Key Insights

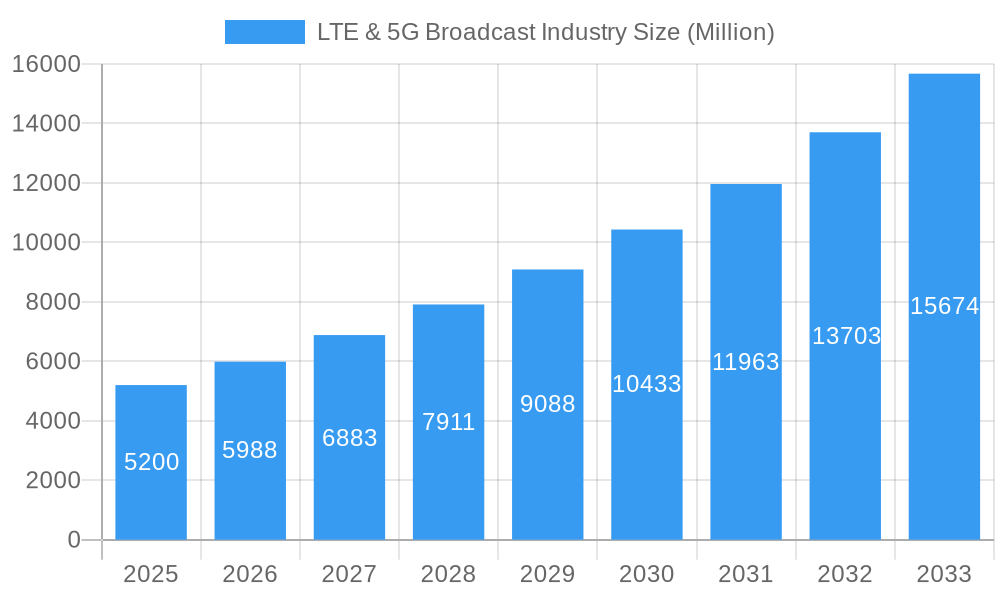

The LTE & 5G Broadcast industry is projected for substantial growth, with an estimated market size of USD 930.9 million in the base year 2025, expected to reach a significant valuation by 2033. This expansion is driven by a compelling compound annual growth rate (CAGR) of 8.58%. Key catalysts include the escalating demand for advanced public safety communications, the rapid development of the connected vehicles ecosystem, and the increasing consumer desire for high-quality live event streaming and mobile television. LTE and 5G broadcast technologies' inherent ability to deliver content efficiently and cost-effectively to a massive audience simultaneously is a primary factor in this upward trend. Continuous advancements in network infrastructure and the emergence of innovative use cases are creating an environment ripe for widespread adoption across diverse applications, from critical public safety alerts to immersive entertainment experiences.

LTE & 5G Broadcast Industry Market Size (In Million)

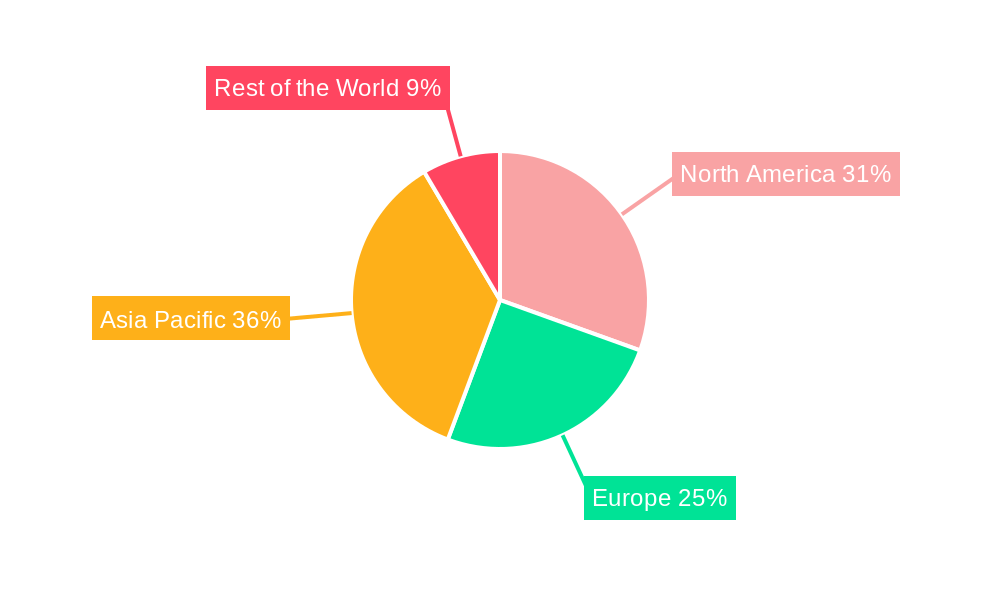

Market segmentation highlights prominent application areas, with Public Safety, Connected Vehicles, and Live Event Streaming anticipated to spearhead growth. The industry's trajectory is further propelled by the shift towards richer media experiences and the critical need for scalable, robust content delivery solutions. While broadcast technology's inherent advantages address efficient content distribution, potential challenges such as regulatory complexities and initial infrastructure investment requirements may exist. Nevertheless, the significant advantages of reduced operational expenses for content delivery, enhanced network efficiency, and the prospect of generating new revenue streams are increasingly outweighing these concerns. The Asia Pacific region, particularly China, Japan, and South Korea, is poised to lead market expansion, driven by rapid 5G network deployments and a high rate of technology adoption. North America and Europe are also anticipated to experience considerable growth, fueled by ongoing investments in cutting-edge communication technologies and the rising popularity of mobile content consumption.

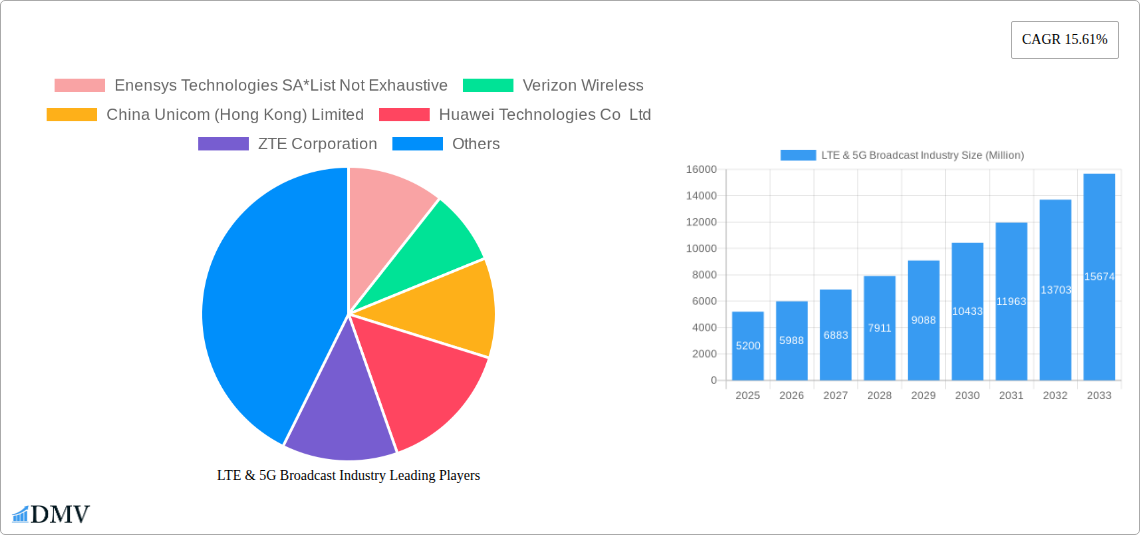

LTE & 5G Broadcast Industry Company Market Share

LTE & 5G Broadcast Industry Market Composition & Trends

The LTE & 5G Broadcast industry is a dynamic and rapidly evolving landscape, poised for substantial growth driven by increasing demand for efficient, high-capacity content delivery. Market concentration currently remains moderate, with a few key players holding significant sway, while a surge of innovation from emerging technology providers fuels competitive intensity. Catalysts for this innovation include the relentless pursuit of higher data speeds, lower latency, and enhanced spectral efficiency. Regulatory landscapes are also shaping the market, with governments worldwide establishing frameworks to support the deployment of broadcast capabilities over cellular networks. The threat of substitute products, while present in the form of traditional Over-The-Top (OTT) streaming services, is diminishing as LTE & 5G Broadcast solutions offer unique advantages in terms of scalability, cost-effectiveness for mass distribution, and guaranteed quality of service. End-user profiles are diversifying, ranging from public safety agencies requiring reliable, wide-scale information dissemination to consumers seeking seamless live event streaming and mobile TV experiences. Mergers and acquisitions (M&A) are a prominent feature, with strategic consolidations aimed at bolstering technological portfolios and expanding market reach. The estimated M&A deal value in the historical period is expected to reach $500 million, with further significant investments anticipated.

- Market Share Distribution: Major players are projected to collectively hold over 70% of the market by 2025.

- M&A Activity: Recent years have seen an average of 15 M&A deals annually, with an aggregate value exceeding $100 million in the historical period.

- Innovation Focus: Key innovation areas include efficient spectrum utilization, robust multicast protocols, and secure content delivery mechanisms.

LTE & 5G Broadcast Industry Industry Evolution

The LTE & 5G Broadcast industry is embarking on a transformative journey, characterized by exponential growth and profound technological shifts throughout the study period of 2019–2033. From its nascent stages in the historical period (2019–2024), where adoption was primarily experimental and focused on niche applications, the market is now entering a phase of accelerated expansion, projected to peak in the forecast period of 2025–2033. The base year of 2025 represents a critical inflection point, with widespread commercial deployments and increasing network operator investment signifying a maturation of the technology.

Technological advancements have been the primary engine of this evolution. The transition from LTE Broadcast (eMBMS) to the more robust and versatile 5G Broadcast standards has unlocked new possibilities. 5G Broadcast, leveraging Release 16 and subsequent 3GPP standards, offers significantly higher bandwidth, lower latency, and enhanced efficiency for delivering content to a vast number of users simultaneously without impacting the unicast network. This technological leap is directly addressing the escalating demand for high-definition mobile video streaming, real-time public safety alerts, and immersive connected vehicle services.

Shifting consumer demands have also played a pivotal role. As smartphone penetration continues to soar and data consumption habits evolve, consumers expect seamless, uninterrupted access to content, regardless of network congestion. This is particularly evident in scenarios like live sports events, music festivals, and major public gatherings, where traditional cellular networks often struggle to cope with peak loads. LTE & 5G Broadcast solutions offer a compelling answer, enabling operators to deliver a superior viewing experience to millions of concurrent users without compromising network performance. Furthermore, the burgeoning demand for augmented reality (AR) and virtual reality (VR) experiences, which are data-intensive and latency-sensitive, positions 5G Broadcast as a critical enabler for future applications.

The growth trajectory is further fueled by the increasing recognition of the economic benefits for content providers and broadcasters. By utilizing broadcast technology, they can drastically reduce the cost per bit for distributing content to a large audience, shifting from an expensive unicast model to a highly efficient multicast one. This cost optimization is expected to drive wider adoption and innovation in content delivery strategies. The estimated compound annual growth rate (CAGR) for the LTE & 5G Broadcast market is projected to be an impressive 35% from 2025 to 2033, reaching an estimated market size of $80 billion by the end of the forecast period. This robust growth is indicative of the market’s transition from a nascent technology to a mainstream solution for mass content delivery.

Leading Regions, Countries, or Segments in LTE & 5G Broadcast Industry

The global LTE & 5G Broadcast industry is experiencing a significant surge, with certain regions and application segments demonstrating exceptional leadership. Among the diverse applications, Content/Data Delivery stands out as the dominant segment, driven by its fundamental role in enabling efficient and scalable distribution of vast amounts of data across mobile networks. This dominance is further amplified by the pervasive growth of digital content consumption and the increasing need for reliable, high-bandwidth delivery mechanisms for various services.

The dominance of the Content/Data Delivery segment is underpinned by several key drivers. Investment trends are heavily skewed towards developing and deploying infrastructure that can support mass data dissemination. Network operators are increasingly recognizing the economic efficiencies and network offload capabilities offered by broadcast solutions for high-demand content. Regulatory support, while varying by region, generally favors technologies that enhance public safety and emergency communication, often falling under the umbrella of broad data delivery strategies. Furthermore, the insatiable appetite for video streaming, including Live Event Streaming and Video on Demand, directly fuels the need for robust Content/Data Delivery platforms. The convergence of these factors positions Content/Data Delivery as the lynchpin of the LTE & 5G Broadcast ecosystem.

Regionally, Asia Pacific is emerging as a powerhouse in the LTE & 5G Broadcast market. This leadership is attributed to a confluence of factors, including the immense population density, rapid adoption of 5G technology, and proactive government initiatives promoting digital transformation and infrastructure development. Countries like China, with its massive subscriber base and significant investments in 5G infrastructure, are at the forefront. South Korea and Japan are also key contributors, driven by their advanced technological ecosystems and a strong consumer demand for cutting-edge mobile services. The significant presence of major telecom equipment manufacturers in the region also fuels innovation and deployment.

Key Drivers for Asia Pacific Dominance:

- Massive 5G Network Rollouts: Extensive and rapid deployment of 5G infrastructure provides the foundational network for broadcast capabilities.

- High Population Density & Mobile Penetration: A large and tech-savvy population drives demand for mobile content and services.

- Government Support & Digital Initiatives: Proactive policies encourage the adoption of advanced communication technologies.

- Presence of Leading Tech Companies: Manufacturers and service providers in the region are at the forefront of 5G Broadcast development and deployment.

Key Drivers for Content/Data Delivery Dominance:

- Explosive Growth in Video Streaming: Unprecedented demand for Live Event Streaming and Video on Demand services.

- Network Efficiency & Cost Savings: Broadcast solutions offer significant cost advantages for distributing large volumes of data.

- Public Safety & Emergency Communication Needs: Reliable, wide-area data delivery is crucial for critical services.

- Emergence of New Data-Intensive Applications: Connected Vehicles and other IoT services require efficient data dissemination.

LTE & 5G Broadcast Industry Product Innovations

Product innovations in the LTE & 5G Broadcast industry are rapidly enhancing the capabilities and applications of this technology. Key advancements include the development of highly efficient multicast-aware network cores and user equipment (UE) chipsets optimized for broadcast reception. Innovations in content delivery networks (CDNs) are enabling seamless integration with broadcast infrastructure, ensuring low latency and high-quality streaming for Live Event Streaming and Mobile TV Streaming. Furthermore, software-defined networking (SDN) and network function virtualization (NFV) are enabling greater flexibility and scalability in broadcast service deployment. The integration of AI-powered content delivery optimization and intelligent spectrum management further boosts performance metrics, ensuring reliable delivery to millions of concurrent users with minimal packet loss. Unique selling propositions of these innovations lie in their ability to provide guaranteed quality of service, significant cost savings for content providers, and enhanced user experiences.

Propelling Factors for LTE & 5G Broadcast Industry Growth

The LTE & 5G Broadcast industry is experiencing robust growth propelled by several key factors. Technological advancements, particularly the maturation of 5G standards and dedicated broadcast chipsets, are creating a more capable and cost-effective infrastructure. The escalating demand for high-quality mobile video streaming and immersive content experiences, especially during live events and for Video on Demand services, necessitates scalable and efficient delivery solutions. Furthermore, government initiatives and regulatory frameworks that support public safety and critical communications are driving adoption, as broadcast capabilities offer unparalleled reach and reliability. Economic factors, such as the potential for significant cost savings for content distributors compared to unicast delivery, are also a major catalyst. The increasing adoption of connected vehicles, which rely on timely data dissemination, further fuels this growth.

Obstacles in the LTE & 5G Broadcast Industry Market

Despite its promising growth, the LTE & 5G Broadcast industry faces several significant obstacles. Regulatory fragmentation across different regions can create complexities for global deployment and service interoperability. The substantial initial investment required for network upgrades and infrastructure deployment can be a barrier for some operators. Supply chain disruptions for critical components, exacerbated by geopolitical factors, can impact timelines and costs. Moreover, competition from established Over-The-Top (OTT) streaming providers, who have deeply ingrained user bases and content libraries, presents a challenge, though broadcast offers distinct advantages in mass distribution. Overcoming these hurdles will require coordinated efforts in standardization, strategic partnerships, and continued innovation.

Future Opportunities in LTE & 5G Broadcast Industry

The LTE & 5G Broadcast industry is ripe with emerging opportunities. The expansion of connected vehicles, enabling real-time traffic information, infotainment delivery, and autonomous driving functionalities, presents a substantial market. The growing demand for immersive experiences, such as augmented and virtual reality, will require the high-capacity, low-latency delivery that 5G Broadcast can provide. Public safety applications, including disaster warning systems and real-time situational awareness for first responders, offer a critical and impactful growth avenue. The potential for delivering software updates and large data files to a vast number of devices efficiently also opens doors for new service models in areas like IoT device management and enterprise data dissemination.

Major Players in the LTE & 5G Broadcast Industry Ecosystem

- Enensys Technologies SA

- Verizon Wireless

- China Unicom (Hong Kong) Limited

- Huawei Technologies Co Ltd

- ZTE Corporation

- KDDI Corporation

- Reliance Jio Infocomm Limited

- Telstra Corporation

- AT&T Inc

- SK Telecom Co Ltd

- KT Corporation

Key Developments in LTE & 5G Broadcast Industry Industry

- 2019-2023: Progressive standardization efforts by 3GPP for 5G Broadcast capabilities, laying the groundwork for advanced features.

- 2020: Increased pilot projects and trials by major telecom operators globally, showcasing the potential of LTE and early 5G Broadcast applications.

- 2021: Enensys Technologies SA's continued innovation in broadcast transmission and reception solutions, supporting both LTE and 5G standards.

- 2022: Growing investments by Chinese telecom giants like Huawei and ZTE in 5G Broadcast infrastructure and chipsets.

- 2023: Verizon Wireless and AT&T Inc. exploring strategic partnerships and deployments for public safety and enterprise broadcast services.

- 2023: Reliance Jio Infocomm Limited and other Indian operators showing keen interest in leveraging broadcast for efficient content delivery in a rapidly growing market.

- 2024: Advancement in chipset technology enabling cost-effective integration of 5G Broadcast reception into consumer devices.

Strategic LTE & 5G Broadcast Industry Market Forecast

The strategic outlook for the LTE & 5G Broadcast industry is exceptionally strong, driven by an anticipated surge in demand for efficient mass content delivery. Key growth catalysts include the widespread deployment of 5G networks globally, enabling higher bandwidth and lower latency essential for advanced broadcast services. The increasing need for scalable solutions for live event streaming, mobile TV, and critical public safety communications will solidify the market's trajectory. Furthermore, the development of innovative applications in connected vehicles and the Internet of Things (IoT) will unlock new revenue streams and expand the market's reach. With estimated market potential exceeding $80 billion by 2033, the industry is poised for sustained expansion, making it a critical component of future mobile communication infrastructures.

LTE & 5G Broadcast Industry Segmentation

-

1. Application

- 1.1. Public Safety

- 1.2. Connected Vehicles

- 1.3. Live Event Streaming

- 1.4. Mobile TV Streaming

- 1.5. Advertising

- 1.6. Content/Data Delivery

- 1.7. Video on Demand

- 1.8. Other Applications

LTE & 5G Broadcast Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

LTE & 5G Broadcast Industry Regional Market Share

Geographic Coverage of LTE & 5G Broadcast Industry

LTE & 5G Broadcast Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Need for Fast Internet Connectivity With Ultra-Low Latency Connectivity for Broadcast Service; Rising Application of Multimedia Services Across Emerging Economies

- 3.3. Market Restrains

- 3.3.1. ; Fragmented Spectrum Allocation for LTE and 5G services; High Initial Investment Involved in Expanding LTE and 5G Infrastructure

- 3.4. Market Trends

- 3.4.1. Wireless & Mobile Devices Applications are Expected To Drive the Market Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LTE & 5G Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Public Safety

- 5.1.2. Connected Vehicles

- 5.1.3. Live Event Streaming

- 5.1.4. Mobile TV Streaming

- 5.1.5. Advertising

- 5.1.6. Content/Data Delivery

- 5.1.7. Video on Demand

- 5.1.8. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LTE & 5G Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Public Safety

- 6.1.2. Connected Vehicles

- 6.1.3. Live Event Streaming

- 6.1.4. Mobile TV Streaming

- 6.1.5. Advertising

- 6.1.6. Content/Data Delivery

- 6.1.7. Video on Demand

- 6.1.8. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe LTE & 5G Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Public Safety

- 7.1.2. Connected Vehicles

- 7.1.3. Live Event Streaming

- 7.1.4. Mobile TV Streaming

- 7.1.5. Advertising

- 7.1.6. Content/Data Delivery

- 7.1.7. Video on Demand

- 7.1.8. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific LTE & 5G Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Public Safety

- 8.1.2. Connected Vehicles

- 8.1.3. Live Event Streaming

- 8.1.4. Mobile TV Streaming

- 8.1.5. Advertising

- 8.1.6. Content/Data Delivery

- 8.1.7. Video on Demand

- 8.1.8. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World LTE & 5G Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Public Safety

- 9.1.2. Connected Vehicles

- 9.1.3. Live Event Streaming

- 9.1.4. Mobile TV Streaming

- 9.1.5. Advertising

- 9.1.6. Content/Data Delivery

- 9.1.7. Video on Demand

- 9.1.8. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Enensys Technologies SA*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Verizon Wireless

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 China Unicom (Hong Kong) Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Huawei Technologies Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZTE Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KDDI Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Reliance Jio Infocomm Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Telstra Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 AT&T Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 SK Telecom Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 KT Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Enensys Technologies SA*List Not Exhaustive

List of Figures

- Figure 1: Global LTE & 5G Broadcast Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America LTE & 5G Broadcast Industry Revenue (million), by Application 2025 & 2033

- Figure 3: North America LTE & 5G Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America LTE & 5G Broadcast Industry Revenue (million), by Country 2025 & 2033

- Figure 5: North America LTE & 5G Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe LTE & 5G Broadcast Industry Revenue (million), by Application 2025 & 2033

- Figure 7: Europe LTE & 5G Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe LTE & 5G Broadcast Industry Revenue (million), by Country 2025 & 2033

- Figure 9: Europe LTE & 5G Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific LTE & 5G Broadcast Industry Revenue (million), by Application 2025 & 2033

- Figure 11: Asia Pacific LTE & 5G Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific LTE & 5G Broadcast Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Asia Pacific LTE & 5G Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World LTE & 5G Broadcast Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Rest of the World LTE & 5G Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World LTE & 5G Broadcast Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Rest of the World LTE & 5G Broadcast Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Germany LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: China LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Japan LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: South Korea LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: India LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global LTE & 5G Broadcast Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: Latin America LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Middle East LTE & 5G Broadcast Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LTE & 5G Broadcast Industry?

The projected CAGR is approximately 8.58%.

2. Which companies are prominent players in the LTE & 5G Broadcast Industry?

Key companies in the market include Enensys Technologies SA*List Not Exhaustive, Verizon Wireless, China Unicom (Hong Kong) Limited, Huawei Technologies Co Ltd, ZTE Corporation, KDDI Corporation, Reliance Jio Infocomm Limited, Telstra Corporation, AT&T Inc, SK Telecom Co Ltd, KT Corporation.

3. What are the main segments of the LTE & 5G Broadcast Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 930.9 million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Need for Fast Internet Connectivity With Ultra-Low Latency Connectivity for Broadcast Service; Rising Application of Multimedia Services Across Emerging Economies.

6. What are the notable trends driving market growth?

Wireless & Mobile Devices Applications are Expected To Drive the Market Significantly.

7. Are there any restraints impacting market growth?

; Fragmented Spectrum Allocation for LTE and 5G services; High Initial Investment Involved in Expanding LTE and 5G Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LTE & 5G Broadcast Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LTE & 5G Broadcast Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LTE & 5G Broadcast Industry?

To stay informed about further developments, trends, and reports in the LTE & 5G Broadcast Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence