Key Insights

The European plastic caps and closures market is projected to reach 2.02 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.42% through 2033. Growth is driven by escalating demand from the beverage and food industries, alongside increasing requirements for secure packaging in the pharmaceutical, healthcare, cosmetics, toiletries, and household products sectors. Innovations in sustainable materials like recyclable PET, PP, LDPE, and HDPE are meeting regulatory standards and appealing to eco-conscious consumers.

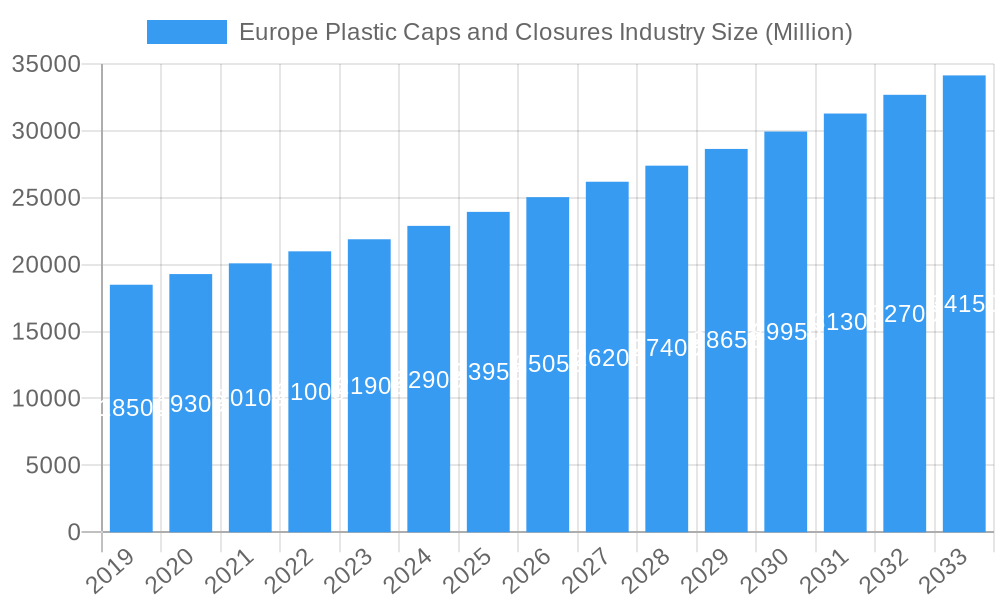

Europe Plastic Caps and Closures Industry Market Size (In Million)

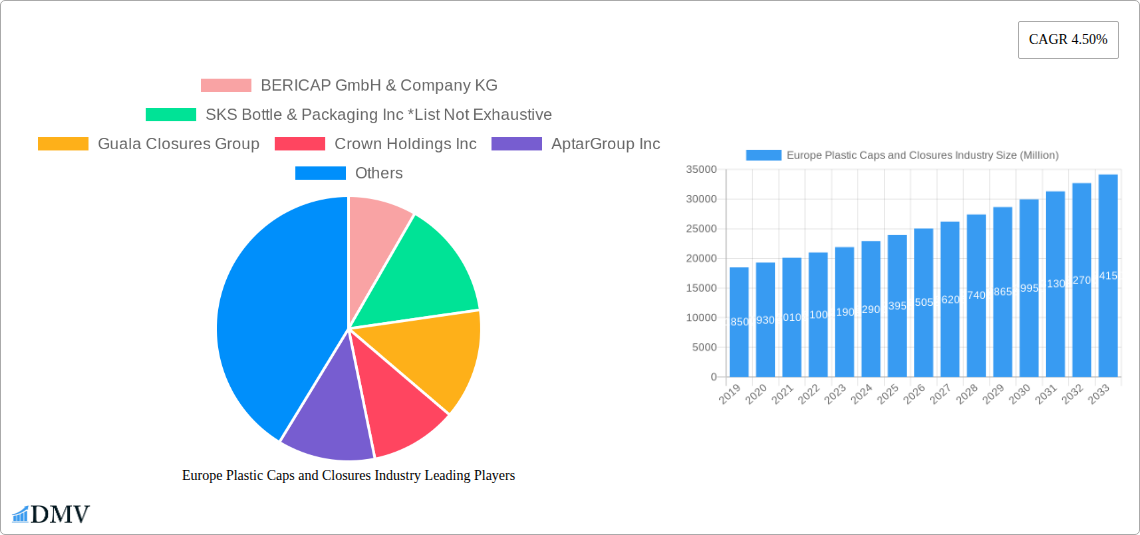

Key market trends include lightweighting, child-resistant features, and smart packaging. Manufacturers are focusing on advanced technologies to minimize material usage while maintaining performance. Sustainability is a paramount trend, leading to increased adoption of recycled and bio-based plastics. However, market growth may be constrained by fluctuating petrochemical prices and stringent environmental regulations. The competitive landscape features prominent players such as BERICAP GmbH & Company KG, SKS Bottle & Packaging Inc., Guala Closures Group, Crown Holdings Inc., and AptarGroup Inc., who are actively pursuing innovation and strategic partnerships.

Europe Plastic Caps and Closures Industry Company Market Share

This report provides an in-depth analysis of the Europe plastic caps and closures market, from 2019-2024 with projections through 2033 and a base year of 2025. It examines market concentration, innovation, regulatory frameworks, substitute products, key end-user segments including Beverage, Food, Pharmaceutical and Healthcare, Cosmetics and Toiletries, and Household, and significant Mergers and Acquisitions (M&A). The report details market share distribution among leading players such as BERICAP GmbH & Company KG, SKS Bottle & Packaging Inc, Guala Closures Group, Crown Holdings Inc, AptarGroup Inc, Amcor PLC, Albea Group, Coral Products PLC, Nippon Closures Co Ltd, Tetra Pak International SA, Berry Global, and Pelliconi & C SPA, including estimated M&A deal values. The analysis explores the influence of sustainability mandates, technological advancements, and evolving consumer preferences on market dynamics.

Europe Plastic Caps and Closures Industry Industry Evolution

The Europe plastic caps and closures industry has undergone a significant transformation, driven by a confluence of technological innovation, stringent environmental regulations, and evolving consumer demands. From 2019 to 2033, the market trajectory has been characterized by robust growth, albeit with distinct phases. The historical period (2019-2024) saw steady expansion fueled by increasing demand from the food & beverage, pharmaceutical, and personal care sectors. However, the forecast period (2025-2033) is anticipated to witness accelerated growth, largely attributed to advancements in materials science and a heightened focus on sustainable packaging solutions.

Technological advancements have been pivotal in shaping the industry's evolution. The development of lighter-weight closures, the incorporation of recycled content, and the introduction of smart closure technologies that offer enhanced tamper evidence and traceability have significantly impacted product design and functionality. For instance, innovations in PET, PP, LDPE, and HDPE materials have enabled the creation of more efficient and environmentally friendly caps and closures. The adoption rate of these advanced materials is projected to increase by approximately XX% annually during the forecast period.

Shifting consumer demands have also played a crucial role. Consumers are increasingly prioritizing convenience, safety, and sustainability. This has translated into a demand for closures that are easy to open and reseal, provide superior product protection, and minimize environmental impact. The rise of e-commerce has further amplified the need for robust and secure packaging, influencing the design and manufacturing processes of plastic caps and closures. The Pharmaceutical and Healthcare segment, in particular, demands high levels of product integrity and child-resistant features, driving innovation in specialized closure designs.

Market growth rates have remained consistently positive, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the study period. This growth is supported by a growing population, increasing disposable incomes in emerging European economies, and a continued reliance on packaged goods across various end-user industries. The Beverage industry, being a primary consumer of plastic caps and closures, continues to be a key growth driver, with a sustained demand for both still and carbonated drinks. The Cosmetics and Toiletries segment also contributes significantly, with a constant need for aesthetically pleasing and functional closures that enhance brand appeal.

The industry's evolution is also marked by a growing emphasis on circular economy principles. Manufacturers are investing in technologies that facilitate the recycling and reuse of plastic materials, leading to the development of closures designed for easier separation from their respective containers. This shift is not only driven by regulatory pressures but also by a proactive approach from leading companies to embrace sustainable business practices and meet the expectations of environmentally conscious consumers. The Europe plastic caps and closures market is therefore poised for continued innovation and growth, adapting to the dynamic needs of the global marketplace.

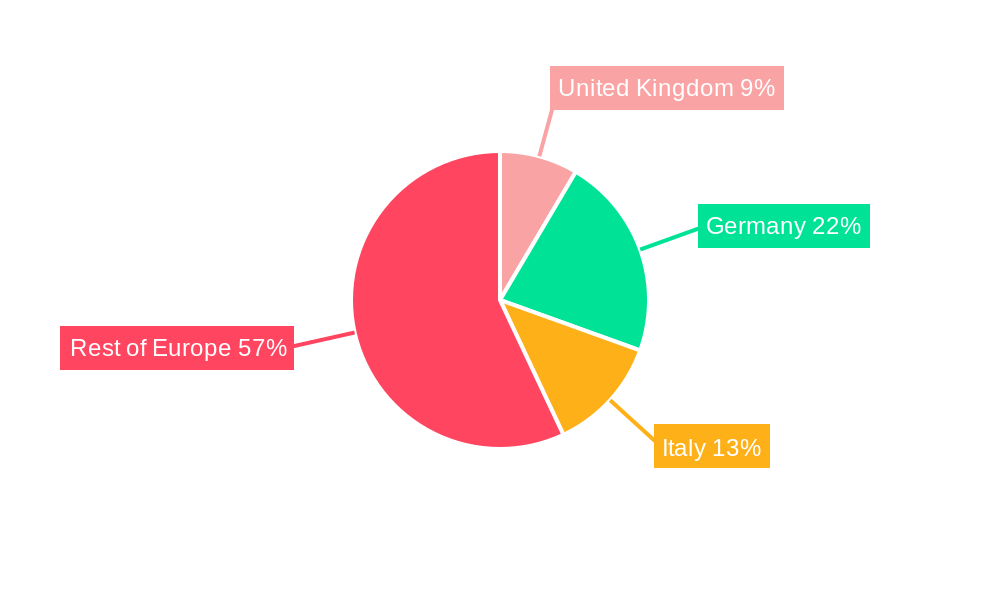

Leading Regions, Countries, or Segments in Europe Plastic Caps and Closures Industry

The Europe plastic caps and closures industry is a dynamic market characterized by regional strengths and segment-specific dominance. Among the material segments, PP (Polypropylene) and HDPE (High-Density Polyethylene) consistently hold a commanding market share, driven by their versatility, durability, and cost-effectiveness in a wide range of applications. These materials are extensively used in the Beverage sector, particularly for carbonated drinks and water bottles, where their ability to withstand pressure and provide a secure seal is paramount. The Food segment also heavily relies on PP and HDPE for various packaging needs, from condiments to dairy products. The market share of PP and HDPE combined is estimated to be around XX% of the total material segment during the forecast period.

In terms of end-users, the Beverage sector remains the undisputed leader, accounting for an estimated XX% of the total market demand. This dominance is attributed to the sheer volume of packaged beverages consumed across Europe, coupled with the continuous demand for innovative and sustainable closure solutions. The Food segment follows closely, with an estimated market share of XX%, driven by the extensive use of caps and closures for a diverse array of food products, including sauces, spreads, and ready-to-eat meals. The Pharmaceutical and Healthcare segment, while smaller in volume, represents a high-value market due to the stringent quality and safety requirements for its closures, such as tamper-evident seals and child-resistant designs. This segment is projected to exhibit a higher CAGR due to the increasing demand for pharmaceutical products and healthcare services.

Geographically, Germany has historically been and continues to be the largest market within Europe for plastic caps and closures. Its robust industrial base, strong manufacturing capabilities, and significant presence of major food, beverage, and pharmaceutical companies contribute to its leading position. Germany accounts for an estimated XX% of the total European market. Other key players include France, the United Kingdom, Italy, and Spain, each contributing significantly to market demand.

Key drivers for the dominance of these regions and segments include:

- Investment Trends: Leading companies are consistently investing in advanced manufacturing facilities and R&D in these dominant regions to cater to the high demand and maintain a competitive edge.

- Regulatory Support: Favorable regulatory frameworks that support packaging innovation and sustainability initiatives in countries like Germany and France encourage the adoption of advanced plastic caps and closures.

- Consumer Demographics: The presence of a large and affluent consumer base with a high propensity to purchase packaged goods in these leading European nations fuels demand.

- Supply Chain Efficiency: Well-established supply chains and logistical networks in these regions ensure timely delivery and cost-effectiveness, further solidifying their dominance.

- Industry Clusters: The concentration of major end-user industries and packaging manufacturers in specific regions creates synergistic ecosystems that foster growth and innovation in the plastic caps and closures market.

The dominance of PP and HDPE materials in the Beverage and Food segments, coupled with the geographical strength of countries like Germany, establishes a clear hierarchy within the Europe plastic caps and closures industry, dictating investment priorities and market strategies for stakeholders.

Europe Plastic Caps and Closures Industry Product Innovations

The Europe plastic caps and closures industry is witnessing a surge in product innovations, driven by sustainability mandates and the pursuit of enhanced functionality. Companies are actively developing lightweight closures, such as Berry Global Inc.'s Cyrano, a dual-port blow fill seal closure for parenteral applications that is up to 64% lighter than competitor products, significantly reducing plastic usage. Guala Closures Group's Divinum Blossom screwcap for wine, launched in June 2021, exemplifies the trend towards sustainable materials, incorporating recyclable and renewable components. These innovations not only reduce material consumption and environmental impact but also offer improved performance metrics, including enhanced tamper evidence, ease of opening, and superior sealing capabilities. The adoption of advanced resins and manufacturing techniques allows for the creation of closures with intricate designs and improved barrier properties, ensuring product integrity across diverse applications in the beverage, food, pharmaceutical, and cosmetic sectors.

Propelling Factors for Europe Plastic Caps and Closures Industry Growth

Several key factors are propelling the growth of the Europe plastic caps and closures industry. A significant driver is the increasing consumer demand for convenience and portability in packaged goods, particularly in the beverage and food sectors. This translates to a continuous need for secure and easy-to-use closures. Secondly, stringent environmental regulations and the growing emphasis on sustainability are forcing manufacturers to innovate with materials like recycled plastics and bio-based alternatives, creating new market opportunities. Furthermore, the pharmaceutical and healthcare industries are witnessing robust growth, necessitating high-quality, safe, and tamper-evident plastic caps and closures for critical applications. Technological advancements in material science and manufacturing processes, enabling lighter, stronger, and more functional closures, also play a crucial role in driving market expansion.

Obstacles in the Europe Plastic Caps and Closures Industry Market

Despite robust growth, the Europe plastic caps and closures market faces several obstacles. Increasing regulatory scrutiny and bans on certain single-use plastics can pose significant challenges, necessitating substantial investment in alternative materials and designs. Volatility in raw material prices, particularly for petrochemical-based plastics, can impact profit margins and create supply chain unpredictability. Intense price competition among numerous manufacturers, especially for standard closure types, can limit profitability. Furthermore, consumer perception and public pressure regarding plastic waste, even with advancements in recyclability, can create market headwinds, pushing for further innovation in circular economy solutions. The estimated impact of these barriers on market growth could be a reduction of XX% in the overall growth trajectory if not effectively addressed.

Future Opportunities in Europe Plastic Caps and Closures Industry

The future for the Europe plastic caps and closures industry is ripe with opportunities. The escalating demand for sustainable and recyclable packaging solutions presents a significant avenue for growth, with advancements in materials science and closed-loop recycling systems. The growth of e-commerce necessitates specialized closures that ensure product integrity during transit, opening up opportunities for innovative designs. Furthermore, the expansion of the pharmaceutical and healthcare sectors, coupled with the increasing demand for specialized medical devices, creates a high-value market for advanced and secure closures. Emerging technologies, such as smart closures with embedded sensors for tracking and authentication, also offer promising future avenues for differentiation and market expansion.

Major Players in the Europe Plastic Caps and Closures Industry Ecosystem

- BERICAP GmbH & Company KG

- SKS Bottle & Packaging Inc

- Guala Closures Group

- Crown Holdings Inc

- AptarGroup Inc

- Amcor PLC

- Albea Group

- Coral Products PLC

- Nippon Closures Co Ltd

- Tetra Pak International SA

- Berry Global

- Pelliconi & C SPA

Key Developments in Europe Plastic Caps and Closures Industry Industry

- June 2021: Guala Closures Group launched the Divinum Blossom, a screwcap for wine made with recyclable and renewable materials, as part of its eco-design strategy.

- January 2021: Berry Global Inc. launched the lightest dual-port blow fill seal closure, Cyrano, for large volume parenteral applications, offering a significant reduction in plastic usage and sustainability benefits for clinical environments.

Strategic Europe Plastic Caps and Closures Industry Market Forecast

The strategic forecast for the Europe plastic caps and closures industry is overwhelmingly positive, driven by a confluence of powerful growth catalysts. The relentless pursuit of sustainability and circular economy principles is creating substantial market opportunities for innovative, eco-friendly closure solutions. Anticipated advancements in material science, leading to the development of novel biodegradable and high-recycled content plastics, will further fuel this trend. The robust growth within the pharmaceutical, healthcare, and beverage sectors, underpinned by an aging population and changing lifestyle dynamics, will continue to demand a high volume of reliable and safe caps and closures. Furthermore, the increasing adoption of advanced manufacturing technologies, such as automation and digitalization, promises to enhance production efficiency and product quality. The strategic outlook emphasizes innovation in lightweight designs, enhanced functionality, and adherence to stringent regulatory frameworks as key drivers for sustained market expansion and profitability.

Europe Plastic Caps and Closures Industry Segmentation

-

1. Material

- 1.1. PET

- 1.2. PP

- 1.3. LDPE and HDPE

- 1.4. Other Materials

-

2. End-user

- 2.1. Beverage

- 2.2. Food

- 2.3. Pharmaceutical and Healthcare

- 2.4. Cosmetics and Toiletries

- 2.5. Househol

- 2.6. Other En

Europe Plastic Caps and Closures Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. Rest of Europe

Europe Plastic Caps and Closures Industry Regional Market Share

Geographic Coverage of Europe Plastic Caps and Closures Industry

Europe Plastic Caps and Closures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovation to Aid Product Differentiation and Branding; Rising Demand for Smaller-sized Packs

- 3.3. Market Restrains

- 3.3.1. Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

- 3.4. Market Trends

- 3.4.1. Beverage Industry is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Plastic Caps and Closures Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. PET

- 5.1.2. PP

- 5.1.3. LDPE and HDPE

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Beverage

- 5.2.2. Food

- 5.2.3. Pharmaceutical and Healthcare

- 5.2.4. Cosmetics and Toiletries

- 5.2.5. Househol

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United Kingdom Europe Plastic Caps and Closures Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. PET

- 6.1.2. PP

- 6.1.3. LDPE and HDPE

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Beverage

- 6.2.2. Food

- 6.2.3. Pharmaceutical and Healthcare

- 6.2.4. Cosmetics and Toiletries

- 6.2.5. Househol

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Germany Europe Plastic Caps and Closures Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. PET

- 7.1.2. PP

- 7.1.3. LDPE and HDPE

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Beverage

- 7.2.2. Food

- 7.2.3. Pharmaceutical and Healthcare

- 7.2.4. Cosmetics and Toiletries

- 7.2.5. Househol

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Italy Europe Plastic Caps and Closures Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. PET

- 8.1.2. PP

- 8.1.3. LDPE and HDPE

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Beverage

- 8.2.2. Food

- 8.2.3. Pharmaceutical and Healthcare

- 8.2.4. Cosmetics and Toiletries

- 8.2.5. Househol

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of Europe Europe Plastic Caps and Closures Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. PET

- 9.1.2. PP

- 9.1.3. LDPE and HDPE

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Beverage

- 9.2.2. Food

- 9.2.3. Pharmaceutical and Healthcare

- 9.2.4. Cosmetics and Toiletries

- 9.2.5. Househol

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BERICAP GmbH & Company KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SKS Bottle & Packaging Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Guala Closures Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Crown Holdings Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AptarGroup Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Amcor PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Albea Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Coral Products PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nippon closures Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Tetra Pak International SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Berry Global

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Pelliconi & C SPA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 BERICAP GmbH & Company KG

List of Figures

- Figure 1: Europe Plastic Caps and Closures Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Plastic Caps and Closures Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Material 2020 & 2033

- Table 2: Europe Plastic Caps and Closures Industry Revenue million Forecast, by End-user 2020 & 2033

- Table 3: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Material 2020 & 2033

- Table 5: Europe Plastic Caps and Closures Industry Revenue million Forecast, by End-user 2020 & 2033

- Table 6: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Material 2020 & 2033

- Table 8: Europe Plastic Caps and Closures Industry Revenue million Forecast, by End-user 2020 & 2033

- Table 9: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Material 2020 & 2033

- Table 11: Europe Plastic Caps and Closures Industry Revenue million Forecast, by End-user 2020 & 2033

- Table 12: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Material 2020 & 2033

- Table 14: Europe Plastic Caps and Closures Industry Revenue million Forecast, by End-user 2020 & 2033

- Table 15: Europe Plastic Caps and Closures Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Plastic Caps and Closures Industry?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the Europe Plastic Caps and Closures Industry?

Key companies in the market include BERICAP GmbH & Company KG, SKS Bottle & Packaging Inc *List Not Exhaustive, Guala Closures Group, Crown Holdings Inc, AptarGroup Inc, Amcor PLC, Albea Group, Coral Products PLC, Nippon closures Co Ltd, Tetra Pak International SA, Berry Global, Pelliconi & C SPA.

3. What are the main segments of the Europe Plastic Caps and Closures Industry?

The market segments include Material, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 million as of 2022.

5. What are some drivers contributing to market growth?

Product Innovation to Aid Product Differentiation and Branding; Rising Demand for Smaller-sized Packs.

6. What are the notable trends driving market growth?

Beverage Industry is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives.

8. Can you provide examples of recent developments in the market?

June 2021 - Guala Closures Group launched latest product in its sustainable range: Divinum Blossom, a screwcap for wine made with recyclable and renewable materials as part of its ongoing ambitious eco-design strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Plastic Caps and Closures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Plastic Caps and Closures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Plastic Caps and Closures Industry?

To stay informed about further developments, trends, and reports in the Europe Plastic Caps and Closures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence