Key Insights

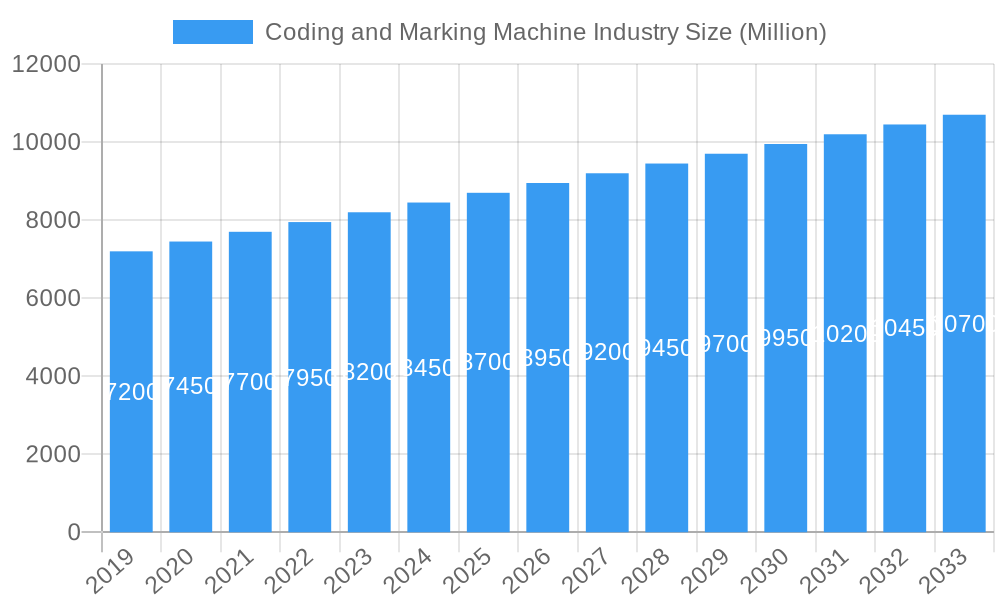

The global Coding and Marking Machine market is poised for robust expansion, projected to reach an estimated market size of approximately $9,300 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.64% through 2033. This growth is primarily propelled by escalating demands for product traceability, brand protection, and compliance with stringent regulatory mandates across diverse industries. The pharmaceutical sector, in particular, is a significant driver, necessitating sophisticated coding solutions for serialization and anti-counterfeiting measures. Similarly, the food and beverage industry's focus on consumer safety and supply chain transparency, coupled with the burgeoning cosmetics market's emphasis on product differentiation and consumer engagement, are further fueling market adoption. Technological advancements in printing technologies, such as the increasing prevalence of Thermal Inkjet (TIJ) and Continuous Inkjet (CIJ) printers, offering higher speeds, greater precision, and reduced environmental impact, are also key contributors to this positive trajectory. The market's expansion is further supported by investments in automation and Industry 4.0 initiatives, leading to the integration of smarter, more connected coding and marking systems.

Coding and Marking Machine Industry Market Size (In Billion)

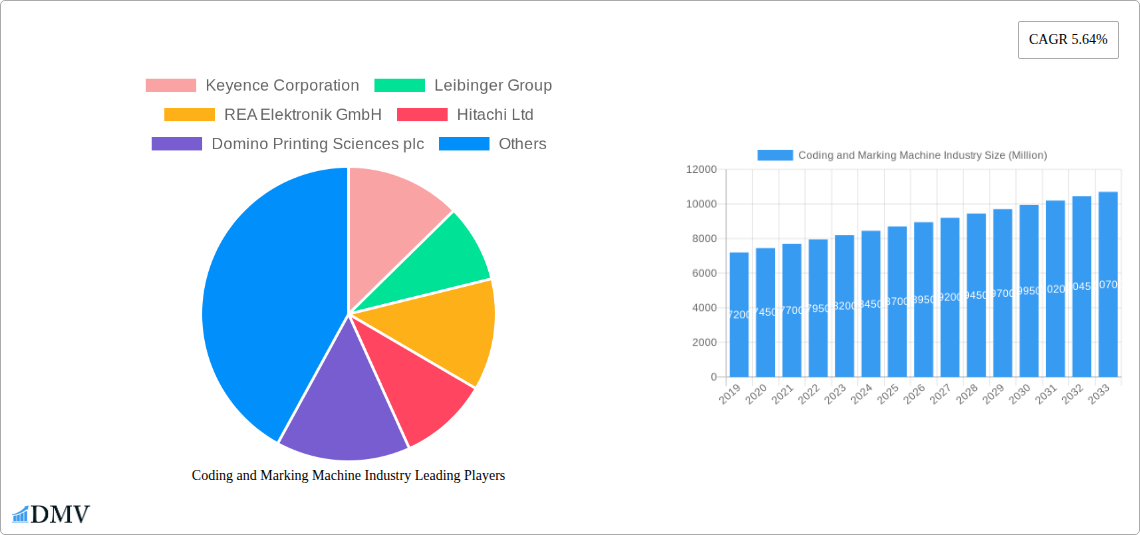

The market landscape is characterized by a dynamic interplay of various segments. The "Equipment" segment, encompassing a range of technologies like Thermal Inkjet (TIJ) Printers, Continuous Inkjet (CIJ) Printers, and Laser Printers, is expected to witness sustained demand, driven by evolving application needs. The "Fluids and Ribbons" segment, crucial for ongoing operations, will also see consistent growth. While the market benefits from strong growth drivers, certain restraints, such as the high initial investment costs for advanced equipment and the need for skilled personnel for operation and maintenance, might temper rapid adoption in specific sub-segments. Nevertheless, the overarching trend towards enhanced supply chain visibility, coupled with increasing globalization and the proliferation of consumer goods, positions the Coding and Marking Machine market for significant and sustained growth in the coming years. Key players like Keyence Corporation, Domino Printing Sciences plc, and Hitachi Ltd. are at the forefront of innovation, catering to the evolving needs of industries worldwide.

Coding and Marking Machine Industry Company Market Share

Coding and Marking Machine Industry Market Composition & Trends

The global Coding and Marking Machine industry is characterized by a dynamic market composition, with key players strategically maneuvering to capture market share. As of the base year 2025, the market size is projected to reach XXX Million, with a significant portion dominated by integrated solution providers offering comprehensive product portfolios. Innovation catalysts are primarily driven by the increasing demand for enhanced traceability and supply chain efficiency across diverse end-user industries. Regulatory landscapes are also playing a pivotal role, with stringent mandates for product authentication and anti-counterfeiting measures fueling adoption. Substitute products, while present in niche applications, struggle to match the precision and versatility of dedicated coding and marking solutions. End-user profiles are increasingly sophisticated, demanding customized solutions tailored to specific packaging materials and production environments. Mergers and acquisitions (M&A) activities are significant, with a total deal value of XXX Million recorded over the historical period (2019–2024), indicating a consolidation trend aimed at expanding technological capabilities and geographical reach.

- Market Share Distribution: Dominated by major players, with a competitive landscape featuring both established giants and agile innovators.

- M&A Deal Values (2019-2024): XXX Million.

- Innovation Drivers: Traceability mandates, supply chain visibility, anti-counterfeiting requirements, Industry 4.0 integration.

Coding and Marking Machine Industry Industry Evolution

The Coding and Marking Machine industry has witnessed a significant evolution, driven by relentless technological advancements and the ever-growing demand for sophisticated product identification and tracking solutions. Over the study period of 2019–2033, the market trajectory has been consistently upward, fueled by a confluence of factors including increasing industrial automation, stringent regulatory requirements for product safety and authenticity, and the burgeoning e-commerce sector. The base year 2025 represents a pivotal point, with an estimated market value of XXX Million, underscoring the substantial growth achieved. The historical period (2019–2024) saw the emergence of advanced printing technologies such as Thermal Inkjet (TIJ) and a growing preference for high-resolution Laser Printers, capable of marking directly onto complex substrates. Continuous Inkjet (CIJ) printers, while mature, continue to be a workhorse for high-speed, high-volume applications, especially in the Food & Beverage and Pharmaceutical sectors. The forecast period (2025–2033) is expected to witness an accelerated growth rate, projected at approximately XX% annually, driven by the integration of smart technologies, IoT capabilities, and AI-powered analytics for predictive maintenance and optimized coding processes. Shifting consumer demands for ethically sourced and verifiable products are further pushing manufacturers to invest in robust coding and marking systems that ensure complete supply chain transparency. The adoption of Industry 4.0 principles has necessitated the development of intelligent coding machines that can seamlessly integrate with other factory automation systems, enabling real-time data exchange and enhanced operational efficiency. The increasing focus on sustainability is also influencing product development, with a push towards eco-friendly inks and consumables.

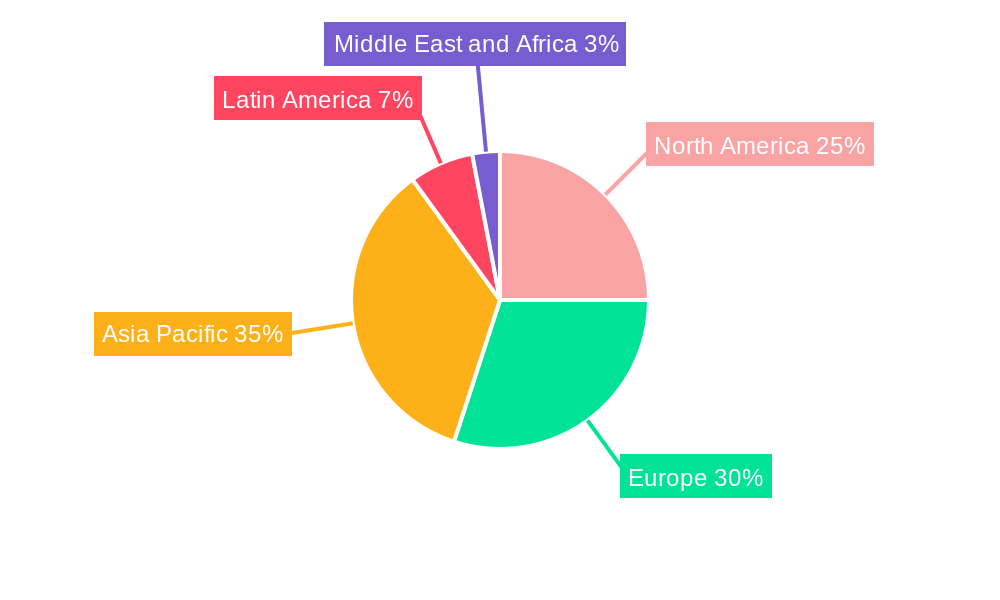

Leading Regions, Countries, or Segments in Coding and Marking Machine Industry

The global Coding and Marking Machine industry's dominance is multifaceted, with specific regions, countries, and solutions segments exhibiting significant leadership. Within the Solution segmentation, Equipment stands out as the most influential category, driven by the constant demand for advanced printing technologies and the substantial capital investment involved. Among the equipment types, Continuous Inkjet (CIJ) Printers have historically held a strong position due to their versatility and cost-effectiveness in high-speed production lines, particularly within the Food and Beverage and Pharmaceutical industries. However, the Laser Printer segment is experiencing robust growth, driven by its precision, permanence, and suitability for a wider range of materials, including plastics and metals, making it increasingly indispensable in sectors like Cosmetics and Automotive.

Geographically, North America and Europe have consistently led the market, owing to their established manufacturing bases, stringent regulatory frameworks mandating product traceability, and high adoption rates of automation. The Asia-Pacific region, however, is emerging as a powerhouse of growth, propelled by rapid industrialization, a burgeoning middle class driving consumer goods demand, and increasing government initiatives promoting localized manufacturing and export competitiveness. Key drivers for dominance in these regions include:

- Investment Trends: Significant capital expenditure by multinational corporations and local manufacturers to upgrade their production lines with state-of-the-art coding and marking solutions.

- Regulatory Support: Strict government regulations concerning product safety, anti-counterfeiting, and import/export compliance that mandate clear and durable product identification. For instance, pharmaceutical industries globally are subject to stringent serialization requirements, directly impacting the demand for high-precision coding.

- Technological Advancements: The presence of leading research and development hubs and a strong ecosystem for technological innovation, leading to the continuous introduction of more efficient and intelligent coding machines.

- End-User Industry Demand: The sheer volume of production in sectors like Food & Beverage, Pharmaceutical, and Cosmetics necessitates reliable and high-throughput coding solutions. The Pharmaceutical industry, in particular, with its critical need for serialization and track-and-trace capabilities to combat counterfeit drugs, represents a major growth driver.

Within the End-user Industry segmentation, Food and Beverage and Pharmaceutical continue to be the largest and most influential sectors, accounting for a substantial portion of the market's revenue. The increasing demand for packaged goods, coupled with the imperative for stringent quality control and supply chain integrity, makes these sectors primary consumers of coding and marking solutions. The Cosmetics industry is also a significant contributor, driven by branding, anti-counterfeiting, and regulatory compliance.

Coding and Marking Machine Industry Product Innovations

The Coding and Marking Machine industry is witnessing a surge in innovative product development, pushing the boundaries of precision, speed, and connectivity. Manufacturers are introducing next-generation Thermal Inkjet (TIJ) printers offering higher resolution and faster drying times, ideal for sensitive substrates and high-speed lines. Continuous Inkjet (CIJ) technology is evolving with reduced solvent consumption and improved ink formulations for enhanced durability and eco-friendliness. Laser printers are becoming more versatile, capable of marking intricate designs and variable data on a wider array of materials with unparalleled permanence. A key innovation is the integration of AI and machine learning for predictive maintenance, reducing downtime and optimizing performance. Furthermore, advancements in traceability solutions, including the ability to print complex 2D codes like QR codes and Data Matrix codes with high accuracy, are crucial for compliance with global track-and-trace regulations. These innovations not only enhance product marking but also contribute to improved supply chain visibility and consumer trust.

Propelling Factors for Coding and Marking Machine Industry Growth

Several key factors are propelling the growth of the Coding and Marking Machine industry. The escalating demand for enhanced product traceability and supply chain visibility, driven by regulatory mandates and consumer expectations for authenticity, is a primary growth catalyst. The burgeoning e-commerce sector necessitates robust and reliable coding for order fulfillment and returns management. Furthermore, increasing industrial automation and the adoption of Industry 4.0 principles are driving the integration of smart, connected coding machines into manufacturing processes. Economic growth in emerging markets is also contributing significantly, as new manufacturing facilities are established and existing ones are upgraded. The continuous innovation in printing technologies, offering higher speeds, greater precision, and wider substrate compatibility, further fuels market expansion.

Obstacles in the Coding and Marking Machine Industry Market

Despite robust growth prospects, the Coding and Marking Machine industry faces several obstacles. Stringent and evolving regulatory landscapes across different regions can pose challenges, requiring constant adaptation of product offerings and compliance strategies. Supply chain disruptions, particularly concerning the availability of raw materials for inks and printer components, can impact production and lead times. Intense competition among established players and new entrants can lead to price pressures and necessitate significant investment in research and development to maintain a competitive edge. The high initial capital expenditure for advanced coding and marking equipment can also be a barrier for small and medium-sized enterprises (SMEs) in certain developing economies.

Future Opportunities in Coding and Marking Machine Industry

The Coding and Marking Machine industry is ripe with future opportunities. The increasing global focus on sustainability presents an opportunity for developing eco-friendly inks and energy-efficient printing technologies. The expansion of the pharmaceutical and food & beverage sectors in emerging economies, coupled with stringent track-and-trace requirements, will drive demand for advanced coding solutions. The growing adoption of smart packaging and the Internet of Things (IoT) opens avenues for integrated coding systems that provide real-time product data and enhance supply chain intelligence. Furthermore, the development of more specialized coding solutions for niche applications, such as high-temperature or corrosive environments, will cater to evolving industrial needs.

Major Players in the Coding and Marking Machine Industry Ecosystem

- Keyence Corporation

- Leibinger Group

- REA Elektronik GmbH

- Hitachi Ltd

- Domino Printing Sciences plc

- Koenig & Bauer Coding GmbH

- Danaher Corporation

- Dover Corporation

- Control Print Ltd

- Matthews International Corporation

Key Developments in Coding and Marking Machine Industry Industry

- May 2022: Markem-Imaje, a subsidiary of Dover, launched the 9750 continuous inkjet printer, designed for robust traceability coding on diverse packaging, featuring multi-line text, logos, and high-resolution 1D/2D codes.

- September 2021: Linx Printing Technologies introduced the Linx SL3 laser coder, a versatile solution for marking dates, batch numbers, text, and logos on various materials, offering flexible mounting and a customizable user interface.

Strategic Coding and Marking Machine Industry Market Forecast

The Coding and Marking Machine industry is poised for sustained growth, driven by an ever-increasing need for product traceability, regulatory compliance, and enhanced supply chain efficiency. The forecasted growth is fueled by ongoing technological innovations, particularly in areas like AI integration for smarter coding and the development of eco-friendly consumables. Emerging markets present significant expansion opportunities as industrialization accelerates. The strategic focus for market players will remain on providing integrated solutions that cater to the evolving demands of key end-user industries such as pharmaceuticals, food and beverage, and cosmetics, ensuring robust and reliable product identification across the entire value chain.

Coding and Marking Machine Industry Segmentation

-

1. Solution

- 1.1. Equipment

- 1.2. Fluids and Ribbons

- 1.3. Spares

-

2. Equipment

- 2.1. Thermal Inkjet (TIJ) Printer

- 2.2. Continuous Inkjet (CIJ) Printer

- 2.3. Laser Printer

- 2.4. Others

-

3. End-user Industry

- 3.1. Pharmaceutical

- 3.2. Construction

- 3.3. Food and Beverage

- 3.4. Cosmetics

- 3.5. Others

Coding and Marking Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Coding and Marking Machine Industry Regional Market Share

Geographic Coverage of Coding and Marking Machine Industry

Coding and Marking Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries

- 3.3. Market Restrains

- 3.3.1. High upfront and operational cost for deploying coding and making equipment

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Analyzed To Hold Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Equipment

- 5.1.2. Fluids and Ribbons

- 5.1.3. Spares

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. Thermal Inkjet (TIJ) Printer

- 5.2.2. Continuous Inkjet (CIJ) Printer

- 5.2.3. Laser Printer

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Construction

- 5.3.3. Food and Beverage

- 5.3.4. Cosmetics

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Equipment

- 6.1.2. Fluids and Ribbons

- 6.1.3. Spares

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. Thermal Inkjet (TIJ) Printer

- 6.2.2. Continuous Inkjet (CIJ) Printer

- 6.2.3. Laser Printer

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Construction

- 6.3.3. Food and Beverage

- 6.3.4. Cosmetics

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Equipment

- 7.1.2. Fluids and Ribbons

- 7.1.3. Spares

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. Thermal Inkjet (TIJ) Printer

- 7.2.2. Continuous Inkjet (CIJ) Printer

- 7.2.3. Laser Printer

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Construction

- 7.3.3. Food and Beverage

- 7.3.4. Cosmetics

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Equipment

- 8.1.2. Fluids and Ribbons

- 8.1.3. Spares

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. Thermal Inkjet (TIJ) Printer

- 8.2.2. Continuous Inkjet (CIJ) Printer

- 8.2.3. Laser Printer

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Construction

- 8.3.3. Food and Beverage

- 8.3.4. Cosmetics

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Equipment

- 9.1.2. Fluids and Ribbons

- 9.1.3. Spares

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. Thermal Inkjet (TIJ) Printer

- 9.2.2. Continuous Inkjet (CIJ) Printer

- 9.2.3. Laser Printer

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Construction

- 9.3.3. Food and Beverage

- 9.3.4. Cosmetics

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Equipment

- 10.1.2. Fluids and Ribbons

- 10.1.3. Spares

- 10.2. Market Analysis, Insights and Forecast - by Equipment

- 10.2.1. Thermal Inkjet (TIJ) Printer

- 10.2.2. Continuous Inkjet (CIJ) Printer

- 10.2.3. Laser Printer

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Construction

- 10.3.3. Food and Beverage

- 10.3.4. Cosmetics

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keyence Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leibinger Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 REA Elektronik GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domino Printing Sciences plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koenig & Bauer Coding GmbH*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dover Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Control Print Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Matthews International Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Coding and Marking Machine Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 3: North America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 11: Europe Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 13: Europe Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 14: Europe Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 19: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 21: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 22: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 27: Latin America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Latin America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 29: Latin America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 30: Latin America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 35: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 37: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 38: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Coding and Marking Machine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 6: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 7: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 11: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 14: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 15: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 18: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 19: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 22: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 23: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coding and Marking Machine Industry?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the Coding and Marking Machine Industry?

Key companies in the market include Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH*List Not Exhaustive, Danaher Corporation, Dover Corporation, Control Print Ltd, Matthews International Corporation.

3. What are the main segments of the Coding and Marking Machine Industry?

The market segments include Solution, Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Analyzed To Hold Highest Share.

7. Are there any restraints impacting market growth?

High upfront and operational cost for deploying coding and making equipment.

8. Can you provide examples of recent developments in the market?

May 2022- Markem-Imaje, a subsidiary of Dover and a global provider of end-to-end supply chain solutions and industrial marking and coding systems, has announced the launch of the 9750 continuous inkjet printer. The 9750 is the first of a new generation of printers that can print robust traceability coding on a wide range of packaging, including up to five-line text messages, logos, and high-resolution 1D and 2D codes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coding and Marking Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coding and Marking Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coding and Marking Machine Industry?

To stay informed about further developments, trends, and reports in the Coding and Marking Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence