Key Insights

The Mexico glass packaging market is projected to experience substantial growth, reaching an estimated market size of 738 million by 2024, with a Compound Annual Growth Rate (CAGR) of 4.5%. This expansion is driven by increasing demand for premium, sustainable packaging across sectors like pharmaceuticals and personal care. The inherent recyclability and inertness of glass align with consumer preferences for eco-friendly products. Technological advancements in glass manufacturing are resulting in lighter, stronger, and more visually appealing packaging, meeting evolving brand and consumer expectations. The pharmaceutical industry's reliance on glass for product integrity and safety further solidifies its market position.

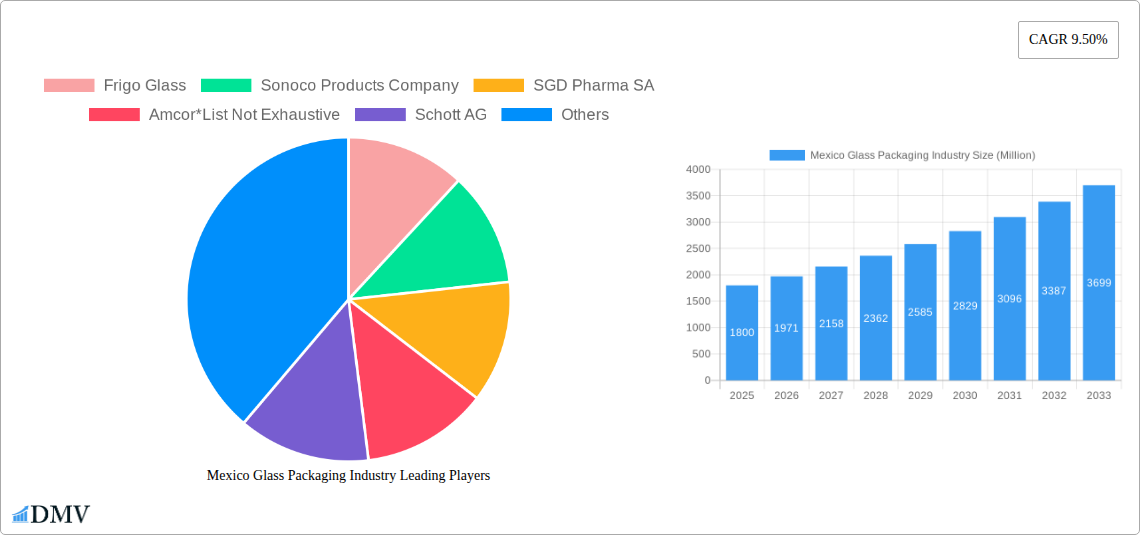

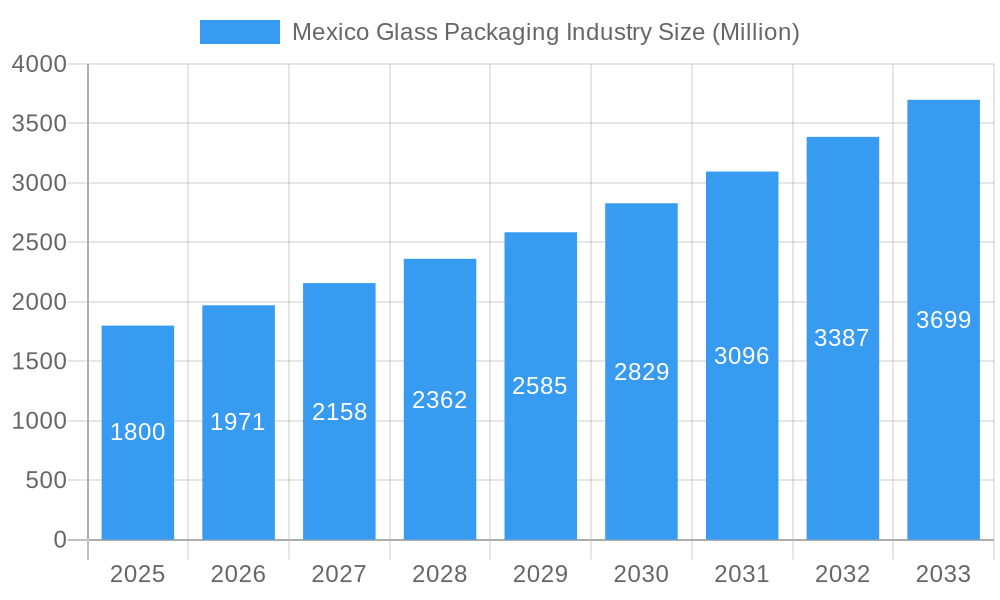

Mexico Glass Packaging Industry Market Size (In Million)

Market growth is also supported by the rising preference for artisanal and premium beverages, where glass bottles are favored for their perceived quality and shelf appeal. In the personal care segment, glass jars and containers are increasingly used for high-end cosmetics and skincare due to their luxurious feel and reusability. Potential restraints include fluctuations in raw material costs and competition from alternative packaging materials, particularly in price-sensitive segments. However, glass's enduring appeal for its visual aesthetic, barrier properties, and environmental credentials is expected to sustain its market dominance and continued growth in Mexico.

Mexico Glass Packaging Industry Company Market Share

This report offers an in-depth analysis of the Mexico Glass Packaging Industry, covering key end-user verticals such as pharmaceuticals, personal care, household care, and agriculture. The analysis spans from 2019 to 2033, with a base year of 2024, providing crucial insights into market dynamics, trends, and future potential. Utilizing granular data and expert analysis, this report serves stakeholders seeking to understand the market for glass containers, bottles, jars, vials, and ampoules in Mexico.

Mexico Glass Packaging Industry Market Composition & Trends

The Mexico Glass Packaging Industry exhibits a moderately concentrated market, with key players like Vitro S A B de CV, Frigo Glass, and Amcor holding significant market share. Innovation in glass packaging is primarily driven by the demand for enhanced product protection, sustainability, and aesthetic appeal. Regulatory landscapes, while evolving, prioritize safety standards and environmental responsibility, impacting manufacturing processes and material choices. Substitute products, such as plastic and metal packaging, present ongoing competition, necessitating continuous improvement in glass's cost-effectiveness and performance. End-user profiles are increasingly sophisticated, demanding tailored solutions for specific product requirements in pharmaceuticals (e.g., sterile vials, amber bottles) and personal care (e.g., premium jars, decorative bottles). Mergers and acquisitions (M&A) activities, though less frequent in recent years, aim to consolidate market presence and expand product portfolios, with past M&A deal values in the tens of Million. The market share distribution among the top five companies is estimated to be around 60-70 Million.

Mexico Glass Packaging Industry Industry Evolution

The Mexico Glass Packaging Industry has undergone significant evolution, driven by a confluence of technological advancements, shifting consumer preferences, and evolving regulatory frameworks. Over the historical period (2019–2024), the market demonstrated a steady growth trajectory, with an average annual growth rate of approximately 4.5% Million. This growth was underpinned by increasing demand from the pharmaceutical sector, propelled by an aging population and rising healthcare expenditure, alongside robust growth in the personal care and cosmetics industry, fueled by rising disposable incomes and a penchant for premium product packaging. Technological advancements have been pivotal, with a notable shift towards energy-efficient manufacturing processes and the development of specialized glass formulations offering enhanced barrier properties and durability. The adoption of lightweighting techniques has also contributed to cost savings and reduced environmental impact. The base year (2025) marks a critical juncture, with projected market revenue reaching approximately 5.8 Million.

The forecast period (2025–2033) is anticipated to witness sustained growth, with an estimated Compound Annual Growth Rate (CAGR) of around 5.2% Million. This optimism is rooted in several factors:

- Continued Pharmaceutical Demand: The ongoing expansion of the pharmaceutical industry in Mexico, coupled with global supply chain diversification efforts, will continue to be a primary growth driver for high-quality glass vials and bottles.

- Premiumization in Consumer Goods: The personal care and household care sectors are increasingly emphasizing premiumization, leading to a greater demand for aesthetically appealing and high-quality glass jars and containers that convey brand value.

- Sustainability Initiatives: Growing environmental awareness and stringent regulations are favoring glass packaging due to its inherent recyclability and inert properties, positioning it favorably against single-use plastics.

- Technological Innovations: Advancements in manufacturing, such as enhanced UV resistance, scratch resistance, and tamper-evident features, will further bolster the appeal of glass packaging.

Specific data points highlighting this evolution include the estimated increase in demand for specialized vials and ampoules for biologics and sensitive pharmaceutical formulations, projected to grow at a CAGR of 6% Million during the forecast period. Furthermore, the adoption of advanced coating technologies to improve product shelf-life is expected to see an uptake of over 15% Million by 2028. The industry's resilience and adaptability to these evolving dynamics are key indicators of its sustained potential.

Leading Regions, Countries, or Segments in Mexico Glass Packaging Industry

Within the Mexico Glass Packaging Industry, the Pharmaceuticals end-user vertical clearly dominates, accounting for an estimated 40% Million of the total market share in the base year (2025). This dominance is driven by several compelling factors, including the robust growth of Mexico's pharmaceutical manufacturing sector, increasing healthcare expenditure, and the stringent regulatory requirements that favor glass packaging for its inertness, impermeability, and ability to maintain product integrity.

Key drivers for the dominance of pharmaceutical glass packaging include:

- Investment Trends: Significant investments by both domestic and international pharmaceutical companies in manufacturing and R&D facilities in Mexico are directly translating into higher demand for glass packaging solutions, particularly vials, ampoules, and specialized bottles. Investments in advanced manufacturing lines capable of handling sterile and high-value pharmaceutical products are estimated to reach over 70 Million annually by 2026.

- Regulatory Support: The strict regulatory environment governing pharmaceutical products, enforced by agencies like COFEPRIS, mandates the use of packaging that ensures product safety, purity, and efficacy. Glass packaging, with its proven track record in preventing contamination and degradation, is the preferred choice. Compliance with GMP (Good Manufacturing Practices) standards further solidifies glass's position.

- Product Integrity and Shelf-Life: The inert nature of glass ensures no leaching of chemicals into sensitive drug formulations, preserving their potency and extending shelf-life, a critical factor for pharmaceutical products. The demand for amber glass for light-sensitive medications is also a significant contributor.

- Technological Advancements: Innovations in pharmaceutical glass, such as Corning Incorporated's Valor Glass, designed to minimize drug-product interactions and improve drug stability, are further cementing its position. The adoption rate of such advanced glass types is projected to increase by 20% Million within the pharmaceutical segment by 2028.

While other segments like Personal Care (contributing approximately 25% Million of the market) and Household Care (around 15% Million) are also substantial, their growth is often influenced by aesthetic trends and price sensitivity, which can lead to greater material substitution. The Agricultural segment, while present, remains a smaller contributor, estimated at around 5% Million. The Other End-user Vertical segment encompasses a diverse range of applications and accounts for the remaining market share. However, the critical nature of pharmaceutical products, combined with the inherent advantages of glass for drug preservation and safety, solidifies the Pharmaceutical sector's leading position in the Mexico Glass Packaging Industry.

Mexico Glass Packaging Industry Product Innovations

Product innovation in the Mexico Glass Packaging Industry is increasingly focused on enhancing functionality, sustainability, and user experience. Advancements in specialty glass formulations are leading to containers with superior barrier properties against oxygen and moisture, crucial for extending the shelf-life of sensitive products in the pharmaceutical and food & beverage sectors. Furthermore, the development of lightweight glass bottles and jars addresses cost and sustainability concerns without compromising structural integrity. Innovations in decoration and finishing techniques, such as advanced printing and coating technologies, enable unique branding opportunities for personal care and cosmetic products. Performance metrics are continuously improving, with enhanced resistance to thermal shock, mechanical stress, and chemical interactions, ensuring product safety and quality.

Propelling Factors for Mexico Glass Packaging Industry Growth

Several key factors are propelling the growth of the Mexico Glass Packaging Industry. Firstly, the burgeoning pharmaceutical sector in Mexico, driven by domestic demand and its role in global supply chains, necessitates high-quality, sterile glass packaging like vials and ampoules. Secondly, the increasing consumer preference for premium and sustainable products in the personal care and household care sectors is driving demand for aesthetically pleasing and eco-friendly glass bottles and jars. Thirdly, ongoing technological advancements in glass manufacturing are leading to lighter, stronger, and more sustainable glass packaging solutions, improving cost-effectiveness and reducing environmental impact. Finally, supportive government initiatives promoting domestic manufacturing and adherence to stringent quality standards further bolster the industry's expansion.

Obstacles in the Mexico Glass Packaging Industry Market

Despite its growth potential, the Mexico Glass Packaging Industry faces several obstacles. Fluctuations in raw material costs, particularly soda ash and sand, can impact profitability and pricing strategies. Intense competition from alternative packaging materials like plastic and metal, which often offer lower price points and lighter weight, poses a significant challenge. Furthermore, environmental concerns and the energy-intensive nature of glass production require continuous investment in sustainable technologies and practices to meet evolving regulatory demands and consumer expectations. Supply chain disruptions, exacerbated by global events, can also lead to increased lead times and operational inefficiencies.

Future Opportunities in Mexico Glass Packaging Industry

Emerging opportunities in the Mexico Glass Packaging Industry are significant. The growing demand for sustainable and recyclable packaging presents a strong advantage for glass, especially as consumer and regulatory pressure against single-use plastics intensifies. The expansion of the biopharmaceutical sector will drive demand for specialized high-barrier glass vials and ampoules. Furthermore, the increasing adoption of e-commerce for pharmaceutical and premium consumer goods creates opportunities for durable and aesthetically appealing glass packaging that can withstand transit. Innovations in smart packaging technologies integrated with glass could also unlock new avenues for product tracking and authentication.

Major Players in the Mexico Glass Packaging Industry Ecosystem

- Frigo Glass

- Sonoco Products Company

- SGD Pharma SA

- Amcor

- Schott AG

- Vitro S A B de CV

- Saver Glass Inc

- Gerresheimer AG

- Corning Incorporated

- Owens-illinois Inc

Key Developments in Mexico Glass Packaging Industry Industry

- May 2020: Pfizer Inc. and Corning Incorporated announced a long-term purchase and supply agreement for Corning Valor Glass. Further, Valor Glass vials will be supplied to a portion of Pfizer's existing marketed drug medicines under the terms of the multiyear deal, which is subject to regulatory approval. This development signifies a major endorsement of advanced glass vial technology for critical pharmaceutical applications.

Strategic Mexico Glass Packaging Industry Market Forecast

The Mexico Glass Packaging Industry is poised for robust growth, driven by the escalating demand from the pharmaceutical sector and the increasing consumer preference for sustainable, premium packaging in personal care and household goods. Technological advancements in glass production, focusing on lightweighting and enhanced barrier properties, will improve cost-effectiveness and environmental credentials, directly addressing key market challenges. Strategic investments in advanced glass formulations and manufacturing processes, coupled with the inherent recyclability of glass, position the industry favorably for sustained expansion. The market is projected to witness a healthy CAGR of approximately 5.2% Million from 2025 to 2033, underscoring a promising future for this vital sector.

Mexico Glass Packaging Industry Segmentation

-

1. Type

- 1.1. Bottles/Containers

- 1.2. Vials

- 1.3. Ampoules

- 1.4. Jars

-

2. End-user Vertical

- 2.1. Pharmaceuticals

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Agricultural

- 2.5. Other End-user Vertical

Mexico Glass Packaging Industry Segmentation By Geography

- 1. Mexico

Mexico Glass Packaging Industry Regional Market Share

Geographic Coverage of Mexico Glass Packaging Industry

Mexico Glass Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Disposable Income and Integration in Premium Packaging; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. ; Environmental Concerns Related to Raw Materials for Packaging and Price Competition

- 3.4. Market Trends

- 3.4.1. Glass Bottles and Containers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Glass Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bottles/Containers

- 5.1.2. Vials

- 5.1.3. Ampoules

- 5.1.4. Jars

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Pharmaceuticals

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Agricultural

- 5.2.5. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frigo Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SGD Pharma SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schott AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vitro S A B de CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saver Glass Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gerresheimer AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corning Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Owens-illinois Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Frigo Glass

List of Figures

- Figure 1: Mexico Glass Packaging Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Glass Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Glass Packaging Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Mexico Glass Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Mexico Glass Packaging Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Mexico Glass Packaging Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: Mexico Glass Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Mexico Glass Packaging Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Glass Packaging Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Mexico Glass Packaging Industry?

Key companies in the market include Frigo Glass, Sonoco Products Company, SGD Pharma SA, Amcor*List Not Exhaustive, Schott AG, Vitro S A B de CV, Saver Glass Inc, Gerresheimer AG, Corning Incorporated, Owens-illinois Inc.

3. What are the main segments of the Mexico Glass Packaging Industry?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 738 million as of 2022.

5. What are some drivers contributing to market growth?

Higher Disposable Income and Integration in Premium Packaging; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

Glass Bottles and Containers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Environmental Concerns Related to Raw Materials for Packaging and Price Competition.

8. Can you provide examples of recent developments in the market?

May 2020 - Pfizer Inc. and Corning Incorporated announced a long-term purchase and supply agreement for Corning Valor Glass. Further, Valor Glass vials will be supplied to a portion of Pfizer's existing marketed drug medicines under the terms of the multiyear deal, which is subject to regulatory approval.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Glass Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Glass Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Glass Packaging Industry?

To stay informed about further developments, trends, and reports in the Mexico Glass Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence