Key Insights

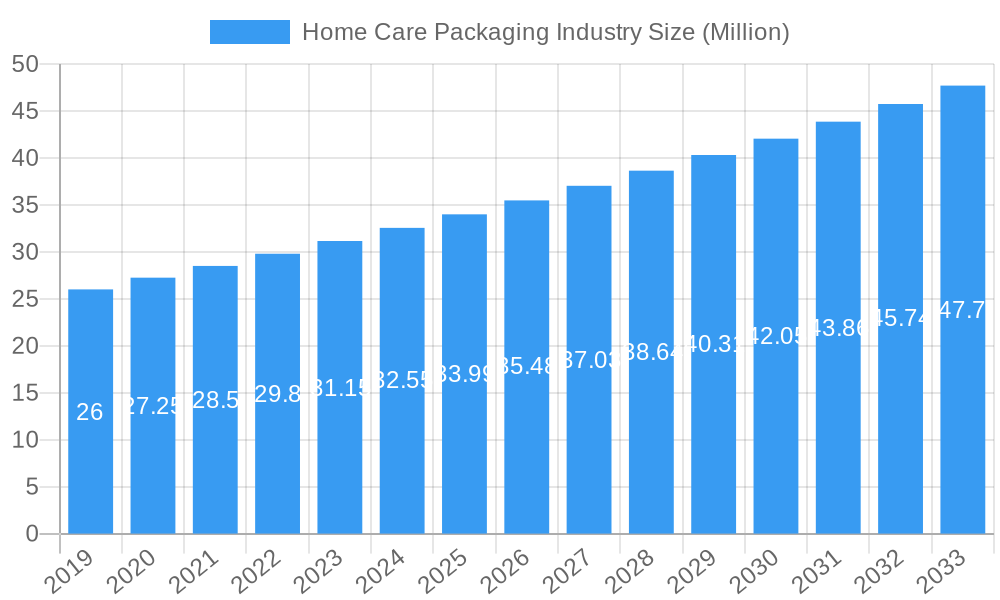

The global Home Care Packaging market is poised for significant expansion, projected to reach approximately $35.37 million with a Compound Annual Growth Rate (CAGR) of 5.42% between 2019 and 2033. This robust growth is primarily fueled by increasing consumer demand for convenience, hygiene, and sustainability in household products. Key drivers include the rising disposable incomes in emerging economies, leading to greater consumption of packaged home care items like detergents, disinfectants, and air fresheners. Furthermore, a growing awareness of cleanliness and sanitation, amplified by global health concerns, is continuously stimulating the market. The trend towards premiumization in home care products, with consumers seeking visually appealing and functional packaging, also contributes to market dynamism. Innovations in material science, such as the development of eco-friendly and recyclable plastics, are also playing a crucial role in shaping the market landscape.

Home Care Packaging Industry Market Size (In Million)

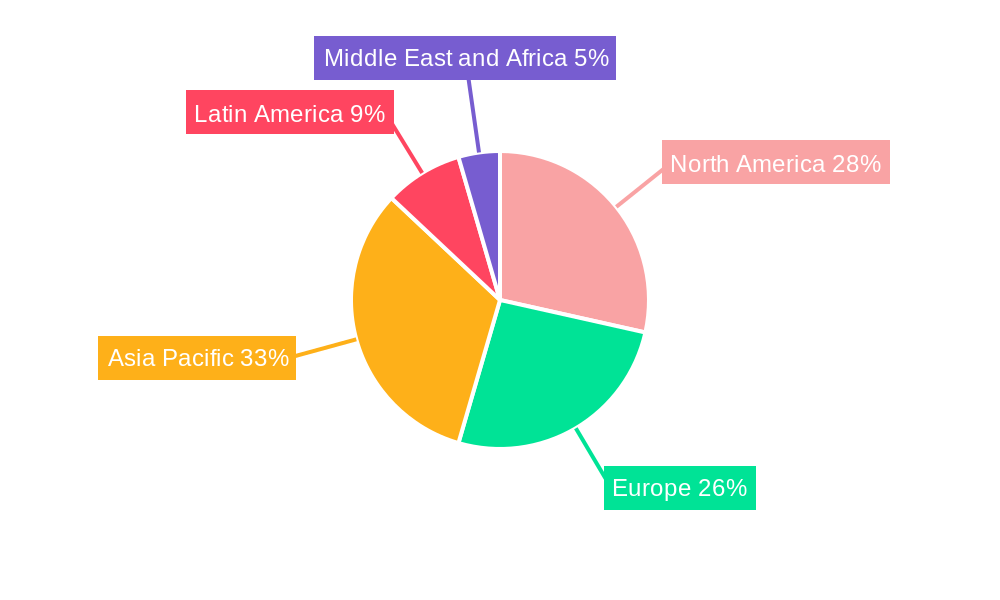

The market's trajectory is further influenced by evolving consumer preferences for specialized and concentrated formulations, necessitating advanced packaging solutions that ensure product integrity and efficacy. The Plastic segment is expected to dominate due to its versatility, cost-effectiveness, and suitability for various product types, including bottles, containers, and pouches. However, rising environmental consciousness is driving a notable shift towards sustainable alternatives like paper, cartons, and recycled materials, presenting both challenges and opportunities for packaging manufacturers. While the demand for sophisticated dispensing mechanisms and child-resistant features is on the rise for products like insecticides and toiletries, the market also faces restraints such as fluctuating raw material prices and stringent regulatory frameworks concerning packaging safety and recyclability. Asia Pacific is anticipated to emerge as a leading region, driven by its large population, rapid urbanization, and escalating demand for home care products.

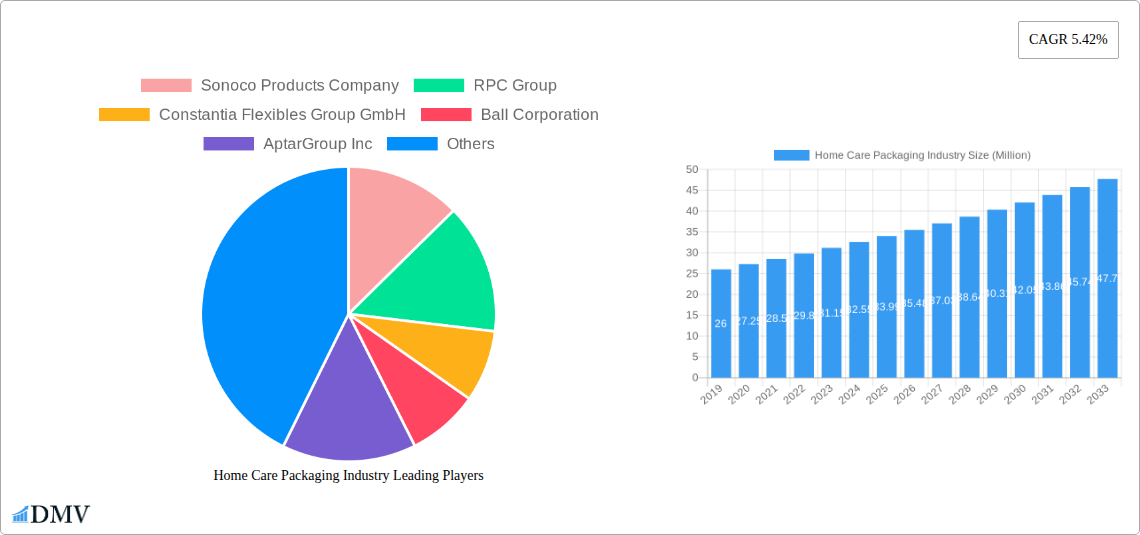

Home Care Packaging Industry Company Market Share

Unlocking Growth: Home Care Packaging Industry Market Analysis & Strategic Forecast (2019-2033)

Dive deep into the dynamic Home Care Packaging Industry with this comprehensive report. Covering the study period of 2019–2033, this analysis provides critical insights for stakeholders seeking to navigate the evolving landscape of household product packaging. Featuring a base year of 2025 and an estimated year also of 2025, the report delivers a robust forecast period of 2025–2033, building upon the historical period of 2019–2024. We explore market composition, industry evolution, regional dominance, product innovations, growth drivers, challenges, and future opportunities. This report is your essential guide to understanding the global home care packaging market, including key players like Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, and ProAmpac LLC.

Home Care Packaging Industry Market Composition & Trends

The Home Care Packaging Market exhibits a dynamic competitive landscape, characterized by a moderate level of market concentration. Key players are continuously investing in innovation, driven by evolving consumer preferences for sustainable and convenient packaging solutions. The regulatory landscape plays a crucial role, with increasing scrutiny on plastic packaging and a push towards recyclable and biodegradable materials. Substitute products, such as concentrated formulations and refillable systems, are gaining traction, necessitating a focus on differentiation. End-user profiles are shifting, with a growing demand for visually appealing, easy-to-use, and eco-conscious packaging for household cleaning products. Merger and acquisition (M&A) activities are strategically shaping the market, with recent deals in the flexible packaging and rigid packaging sectors valued in the hundreds of millions to billions of dollars. For instance, significant M&A activity in the plastic packaging segment alone has been estimated at over $5 Billion. Market share distribution reveals a strong presence of manufacturers specializing in plastic bottles and containers and pouches and bags, catering to diverse product needs like laundry care and dishwashing. The increasing emphasis on circular economy principles is a major trend influencing packaging design and material selection.

Home Care Packaging Industry Industry Evolution

The Home Care Packaging Industry has witnessed a transformative evolution over the historical period (2019-2024) and is poised for significant growth throughout the forecast period (2025-2033). Market growth trajectories have been primarily shaped by shifting consumer behaviors, the imperative for enhanced product protection and preservation, and the relentless pursuit of cost-efficiency in manufacturing and distribution. Technological advancements have been instrumental, with the adoption of advanced printing techniques, smart packaging features, and the development of novel materials that enhance shelf-life and user experience for products ranging from insecticides to toiletries. For example, the adoption of lightweight yet durable plastic materials for bottles and containers has seen a growth rate of approximately 7% year-on-year. Furthermore, the industry has responded to escalating environmental concerns by investing heavily in the research and development of sustainable packaging solutions. This includes an increased focus on recyclable materials, the exploration of biodegradable and compostable alternatives, and the implementation of reusable packaging models, particularly for laundry care detergents. The transition towards e-commerce has also spurred innovation, demanding packaging designs that offer superior transit protection, reduced shipping volumes, and enhanced unboxing experiences. Consumer demand for convenience and single-use formats, while facing scrutiny, continues to drive the market for pouches and bags, especially for smaller, single-dose applications in segments like air care. The overall market growth is projected to maintain a healthy CAGR of XX% between 2025 and 2033, driven by both volume expansion and the increasing value associated with premium and sustainable packaging offerings. The integration of digital technologies, such as QR codes for enhanced product traceability and consumer engagement, is also becoming a key differentiator.

Leading Regions, Countries, or Segments in Home Care Packaging Industry

The North America region stands as a dominant force within the Home Care Packaging Industry, driven by a confluence of robust economic conditions, a highly developed consumer market, and proactive regulatory frameworks that encourage sustainable practices. Within North America, the United States spearheads this dominance, fueled by substantial consumer spending on a wide array of home care products, from dishwashing detergents to laundry care essentials and toiletries. The preference for convenience and premiumization in packaging among its consumer base directly translates into significant demand for innovative packaging formats.

Material Dominance: Plastic emerges as the leading material in North America, primarily due to its versatility, cost-effectiveness, and ability to be molded into various shapes and sizes. This dominance is particularly evident in bottles and containers, which are extensively used for liquid detergents, cleaning agents, and personal care products. The market for pouches and bags made from flexible plastic also experiences significant growth, catering to the demand for single-use and travel-sized options. The estimated market share for plastic in this region is approximately 65%.

Type Dominance: Bottles and Containers represent the most significant packaging type within the North American Home Care Packaging Industry. Their widespread application across product categories, coupled with advancements in design for improved functionality and aesthetics, solidifies their leading position. The market size for this segment is projected to reach over $15 Billion by 2025.

Product Dominance: Laundry Care and Dishwashing products are major contributors to the demand for home care packaging in North America. The high volume of consumption for these everyday essentials necessitates a continuous supply of reliable and functional packaging. The demand for specialized packaging solutions that enhance product efficacy and user experience for these categories is substantial.

Key Drivers:

- Consumer Demand for Convenience: North American consumers exhibit a strong preference for convenient packaging solutions, including easy-pour spouts, tamper-evident seals, and single-dose formats, driving innovation in bottles and containers and pouches and bags.

- Sustainability Initiatives: Increasing consumer awareness and regulatory pressure are driving demand for recyclable, recycled content, and biodegradable packaging. This is spurring investment in advanced recycling technologies and the development of bio-based plastics.

- E-commerce Growth: The burgeoning e-commerce sector necessitates robust and protective packaging that can withstand the rigors of shipping, further bolstering the demand for durable bottles and containers and specialized cartons and corrugated boxes.

- Technological Advancements: Innovations in material science and manufacturing processes are enabling the creation of lighter, stronger, and more aesthetically appealing packaging options.

Home Care Packaging Industry Product Innovations

Product innovations within the Home Care Packaging Industry are largely centered around enhancing sustainability, user convenience, and product performance. Manufacturers are increasingly developing packaging solutions that incorporate recycled content and are designed for greater recyclability. Innovations in flexible packaging, such as advanced barrier films for pouches and bags, are extending the shelf-life of products like insecticides and air care fresheners. Furthermore, the integration of smart features, like QR codes on bottles and containers, is enabling greater product traceability and consumer engagement, offering unique selling propositions. The development of concentrated formulations for laundry care and dishwashing is also driving demand for smaller, more efficient packaging, reducing material usage and transportation costs. The focus remains on delivering packaging that is both functional and environmentally responsible.

Propelling Factors for Home Care Packaging Industry Growth

The Home Care Packaging Industry is propelled by several key factors. Technological advancements in material science and manufacturing processes are enabling the creation of more sustainable, durable, and cost-effective packaging solutions. Growing consumer demand for convenience and aesthetic appeal for household products fuels innovation in packaging design. Furthermore, increasing global disposable incomes, particularly in emerging economies, are driving higher consumption of home care products, thereby increasing the demand for their packaging. The regulatory landscape, while presenting challenges, also incentivizes the adoption of eco-friendly packaging, fostering growth in recyclable and biodegradable materials. The expanding e-commerce sector also necessitates specialized packaging that ensures product integrity during transit. The market size for sustainable home care packaging is projected to grow at a CAGR of XX%.

Obstacles in the Home Care Packaging Industry Market

Despite its growth trajectory, the Home Care Packaging Industry faces several significant obstacles. Regulatory challenges, particularly concerning plastic waste and the implementation of Extended Producer Responsibility (EPR) schemes, create compliance burdens and can increase operational costs, estimated at an additional 5-10% for some manufacturers. Supply chain disruptions, exacerbated by geopolitical events and fluctuating raw material prices, can lead to production delays and increased input costs, impacting profit margins. Intense competitive pressures among numerous global and regional players drive down prices and necessitate continuous innovation and investment in efficiency. The high cost of developing and implementing advanced sustainable packaging solutions can also be a barrier for smaller manufacturers. Furthermore, fluctuating energy costs impact production expenses, representing a substantial portion of manufacturing overhead.

Future Opportunities in Home Care Packaging Industry

The Home Care Packaging Industry is ripe with emerging opportunities. The escalating global demand for sustainable packaging solutions presents a significant growth avenue, with a projected market expansion in reusable, recyclable, and biodegradable materials exceeding XX% annually. Innovations in smart packaging, such as integrated sensors for product freshness and consumer engagement features, will create new value propositions. The growing popularity of e-commerce continues to drive demand for robust, lightweight, and customizable packaging solutions for direct-to-consumer shipments. Furthermore, the development of novel materials derived from renewable resources, like plant-based plastics, offers a promising alternative to traditional petroleum-based packaging. Expansion into emerging markets with growing middle classes and increasing awareness of hygiene and cleanliness will also fuel demand for a wider range of home care products and their associated packaging.

Major Players in the Home Care Packaging Industry Ecosystem

- Sonoco Products Company

- RPC Group

- Constantia Flexibles Group GmbH

- Ball Corporation

- AptarGroup Inc

- DS Smith PLC

- Winpak Ltd

- Amcor PLC

- Can-Pack SA

- Silgan Holdings

- ProAmpac LLC

Key Developments in Home Care Packaging Industry Industry

- 2023 October: Amcor PLC launched a new range of recyclable high-barrier pouches and bags for household cleaning products, enhancing product protection and reducing environmental impact.

- 2023 September: DS Smith PLC announced significant investment in new corrugated box manufacturing capabilities, catering to the growing demand for e-commerce ready packaging in the home care sector.

- 2023 July: Ball Corporation introduced innovative lightweight aluminum cans for household sprays, offering a more sustainable alternative to plastic.

- 2023 April: Constantia Flexibles Group GmbH unveiled advanced mono-material solutions for flexible packaging, improving recyclability for products like laundry detergent pods.

- 2022 December: AptarGroup Inc acquired a leading manufacturer of dispensing closures, expanding its portfolio of innovative solutions for bottles and containers in the home care market.

- 2022 September: Sonoco Products Company invested in advanced recycling technologies to increase the use of post-consumer recycled content in its plastic packaging offerings.

- 2022 June: Winpak Ltd launched a new line of compostable films for pouches and bags, addressing the growing demand for end-of-life sustainable packaging.

- 2022 February: Silgan Holdings acquired a competitor in the rigid plastic containers market, consolidating its position and expanding its production capacity.

- 2021 November: ProAmpac LLC developed innovative child-resistant pouches and bags for household chemicals, enhancing safety and compliance.

- 2021 July: Can-Pack SA expanded its production of metal cans for household aerosols, capitalizing on the demand for premium and durable packaging.

Strategic Home Care Packaging Industry Market Forecast

The Home Care Packaging Industry is projected for robust and sustained growth, driven by a powerful combination of accelerating consumer demand for sustainable and convenient solutions, alongside continuous technological innovation. The increasing global focus on environmental responsibility will significantly boost the adoption of recyclable, biodegradable, and reusable packaging formats, creating substantial market opportunities. Furthermore, the expansion of e-commerce logistics necessitates more resilient and efficient packaging, particularly for bottles and containers and cartons and corrugated boxes. Emerging economies, with their burgeoning middle classes and rising hygiene awareness, represent key growth frontiers. Strategic investments in advanced materials and production technologies will enable manufacturers to meet these evolving demands, solidifying the market's promising future. The overall market size is expected to reach $XXX Billion by 2033.

Home Care Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Type

- 2.1. Bottles and Containers

- 2.2. Metal Cans

- 2.3. Cartons and Corrugated Box

- 2.4. Pouches and Bags

- 2.5. Other Types

-

3. Products

- 3.1. Dishwashing

- 3.2. Insecticides

- 3.3. Laundry Care

- 3.4. Toiletries

- 3.5. Polishes

- 3.6. Air Care

- 3.7. Other Products

Home Care Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Home Care Packaging Industry Regional Market Share

Geographic Coverage of Home Care Packaging Industry

Home Care Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Product Innovation

- 3.2.2 Differentiation

- 3.2.3 and Branding; Rising Per Capita Income Positively Impacting Purchase Power

- 3.3. Market Restrains

- 3.3.1. ; Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1 Flexibility

- 3.4.2 Strength

- 3.4.3 and Durability of Plastic Make it Ideal for Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bottles and Containers

- 5.2.2. Metal Cans

- 5.2.3. Cartons and Corrugated Box

- 5.2.4. Pouches and Bags

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Products

- 5.3.1. Dishwashing

- 5.3.2. Insecticides

- 5.3.3. Laundry Care

- 5.3.4. Toiletries

- 5.3.5. Polishes

- 5.3.6. Air Care

- 5.3.7. Other Products

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper

- 6.1.3. Metal

- 6.1.4. Glass

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Bottles and Containers

- 6.2.2. Metal Cans

- 6.2.3. Cartons and Corrugated Box

- 6.2.4. Pouches and Bags

- 6.2.5. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Products

- 6.3.1. Dishwashing

- 6.3.2. Insecticides

- 6.3.3. Laundry Care

- 6.3.4. Toiletries

- 6.3.5. Polishes

- 6.3.6. Air Care

- 6.3.7. Other Products

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper

- 7.1.3. Metal

- 7.1.4. Glass

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Bottles and Containers

- 7.2.2. Metal Cans

- 7.2.3. Cartons and Corrugated Box

- 7.2.4. Pouches and Bags

- 7.2.5. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Products

- 7.3.1. Dishwashing

- 7.3.2. Insecticides

- 7.3.3. Laundry Care

- 7.3.4. Toiletries

- 7.3.5. Polishes

- 7.3.6. Air Care

- 7.3.7. Other Products

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper

- 8.1.3. Metal

- 8.1.4. Glass

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Bottles and Containers

- 8.2.2. Metal Cans

- 8.2.3. Cartons and Corrugated Box

- 8.2.4. Pouches and Bags

- 8.2.5. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Products

- 8.3.1. Dishwashing

- 8.3.2. Insecticides

- 8.3.3. Laundry Care

- 8.3.4. Toiletries

- 8.3.5. Polishes

- 8.3.6. Air Care

- 8.3.7. Other Products

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper

- 9.1.3. Metal

- 9.1.4. Glass

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Bottles and Containers

- 9.2.2. Metal Cans

- 9.2.3. Cartons and Corrugated Box

- 9.2.4. Pouches and Bags

- 9.2.5. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Products

- 9.3.1. Dishwashing

- 9.3.2. Insecticides

- 9.3.3. Laundry Care

- 9.3.4. Toiletries

- 9.3.5. Polishes

- 9.3.6. Air Care

- 9.3.7. Other Products

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Home Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper

- 10.1.3. Metal

- 10.1.4. Glass

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Bottles and Containers

- 10.2.2. Metal Cans

- 10.2.3. Cartons and Corrugated Box

- 10.2.4. Pouches and Bags

- 10.2.5. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Products

- 10.3.1. Dishwashing

- 10.3.2. Insecticides

- 10.3.3. Laundry Care

- 10.3.4. Toiletries

- 10.3.5. Polishes

- 10.3.6. Air Care

- 10.3.7. Other Products

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sonoco Products Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RPC Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Constantia Flexibles Group GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AptarGroup Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DS Smith PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Winpak Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amcor PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Can-Pack SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silgan Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ProAmpac LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Sonoco Products Company

List of Figures

- Figure 1: Global Home Care Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Home Care Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Home Care Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Home Care Packaging Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Home Care Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Home Care Packaging Industry Revenue (Million), by Products 2025 & 2033

- Figure 7: North America Home Care Packaging Industry Revenue Share (%), by Products 2025 & 2033

- Figure 8: North America Home Care Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Home Care Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Home Care Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Home Care Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Home Care Packaging Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Home Care Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Home Care Packaging Industry Revenue (Million), by Products 2025 & 2033

- Figure 15: Europe Home Care Packaging Industry Revenue Share (%), by Products 2025 & 2033

- Figure 16: Europe Home Care Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Home Care Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Home Care Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Home Care Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Home Care Packaging Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Home Care Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Home Care Packaging Industry Revenue (Million), by Products 2025 & 2033

- Figure 23: Asia Pacific Home Care Packaging Industry Revenue Share (%), by Products 2025 & 2033

- Figure 24: Asia Pacific Home Care Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Home Care Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Home Care Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Latin America Home Care Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Home Care Packaging Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Home Care Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Home Care Packaging Industry Revenue (Million), by Products 2025 & 2033

- Figure 31: Latin America Home Care Packaging Industry Revenue Share (%), by Products 2025 & 2033

- Figure 32: Latin America Home Care Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Home Care Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Home Care Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Home Care Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Home Care Packaging Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Home Care Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Home Care Packaging Industry Revenue (Million), by Products 2025 & 2033

- Figure 39: Middle East and Africa Home Care Packaging Industry Revenue Share (%), by Products 2025 & 2033

- Figure 40: Middle East and Africa Home Care Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Home Care Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 4: Global Home Care Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 8: Global Home Care Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 12: Global Home Care Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 16: Global Home Care Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 18: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 20: Global Home Care Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Home Care Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Home Care Packaging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Home Care Packaging Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 24: Global Home Care Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Care Packaging Industry?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the Home Care Packaging Industry?

Key companies in the market include Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, ProAmpac LLC*List Not Exhaustive.

3. What are the main segments of the Home Care Packaging Industry?

The market segments include Material, Type, Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.37 Million as of 2022.

5. What are some drivers contributing to market growth?

; Product Innovation. Differentiation. and Branding; Rising Per Capita Income Positively Impacting Purchase Power.

6. What are the notable trends driving market growth?

Flexibility. Strength. and Durability of Plastic Make it Ideal for Packaging.

7. Are there any restraints impacting market growth?

; Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Care Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Care Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Care Packaging Industry?

To stay informed about further developments, trends, and reports in the Home Care Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence