Key Insights

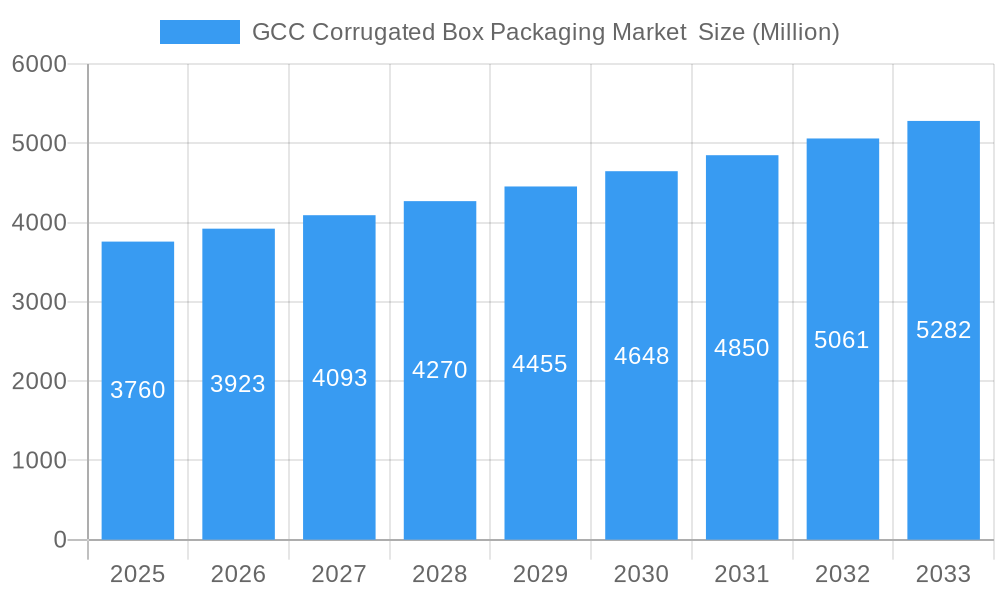

The GCC Corrugated Box Packaging Market is experiencing robust growth, projected to reach a substantial market size and demonstrating a healthy Compound Annual Growth Rate (CAGR) of 4.34%. This expansion is primarily fueled by the burgeoning demand for corrugated boxes across diverse end-user industries, most notably in processed food and beverages, which represent significant consumption segments. The increasing preference for sustainable and eco-friendly packaging solutions is a key driver, aligning with global environmental initiatives and consumer consciousness. Furthermore, the growth in e-commerce activities within the GCC region necessitates reliable and efficient secondary packaging, further bolstering the demand for corrugated boxes. The market is also benefiting from advancements in printing technologies, such as litho-laminate, enabling enhanced branding and visual appeal for packaged goods, thereby adding value for manufacturers and retailers.

GCC Corrugated Box Packaging Market Market Size (In Billion)

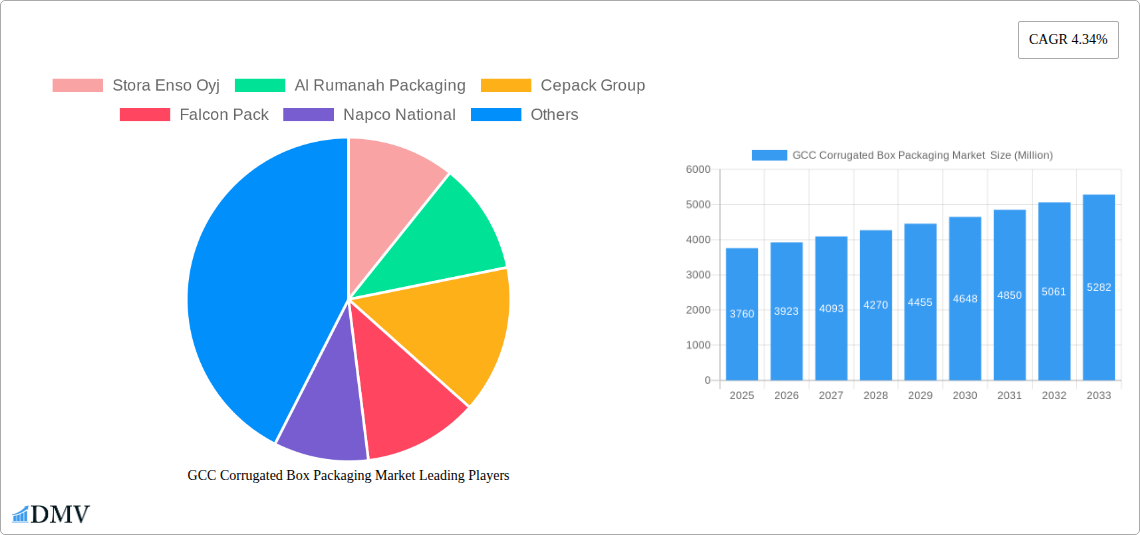

Despite the positive growth trajectory, the market faces certain restraints, including fluctuating raw material prices, particularly for paper pulp, which can impact manufacturing costs and, consequently, pricing. The intense competition among key players, including Stora Enso Oyj, Cepack Group, Falcon Pack, and Napco National, also puts pressure on profit margins. However, the market's resilience is evident in its ability to adapt and innovate. The trend towards customized and lightweight packaging solutions to optimize logistics and reduce shipping costs is gaining momentum. Emerging opportunities lie in the expansion of industries like personal care and pharmaceuticals within the GCC, which are increasingly adopting corrugated packaging for their product lines. Strategic initiatives focusing on efficient supply chain management and the development of high-performance, sustainable corrugated board will be crucial for sustained market leadership.

GCC Corrugated Box Packaging Market Company Market Share

Unlock strategic insights into the burgeoning GCC Corrugated Box Packaging Market with this in-depth report. Spanning from 2019 to 2033, with a robust analysis focused on the 2025 base and estimated year, this report provides unparalleled clarity on market dynamics, growth drivers, and competitive landscapes. Discover the strategic opportunities within sustainable packaging solutions, e-commerce packaging demands, and the evolving food and beverage packaging trends across the Gulf Cooperation Council. This research is indispensable for manufacturers, suppliers, investors, and policymakers seeking to capitalize on the significant growth potential of corrugated box packaging in Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain.

GCC Corrugated Box Packaging Market Market Composition & Trends

The GCC corrugated box packaging market is characterized by a moderate level of concentration, with key players actively pursuing strategic expansions and technological upgrades to cater to escalating demand. Innovation is primarily driven by the increasing emphasis on sustainable materials, advanced printing techniques for enhanced branding, and specialized packaging solutions for diverse end-user industries. The regulatory landscape is progressively favoring eco-friendly packaging, influencing material choices and production processes. Substitute products, such as plastic or other paper-based alternatives, face increasing competition from the inherent recyclability and cost-effectiveness of corrugated boxes. End-user profiles reveal a strong reliance on the processed food, fresh food, and beverage sectors, with personal care and other burgeoning industries also contributing significantly to market penetration. Mergers and acquisitions (M&A) activities, while not yet dominant, are anticipated to increase as companies seek to consolidate market share, acquire new technologies, and expand geographical reach. The market share distribution is expected to see shifts as investments in capacity expansion materialize.

- Market Concentration: Moderate, with a few dominant players and a growing number of regional manufacturers.

- Innovation Catalysts: Sustainability, e-commerce growth, enhanced printing capabilities, and demand for protective packaging.

- Regulatory Landscapes: Increasing focus on environmental regulations and the promotion of recycled content.

- Substitute Products: Facing pressure from corrugated boxes due to their sustainability and cost-effectiveness.

- End-User Profiles: Dominance of food & beverage, growing demand from e-commerce and personal care.

- M&A Activities: Anticipated to rise as companies seek to expand capacity and market reach.

GCC Corrugated Box Packaging Market Industry Evolution

The GCC corrugated box packaging industry has witnessed a significant transformation over the historical period (2019-2024), evolving from a largely functional packaging medium to a strategic element in brand presentation and supply chain efficiency. The study period (2019-2033) forecasts a robust growth trajectory for this market, driven by a confluence of economic development, increasing consumer spending, and the exponential rise of e-commerce. Technological advancements have played a pivotal role, with innovations in paper manufacturing, printing technologies (including high-quality litho-laminate printing), and box design enabling the creation of more durable, aesthetically pleasing, and customized packaging solutions. The adoption of advanced machinery for corrugated board production and converting has led to increased operational efficiency and output capacity.

Consumer demands have shifted dramatically, with a greater preference for products that are not only well-protected during transit but also visually appealing and environmentally responsible. This has spurred demand for printed corrugated boxes, particularly those featuring advanced graphics and sustainable inks. The rise of online retail has been a monumental catalyst, creating an insatiable appetite for lightweight, protective, and brandable shipping boxes. The processed food, fresh food, and beverage sectors continue to be primary consumers, relying on corrugated packaging for hygiene, protection, and efficient logistics. However, the personal care and other end-user segments are showing accelerated growth, fueled by increasing disposable incomes and evolving lifestyle choices. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6-7% during the forecast period (2025-2033), reflecting sustained demand and ongoing industry expansion. Key developments, such as significant investments in new manufacturing plants with substantial production capacities, underscore the confidence in the market's future.

Leading Regions, Countries, or Segments in GCC Corrugated Box Packaging Market

The United Arab Emirates (UAE) consistently emerges as a leading region within the GCC corrugated box packaging market. Its strategic location, robust economic infrastructure, and status as a major trade and logistics hub make it a focal point for packaging demand. The country's proactive approach to economic diversification, coupled with significant investments in sectors like e-commerce, food processing, and hospitality, fuels the continuous need for high-quality corrugated packaging solutions.

- Dominant Region: United Arab Emirates (UAE)

- Key Drivers:

- E-commerce Boom: The UAE has one of the highest e-commerce penetration rates in the region, driving substantial demand for shipping boxes, transit packaging, and customized e-commerce mailers. This segment alone accounts for a significant portion of the Printed and Litho-Laminate box demand.

- Food & Beverage Sector Growth: As a major consumer market and re-export hub, the UAE's processed food, fresh food, and beverage industries require extensive corrugated packaging for distribution, both domestically and internationally. This segment heavily influences the demand for both Plain and Printed boxes.

- Logistics and Warehousing Hub: The UAE's advanced logistics infrastructure necessitates efficient and protective packaging for the movement of goods across various supply chains.

- Government Initiatives: Supportive government policies promoting industrial growth and foreign investment encourage packaging manufacturers to establish and expand their operations.

- Sustainable Packaging Push: Increasing environmental awareness and regulatory impetus are driving demand for recyclable and sustainable corrugated packaging options, particularly in the Printed segment where sustainable inks and materials are being adopted.

- Key Drivers:

The Processed Food segment exhibits strong dominance in terms of volume consumption of corrugated boxes. This is attributable to the large-scale production and distribution networks of processed food manufacturers across the GCC. The need for protective packaging that maintains product integrity and shelf life is paramount. Following closely is the Fresh Food segment, where specialized packaging is crucial for preserving quality and extending the shelf life of perishable goods during transit. The Beverages sector also represents a substantial market share, utilizing corrugated boxes for secondary and tertiary packaging of various beverage types. While Personal Care and Other End Users (including electronics, textiles, and industrial goods) currently hold smaller market shares, they are poised for significant growth, especially with the expansion of localized manufacturing and the increasing demand for premium and customized packaging solutions. The Printed segment, encompassing both Litho-Laminate and other printing techniques, is experiencing the fastest growth, as brands increasingly leverage packaging for marketing and differentiation.

GCC Corrugated Box Packaging Market Product Innovations

Product innovations in the GCC corrugated box packaging market are increasingly focused on enhancing functionality, sustainability, and visual appeal. Advanced printing techniques, such as high-resolution litho-laminating, are enabling brands to achieve superior graphics and vibrant colors on corrugated surfaces, transforming boxes into powerful marketing tools. Innovations in structural design are leading to lighter yet stronger boxes, optimized for reduced shipping costs and improved product protection. The development of specialized coatings and barriers is enhancing the performance of corrugated packaging for sensitive goods like fresh produce and certain processed foods, improving moisture resistance and extending shelf life. Furthermore, the integration of smart technologies, such as QR codes for traceability and anti-counterfeiting features, is gaining traction, particularly in the high-value segments. The drive towards eco-friendly solutions has spurred the development of boxes made from higher percentages of recycled content and the use of biodegradable inks, offering unique selling propositions in a sustainability-conscious market.

Propelling Factors for GCC Corrugated Box Packaging Market Growth

The GCC corrugated box packaging market is propelled by a confluence of robust growth drivers. The surging e-commerce sector, driven by changing consumer shopping habits, is a primary catalyst, demanding vast quantities of shipping and transit packaging. Economic diversification initiatives across GCC nations are fostering industrial growth in manufacturing, food processing, and consumer goods, all of which are significant end-users of corrugated boxes. Increased consumer spending power, coupled with a growing preference for convenience and packaged goods, further bolsters demand. Furthermore, the ongoing emphasis on sustainability and recyclability aligns perfectly with the inherent environmental benefits of corrugated packaging, making it a preferred choice over less eco-friendly alternatives. Investments in advanced manufacturing technologies are enhancing production efficiency and quality, enabling manufacturers to meet the evolving demands of their clientele.

Obstacles in the GCC Corrugated Box Packaging Market Market

Despite its strong growth potential, the GCC corrugated box packaging market faces certain obstacles. Fluctuations in the cost of raw materials, particularly paper pulp, can impact manufacturing costs and profit margins. Supply chain disruptions, stemming from geopolitical events or logistical challenges, can affect the availability of raw materials and the timely delivery of finished products. Intense competition within the market, with numerous regional and international players, can lead to price pressures. Additionally, while environmental regulations are a growth driver, the initial investment required for upgrading to more sustainable technologies or adhering to stricter compliance standards can be a barrier for smaller manufacturers. The relatively nascent stage of advanced waste management and recycling infrastructure in certain parts of the region can also pose challenges for achieving circular economy goals.

Future Opportunities in GCC Corrugated Box Packaging Market

The future of the GCC corrugated box packaging market is ripe with opportunities. The continued expansion of e-commerce presents a sustained demand for innovative and tailored packaging solutions. Growth in the GCC's burgeoning food processing and logistics sectors offers substantial potential for specialized corrugated packaging. The increasing consumer awareness regarding sustainability creates a significant opportunity for manufacturers focused on eco-friendly materials and production processes. Emerging markets within the GCC, with their developing economies and growing middle class, represent untapped potential for increased market penetration. Furthermore, technological advancements in printing and material science will enable the development of high-value, customized packaging solutions that cater to niche market demands, such as luxury goods and specialized electronics.

Major Players in the GCC Corrugated Box Packaging Market Ecosystem

- Stora Enso Oyj

- Al Rumanah Packaging

- Cepack Group

- Falcon Pack

- Napco National

- United Carton Industries Company (UCIC)

- Unipack Containers & Carton Products LLC

- Universal Carton Industries Group

- Express Pack Print

- Tarboosh Packaging Co LLC

- World Pack Industries LLC

- Green Packaging Boxes Ind LLC

- Arabian Packaging Co LLC

- NBM Pack

- Queenex Corrugated Carton Factory

Key Developments in GCC Corrugated Box Packaging Market Industry

- December 2022: Universal Carton Industries (UCI), a leading corrugated cardboard box manufacturer in the Ras Al Khaimah Economic Zone (RAKEZ), invested AED 55 million (~USD 14.97 million) to triple its production capacity to 100,000 tons annually. This expansion aims to meet the growing demand for sustainable packaging solutions in the UAE and overseas, with plans to increase manpower to 300 employees.

- October 2022: Middle East Paper Co. announced plans to invest SAR 1.5 billion (~USD 400 million) in a domestic cardboard or paper packaging plant. Upon completion, this facility is projected to have an annual production capacity of 400,000 tons, catering to both domestic and global markets, signifying a substantial commitment to increasing regional production capabilities.

Strategic GCC Corrugated Box Packaging Market Market Forecast

The strategic forecast for the GCC corrugated box packaging market anticipates sustained and robust growth, driven by key catalysts. The insatiable demand from the rapidly expanding e-commerce sector, coupled with the continued growth of the food and beverage industries, will remain primary growth engines. Investments in advanced manufacturing technologies and sustainable packaging solutions are expected to further shape the market landscape, offering new avenues for product innovation and differentiation. The increasing focus on environmental consciousness and circular economy principles will favor corrugated packaging due to its inherent recyclability. As GCC economies continue to diversify and industrialize, the demand for reliable, protective, and aesthetically pleasing packaging solutions will only intensify, presenting significant market potential for astute industry players.

GCC Corrugated Box Packaging Market Segmentation

-

1. Type

- 1.1. Plain

- 1.2. Printed

-

2. Printed

- 2.1. Litho-Laminate

- 2.2. Others

-

3. End User

- 3.1. Processed Food

- 3.2. Fresh Food

- 3.3. Beverages

- 3.4. Personal Care

- 3.5. Other End Users

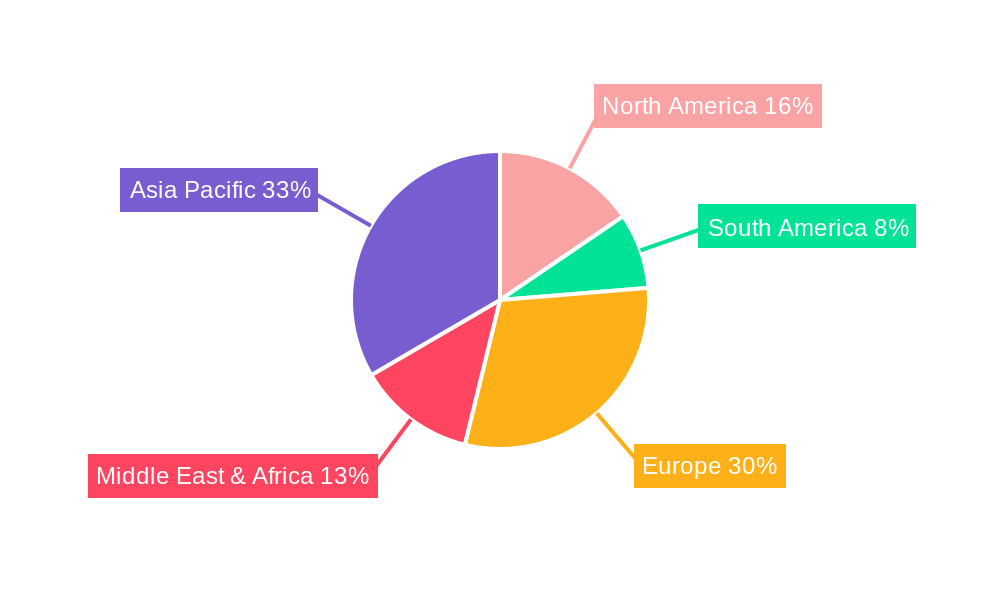

GCC Corrugated Box Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Corrugated Box Packaging Market Regional Market Share

Geographic Coverage of GCC Corrugated Box Packaging Market

GCC Corrugated Box Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Sectors

- 3.3. Market Restrains

- 3.3.1. Concerns About Material Availability and Durability of Corrugated-based Products

- 3.4. Market Trends

- 3.4.1. Increased Demand from the E-commerce Sector for Lightweight Packaging Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plain

- 5.1.2. Printed

- 5.2. Market Analysis, Insights and Forecast - by Printed

- 5.2.1. Litho-Laminate

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Processed Food

- 5.3.2. Fresh Food

- 5.3.3. Beverages

- 5.3.4. Personal Care

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plain

- 6.1.2. Printed

- 6.2. Market Analysis, Insights and Forecast - by Printed

- 6.2.1. Litho-Laminate

- 6.2.2. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Processed Food

- 6.3.2. Fresh Food

- 6.3.3. Beverages

- 6.3.4. Personal Care

- 6.3.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plain

- 7.1.2. Printed

- 7.2. Market Analysis, Insights and Forecast - by Printed

- 7.2.1. Litho-Laminate

- 7.2.2. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Processed Food

- 7.3.2. Fresh Food

- 7.3.3. Beverages

- 7.3.4. Personal Care

- 7.3.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plain

- 8.1.2. Printed

- 8.2. Market Analysis, Insights and Forecast - by Printed

- 8.2.1. Litho-Laminate

- 8.2.2. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Processed Food

- 8.3.2. Fresh Food

- 8.3.3. Beverages

- 8.3.4. Personal Care

- 8.3.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plain

- 9.1.2. Printed

- 9.2. Market Analysis, Insights and Forecast - by Printed

- 9.2.1. Litho-Laminate

- 9.2.2. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Processed Food

- 9.3.2. Fresh Food

- 9.3.3. Beverages

- 9.3.4. Personal Care

- 9.3.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Corrugated Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Plain

- 10.1.2. Printed

- 10.2. Market Analysis, Insights and Forecast - by Printed

- 10.2.1. Litho-Laminate

- 10.2.2. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Processed Food

- 10.3.2. Fresh Food

- 10.3.3. Beverages

- 10.3.4. Personal Care

- 10.3.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stora Enso Oyj

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Al Rumanah Packaging

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cepack Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Falcon Pack

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Napco National

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 United Carton Industries Company (UCIC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unipack Containers & Carton Products LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Universal Carton Industries Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Express Pack Print

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tarboosh Packaging Co LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 World Pack Industries LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Green Packaging Boxes Ind LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Arabian Packaging Co LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NBM Pack*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Queenex Corrugated Carton Factory

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Stora Enso Oyj

List of Figures

- Figure 1: Global GCC Corrugated Box Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Corrugated Box Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Corrugated Box Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Corrugated Box Packaging Market Revenue (Million), by Printed 2025 & 2033

- Figure 5: North America GCC Corrugated Box Packaging Market Revenue Share (%), by Printed 2025 & 2033

- Figure 6: North America GCC Corrugated Box Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America GCC Corrugated Box Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America GCC Corrugated Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America GCC Corrugated Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Corrugated Box Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America GCC Corrugated Box Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America GCC Corrugated Box Packaging Market Revenue (Million), by Printed 2025 & 2033

- Figure 13: South America GCC Corrugated Box Packaging Market Revenue Share (%), by Printed 2025 & 2033

- Figure 14: South America GCC Corrugated Box Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 15: South America GCC Corrugated Box Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America GCC Corrugated Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America GCC Corrugated Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Corrugated Box Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe GCC Corrugated Box Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe GCC Corrugated Box Packaging Market Revenue (Million), by Printed 2025 & 2033

- Figure 21: Europe GCC Corrugated Box Packaging Market Revenue Share (%), by Printed 2025 & 2033

- Figure 22: Europe GCC Corrugated Box Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe GCC Corrugated Box Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe GCC Corrugated Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe GCC Corrugated Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Corrugated Box Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa GCC Corrugated Box Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa GCC Corrugated Box Packaging Market Revenue (Million), by Printed 2025 & 2033

- Figure 29: Middle East & Africa GCC Corrugated Box Packaging Market Revenue Share (%), by Printed 2025 & 2033

- Figure 30: Middle East & Africa GCC Corrugated Box Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa GCC Corrugated Box Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa GCC Corrugated Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Corrugated Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Corrugated Box Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific GCC Corrugated Box Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific GCC Corrugated Box Packaging Market Revenue (Million), by Printed 2025 & 2033

- Figure 37: Asia Pacific GCC Corrugated Box Packaging Market Revenue Share (%), by Printed 2025 & 2033

- Figure 38: Asia Pacific GCC Corrugated Box Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific GCC Corrugated Box Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific GCC Corrugated Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Corrugated Box Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 3: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 7: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 14: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 21: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 34: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Printed 2020 & 2033

- Table 44: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global GCC Corrugated Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Corrugated Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Corrugated Box Packaging Market ?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the GCC Corrugated Box Packaging Market ?

Key companies in the market include Stora Enso Oyj, Al Rumanah Packaging, Cepack Group, Falcon Pack, Napco National, United Carton Industries Company (UCIC), Unipack Containers & Carton Products LLC, Universal Carton Industries Group, Express Pack Print, Tarboosh Packaging Co LLC, World Pack Industries LLC, Green Packaging Boxes Ind LLC, Arabian Packaging Co LLC, NBM Pack*List Not Exhaustive, Queenex Corrugated Carton Factory.

3. What are the main segments of the GCC Corrugated Box Packaging Market ?

The market segments include Type, Printed, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Sectors.

6. What are the notable trends driving market growth?

Increased Demand from the E-commerce Sector for Lightweight Packaging Materials.

7. Are there any restraints impacting market growth?

Concerns About Material Availability and Durability of Corrugated-based Products.

8. Can you provide examples of recent developments in the market?

December 2022 - Universal Carton Industries (UCI), one of UAE's leading corrugated cardboard box manufacturing companies in the Ras Al Khaimah Economic Zone (RAKEZ), invested AED 55 million (~USD 14.97 million) to expand its production volume to meet the growing demand for sustainable packaging solutions in the UAE and overseas. This expansion will increase UCI's production capacity by threefold to 100,000 tons annually. The company aims to increase its manpower to 300 employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Corrugated Box Packaging Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Corrugated Box Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Corrugated Box Packaging Market ?

To stay informed about further developments, trends, and reports in the GCC Corrugated Box Packaging Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence