Key Insights

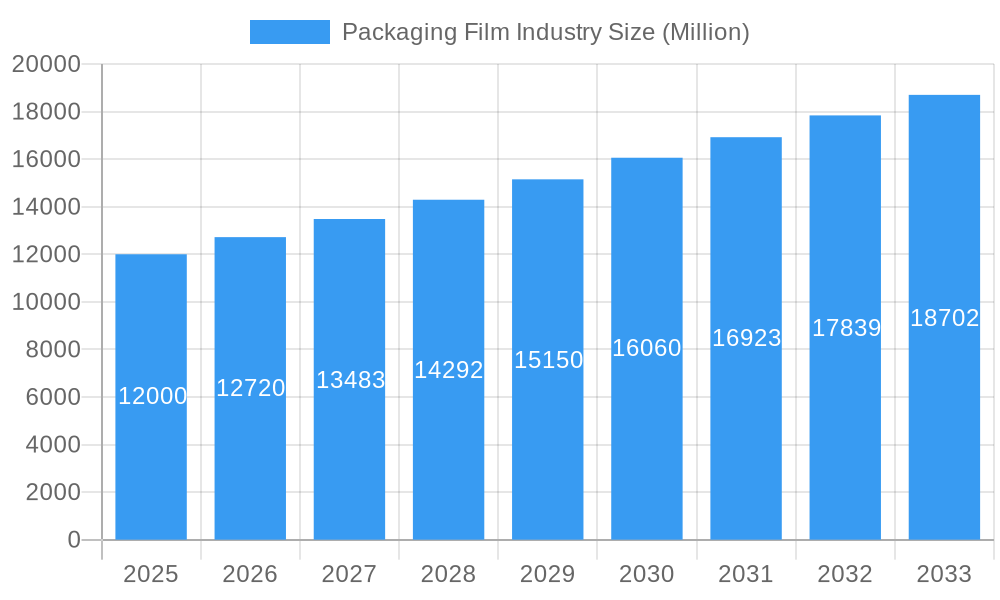

The global packaging film market is poised for significant expansion, projected to reach a substantial market size by 2033, driven by a robust CAGR of 6.00%. This growth is primarily fueled by an increasing demand for versatile and protective packaging solutions across diverse end-use industries. The Food and Beverage sector continues to be a dominant application, owing to the growing need for extended shelf-life, tamper-evidence, and convenient packaging formats. Similarly, the Medical and Pharmaceutical industries are witnessing a surge in demand for specialized packaging films that ensure product integrity, sterility, and compliance with stringent regulatory standards. Advancements in material science, leading to the development of high-performance films with enhanced barrier properties, recyclability, and biodegradability, are also key drivers propelling market growth.

Packaging Film Industry Market Size (In Billion)

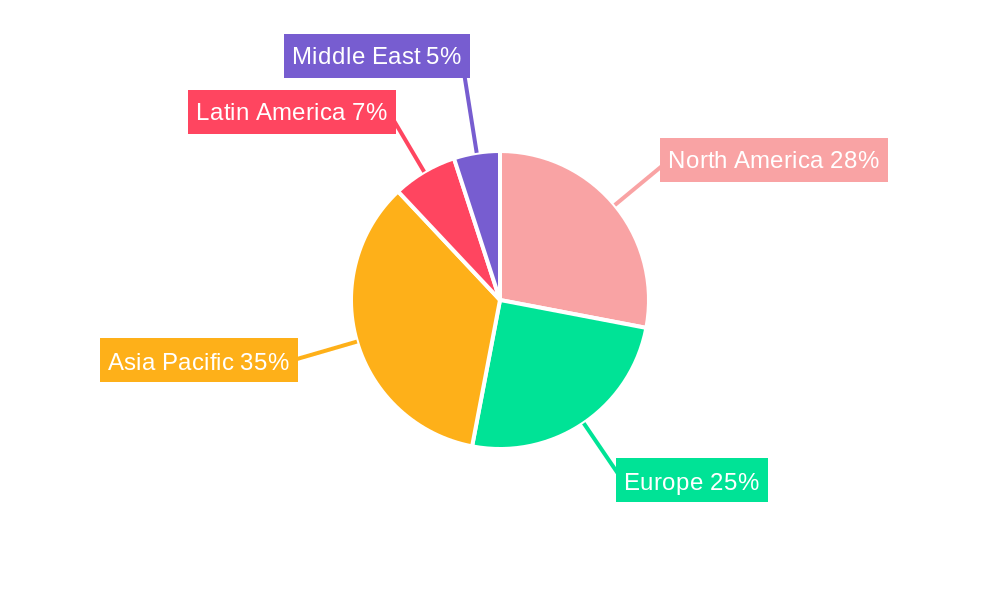

Emerging trends such as the increasing adoption of sustainable packaging materials, including bio-based and recycled films, are reshaping the market landscape. Consumers and regulatory bodies are exerting pressure on manufacturers to reduce their environmental footprint, prompting innovation in this space. However, challenges such as fluctuating raw material prices, particularly for petrochemical derivatives like polyethylene and polypropylene, and intense price competition among market players, present potential restraints. Geographically, the Asia Pacific region is expected to emerge as a leading market, fueled by rapid industrialization, a burgeoning middle class, and increasing disposable incomes, leading to higher consumption of packaged goods. North America and Europe remain significant markets, with a strong focus on premium and sustainable packaging solutions.

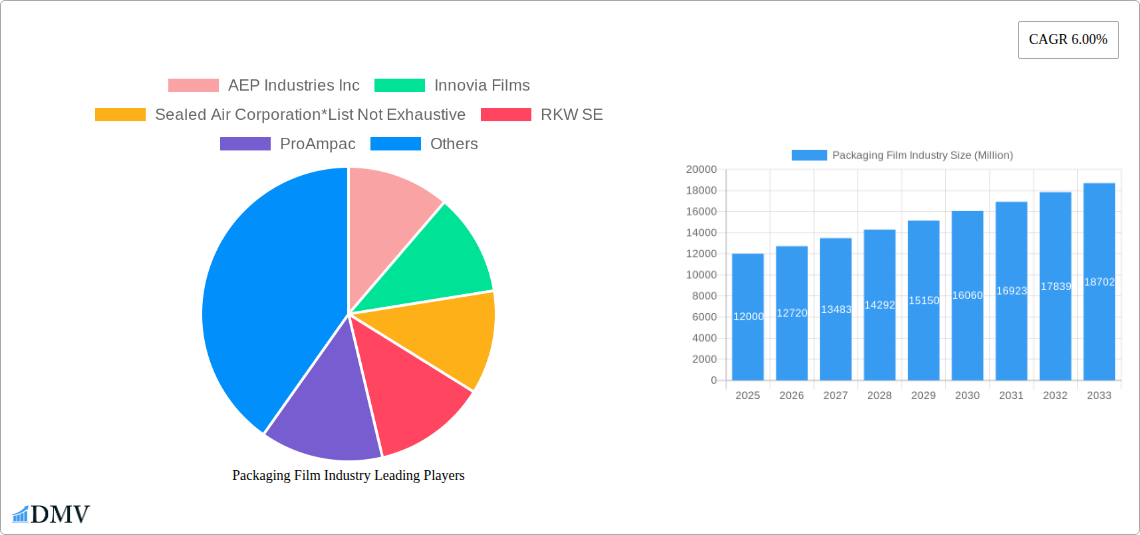

Packaging Film Industry Company Market Share

Dive deep into the dynamic packaging film market with this exhaustive report, meticulously analyzing the landscape from 2019 to 2033. We present a robust forecast for the packaging film industry, with a base year of 2025 and an estimated year of 2025, covering the forecast period of 2025–2033 and the historical period of 2019–2024. This in-depth analysis explores critical segments like Polyethylene packaging film, Polypropylene packaging film, Polyester packaging film, and PVC packaging film, alongside key applications including food packaging film, medical packaging film, consumer product packaging film, and industrial packaging film. Discover market-driving innovations, emerging opportunities, and strategic insights for stakeholders navigating this multi-million dollar industry.

Packaging Film Industry Market Composition & Trends

The global packaging film market exhibits a moderately concentrated structure, with key players driving innovation and strategic expansion. Market concentration is influenced by substantial capital investments in advanced manufacturing technologies and the continuous pursuit of sustainable solutions. Innovation catalysts are primarily driven by the demand for enhanced barrier properties, extended shelf-life solutions, and environmentally friendly alternatives. Regulatory landscapes, particularly concerning plastic waste reduction and recycling mandates, are significantly shaping market dynamics. Substitute products, such as paper-based packaging and bio-plastics, are gaining traction, prompting a strategic shift towards circular economy principles within the flexible packaging film sector. End-user profiles range from major food and beverage conglomerates to pharmaceutical giants and burgeoning e-commerce businesses, each with distinct packaging requirements. Mergers and acquisitions (M&A) activities are a notable trend, with deal values reaching hundreds of millions, aimed at consolidating market share, acquiring new technologies, and expanding geographical reach.

- Market Share Distribution: Leading companies command significant market share, with a few players holding substantial portions of the global market.

- M&A Deal Values: Historical M&A activities indicate strategic consolidation, with reported deal values often in the range of hundreds of millions of USD.

- Key Innovation Areas: High-barrier films, compostable films, recycled content films, and smart packaging solutions are key areas of R&D focus.

Packaging Film Industry Industry Evolution

The packaging film industry has witnessed remarkable evolution, driven by a confluence of technological advancements, shifting consumer preferences, and an increasing global emphasis on sustainability. Over the historical period (2019-2024), the market has experienced consistent growth, with an estimated Compound Annual Growth Rate (CAGR) in the mid-single digits. This trajectory is projected to continue through the forecast period (2025-2033), propelled by increasing demand for convenience and the expanding reach of various end-use industries. Technological breakthroughs have been pivotal, with significant investments in extrusion technologies leading to the development of thinner yet more robust films, enhanced barrier properties, and improved printability for branding and information. The adoption of multilayer film technologies has allowed for the creation of specialized films catering to specific product needs, such as oxygen and moisture barrier films crucial for extending the shelf life of perishable goods. Consumer demand has increasingly leaned towards packaging that is not only functional and aesthetically pleasing but also environmentally responsible. This has spurred the development and adoption of sustainable packaging films, including those made from recycled content and biodegradable or compostable materials. The rise of e-commerce has also created new demands, necessitating protective and efficient packaging solutions that can withstand the rigors of shipping and handling. Furthermore, regulatory pressures from governments worldwide, aiming to curb plastic waste and promote a circular economy, are actively shaping the industry's innovation pipeline and product development strategies. This includes initiatives promoting the use of post-consumer recycled (PCR) materials and the development of recyclable mono-material structures. The integration of smart technologies, such as embedded sensors for tracking and monitoring, is another emerging trend that promises to enhance supply chain transparency and product integrity. The market is actively responding to these multifaceted drivers, demonstrating a clear shift towards intelligent, efficient, and eco-conscious packaging solutions.

Leading Regions, Countries, or Segments in Packaging Film Industry

The packaging film industry is characterized by regional dominance and segment-specific growth patterns. Among the material types, Polyethylene (PE) packaging film and Polypropylene (PP) packaging film consistently hold the largest market shares due to their versatility, cost-effectiveness, and wide range of applications. The Food and Beverage Packaging application segment remains the largest revenue generator, driven by global population growth and the increasing demand for packaged convenience foods and beverages.

Dominant Segments & Key Drivers:

Type of Material:

- Polyethylene (PE): This segment is a powerhouse due to its excellent flexibility, moisture resistance, and low cost. It is extensively used in various applications, from flexible food packaging to industrial films. Investment in advanced PE extrusion technologies and the development of PE films with higher recycled content are key drivers.

- Polypropylene (PP): Valued for its high tensile strength, clarity, and resistance to heat and chemicals, PP films are crucial for applications requiring superior barrier properties and aesthetic appeal, such as in snack food packaging and medical applications.

- Polyester (PET): Known for its excellent clarity, rigidity, and gas barrier properties, PET films are vital for high-performance packaging, particularly in food and medical sectors.

- PVC: While facing some environmental scrutiny, PVC films continue to be utilized for their good clarity, strength, and cost-effectiveness in specific applications like cling films and shrink films.

- Other Type of Materials: Innovations in bioplastics and advanced polymers are gradually carving out niche segments.

Application:

- Food and Beverage Packaging: This segment's dominance is fueled by the continuous need for safe, hygienic, and shelf-stable food products. The growth of ready-to-eat meals and processed foods further bolsters demand.

- Medical and Pharmaceutical Packaging: Stringent regulatory requirements and the need for sterile, high-barrier packaging solutions ensure robust growth in this segment.

- Consumer Products Packaging: Encompasses a broad range of goods, from personal care items to electronics, where protective and visually appealing packaging is essential.

- Industrial Packaging: Includes films for protective wrapping, palletizing, and heavy-duty applications, driven by global trade and manufacturing.

- Other Applications: Emerging uses in agriculture, construction, and specialized industrial sectors contribute to overall market expansion.

Geographically, North America and Europe are mature markets with a strong focus on sustainable packaging solutions and advanced material technologies. Asia Pacific, however, is the fastest-growing region, driven by rapid industrialization, a burgeoning middle class, and increasing demand for packaged goods. Government initiatives promoting local manufacturing and stringent environmental regulations in countries like China and India are further accelerating growth in this dynamic region.

Packaging Film Industry Product Innovations

The packaging film industry is witnessing a wave of groundbreaking product innovations designed to enhance performance, sustainability, and functionality. Leading companies are investing heavily in developing high-barrier films that extend product shelf-life and reduce food waste. Innovations include advanced multilayer films incorporating novel barrier resins and functional coatings that provide superior protection against oxygen, moisture, and UV light. For instance, the collaboration between TIPA Ltd and Aquapak to develop PVDC-free compostable films with high-barrier properties showcases a significant leap towards sustainable and high-performance packaging. Furthermore, the drive towards a circular economy is fueling the development of films with increased recycled content, such as Coveris' launch of stretch films with a minimum of 30% recycled content, addressing both environmental concerns and regulatory pressures. Pregis' investment in advanced multilayer PE film technology, enabling the production of high-yield, thin PE films with exceptional performance, exemplifies the industry's commitment to efficiency and sustainability. These innovations not only meet evolving consumer demands for eco-friendly packaging but also offer enhanced product protection and extended usability.

Propelling Factors for Packaging Film Industry Growth

Several key factors are propelling the packaging film industry forward. The escalating global demand for packaged goods, particularly in the food and beverage and healthcare sectors, is a primary driver. Technological advancements, such as the development of advanced barrier films and thinner, more robust materials, enhance product preservation and reduce material usage. Growing environmental consciousness among consumers and stringent government regulations promoting recyclability and the use of recycled content are pushing manufacturers towards sustainable solutions. The expansion of e-commerce also necessitates efficient and protective packaging. Furthermore, economic growth in emerging markets is leading to increased disposable income, driving demand for convenience and packaged consumer products.

Obstacles in the Packaging Film Industry Market

Despite robust growth, the packaging film industry faces several significant obstacles. Stringent and evolving environmental regulations, while driving innovation, can also increase compliance costs and complexity for manufacturers. The volatility of raw material prices, particularly for petrochemical-based resins, can impact profitability and market stability. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can lead to production delays and increased costs. Intense competition, both from established players and emerging companies, can put pressure on profit margins. Furthermore, consumer perception and the ongoing debate surrounding plastic waste can pose challenges, requiring continuous efforts in education and the development of genuinely sustainable alternatives.

Future Opportunities in Packaging Film Industry

The packaging film industry is poised for significant future opportunities driven by emerging trends and unmet needs. The increasing global focus on a circular economy presents a substantial opportunity for the development and widespread adoption of recyclable, compostable, and biodegradable film solutions. Advancements in material science are opening doors for smart packaging, incorporating features like freshness indicators and anti-counterfeiting technologies, which will be highly sought after in the food and pharmaceutical sectors. The expanding global middle class and the continued growth of e-commerce will drive demand for innovative and protective packaging. Furthermore, the exploration of novel bio-based polymers and advanced recycling technologies offers pathways for growth and differentiation, allowing companies to meet both performance requirements and sustainability mandates.

Major Players in the Packaging Film Industry Ecosystem

- AEP Industries Inc

- Innovia Films

- Sealed Air Corporation

- RKW SE

- ProAmpac

- SRF Limited

- Sigma Plastics Group

- Dupont Teijin Films

- Graphic Packaging International LLC

- Novolex

- Cosmo Films Ltd

- Jindal Poly Films Ltd

- Amcor PLC (Bemis Company Inc )

Key Developments in Packaging Film Industry Industry

- August 2022: TIPA Ltd and Aquapak collaborated to develop new compostable film solutions. This collaboration involved TIPA Ltd using Aquapak's water-soluble polymer technology to deliver high-barrier and polyvinylidene dichloride (PVDC)-free compostable films for packaging.

- June 2022: Pregis, the producer of protective packaging solutions, announced that it would invest more than EUR 10 million (USD 10.6 million) in multilayer PE film technology and manufacturing tools at its location in Heerlen, Netherlands. With this investment, Pregis can continue to provide the packaging industry with cutting-edge sustainable solutions. Utilizing the Pregis AirSpeed inflatable systems for void fill and Hybrid Cushioning "HC" performance packaging solutions, the new extrusion technology will enable Pregis to create and produce high-yield "thin" PE film with exceptional performance.

- February 2022: To lessen reliance on virgin plastics and satisfy upcoming UK Plastic Packaging Tax requirements, Coveris launched a variety of lightweight, next-generation stretch films with a minimum of 30% recycled content. The films are the most recent in a recent line of recycled product breakthroughs that also assist the businesses' objective of zero net waste. They were developed at Coveris' cutting-edge extrusion factory and Film Science Lab in Winsford.

Strategic Packaging Film Industry Market Forecast

The packaging film industry market forecast is highly optimistic, driven by a clear shift towards sustainable and high-performance solutions. The growing emphasis on the circular economy, coupled with advancements in material science, will unlock significant opportunities for recyclable and compostable films. Investments in advanced manufacturing technologies, particularly for multilayer films and films with enhanced barrier properties, will continue to be a focal point, ensuring product integrity and extended shelf life. The burgeoning demand from developing economies and the sustained growth of e-commerce will provide a steady revenue stream. Strategic partnerships and M&A activities are expected to shape the competitive landscape, leading to greater consolidation and innovation. The industry's ability to adapt to evolving regulatory frameworks and consumer preferences will be critical in capitalizing on the projected market expansion, ensuring a robust and dynamic future for this essential sector.

Packaging Film Industry Segmentation

-

1. Type of Material

- 1.1. Polyethylene

- 1.2. Polypropylene

- 1.3. Polyester

- 1.4. PVC

- 1.5. Other Type of Materials

-

2. Application

- 2.1. Food and Beverage Packaging

- 2.2. Medical and Pharmaceutical Packaging

- 2.3. Consumer Products Packaging

- 2.4. Industrial Packaging

- 2.5. Other Applications

Packaging Film Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Packaging Film Industry Regional Market Share

Geographic Coverage of Packaging Film Industry

Packaging Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in E-commerce Business has Fueled Demand for Packaging; Innovations in Food and Beverage Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations for Chemical Composition of Packaging Materials

- 3.4. Market Trends

- 3.4.1. A Surge in E-commerce Business has Fueled Demand for Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 5.1.1. Polyethylene

- 5.1.2. Polypropylene

- 5.1.3. Polyester

- 5.1.4. PVC

- 5.1.5. Other Type of Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage Packaging

- 5.2.2. Medical and Pharmaceutical Packaging

- 5.2.3. Consumer Products Packaging

- 5.2.4. Industrial Packaging

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 6. North America Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 6.1.1. Polyethylene

- 6.1.2. Polypropylene

- 6.1.3. Polyester

- 6.1.4. PVC

- 6.1.5. Other Type of Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage Packaging

- 6.2.2. Medical and Pharmaceutical Packaging

- 6.2.3. Consumer Products Packaging

- 6.2.4. Industrial Packaging

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 7. Europe Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 7.1.1. Polyethylene

- 7.1.2. Polypropylene

- 7.1.3. Polyester

- 7.1.4. PVC

- 7.1.5. Other Type of Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage Packaging

- 7.2.2. Medical and Pharmaceutical Packaging

- 7.2.3. Consumer Products Packaging

- 7.2.4. Industrial Packaging

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 8. Asia Pacific Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 8.1.1. Polyethylene

- 8.1.2. Polypropylene

- 8.1.3. Polyester

- 8.1.4. PVC

- 8.1.5. Other Type of Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage Packaging

- 8.2.2. Medical and Pharmaceutical Packaging

- 8.2.3. Consumer Products Packaging

- 8.2.4. Industrial Packaging

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 9. Latin America Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 9.1.1. Polyethylene

- 9.1.2. Polypropylene

- 9.1.3. Polyester

- 9.1.4. PVC

- 9.1.5. Other Type of Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage Packaging

- 9.2.2. Medical and Pharmaceutical Packaging

- 9.2.3. Consumer Products Packaging

- 9.2.4. Industrial Packaging

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 10. Middle East Packaging Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Material

- 10.1.1. Polyethylene

- 10.1.2. Polypropylene

- 10.1.3. Polyester

- 10.1.4. PVC

- 10.1.5. Other Type of Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage Packaging

- 10.2.2. Medical and Pharmaceutical Packaging

- 10.2.3. Consumer Products Packaging

- 10.2.4. Industrial Packaging

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AEP Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Innovia Films

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sealed Air Corporation*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RKW SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ProAmpac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SRF Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sigma Plastics Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dupont Teijin Films

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Graphic Packaging International LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Novolex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cosmo Films Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jindal Poly Films Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Amcor PLC (Bemis Company Inc )

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 AEP Industries Inc

List of Figures

- Figure 1: Global Packaging Film Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Packaging Film Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 3: North America Packaging Film Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 4: North America Packaging Film Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Packaging Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Packaging Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Packaging Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Packaging Film Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 9: Europe Packaging Film Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 10: Europe Packaging Film Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Packaging Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Packaging Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Packaging Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Packaging Film Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 15: Asia Pacific Packaging Film Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 16: Asia Pacific Packaging Film Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Packaging Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Packaging Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Packaging Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Packaging Film Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 21: Latin America Packaging Film Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 22: Latin America Packaging Film Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Packaging Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Packaging Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Packaging Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Packaging Film Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 27: Middle East Packaging Film Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 28: Middle East Packaging Film Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East Packaging Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Packaging Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Packaging Film Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 2: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Packaging Film Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 5: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Packaging Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 8: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Packaging Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 11: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Packaging Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 14: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Packaging Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Packaging Film Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 17: Global Packaging Film Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Packaging Film Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Film Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Packaging Film Industry?

Key companies in the market include AEP Industries Inc, Innovia Films, Sealed Air Corporation*List Not Exhaustive, RKW SE, ProAmpac, SRF Limited, Sigma Plastics Group, Dupont Teijin Films, Graphic Packaging International LLC, Novolex, Cosmo Films Ltd, Jindal Poly Films Ltd, Amcor PLC (Bemis Company Inc ).

3. What are the main segments of the Packaging Film Industry?

The market segments include Type of Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Surge in E-commerce Business has Fueled Demand for Packaging; Innovations in Food and Beverage Packaging.

6. What are the notable trends driving market growth?

A Surge in E-commerce Business has Fueled Demand for Packaging.

7. Are there any restraints impacting market growth?

Stringent Regulations for Chemical Composition of Packaging Materials.

8. Can you provide examples of recent developments in the market?

August 2022: TIPA Ltd and Aquapak collaborated to develop new compostable film solutions. This collaboration involved TIPA Ltd using Aquapak'swater-soluble polymer technology to deliver high-barrier and polyvinylidene dichloride (PVDC)-free compostable films for packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging Film Industry?

To stay informed about further developments, trends, and reports in the Packaging Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence