segment leadership, driven by a confluence of economic, regulatory, and infrastructural factors. Examining the key segments – Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis – reveals specific areas of strength and opportunity.

In terms of Production Analysis, Eastern China, particularly provinces like Guangdong, Jiangsu, and Zhejiang, stands out as the manufacturing powerhouse. This dominance is fueled by established industrial infrastructure, a skilled workforce, and proximity to major ports for raw material imports and finished product exports. Investment trends in these regions have consistently favored advanced manufacturing technologies and capacity expansion, supported by provincial governments through various incentives.

The Consumption Analysis is largely driven by the economically vibrant coastal regions and rapidly urbanizing inland areas. The food and beverage sector consistently leads in consumption volume, followed closely by personal care and pharmaceuticals. The sheer size of China's population and its increasing disposable income contribute to this high demand. Regulatory support for domestic consumption and the growth of modern retail formats further bolster this segment.

The Import Market Analysis (Value & Volume) showcases China's reliance on specialized raw materials and high-performance plastic resins not readily produced domestically. Imports are crucial for sectors demanding premium quality and specific functionalities. Key drivers include the need for advanced polymer grades for specialized applications in electronics and automotive industries, and certain food-grade resins with stringent certifications. The value of imports in 2025 is projected to be XXX Million, with a volume of XX Million Tons.

Conversely, the Export Market Analysis (Value & Volume) highlights China's emergence as a global supplier of a wide range of plastic packaging products. The cost-effectiveness of Chinese manufacturing, coupled with improving product quality and adherence to international standards, has facilitated strong export growth. The value of exports in 2025 is estimated at XXX Million, with a volume of XX Million Tons. Key drivers include competitive pricing, diversified product offerings, and strategic trade agreements.

The Price Trend Analysis is influenced by global petrochemical prices, domestic supply-demand dynamics, and government policies related to environmental protection and resource utilization. Fluctuations in crude oil prices directly impact the cost of plastic resins, a primary raw material. The report anticipates a consistent upward trend in prices over the forecast period, driven by increasing raw material costs and stricter environmental regulations.

- Production Dominance: Eastern China (Guangdong, Jiangsu, Zhejiang) due to advanced infrastructure and skilled labor.

- Consumption Drivers: Food & Beverage, Personal Care, Pharmaceuticals, and E-commerce sectors, concentrated in urbanized areas.

- Import Needs: Specialized raw materials and high-performance resins for advanced applications.

- Export Strengths: Cost-effectiveness, diversified product range, and growing adherence to international quality standards.

- Price Influences: Global petrochemical prices, domestic supply-demand, and environmental policies.

China Plastic Packaging Industry Product Innovations

The China plastic packaging industry is witnessing a surge in product innovations focused on sustainability, functionality, and consumer appeal. Leading companies are developing single-material flexible packaging solutions like Liquidbox's Liquidure, which simplifies recycling. Advancements include biodegradable and compostable films derived from corn starch and sugarcane, offering viable alternatives to conventional plastics. High-barrier films are being enhanced to extend shelf life for food products, reducing waste. Smart packaging technologies, such as embedded sensors for temperature monitoring and QR codes for traceability, are gaining traction, particularly in the pharmaceutical and high-value food sectors. The performance metrics of these innovations are measured by improved recyclability rates, reduced carbon footprint, enhanced product protection, and extended shelf life, making them key selling propositions in a competitive market.

Propelling Factors for China Plastic Packaging Industry Growth

Several key factors are propelling the growth of the China plastic packaging industry. Technologically, the continuous development of advanced materials, such as biodegradable polymers and high-performance films, caters to evolving market demands for sustainability and product protection. Economically, the burgeoning middle class, rising disposable incomes, and rapid urbanization fuel increased consumption across various sectors like food and beverage, e-commerce, and healthcare. Regulatory influences, while sometimes posing challenges, also drive innovation, with government mandates for waste reduction and recycling encouraging the adoption of eco-friendly packaging solutions. For instance, the increasing focus on single-use plastic bans in specific product categories is pushing manufacturers towards reusable or easily recyclable alternatives.

Obstacles in the China Plastic Packaging Industry Market

Despite robust growth, the China plastic packaging industry faces significant obstacles. Regulatory challenges, particularly concerning environmental protection and the disposal of plastic waste, can lead to increased compliance costs and operational restrictions. Supply chain disruptions, exemplified by fluctuations in raw material prices (e.g., crude oil) and geopolitical uncertainties, can impact production costs and availability. Intense competitive pressures from both domestic and international players, coupled with the growing demand for sustainable alternatives, necessitate continuous investment in R&D and process optimization. Furthermore, the perception of plastic as an environmentally damaging material can impact consumer purchasing decisions and brand reputation, requiring proactive communication and a demonstrated commitment to circular economy principles. The projected increase in raw material costs alone is estimated to impact profit margins by XX% over the forecast period.

Future Opportunities in the China Plastic Packaging Industry

The China plastic packaging industry is ripe with emerging opportunities. The growing global demand for sustainable packaging presents a significant opportunity for manufacturers investing in biodegradable, compostable, and recycled plastic solutions. The expansion of e-commerce, particularly in Tier 3 and Tier 4 cities, will continue to drive demand for robust and efficient shipping packaging. Advancements in smart packaging technology, offering enhanced traceability and consumer engagement, represent a niche but growing market. Furthermore, opportunities exist in developing specialized packaging for emerging industries like personalized medicine and advanced food technologies. The ongoing focus on the circular economy also presents opportunities for businesses involved in plastic recycling and upcycling.

Major Players in the China Plastic Packaging Industry Ecosystem

- Sonoco Products Company

- Wipak Ltd

- Logos Pack

- Jieshou Tianhong New Material Co Ltd

- Amcor Plc

- Tetra Laval

- Qingdao Haoyu Packing Co Ltd

- Berry Global

- Sealed Air Corporation

- Silgan Holdings

Key Developments in China Plastic Packaging Industry Industry

- February 2022: Liquidbox, a US-based liquid packaging and dispensing solution provider, expanded Liquidure, a single-material, flexible packaging solution for its global customers. The company plans to begin manufacturing solutions at its Asia-Pacific (APAC) region bag sites to meet growing demand in China, India, and other countries. This development signifies a growing trend towards sustainable, single-material solutions and localized production to cater to regional demand in the burgeoning Asian markets, including China.

Strategic China Plastic Packaging Industry Market Forecast

The China plastic packaging industry is poised for strategic growth, driven by a confluence of factors that are reshaping the market landscape. Future opportunities in sustainable packaging, particularly biodegradable and recycled materials, will be a primary growth catalyst, aligning with global environmental concerns and China's own sustainability initiatives. The expanding e-commerce sector and the increasing demand for convenience in food and beverage packaging will continue to fuel consumption. Advancements in smart packaging and functional films will unlock new applications and value-added services. The industry's ability to innovate and adapt to stringent environmental regulations while meeting the evolving demands of consumers will be critical for sustained growth and market leadership. The overall market value is projected to reach XXX Million by 2033.

China Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Plastic Packaging Industry Segmentation By Geography

- 1. China

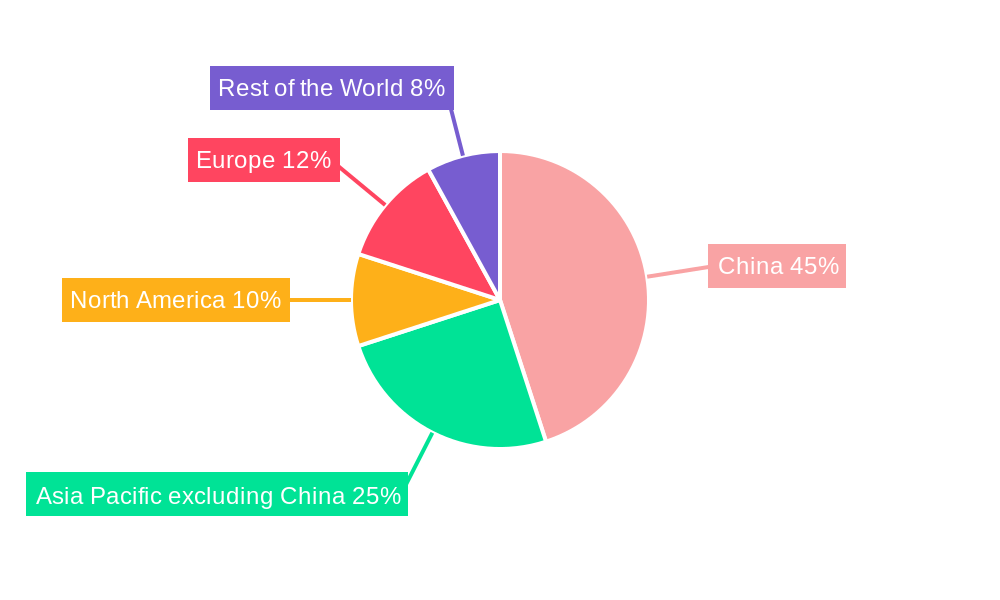

China Plastic Packaging Industry Regional Market Share

Geographic Coverage of China Plastic Packaging Industry

China Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from E-commerce Industry; Increasing Adoption of Lightweight-packaging Methods

- 3.3. Market Restrains

- 3.3.1. ; Environmental Legislations For Recycling

- 3.4. Market Trends

- 3.4.1. E-commerce Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Pack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jieshou Tianhong New Material Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Laval

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Haoyu Packing Co Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: China Plastic Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Plastic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: China Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: China Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Packaging Industry?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the China Plastic Packaging Industry?

Key companies in the market include Sonoco Products Company, Wipak Ltd, Logos Pack, Jieshou Tianhong New Material Co Ltd, Amcor Plc, Tetra Laval, Qingdao Haoyu Packing Co Ltd*List Not Exhaustive, Berry Global, Sealed Air Corporation, Silgan Holdings.

3. What are the main segments of the China Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 432.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from E-commerce Industry; Increasing Adoption of Lightweight-packaging Methods.

6. What are the notable trends driving market growth?

E-commerce Industry is Driving the Market.

7. Are there any restraints impacting market growth?

; Environmental Legislations For Recycling.

8. Can you provide examples of recent developments in the market?

February 2022: Liquidbox, a US-based liquid packaging and dispensing solution provider, expanded Liquidure, a single-material, flexible packaging solution for its global customers. The company plans to begin manufacturing solutions at its Asia-Pacific (APAC) region bag sites to meet growing demand in China, India, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the China Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence