Key Insights

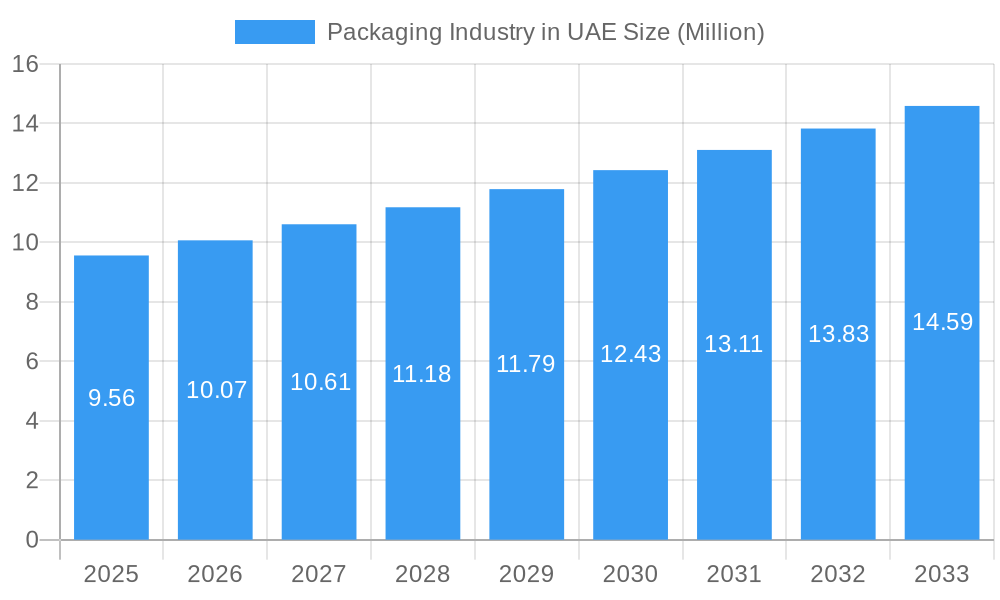

The UAE Packaging Industry is poised for robust growth, projected to reach a market size of approximately USD 9.56 billion by 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 5.41%, indicating a dynamic and expanding market landscape. Key drivers behind this growth include the burgeoning e-commerce sector, which necessitates efficient and innovative packaging solutions, and the UAE's strategic location as a global trade hub, attracting significant import and export activities requiring substantial packaging. Furthermore, increasing consumer demand for convenience, sustainability, and premium product presentation across various end-user industries like food & beverage, pharmaceuticals, and personal & homecare is significantly contributing to market expansion. The report highlights a diverse segmentation within the market, with plastic and paper & paperboard materials dominating, alongside rigid and flexible packaging types catering to a wide array of product needs.

Packaging Industry in UAE Market Size (In Million)

The industry's trajectory is also shaped by evolving consumer preferences and regulatory landscapes. A strong emphasis on sustainable packaging solutions, including recycled content and biodegradable options, is emerging as a significant trend, aligning with global environmental initiatives and governmental pushes towards a circular economy. This trend is expected to drive innovation in material science and packaging design. However, the market also faces certain restraints. Fluctuations in raw material prices, particularly for plastics and paper, can impact profitability and lead to increased costs for end-users. Additionally, stringent environmental regulations and the associated compliance costs might pose challenges for some manufacturers. Despite these challenges, the strategic investments in advanced manufacturing technologies and the continuous development of specialized packaging for niche applications are expected to propel the UAE packaging market forward. The presence of major global and local players like Amcor Ltd, Mondi Group, and Hotpack Packaging LLC indicates a competitive yet promising environment for the sector.

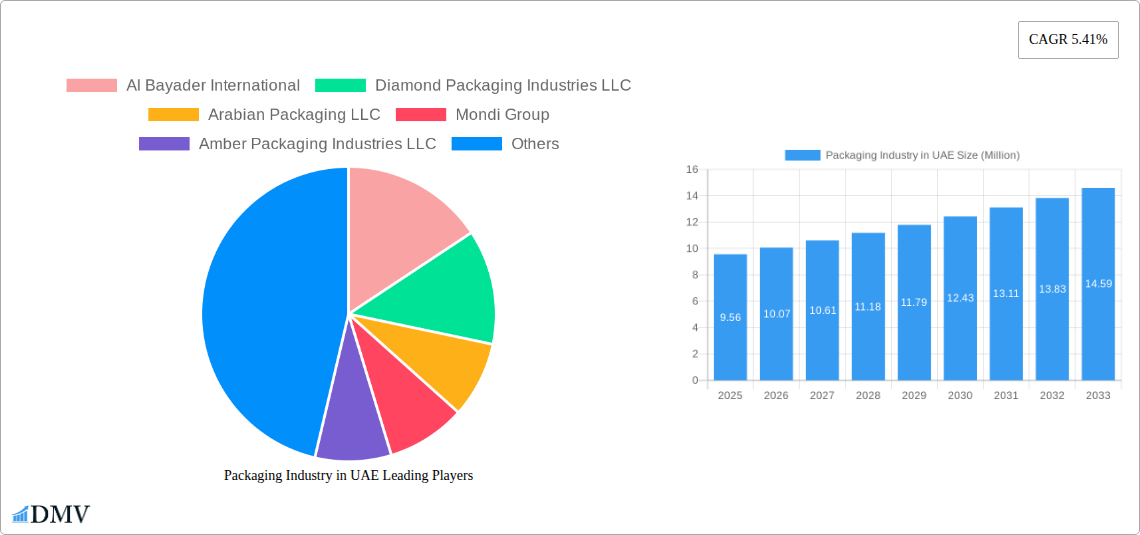

Packaging Industry in UAE Company Market Share

Here is an SEO-optimized, insightful report description for the Packaging Industry in UAE, designed to boost search visibility and captivate stakeholders.

Dive deep into the dynamic UAE packaging industry with this definitive report, meticulously analyzing market composition, trends, and future trajectories from 2019 to 2033. As the United Arab Emirates solidifies its position as a global hub for commerce and innovation, understanding the nuances of its burgeoning packaging sector is paramount. This comprehensive study offers unparalleled insights for businesses, investors, and policymakers, covering market concentration, regulatory frameworks, technological advancements, and evolving end-user demands. Explore the strategic landscape, from dominant flexible packaging solutions to the pivotal role of sustainable packaging, and identify key growth drivers and potential impediments. This report is your essential guide to navigating the opportunities and challenges within one of the fastest-growing packaging markets in the Middle East.

Packaging Industry in UAE Market Composition & Trends

The UAE packaging market is characterized by a moderate to high level of concentration, with key players like Al Bayader International, Diamond Packaging Industries LLC, and Arabian Packaging LLC holding significant market share. Innovation is being spurred by a growing emphasis on sustainability and operational efficiency. Regulatory landscapes are evolving, with initiatives promoting the adoption of recycled packaging and reducing single-use plastics. Substitute products, particularly eco-friendly alternatives, are gaining traction, influencing material choices. End-user profiles reveal a strong demand from the food packaging and beverage packaging sectors, followed closely by pharmaceutical packaging and personal care packaging. Mergers and acquisitions (M&A) activities, with an estimated total deal value of over $500 Million in the historical period, are shaping the competitive ecosystem, consolidating market power and fostering technological integration. Market share distribution shows paper and paperboard packaging and plastic packaging segments leading the pack, driven by their versatility and cost-effectiveness for various applications.

Packaging Industry in UAE Industry Evolution

The packaging industry in UAE has witnessed remarkable evolution throughout the Study Period (2019–2033), with a notable growth trajectory from the Historical Period (2019–2024) into the Estimated Year (2025) and the projected Forecast Period (2025–2033). Market growth has been consistently robust, averaging an estimated 7.5% annually in recent years, fueled by a burgeoning population, expanding e-commerce, and significant government investments in infrastructure and industrial diversification. Technological advancements are at the forefront of this evolution. The adoption of Industry 4.0 principles, automation, and smart packaging solutions is transforming manufacturing processes, enhancing efficiency, and improving traceability. For instance, Hotpack Packaging's strategic agreement with Maxbyte to digitize its factories underscores a commitment to leveraging AI and robotics for optimized production and supply chain management. Shifting consumer demands are also playing a critical role. There's a discernible and accelerating preference for sustainable packaging, eco-friendly materials, and minimalist designs. This shift is compelling manufacturers to invest in R&D for biodegradable, recyclable, and compostable packaging solutions. The rise of premiumization in sectors like food and personal care is also driving demand for high-quality, aesthetically pleasing, and functional packaging. Furthermore, the growing emphasis on food safety and shelf-life extension is pushing innovation in barrier properties and active packaging technologies. The expansion of the healthcare sector, particularly with the increased demand for pharmaceuticals and medical devices, has also contributed significantly to the growth of specialized and high-performance packaging solutions. Overall, the UAE packaging industry is transitioning from a predominantly functional role to a more strategic one, deeply integrated with brand image, consumer experience, and environmental responsibility.

Leading Regions, Countries, or Segments in Packaging Industry in UAE

The UAE packaging industry landscape is dominated by several key segments, each driven by distinct factors. Within the Material segment, Plastic packaging stands out as the leader, accounting for an estimated 45% of the market share. Its dominance is attributed to its versatility, durability, cost-effectiveness, and suitability for a wide range of applications, particularly in the food and beverage industries. Paper and paperboard packaging follows closely, driven by increasing demand for sustainable and recyclable options, especially for e-commerce and consumer goods.

In terms of Packaging Type, Flexible packaging emerges as the most prominent segment, estimated to hold over 50% of the market. This is largely due to its lightweight nature, cost-efficiency, and adaptability for products ranging from snacks and confectionery to pharmaceuticals and personal care items. Rigid packaging maintains a significant presence, particularly for premium products, glass bottles, and certain food and beverage applications requiring structural integrity and a high-end feel.

The End-user Industry segment is overwhelmingly led by the Food industry, which is estimated to consume around 55% of all packaging produced in the UAE. This is a direct consequence of the UAE's status as a major food import and re-export hub, coupled with a large and growing consumer base. The Beverage industry is the second-largest consumer, followed by Pharmaceutical and Personal and Homecare industries.

Key drivers for the dominance of these segments include:

- Investment Trends: Significant investments are being channeled into advanced plastic recycling technologies and the development of high-barrier flexible films to meet the evolving demands of the food and beverage sectors.

- Regulatory Support: Government initiatives promoting local manufacturing and sustainable practices are indirectly boosting segments that align with these goals, such as paper and paperboard and recyclable plastics.

- Consumer Preferences: The rising middle class and expatriate population drive demand for convenience, portion-controlled packaging, and visually appealing designs, favoring flexible and innovative plastic solutions.

- E-commerce Growth: The exponential growth of e-commerce in the UAE has significantly boosted the demand for lightweight, durable, and protective packaging, primarily in the flexible and paper-based categories.

The Other End-user Industries, encompassing sectors like industrial goods and electronics, also represent a growing segment, demanding specialized and protective packaging solutions.

Packaging Industry in UAE Product Innovations

The UAE packaging industry is abuzz with innovation, focusing on enhanced functionality, sustainability, and consumer engagement. Innovations include the development of advanced barrier films for extended shelf-life in food packaging, the creation of biodegradable and compostable plastic packaging alternatives, and the integration of smart technologies like QR codes for enhanced traceability and consumer interaction. Performance metrics are improving with lighter-weight materials, increased puncture resistance in flexible formats, and superior sealing capabilities. For instance, the adoption of post-consumer recycled plastic (rPET) by companies like Al Bayader International signifies a strong commitment to circular economy principles, offering a sustainable yet high-performance packaging solution that meets stringent food-grade requirements.

Propelling Factors for Packaging Industry in UAE Growth

Several key factors are propelling the UAE packaging industry forward.

- Economic Diversification: The UAE's strategic vision for economic diversification beyond oil is fostering growth across various sectors, including manufacturing and logistics, directly benefiting the packaging ecosystem.

- E-commerce Boom: The rapid expansion of online retail necessitates robust and efficient packaging solutions for shipping and handling.

- Growing Population & Tourism: An increasing population and a strong tourism sector drive demand for packaged consumer goods, food, and beverages.

- Sustainability Mandates: Government initiatives and growing consumer awareness are pushing for eco-friendly and recyclable packaging solutions, stimulating innovation and investment in this area.

- Technological Advancements: The adoption of Industry 4.0, automation, and smart packaging technologies enhances operational efficiency and product appeal.

Obstacles in the Packaging Industry in UAE Market

Despite its growth, the UAE packaging market faces several obstacles.

- Raw Material Price Volatility: Fluctuations in the global prices of plastics, paper, and metals can impact manufacturing costs and profitability.

- Stringent Environmental Regulations: While driving innovation, the evolving regulatory landscape concerning plastic waste and recycling can pose compliance challenges and require significant investment in new technologies and processes.

- Supply Chain Disruptions: Global geopolitical events and logistical challenges can disrupt the supply of raw materials and the distribution of finished products.

- Intense Competition: The market is highly competitive, with numerous local and international players vying for market share, potentially leading to price pressures.

- Consumer Education on Recycling: Effective consumer engagement and education on proper recycling practices remain crucial for the success of circular economy initiatives.

Future Opportunities in Packaging Industry in UAE

The UAE packaging industry is poised for significant future opportunities.

- Growth in Sustainable Packaging: Increasing demand for biodegradable, compostable, and recycled materials presents substantial growth potential for innovative solutions.

- Expansion of E-commerce Packaging: The continued rise of online retail will drive demand for specialized, protective, and efficient e-commerce packaging.

- Smart Packaging Integration: The adoption of IoT, AI, and blockchain in packaging for enhanced traceability, authentication, and consumer engagement offers a nascent but promising avenue.

- Emerging Markets: Potential for expansion into neighboring GCC countries and other regional markets seeking advanced packaging solutions.

- Personalized Packaging: Growing consumer desire for customized and personalized products will drive demand for flexible and adaptable packaging formats.

Major Players in the Packaging Industry in UAE Ecosystem

- Al Bayader International

- Diamond Packaging Industries LLC

- Arabian Packaging LLC

- Mondi Group

- Amber Packaging Industries LLC

- Tetra Pak International

- Hotpack Packaging LLC

- DS Smith PL

- Corys Packaging LLC

- Gulf East Paper and Plastic Industries LLC

- Amcor Ltd

Key Developments in Packaging Industry in UAE Industry

- November 2023: Al Bayader International partnered with Spinney's to introduce recycled plastic packaging (rPET) across its stores, diverting substantial plastic waste from landfills.

- May 2023: Hotpack Packaging signed an agreement with Maxbyte to digitize all 15 of its factories, aiming for Industry 4.0 transformation across its operations.

Strategic Packaging Industry in UAE Market Forecast

The strategic packaging industry in UAE market forecast is exceptionally positive, projecting sustained growth driven by robust economic diversification, a rapidly expanding e-commerce sector, and increasing consumer demand for convenience and sustainability. Future opportunities lie in the widespread adoption of advanced sustainable packaging materials, the integration of smart technologies for enhanced supply chain visibility and consumer interaction, and the expansion of specialized packaging for high-growth sectors like pharmaceuticals and e-commerce. Investments in R&D for innovative materials and manufacturing processes will be crucial. The UAE's strategic location and supportive business environment further solidify its position as a pivotal hub for packaging innovation and production in the Middle East, with an estimated market value poised to reach several Billion by 2033.

Packaging Industry in UAE Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paper and Paperboard

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Flexible

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical

- 3.4. Personal and Homecare

- 3.5. Other End-user Industries

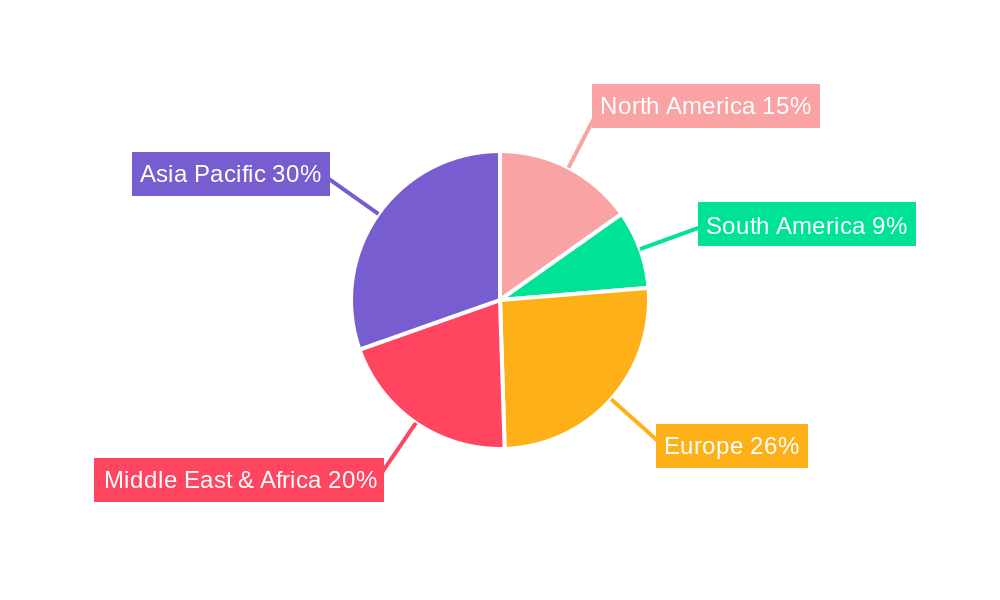

Packaging Industry in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Packaging Industry in UAE Regional Market Share

Geographic Coverage of Packaging Industry in UAE

Packaging Industry in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Environmental Awareness; Growing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Lack of Supply of Bio-plastics and Related Materials

- 3.4. Market Trends

- 3.4.1. The Food Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical

- 5.3.4. Personal and Homecare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Rigid

- 6.2.2. Flexible

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceutical

- 6.3.4. Personal and Homecare

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Rigid

- 7.2.2. Flexible

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceutical

- 7.3.4. Personal and Homecare

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Rigid

- 8.2.2. Flexible

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceutical

- 8.3.4. Personal and Homecare

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Rigid

- 9.2.2. Flexible

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceutical

- 9.3.4. Personal and Homecare

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Packaging Industry in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Metal

- 10.1.3. Glass

- 10.1.4. Paper and Paperboard

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Rigid

- 10.2.2. Flexible

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceutical

- 10.3.4. Personal and Homecare

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al Bayader International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Diamond Packaging Industries LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arabian Packaging LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mondi Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amber Packaging Industries LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tetra Pak International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hotpack Packaging LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DS Smith PL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Corys Packaging LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf East Paper and Plastic Industries LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amcor Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Al Bayader International

List of Figures

- Figure 1: Global Packaging Industry in UAE Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Packaging Industry in UAE Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Packaging Industry in UAE Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Packaging Industry in UAE Revenue (Million), by Packaging Type 2025 & 2033

- Figure 5: North America Packaging Industry in UAE Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Packaging Industry in UAE Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Packaging Industry in UAE Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Packaging Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Packaging Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Packaging Industry in UAE Revenue (Million), by Material 2025 & 2033

- Figure 11: South America Packaging Industry in UAE Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America Packaging Industry in UAE Revenue (Million), by Packaging Type 2025 & 2033

- Figure 13: South America Packaging Industry in UAE Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America Packaging Industry in UAE Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Packaging Industry in UAE Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Packaging Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Packaging Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Packaging Industry in UAE Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Packaging Industry in UAE Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Packaging Industry in UAE Revenue (Million), by Packaging Type 2025 & 2033

- Figure 21: Europe Packaging Industry in UAE Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe Packaging Industry in UAE Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Packaging Industry in UAE Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Packaging Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Packaging Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Packaging Industry in UAE Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa Packaging Industry in UAE Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa Packaging Industry in UAE Revenue (Million), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa Packaging Industry in UAE Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa Packaging Industry in UAE Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Packaging Industry in UAE Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Packaging Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Packaging Industry in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Packaging Industry in UAE Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific Packaging Industry in UAE Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific Packaging Industry in UAE Revenue (Million), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific Packaging Industry in UAE Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific Packaging Industry in UAE Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Packaging Industry in UAE Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Packaging Industry in UAE Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Packaging Industry in UAE Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Packaging Industry in UAE Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Packaging Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Packaging Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 21: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Packaging Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 34: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Packaging Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Packaging Industry in UAE Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Packaging Industry in UAE Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 44: Global Packaging Industry in UAE Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Packaging Industry in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Packaging Industry in UAE Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Industry in UAE?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Packaging Industry in UAE?

Key companies in the market include Al Bayader International, Diamond Packaging Industries LLC, Arabian Packaging LLC, Mondi Group, Amber Packaging Industries LLC, Tetra Pak International, Hotpack Packaging LLC, DS Smith PL, Corys Packaging LLC, Gulf East Paper and Plastic Industries LLC, Amcor Ltd.

3. What are the main segments of the Packaging Industry in UAE?

The market segments include Material, Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Environmental Awareness; Growing E-commerce Sector.

6. What are the notable trends driving market growth?

The Food Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Supply of Bio-plastics and Related Materials.

8. Can you provide examples of recent developments in the market?

November 2023 - Al Bayader International and Spinney's, one of the leading fresh food retailers, announced a partnership to introduce recycled plastic packaging (rPET) across its stores. Al Bayader collects and converts plastic waste into post-consumer recycled plastic (rPET), diverting substantial waste from landfills.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging Industry in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging Industry in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging Industry in UAE?

To stay informed about further developments, trends, and reports in the Packaging Industry in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence