Key Insights

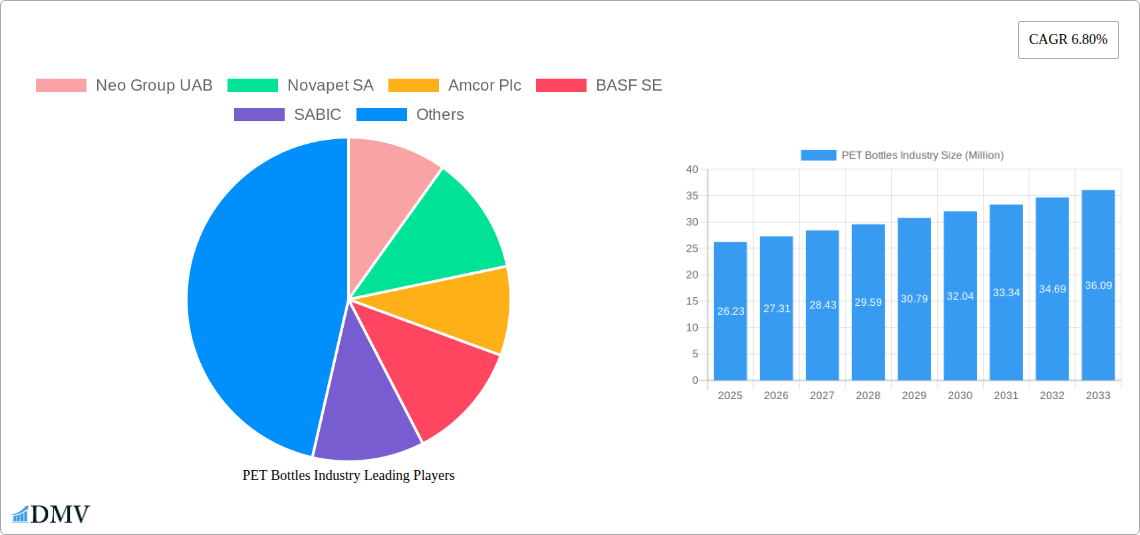

The global PET bottles market is poised for significant growth, projected to reach USD 26.23 million in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 4.18% through 2033. This expansion is primarily fueled by a burgeoning demand for convenient and sustainable packaging solutions across various consumer industries. The beverage sector, particularly packaged water and carbonated soft drinks, continues to be a dominant force, driven by increasing consumption patterns and a growing preference for single-use, portable packaging. Furthermore, the rising awareness and adoption of recycling initiatives globally are bolstering the market, as PET bottles are highly recyclable and contribute to a circular economy. Innovations in bottle design, lightweighting, and enhanced barrier properties are also contributing to market expansion, offering improved product shelf-life and consumer appeal. The personal care and household care segments are also exhibiting strong growth, with manufacturers increasingly opting for PET due to its durability, transparency, and cost-effectiveness.

PET Bottles Industry Market Size (In Million)

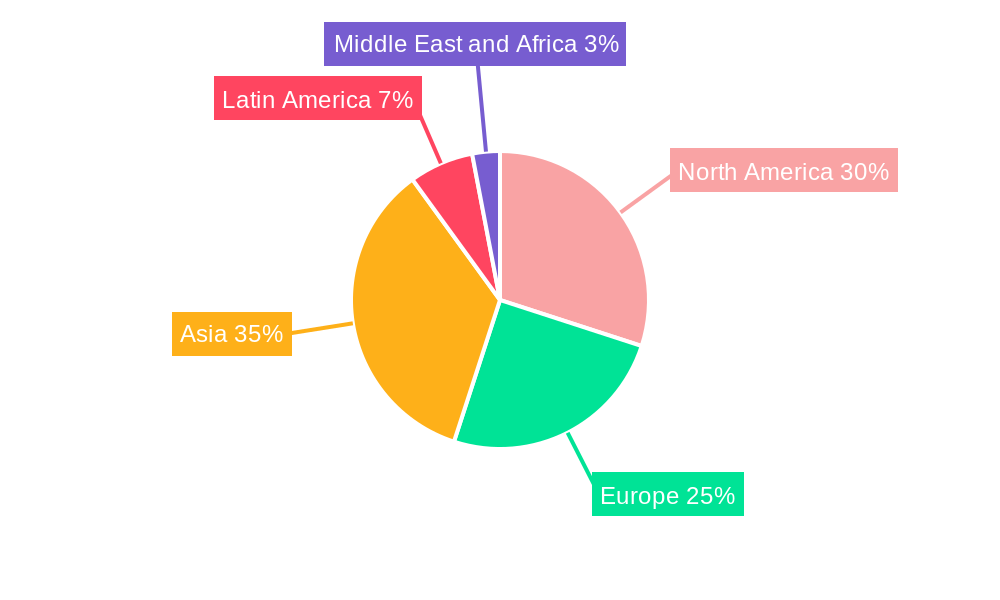

While the market demonstrates strong upward momentum, certain factors could influence its trajectory. Increased competition and fluctuating raw material prices, particularly for crude oil derivatives which are key components in PET production, may present challenges. However, the ongoing development of bio-based and recycled PET (rPET) alternatives is expected to mitigate some of these concerns, aligning with evolving regulatory landscapes and consumer preferences for eco-friendly products. Regional dynamics also play a crucial role, with Asia and North America leading in terms of consumption and production, driven by large populations and advanced manufacturing capabilities. Continuous investment in research and development to enhance the sustainability profile of PET bottles and optimize production processes will be instrumental in sustaining this growth trajectory and addressing potential environmental concerns.

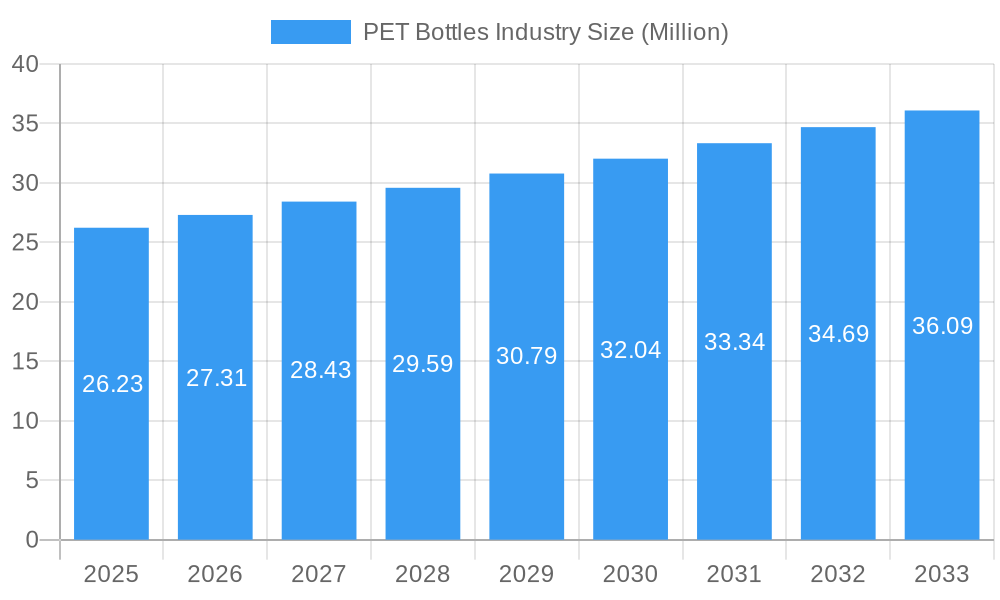

PET Bottles Industry Company Market Share

PET Bottles Industry Market Composition & Trends

The global PET bottles market is characterized by moderate concentration, with key players like Indorama Ventures Public Company Ltd, Amcor Plc, and Berry Global Inc. holding significant market shares, estimated to be in the range of 20-30 million for the top 5. Innovation is a primary catalyst, driven by the demand for sustainable packaging solutions and advancements in lightweighting technologies, leading to an estimated CAGR of 5-7%. Regulatory landscapes are evolving, with increasing mandates for recycled content and extended producer responsibility programs influencing market dynamics. Substitute products, such as glass bottles and aluminum cans, pose a competitive threat, particularly in premium segments, but PET's lightweight, shatterproof, and cost-effective nature continues to ensure its dominance, projected to hold over 80% of the beverage packaging market by 2030. End-user profiles reveal a strong reliance on the beverages sector, accounting for over 70% of market demand, followed by food, personal care, and pharmaceuticals. Mergers and acquisitions (M&A) are strategic moves to consolidate market presence and expand technological capabilities, with estimated deal values ranging from 500 million to 1.5 billion for significant acquisitions.

- Market Share Distribution: Top 5 players command an estimated 20-30 million market share in terms of revenue.

- M&A Deal Values: Significant acquisitions are valued between 500 million and 1.5 billion.

- Key Innovation Focus: Sustainability, lightweighting, and barrier properties.

- Regulatory Impact: Growing influence of recycled content mandates and EPR.

PET Bottles Industry Industry Evolution

The PET bottles industry has undergone a significant evolution, transforming from a nascent packaging material to a global cornerstone, driven by a confluence of technological advancements, shifting consumer preferences, and an ever-expanding array of applications. Historically, the industry's growth trajectory was propelled by the development of improved manufacturing processes, such as injection stretch blow molding, which significantly enhanced production efficiency and the quality of PET containers. This enabled PET bottles to effectively displace traditional materials like glass and metal in many beverage and food applications due to their superior shatter resistance, lighter weight, and lower transportation costs. The market has witnessed a consistent upward trend, with a projected Compound Annual Growth Rate (CAGR) of approximately 5-7% from 2019 to 2033. This growth is not merely quantitative but also qualitative, as manufacturers have continuously innovated to meet evolving consumer demands. The increasing health consciousness and demand for convenience have fueled the growth of packaged water and functional beverages, directly benefiting the PET bottles sector. Furthermore, the burgeoning e-commerce landscape has introduced new packaging requirements, wherein PET bottles offer a robust and safe solution for shipping a variety of liquid products. Technological advancements continue to be a cornerstone of this evolution, with ongoing research and development focused on enhancing barrier properties to extend shelf life, reducing material usage through lightweighting initiatives, and improving the recyclability and biodegradability of PET. The adoption of advanced additive technologies, for instance, has allowed for enhanced UV protection for sensitive products and improved oxygen scavenging capabilities, expanding the range of products suitable for PET packaging. The industry's ability to adapt to these dynamic forces, including the increasing imperative for circular economy principles, has solidified its position as a leading packaging solution worldwide.

Leading Regions, Countries, or Segments in PET Bottles Industry

The Beverages end-user vertical stands as the undisputed leader within the global PET bottles industry, commanding an estimated 70-75% of the total market demand throughout the forecast period (2025-2033). This dominance is a testament to PET's inherent suitability for packaging a wide spectrum of liquid consumables. Within the Beverages segment, Packaged Water emerges as the single largest contributor, driven by increasing global access to clean water, growing health and wellness trends, and the perceived convenience of portable hydration solutions. This sub-segment alone is projected to account for over 25% of the overall PET bottles market. Carbonated Soft Drinks (CSDs) and Fruit Juice also represent substantial demand drivers, benefiting from established market presence and continuous product innovation in flavors and functional benefits. Energy Drinks constitute a rapidly growing niche, fueled by younger demographics and an expanding lifestyle segment. The sheer volume and frequency of consumption of these beverage categories make them the primary engine of growth for PET bottle manufacturers.

The dominance of the Beverages segment is further bolstered by several interconnected factors:

- Economic Growth and Disposable Income: Rising disposable incomes in emerging economies translate into increased consumer spending on packaged beverages, directly impacting PET bottle demand. Projections indicate a 6-8% increase in beverage consumption in Asia-Pacific economies, fueling PET bottle sales.

- Ubiquitous Distribution Networks: The extensive global distribution networks of major beverage companies ensure a consistent and widespread demand for PET packaging, reaching consumers in urban and rural areas alike.

- Technological Advancements in Beverage Formulation: Innovations in beverage production, including the development of new functional ingredients and extended shelf-life formulations, often necessitate advanced packaging solutions like PET, which can maintain product integrity.

- Consumer Preference for Convenience and Portability: The lightweight, shatterproof, and resealable nature of PET bottles aligns perfectly with modern consumer lifestyles, favoring on-the-go consumption and ease of use.

- Investment Trends in Beverage Production Capacity: Significant investments are consistently being made in new beverage production facilities worldwide, particularly in regions experiencing demographic growth, directly driving the demand for PET bottles. For example, investments in new bottling plants in Southeast Asia are estimated to exceed 2 billion over the next five years.

- Regulatory Support for Recyclable Materials: While regulatory scrutiny exists, many governments actively promote the use of recyclable materials like PET, incentivizing beverage companies to adopt PET packaging solutions.

While other end-user verticals like Food, Personal Care, Household Care, and Pharmaceuticals are important contributors, their demand for PET bottles remains significantly lower compared to the Beverages sector. However, growth within these segments is also anticipated, driven by trends in convenient packaging formats and product preservation requirements.

PET Bottles Industry Product Innovations

Product innovations in the PET bottles industry are primarily focused on enhancing sustainability and performance. Key advancements include the development of chemically and mechanically recycled PET (rPET) grades with comparable performance to virgin PET, enabling higher recycled content incorporation without compromising bottle integrity. Lightweighting technologies continue to be a major focus, with innovative bottle designs and advanced molding techniques reducing material usage by up to 15% while maintaining structural strength. Furthermore, the introduction of PET resins with improved barrier properties is extending product shelf life for sensitive contents, and the development of bio-based PET alternatives is addressing the growing demand for renewable packaging solutions. These innovations are crucial for meeting evolving consumer expectations and stringent environmental regulations.

Propelling Factors for PET Bottles Industry Growth

The PET bottles industry's growth is propelled by several key factors. The ever-increasing global demand for beverages, especially packaged water and soft drinks, remains a primary driver, supported by a growing population and rising disposable incomes. Technological advancements in lightweighting and barrier technologies are enhancing PET's competitiveness and expanding its application scope. Furthermore, the growing emphasis on sustainability is driving the adoption of recycled PET (rPET), creating a circular economy loop and opening new market avenues. Supportive government policies promoting recycling and sustainable packaging also play a crucial role.

- Rising Beverage Consumption: Global beverage consumption is projected to grow at a rate of 4-5% annually.

- Advancements in Recycling Technologies: Improved rPET production methods are increasing its viability and adoption.

- Sustainability Mandates: Government regulations pushing for higher recycled content are a significant catalyst.

- Lightweighting Innovations: Reduced material usage leads to cost savings and environmental benefits.

Obstacles in the PET Bottles Industry Market

Despite its robust growth, the PET bottles industry faces several obstacles. Intense competition from alternative packaging materials like glass and aluminum, especially in premium segments, poses a constant challenge. Fluctuations in raw material prices, particularly crude oil derivatives, can impact production costs and profit margins. Stringent environmental regulations and growing consumer concerns about plastic waste, though driving recycling initiatives, also place pressure on manufacturers to innovate and invest in sustainable solutions. Supply chain disruptions, as witnessed during global events, can affect the availability and cost of raw materials and finished products.

- Competition from Alternatives: Glass and aluminum maintain strong market presence in certain beverage categories.

- Raw Material Price Volatility: Dependence on petrochemicals leads to cost uncertainties.

- Plastic Waste Perception: Negative public perception of plastic pollution necessitates continuous innovation in recyclability.

- Supply Chain Vulnerabilities: Global logistics and material sourcing can be subject to disruptions.

Future Opportunities in PET Bottles Industry

The future of the PET bottles industry is ripe with opportunities. The increasing demand for functional beverages and premium spirits presents avenues for specialized PET packaging with enhanced barrier properties and aesthetic appeal. The growing adoption of mono-material packaging solutions is simplifying recyclability. Furthermore, advancements in chemical recycling technologies are expected to unlock the potential for an infinite loop of PET recycling, creating a truly circular economy. Emerging markets in developing economies continue to offer significant untapped potential for market expansion.

- Growth in Functional Beverages: Demand for specialized packaging for health and wellness drinks.

- Mono-Material Solutions: Simplified recycling processes and improved environmental footprint.

- Advanced Chemical Recycling: Enabling higher quality and quantity of recycled PET.

- Untapped Emerging Markets: Significant growth potential in developing regions.

Major Players in the PET Bottles Industry Ecosystem

- Neo Group UAB

- Novapet SA

- Amcor Plc

- BASF SE

- SABIC

- Alpha Packaging

- Indorama Ventures Public Company Ltd

- Graham Packaging Company Inc

- Berry Global Inc

- Plastipak Holdings Inc

Key Developments in PET Bottles Industry Industry

- October 2022: Indorama Ventures announced the opening of its PETValue bottle-to-bottle recycling plant in the Philippines in partnership with Coca-Cola Beverages Philippines. The plant is IVL's latest recycled PET plant. This internationally integrated petrochemical company continues to expand its position as one of the world's largest producers of recycled resins for plastic beverage bottles.

- May 2022: SABIC, one of the leaders in the chemical industry, introduced LNP ELCRIN WF0061BiQ resin. This material utilizes ocean-bound polyethylene terephthalate (PET) bottles as a feed stream for chemical upcycling into polybutylene terephthalate (PBT) resin. This new grade adds to the company's extensive portfolio of chemically upcycled LNP ELCRIN iQ materials.

Strategic PET Bottles Industry Market Forecast

The strategic PET bottles market forecast indicates continued robust growth, driven by the synergistic forces of increasing global beverage consumption and a strong push towards sustainable packaging solutions. The expanding adoption of recycled PET (rPET) will be a cornerstone of this growth, fueled by technological advancements in recycling processes and supportive regulatory frameworks, leading to an estimated market size of over 50 million by 2033. Innovations in lightweighting and enhanced barrier properties will further solidify PET's position against competing materials. Emerging economies, with their growing middle class and increasing demand for packaged goods, represent significant untapped potential. The industry's ability to embrace circular economy principles and invest in advanced recycling technologies will be crucial in navigating future challenges and capitalizing on the substantial opportunities that lie ahead.

PET Bottles Industry Segmentation

-

1. End-user Vertical

-

1.1. Beverages

- 1.1.1. Packaged Water

- 1.1.2. Carbonated Soft Drinks

- 1.1.3. Fruit Juice

- 1.1.4. Energy Drinks

- 1.1.5. Other Beverages

- 1.2. Food

- 1.3. Personal Care

- 1.4. Household Care

- 1.5. Pharmaceuticals

- 1.6. Other End-user Verticals

-

1.1. Beverages

PET Bottles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Columbia

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. United Arab Emirates

PET Bottles Industry Regional Market Share

Geographic Coverage of PET Bottles Industry

PET Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Increasing Demand from Bottled-water Industry

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding Use of Plastics

- 3.4. Market Trends

- 3.4.1. Beverages Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Beverages

- 5.1.1.1. Packaged Water

- 5.1.1.2. Carbonated Soft Drinks

- 5.1.1.3. Fruit Juice

- 5.1.1.4. Energy Drinks

- 5.1.1.5. Other Beverages

- 5.1.2. Food

- 5.1.3. Personal Care

- 5.1.4. Household Care

- 5.1.5. Pharmaceuticals

- 5.1.6. Other End-user Verticals

- 5.1.1. Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Beverages

- 6.1.1.1. Packaged Water

- 6.1.1.2. Carbonated Soft Drinks

- 6.1.1.3. Fruit Juice

- 6.1.1.4. Energy Drinks

- 6.1.1.5. Other Beverages

- 6.1.2. Food

- 6.1.3. Personal Care

- 6.1.4. Household Care

- 6.1.5. Pharmaceuticals

- 6.1.6. Other End-user Verticals

- 6.1.1. Beverages

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Beverages

- 7.1.1.1. Packaged Water

- 7.1.1.2. Carbonated Soft Drinks

- 7.1.1.3. Fruit Juice

- 7.1.1.4. Energy Drinks

- 7.1.1.5. Other Beverages

- 7.1.2. Food

- 7.1.3. Personal Care

- 7.1.4. Household Care

- 7.1.5. Pharmaceuticals

- 7.1.6. Other End-user Verticals

- 7.1.1. Beverages

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Beverages

- 8.1.1.1. Packaged Water

- 8.1.1.2. Carbonated Soft Drinks

- 8.1.1.3. Fruit Juice

- 8.1.1.4. Energy Drinks

- 8.1.1.5. Other Beverages

- 8.1.2. Food

- 8.1.3. Personal Care

- 8.1.4. Household Care

- 8.1.5. Pharmaceuticals

- 8.1.6. Other End-user Verticals

- 8.1.1. Beverages

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Latin America PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Beverages

- 9.1.1.1. Packaged Water

- 9.1.1.2. Carbonated Soft Drinks

- 9.1.1.3. Fruit Juice

- 9.1.1.4. Energy Drinks

- 9.1.1.5. Other Beverages

- 9.1.2. Food

- 9.1.3. Personal Care

- 9.1.4. Household Care

- 9.1.5. Pharmaceuticals

- 9.1.6. Other End-user Verticals

- 9.1.1. Beverages

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Middle East and Africa PET Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.1.1. Beverages

- 10.1.1.1. Packaged Water

- 10.1.1.2. Carbonated Soft Drinks

- 10.1.1.3. Fruit Juice

- 10.1.1.4. Energy Drinks

- 10.1.1.5. Other Beverages

- 10.1.2. Food

- 10.1.3. Personal Care

- 10.1.4. Household Care

- 10.1.5. Pharmaceuticals

- 10.1.6. Other End-user Verticals

- 10.1.1. Beverages

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Neo Group UAB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novapet SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SABIC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpha Packaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Indorama Ventures Public Company Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Graham Packaging Company Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Plastipak Holdings Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Neo Group UAB

List of Figures

- Figure 1: Global PET Bottles Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America PET Bottles Industry Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 3: North America PET Bottles Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 4: North America PET Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America PET Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe PET Bottles Industry Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 7: Europe PET Bottles Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: Europe PET Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe PET Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia PET Bottles Industry Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 11: Asia PET Bottles Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Asia PET Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia PET Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America PET Bottles Industry Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 15: Latin America PET Bottles Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Latin America PET Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America PET Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa PET Bottles Industry Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 19: Middle East and Africa PET Bottles Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 20: Middle East and Africa PET Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa PET Bottles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 2: Global PET Bottles Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global PET Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global PET Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global PET Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: China PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Japan PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Australia and New Zealand PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global PET Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Mexico PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Brazil PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Columbia PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global PET Bottles Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 25: Global PET Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Africa PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Arab Emirates PET Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PET Bottles Industry?

The projected CAGR is approximately 3.07%.

2. Which companies are prominent players in the PET Bottles Industry?

Key companies in the market include Neo Group UAB, Novapet SA, Amcor Plc, BASF SE, SABIC, Alpha Packaging, Indorama Ventures Public Company Ltd, Graham Packaging Company Inc, Berry Global Inc, Plastipak Holdings Inc *List Not Exhaustive.

3. What are the main segments of the PET Bottles Industry?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Increasing Demand from Bottled-water Industry.

6. What are the notable trends driving market growth?

Beverages Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding Use of Plastics.

8. Can you provide examples of recent developments in the market?

October 2022: Indorama Ventures announced the opening of its PETValue bottle-to-bottle recycling plant in the Philippines in partnership with Coca-Cola Beverages Philippines. The plant is IVL's latest recycled PET plant. This internationally integrated petrochemical company continues to expand its position as one of the world's largest producers of recycled resins for plastic beverage bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PET Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PET Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PET Bottles Industry?

To stay informed about further developments, trends, and reports in the PET Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence