Key Insights

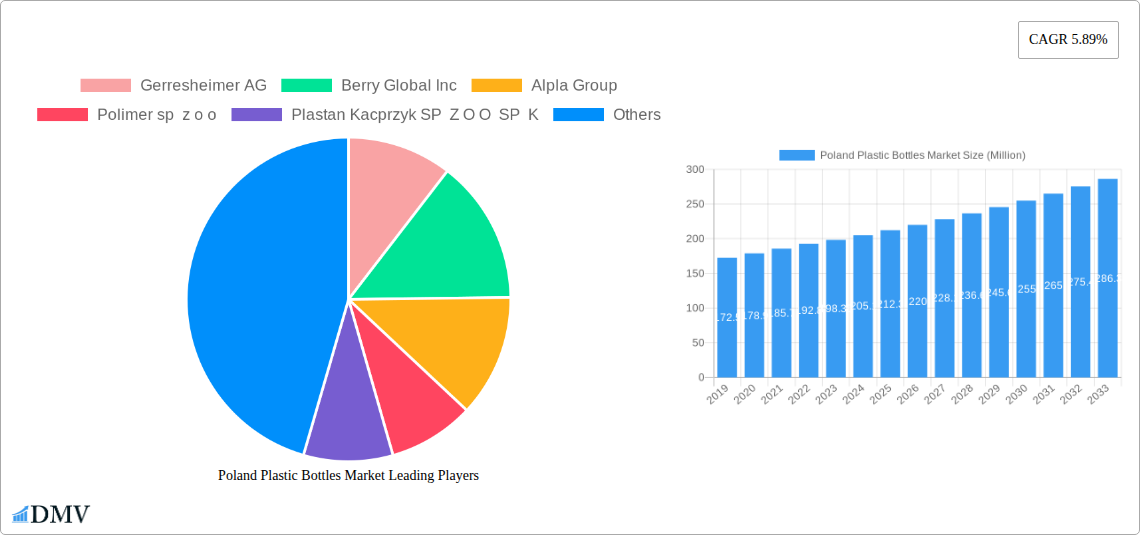

The Poland Plastic Bottles Market is poised for robust growth, demonstrating a projected Compound Annual Growth Rate (CAGR) of 5.89% over the forecast period of 2025-2033. Starting from a market size of USD 198.35 million in 2025, this expansion signifies a dynamic and expanding industry. The market's momentum is primarily fueled by increasing consumer demand for convenient and portable packaging solutions across various sectors. Key drivers include the ever-growing food and beverage industry, which heavily relies on plastic bottles for products like bottled water, carbonated soft drinks, and juices. Furthermore, the pharmaceutical sector's consistent need for sterile and safe packaging for medicines, alongside the burgeoning personal care and toiletries market, contributes significantly to this upward trajectory. The convenience and cost-effectiveness of plastic bottles, particularly those made from Polyethylene Terephthalate (PET) and Polyethylene (PE), make them a preferred choice for both manufacturers and consumers.

Poland Plastic Bottles Market Market Size (In Million)

Looking ahead, the market's evolution will be shaped by several emerging trends. A strong focus on sustainability and the circular economy will drive innovation in recycled plastics and lightweight bottle designs, aiming to reduce environmental impact. Advancements in manufacturing technologies are expected to enhance production efficiency and product quality. However, the market also faces certain restraints, including increasing regulatory scrutiny regarding plastic waste management and the growing adoption of alternative packaging materials by some environmentally conscious brands. Despite these challenges, the inherent versatility and cost-efficiency of plastic bottles, coupled with anticipated population growth and rising disposable incomes in Poland, are expected to sustain a healthy market expansion. Key segments within the market include PET, PE, and PP resins, with end-use industries such as Food & Beverage, Pharmaceuticals, and Personal Care & Toiletries leading the demand.

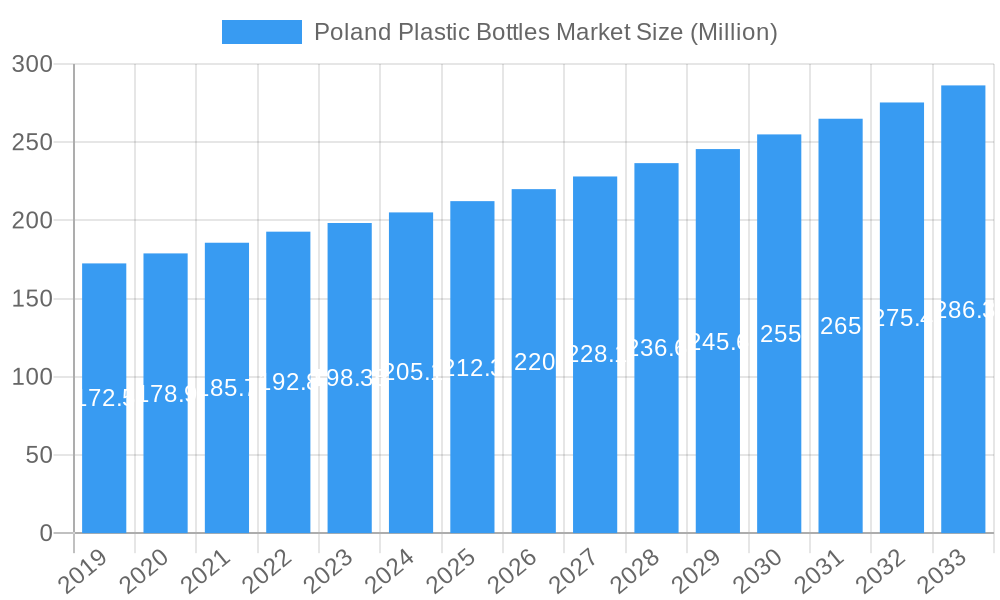

Poland Plastic Bottles Market Company Market Share

This in-depth market report offers a granular analysis of the Poland Plastic Bottles Market, a critical segment within the European packaging landscape. With a focus on historical trends (2019-2024), current dynamics (Base Year: 2025), and a robust forecast period (2025-2033), this study provides invaluable insights for stakeholders seeking to navigate this evolving market. We meticulously dissect market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities, all underpinned by a comprehensive competitive landscape and key industry developments. Utilizing high-ranking keywords such as "Poland plastic bottles," "PET bottles," "plastic packaging market," "beverage packaging," "pharmaceutical packaging," "sustainable packaging," and "EU SUP directive," this report is optimized for maximum search visibility and stakeholder engagement.

Poland Plastic Bottles Market Market Composition & Trends

The Poland Plastic Bottles Market is characterized by a dynamic interplay of market concentration, technological innovation, evolving regulatory frameworks, and shifting end-user demands. While established players hold significant market share, emerging companies are increasingly contributing to innovation and competition. Key trends include a strong emphasis on sustainable packaging solutions, driven by consumer preferences and stringent environmental regulations, particularly the EU Single-Use Plastics (SUP) Directive. The adoption of recycled PET (rPET) and lightweighting technologies are paramount. Mergers and acquisitions (M&A) are expected to play a role in market consolidation, with potential deal values reaching into the tens of millions.

- Market Concentration: A moderate to high level of concentration is observed, with a few key players dominating production.

- Innovation Catalysts: Focus on lightweighting, enhanced barrier properties, increased recyclability, and the incorporation of recycled content.

- Regulatory Landscape: Strong influence of EU directives, particularly the SUP Directive, mandating increased recycled content and reduced plastic waste.

- Substitute Products: Growing competition from glass and aluminum, particularly for premium beverage segments, but plastic bottles retain advantages in cost and durability.

- End-User Profiles: Diverse, with significant demand from the Food & Beverage, Pharmaceuticals, and Personal Care sectors.

- M&A Activities: Potential for consolidation to achieve economies of scale and enhance technological capabilities, with projected deal values in the XX to XX Million range.

Poland Plastic Bottles Market Industry Evolution

The Poland Plastic Bottles Market has witnessed a significant evolutionary trajectory, shaped by a confluence of technological advancements, economic factors, and evolving consumer preferences over the historical period (2019-2024) and projected into the forecast period (2025-2033). During the historical phase, the market saw steady growth driven by increasing per capita consumption of packaged goods, particularly in the beverage and personal care sectors. The base year (2025) marks a pivotal point where the impact of increasingly stringent environmental regulations, like the EU SUP Directive, becomes more pronounced, influencing material choices and design. Technological advancements have been a constant catalyst, with improvements in PET (Polyethylene Terephthalate) resin quality, leading to lighter yet stronger bottles, and advancements in blow molding technologies enabling greater design flexibility and cost efficiencies. The adoption of barrier technologies has expanded the application of plastic bottles in sensitive product categories like pharmaceuticals and certain food products, ensuring extended shelf life and product integrity.

Consumer demand has also undergone a significant shift. There is a discernible growing preference for convenience and portability, directly benefiting the plastic bottle segment. However, this is increasingly tempered by a heightened awareness of environmental sustainability. Consumers are actively seeking brands that demonstrate a commitment to eco-friendly packaging, pushing manufacturers to invest in recyclable materials and closed-loop systems. This has spurred innovation in areas such as bio-based plastics and advanced recycling techniques. For instance, the growth rate of PET bottle production has consistently remained in the XX% to XX% range during the historical period, reflecting robust demand. Projections for the forecast period (2025-2033) indicate a continued positive growth trajectory, albeit with a greater emphasis on sustainable solutions, with an anticipated average annual growth rate of XX% to XX%. This evolution is further accelerated by investments in local manufacturing capabilities and the integration of digital technologies in the production process, enhancing efficiency and traceability.

Leading Regions, Countries, or Segments in Poland Plastic Bottles Market

The Beverage end-use industry stands as the dominant force within the Poland Plastic Bottles Market, showcasing remarkable resilience and growth potential across its diverse sub-segments. Within this sector, Bottled Water and Carbonated Soft Drinks are primary demand drivers, benefiting from widespread consumer adoption and large-scale production by major beverage manufacturers. The convenience, affordability, and safety offered by plastic bottles, particularly PET, make them the preferred choice for these high-volume products. The market is further bolstered by substantial investments in bottling infrastructure and distribution networks across Poland.

- Resin Dominance: Polyethylene Terephthalate (PET) emerges as the leading resin due to its exceptional clarity, strength-to-weight ratio, barrier properties, and recyclability. Its widespread application in beverages and food packaging makes it the cornerstone of the market.

- Key Drivers: Cost-effectiveness, excellent visual appeal for branding, and established recycling infrastructure.

- End-use Industry Leadership:

- Beverage:

- Bottled Water: Ubiquitous demand driven by health consciousness and on-the-go consumption. Significant investment in lightweighting and rPET integration by leading brands.

- Carbonated Soft Drinks: High demand due to carbonation pressure requirements, where PET's strength is critical. Focus on innovative cap designs and barrier technologies to maintain fizz.

- Alcoholic Beverages: Growing adoption for certain categories like pre-mixed cocktails and lower-alcohol beverages, offering a safer and lighter alternative to glass.

- Juices & Energy Drinks: Consistent demand driven by health trends and busy lifestyles. Advanced barrier properties are crucial for preserving flavor and nutritional value.

- Food: Significant demand for oils, sauces, and condiments, where plastic bottles offer safety and convenience.

- Pharmaceuticals: Increasing use of PET bottles for syrups, suspensions, and solid dosage forms, driven by safety, tamper-evidence, and cost advantages over glass. Regulatory compliance is a critical factor.

- Personal Care & Toiletries: Consistent demand for shampoos, conditioners, lotions, and cleaning products, where durability, design flexibility, and cost are key considerations.

- Beverage:

The sustained demand in these sub-segments, coupled with ongoing product development and innovation, solidifies the dominance of the Beverage sector and its associated resins like PET within the Polish plastic bottles market.

Poland Plastic Bottles Market Product Innovations

Product innovations in the Poland Plastic Bottles Market are primarily focused on enhancing sustainability and functionality. Lightweighting remains a key area, with manufacturers continually reducing bottle weight without compromising structural integrity, thereby lowering material costs and transportation emissions. The increasing integration of recycled PET (rPET) content, often reaching up to 100% in certain applications, is a significant innovation driven by regulatory mandates and consumer demand for circular economy solutions. Furthermore, advancements in barrier technologies are extending the shelf life of sensitive products, while innovative design features like integrated handles, ergonomic grips, and tamper-evident closures are enhancing user convenience and brand appeal. For example, new PET bottles are being developed with enhanced UV protection for light-sensitive liquids, and some are incorporating advanced antimicrobial properties for increased hygiene.

Propelling Factors for Poland Plastic Bottles Market Growth

The Poland Plastic Bottles Market is propelled by several key factors that fuel its sustained growth. A primary driver is the robust expansion of the Food and Beverage industry, particularly bottled water and carbonated soft drinks, which represent significant end-use segments for plastic bottles. The growing consumer preference for convenience and portability further amplifies demand. Economically, Poland's steady economic development and rising disposable incomes contribute to increased per capita consumption of packaged goods.

- Technological Advancements: Innovations in PET resin technology, lightweighting, and advanced barrier properties enhance product performance and cost-effectiveness.

- Regulatory Support: While regulations like the EU SUP Directive present challenges, they also drive innovation in sustainable packaging, such as increased recycled content, creating new market opportunities.

- Consumer Trends: The demand for convenience, hygiene, and single-serve packaging continues to favor plastic bottles.

- Industrial Growth: Expansion in sectors like pharmaceuticals and personal care, requiring safe and reliable packaging solutions.

Obstacles in the Poland Plastic Bottles Market Market

Despite its growth potential, the Poland Plastic Bottles Market faces several significant obstacles. The most prominent is the increasing regulatory scrutiny and pressure to reduce plastic waste, stemming from EU directives such as the SUP Directive. This necessitates substantial investment in recycling infrastructure and the transition to more sustainable materials. Fluctuations in raw material prices, particularly PET resin, can impact manufacturing costs and profitability.

- Environmental Concerns & Regulations: Growing public and governmental pressure to reduce single-use plastic consumption and improve recycling rates.

- Competition from Alternatives: Increasing adoption of glass and aluminum packaging, especially in premium beverage segments, poses a competitive threat.

- Supply Chain Disruptions: Global and regional supply chain volatilities can affect the availability and cost of raw materials.

- Consumer Perception: Negative consumer perception surrounding plastic waste can influence purchasing decisions, requiring manufacturers to actively communicate sustainability efforts.

Future Opportunities in Poland Plastic Bottles Market

The Poland Plastic Bottles Market is poised to capitalize on several emerging opportunities. The growing demand for sustainable packaging solutions presents a significant avenue for growth, with increasing adoption of rPET and bio-based plastics. The expansion of the e-commerce sector necessitates robust and lightweight packaging, which plastic bottles are well-suited to provide. Furthermore, the pharmaceutical industry's continued reliance on safe, sterile, and cost-effective packaging offers ongoing opportunities for growth and innovation in specialized bottle designs and barrier technologies.

- Sustainable Packaging Solutions: Development and adoption of high-percentage rPET, bio-plastics, and advanced recycling technologies.

- E-commerce Packaging: Lightweight, durable, and tamper-evident plastic bottles for online retail.

- Pharmaceutical and Healthcare Growth: Increasing demand for specialized plastic bottles for medications and health products.

- Innovation in Design: Opportunities in personalized packaging, smart packaging features, and enhanced user experience.

Major Players in the Poland Plastic Bottles Market Ecosystem

- Gerresheimer AG

- Berry Global Inc

- Alpla Group

- Polimer sp z o o

- Plastan Kacprzyk SP Z O O SP K

- Bech Packaging sp z o o

- PetRing Sp z o o

- Rosinski Packaging Sp z o o

- Embaco A/S

- K G International Inc

Key Developments in Poland Plastic Bottles Market Industry

- August 2024: ALPLA unveiled a new PET bottle tailored for Polish mineral water brands Staropolanka and Krystynka. This innovative packaging solution is safe and affordable and mirrors its glass predecessor's premium aesthetic. The new PET bottle retains its original shape and familiar feel, is lighter, and offers more capacity. Weighing in at a mere 32 grams, which is only one-sixth the weight of the glass version, the bottle can hold 380 millilitres of water. This is an increase of 50 millilitres compared to the glass bottle, all while keeping the same external dimensions. The new bottle is fully recyclable in line with ALPLA's sustainability commitment.

- May 2023: Poland adopted a law to progressively implement the EU directive's obligations between 2023 and 2025. In Poland, the packaging industry consumes nearly 35% of the plastics processed by Polish manufacturers. However, the recycling rate for plastics lagged behind that of other materials. Following the enforcement of the EU SUP Directive on July 3, 2021, which aims to mitigate the environmental impact of specific plastic products, the Polish government was mandated to enact corresponding national legislation.

Strategic Poland Plastic Bottles Market Market Forecast

The strategic forecast for the Poland Plastic Bottles Market (2025-2033) is overwhelmingly positive, driven by a confluence of robust demand from key end-use industries and an increasing imperative for sustainable packaging solutions. The Food & Beverage sector, particularly bottled water and carbonated soft drinks, will continue to be a primary growth engine, benefiting from stable consumer preferences and expanding distribution channels. The ongoing integration of recycled PET (rPET) and the development of lightweighting technologies will not only address environmental concerns but also enhance cost-competitiveness, further solidifying plastic bottles' market position. The pharmaceutical and personal care sectors will also contribute significantly, driven by their consistent need for safe, reliable, and cost-effective packaging. Emerging opportunities in e-commerce and innovative design are expected to unlock new avenues for market expansion, painting a promising picture for the industry's future.

Poland Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Re

-

2. End-use Industries

- 2.1. Food

-

2.2. Beverage

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices & Energy Drinks

- 2.2.5. Other Beverage

- 2.3. Pharmaceuticals

- 2.4. Personal Care & Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints & Coatings

- 2.8. Other End-use Industries

Poland Plastic Bottles Market Segmentation By Geography

- 1. Poland

Poland Plastic Bottles Market Regional Market Share

Geographic Coverage of Poland Plastic Bottles Market

Poland Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.4. Market Trends

- 3.4.1. Demand For Bottled Beverage Drives Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices & Energy Drinks

- 5.2.2.5. Other Beverage

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care & Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints & Coatings

- 5.2.8. Other End-use Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gerresheimer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpla Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Polimer sp z o o

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plastan Kacprzyk SP Z O O SP K

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bech Packaging sp z o o

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PetRing Sp z o o

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rosinski Packaging Sp z o o

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Embaco A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 K G International Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gerresheimer AG

List of Figures

- Figure 1: Poland Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Poland Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Poland Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 4: Poland Plastic Bottles Market Volume Million Forecast, by End-use Industries 2020 & 2033

- Table 5: Poland Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Poland Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Poland Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Poland Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Poland Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 10: Poland Plastic Bottles Market Volume Million Forecast, by End-use Industries 2020 & 2033

- Table 11: Poland Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Poland Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Plastic Bottles Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Poland Plastic Bottles Market?

Key companies in the market include Gerresheimer AG, Berry Global Inc, Alpla Group, Polimer sp z o o, Plastan Kacprzyk SP Z O O SP K, Bech Packaging sp z o o, PetRing Sp z o o, Rosinski Packaging Sp z o o, Embaco A/S, K G International Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Poland Plastic Bottles Market?

The market segments include Resin, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 198.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Demand For Bottled Beverage Drives Market Growth.

7. Are there any restraints impacting market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

8. Can you provide examples of recent developments in the market?

August 2024: ALPLA unveiled a new PET bottle tailored for Polish mineral water brands Staropolanka and Krystynka. This innovative packaging solution is safe and affordable and mirrors its glass predecessor's premium aesthetic. The new PET bottle retains its original shape and familiar feel, is lighter, and offers more capacity. Weighing in at a mere 32 grams, which is only one-sixth the weight of the glass version, the bottle can hold 380 millilitres of water. This is an increase of 50 millilitres compared to the glass bottle, all while keeping the same external dimensions. The new bottle is fully recyclable in line with ALPLA's sustainability commitment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Poland Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence