Key Insights

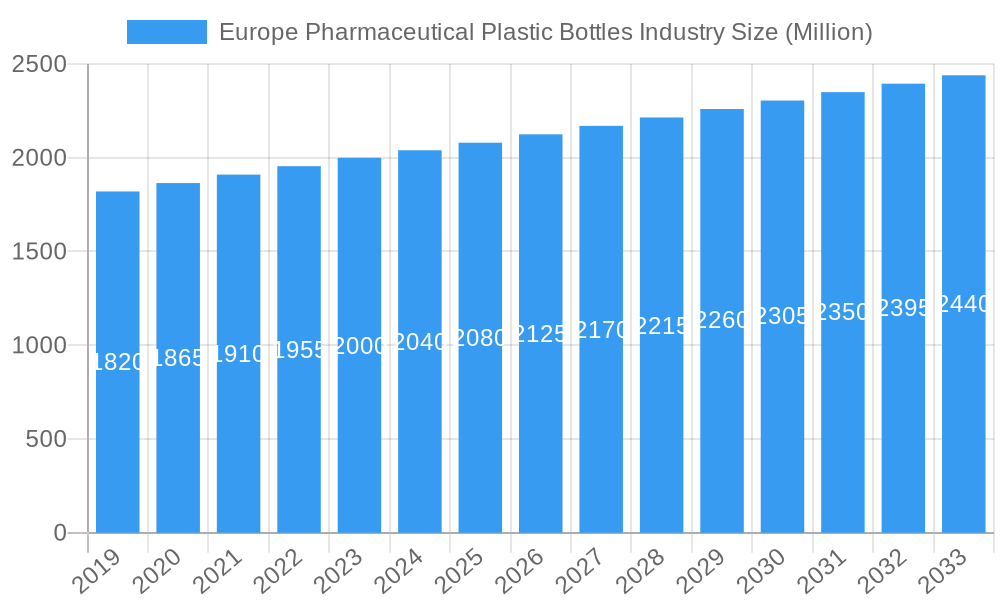

The European pharmaceutical plastic bottles market is poised for steady expansion, projected to reach a substantial USD 2.08 billion by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.48% throughout the forecast period of 2019-2033. The increasing demand for safe, lightweight, and cost-effective packaging solutions within the pharmaceutical industry is a primary driver. Advancements in plastic materials, such as improved barrier properties and enhanced recyclability of Polyethylene Terephthalate (PET) and Polypropylene (PP), are also contributing to market vitality. Furthermore, the rising prevalence of chronic diseases and an aging population in Europe are escalating the need for pharmaceutical products, consequently boosting the demand for their packaging. The market is witnessing a surge in demand for specialized bottle types like dropper bottles for precise dosage delivery and nasal spray bottles for respiratory medications, alongside traditional liquid and solid containers.

Europe Pharmaceutical Plastic Bottles Industry Market Size (In Billion)

Key trends shaping the European pharmaceutical plastic bottles market include a strong emphasis on sustainability and the circular economy, leading to increased adoption of recycled plastics and innovative eco-friendly packaging designs. Regulatory compliance, with stringent quality and safety standards for pharmaceutical packaging, is a critical factor influencing product development and material selection. While the market benefits from cost-effectiveness and versatility, it faces challenges related to potential plastic pollution and the ongoing search for sustainable alternatives. Despite these restraints, the market is expected to continue its upward trajectory, driven by continuous innovation in material science and bottle designs catering to specific pharmaceutical applications, such as oral care products and other specialized therapeutic formulations. Leading players like Amcor Group GmbH, Gerresheimer AG, and Berry Global Inc. are instrumental in driving this growth through strategic investments in research and development and expanding their product portfolios.

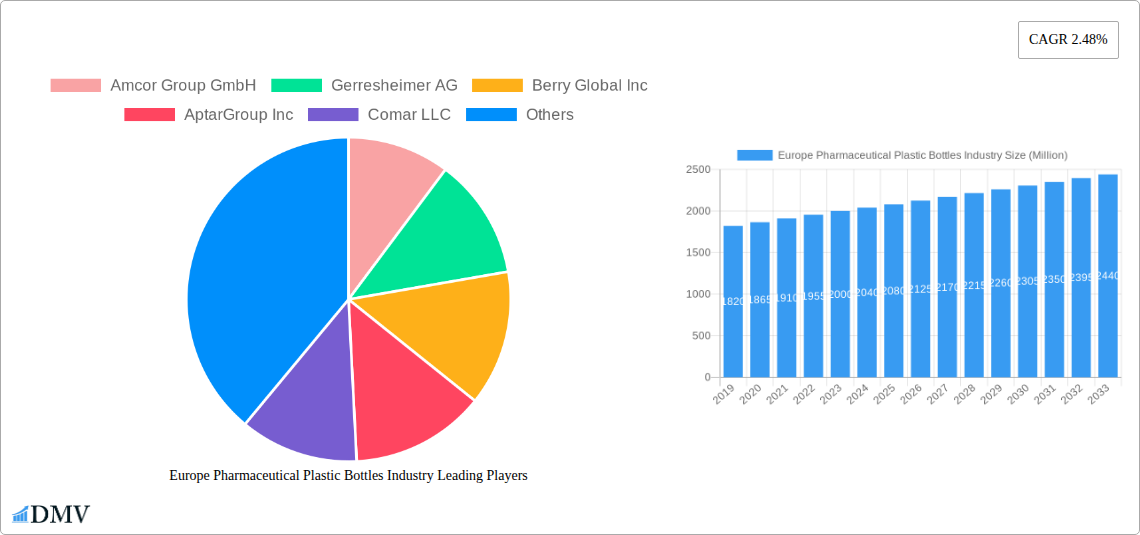

Europe Pharmaceutical Plastic Bottles Industry Company Market Share

Europe Pharmaceutical Plastic Bottles Industry Market Composition & Trends

The Europe Pharmaceutical Plastic Bottles market is characterized by a dynamic interplay of innovation, regulatory evolution, and evolving end-user demands. Market concentration is moderate, with key players vying for market share through strategic investments in sustainable materials and advanced manufacturing techniques. Innovation is primarily driven by the pharmaceutical industry's stringent requirements for product integrity, safety, and compliance. Regulatory landscapes, such as the European Union's emphasis on the circular economy and waste reduction, are significant catalysts, pushing manufacturers towards eco-friendly solutions. Substitute products, primarily glass and metal containers, are gaining traction in niche applications but face challenges in terms of cost-effectiveness and shatter resistance compared to advanced plastic formulations. End-user profiles are diverse, encompassing small-batch specialty pharmaceuticals to high-volume over-the-counter medications. Mergers and acquisitions (M&A) activity, valued at approximately €500 Million in the historical period, is crucial for consolidating market presence and acquiring innovative technologies. The market is projected to reach a valuation of over €15 Billion by 2033.

Europe Pharmaceutical Plastic Bottles Industry Industry Evolution

The European pharmaceutical plastic bottles industry has undergone a significant transformation over the historical period of 2019–2024, driven by a confluence of technological advancements, stringent regulatory frameworks, and evolving consumer preferences towards sustainable and safe packaging solutions. The market experienced a steady Compound Annual Growth Rate (CAGR) of approximately 6.5% during this period, a testament to the increasing demand for pharmaceutical products and the critical role of high-quality plastic bottles in their containment and delivery. This growth trajectory has been further amplified by a surge in investment, estimated at over €2 Billion in R&D and infrastructure upgrades across the continent, enabling manufacturers to develop more sophisticated and specialized packaging. Technological advancements have been pivotal, with the adoption of advanced injection molding techniques, multi-layer co-extrusion for enhanced barrier properties, and the integration of smart packaging features like tamper-evident seals and child-resistant closures becoming standard. The industry has also witnessed a significant shift towards the use of lighter-weight yet highly durable plastic materials, leading to a reduction in shipping costs and environmental impact. Furthermore, the increasing prevalence of chronic diseases and an aging population across Europe have directly translated into a sustained demand for pharmaceuticals, consequently bolstering the market for pharmaceutical plastic bottles. The continuous push for improved patient safety, shelf-life extension, and convenient drug administration has also fueled innovation, leading to the development of specialized bottle types catering to specific therapeutic areas. For instance, the demand for precision dosage delivery has spurred innovation in dropper bottles and nasal spray bottles, while the need for secure containment of solid dosage forms has driven advancements in rigid plastic containers. The industry's ability to adapt to these multifaceted demands, while adhering to rigorous quality and safety standards, has been instrumental in its consistent evolution and projected growth throughout the forecast period of 2025–2033.

Leading Regions, Countries, or Segments in Europe Pharmaceutical Plastic Bottles Industry

The European pharmaceutical plastic bottles industry exhibits distinct regional and segmental dominance, shaped by established pharmaceutical manufacturing hubs, robust regulatory support, and concentrated consumer demand. Among the raw materials, Polyethylene Terephthalate (PET) stands out as a leading segment, accounting for an estimated 45% of the market share in the base year 2025. Its widespread adoption is driven by its excellent clarity, barrier properties, shatter resistance, and recyclability, making it an ideal choice for a vast array of liquid and solid pharmaceutical formulations. The increasing focus on sustainability across Europe further solidifies PET's position, as advancements in recycling technologies make it a more viable option for circular economy initiatives.

Within the "Type" segment, Liquid Bottles are the largest contributor, representing approximately 35% of the market value in 2025. This dominance stems from the high volume of liquid medications, including syrups, suspensions, and solutions, that require secure and precisely engineered packaging. The demand for oral care products also significantly contributes to this segment's leadership.

Dominant Raw Material - PET:

- Key Drivers: Excellent chemical resistance, good barrier properties against moisture and oxygen, lightweight nature, high recyclability, cost-effectiveness.

- Investment Trends: Significant investments in advanced PET processing technologies, including preform production and blow molding, to enhance efficiency and sustainability.

- Regulatory Support: Favorable regulations promoting the use of recyclable materials in packaging, aligning with the EU's circular economy objectives.

- Market Penetration: Widespread use across various pharmaceutical applications, from over-the-counter (OTC) drugs to prescription medications.

Dominant Type - Liquid Bottles:

- Key Drivers: High demand for oral liquid medications, syrups, suspensions, and solutions. The growing prevalence of conditions requiring liquid formulations.

- Technological Advancements: Innovations in dispensing mechanisms, child-resistant caps, and tamper-evident features tailored for liquid containers.

- End-User Preference: Preference for safe, convenient, and accurate dosage delivery systems for liquid pharmaceuticals.

- Application Breadth: Encompasses a wide range of therapeutic areas, including pediatrics, geriatrics, and chronic disease management.

Geographically, Germany emerges as a leading country in the Europe Pharmaceutical Plastic Bottles market, representing an estimated 20% of the regional market value. Its leadership is attributed to a well-established pharmaceutical industry, a strong focus on research and development, and a high level of consumer spending on healthcare products. Furthermore, Germany's commitment to environmental regulations and sustainable manufacturing practices aligns perfectly with the evolving demands of the pharmaceutical packaging sector. The country’s advanced infrastructure and skilled workforce contribute to its capacity for producing high-quality and innovative pharmaceutical plastic bottles.

Europe Pharmaceutical Plastic Bottles Industry Product Innovations

Product innovation in the Europe pharmaceutical plastic bottles industry is heavily focused on enhancing patient safety, drug efficacy, and sustainability. Manufacturers are introducing advanced barrier technologies, such as multi-layer PET and PP bottles, to protect sensitive pharmaceutical formulations from degradation due to light, oxygen, and moisture, thereby extending shelf life. Innovations include the development of lightweight yet robust designs that reduce material consumption and transportation costs. Furthermore, there's a growing trend towards integrated dispensing systems and smart features, like NFC tags for authentication and tracking, and child-resistant closures with visual indicators for ease of use and compliance. The introduction of bioplastics and recycled content in plastic bottles is also a significant area of innovation, addressing the growing demand for environmentally conscious packaging solutions without compromising performance metrics like chemical inertness and mechanical strength.

Propelling Factors for Europe Pharmaceutical Plastic Bottles Industry Growth

Several key factors are propelling the growth of the Europe pharmaceutical plastic bottles industry. The increasing global demand for pharmaceutical products, driven by an aging population and the rising prevalence of chronic diseases, directly translates into a higher requirement for reliable and safe packaging solutions. Technological advancements in material science and manufacturing processes are enabling the creation of more durable, lightweight, and cost-effective plastic bottles with superior barrier properties. Stringent regulatory mandates, while sometimes posing challenges, are also driving innovation by pushing for safer, more tamper-evident, and increasingly sustainable packaging options. Government initiatives promoting recycling and the circular economy are encouraging the use of recycled plastics and the development of more recyclable bottle designs. Finally, the convenience and versatility of plastic bottles, compared to alternatives like glass, make them a preferred choice for a wide range of pharmaceutical applications, from over-the-counter medications to specialized drug delivery systems.

Obstacles in the Europe Pharmaceutical Plastic Bottles Industry Market

Despite robust growth prospects, the Europe pharmaceutical plastic bottles industry faces several obstacles. Stringent regulatory requirements for pharmaceutical packaging, including compliance with GMP (Good Manufacturing Practices) and specific material safety standards, necessitate significant investment in quality control and validation, potentially increasing production costs. The volatile prices of raw materials, primarily derived from petrochemicals, can impact profitability and supply chain stability. Growing environmental concerns and increasing pressure for plastic waste reduction are driving a shift towards sustainable alternatives, which can pose a challenge for traditional plastic bottle manufacturers if they do not adapt quickly. Furthermore, intense competition within the market can lead to price pressures and a need for continuous innovation to maintain market share. Supply chain disruptions, exacerbated by global events, can also impact the availability and cost of raw materials and finished products.

Future Opportunities in Europe Pharmaceutical Plastic Bottles Industry

Emerging opportunities in the Europe pharmaceutical plastic bottles industry are abundant, particularly in the realm of sustainable packaging. The increasing adoption of circular economy principles is creating demand for bottles made from high-recycled content (HRC) PET and other post-consumer recycled (PCR) materials. The development of biodegradable and compostable plastic alternatives for specific pharmaceutical applications presents another significant growth avenue. Advancements in smart packaging technologies, such as integrated sensors for temperature monitoring or authentication features, offer opportunities to enhance product integrity and patient adherence. The expansion of e-pharmacies and personalized medicine also creates demand for specialized, smaller-volume packaging solutions. Furthermore, the growing emphasis on preventative healthcare and the self-medication market will continue to drive the demand for user-friendly and safe OTC pharmaceutical packaging.

Major Players in the Europe Pharmaceutical Plastic Bottles Industry Ecosystem

- Amcor Group GmbH

- Gerresheimer AG

- Berry Global Inc

- AptarGroup Inc

- Comar LLC

- Frapak Packaging

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc

- Pretium Packaging

- Greiner Packaging International GmbH

Key Developments in Europe Pharmaceutical Plastic Bottles Industry Industry

- April 2024: The United Kingdom has initiated the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) to spearhead the development and execution of strategies to enhance the end-of-use recycling of medicinal devices and pharmaceutical packaging. Furthermore, CPA focuses on enhancing the end-of-use recycling of medicinal devices and pharmaceutical packaging. By improving recycling infrastructure and practices, pharmaceutical plastic bottles can be recycled rather than disposed of, increasing the supply of recycled materials for manufacturing new bottles.

- February 2024: The UK's National Health Service (NHS) University College London Hospitals (UCLH) initiative to recycle single-use surgical item packaging could positively impact the growth of the European pharmaceutical plastic bottle market. This increased demand for sustainable packaging solutions could drive innovation and investment in developing recyclable or biodegradable alternatives to traditional plastic bottles used in pharmaceutical packaging.

Strategic Europe Pharmaceutical Plastic Bottles Industry Market Forecast

The strategic forecast for the Europe pharmaceutical plastic bottles industry is exceptionally positive, driven by a confluence of increasing healthcare demands and a strong commitment to sustainability. The industry is poised for sustained growth, projected to reach over €15 Billion by 2033, with a robust CAGR of approximately 6.8% during the forecast period of 2025–2033. Key growth catalysts include the expanding pharmaceutical market, fueled by an aging demographic and the rising incidence of chronic diseases. Innovations in material science and packaging technology will continue to drive the development of lighter, stronger, and more environmentally friendly plastic bottles. Furthermore, evolving regulatory landscapes that champion the circular economy and waste reduction will incentivize the adoption of recycled and recyclable materials, presenting significant opportunities for manufacturers who prioritize sustainability. The inherent advantages of plastic bottles in terms of cost-effectiveness, versatility, and safety will ensure their continued dominance in diverse pharmaceutical applications, from essential medicines to advanced drug delivery systems.

Europe Pharmaceutical Plastic Bottles Industry Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polypropylene (PP)

- 1.3. Low-density Polyethylene (LDPE)

- 1.4. High-density Polyethylene (HDPE)

-

2. Type

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Other Types

Europe Pharmaceutical Plastic Bottles Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

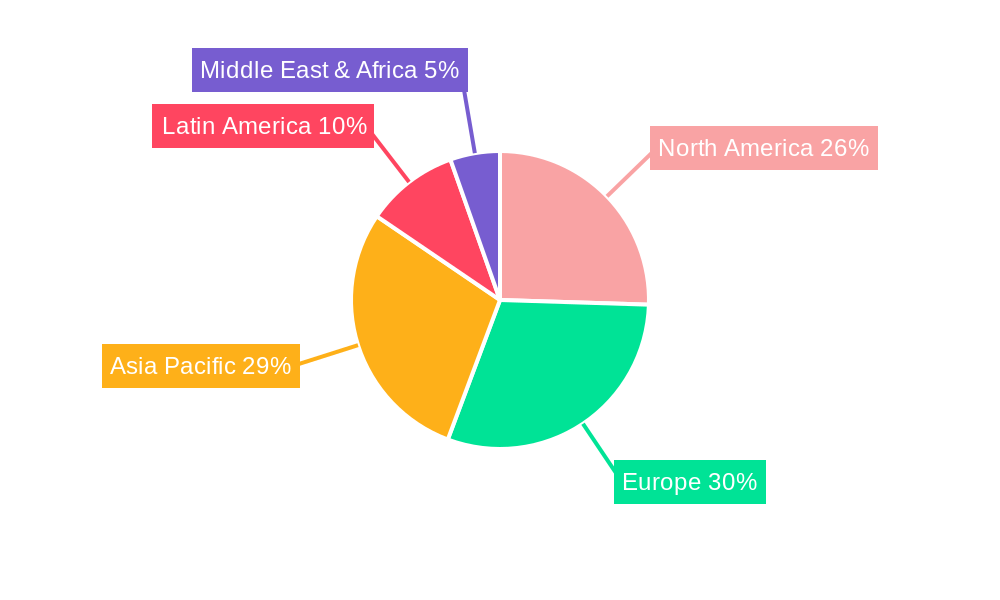

Europe Pharmaceutical Plastic Bottles Industry Regional Market Share

Geographic Coverage of Europe Pharmaceutical Plastic Bottles Industry

Europe Pharmaceutical Plastic Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design

- 3.3. Market Restrains

- 3.3.1. High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design

- 3.4. Market Trends

- 3.4.1. The Polyethylene Terephthalate (PET) Segment is Expected to Witness a Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Plastic Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polypropylene (PP)

- 5.1.3. Low-density Polyethylene (LDPE)

- 5.1.4. High-density Polyethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gerresheimer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AptarGroup Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comar LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frapak Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Silgan Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greiner Packaging International GmbH*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Europe Pharmaceutical Plastic Bottles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Plastic Bottles Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 9: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Plastic Bottles Industry?

The projected CAGR is approximately 2.48%.

2. Which companies are prominent players in the Europe Pharmaceutical Plastic Bottles Industry?

Key companies in the market include Amcor Group GmbH, Gerresheimer AG, Berry Global Inc, AptarGroup Inc, Comar LLC, Frapak Packaging, ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc, Pretium Packaging, Greiner Packaging International GmbH*List Not Exhaustive.

3. What are the main segments of the Europe Pharmaceutical Plastic Bottles Industry?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.08 Million as of 2022.

5. What are some drivers contributing to market growth?

High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design.

6. What are the notable trends driving market growth?

The Polyethylene Terephthalate (PET) Segment is Expected to Witness a Significant Growth in the Market.

7. Are there any restraints impacting market growth?

High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design.

8. Can you provide examples of recent developments in the market?

April 2024: The United Kingdom has initiated the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) to spearhead the development and execution of strategies to enhance the end-of-use recycling of medicinal devices and pharmaceutical packaging. Furthermore, CPA focuses on enhancing the end-of-use recycling of medicinal devices and pharmaceutical packaging. By improving recycling infrastructure and practices, pharmaceutical plastic bottles can be recycled rather than disposed of, increasing the supply of recycled materials for manufacturing new bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Plastic Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Plastic Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Plastic Bottles Industry?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Plastic Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence