Key Insights

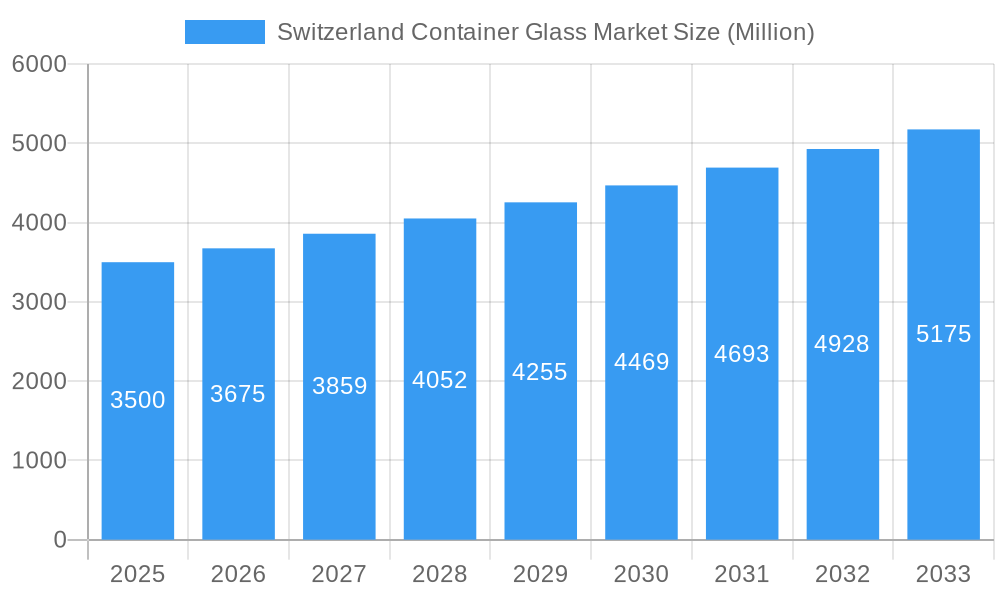

The Switzerland container glass market is projected for robust expansion, with an estimated market size of $0.5 billion in 2024, driven by a Compound Annual Growth Rate (CAGR) of 4.5%. This growth is primarily fueled by strong demand from the beverage industry, including both alcoholic and non-alcoholic drinks. Wines and spirits are significant contributors, leveraging Switzerland's high per capita consumption and premium product offerings. The increasing consumer preference for aesthetically pleasing and eco-friendly packaging further boosts demand for glass containers. The food sector's reliance on glass for product preservation and premium presentation also supports market buoyancy. Pharmaceutical applications, requiring high purity and inertness, offer a stable growth avenue.

Switzerland Container Glass Market Market Size (In Million)

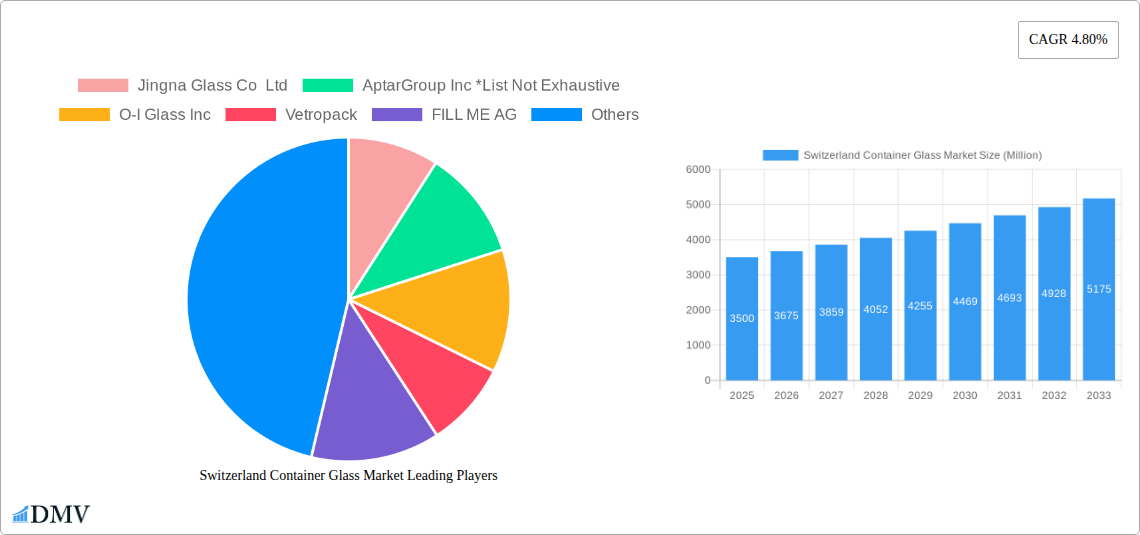

Key market participants, including Jingna Glass Co Ltd, AptarGroup Inc, O-I Glass Inc, Vetropack, FILL ME AG, and Ardagh Group S.A., are actively driving innovation in design and manufacturing. Trends such as lightweight glass, enhanced safety features, and increased use of recycled content align with Switzerland's environmental consciousness and regulatory framework. Market restraints include raw material and energy price volatility, impacting production costs. The convenience of alternative packaging materials in certain segments may also present competitive challenges. Despite these factors, glass's inherent recyclability, inertness, and premium perception are expected to maintain its leading position in the Swiss packaging market throughout the forecast period.

Switzerland Container Glass Market Company Market Share

This comprehensive report analyzes the Switzerland container glass market, providing critical insights for stakeholders from 2019 to 2033. It examines historical trends, current market dynamics, and future projections for glass packaging solutions, specialty glass containers, and sustainable glass manufacturing in Switzerland. The report details market size, segmentation, competitive landscape, and emerging opportunities, serving as an essential resource for glass manufacturers, packaging converters, brand owners, and investment firms interested in the evolving Swiss packaging industry. The forecast period is 2025-2033, with a base year of 2024 and historical data from 2019-2024.

Switzerland Container Glass Market Market Composition & Trends

The Switzerland container glass market is characterized by a moderate level of concentration, driven by a few key global players alongside specialized regional manufacturers. Innovation is a significant catalyst, with a strong emphasis on sustainable packaging solutions, lightweight glass bottles, and decorative glass packaging. Regulatory landscapes, particularly concerning environmental impact and material recycling, play a crucial role in shaping market strategies and product development. The threat of substitute products, while present in the form of plastic and metal packaging, is mitigated by the premium perception and inherent recyclability of glass, especially in the food and beverage, pharmaceuticals, and cosmetics sectors. End-user profiles are diverse, ranging from high-volume alcoholic beverages and non-alcoholic beverages to niche cosmetic brands and critical pharmaceutical packaging. M&A activities are anticipated to continue, driven by the pursuit of enhanced production capabilities and expanded market reach.

- Market Share Distribution: Leading players hold a significant but not dominant share, indicating room for niche players and new entrants.

- M&A Deal Values: Recent and anticipated M&A activities reflect strategic consolidation and investments in advanced manufacturing technologies. XXX Million.

- Innovation Catalysts: Focus on eco-friendly materials, enhanced product shelf-life, and premium aesthetic finishes for premium packaging.

- Regulatory Landscape: Stringent Swiss environmental regulations and extended producer responsibility schemes are pushing for higher recycling rates and the adoption of recycled content in new glass production.

Switzerland Container Glass Market Industry Evolution

The Switzerland container glass market has witnessed a steady evolution driven by a confluence of factors, including robust economic conditions, a discerning consumer base, and a strong commitment to sustainability. The market growth trajectory has been consistently upward, fueled by increasing demand across key end-user industries. Technological advancements have played a pivotal role, with manufacturers investing heavily in state-of-the-art production lines to enhance efficiency, reduce energy consumption, and improve the quality of glass containers. The adoption of advanced forming techniques and sophisticated quality control systems ensures the production of high-performance glass packaging suitable for a wide range of applications. Shifting consumer demands are a significant driver, with a growing preference for visually appealing, premium, and environmentally responsible packaging. This trend is particularly evident in the beverage sector, where consumers associate glass with higher quality and freshness, and in the cosmetics and personal care industry, where aesthetic appeal is paramount. Furthermore, the stringent requirements of the pharmaceutical industry for sterile, inert, and protective packaging continue to bolster demand for high-quality container glass. Market growth rates have been estimated at approximately 3.5% annually, with adoption metrics for recycled content in glass production exceeding 70% in recent years. The overall market value for container glass in Switzerland is projected to reach XXX Million by 2025, with continued growth anticipated throughout the forecast period.

Leading Regions, Countries, or Segments in Switzerland Container Glass Market

The Switzerland container glass market exhibits distinct leadership across several segments and geographical nuances, primarily dictated by the concentration of key end-user industries and manufacturing capabilities. The Beverage segment stands out as the dominant force, encompassing a significant share of the market's demand. Within beverages, Alcoholic Beverages, particularly Wines and Spirits, represent a high-value segment where the aesthetic and protective qualities of glass are paramount for preserving product integrity and brand prestige. The Beer and Cider sub-segment also contributes substantially, driven by consumer preference for traditional packaging and a growing craft beverage scene. Non-Alcoholic Beverages, especially Water and Juices, are experiencing robust growth due to increasing health consciousness and the demand for convenient, single-serve options. The Food industry is another major consumer of container glass, with applications ranging from preserved goods to premium dairy products. The Cosmetics sector leverages glass for its perceived luxury and inertness, ensuring product stability and a premium brand image. The Pharmaceuticals segment, while smaller in volume, represents a critical and high-value niche, requiring the highest standards of purity, safety, and barrier properties for medications and healthcare products.

- Key Drivers in the Beverage Segment:

- Investment Trends: Significant investments by beverage producers in premium and sustainable packaging, favoring glass.

- Regulatory Support: Favorable regulations promoting the recyclability and reusability of glass packaging.

- Consumer Preferences: Growing demand for natural, high-quality products associated with glass packaging.

- Brand Differentiation: Use of bespoke glass bottle designs to enhance brand identity and shelf appeal for wines, spirits, and craft beers.

The dominance of the beverage sector is underpinned by Switzerland's strong tradition of high-quality wine and spirit production, coupled with a large domestic and tourist market for these products. The focus on premiumization within these categories directly translates to a preference for glass packaging. Furthermore, the growing market for specialty water and healthy juices contributes to the sustained demand. The food industry's consistent need for safe and durable packaging for a wide array of products also solidifies its significant market share. While cosmetics and pharmaceuticals are more niche, their high-value nature and specific requirements make them crucial components of the overall market landscape.

Switzerland Container Glass Market Product Innovations

Product innovation in the Switzerland container glass market is primarily focused on enhancing sustainability, functionality, and aesthetic appeal. Advancements in lightweighting technologies are reducing the material content and transportation costs of glass bottles, contributing to a lower carbon footprint. The development of specialty glass coatings is improving product shelf-life and offering UV protection for sensitive contents. Furthermore, manufacturers are increasingly exploring innovative decorative techniques, such as advanced etching, color fusion, and tactile finishes, to elevate brand positioning, particularly within the premium food and beverage and cosmetics sectors. The adoption of recycled glass content is also a key innovation, driving the circular economy. For instance, new glass manufacturing processes are being developed to accommodate higher percentages of cullet without compromising structural integrity or optical clarity, leading to enhanced eco-friendly glass packaging.

Propelling Factors for Switzerland Container Glass Market Growth

Several factors are propelling the growth of the Switzerland container glass market. The increasing consumer preference for sustainable packaging solutions and the inherent recyclability of glass are major drivers. Stringent Swiss environmental regulations further incentivize the use of glass, particularly as manufacturers aim for higher recycled content. Technological advancements in glass manufacturing processes, leading to lighter, stronger, and more aesthetically pleasing containers, are also boosting demand. The premium perception associated with glass packaging in key sectors like beverages, food, and cosmetics continues to be a significant growth catalyst. Furthermore, the growing pharmaceutical industry's demand for sterile and protective packaging solutions ensures a steady market for high-quality container glass.

Obstacles in the Switzerland Container Glass Market Market

Despite its strengths, the Switzerland container glass market faces several obstacles. The higher initial cost of glass packaging compared to some alternatives like plastic can be a barrier, particularly for budget-conscious brands. Supply chain disruptions, including volatile raw material prices and logistics challenges, can impact production costs and lead times. Intense competition from other packaging materials, particularly advanced plastics with improved barrier properties, poses a continuous threat. Furthermore, the energy-intensive nature of glass manufacturing and associated carbon emissions present ongoing challenges in meeting ambitious sustainability targets, requiring continuous investment in greener technologies.

Future Opportunities in Switzerland Container Glass Market

The Switzerland container glass market is poised for significant future opportunities. The growing demand for premium and artisanal products across beverages, food, and cosmetics will continue to favor glass's aesthetic and perceived quality. Emerging trends in health and wellness, such as the increased consumption of natural juices and functional beverages, will drive demand for glass packaging. The ongoing push towards a circular economy presents opportunities for innovation in recycled glass utilization and the development of reusable glass packaging systems. Furthermore, advancements in smart packaging technologies integrated into glass containers could unlock new possibilities for enhanced product tracking and consumer engagement.

Major Players in the Switzerland Container Glass Market Ecosystem

- Jingna Glass Co Ltd

- AptarGroup Inc

- O-I Glass Inc

- Vetropack

- FILL ME AG

- Ardagh Group S A

Key Developments in Switzerland Container Glass Market Industry

- May 2022: Schott intends to invest in a production expansion at its glass manufacturing facility in St Gallen, Switzerland. The capacity increase is intended to pave the way for a new manufacturing era with a glass-to-glass contact-free process. This helps to eliminate potential scratches or other glass defects while also contributing to the safe delivery of medications to patients.

Strategic Switzerland Container Glass Market Market Forecast

The Switzerland container glass market is projected for continued robust growth, driven by a strategic combination of sustainable innovation, premiumization trends, and regulatory support. The increasing consumer preference for environmentally friendly packaging solutions, coupled with the inherent recyclability of glass, will remain a key growth catalyst. Manufacturers are expected to invest further in advanced lightweighting technologies and the integration of higher percentages of recycled cullet, enhancing both cost-effectiveness and environmental credentials. The premium appeal of glass packaging will continue to fuel demand in high-value segments such as wines, spirits, specialty foods, and high-end cosmetics. The pharmaceutical sector's unwavering need for sterile and protective packaging will provide a stable foundation for market expansion. Emerging opportunities in reusable glass systems and smart packaging integration are also anticipated to contribute significantly to the market's future potential, positioning Switzerland as a leader in advanced and sustainable glass packaging solutions.

Switzerland Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholic Beverages

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alcoholic Beverages

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy-Based

- 1.1.2.5. Flavored Drinks

- 1.1.2.6. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Switzerland Container Glass Market Segmentation By Geography

- 1. Switzerland

Switzerland Container Glass Market Regional Market Share

Geographic Coverage of Switzerland Container Glass Market

Switzerland Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Production of the Soft Drinks and Soda in the Country; Rise of Food and Bavarage industy and The Growing Demand for Glass Container in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Availablity of the Substitute can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increasing Production of the Soft Drinks and Soda in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy-Based

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jingna Glass Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AptarGroup Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 O-I Glass Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vetropack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FILL ME AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Jingna Glass Co Ltd

List of Figures

- Figure 1: Switzerland Container Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Switzerland Container Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Switzerland Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Switzerland Container Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Container Glass Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Switzerland Container Glass Market?

Key companies in the market include Jingna Glass Co Ltd, AptarGroup Inc *List Not Exhaustive, O-I Glass Inc, Vetropack, FILL ME AG, Ardagh Group S A.

3. What are the main segments of the Switzerland Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Production of the Soft Drinks and Soda in the Country; Rise of Food and Bavarage industy and The Growing Demand for Glass Container in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increasing Production of the Soft Drinks and Soda in the Country.

7. Are there any restraints impacting market growth?

Availablity of the Substitute can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2022 - Schott intends to invest in a production expansion at its glass manufacturing facility in St Gallen, Switzerland. The capacity increase is intended to pave the way for a new manufacturing era with a glass-to-glass contact-free process. This helps to eliminate potential scratches or other glass defects while also contributing to the safe delivery of medications to patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Container Glass Market?

To stay informed about further developments, trends, and reports in the Switzerland Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence