Key Insights

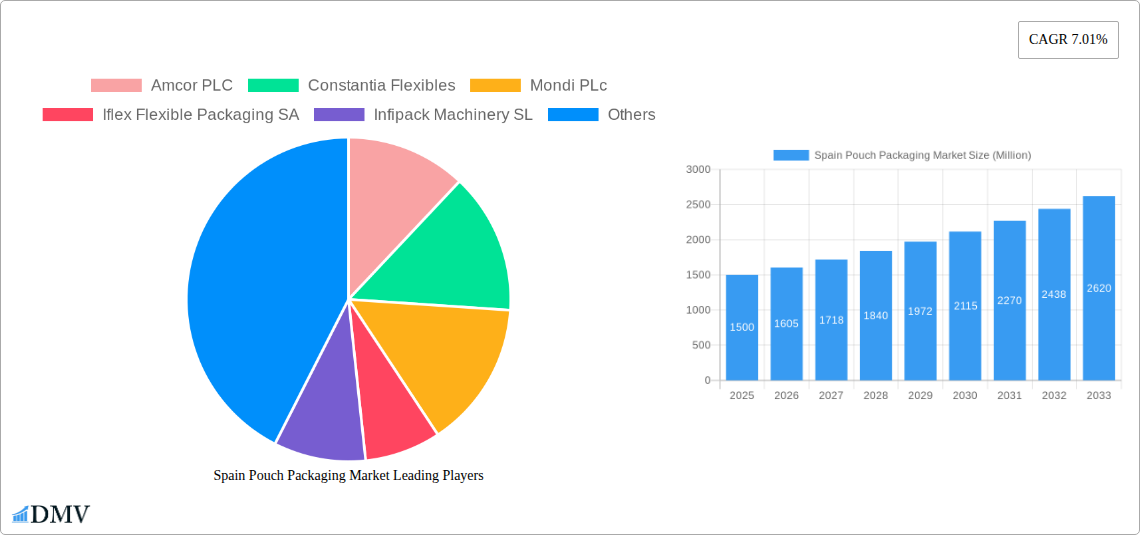

The Spanish pouch packaging market is poised for robust growth, projected to reach an estimated [estimated market size based on 0.62 unit value, assuming unit refers to billions or a similar large denomination] million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.01% anticipated through 2033. This expansion is primarily fueled by escalating consumer demand for convenient, portable, and sustainable packaging solutions across key end-user industries. The food and beverage sector, in particular, is a significant driver, with specialized pouches for products like confectionery, frozen foods, dairy, and pet food witnessing substantial uptake. Advancements in material science, leading to the development of more durable, eco-friendly, and barrier-efficient plastics such as polyethylene and polypropylene, alongside innovative paper and aluminum-based structures, are enabling manufacturers to meet evolving consumer and regulatory requirements. Furthermore, the increasing adoption of flat and stand-up pouch formats offers enhanced product visibility and user experience, directly contributing to market buoyancy.

Spain Pouch Packaging Market Market Size (In Billion)

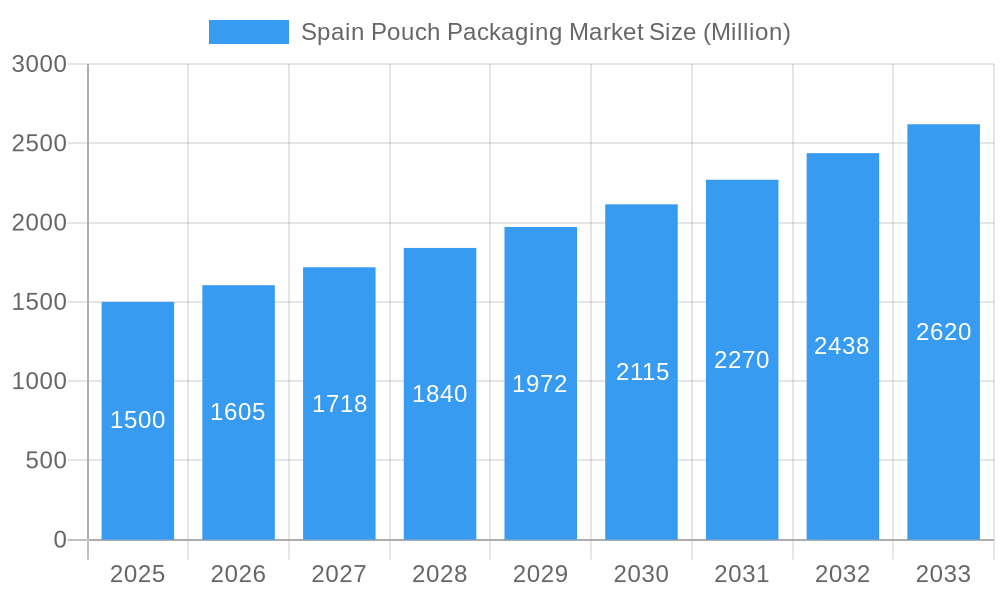

The market's trajectory is further supported by a growing emphasis on sustainability and recyclability within the packaging industry. Innovations in materials and design are actively addressing environmental concerns, driving the adoption of recyclable and compostable pouch options. While the convenience and shelf-life extension offered by pouch packaging remain strong selling points, the market faces some challenges. Fluctuations in raw material prices, particularly for plastics and aluminum, can impact manufacturing costs. Additionally, the ongoing evolution of regulations concerning plastic usage and waste management necessitates continuous adaptation and investment in sustainable alternatives by market players. Despite these considerations, the overall outlook for the Spanish pouch packaging market remains exceptionally positive, driven by innovation, consumer preference for convenience, and a growing commitment to environmental responsibility. Key players like Amcor PLC, Constantia Flexibles, and Mondi Plc are actively shaping this landscape through strategic investments and product development.

Spain Pouch Packaging Market Company Market Share

This in-depth report provides a strategic overview of the Spain Pouch Packaging Market, offering critical insights into market dynamics, growth drivers, and future potential. With a focus on SEO optimization and high-ranking keywords such as flexible packaging Spain, pouch packaging solutions, food packaging trends Spain, pharmaceutical packaging Spain, and sustainable packaging Spain, this report is designed to captivate stakeholders and boost search visibility. We cover the Spain pouch packaging market size, Spain pouch packaging market share, Spain pouch packaging market forecast, and Spain pouch packaging market trends across a comprehensive study period from 2019 to 2033, with the base year at 2025.

Spain Pouch Packaging Market Market Composition & Trends

The Spain Pouch Packaging Market exhibits a moderately concentrated landscape, driven by innovation and evolving consumer preferences for convenience and sustainability. Key innovation catalysts include the increasing demand for shelf-stable products, the rise of e-commerce requiring robust and lightweight packaging, and stringent environmental regulations promoting recyclable and biodegradable pouch materials. The regulatory environment in Spain is increasingly focusing on plastic waste reduction, incentivizing the adoption of eco-friendly flexible packaging solutions. Substitute products, such as rigid containers, face challenges from the superior barrier properties, extended shelf life, and cost-effectiveness of pouches. End-user profiles are diverse, with the food packaging Spain sector leading consumption, followed by beverages, pharmaceuticals, and personal care. Mergers and acquisitions (M&A) activity is a significant trend, with deal values influencing market consolidation and the strategic positioning of key players. For instance, strategic acquisitions are expected to bolster market share distribution, with top players aiming to enhance their product portfolios and geographical reach. Estimated market value for M&A activities in the forecast period is projected to be in the range of XXX Million.

Spain Pouch Packaging Market Industry Evolution

The Spain Pouch Packaging Market has witnessed a dynamic evolution, characterized by sustained growth trajectories fueled by a confluence of technological advancements and shifting consumer demands. From 2019 to 2024, the historical period saw a steady increase in pouch adoption driven by the inherent advantages of flexible packaging, including its lighter weight, reduced material usage, and enhanced product protection. The base year 2025 marks a pivotal point, with the market poised for accelerated expansion. Technological advancements have played a crucial role, with innovations in material science leading to the development of enhanced barrier films, compostable and biodegradable pouches, and advanced printing techniques that offer superior aesthetics and brand differentiation. The adoption of these advanced materials and technologies is projected to grow at an annual rate of approximately 5-7% in the forecast period 2025–2033.

Consumer demand has been a significant propeller, with a marked preference for convenience-driven formats like single-serve pouches and resealable options. The growing emphasis on health and wellness has also translated into demand for specialized pharmaceutical packaging Spain and medical packaging Spain, where pouches offer tamper-evidence and precise dosage delivery. Furthermore, the burgeoning e-commerce sector has underscored the need for packaging that can withstand transit while remaining lightweight and space-efficient, a niche where pouches excel. The integration of smart packaging features, such as QR codes for product traceability and interactive labels, is another emerging trend contributing to the industry's evolution. This continuous adaptation to consumer needs and technological innovation solidifies the Spain pouch packaging market forecast for robust and sustained growth. The overall Spain pouch packaging market size is projected to reach an impressive XXX Million by 2033, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period.

Leading Regions, Countries, or Segments in Spain Pouch Packaging Market

The Spain Pouch Packaging Market is significantly influenced by its segmentation across various materials, product types, and end-user industries, with Plastic materials currently dominating due to their versatility, cost-effectiveness, and excellent barrier properties. Within the plastic segment, Polyethylene (PE) and Polypropylene (PP) are the most widely utilized resins, accounting for an estimated 65% of the material market share. These materials are favored for their flexibility, durability, and printability, making them ideal for a wide range of pouch applications.

Material Dominance (Plastic):

- Polyethylene (PE) & Polypropylene (PP): These constitute the backbone of the plastic pouch market, offering a balance of performance and affordability for everyday packaging needs, from dry foods to personal care items. Their widespread availability and established manufacturing processes contribute to their leading position.

- PET (Polyethylene Terephthalate): Valued for its excellent clarity and good barrier properties, PET is often used in multi-layer structures for products requiring extended shelf life and visual appeal.

- EVOH (Ethylene Vinyl Alcohol): Crucial for high-barrier applications, EVOH is integrated into plastic films to provide superior oxygen and moisture resistance, essential for preserving the freshness of sensitive food products and pharmaceuticals.

Product Type Dominance (Stand-up Pouches):

- Stand-up Pouches: These pouches are experiencing remarkable growth, capturing an estimated 40% of the product segment. Their inherent design allows for excellent shelf presence, consumer convenience with resealability, and efficient storage, making them a preferred choice for brands across the food, beverage, and personal care sectors. Their ability to stand upright on shelves significantly enhances brand visibility and consumer engagement.

- Flat (Pillow & Side-Seal) Pouches: While still significant, these formats are seeing slower growth compared to stand-up pouches, primarily used for single-serve portions, snacks, and smaller product items where the primary focus is on protection and cost-efficiency.

End-User Industry Dominance (Food):

- Food Industry: This sector represents the largest consumer of pouch packaging in Spain, accounting for an estimated 55% of the overall market. The diverse sub-segments within food highlight the broad applicability of pouches:

- Dry Foods: Including pasta, grains, snacks, and baking ingredients, benefiting from moisture and oxygen barrier properties.

- Candy & Confectionery: Pouches provide attractive, resealable packaging for sweets and chocolates, enhancing consumer appeal.

- Frozen Foods & Dairy Products: Pouches are increasingly used for frozen vegetables, ready meals, yogurt, and cheese, offering convenience and extended shelf life.

- Meat, Poultry, And Seafood: High-barrier pouches are crucial for extending the shelf life and ensuring the safety of these perishable goods.

- Pet Food: The booming pet food market relies heavily on large, convenient, and resealable pouches.

- Beverage Industry: Pouches are gaining traction for juices, powdered drink mixes, and even some alcoholic beverages, offering portability and reduced shipping costs.

- Medical and Pharmaceutical: Pouches are vital for sterile packaging of medications, diagnostic kits, and medical devices, demanding high levels of barrier protection and tamper-evidence.

- Personal Care and Household Care: Pouches are used for detergents, soaps, shampoos, and cosmetics, offering a lighter and often more sustainable alternative to rigid containers.

- Food Industry: This sector represents the largest consumer of pouch packaging in Spain, accounting for an estimated 55% of the overall market. The diverse sub-segments within food highlight the broad applicability of pouches:

Key drivers for this dominance include extensive investment in advanced manufacturing facilities by key players, robust regulatory support for food safety and packaging innovations, and consumer trends favoring convenience and portion control, particularly within the food packaging trends Spain landscape.

Spain Pouch Packaging Market Product Innovations

Product innovation in the Spain Pouch Packaging Market is primarily focused on enhancing sustainability, functionality, and consumer appeal. The introduction of compostable and biodegradable pouches made from plant-based materials is a significant development, addressing growing environmental concerns and meeting regulatory demands. Advances in multi-layer film technology are yielding pouches with superior barrier properties, extending shelf life for sensitive products like fresh produce and pharmaceuticals without compromising on recyclability. Smart packaging solutions, incorporating QR codes for traceability and authentication, are also emerging, particularly within the pharmaceutical packaging Spain sector to combat counterfeiting and provide consumers with product information. The development of easy-open and resealable features continues to be a key focus, enhancing user convenience for a wide range of consumer goods, from snacks to household products. These innovations collectively drive the Spain pouch packaging market growth.

Propelling Factors for Spain Pouch Packaging Market Growth

Several key factors are propelling the growth of the Spain Pouch Packaging Market. The ever-increasing consumer demand for convenience and portability, particularly in the food packaging trends Spain sector, significantly boosts the adoption of single-serve and resealable pouches. A growing emphasis on sustainability and environmental responsibility is driving the market towards flexible packaging solutions that are recyclable, compostable, or made from recycled content. Technological advancements in material science and manufacturing processes are enabling the creation of pouches with enhanced barrier properties, extended shelf life, and improved aesthetics. Furthermore, the burgeoning e-commerce sector necessitates lightweight, durable, and cost-effective packaging, a niche where pouches excel. The expanding pharmaceutical and medical sectors also contribute, with pouches offering sterile, tamper-evident packaging solutions.

Obstacles in the Spain Pouch Packaging Market Market

Despite robust growth prospects, the Spain Pouch Packaging Market faces several obstacles. Regulatory complexities and evolving waste management policies, particularly concerning plastic packaging, can pose challenges for manufacturers. Supply chain disruptions, including volatile raw material prices and availability, can impact production costs and lead times. Intense competition within the market, both from established players and new entrants, exerts pressure on pricing and profit margins. The need for significant capital investment in advanced manufacturing technologies and sustainable material development can also be a barrier for smaller enterprises. Consumer perception regarding the recyclability of certain flexible packaging structures can also be a restraint, necessitating ongoing educational initiatives.

Future Opportunities in Spain Pouch Packaging Market

The Spain Pouch Packaging Market is ripe with future opportunities. The increasing demand for sustainable packaging Spain presents a significant avenue for growth, with innovations in biodegradable, compostable, and recyclable pouches expected to gain substantial market share. The expanding e-commerce landscape will continue to drive the need for lightweight, protective, and space-efficient pouch solutions. Growth in niche segments like premium pet food, specialized beverages, and medical supplies will offer new markets for customized pouch designs and advanced functionalities. Furthermore, the development of smart pouch technologies, integrating features like temperature indicators and authentication mechanisms, presents an opportunity to add value and cater to specific industry needs within the pharmaceutical packaging Spain and food sectors.

Major Players in the Spain Pouch Packaging Market Ecosystem

- Amcor PLC

- Constantia Flexibles

- Mondi Plc

- Iflex Flexible Packaging SA

- Infipack Machinery SL

- Emsur (Grupo Lantero)

- Sonoco Products Company

Key Developments in Spain Pouch Packaging Market Industry

- June 2024: Constantia Flexibles celebrated its 75th anniversary at its Burgos, Spain production facilities. The Mayor of Burgos toured the site, gaining insight into advanced manufacturing of premier consumer and pharmaceutical flexible packaging, underscoring the company's strong position to offer more flexible products, such as pouches in the country.

- June 2023: Amcor PLC expanded its AmFiber Performance Paper packaging line in Europe, introducing heat-sealing sachets for dry culinary and beverage applications. This expansion, including a new production line at its Amcor Flexibles Alzira facility in Spain, bolsters manufacturing capabilities and diversifies product categories to meet rising demand.

Strategic Spain Pouch Packaging Market Market Forecast

The Spain Pouch Packaging Market is strategically positioned for significant growth, driven by the inherent advantages of flexible packaging and evolving market demands. The forecast period (2025–2033) will witness a surge in demand for sustainable pouch solutions, including compostable and recyclable options, aligning with environmental mandates and consumer preferences. Continuous innovation in barrier technologies will further enhance product protection and shelf life, particularly within the food and pharmaceutical sectors. The expanding e-commerce sector will also remain a strong growth catalyst, demanding lightweight, durable, and cost-effective packaging. With a projected Spain pouch packaging market size of XXX Million by 2033 and an estimated CAGR of 6.5%, the market presents substantial opportunities for stakeholders focusing on technological advancement, sustainability, and catering to evolving consumer needs.

Spain Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Spain Pouch Packaging Market Segmentation By Geography

- 1. Spain

Spain Pouch Packaging Market Regional Market Share

Geographic Coverage of Spain Pouch Packaging Market

Spain Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Small and Convenient Packaging; Growing Supermarkets and Retail Sales

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Small and Convenient Packaging; Growing Supermarkets and Retail Sales

- 3.4. Market Trends

- 3.4.1. Supermarkets to Push the Demand for Convenient Pouch Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Constantia Flexibles

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi PLc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iflex Flexible Packaging SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Infipack Machinery SL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Emsur (Grupo Lantero)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonoco Products Company8 2 Heat Map Analysi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: Spain Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Spain Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Spain Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Spain Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Spain Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Spain Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Spain Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Spain Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Spain Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Spain Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Spain Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Spain Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Spain Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Spain Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Spain Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Spain Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Pouch Packaging Market?

The projected CAGR is approximately 7.01%.

2. Which companies are prominent players in the Spain Pouch Packaging Market?

Key companies in the market include Amcor PLC, Constantia Flexibles, Mondi PLc, Iflex Flexible Packaging SA, Infipack Machinery SL, Emsur (Grupo Lantero), Sonoco Products Company8 2 Heat Map Analysi.

3. What are the main segments of the Spain Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Small and Convenient Packaging; Growing Supermarkets and Retail Sales.

6. What are the notable trends driving market growth?

Supermarkets to Push the Demand for Convenient Pouch Packaging.

7. Are there any restraints impacting market growth?

Rising Demand for Small and Convenient Packaging; Growing Supermarkets and Retail Sales.

8. Can you provide examples of recent developments in the market?

June 2024: Constantia Flexibles achieved its goal and celebrated the 75th anniversary of its production facilities in Burgos, Spain. In honor of this occasion, the Mayor of Burgos toured the site, gaining insight into the advanced manufacturing of premier consumer and pharmaceutical flexible packaging. Throughout the visit, employees and management provided a detailed look at the intricate production methods, underscoring the company's global reputation for top-tier packaging solutions. This would mark a strong position for the company to offer more flexible products, such as pouches in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Spain Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence