Key Insights

The South African plastic packaging films market is projected to experience robust growth, with an estimated market size of $2.81 billion in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 3.25% through 2033. This expansion is significantly driven by the food and beverage sector, a key consumer of plastic packaging films for confectionery, frozen foods, fresh produce, dairy, and dry goods. Rising consumer demand for convenient, shelf-stable, and visually appealing food packaging is a primary growth catalyst. The healthcare and personal care industries are also contributing to market expansion, necessitating hygienic and protective packaging solutions. Industrial packaging, though a smaller segment, exhibits steady demand, supported by South Africa's manufacturing and export activities.

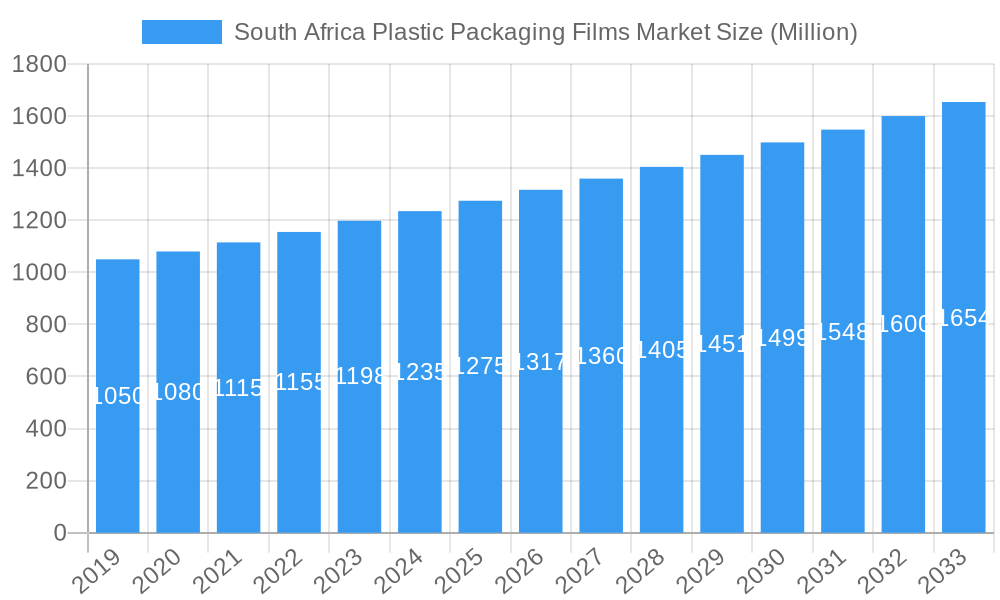

South Africa Plastic Packaging Films Market Market Size (In Billion)

The market features a diverse array of film types, with Polypropylene and Polyethylene films dominating due to their adaptability, cost-efficiency, and superior barrier characteristics. Increasing adoption of sustainable packaging is fostering interest in bio-based films, though their market presence is still evolving. Market limitations include volatile raw material pricing, particularly for petrochemical-based derivatives, and intensifying regulations on plastic waste management and environmental impact. However, continuous advancements in film technology, such as the development of thinner, stronger films with enhanced recyclability, are anticipated to address these challenges and sustain market expansion. Leading companies, including Amcor Group GmbH, Berry Global Inc., and UFlex Limited, are actively engaged in research and development and strategic growth initiatives to leverage these market trends and strengthen their competitive standing in the South African plastic packaging films sector.

South Africa Plastic Packaging Films Market Company Market Share

South Africa Plastic Packaging Films Market: In-depth Analysis and Future Outlook (2019-2033)

Unlock the strategic insights into the burgeoning South Africa Plastic Packaging Films Market. This comprehensive report delivers critical analysis of market dynamics, segmentation, key players, and future projections, offering an unparalleled advantage to stakeholders navigating this dynamic industry. With a focus on high-ranking keywords and actionable data, this report is your definitive guide to understanding the opportunities and challenges within South Africa's vital plastic packaging films sector.

South Africa Plastic Packaging Films Market Market Composition & Trends

The South Africa plastic packaging films market is characterized by a moderate concentration, with a few key players holding significant market share. Innovation is driven by the increasing demand for sustainable and high-performance packaging solutions, particularly within the food and beverage sectors. Regulatory landscapes are evolving, with a growing emphasis on recyclability and the reduction of single-use plastics. Substitute products, such as paper-based packaging and compostable alternatives, are gaining traction, necessitating continuous innovation from plastic film manufacturers. End-user profiles are diverse, ranging from large multinational food corporations to smaller personal care brands, each with specific packaging requirements. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, gain market access, and achieve economies of scale. The market share distribution is influenced by the dominant film types like Polyethylene and Polypropylene, and their adoption in high-volume end-user industries. M&A deal values, while not consistently publicly disclosed, indicate strategic consolidation aimed at enhancing competitive positioning and operational efficiency.

South Africa Plastic Packaging Films Market Industry Evolution

The South Africa plastic packaging films market has witnessed significant evolution over the historical period (2019-2024) and is poised for robust growth throughout the forecast period (2025-2033). This evolution is fundamentally driven by a confluence of factors including shifting consumer preferences towards convenience and extended shelf life, coupled with a growing awareness regarding the environmental impact of packaging. The food packaging films segment, particularly for candy and confectionery, frozen foods, fresh produce, and dairy products, has been a consistent growth engine. This demand is supported by South Africa's expanding middle class and its urbanization, leading to increased consumption of packaged food items. Technological advancements have played a pivotal role, with the development of advanced barrier films, multi-layer structures, and thinner, yet stronger, materials enabling better product preservation and reduced material usage. The adoption of polyethylene (PE) and polypropylene (PP) films remains dominant due to their versatility, cost-effectiveness, and excellent mechanical properties. However, the market is also seeing a gradual, albeit nascent, rise in bio-based and recyclable film types like PETG, responding to global sustainability trends. Growth rates, estimated to be in the range of 4-6% annually over the forecast period, are influenced by economic stability, infrastructure development, and the effectiveness of waste management initiatives.

The healthcare sector, with its stringent requirements for sterility and product protection, also contributes steadily to market expansion, particularly for medical device packaging and pharmaceuticals. Similarly, the personal care and home care segments benefit from innovation in aesthetically appealing and functional packaging films. Industrial packaging applications, while perhaps less dynamic in terms of growth rate, represent a significant volume segment, driven by the country's manufacturing and export activities. The market is also shaped by the increasing emphasis on product differentiation, leading manufacturers to invest in films with enhanced printability, gloss, and special effects. The overall trajectory indicates a market that is not only expanding in volume but also becoming more sophisticated in its offerings, driven by a blend of consumer needs, technological innovation, and a growing imperative for environmental responsibility.

Leading Regions, Countries, or Segments in South Africa Plastic Packaging Films Market

Within the South Africa plastic packaging films market, the dominance is largely dictated by the food end-user industry, particularly for fresh produce, dairy products, and meat, poultry, and seafood segments. These categories consistently represent the largest share due to South Africa's significant agricultural output and the growing consumer demand for conveniently packaged perishable goods. The polyethylene (PE) film segment, encompassing both low-density (LDPE) and high-density (HDPE) variants, holds a commanding position across most end-user industries due to its versatility, cost-effectiveness, and excellent barrier properties for moisture and puncture resistance. Polypropylene (PP) films also command a substantial share, especially in applications requiring higher stiffness and clarity, such as confectionery and dry food packaging.

Dominant End-User Industry (Food):

- Fresh Produce: Driven by the need for extended shelf life and prevention of spoilage through modified atmosphere packaging (MAP). Significant investments are made in breathable films and high-clarity options.

- Dairy Products: Requires excellent barrier properties against oxygen and moisture to maintain freshness and prevent contamination. Films for cheese, yogurt, and milk are critical.

- Meat, Poultry, and Seafood: High-barrier films with oxygen scavenging capabilities are essential to extend shelf life and maintain product safety and appearance. Vacuum packaging and modified atmosphere packaging are prevalent.

Dominant Film Type (Polyethylene):

- Versatility and Cost-Effectiveness: PE's widespread applicability across various packaging formats, from flexible pouches to shrink films, makes it a staple.

- Barrier Properties: Its inherent resistance to moisture makes it ideal for protecting products from environmental degradation.

- Recyclability: As recycling infrastructure improves, the inherent recyclability of PE further solidifies its market position.

Key Drivers for Dominance:

- Investment Trends: Major food processors and packaging converters are continually investing in advanced machinery and film technologies to meet the evolving demands of the food sector.

- Regulatory Support (Indirect): While direct regulations favoring specific film types are evolving, the emphasis on food safety and hygiene indirectly supports the use of robust and reliable plastic films.

- Consumer Demand: The consistent growth in the South African population and rising disposable incomes fuel the demand for packaged food, thereby driving the demand for associated packaging films.

- Technological Advancements: Innovations in extrusion and co-extrusion technologies enable the creation of specialized PE and PP films with tailored properties for specific food applications.

While other segments like Healthcare and Personal Care and Home Care are significant, their volume and growth trajectory, though important, do not yet match the sheer scale and consistent demand originating from the food industry. Similarly, while Bio-based films and EVOH offer niche advantages, their current market penetration remains limited compared to the established dominance of Polyethylene and Polypropylene.

South Africa Plastic Packaging Films Market Product Innovations

Product innovations in the South Africa plastic packaging films market are increasingly focused on enhancing sustainability, functionality, and consumer appeal. Advanced multi-layer films incorporating recycled content (rPET) are gaining traction, offering comparable performance to virgin materials while addressing environmental concerns. Innovations in barrier technologies are enabling longer shelf life for perishable goods, reducing food waste. Furthermore, the development of thinner, yet stronger, films is leading to material reduction and improved resource efficiency. Applications span from high-barrier flexible pouches for snacks and ready-to-eat meals to specialized films for medical packaging, all demonstrating improved puncture resistance, tear strength, and printability. These advancements underscore a market driven by both performance and ecological responsibility.

Propelling Factors for South Africa Plastic Packaging Films Market Growth

The South Africa plastic packaging films market is propelled by several key factors. Firstly, the burgeoning food and beverage industry, with its ever-increasing demand for convenient and preserved packaged goods, is a primary growth driver. Secondly, technological advancements in film manufacturing, such as enhanced barrier properties and thinner gauges, are creating more efficient and sustainable packaging solutions. Thirdly, a growing consumer awareness regarding food safety and hygiene necessitates the use of reliable plastic packaging. Lastly, supportive government initiatives aimed at improving waste management and promoting recycling, coupled with investments from industry players in advanced recycling technologies, are fostering a more sustainable market environment and driving demand for rPET-based films.

Obstacles in the South Africa Plastic Packaging Films Market Market

Despite its growth, the South Africa plastic packaging films market faces several obstacles. Regulatory challenges, particularly concerning the phase-out of certain single-use plastics and evolving Extended Producer Responsibility (EPR) schemes, can create uncertainty and necessitate significant investment in compliance. Supply chain disruptions, influenced by global economic factors and raw material price volatility, can impact production costs and availability. Furthermore, intense competition from both domestic and international players, alongside the growing demand for alternative packaging materials like paper and bioplastics, exerts constant pressure on pricing and innovation. The public perception surrounding plastic pollution also poses a continuous challenge, requiring proactive efforts in waste management and recycling to maintain market confidence.

Future Opportunities in South Africa Plastic Packaging Films Market

Emerging opportunities in the South Africa plastic packaging films market lie in the growing demand for sustainable packaging solutions, including films made from recycled content (rPET) and bio-based materials. The expansion of the e-commerce sector presents opportunities for specialized industrial packaging films with enhanced protection and tamper-evident features. Furthermore, advancements in smart packaging technologies, offering features like spoilage indicators, can create new market niches. The increasing focus on food safety and shelf-life extension will continue to drive innovation in high-barrier films, particularly for perishable goods. Investments in localized recycling infrastructure and the circular economy model are also poised to unlock new avenues for growth and material innovation.

Major Players in the South Africa Plastic Packaging Films Market Ecosystem

- Berry Global Inc

- AVPack Plastic Manufacturers

- Ampa Plastics Group

- Apac Enterprise Trading

- SRF LIMITED

- Mpact Group

- Flexible Packages Convertors (Pty) Ltd

- Amcor Group GmbH

- UFlex Limited

Key Developments in South Africa Plastic Packaging Films Market Industry

- April 2024: Coca-Cola Beverages Africa (CCBA) and Plastic Packaging joined forces, investing over USD 1.2 million to establish a cutting-edge polyethylene terephthalate (PET) flaking plant in Okahandja, Namibia. This strategic move not only marks the inauguration of a new facility but also promises to amplify the nation's plastic waste recycling capacity, effectively doubling the output of its sole mechanical recycler. Furthermore, the new plant will double the capacity of PET recycling in Namibia, increasing the availability of high-quality recycled PET (rPET) materials, providing a stable and increased supply of rPET to South African manufacturers, promoting the use of recycled materials in plastic packaging films.

- September 2023: South African Plastic Recycling Organisation (SAPRO) celebrated its 9th biennial Best Recycled Plastic Product Awards. The event, designed to spotlight and honor innovative recycled plastic products, serves as a catalyst for manufacturers, urging them to enhance the quality and utility of recycled plastic films. Such advancements bolster consumer confidence and foster wider acceptance of recycled goods.

Strategic South Africa Plastic Packaging Films Market Market Forecast

The strategic forecast for the South Africa plastic packaging films market indicates a period of sustained and robust growth, driven by an expanding consumer base and evolving packaging demands. The increasing emphasis on sustainability will continue to fuel the adoption of films with recycled content and bio-based alternatives, presenting significant opportunities for innovation and investment. Advancements in barrier technology and material science will enable the development of thinner, stronger, and more functional films, contributing to reduced material usage and enhanced product shelf life, thereby mitigating food waste. The market will also benefit from continued investments in recycling infrastructure and the broader adoption of circular economy principles. With a projected CAGR of approximately 5.5% between 2025 and 2033, the market is set to expand significantly, driven by both domestic consumption and potential export opportunities, solidifying its importance within the broader South African economy.

South Africa Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

South Africa Plastic Packaging Films Market Segmentation By Geography

- 1. South Africa

South Africa Plastic Packaging Films Market Regional Market Share

Geographic Coverage of South Africa Plastic Packaging Films Market

South Africa Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging

- 3.3. Market Restrains

- 3.3.1. Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging

- 3.4. Market Trends

- 3.4.1. Polypropylene Film is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AVPack Plastic Manufacturers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ampa Plastics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apac Enterprise Trading

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SRF LIMITED

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mpact Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flexible Packages Convertors (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor Group GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UFlex Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: South Africa Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Africa Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: South Africa Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Plastic Packaging Films Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the South Africa Plastic Packaging Films Market?

Key companies in the market include Berry Global Inc, AVPack Plastic Manufacturers, Ampa Plastics Group, Apac Enterprise Trading, SRF LIMITED, Mpact Group, Flexible Packages Convertors (Pty) Ltd, Amcor Group GmbH, UFlex Limite.

3. What are the main segments of the South Africa Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging.

6. What are the notable trends driving market growth?

Polypropylene Film is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging.

8. Can you provide examples of recent developments in the market?

April 2024: Coca-Cola Beverages Africa (CCBA) and Plastic Packaging joined forces, investing over USD 1.2 million to establish a cutting-edge polyethylene terephthalate (PET) flaking plant in Okahandja, Namibia. This strategic move not only marks the inauguration of a new facility but also promises to amplify the nation's plastic waste recycling capacity, effectively doubling the output of its sole mechanical recycler.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the South Africa Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence