Key Insights

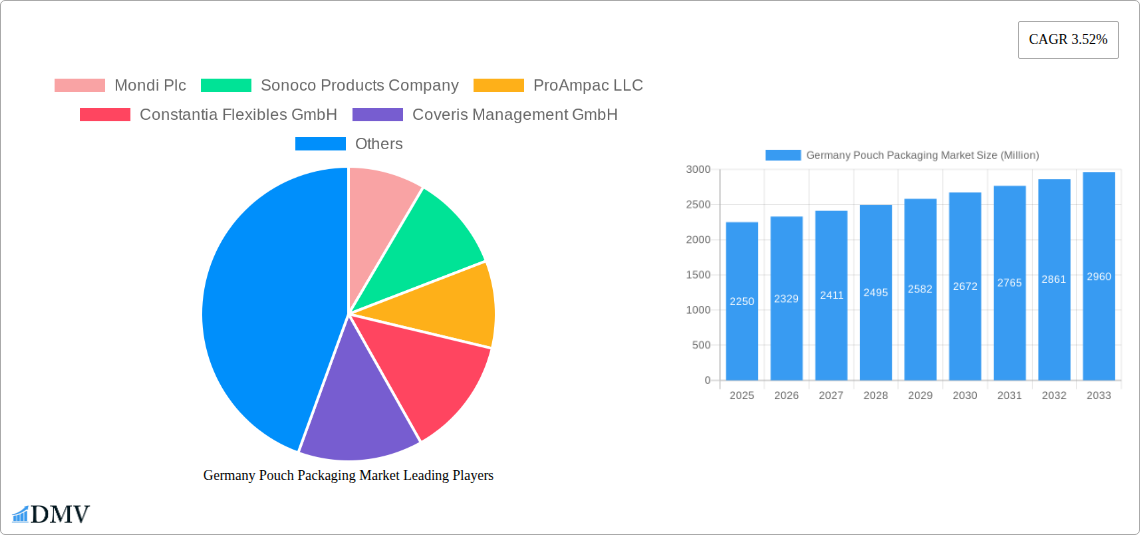

The German pouch packaging market is poised for steady growth, projected to reach a market size of approximately €2,250 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.52% anticipated through 2033. This expansion is primarily driven by the escalating demand for convenient, lightweight, and sustainable packaging solutions across various end-user industries. The food sector, in particular, stands as a significant contributor, fueled by evolving consumer preferences for ready-to-eat meals, frozen foods, and fresh produce requiring specialized preservation and extended shelf life. Similarly, the beverage industry is increasingly adopting pouches for single-serve portions and innovative product formats. The medical and pharmaceutical sector's reliance on sterile, tamper-evident pouches for sensitive medications and devices further bolsters market penetration.

Germany Pouch Packaging Market Market Size (In Billion)

Key trends shaping the German pouch packaging landscape include a pronounced shift towards eco-friendly materials, with a growing emphasis on recyclable plastics like Polyethylene (PE) and Polypropylene (PP), alongside advancements in paper-based and aluminum composite structures to meet stringent environmental regulations and consumer expectations. Innovations in product design, such as the increasing popularity of stand-up pouches with resealable features, enhance user convenience and product appeal. However, the market faces certain restraints, including the fluctuating raw material prices of plastics and aluminum, which can impact overall cost-effectiveness. Furthermore, the complexity of recycling certain multi-layer pouch materials necessitates ongoing investment in advanced recycling technologies and infrastructure. Despite these challenges, the inherent versatility and functional benefits of pouch packaging, coupled with continuous innovation in materials and design, are expected to propel sustained market expansion in Germany.

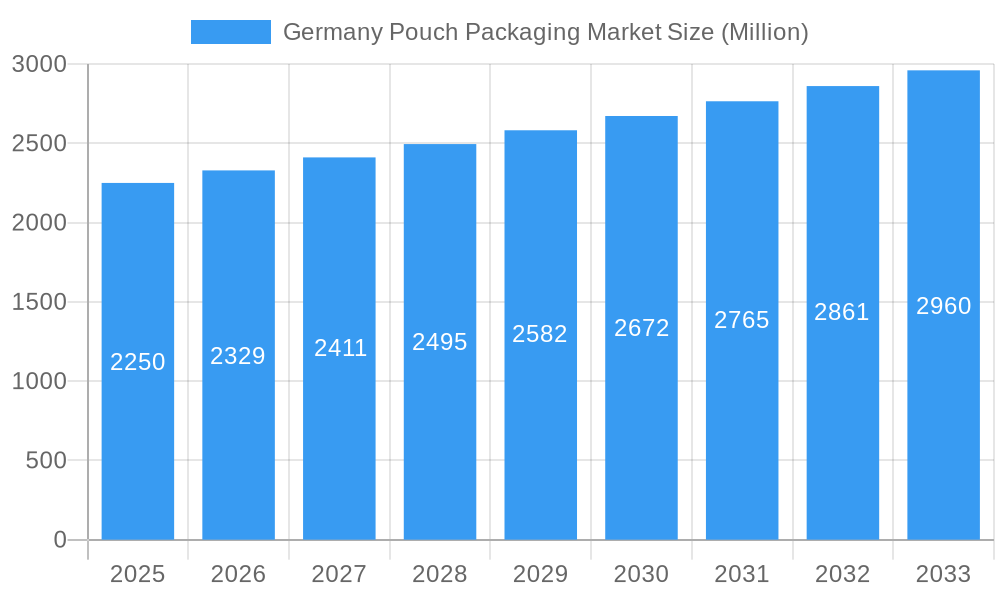

Germany Pouch Packaging Market Company Market Share

Germany Pouch Packaging Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Pouch Packaging Market, offering strategic insights and data-driven forecasts from 2019 to 2033. Explore market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities within this dynamic sector. Covering key players and pivotal industry developments, this report is your essential guide to navigating the German pouch packaging landscape.

Germany Pouch Packaging Market Market Composition & Trends

The Germany Pouch Packaging Market is characterized by a moderate concentration, with a few key players holding significant market share, estimated to be around 60-70% in 2025. Innovation catalysts such as advancements in material science, sustainability initiatives, and digital printing technologies are continuously shaping the market. The regulatory landscape, particularly concerning food contact materials and recyclability, plays a crucial role in product development and market entry. Substitute products, while present in some applications, are increasingly being challenged by the versatility and sustainability advancements of pouches. End-user profiles are diverse, with the food and beverage industry remaining the largest consumer, followed by medical and pharmaceutical, and personal care sectors. Mergers and acquisitions (M&A) activities, with an estimated deal value of over XX Million in the past two years, are driven by the pursuit of market consolidation, technological integration, and expanded product portfolios.

Germany Pouch Packaging Market Industry Evolution

The Germany Pouch Packaging Market has witnessed robust growth and significant evolution throughout the historical period of 2019-2024, with an estimated market size of XXX Million in 2024. This trajectory is projected to continue with a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025-2033, reaching an estimated XXX Million by 2033. Technological advancements have been a primary driver, with the introduction of sophisticated barrier technologies, enhanced printing capabilities, and the development of more sustainable material options, such as compostable and bio-based resins. These innovations have enabled pouch packaging to compete effectively with traditional rigid packaging solutions, particularly in terms of product preservation and shelf life. Shifting consumer demands, influenced by factors like convenience, portion control, and a growing preference for eco-friendly packaging, have further propelled the adoption of pouch formats. The market has seen a notable increase in the demand for flexible pouches that offer ease of use, portability, and reduced material consumption, aligning with sustainability goals. The increasing focus on lightweighting and material reduction in packaging has also favored the adoption of pouches, contributing to their widespread acceptance across various end-user industries.

Leading Regions, Countries, or Segments in Germany Pouch Packaging Market

The Plastic material segment dominates the Germany Pouch Packaging Market, commanding an estimated market share of over 65% in 2025. Within the plastic category, Polyethylene (PE) and Polypropylene (PP) are the most widely utilized resins due to their excellent barrier properties, flexibility, and cost-effectiveness. PET also holds a significant share, particularly for applications requiring enhanced clarity and rigidity. The Food end-user industry is the largest contributor to the market's growth, accounting for an estimated 55% of the total market value in 2025. Within the food sector, Candy & Confectionery and Frozen Foods are particularly strong segments, benefiting from the extended shelf life and product protection offered by pouches. The Stand-up product segment is also experiencing remarkable growth, driven by its superior on-shelf presence and consumer convenience compared to flat pouches.

Key drivers contributing to the dominance of these segments include:

- Investment Trends: Significant investments in advanced extrusion and lamination technologies for plastic film production, along with substantial R&D for new barrier materials and sustainable alternatives.

- Consumer Preference: Growing consumer demand for convenient, single-serving, and resealable packaging solutions, especially for snacks, ready-to-eat meals, and convenience foods.

- Regulatory Support for Sustainability: While stringent, regulations promoting recyclability and reduced waste are indirectly driving innovation in plastic pouch materials and mono-material solutions.

- Technological Advancements in Food Processing: Innovations in food preservation and processing techniques are enabling the use of pouches for a wider range of food products, including those with longer shelf-life requirements.

- E-commerce Growth: The increasing popularity of e-commerce has favored the use of flexible and lightweight pouch packaging, which reduces shipping costs and minimizes damage during transit.

The Medical and Pharmaceutical segment, though smaller in volume, represents a high-value market due to stringent quality and safety requirements, driving demand for specialized, high-barrier pouches. The Beverage sector is also a growing area, particularly for single-serve or on-the-go options. The ongoing advancements in printing and design capabilities are further enhancing the appeal and functionality of pouches across all these end-user industries, solidifying the dominance of plastic materials and specific product and end-user segments.

Germany Pouch Packaging Market Product Innovations

Product innovations in the Germany Pouch Packaging Market are primarily focused on enhancing sustainability, functionality, and product safety. This includes the development of mono-material plastic pouches for improved recyclability, advanced barrier coatings to extend shelf life for sensitive products like fresh produce and pharmaceuticals, and innovative dispensing features such as spouts and resealable zippers for enhanced consumer convenience. Heat-sealable pouch designs are being optimized for a wider range of product types, including those with high moisture or oxygen sensitivity. Furthermore, the integration of smart packaging features, such as indicators for freshness or temperature monitoring, is an emerging area of product development.

Propelling Factors for Germany Pouch Packaging Market Growth

The Germany Pouch Packaging Market is propelled by several key factors. Firstly, the increasing consumer demand for convenience, portability, and single-serving portions significantly favors the adoption of pouch packaging, especially within the food and beverage sectors. Secondly, advancements in material science have led to the development of pouches with superior barrier properties, offering enhanced product protection and extended shelf life. Thirdly, growing environmental consciousness and stricter regulations on waste reduction are driving the adoption of lightweight and recyclable pouch solutions, aligning with sustainability goals. Finally, the cost-effectiveness and versatility of pouch packaging compared to rigid alternatives continue to make it an attractive option for manufacturers across various industries, including personal care and medical applications.

Obstacles in the Germany Pouch Packaging Market Market

Despite the positive growth trajectory, the Germany Pouch Packaging Market faces certain obstacles. Stringent regulatory requirements, particularly concerning food contact and recyclability, can increase development and compliance costs for manufacturers. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials like resins and films. Furthermore, while sustainability is a driver, the complexity of recycling multi-material pouches remains a challenge, potentially leading to landfill waste if not managed effectively. Competitive pressures from established rigid packaging formats, although diminishing, still exist in specific niche applications where their perceived durability or tamper-evidence is paramount.

Future Opportunities in Germany Pouch Packaging Market

Future opportunities within the Germany Pouch Packaging Market lie in the continued innovation of sustainable materials, including fully compostable and biodegradable pouches derived from renewable resources. The expansion of the market for medical and pharmaceutical packaging, driven by the demand for sterile and safe delivery systems, presents a significant growth avenue. The increasing adoption of pouches for e-commerce and direct-to-consumer (DTC) shipping offers further potential due to their lightweight and space-saving attributes. Moreover, the integration of smart technologies, such as anti-counterfeiting features and interactive elements, can unlock new value propositions and market segments.

Major Players in the Germany Pouch Packaging Market Ecosystem

- Mondi Plc

- Sonoco Products Company

- ProAmpac LLC

- Constantia Flexibles GmbH

- Coveris Management GmbH

- Bischof + Klein SE & Co KG

- Sudpack Holding GmbH

- Strobel GmbH

Key Developments in Germany Pouch Packaging Market Industry

- May 2024: Coveris Group significantly boosted its production capacity for medical device packaging at its facilities in Rohrdorf and Halle, Germany. The Rohrdorf facility, since its launch in May 2021, meets stringent medical packaging standards with ISO Class 7 certification. This year, the site will install two new pouch lines and one header bag line to meet surging market demands and elevate service levels, integrating seamlessly with existing technology for swift transitions.

- April 2024: SIG Group AG launched the SIG Prime 55 In-Line Aseptic, a new aseptic spouted pouch filling system. This innovative equipment features in-line pouch sterilization, eliminating the need for third-party pre-sterilization, thereby reducing supply chain complexity and improving production costs for aseptically packaged products in spouted pouches. The system has reached commercialization and was showcased at the 2024 Anuga FoodTec exhibition in Cologne, Germany.

Strategic Germany Pouch Packaging Market Market Forecast

The strategic outlook for the Germany Pouch Packaging Market is overwhelmingly positive, fueled by relentless innovation in sustainable materials and enhanced functionality. The increasing consumer inclination towards convenience and portion control will continue to drive demand for diverse pouch formats across food, beverage, and personal care sectors. Key growth catalysts include the development of mono-material solutions for improved recyclability, further penetration into the high-value medical and pharmaceutical packaging segment, and the expanding opportunities presented by the e-commerce landscape. Manufacturers that prioritize eco-friendly alternatives and invest in advanced manufacturing technologies will be best positioned to capitalize on the robust market potential and shape the future of packaging in Germany.

Germany Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Germany Pouch Packaging Market Segmentation By Geography

- 1. Germany

Germany Pouch Packaging Market Regional Market Share

Geographic Coverage of Germany Pouch Packaging Market

Germany Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from the Food and Beverage Industry to Push the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Demand from the Food and Beverage Industry to Push the Market's Growth

- 3.4. Market Trends

- 3.4.1. Stand-up Pouches to Witness Growth Across Food Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mondi Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ProAmpac LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Constantia Flexibles GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coveris Management GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bischof + Klein SE & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sudpack Holding GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Strobel GmbH10 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mondi Plc

List of Figures

- Figure 1: Germany Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Germany Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Germany Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Germany Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Germany Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Germany Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Germany Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Germany Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Germany Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Germany Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Germany Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Germany Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Germany Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Germany Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Germany Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Pouch Packaging Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the Germany Pouch Packaging Market?

Key companies in the market include Mondi Plc, Sonoco Products Company, ProAmpac LLC, Constantia Flexibles GmbH, Coveris Management GmbH, Bischof + Klein SE & Co KG, Sudpack Holding GmbH, Strobel GmbH10 2 Heat Map Analysi.

3. What are the main segments of the Germany Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand from the Food and Beverage Industry to Push the Market's Growth.

6. What are the notable trends driving market growth?

Stand-up Pouches to Witness Growth Across Food Industries.

7. Are there any restraints impacting market growth?

Demand from the Food and Beverage Industry to Push the Market's Growth.

8. Can you provide examples of recent developments in the market?

May 2024: Coveris Group is significantly boosting its production capacity for medical device packaging at its facilities in Rohrdorf and Halle, Germany. Since its launch in May 2021, the cutting-edge facility in Rohrdorf has been meeting the most stringent medical packaging standards, boasting an ISO Class 7 certification. This year, the site will see the installation of two new pouch lines and one header bag line, aimed at elevating service levels and keeping pace with the surging market demands. These new lines are designed to seamlessly integrate with the existing technology, ensuring a swift transition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence