Key Insights

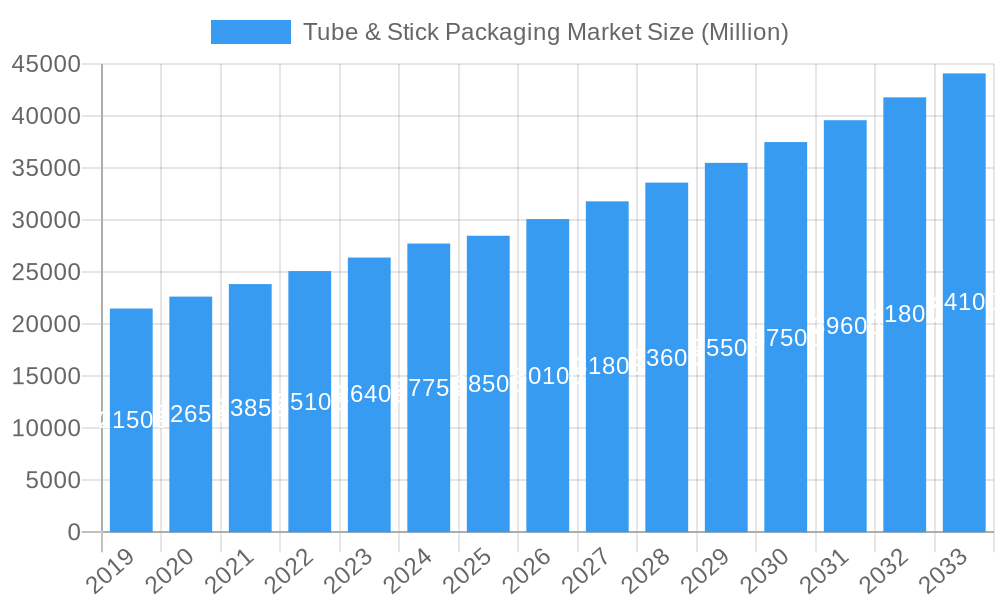

The global Tube & Stick Packaging Market is poised for robust growth, projected to reach a substantial market size of approximately $28,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.60% through 2033. This expansion is primarily fueled by the escalating demand across diverse applications, including personal care, healthcare, food, and homecare. The convenience and functionality offered by tube and stick packaging, such as easy dispensing, portion control, and enhanced product protection, are key drivers of this market's upward trajectory. Innovations in materials, particularly the increasing adoption of sustainable options like recycled plastics and advanced paper-based solutions, are further propelling market adoption. The shift towards eco-friendly packaging is not only responding to consumer preferences but also aligning with stringent regulatory mandates, creating a favorable environment for manufacturers investing in sustainable technologies.

Tube & Stick Packaging Market Market Size (In Billion)

While the market demonstrates strong growth potential, certain restraints are noteworthy. The fluctuating raw material costs, particularly for plastics and aluminium, can impact profit margins and necessitate strategic sourcing and price hedging. Furthermore, intense competition among established players and emerging entrants can lead to price pressures and a need for continuous product differentiation through enhanced features and aesthetic appeal. However, the market's inherent resilience, coupled with ongoing advancements in manufacturing processes and material science, is expected to mitigate these challenges. The strategic focus on developing advanced barrier properties, tamper-evident features, and user-friendly designs will be crucial for sustained success. The market's segmentation by packaging type (squeeze, twist, cartridge) and material type (plastic, paper, aluminium) offers significant opportunities for specialized product development and targeted marketing strategies across various end-use industries.

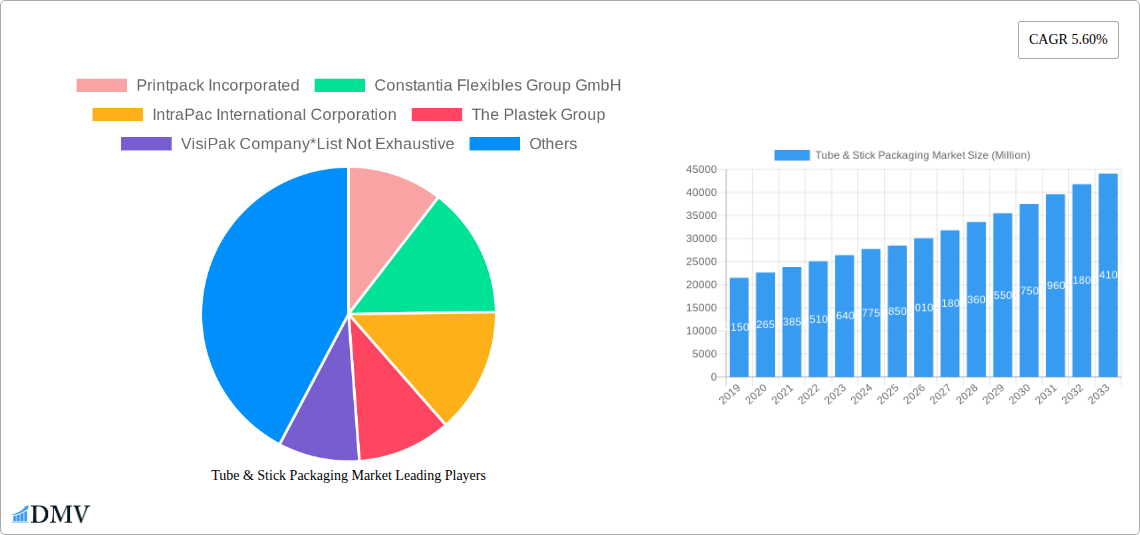

Tube & Stick Packaging Market Company Market Share

This in-depth report offers an exhaustive analysis of the global Tube & Stick Packaging Market, examining its intricate composition, evolutionary trends, and strategic future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report provides critical insights for stakeholders seeking to navigate this dynamic sector. We delve into market concentration, innovation drivers, regulatory landscapes, and emerging opportunities across key segments including Squeeze Tubes, Twist Tubes, Cartridge Packaging, Plastic Tubes, Paper Tubes, Aluminium Tubes, and applications spanning Personal Care, Healthcare, Food, and Homecare.

Tube & Stick Packaging Market Market Composition & Trends

The Tube & Stick Packaging Market exhibits a moderately consolidated structure, with key players like Amcor PLC and Berry Global Inc. holding significant market share. Innovation catalysts are primarily driven by the demand for enhanced functionality, sustainability, and consumer convenience. The regulatory landscape, particularly concerning material safety and recyclability, is continuously evolving, influencing packaging material choices and design. Substitute products, such as rigid containers and pouches, pose a competitive challenge, necessitating continuous product development. End-user profiles are diverse, ranging from premium cosmetic brands seeking sophisticated dispensing solutions to pharmaceutical companies prioritizing product integrity and tamper-proofing. Merger and acquisition (M&A) activities are prevalent, with strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, the acquisition of a specialized tube manufacturer by a larger packaging solutions provider for an estimated value of $50 Million in 2023 underscores this trend. Market share distribution is closely monitored, with leading companies striving to maintain and grow their positions through technological advancements and strategic partnerships.

Tube & Stick Packaging Market Industry Evolution

The Tube & Stick Packaging Market has witnessed a remarkable evolutionary journey, characterized by consistent growth trajectories and significant technological advancements. Over the historical period of 2019–2024, the market experienced a steady Compound Annual Growth Rate (CAGR) of approximately 5.5%, driven by escalating consumer demand for convenient and hygienic packaging solutions. The base year of 2025 marks a pivotal point, with an estimated market value projected to reach $25,000 Million. This growth is intrinsically linked to the increasing popularity of personal care products, cosmetics, and healthcare items that heavily rely on tube and stick formats for their application and preservation.

Technological innovations have been instrumental in shaping this evolution. The development of advanced barrier properties in plastic and laminate tubes has significantly improved product shelf-life and protection against environmental factors, a critical factor for pharmaceuticals and sensitive cosmetic formulations. Furthermore, the adoption of smart packaging features, such as tamper-evident seals and integrated applicators, has enhanced consumer trust and product usability. The shift towards sustainable packaging solutions has also spurred innovation. Manufacturers are increasingly investing in research and development for biodegradable, compostable, and recycled materials, responding to growing consumer and regulatory pressures for eco-friendly alternatives. This includes the introduction of mono-material tubes and the optimization of paper-based packaging for certain applications.

Consumer demands have also played a crucial role in this market's evolution. The quest for portability, ease of use, and aesthetic appeal in personal care and cosmetic products has propelled the demand for sleek and functional tube and stick packaging. The healthcare sector’s need for precise dosing and sterile delivery mechanisms has further fueled the development of specialized cartridge and dispensing systems. The food industry is also witnessing a growing adoption of tube packaging for condiments, spreads, and single-serve portions, driven by convenience and portion control.

The market's growth trajectory is further supported by increasing disposable incomes in emerging economies, leading to higher consumption of products that utilize these packaging formats. The forecast period of 2025–2033 anticipates a sustained CAGR of around 6.2%, fueled by continued innovation, expanding application areas, and a growing emphasis on sustainability within the packaging industry. The market's ability to adapt to evolving consumer preferences and regulatory mandates will be key to its continued success.

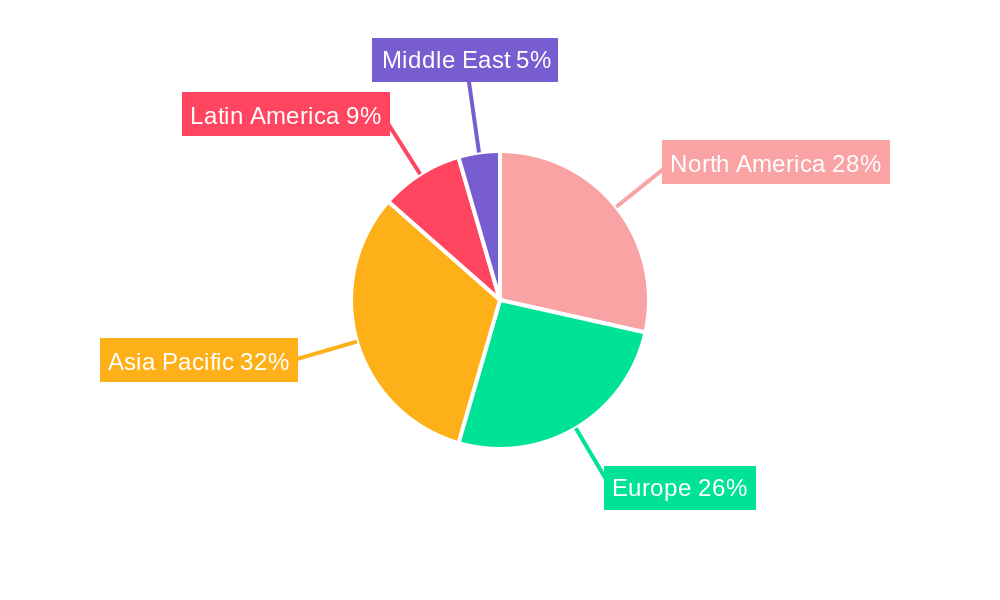

Leading Regions, Countries, or Segments in Tube & Stick Packaging Market

The Tube & Stick Packaging Market is dominated by the Plastic material type and the Personal Care application segment, demonstrating the most robust growth and market penetration. North America and Europe currently lead in terms of market value, driven by established consumer bases with high disposable incomes and a strong demand for premium personal care and healthcare products.

Key Drivers for Dominance:

- Personal Care Application: This segment's dominance is fueled by the extensive use of tubes and sticks in skincare, haircare, oral care, and cosmetic products. The convenience, hygiene, and precise application offered by these formats are highly valued by consumers.

- Plastic Material Type: Plastics, particularly polyethylene (PE) and polypropylene (PP), are preferred for their versatility, durability, cost-effectiveness, and excellent barrier properties. The ability to create complex shapes and provide good product protection makes them ideal for a wide range of tube and stick applications.

- North America & Europe: These regions exhibit strong consumer demand for innovative and premium packaging. Significant investment in research and development, coupled with a mature retail infrastructure, supports the widespread adoption of advanced tube and stick packaging solutions. Stringent quality and safety regulations in these regions also drive the demand for high-quality, reliable packaging.

In-depth Analysis of Dominance Factors:

The Personal Care sector, representing an estimated 40% of the total market value, consistently drives demand for Squeeze Tubes and Cartridge Packaging. Skincare formulations, including moisturizers, serums, and sunscreens, frequently utilize squeeze tubes for controlled dispensing. Similarly, the demand for lipsticks, lip glosses, and concealers fuels the market for stick applicators. The Healthcare application segment, accounting for approximately 25% of the market, is a significant contributor, with a growing reliance on tubes and cartridges for topical medications, ointments, and dental care products. The need for sterility and precise dosage delivery in healthcare applications further solidifies the position of specialized tube and stick packaging.

Within the material types, Plastic packaging commands an estimated market share of 65%, owing to its inherent advantages. The continuous innovation in plastic resin technologies, including the development of enhanced barrier films and recycled content options, further strengthens its market position. While Aluminium tubes (around 20% market share) offer excellent barrier properties and are favored for certain high-end cosmetics and pharmaceutical products, their higher cost and limited design flexibility compared to plastics often restrict their widespread adoption. Paper tubes, representing a smaller but growing segment (around 15%), are gaining traction due to their sustainability appeal, particularly for dry products and eco-conscious brands.

Geographically, North America (estimated 30% market share) and Europe (estimated 30% market share) are the leading regions. Their mature economies, high per capita consumption of personal care and healthcare products, and the presence of major global brands contribute significantly to their market leadership. The Asia-Pacific region is emerging as a rapidly growing market, driven by increasing urbanization, a burgeoning middle class, and expanding e-commerce penetration, which boosts the demand for packaged goods.

Tube & Stick Packaging Market Product Innovations

Product innovations in the Tube & Stick Packaging Market are largely driven by the pursuit of enhanced user experience, sustainability, and functionality. Advancements in dispensing mechanisms, such as airless pump tubes and precision applicators, offer superior product protection and controlled dosage, a key selling proposition for premium cosmetics and pharmaceuticals. The development of mono-material plastic tubes, designed for improved recyclability, addresses growing environmental concerns. Furthermore, innovations in barrier technologies within laminate and plastic tubes significantly extend product shelf-life and maintain product integrity. The introduction of integrated stick applicators with cooling or massage functionalities for eye creams exemplifies a trend towards multi-functional packaging solutions.

Propelling Factors for Tube & Stick Packaging Market Growth

The Tube & Stick Packaging Market is propelled by a confluence of factors. Technological advancements in material science and manufacturing processes are enabling the creation of more sustainable, functional, and aesthetically pleasing packaging. The burgeoning global demand for personal care and cosmetic products, particularly in emerging economies, is a significant growth driver. Increasing consumer preference for convenience, portability, and hygiene in product packaging further fuels adoption. Regulatory support for sustainable packaging solutions, coupled with growing consumer awareness regarding environmental impact, is encouraging the development and use of eco-friendly tube and stick packaging. Economic growth and rising disposable incomes worldwide are contributing to increased spending on consumer goods that utilize these packaging formats.

Obstacles in the Tube & Stick Packaging Market Market

Despite its robust growth, the Tube & Stick Packaging Market faces several obstacles. Stringent regulatory compliance concerning material safety, recyclability, and chemical migration can pose challenges for manufacturers, particularly when introducing novel materials or designs. Fluctuations in raw material prices, especially for plastics and aluminium, can impact production costs and profit margins. Supply chain disruptions, as witnessed in recent global events, can lead to production delays and increased logistics expenses. Intense competition from alternative packaging formats, such as rigid containers and pouches, necessitates continuous innovation and cost optimization. Furthermore, the initial investment required for advanced manufacturing technologies can be a barrier for smaller players.

Future Opportunities in Tube & Stick Packaging Market

The Tube & Stick Packaging Market is ripe with future opportunities. The growing demand for sustainable and eco-friendly packaging presents a significant avenue for innovation in biodegradable, compostable, and recycled materials. The expansion of e-commerce logistics necessitates robust and protective packaging solutions, a niche where tubes and sticks can excel. The increasing consumer interest in personalized and on-the-go beauty and wellness products will drive demand for smaller, portable stick and tube formats. Emerging markets, with their rapidly expanding consumer bases, offer substantial growth potential. Furthermore, the integration of smart packaging technologies, such as NFC tags or QR codes, for enhanced product traceability and consumer engagement, represents a promising frontier.

Major Players in the Tube & Stick Packaging Market Ecosystem

- Printpack Incorporated

- Constantia Flexibles Group GmbH

- IntraPac International Corporation

- The Plastek Group

- VisiPak Company

- World Wide Packaging LLC

- Essel Propack Limited

- Amcor PLC

- CCL Industries Inc

- Albea S A

- Plastube Incorporated

- Berry Global Inc

- Clariant International Ltd

- Armbrust Paper Tubes Inc

Key Developments in Tube & Stick Packaging Market Industry

- 2024: Launch of innovative mono-material PE tubes designed for enhanced recyclability by a leading global packaging manufacturer.

- 2023: Acquisition of a specialized dispensing technology company by a major tube manufacturer to enhance product innovation in the cosmetic sector.

- 2023: Introduction of plant-based laminate tubes for personal care applications, emphasizing sustainability and reduced carbon footprint.

- 2022: Significant investment in advanced barrier coating technologies for plastic tubes to improve product shelf-life in the pharmaceutical industry.

- 2021: Development of tamper-evident stick packaging solutions with integrated security features for high-value cosmetic products.

- 2020: Expansion of production capacity for paper-based tubes to meet the growing demand for sustainable packaging alternatives.

- 2019: Introduction of airless pump tube technology for sensitive formulations in skincare, offering superior protection against oxidation and contamination.

Strategic Tube & Stick Packaging Market Market Forecast

The strategic forecast for the Tube & Stick Packaging Market is exceptionally positive, driven by sustained innovation and evolving consumer preferences. The market's trajectory is expected to be shaped by a strong emphasis on sustainability, leading to increased adoption of recycled and biodegradable materials. Continued technological advancements in dispensing systems will enhance product functionality and consumer convenience, particularly in the personal care and healthcare sectors. The expanding middle class in emerging economies will unlock new consumer bases and drive demand. The market's ability to adapt to evolving regulatory landscapes and to capitalize on the growing demand for premium, functional, and eco-conscious packaging will be critical for achieving its projected growth potential.

Tube & Stick Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Squeeze

- 1.2. Twist

- 1.3. Cartridge

- 1.4. Other Packaging Types

-

2. Material Type

- 2.1. Plastic

- 2.2. Paper

- 2.3. Aluminium

- 2.4. Other Materials

-

3. Application

- 3.1. Personal Care

- 3.2. Healthcare

- 3.3. Food

- 3.4. Homecare

- 3.5. Other Applications

Tube & Stick Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Tube & Stick Packaging Market Regional Market Share

Geographic Coverage of Tube & Stick Packaging Market

Tube & Stick Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Convenience Packaging

- 3.3. Market Restrains

- 3.3.1. ; Consumer Preference of Wine and Liquor Over Beer in a Few Regions

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Continue Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Squeeze

- 5.1.2. Twist

- 5.1.3. Cartridge

- 5.1.4. Other Packaging Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic

- 5.2.2. Paper

- 5.2.3. Aluminium

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Care

- 5.3.2. Healthcare

- 5.3.3. Food

- 5.3.4. Homecare

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Squeeze

- 6.1.2. Twist

- 6.1.3. Cartridge

- 6.1.4. Other Packaging Types

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic

- 6.2.2. Paper

- 6.2.3. Aluminium

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal Care

- 6.3.2. Healthcare

- 6.3.3. Food

- 6.3.4. Homecare

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Europe Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Squeeze

- 7.1.2. Twist

- 7.1.3. Cartridge

- 7.1.4. Other Packaging Types

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic

- 7.2.2. Paper

- 7.2.3. Aluminium

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal Care

- 7.3.2. Healthcare

- 7.3.3. Food

- 7.3.4. Homecare

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Asia Pacific Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Squeeze

- 8.1.2. Twist

- 8.1.3. Cartridge

- 8.1.4. Other Packaging Types

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic

- 8.2.2. Paper

- 8.2.3. Aluminium

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal Care

- 8.3.2. Healthcare

- 8.3.3. Food

- 8.3.4. Homecare

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Latin America Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Squeeze

- 9.1.2. Twist

- 9.1.3. Cartridge

- 9.1.4. Other Packaging Types

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic

- 9.2.2. Paper

- 9.2.3. Aluminium

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal Care

- 9.3.2. Healthcare

- 9.3.3. Food

- 9.3.4. Homecare

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Middle East Tube & Stick Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10.1.1. Squeeze

- 10.1.2. Twist

- 10.1.3. Cartridge

- 10.1.4. Other Packaging Types

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Plastic

- 10.2.2. Paper

- 10.2.3. Aluminium

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal Care

- 10.3.2. Healthcare

- 10.3.3. Food

- 10.3.4. Homecare

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Printpack Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Constantia Flexibles Group GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IntraPac International Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Plastek Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VisiPak Company*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 World Wide Packaging LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Essel Propack Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amcor PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CCL Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Albea S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Plastube Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clariant International Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Armbrust Paper Tubes Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Printpack Incorporated

List of Figures

- Figure 1: Global Tube & Stick Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Tube & Stick Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 3: North America Tube & Stick Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 4: North America Tube & Stick Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Tube & Stick Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Tube & Stick Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Tube & Stick Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Tube & Stick Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Tube & Stick Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tube & Stick Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 11: Europe Tube & Stick Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 12: Europe Tube & Stick Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Tube & Stick Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Tube & Stick Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Tube & Stick Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Tube & Stick Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Tube & Stick Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tube & Stick Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 19: Asia Pacific Tube & Stick Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 20: Asia Pacific Tube & Stick Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Tube & Stick Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Tube & Stick Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Tube & Stick Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Tube & Stick Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Tube & Stick Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Tube & Stick Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 27: Latin America Tube & Stick Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 28: Latin America Tube & Stick Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Latin America Tube & Stick Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Latin America Tube & Stick Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Tube & Stick Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Tube & Stick Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Tube & Stick Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Tube & Stick Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 35: Middle East Tube & Stick Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 36: Middle East Tube & Stick Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 37: Middle East Tube & Stick Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Middle East Tube & Stick Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East Tube & Stick Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East Tube & Stick Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Tube & Stick Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Tube & Stick Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 6: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Tube & Stick Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 10: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Tube & Stick Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 15: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Tube & Stick Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 18: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 19: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Tube & Stick Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Tube & Stick Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 22: Global Tube & Stick Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Tube & Stick Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Tube & Stick Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tube & Stick Packaging Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Tube & Stick Packaging Market?

Key companies in the market include Printpack Incorporated, Constantia Flexibles Group GmbH, IntraPac International Corporation, The Plastek Group, VisiPak Company*List Not Exhaustive, World Wide Packaging LLC, Essel Propack Limited, Amcor PLC, CCL Industries Inc, Albea S A, Plastube Incorporated, Berry Global Inc, Clariant International Ltd, Armbrust Paper Tubes Inc.

3. What are the main segments of the Tube & Stick Packaging Market?

The market segments include Packaging Type, Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Convenience Packaging.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Continue Significant Demand.

7. Are there any restraints impacting market growth?

; Consumer Preference of Wine and Liquor Over Beer in a Few Regions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tube & Stick Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tube & Stick Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tube & Stick Packaging Market?

To stay informed about further developments, trends, and reports in the Tube & Stick Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence