Key Insights

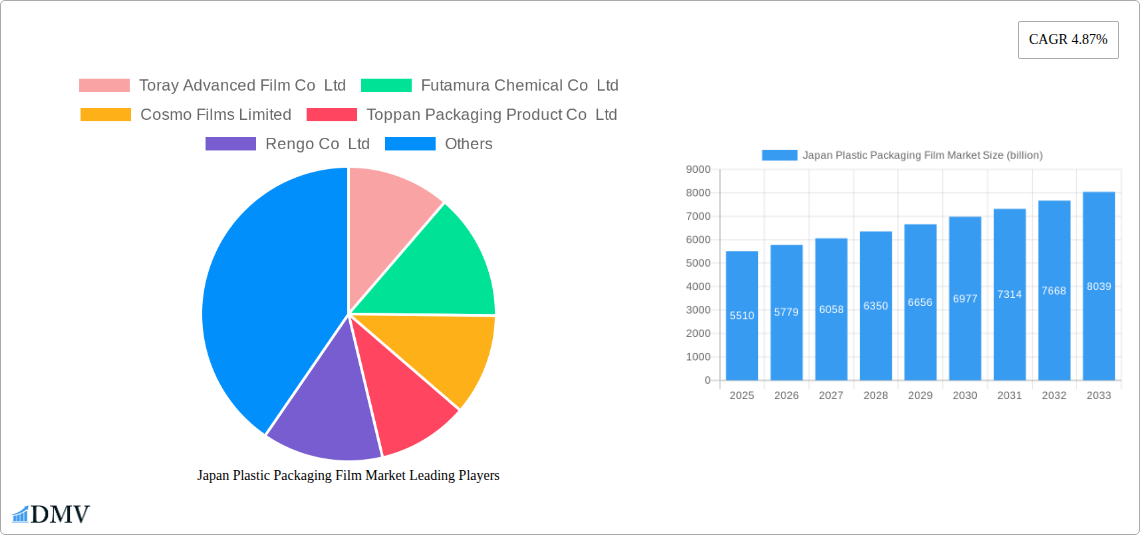

The Japan Plastic Packaging Film Market is poised for steady expansion, with a projected market size of 5.51 billion USD in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.87%, indicating a healthy and sustained upward trajectory for the industry throughout the forecast period of 2025-2033. Key market drivers are expected to include increasing consumer demand for convenience in food packaging, particularly for fresh produce, frozen foods, and confectionery. Furthermore, the healthcare sector's growing need for sterile and protective packaging solutions will contribute significantly to market expansion. The rising adoption of advanced film types, such as Polyethylene Terephthalate Glycol (PETG) and Bio-Based films, reflects a broader industry shift towards enhanced barrier properties, sustainability, and consumer appeal.

Japan Plastic Packaging Film Market Market Size (In Billion)

The market's segmentation reveals a diverse landscape. Polyethylene and Polypropylene films are anticipated to continue holding significant shares due to their versatility and cost-effectiveness. However, the rising environmental consciousness among Japanese consumers and stringent regulations are expected to fuel the growth of Bio-Based films. While the demand for conventional packaging films remains strong, emerging trends like smart packaging, antimicrobial films, and recyclable solutions are set to redefine the market's competitive edge. Restraints might arise from fluctuating raw material prices and the ongoing development of alternative packaging materials. Despite these challenges, the continuous innovation in film technology and the persistent demand across various end-use industries, from food and healthcare to personal care and industrial applications, will ensure a dynamic and evolving market.

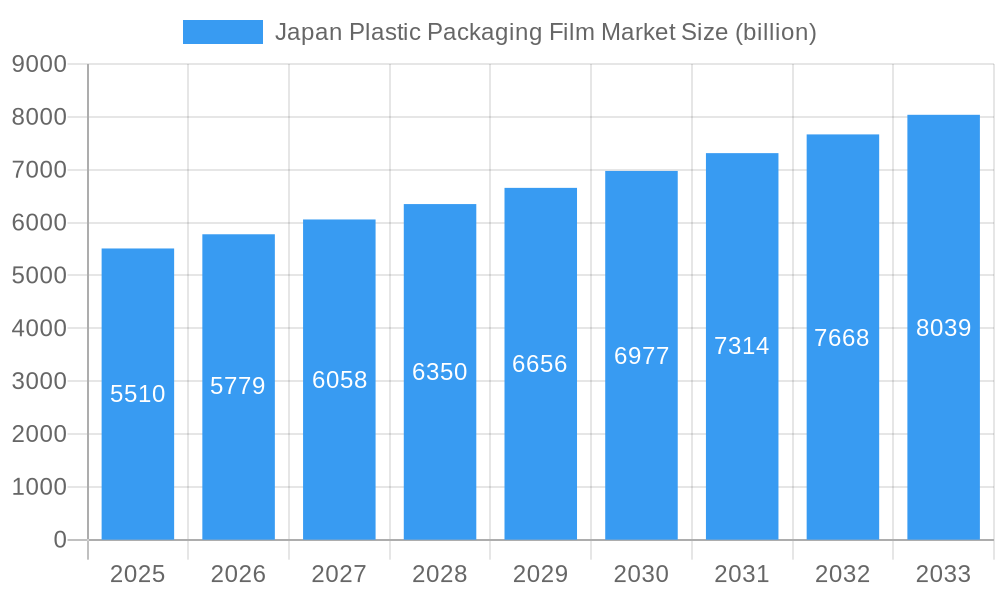

Japan Plastic Packaging Film Market Company Market Share

This comprehensive report delves into the dynamic Japan Plastic Packaging Film Market, providing an in-depth analysis of its current state and future trajectory from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers critical insights for stakeholders seeking to capitalize on emerging opportunities and navigate industry challenges. The market is expected to reach a valuation of over $15.5 billion by 2025, with significant growth projected throughout the forecast period.

Japan Plastic Packaging Film Market Market Composition & Trends

The Japan Plastic Packaging Film Market exhibits a moderate concentration, characterized by a blend of established giants and agile innovators. Key drivers of innovation include stringent environmental regulations, a growing demand for sustainable packaging solutions, and advancements in material science. The regulatory landscape, particularly concerning plastic waste management and recycling, is a significant influencer shaping market strategies. Substitute products, such as paper-based packaging and compostable films, pose a growing challenge, necessitating continuous product development and enhanced performance metrics for plastic films. End-user profiles are diverse, with the food industry representing the largest segment, followed by healthcare and personal care. Mergers and acquisitions (M&A) activities, while not dominant, are strategically important for expanding market reach and acquiring cutting-edge technologies. For instance, a hypothetical M&A deal of $1.2 billion could significantly reshape a specific niche within the market. The market share distribution is closely watched, with key players holding substantial but not monopolistic positions. Understanding these dynamics is crucial for forecasting future market growth and competitive positioning.

Japan Plastic Packaging Film Market Industry Evolution

The Japan Plastic Packaging Film Market has undergone a significant evolution, driven by a confluence of technological advancements, shifting consumer preferences, and increasing environmental consciousness. Over the historical period (2019-2024), the market has witnessed a steady growth trajectory, fueled by the robust demand for flexible packaging solutions across various end-use industries. The base year, 2025, serves as a critical inflection point, with projected market revenues estimated to be over $15.5 billion. Technological breakthroughs have been pivotal in this evolution. The development of high-barrier films, such as those incorporating EVOH and PETG, has enhanced product shelf-life and reduced food waste, particularly in the Food Packaging segment. Similarly, advancements in bio-based and compostable plastic films are responding to consumer pressure for eco-friendly alternatives, albeit with ongoing challenges in cost-competitiveness and performance parity.

Shifting consumer demands have played an equally important role. There is a discernible trend towards lightweight, convenient, and aesthetically pleasing packaging. This has spurred innovation in film extrusion, printing, and lamination technologies. The healthcare sector, with its stringent requirements for sterility and product integrity, continues to be a strong driver for advanced plastic films. Personal care and home care segments also exhibit consistent demand due to their reliance on visually appealing and functional packaging. The industrial packaging sector, while mature, continues to adopt innovative film solutions for enhanced protection and logistics efficiency. The forecast period (2025-2033) is anticipated to witness accelerated growth, with an estimated compound annual growth rate (CAGR) of approximately 4.2%. This growth will be underpinned by continued innovation in material science, a greater emphasis on circular economy principles, and the potential for novel applications in emerging sectors. The industry's ability to adapt to evolving environmental regulations and consumer expectations will be paramount in sustaining this upward trajectory. The adoption of advanced recycling technologies and the development of films with improved recyclability are expected to become key competitive differentiators, shaping the industry’s future.

Leading Regions, Countries, or Segments in Japan Plastic Packaging Film Market

Within the Japan Plastic Packaging Film Market, the Food segment stands as the dominant force, driven by the nation's high consumption of packaged food products and a growing demand for convenience. This segment alone is estimated to account for over 40% of the total market revenue by 2025. The sub-segments within food packaging, including Candy & Confectionery, Frozen Foods, and Dairy Products, exhibit particularly robust growth due to evolving consumer lifestyles and the demand for longer shelf-life solutions.

- Food Segment Dominance:

- Key Drivers: Increasing disposable incomes, a growing demand for convenience foods, stringent food safety regulations, and the popularity of smaller portion sizes all contribute to the sustained demand for high-performance plastic packaging films.

- Sub-segment Growth: Frozen Foods benefit from advanced barrier films that maintain quality and freshness. Candy & Confectionery rely on visually appealing and protective films for brand differentiation. Dairy Products require films with excellent oxygen and moisture barriers.

- Market Share: The food segment is projected to maintain its leading position, with a market share exceeding $6.2 billion by 2025.

Beyond food, the Healthcare segment represents a significant and growing area of demand. The stringent requirements for sterility, tamper-evidence, and product protection in pharmaceutical and medical device packaging necessitate the use of specialized, high-performance plastic films.

- Healthcare Segment Significance:

- Key Drivers: An aging population, advancements in medical technology, and increasing healthcare spending in Japan drive the demand for sterile and protective packaging.

- Applications: Films for sterile packaging of medical devices, pharmaceutical blister packs, and diagnostic kits are crucial.

- Growth Potential: This segment is expected to witness a CAGR of around 5.0% over the forecast period.

The Personal Care & Home Care segment also contributes substantially to market growth, driven by consumer preference for attractive and functional packaging that enhances product appeal and user experience. Industrial Packaging remains a stable contributor, with demand for protective films for goods during transit and storage.

Among the film types, Polyethylene (PE) and Polypropylene (PP) films are expected to continue their dominance due to their versatility, cost-effectiveness, and a wide range of applications across various industries. However, the market is also witnessing a growing interest in specialized films like EVOH and PETG for their superior barrier properties, particularly in demanding food and healthcare applications. The rising awareness of environmental issues is also fueling the growth of Bio-Based film types, although their market share is still relatively smaller compared to conventional plastics.

Japan Plastic Packaging Film Market Product Innovations

Recent product innovations in the Japan Plastic Packaging Film Market are centered around enhancing sustainability, functionality, and performance. Companies are actively developing high-barrier films with reduced material usage, enabling lighter and more eco-friendly packaging solutions. The emergence of films with improved recyclability, including those designed for horizontal recycling processes as exemplified by the Toppan initiative, is a significant development. Furthermore, advancements in specialized films, such as the per- and polyfluoroalkyl substance-free mold release films developed by Toray Industries for semiconductor applications, highlight the market's diversification and its ability to cater to niche, high-tech industries. These innovations aim to improve product shelf-life, reduce waste, and meet stringent regulatory and consumer demands for greener packaging.

Propelling Factors for Japan Plastic Packaging Film Market Growth

Several key factors are propelling the growth of the Japan Plastic Packaging Film Market. Technologically, advancements in extrusion, co-extrusion, and lamination techniques allow for the creation of multi-layer films with enhanced barrier properties, improved strength, and better printability. Economically, rising consumer spending and a growing demand for processed and convenience foods continue to drive the need for sophisticated packaging solutions. Regulatory influences, while sometimes posing challenges, also act as catalysts for innovation, particularly concerning sustainability mandates and the push for circular economy principles. The increasing focus on reducing food waste through effective packaging further boosts demand for high-performance films.

Obstacles in the Japan Plastic Packaging Film Market Market

Despite its growth potential, the Japan Plastic Packaging Film Market faces several obstacles. Stringent environmental regulations, particularly concerning plastic waste management and single-use plastics, necessitate significant investment in research and development for sustainable alternatives and enhanced recyclability. Supply chain disruptions, exacerbated by global economic volatility and raw material price fluctuations, can impact production costs and lead times. Furthermore, the growing competition from substitute materials like paper and compostable alternatives, coupled with increasing consumer and regulatory pressure for reduced plastic usage, presents a significant challenge. The cost-effectiveness and performance parity of sustainable alternatives remain critical hurdles for widespread adoption.

Future Opportunities in Japan Plastic Packaging Film Market

The Japan Plastic Packaging Film Market is poised for significant future opportunities. The burgeoning demand for e-commerce packaging, requiring durable and protective films, presents a growing niche. The continued advancement and wider adoption of bio-based and compostable plastic films, supported by government initiatives and consumer preference, offer substantial growth potential. Furthermore, the development of smart packaging solutions, incorporating features like spoilage indicators or traceability, will create new avenues for innovation. The drive towards a circular economy will also spur opportunities in advanced recycling technologies and the development of films designed for closed-loop systems.

Major Players in the Japan Plastic Packaging Film Market Ecosystem

- Toray Advanced Film Co Ltd

- Futamura Chemical Co Ltd

- Cosmo Films Limited

- Toppan Packaging Product Co Ltd

- Rengo Co Ltd

- Kingchuan Packaging

- KISCO LTD

- Gunze Limited

- GSI Creos Corporation

- Unitika LTD

Key Developments in Japan Plastic Packaging Film Market Industry

- August 2023: Toppan, Mitsui Chemicals Tohcello, and Mitsui Chemicals jointly initiated a pilot program to develop and commercialize a technology for the horizontal recycling of packaging films, aiming to transform printed biaxially oriented polypropylene (BOPP) film into new, pliable packaging material.

- May 2024: Toray Industries, Inc. unveiled a breakthrough mold release film for cutting-edge semiconductor applications, notably devoid of per- and polyfluoroalkyl substances. This development enhances the semiconductor packaging process by ensuring product integrity during mold operations.

Strategic Japan Plastic Packaging Film Market Market Forecast

The strategic forecast for the Japan Plastic Packaging Film Market anticipates robust growth driven by an increasing focus on sustainability and technological innovation. The market is expected to expand significantly as companies invest in advanced recycling technologies and the development of bio-based alternatives. The demand for high-barrier films in the food and healthcare sectors will remain a key growth catalyst, ensuring product safety and extending shelf-life. Regulatory support for a circular economy and consumer preference for eco-friendly packaging will further accelerate the adoption of sustainable film solutions. Strategic collaborations and targeted product development will be crucial for players to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

Japan Plastic Packaging Film Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End User

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, And Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Food Products

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other End-use Industry

-

2.1. Food

Japan Plastic Packaging Film Market Segmentation By Geography

- 1. Japan

Japan Plastic Packaging Film Market Regional Market Share

Geographic Coverage of Japan Plastic Packaging Film Market

Japan Plastic Packaging Film Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food

- 3.2.2 Beverage and Pharmaceutical Sector Aids Growth

- 3.3. Market Restrains

- 3.3.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food

- 3.3.2 Beverage and Pharmaceutical Sector Aids Growth

- 3.4. Market Trends

- 3.4.1. Strong Demand For Polypropylene (PP) Films Aids the Top-Line

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Plastic Packaging Film Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, And Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Food Products

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other End-use Industry

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toray Advanced Film Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Futamura Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cosmo Films Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toppan Packaging Product Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rengo Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kingchuan Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KISCO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gunze Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GSI Creos Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitika LTD *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Toray Advanced Film Co Ltd

List of Figures

- Figure 1: Japan Plastic Packaging Film Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Plastic Packaging Film Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Plastic Packaging Film Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Japan Plastic Packaging Film Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Japan Plastic Packaging Film Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Plastic Packaging Film Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Japan Plastic Packaging Film Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Japan Plastic Packaging Film Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Plastic Packaging Film Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Japan Plastic Packaging Film Market?

Key companies in the market include Toray Advanced Film Co Ltd, Futamura Chemical Co Ltd, Cosmo Films Limited, Toppan Packaging Product Co Ltd, Rengo Co Ltd, Kingchuan Packaging, KISCO LTD, Gunze Limited, GSI Creos Corporation, Unitika LTD *List Not Exhaustive.

3. What are the main segments of the Japan Plastic Packaging Film Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food. Beverage and Pharmaceutical Sector Aids Growth.

6. What are the notable trends driving market growth?

Strong Demand For Polypropylene (PP) Films Aids the Top-Line.

7. Are there any restraints impacting market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food. Beverage and Pharmaceutical Sector Aids Growth.

8. Can you provide examples of recent developments in the market?

August 2023 - Toppan, Mitsui Chemicals Tohcello, and Mitsui Chemicals have jointly initiated a pilot program. Their goal is to bring to market a technology that emphasizes the horizontal recycling of packaging films. This endeavor is a pivotal part of a larger strategy by these Tokyo-based plastic firms. Their aim is to pioneer a unique method: transforming printed biaxially oriented polypropylene (BOPP) film into new, pliable packaging material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Plastic Packaging Film Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Plastic Packaging Film Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Plastic Packaging Film Market?

To stay informed about further developments, trends, and reports in the Japan Plastic Packaging Film Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence