Key Insights

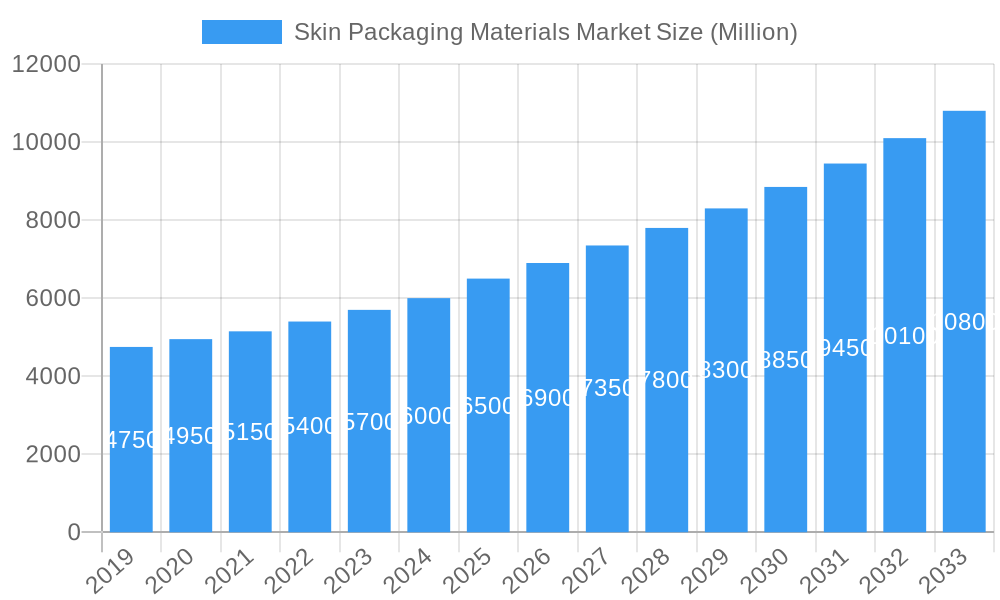

The global Skin Packaging Materials Market is projected to expand significantly, driven by increasing consumer demand for enhanced convenience and extended shelf life in food products. The market is anticipated to reach a size of $12.42 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4%. Skin packaging's superior protective barrier, which minimizes spoilage and preserves freshness, directly addresses these consumer needs. The medical device sector also presents a key growth opportunity, requiring secure, sterile, and tamper-evident packaging. Innovations in material science, focusing on sustainable and high-performance films, are further fueling market expansion, with a notable trend towards recyclable and bio-based alternatives.

Skin Packaging Materials Market Market Size (In Billion)

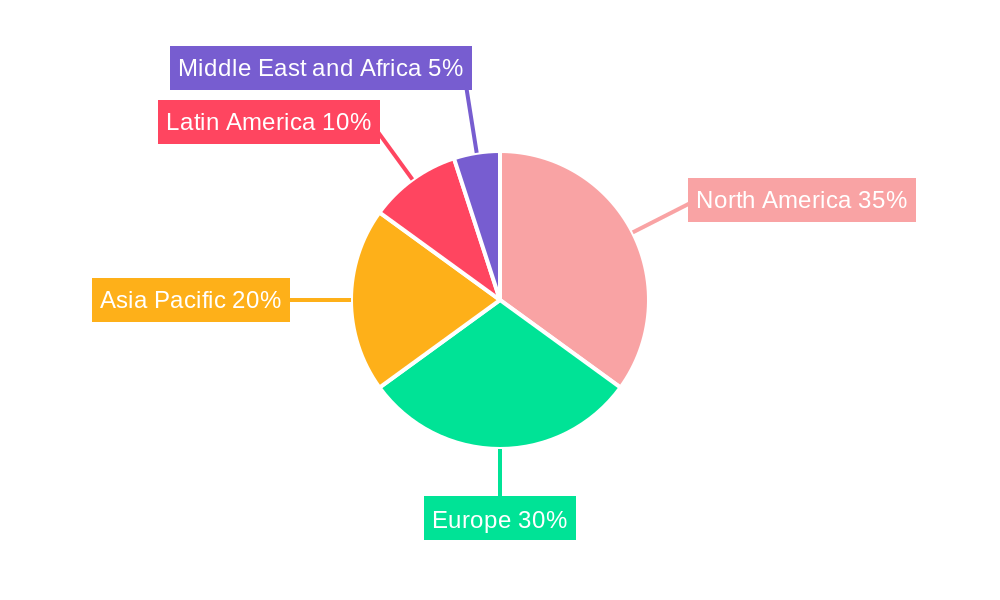

While the market demonstrates strong growth potential, certain factors may influence its trajectory. The comparatively higher cost of skin packaging compared to conventional methods could present a barrier for price-sensitive applications. Additionally, raw material availability and price volatility can pose economic challenges. The market is segmented across key applications, with the Food segment, including Meat, Fish and Seafood, Processed Food, and Cheese, being the largest. Industrial and Medical Devices segments are also experiencing robust growth. Geographically, North America and Europe are expected to lead due to established food processing industries and stringent quality standards. However, the Asia Pacific region is poised for the most rapid expansion, driven by rising disposable incomes and an increasing demand for convenient, packaged food products. Leading industry players are actively investing in innovation and production capacity to meet the escalating global demand for advanced skin packaging solutions.

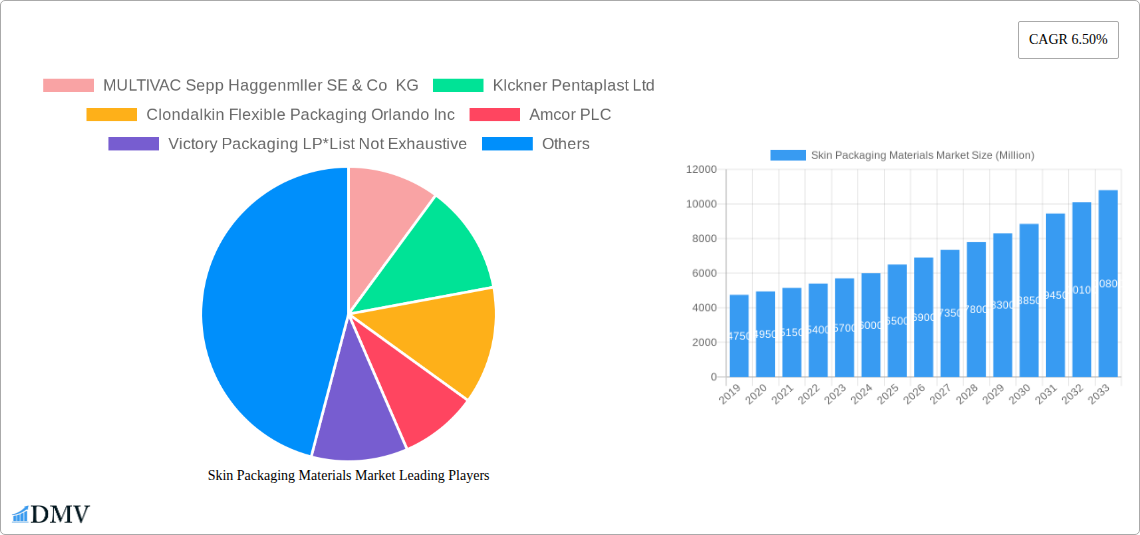

Skin Packaging Materials Market Company Market Share

This comprehensive report offers an in-depth analysis of the skin packaging materials market, providing critical insights into market dynamics, growth drivers, and future opportunities. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report equips stakeholders with actionable intelligence for strategic decision-making. The historical period of 2019-2024 provides a foundational understanding of past market trends.

Skin Packaging Materials Market Market Composition & Trends

The skin packaging materials market is characterized by a dynamic interplay of established players and emerging innovators, with a moderate to high market concentration. Key trends include the escalating demand for sustainable and recyclable skin packaging solutions, driven by both consumer preference and stringent environmental regulations. Innovation catalysts are primarily focused on developing high-barrier skin films that enhance product shelf-life and reduce food waste, alongside advancements in thermoforming capabilities. The regulatory landscape is increasingly shaping material choices, pushing for eco-friendly alternatives and clear labeling. Substitute products, such as modified atmosphere packaging (MAP) and vacuum sealing, present a competitive challenge, though skin packaging's unique product presentation and tamper-evidence offer distinct advantages. End-user profiles vary significantly, with the food industry (particularly meat, fish and seafood, processed food, and cheese) being the largest consumer, followed by medical devices, durable consumer goods, and industrial applications. Mergers and acquisitions (M&A) activity is expected to continue, driven by the pursuit of market share and technological integration, with estimated M&A deal values likely to see substantial growth. Market share distribution is influenced by product innovation, global supply chain capabilities, and strategic partnerships. XXX (e.g., projected market share for top 5 players: 45-55%).

Skin Packaging Materials Market Industry Evolution

The skin packaging materials market has witnessed robust evolution, driven by a confluence of technological advancements and shifting consumer demands. Over the forecast period (2025-2033), the market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.5%, reaching an estimated market size of XX Billion USD by 2033. This growth trajectory is propelled by the intrinsic benefits of skin packaging, including superior product protection, enhanced visual appeal, and improved shelf life, which directly contribute to reducing food waste. Technological advancements have been pivotal, with the development of advanced barrier films, including high-barrier polyethylene terephthalate (PET) and polypropylene (PP) variants, playing a crucial role. These materials offer superior oxygen and moisture resistance, extending the freshness of perishable goods like meat, fish, and seafood. The adoption of mono-material solutions is also on the rise, addressing recyclability concerns and aligning with circular economy principles. Consumer demand has significantly influenced this evolution, with an increasing preference for visually appealing, tamper-evident, and sustainably packaged products. The transparency offered by skin packaging allows consumers to clearly see the product, fostering trust and driving purchasing decisions. Furthermore, the market is responding to the growing demand for convenience, with skin packaging enabling easy handling and storage for consumers. The medical devices segment is also a significant contributor to market growth, where the sterile presentation and secure containment provided by skin packaging are paramount. The industry's ability to adapt to these evolving demands, by investing in R&D for new materials and manufacturing processes, will be critical for sustained growth and market leadership in the coming years. The adoption rate of advanced skin packaging technologies is projected to increase by over 20% in the food sector by 2028.

Leading Regions, Countries, or Segments in Skin Packaging Materials Market

The Food application segment is the undisputed leader within the skin packaging materials market, commanding a significant market share estimated at XX% by 2025. Within this dominant segment, Meat, Fish and Seafood applications represent the largest sub-segment, accounting for approximately XX% of the total food application market. The inherent need for superior protection, extended shelf life, and appealing presentation for these perishable products makes skin packaging an ideal choice. Key drivers for this dominance include:

- High Consumer Demand for Freshness and Quality: Consumers are increasingly willing to pay a premium for products that are perceived as fresh and of high quality. Skin packaging directly addresses this by showcasing the product's visual appeal and ensuring its integrity.

- Reduction of Food Waste: The excellent barrier properties of skin packaging significantly reduce spoilage, aligning with global initiatives to combat food waste. This is a critical factor for retailers and food manufacturers alike.

- Enhanced Product Presentation: Skin packaging offers a premium, retail-ready presentation that enhances shelf appeal and differentiates products in a crowded marketplace.

- Tamper-Evident Features: The sealed nature of skin packaging provides a clear indication of tampering, building consumer confidence in product safety and hygiene.

The North America region is currently the largest geographical market for skin packaging materials, driven by a mature food processing industry, high disposable incomes, and a strong emphasis on product safety and quality. The United States, in particular, is a major consumer due to its extensive retail infrastructure and a large population with a high demand for pre-packaged food items. Europe follows closely, with a growing emphasis on sustainable packaging solutions and stringent regulations promoting waste reduction.

Beyond the food sector, the Medical Devices segment is exhibiting strong growth potential, driven by the increasing need for sterile, secure, and tamper-evident packaging for a wide range of medical products, from surgical instruments to implantable devices.

Skin Packaging Materials Market Product Innovations

Product innovations in the skin packaging materials market are centered around enhanced functionality and sustainability. Leading manufacturers are developing high-barrier skin films with improved oxygen and moisture transmission rates, extending product shelf-life significantly for sensitive applications like meat, fish, and seafood. Innovations also include the introduction of mono-material solutions, such as recyclable PE or PP films, to address environmental concerns and facilitate easier recycling processes. Performance metrics are being optimized for increased puncture resistance, better sealing integrity, and improved clarity for superior product visibility. Unique selling propositions often lie in the development of bio-based or compostable skin packaging alternatives, catering to the growing demand for eco-friendly solutions, as well as advancements in thermoformable skin packaging that can adapt to complex product shapes.

Propelling Factors for Skin Packaging Materials Market Growth

The skin packaging materials market is propelled by several key factors. The rising global demand for convenience foods and premium packaged goods, especially within the food industry, is a significant driver. Technological advancements in barrier film technology are enabling longer shelf life and better product protection, thereby reducing food waste. Stringent regulations promoting food safety and waste reduction further encourage the adoption of effective packaging solutions like skin packaging. The increasing consumer preference for visually appealing products and tamper-evident packaging also fuels market expansion. Finally, the growing use of skin packaging in medical devices for sterile and secure containment presents a substantial growth avenue.

Obstacles in the Skin Packaging Materials Market Market

Despite its growth, the skin packaging materials market faces certain obstacles. The cost of advanced skin packaging materials, particularly those with high-barrier properties, can be higher compared to conventional packaging. Regulatory complexities and evolving recycling infrastructure in some regions can pose challenges for widespread adoption of sustainable solutions. Supply chain disruptions, as experienced in recent years, can impact the availability and pricing of raw materials. Furthermore, competition from alternative packaging formats like modified atmosphere packaging (MAP) and retort pouches, especially for specific food applications, presents a constant challenge. The need for specialized sealing equipment also represents an initial investment barrier for some smaller businesses.

Future Opportunities in Skin Packaging Materials Market

Emerging opportunities within the skin packaging materials market are diverse and promising. The continued focus on sustainability presents a significant avenue for growth, with the development of biodegradable, compostable, and fully recyclable skin packaging materials gaining traction. Expansion into emerging economies with growing middle classes and increasing demand for packaged foods offers substantial market potential. Innovations in active and intelligent packaging integrated with skin films, such as those indicating spoilage or freshness, are also creating new possibilities. The increasing demand for personalized and single-serve portions in the food sector provides opportunities for specialized skin packaging solutions. Furthermore, exploring new applications in non-food sectors, beyond durable consumer goods and industrial uses, could unlock untapped market segments.

Major Players in the Skin Packaging Materials Market Ecosystem

- MULTIVAC Sepp Haggenmüller SE & Co KG

- Klöckner Pentaplast Ltd

- Clondalkin Flexible Packaging Orlando Inc

- Amcor PLC

- Victory Packaging LP

- Winpak LTD

- LINPAC Packaging Ltd

- Flexopack SA

- Plastopil Hazorea Co Ltd

- Sealed Air Corporation

Key Developments in Skin Packaging Materials Market Industry

- April 2022: Mondi unveiled new recyclable packaging options for the food business at Anuga FoodTec, including PerFORMing Monoloop and Mono Formable PP, focusing on reducing food waste and providing high-barrier protection.

- March 2022: Berry Global Group partnered with Koa to launch Body Cleanser & Body Moisturizer bottles made from 100% recycled plastic, highlighting a shared vision for sustainability in packaging.

- January 2022: Waddington Europe (Novolex) introduced a novel recyclable tray for meat, fish, and poultry, the Piranh container, utilizing a unique lid sealing mechanism for modified atmosphere packaging (MAP).

Strategic Skin Packaging Materials Market Market Forecast

The strategic forecast for the skin packaging materials market points towards sustained growth, driven by an increasing emphasis on product preservation, consumer safety, and environmental responsibility. The market is poised to benefit from ongoing innovations in material science, leading to more sustainable and high-performance skin packaging solutions. The expansion of e-commerce and the demand for resilient packaging for direct-to-consumer shipments will further bolster market penetration. Key growth catalysts include the persistent need to minimize food waste across the supply chain, stringent regulatory frameworks promoting eco-friendly packaging, and the evolving preferences of a conscious consumer base. Opportunities in emerging markets and the exploration of novel applications will provide additional avenues for expansion, making the skin packaging market a dynamic and evolving landscape for the foreseeable future.

Skin Packaging Materials Market Segmentation

-

1. Application

-

1.1. Food

- 1.1.1. Meat

- 1.1.2. Fish and Seafood

- 1.1.3. Processed Food

- 1.1.4. Cheese

- 1.2. Industri

- 1.3. Medical Devices

- 1.4. Durable Consumer Goods

-

1.1. Food

Skin Packaging Materials Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Skin Packaging Materials Market Regional Market Share

Geographic Coverage of Skin Packaging Materials Market

Skin Packaging Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Ready-to-Consume Packaged Food Products; Growing demand for flavor retaining packaging

- 3.3. Market Restrains

- 3.3.1. Rising Concerns About the Environment and Stringent Government Regulations Regarding the Use of Plastic

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.1.1. Meat

- 5.1.1.2. Fish and Seafood

- 5.1.1.3. Processed Food

- 5.1.1.4. Cheese

- 5.1.2. Industri

- 5.1.3. Medical Devices

- 5.1.4. Durable Consumer Goods

- 5.1.1. Food

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.1.1. Meat

- 6.1.1.2. Fish and Seafood

- 6.1.1.3. Processed Food

- 6.1.1.4. Cheese

- 6.1.2. Industri

- 6.1.3. Medical Devices

- 6.1.4. Durable Consumer Goods

- 6.1.1. Food

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.1.1. Meat

- 7.1.1.2. Fish and Seafood

- 7.1.1.3. Processed Food

- 7.1.1.4. Cheese

- 7.1.2. Industri

- 7.1.3. Medical Devices

- 7.1.4. Durable Consumer Goods

- 7.1.1. Food

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.1.1. Meat

- 8.1.1.2. Fish and Seafood

- 8.1.1.3. Processed Food

- 8.1.1.4. Cheese

- 8.1.2. Industri

- 8.1.3. Medical Devices

- 8.1.4. Durable Consumer Goods

- 8.1.1. Food

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.1.1. Meat

- 9.1.1.2. Fish and Seafood

- 9.1.1.3. Processed Food

- 9.1.1.4. Cheese

- 9.1.2. Industri

- 9.1.3. Medical Devices

- 9.1.4. Durable Consumer Goods

- 9.1.1. Food

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Skin Packaging Materials Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.1.1. Meat

- 10.1.1.2. Fish and Seafood

- 10.1.1.3. Processed Food

- 10.1.1.4. Cheese

- 10.1.2. Industri

- 10.1.3. Medical Devices

- 10.1.4. Durable Consumer Goods

- 10.1.1. Food

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MULTIVAC Sepp Haggenmller SE & Co KG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Klckner Pentaplast Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clondalkin Flexible Packaging Orlando Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Victory Packaging LP*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Winpak LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LINPAC Packaging Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flexopack SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Plastopil Hazorea Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sealed Air Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MULTIVAC Sepp Haggenmller SE & Co KG

List of Figures

- Figure 1: Global Skin Packaging Materials Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Skin Packaging Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Skin Packaging Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Skin Packaging Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Skin Packaging Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Skin Packaging Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Skin Packaging Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Skin Packaging Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Skin Packaging Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Skin Packaging Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Skin Packaging Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Skin Packaging Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Skin Packaging Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Skin Packaging Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America Skin Packaging Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Skin Packaging Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Skin Packaging Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Skin Packaging Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Skin Packaging Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Skin Packaging Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Skin Packaging Materials Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Skin Packaging Materials Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Skin Packaging Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Skin Packaging Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Skin Packaging Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Skin Packaging Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Skin Packaging Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Skin Packaging Materials Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Skin Packaging Materials Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Skin Packaging Materials Market?

Key companies in the market include MULTIVAC Sepp Haggenmller SE & Co KG, Klckner Pentaplast Ltd, Clondalkin Flexible Packaging Orlando Inc, Amcor PLC, Victory Packaging LP*List Not Exhaustive, Winpak LTD, LINPAC Packaging Ltd, Flexopack SA, Plastopil Hazorea Co Ltd, Sealed Air Corporation.

3. What are the main segments of the Skin Packaging Materials Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.42 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Ready-to-Consume Packaged Food Products; Growing demand for flavor retaining packaging.

6. What are the notable trends driving market growth?

Food Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Rising Concerns About the Environment and Stringent Government Regulations Regarding the Use of Plastic.

8. Can you provide examples of recent developments in the market?

April 2022: At Anuga FoodTec in Cologne, Germany, Mondi unveiled new packaging options for the food business. Two-tray packaging products provide fresh food producers with recyclable possibilities, which will assist in reducing food waste. High-barrier food protection will be provided by PerFORMing Monoloop and Mono Formable PP, illustrating the crucial role that packaging plays throughout the supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Skin Packaging Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Skin Packaging Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Skin Packaging Materials Market?

To stay informed about further developments, trends, and reports in the Skin Packaging Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence