Key Insights

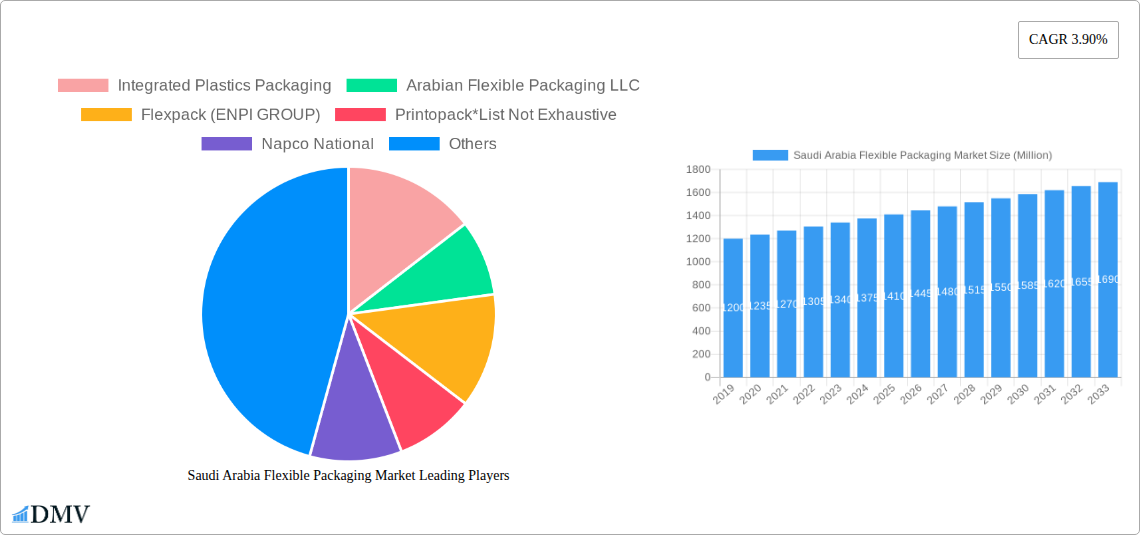

The Saudi Arabia flexible packaging market is projected for robust growth, driven by escalating demand across vital end-use sectors and a Compound Annual Growth Rate (CAGR) of 3.52%. The market, valued at approximately $1357.3 million in the base year 2025, is expected to witness significant expansion through 2033. Key growth catalysts include the thriving food and beverage industry, fueled by consumer preference for convenient and shelf-stable packaging, and the expanding healthcare and pharmaceutical sectors requiring sterile, tamper-evident solutions for medicines and medical devices. The adoption of innovative materials like advanced plastics and specialized films, alongside heightened consumer awareness of product safety and shelf life, further propels market growth. Government initiatives, such as Vision 2030, indirectly support this sector through industrial development and increased domestic consumption.

Saudi Arabia Flexible Packaging Market Market Size (In Billion)

Market challenges include raw material price volatility, particularly for petroleum-based plastics, and stringent environmental regulations pushing for sustainable packaging alternatives like biodegradable and recyclable materials. These factors necessitate investment in greener technologies, presenting opportunities for innovation. Leading companies such as Integrated Plastics Packaging, Huhtamaki Flexibles UAE, and Saudi Printing & Packaging Company are enhancing capacities and product portfolios, focusing on functionality, sustainability, and cost-effectiveness to maintain a competitive edge.

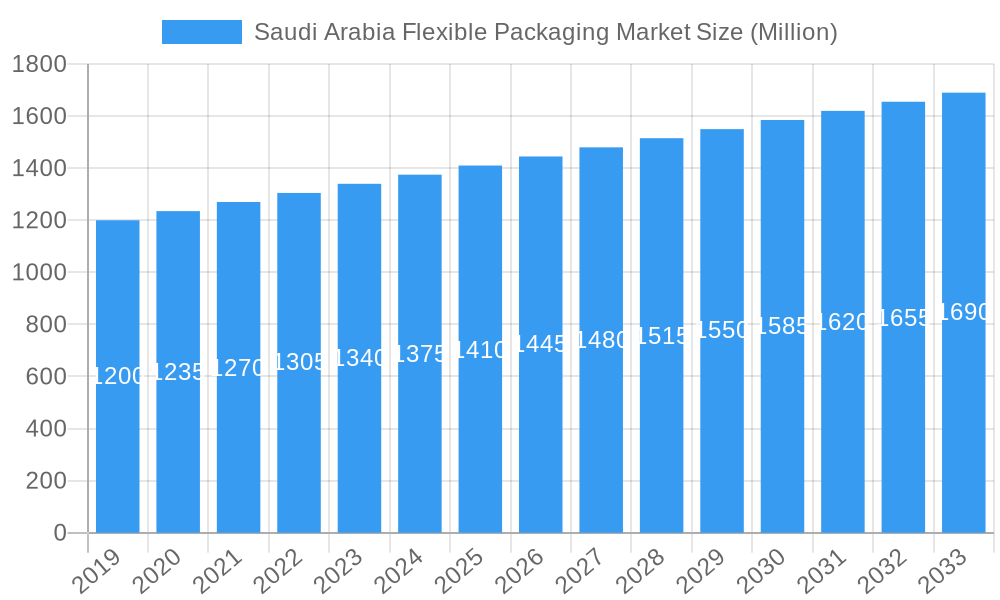

Saudi Arabia Flexible Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the Saudi Arabia Flexible Packaging Market, detailing its current status and future projections through 2033. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, the report offers critical insights for stakeholders. It examines market composition, industry evolution, regional and segmental dynamics, product innovations, growth drivers, restraints, future opportunities, and major players, supported by extensive data and expert analysis. The report also details market share, M&A activities, growth rates, and adoption metrics for a holistic market understanding.

Saudi Arabia Flexible Packaging Market Market Composition & Trends

The Saudi Arabia Flexible Packaging Market is characterized by a moderate concentration of key players, with a dynamic interplay of established entities and emerging innovators driving market evolution. Regulatory frameworks are increasingly emphasizing sustainability and product safety, acting as significant catalysts for innovation in recyclable and biodegradable packaging solutions. The presence of readily available substitute products, particularly in traditional packaging formats, necessitates a continuous focus on enhancing the value proposition of flexible packaging through improved performance, cost-effectiveness, and environmental credentials. Understanding the evolving profiles of end-users, from the dominant Food and Beverage sectors to the growing Healthcare and Pharmaceutical industries, is crucial for strategic market positioning. Mergers and acquisitions (M&A) activities, while not extensively documented with specific deal values in public domain, are expected to play a pivotal role in consolidating market share and expanding technological capabilities. The market share distribution is influenced by the dominant material segment, with Plastic currently holding the largest share, followed by Paper and Metal. M&A deal values are estimated to be in the range of tens of millions, reflecting strategic investments in capacity expansion and technological integration.

Saudi Arabia Flexible Packaging Market Industry Evolution

The Saudi Arabia Flexible Packaging Market has witnessed a consistent and robust growth trajectory over the historical period of 2019-2024, driven by a confluence of economic development, rising consumer disposable income, and a burgeoning retail sector. The market’s evolution is intrinsically linked to technological advancements, with manufacturers increasingly adopting sophisticated printing techniques, advanced barrier materials, and innovative sealing technologies to meet stringent product protection and shelf-life requirements. Furthermore, a significant shift in consumer demands towards convenience, portion control, and aesthetically pleasing packaging has fueled the adoption of diverse flexible packaging formats. The e-commerce boom has also played a catalytic role, necessitating durable yet lightweight packaging solutions for product transit. Growth rates for the overall market are projected to be in the high single digits annually during the forecast period. The adoption of sustainable packaging solutions has seen a notable surge, with an estimated 15% increase in demand for recyclable and biodegradable options in the last two years. The penetration of advanced barrier films, crucial for extending product shelf life in the food and beverage industry, has also grown by approximately 20% since 2021.

Leading Regions, Countries, or Segments in Saudi Arabia Flexible Packaging Market

Within the Saudi Arabia Flexible Packaging Market, the Plastic segment unequivocally dominates, driven by its versatility, cost-effectiveness, and superior barrier properties, making it indispensable for a wide array of applications. This dominance is further amplified by its extensive use across the most significant end-user industries, namely Food and Beverages.

- Plastic Segment Dominance:

- Material Properties: Excellent flexibility, durability, moisture resistance, and gas barrier properties are key attributes.

- Cost-Effectiveness: Compared to metal and often paper, plastics offer a more economical solution for mass production.

- End-User Synergy: Critical for packaging processed foods, snacks, beverages, confectionery, and frozen goods, where product preservation is paramount.

- Technological Advancements: Ongoing innovations in polymer science are leading to the development of thinner, stronger, and more sustainable plastic films.

The Food end-user segment represents the largest consumer of flexible packaging, fueled by a growing population, increasing urbanization, and evolving dietary habits that favor convenience foods and ready-to-eat meals. The Beverages sector follows closely, with a consistent demand for pouches, sachets, and flexible bottles.

- Food End-User Dominance:

- Product Variety: Encompasses everything from fresh produce and baked goods to processed meats, dairy products, and snacks.

- Shelf-Life Extension: Flexible packaging is crucial for extending the shelf life of perishable food items, reducing spoilage and waste.

- Consumer Convenience: Demand for single-serving packs, resealable pouches, and easy-to-open packaging is a significant driver.

- Regulatory Compliance: Adherence to food safety regulations necessitates high-quality, inert packaging materials.

The Bags and Pouches product type also commands a leading position, owing to their versatility in holding a wide range of products, from dry goods and snacks to liquids and powders. Their resealability and stand-up features further enhance consumer appeal.

- Bags and Pouches Product Type Dominance:

- Versatility: Suitable for a vast array of products, including snacks, coffee, pet food, detergents, and personal care items.

- Consumer Appeal: Features like stand-up capabilities, resealability, and premium printability enhance product visibility and convenience.

- Cost-Efficiency: Offers an efficient packaging solution for both manufacturers and consumers.

- Innovation Hub: Continuous development in zipper closures, spouts, and barrier technologies.

Investment trends in this dominant segment are robust, with manufacturers investing heavily in advanced extrusion and lamination technologies to produce high-performance plastic films. Regulatory support for food safety and hygiene standards indirectly bolsters the demand for high-quality flexible packaging.

Saudi Arabia Flexible Packaging Market Product Innovations

Product innovation in the Saudi Arabia Flexible Packaging Market is primarily focused on enhancing sustainability, functionality, and visual appeal. Developments include the introduction of advanced barrier films that significantly extend product shelf life, reducing food waste. There is a growing emphasis on recyclable mono-material structures that can replace multi-layer laminates, addressing environmental concerns without compromising performance. Furthermore, innovations in printing technologies, such as high-definition rotogravure and flexographic printing, enable vibrant graphics and brand differentiation, capturing consumer attention. The incorporation of smart features, like freshness indicators and tamper-evident seals, is also gaining traction, enhancing product safety and consumer trust.

Propelling Factors for Saudi Arabia Flexible Packaging Market Growth

Several key factors are propelling the growth of the Saudi Arabia Flexible Packaging Market. The rapidly expanding food and beverage industry, driven by population growth and changing consumer lifestyles, is a primary driver, demanding convenient and long-lasting packaging solutions. The increasing adoption of e-commerce necessitates lightweight and durable packaging that can withstand transit. Government initiatives promoting local manufacturing and industrial diversification also provide a supportive ecosystem for the flexible packaging sector. Furthermore, a growing awareness of environmental sustainability is spurring innovation in recyclable and biodegradable packaging materials.

Obstacles in the Saudi Arabia Flexible Packaging Market Market

Despite its strong growth, the Saudi Arabia Flexible Packaging Market faces certain obstacles. Fluctuations in raw material prices, particularly petrochemical derivatives, can impact production costs and profitability. Stringent waste management regulations and the ongoing debate surrounding single-use plastics present a challenge, requiring manufacturers to invest in sustainable alternatives. Supply chain disruptions, though less pronounced recently, can still pose a risk to raw material availability and timely delivery. Intense competition from both local and international players also puts pressure on profit margins.

Future Opportunities in Saudi Arabia Flexible Packaging Market

The Saudi Arabia Flexible Packaging Market is ripe with future opportunities. The growing demand for health and wellness products, including functional foods and pharmaceuticals, opens avenues for specialized flexible packaging with enhanced barrier properties and safety features. The expansion of the QSR (Quick Service Restaurant) and foodservice industries presents significant potential for convenient and portion-controlled flexible packaging. Furthermore, the Kingdom's Vision 2030 initiative, which aims to diversify the economy and promote local manufacturing, is expected to create new avenues for investment and growth in the flexible packaging sector. The increasing adoption of smart packaging solutions, offering traceability and enhanced consumer engagement, also presents a nascent but promising opportunity.

Major Players in the Saudi Arabia Flexible Packaging Market Ecosystem

- Integrated Plastics Packaging

- Arabian Flexible Packaging LLC

- Flexpack (ENPI GROUP)

- Printopack

- Napco National

- Huhtamaki Flexibles UAE

- Saudi Printing & Packaging Company

- Swiss Pac UAE

- Gulf East Paper & Plastic Industries LLC

- Amber Packaging Industries L L C

Key Developments in Saudi Arabia Flexible Packaging Market Industry

- August 2022: Symphony Environmental Technologies PLC announced the completion of a manufacturing agreement with Ecobatch Plastic Factory in the United Arab Emirates. This agreement is poised to significantly enhance Ecobatch's production capacity, enabling it to meet the projected substantial increase in demand within the GCC region. This surge in demand is anticipated due to the more comprehensive enforcement of regulations that champion the use of d2w type biodegradable technology, marking a pivotal step towards more sustainable packaging solutions.

Strategic Saudi Arabia Flexible Packaging Market Market Forecast

The Saudi Arabia Flexible Packaging Market is strategically positioned for robust growth in the coming years. Future opportunities stemming from the expanding food and beverage, healthcare, and e-commerce sectors will be key growth catalysts. The increasing focus on sustainable packaging solutions, driven by both consumer preference and evolving regulations, will further propel the market. Investments in advanced manufacturing technologies and the exploration of new material innovations are expected to enhance product offerings and market competitiveness. The ongoing economic diversification initiatives within Saudi Arabia are likely to create a more favorable environment for domestic manufacturing and increased demand for flexible packaging across various industries, ensuring continued market expansion and increased market potential.

Saudi Arabia Flexible Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Paper

-

2. Product Type

- 2.1. Bags and Pouches

- 2.2. Films and Wraps

- 2.3. Other Product Types

-

3. End-User

- 3.1. Food

- 3.2. Beverages

- 3.3. Healthcare and Pharmaceutical

Saudi Arabia Flexible Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Flexible Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Flexible Packaging Market

Saudi Arabia Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Composable Plastics is Expected to Increase with New Regulations Being Enforced; Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Paper

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bags and Pouches

- 5.2.2. Films and Wraps

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Healthcare and Pharmaceutical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Integrated Plastics Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arabian Flexible Packaging LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flexpack (ENPI GROUP)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Printopack*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Napco National

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Flexibles UAE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Printing & Packaging Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Pac UAE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gulf East Paper & Plastic Industries LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amber Packaging Industries L L C

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Integrated Plastics Packaging

List of Figures

- Figure 1: Saudi Arabia Flexible Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 2: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Saudi Arabia Flexible Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Flexible Packaging Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the Saudi Arabia Flexible Packaging Market?

Key companies in the market include Integrated Plastics Packaging, Arabian Flexible Packaging LLC, Flexpack (ENPI GROUP), Printopack*List Not Exhaustive, Napco National, Huhtamaki Flexibles UAE, Saudi Printing & Packaging Company, Swiss Pac UAE, Gulf East Paper & Plastic Industries LLC, Amber Packaging Industries L L C.

3. What are the main segments of the Saudi Arabia Flexible Packaging Market?

The market segments include Material, Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1357.3 million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Composable Plastics is Expected to Increase with New Regulations Being Enforced; Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry.

6. What are the notable trends driving market growth?

Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

August 2022: Symphony Environmental Technologies PLC announced the completion of a manufacturing agreement with EcobatchPlastic Factory in the United Arab Emirates. According to the company, Ecobatchhas improved its capacity to support a substantial increase in demand in the GCC (Gulf Cooperation Council) region, which is projected due to more comprehensive enforcement of regulations that support the d2w type of biodegradable technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence