Key Insights

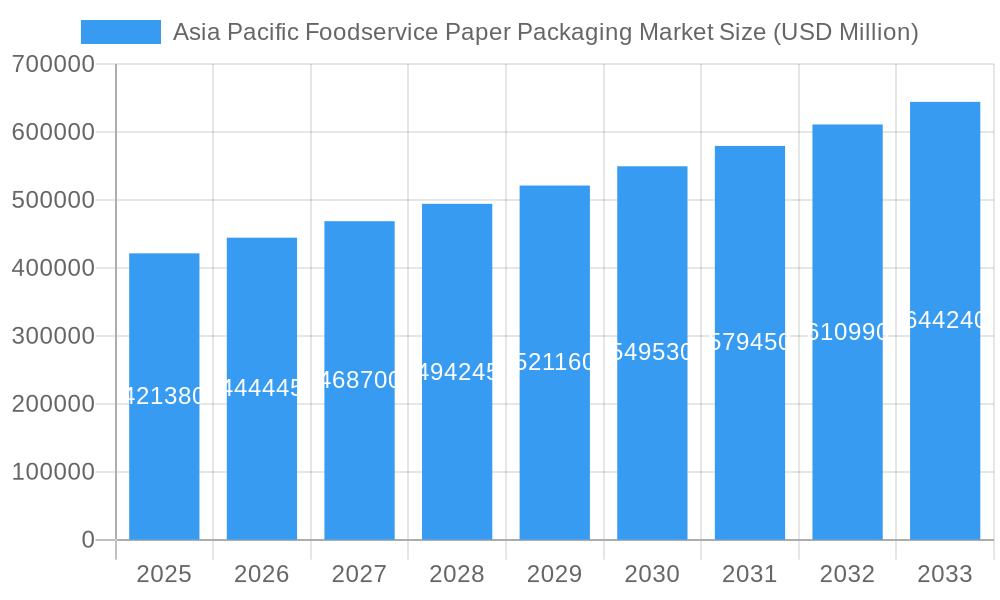

The Asia Pacific Foodservice Paper Packaging Market is poised for significant expansion, projected to reach USD 421.38 billion in 2025, demonstrating robust growth at a Compound Annual Growth Rate (CAGR) of 5.4% over the forecast period. This upward trajectory is primarily fueled by a burgeoning demand for convenient and sustainable food packaging solutions across a diverse range of foodservice establishments, including quick-service restaurants, full-service dining, retail, and institutional settings. The increasing urbanization, coupled with a growing middle class and evolving consumer lifestyles, is driving the consumption of ready-to-eat meals and on-the-go food options, directly boosting the need for reliable and eco-friendly paper packaging. Key product segments such as cups and lids, alongside boxes and cartons, are expected to witness substantial demand, driven by their versatility and widespread use in packaging fruits and vegetables, dairy products, bakery and confectionery items, beverages, and meat and poultry. The inherent recyclability and biodegradability of paper-based packaging align with the growing environmental consciousness among consumers and regulatory bodies, further solidifying its market dominance.

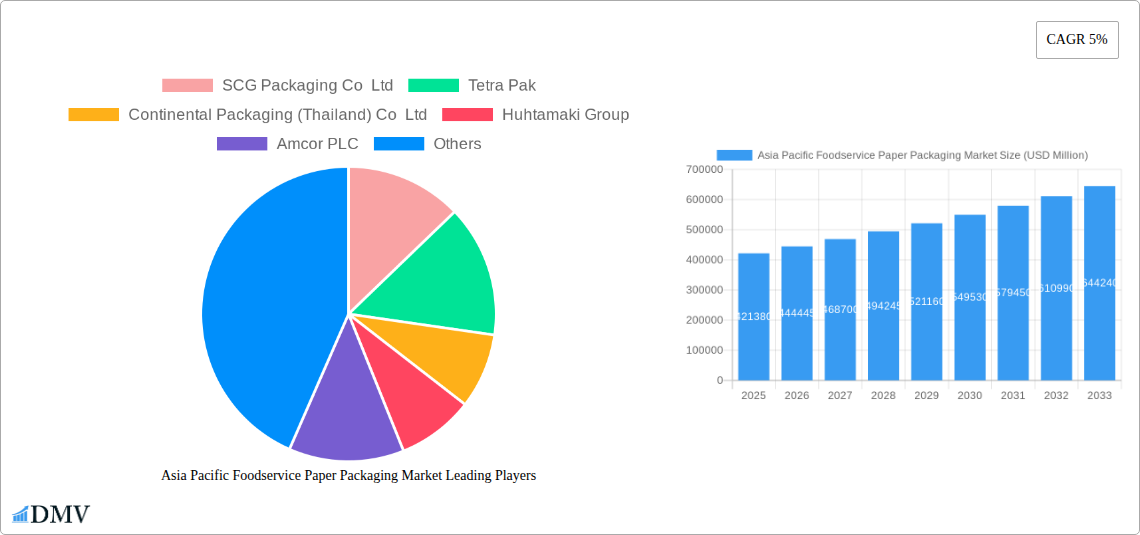

Asia Pacific Foodservice Paper Packaging Market Market Size (In Billion)

Further analysis indicates that the market's growth is underpinned by several influential factors. The burgeoning foodservice sector, encompassing restaurants of all types and retail food vendors, acts as a primary driver, demanding efficient and aesthetically pleasing packaging solutions. Innovations in paperboard technology, including enhanced barrier properties and printability, are enabling the development of sophisticated packaging for a wider array of food products, from hot beverages to greasy fried foods. While the market enjoys strong growth, potential restraints might include fluctuating raw material costs for paper pulp and the presence of alternative packaging materials like plastics and bioplastics. However, the prevailing trend towards sustainability and the increasing stringency of environmental regulations are tilting the scales in favor of paper packaging. Major players like SCG Packaging Co Ltd, Tetra Pak, and Huhtamaki Group are actively investing in research and development and expanding their production capacities to cater to this escalating demand across key Asia Pacific nations such as China, India, and Southeast Asian countries.

Asia Pacific Foodservice Paper Packaging Market Company Market Share

Asia Pacific Foodservice Paper Packaging Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

Report Description:

Dive deep into the burgeoning Asia Pacific Foodservice Paper Packaging Market, a dynamic sector projected to reach USD XX billion by 2033, expanding at a robust CAGR of XX% from 2025 to 2033. This comprehensive report offers unparalleled insights into market segmentation, key growth drivers, emerging opportunities, and the competitive landscape. With a focus on sustainable packaging solutions and eco-friendly food packaging, this analysis is crucial for stakeholders seeking to capitalize on the evolving demands for paper cups, food boxes, and cartons across diverse applications like beverages, bakery & confectionery, and dairy products. Our in-depth research, covering the historical period from 2019 to 2024 and extending to a forecast period of 2025-2033, provides a data-driven roadmap for strategic decision-making within this rapidly expanding market. Understand the impact of regulatory advancements and consumer preferences on foodservice packaging innovation and secure a competitive edge.

Asia Pacific Foodservice Paper Packaging Market Market Composition & Trends

The Asia Pacific Foodservice Paper Packaging Market is characterized by a moderately consolidated landscape, with key players actively investing in sustainable packaging innovations and expanding their manufacturing capacities to meet rising demand. The market's dynamism is fueled by increasing consumer awareness regarding environmental impact, driving the adoption of eco-friendly food packaging. Regulatory landscapes are evolving, with governments in various APAC nations introducing stricter guidelines on single-use plastics, thereby creating a favorable environment for paper-based alternatives. Substitute products, while present, face increasing scrutiny due to their environmental footprint, further bolstering the market for paper packaging. End-user profiles are diverse, ranging from fast-growing quick-service restaurants (QSRs) and full-service dining establishments to retail outlets and institutional food services. Mergers and acquisitions (M&A) activities, while not dominating, play a role in market consolidation and the expansion of product portfolios. For instance, the M&A deal value for strategic acquisitions aimed at enhancing sustainable offerings is estimated at USD XX billion during the historical period.

- Market Concentration: Moderately consolidated with a focus on strategic partnerships and capacity expansion.

- Innovation Catalysts: Growing consumer demand for sustainable packaging, stringent environmental regulations, and the drive for biodegradable food packaging.

- Regulatory Landscapes: Increasingly supportive of paper-based foodservice packaging due to concerns over plastic waste.

- Substitute Products: Traditional plastics and other non-paper alternatives are facing declining demand due to environmental concerns.

- End-User Profiles: Diverse, including QSRs, full-service restaurants, retail, and institutional food services.

- M&A Activities: Strategic acquisitions focused on expanding product lines and geographic reach in the eco-friendly packaging space.

Asia Pacific Foodservice Paper Packaging Market Industry Evolution

The Asia Pacific Foodservice Paper Packaging Market has witnessed a remarkable evolution, driven by a confluence of factors including robust economic growth, escalating urbanization, and a significant shift in consumer lifestyles and preferences. The historical period from 2019 to 2024 laid a strong foundation, with the market experiencing consistent expansion as emerging economies in the region witnessed a surge in disposable incomes and a corresponding increase in out-of-home dining habits. This trend directly translates to a higher demand for convenient and disposable foodservice packaging. Technological advancements have been instrumental in shaping this evolution. Manufacturers have invested heavily in developing advanced paper-based materials that offer improved barrier properties, heat resistance, and structural integrity, making them suitable for a wider array of food products, from hot beverages to oily snacks. The adoption of sophisticated printing techniques and innovative designs has also enhanced the appeal and functionality of these packaging solutions.

Furthermore, the growing global consciousness around environmental sustainability has become a paramount catalyst for change. Consumers are increasingly demanding eco-friendly packaging alternatives to single-use plastics. This demand has spurred innovation in the use of recycled paper fibers, biodegradable coatings, and compostable materials within the foodservice paper packaging sector. The market has responded by developing a wider range of sustainable food packaging options, including paper cups with lids, eco-friendly food boxes, and recyclable cartons. This evolution is not merely about material substitution; it also involves optimizing packaging designs for efficiency in production, transportation, and waste management. For example, lightweighting initiatives and modular designs are becoming prevalent to reduce material usage and carbon footprint. The base year of 2025 is anticipated to see the market consolidate its position as a preferred choice for a significant portion of the foodservice industry, with a projected growth rate of XX% in the subsequent years, driven by continued innovation and supportive regulatory frameworks. The adoption of advanced paperboard technologies and the increasing demand for customized branding on packaging are key indicators of this ongoing industry transformation.

Leading Regions, Countries, or Segments in Asia Pacific Foodservice Paper Packaging Market

The Asia Pacific Foodservice Paper Packaging Market exhibits distinct regional dominance and segmentation patterns, driven by economic development, population density, and evolving consumer behaviors. Among the key segments, Beverages consistently emerges as a leading application, owing to the widespread consumption of coffee, tea, juices, and other ready-to-drink options across the region, fueling demand for paper cups and lids. Similarly, Bakery & Confectionery applications are substantial, with the demand for paper boxes and cartons for pastries, cakes, and chocolates experiencing robust growth.

China stands out as a leading country within the APAC region, its vast population, rapid urbanization, and the phenomenal growth of its foodservice industry, particularly the quick-service restaurant (QSR) segment, driving unparalleled demand for foodservice paper packaging. The Chinese government's increasing focus on environmental protection and waste reduction further accelerates the adoption of sustainable foodservice paper packaging solutions.

Dominant Segment (Application): Beverages – fueled by the popularity of hot and cold drinks in cafes, restaurants, and takeaway services. This segment is expected to contribute approximately XX% to the overall market revenue by 2033.

- Key Drivers:

- High per capita consumption of beverages.

- Proliferation of coffee chains and fast-food outlets.

- Growing preference for on-the-go consumption.

- Innovative designs for hot and cold beverage cups.

- Key Drivers:

Dominant Segment (Type): Cups & Lids – intricately linked to the beverage sector's growth. The demand for various types of paper cups, including hot beverage cups, cold drink cups, and travel mugs, is immense.

- Key Drivers:

- Convenience and disposability.

- Increased use in corporate environments and events.

- Advancements in insulation and leak-proof designs.

- Key Drivers:

Dominant Country: China – its sheer market size and rapid growth in the foodservice sector make it the largest consumer of foodservice paper packaging in APAC.

- Key Drivers:

- Massive population and increasing disposable income.

- Booming food delivery services and e-commerce.

- Government initiatives promoting green packaging.

- Significant investments by both domestic and international packaging manufacturers.

- Key Drivers:

End User Dominance: Restaurants (Quick & Full-service based) – this segment represents the largest consumer base, driven by the sheer volume of food and beverage served daily.

- Key Drivers:

- Convenience and hygiene in food service operations.

- Brand visibility through custom-printed packaging.

- Adaptability to various menu items.

- Key Drivers:

The dominance of these segments and regions underscores the broader trend towards convenience, sustainability, and the expanding foodservice landscape across Asia Pacific, making it a critical market for foodservice paper packaging manufacturers and suppliers.

Asia Pacific Foodservice Paper Packaging Market Product Innovations

Product innovation in the Asia Pacific Foodservice Paper Packaging Market is primarily driven by the imperative for enhanced sustainability, functionality, and consumer appeal. Manufacturers are actively developing eco-friendly food packaging solutions such as compostable paper cups, biodegradable food boxes, and recyclable paper straws. Innovations include the use of advanced coatings derived from plant-based materials, providing superior grease and moisture resistance without compromising biodegradability. High-definition printing technologies allow for vibrant branding on food packaging cartons, catering to the marketing needs of foodservice establishments. Furthermore, companies are exploring new paperboard structures that offer improved insulation properties for hot beverages and enhanced rigidity for takeout containers, ensuring product integrity during transit. These advancements not only address environmental concerns but also elevate the user experience, solidifying the market's commitment to innovative and responsible foodservice packaging.

Propelling Factors for Asia Pacific Foodservice Paper Packaging Market Growth

The Asia Pacific Foodservice Paper Packaging Market is propelled by a robust combination of economic, environmental, and societal factors. The escalating disposable incomes and a burgeoning middle class across the region are fueling a significant rise in out-of-home dining, thereby increasing the demand for convenient and disposable foodservice packaging. Growing environmental consciousness among consumers and stringent government regulations aimed at curbing plastic pollution are acting as major catalysts, driving the preference for sustainable and eco-friendly food packaging alternatives like paper cups and food boxes. Technological advancements in material science and manufacturing processes are enabling the production of higher-performing, cost-effective, and aesthetically pleasing paper-based packaging solutions. The rapid expansion of the food delivery and e-commerce sectors further amplifies the need for efficient and safe food packaging cartons for a diverse range of food products.

Obstacles in the Asia Pacific Foodservice Paper Packaging Market Market

Despite its significant growth potential, the Asia Pacific Foodservice Paper Packaging Market faces several obstacles. Regulatory hurdles, while often encouraging sustainability, can also create complexities due to varying standards across different countries. The cost of sustainable raw materials and advanced manufacturing processes can lead to higher product prices compared to traditional plastic packaging, potentially impacting adoption rates, especially in price-sensitive markets. Supply chain disruptions, exacerbated by geopolitical factors and raw material availability, can affect production schedules and lead to price volatility. Intense competition from established plastic packaging manufacturers and the continued presence of non-recyclable alternatives pose a continuous challenge. Furthermore, inadequate waste management infrastructure in some regions can hinder the effective recycling and disposal of paper-based packaging, thus mitigating its perceived environmental benefits.

Future Opportunities in Asia Pacific Foodservice Paper Packaging Market

The future of the Asia Pacific Foodservice Paper Packaging Market is rife with opportunities, primarily centered around innovation and market expansion. The growing demand for customizable and branded foodservice packaging presents a significant avenue for differentiation. The increasing adoption of plant-based food packaging and biodegradable materials signifies a long-term trend, opening doors for novel material development and sustainable solutions. Expansion into emerging economies within Southeast Asia and Oceania, where disposable income and foodservice penetration are on the rise, offers substantial growth potential. Collaborations with food service providers to develop specialized packaging for niche food items, such as plant-based meals or organic produce, will cater to evolving consumer preferences. Furthermore, advancements in recycling technologies and the development of circular economy models for paper packaging will create new revenue streams and enhance the overall sustainability appeal of the sector.

Major Players in the Asia Pacific Foodservice Paper Packaging Market Ecosystem

- SCG Packaging Co Ltd

- Tetra Pak

- Continental Packaging (Thailand) Co Ltd

- Huhtamaki Group

- Amcor PLC

- Pura Group

- Oji Holdings Corporation

- International Paper Company

- Toppan Inc

- Sarnti Packaging Co Ltd

Key Developments in Asia Pacific Foodservice Paper Packaging Market Industry

- August 2022: Amcor PLC expanded its global network by inaugurating a new Innovation Center in Jiangyin, China. This facility provides regional customers with enhanced access to Amcor's expertise in developing innovative and environmentally responsible packaging solutions, accelerating the adoption of sustainable practices in the region.

- March 2022: The Food Safety and Standards Authority of India (FSSAI) introduced new regulations to govern the use of recycled plastic in food packaging. This move, prompted by concerns from scientific experts, signifies a critical step towards better management of plastic waste and creates a more favorable environment for the adoption of alternative, safer, and more sustainable packaging materials like paper.

Strategic Asia Pacific Foodservice Paper Packaging Market Market Forecast

The strategic forecast for the Asia Pacific Foodservice Paper Packaging Market highlights sustained growth driven by a potent combination of consumer-led demand for sustainable packaging and supportive regulatory environments. The increasing prevalence of out-of-home dining and food delivery services will continue to fuel the need for convenient and hygienic packaging solutions. Innovations in biodegradable and compostable paper packaging will play a pivotal role in capturing market share, particularly among environmentally conscious consumers. Expansion into untapped and emerging markets within the region presents significant opportunities for market players. Strategic investments in advanced manufacturing technologies and the development of circular economy models will solidify the market's trajectory towards a more sustainable and profitable future, with an estimated market value reaching USD XX billion by 2033.

Asia Pacific Foodservice Paper Packaging Market Segmentation

-

1. Type

- 1.1. Cups & Lids

- 1.2. Boxes & Cartons

-

2. Application

- 2.1. Fruits and vegetables

- 2.2. Dairy products

- 2.3. Bakery & Confectionery

- 2.4. Beverages

- 2.5. Meat & Poultry

- 2.6. Others

-

3. End User

- 3.1. Restaurants (Quick & Full-service based)

- 3.2. Retail establishments

- 3.3. Institutional

- 3.4. Other End-user Applications

Asia Pacific Foodservice Paper Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

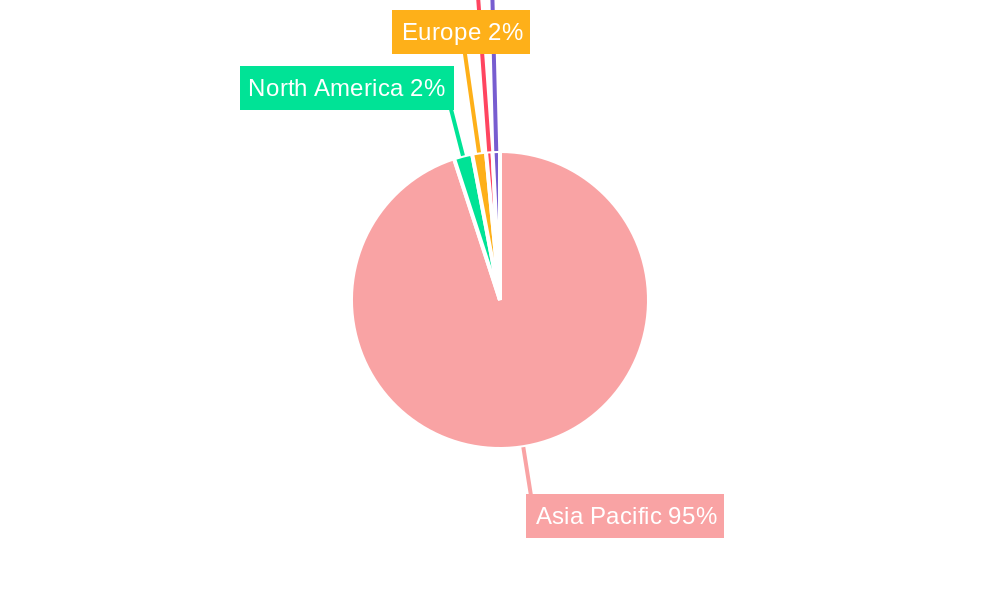

Asia Pacific Foodservice Paper Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Foodservice Paper Packaging Market

Asia Pacific Foodservice Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Price Volatility of Raw Materials

- 3.4. Market Trends

- 3.4.1. Online Food Ordering Services are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Foodservice Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cups & Lids

- 5.1.2. Boxes & Cartons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and vegetables

- 5.2.2. Dairy products

- 5.2.3. Bakery & Confectionery

- 5.2.4. Beverages

- 5.2.5. Meat & Poultry

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Restaurants (Quick & Full-service based)

- 5.3.2. Retail establishments

- 5.3.3. Institutional

- 5.3.4. Other End-user Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Packaging Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tetra Pak

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Packaging (Thailand) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pura Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toppan Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sarnti Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCG Packaging Co Ltd

List of Figures

- Figure 1: Asia Pacific Foodservice Paper Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Foodservice Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Foodservice Paper Packaging Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Asia Pacific Foodservice Paper Packaging Market?

Key companies in the market include SCG Packaging Co Ltd, Tetra Pak, Continental Packaging (Thailand) Co Ltd, Huhtamaki Group, Amcor PLC, Pura Group, Oji Holdings Corporation, International Paper Company, Toppan Inc, Sarnti Packaging Co Ltd.

3. What are the main segments of the Asia Pacific Foodservice Paper Packaging Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Online Food Ordering Services are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Price Volatility of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: Amcor added a new location in Jiangyin, China, to its network of Innovation Centers. Customers in the area now have access to Amcor's expertise through the new facility in China. This speeds up the development of packaging solutions that are better for the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Foodservice Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Foodservice Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Foodservice Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Foodservice Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence