Key Insights

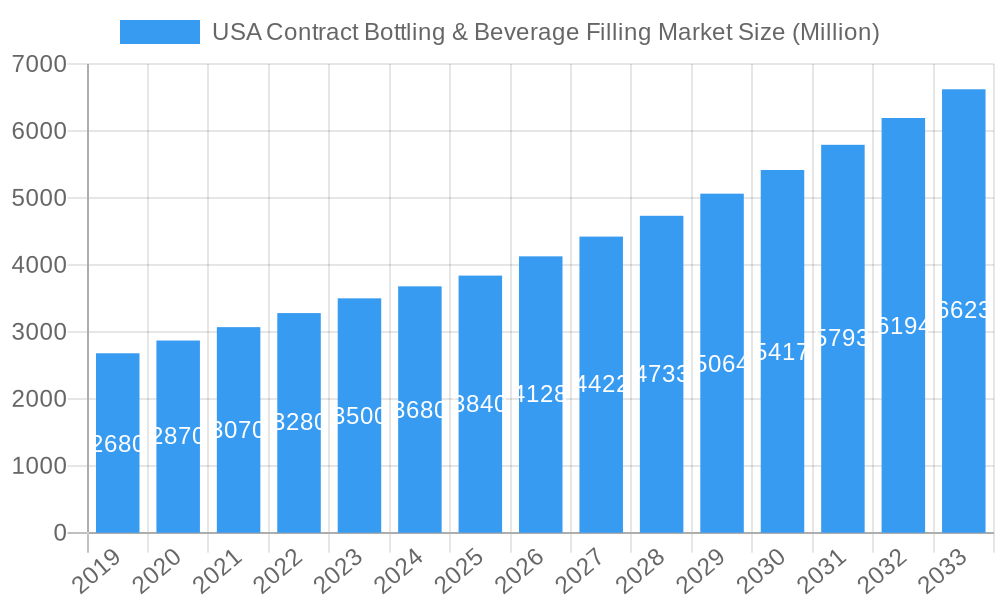

The USA Contract Bottling & Beverage Filling Market is poised for significant expansion, projected to reach approximately $3.84 million in 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 7.67% through 2033. This growth is fueled by several key drivers. The increasing demand for diverse beverage options, including specialized functional drinks, premium craft beverages, and a surge in private label brands, is compelling more companies to outsource their bottling and filling needs. This allows manufacturers to focus on core competencies like product development and marketing, while leveraging the expertise and infrastructure of contract bottlers for efficient production and distribution. Furthermore, the evolving regulatory landscape and stringent quality control requirements in the beverage industry often make contract bottling a more cost-effective and compliant solution for smaller and mid-sized enterprises. Technological advancements in filling and packaging machinery are also contributing to market growth by enabling faster turnaround times, enhanced product shelf life, and a wider array of packaging formats.

USA Contract Bottling & Beverage Filling Market Market Size (In Billion)

Key trends shaping the USA Contract Bottling & Beverage Filling Market include a growing emphasis on sustainability, with a rising demand for eco-friendly packaging materials and reduced waste in production processes. This is driving innovation in areas like lightweighting of bottles, use of recycled content, and development of biodegradable packaging. The market is also witnessing an expansion in specialized filling services, catering to niche segments like alcoholic beverages, dairy products, and plant-based drinks, each with unique handling and packaging requirements. While the market enjoys strong growth, certain restraints could influence its trajectory. Fluctuations in raw material costs, particularly for packaging components and ingredients, can impact profitability. Additionally, intense competition among contract bottlers, leading to price pressures, and the need for substantial capital investment in state-of-the-art facilities, represent significant challenges. However, the overarching demand for flexibility, scalability, and expertise in beverage production ensures a positive outlook for contract bottling services across the nation.

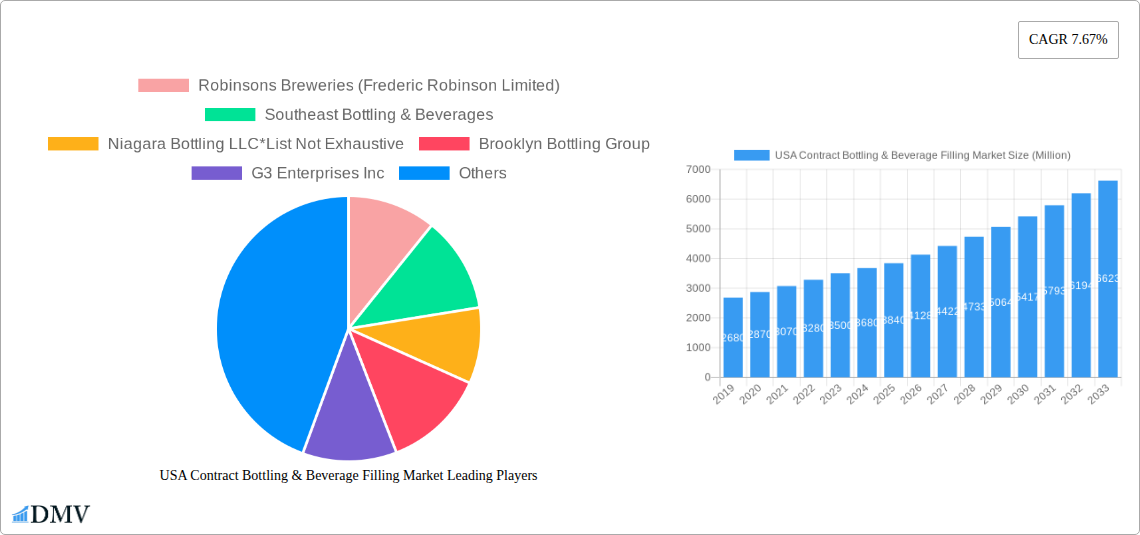

USA Contract Bottling & Beverage Filling Market Company Market Share

Here's the SEO-optimized, insightful report description for the USA Contract Bottling & Beverage Filling Market, designed for immediate use without modification:

USA Contract Bottling & Beverage Filling Market Market Composition & Trends

The USA Contract Bottling & Beverage Filling Market is a dynamic and consolidating sector driven by increasing demand for outsourced production and specialized beverage solutions. Market concentration is observed as larger players leverage economies of scale and advanced technological capabilities, while emerging niche providers cater to specific product categories. Innovation catalysts include the pursuit of sustainable packaging solutions, demand for novel beverage formulations, and the integration of advanced filling and sealing technologies. The regulatory landscape, encompassing food safety standards, labeling requirements, and environmental compliance, significantly influences operational strategies. Substitute products, such as in-home beverage preparation or direct-to-consumer (DTC) beverage kits, pose a minor threat but are outweighed by the convenience and expertise offered by contract bottlers. End-user profiles range from burgeoning craft breweries and RTD cocktail producers to established national beverage brands seeking efficient production and expanded market reach. Mergers and acquisitions (M&A) are a key trend, with significant deal values reflecting the strategic importance of acquiring capacity, expertise, and market share. For instance, the acquisition of Lion Beverages by Encore Consumer Capital signals private equity interest in bolstering contract manufacturing capabilities. Market share distribution is evolving, with leading contract bottlers continually investing in expansion and technological upgrades to meet escalating demand for diverse beverage types. The overall M&A deal value is projected to reach tens of millions of dollars annually as companies seek to enhance their competitive positioning.

USA Contract Bottling & Beverage Filling Market Industry Evolution

The USA Contract Bottling & Beverage Filling Market has undergone a significant transformation over the historical period of 2019-2024, poised for substantial growth throughout the forecast period of 2025-2033. This evolution is characterized by escalating market growth trajectories, fueled by an increasing reliance on specialized contract manufacturers by beverage companies looking to optimize their operations and expand their product lines without substantial capital investment. Technological advancements have been a cornerstone of this evolution, with contract bottlers continuously adopting state-of-the-art filling, capping, sealing, and labeling technologies. This includes the integration of high-speed automated lines, aseptic filling capabilities for sensitive beverages, and advanced quality control systems to ensure product integrity and safety. The adoption of advanced filling technologies has seen a considerable uptick, with an estimated XX% increase in adoption rates of aseptic filling and a XX% rise in the implementation of sophisticated canning and bottling machinery over the past five years. Shifting consumer demands have also played a pivotal role. The surge in demand for functional beverages, plant-based drinks, low-sugar options, and ready-to-drink (RTD) cocktails has created new avenues for contract manufacturers to innovate and diversify their service offerings. For example, the demand for bottled water has seen a consistent annual growth rate of approximately XX%, necessitating scalable and efficient bottling solutions. Similarly, the burgeoning RTD cocktail market, with its rapid product development cycles, requires flexible and rapid contract manufacturing partners. The market has witnessed a compound annual growth rate (CAGR) of approximately XX% during the historical period, a trend projected to accelerate to XX% during the forecast period, driven by these synergistic factors of technological adoption and evolving consumer preferences. The base year of 2025 stands as a crucial benchmark, reflecting robust market performance and setting the stage for projected expansions. The increasing complexity of beverage formulations and packaging requirements, from unique bottle shapes to specialized closures and sustainable packaging materials, further underscores the indispensable role of contract bottlers in the modern beverage industry.

Leading Regions, Countries, or Segments in USA Contract Bottling & Beverage Filling Market

The USA Contract Bottling & Beverage Filling Market exhibits distinct regional strengths and segment dominance, with Bottled Water emerging as a particularly influential segment. This dominance is underpinned by several key drivers, including sustained high consumer demand for convenient and accessible hydration, the growing awareness of water's health benefits, and the expansion of premium and enhanced water offerings. Investment trends within the bottled water segment are robust, with significant capital flowing into expanding bottling capacities, enhancing water purification technologies, and developing innovative packaging solutions, including sustainable and eco-friendly options. Regulatory support, particularly concerning water quality standards and environmental sustainability initiatives, indirectly bolsters the demand for efficient and compliant contract bottling services.

- Bottled Water Dominance Factors:

- Consistent Consumer Demand: Hydration remains a fundamental consumer need, making bottled water a staple product with consistent demand across all demographics and geographical locations.

- Health and Wellness Trends: The increasing emphasis on healthy lifestyles and the perception of bottled water as a healthier alternative to sugar-sweetened beverages drive its consumption.

- Product Diversification: The market has seen a proliferation of product variations, including flavored waters, electrolyte-enhanced waters, sparkling waters, and alkaline waters, all requiring specialized bottling and filling expertise.

- Scalability Requirements: The sheer volume of bottled water produced necessitates large-scale, efficient bottling operations that contract manufacturers are well-equipped to provide.

- Sustainability Initiatives: Growing consumer and regulatory pressure for sustainable packaging is driving innovation in PET and aluminum bottle production, as well as alternative materials, a niche where contract bottlers are actively investing.

Beyond bottled water, other beverage types also contribute significantly to the market's dynamics. Carbonated Drinks continue to hold a substantial market share, driven by established brand loyalty and the enduring popularity of soft drinks. The demand for Fruit-based Beverages, including juices and juice drinks, remains strong, catering to health-conscious consumers seeking natural ingredients. The Other Beverage Types segment, encompassing sport drinks and energy drinks, is experiencing rapid growth due to increasing health and fitness consciousness and demand for performance-enhancing beverages. Beer contract bottling, while potentially more niche in terms of volume compared to non-alcoholic beverages, is a vital segment for craft breweries and regional players seeking specialized brewing, blending, canning, and bottling services, as evidenced by developments like G3 Enterprises' dedicated aluminum can supply for craft brewers. The strategic importance of these segments is reflected in the ongoing investments and M&A activities aimed at expanding capabilities and market reach within each.

USA Contract Bottling & Beverage Filling Market Product Innovations

Product innovations within the USA Contract Bottling & Beverage Filling Market are largely driven by advancements in packaging technology and the development of novel beverage formulations. Companies are increasingly focusing on sustainable packaging solutions, such as lightweight PET bottles, aluminum cans, and recyclable materials, to meet growing consumer and regulatory demand. For instance, G3 Enterprises' introduction of a dedicated aluminum can supply directly addresses the critical need for consistent and accessible canning solutions for craft brewers and RTD cocktail producers, particularly in light of recent aluminum can shortages. Aseptic filling technology continues to be a key innovation, enabling the safe and efficient filling of sensitive beverages like dairy-based drinks and plant-based alternatives without the need for extensive preservatives. Performance metrics that are constantly being improved include fill accuracy, seal integrity, shelf-life extension, and reduced material usage for lighter-weight packaging.

Propelling Factors for USA Contract Bottling & Beverage Filling Market Growth

Several key factors are propelling the growth of the USA Contract Bottling & Beverage Filling Market. Firstly, the increasing demand for outsourced manufacturing by beverage brands seeking to reduce capital expenditure, optimize operational efficiency, and leverage specialized expertise is a significant driver. Secondly, technological advancements in bottling and filling machinery, including automation, aseptic filling, and advanced quality control systems, enable contract bottlers to offer a wider range of services and handle more complex product formulations. Thirdly, shifting consumer preferences towards convenience, health-consciousness, and premium beverages such as functional drinks, RTDs, and specialty waters fuels the need for agile and responsive contract manufacturing. Finally, regulatory compliance and sustainability mandates are pushing companies to partner with contract bottlers who possess the necessary infrastructure and knowledge to meet stringent standards, particularly concerning food safety and environmental impact.

Obstacles in the USA Contract Bottling & Beverage Filling Market Market

The USA Contract Bottling & Beverage Filling Market faces several obstacles that can impede its growth trajectory. Supply chain disruptions, as exemplified by the recent aluminum can shortage impacting craft brewers, can lead to production delays and increased costs, affecting both contract bottlers and their clients. Stringent regulatory requirements related to food safety, labeling, and environmental standards necessitate continuous investment in compliance, which can be a financial burden, especially for smaller players. Intense competitive pressure from both established contract manufacturers and in-house bottling operations can lead to price wars and pressure on profit margins. Furthermore, rising raw material costs, particularly for packaging components like glass and aluminum, directly impact the cost of services. The need for significant capital investment in advanced machinery and infrastructure also presents a barrier to entry and expansion for some companies.

Future Opportunities in USA Contract Bottling & Beverage Filling Market

The USA Contract Bottling & Beverage Filling Market is ripe with future opportunities. The burgeoning market for functional beverages, adaptogens, and plant-based alternatives presents a significant avenue for contract bottlers to expand their specialized filling capabilities. The continued growth of the Ready-to-Drink (RTD) cocktail and mocktail segment offers substantial potential for manufacturers adept at handling diverse formulations and packaging formats. Innovations in sustainable packaging, such as biodegradable materials and reusable container systems, represent a growing demand area where forward-thinking contract bottlers can differentiate themselves. Furthermore, the increasing demand for private label and white label beverage production provides opportunities for contract manufacturers to serve a wider range of businesses, from startups to established retailers. The integration of digitalization and automation in supply chain management and production processes also offers opportunities to enhance efficiency and traceability, providing value-added services to clients.

Major Players in the USA Contract Bottling & Beverage Filling Market Ecosystem

- Robinsons Breweries (Frederic Robinson Limited)

- Southeast Bottling & Beverages

- Niagara Bottling LLC

- Brooklyn Bottling Group

- G3 Enterprises Inc

- CSD Co-Packers Inc

- Western Innovations Inc

Key Developments in USA Contract Bottling & Beverage Filling Market Industry

- April 2022: G3 Enterprises introduces a new, dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. This development is crucial in addressing the recent aluminum can shortage, which has disproportionately affected smaller beer companies by increasing costs and limiting availability.

- January 2022: Encore Consumer Capital, a private equity firm, has acquired contract manufacturer Lion Beverages. Lion brews craft beer and offers comprehensive brewing, blending, canning, bottling, and packaging services to national beverage brands. This acquisition signifies strategic investment aimed at leveraging Encore's expertise to enhance Lion Beverages' capabilities and market reach.

- October 2021: MSI Express, backed by HCI Equity Partners, acquired Power Packaging. This strategic move expanded MSI Express's contract packaging and manufacturing services into the beverage sector, incorporating Power Packaging's expertise in aseptic beverage filling, stick packaging, and filling of jars and cans, across its four U.S. locations.

Strategic USA Contract Bottling & Beverage Filling Market Market Forecast

The strategic forecast for the USA Contract Bottling & Beverage Filling Market is exceptionally positive, driven by a confluence of escalating demand for outsourced production and innovative beverage solutions. The market's growth trajectory is set to be significantly influenced by the ongoing consumer shift towards healthier and more convenient beverage options, including functional drinks and RTDs, which require specialized contract manufacturing expertise. Technological advancements in high-speed, flexible filling lines and sustainable packaging solutions will continue to be pivotal. Furthermore, the consolidation trend through strategic mergers and acquisitions is expected to persist as larger entities seek to enhance their capacity and service portfolios. The market is poised for robust expansion, with projected growth rates reflecting increased investment in advanced manufacturing capabilities and a broadening client base, from craft producers to established national brands seeking to navigate complex supply chains and evolving consumer tastes.

USA Contract Bottling & Beverage Filling Market Segmentation

-

1. Beverage Type

- 1.1. Beer

- 1.2. Carbonated Drinks and Fruit-based Beverages

- 1.3. Bottled Water

- 1.4. Other Beverage Types (Sport Drinks)

USA Contract Bottling & Beverage Filling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

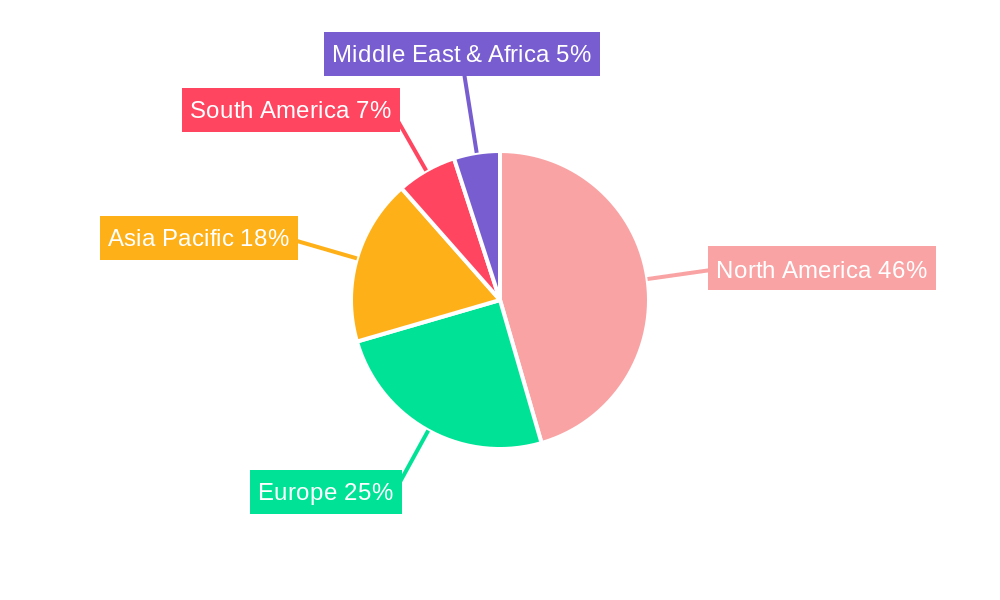

USA Contract Bottling & Beverage Filling Market Regional Market Share

Geographic Coverage of USA Contract Bottling & Beverage Filling Market

USA Contract Bottling & Beverage Filling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Beer is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 5.1.1. Beer

- 5.1.2. Carbonated Drinks and Fruit-based Beverages

- 5.1.3. Bottled Water

- 5.1.4. Other Beverage Types (Sport Drinks)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6. North America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6.1.1. Beer

- 6.1.2. Carbonated Drinks and Fruit-based Beverages

- 6.1.3. Bottled Water

- 6.1.4. Other Beverage Types (Sport Drinks)

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7. South America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7.1.1. Beer

- 7.1.2. Carbonated Drinks and Fruit-based Beverages

- 7.1.3. Bottled Water

- 7.1.4. Other Beverage Types (Sport Drinks)

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8. Europe USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8.1.1. Beer

- 8.1.2. Carbonated Drinks and Fruit-based Beverages

- 8.1.3. Bottled Water

- 8.1.4. Other Beverage Types (Sport Drinks)

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9. Middle East & Africa USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9.1.1. Beer

- 9.1.2. Carbonated Drinks and Fruit-based Beverages

- 9.1.3. Bottled Water

- 9.1.4. Other Beverage Types (Sport Drinks)

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10. Asia Pacific USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10.1.1. Beer

- 10.1.2. Carbonated Drinks and Fruit-based Beverages

- 10.1.3. Bottled Water

- 10.1.4. Other Beverage Types (Sport Drinks)

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southeast Bottling & Beverages

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niagara Bottling LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bottling Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G3 Enterprises Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CSD Co-Packers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Western Innovations Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

List of Figures

- Figure 1: Global USA Contract Bottling & Beverage Filling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 3: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 4: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 7: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 8: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 11: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 12: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 15: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 16: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 19: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 20: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 2: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 4: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 9: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 14: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 25: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 33: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Contract Bottling & Beverage Filling Market?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the USA Contract Bottling & Beverage Filling Market?

Key companies in the market include Robinsons Breweries (Frederic Robinson Limited), Southeast Bottling & Beverages, Niagara Bottling LLC*List Not Exhaustive, Brooklyn Bottling Group, G3 Enterprises Inc, CSD Co-Packers Inc, Western Innovations Inc.

3. What are the main segments of the USA Contract Bottling & Beverage Filling Market?

The market segments include Beverage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement.

6. What are the notable trends driving market growth?

Beer is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Contract Bottling & Beverage Filling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Contract Bottling & Beverage Filling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Contract Bottling & Beverage Filling Market?

To stay informed about further developments, trends, and reports in the USA Contract Bottling & Beverage Filling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence