Key Insights

The Latin American Consumer Electronics Market, valued at approximately 87.96 billion in 2025, is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 1.7% from 2025 to 2033. This growth is propelled by rising disposable incomes, particularly in key economies like Brazil, Mexico, and Argentina, fostering increased consumer spending on advanced electronics. The expanding middle class, concentrated in urban centers, is a primary demand driver for smartphones, laptops, smart TVs, and home appliances. Enhanced e-commerce penetration and diverse online sales channels are broadening market access and boosting sales. Government initiatives aimed at digital inclusion and infrastructure development further support this positive market trajectory.

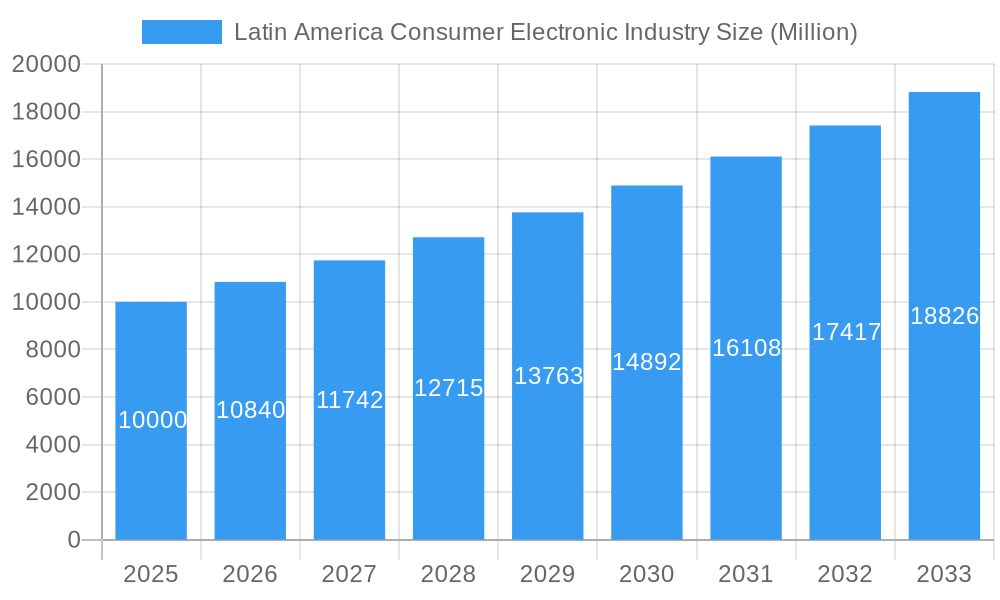

Latin America Consumer Electronic Industry Market Size (In Billion)

Despite robust growth prospects, the market encounters several constraints. Consumer price sensitivity, especially within lower-income demographics, mandates competitive pricing strategies. The proliferation of counterfeit goods presents a substantial challenge to established brands and compromises market integrity. Uneven infrastructure development across the region also impedes market penetration in specific areas. Intense competition from global leaders such as Samsung, LG, Panasonic, and Lenovo, alongside regional players like SEMP TCL and Esmaltec, fuels continuous innovation and price pressures. Effective market segmentation across product categories (electronic devices, household appliances), sales channels (online, offline), and geographic regions (Brazil, Mexico, Argentina, Rest of Latin America) is crucial for sustained growth. Companies that adapt to evolving consumer preferences, optimize digital strategies, and efficiently manage supply chains will secure a competitive advantage.

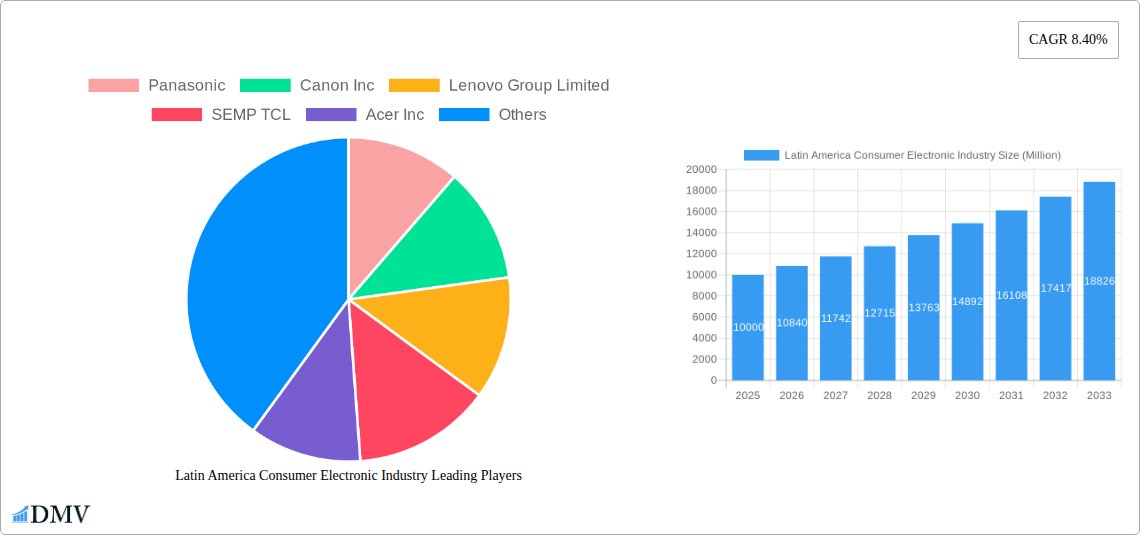

Latin America Consumer Electronic Industry Company Market Share

Latin America Consumer Electronics Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America consumer electronics industry, covering the period 2019-2033. We delve into market trends, competitive landscapes, and future growth prospects, offering invaluable insights for stakeholders across the value chain. The report features detailed segmentation by product type (electronic devices, household appliances), sales channel (online, offline), and country (Brazil, Mexico, Argentina, Rest of Latin America), providing a granular understanding of this dynamic market. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for strategic decision-making. The total market size is estimated at XXX Million in 2025 and is projected to reach XXX Million by 2033.

Latin America Consumer Electronic Industry Market Composition & Trends

This section evaluates the market concentration, analyzing the market share distribution amongst key players like Samsung, LG Electronics, Panasonic, and others. We examine innovation drivers, regulatory landscapes, the impact of substitute products, and the evolving end-user profiles. The report also details Mergers & Acquisitions (M&A) activities within the industry, including deal values (e.g., XX Million for a significant acquisition in 2022) and their impact on market dynamics.

- Market Concentration: The Latin American consumer electronics market is characterized by a relatively concentrated landscape, with a few major players holding significant market share. Samsung and LG Electronics consistently rank among the top players. However, regional players and niche brands also contribute substantially. We analyze market share distribution, identifying the top 5 players and their respective percentages (e.g., Samsung - 25%, LG - 20%, etc.).

- Innovation Catalysts: The industry is driven by innovations in areas like foldable smartphones, smart home devices, and energy-efficient appliances. Government initiatives promoting technological advancements further fuel innovation.

- Regulatory Landscape: Government regulations concerning import duties, product standards, and data privacy significantly influence market dynamics. We analyze the regulatory environment in key Latin American countries.

- Substitute Products: The availability of alternative products and services, particularly in the household appliance sector, influences consumer choices. We assess the impact of substitute products on market growth.

- End-User Profiles: The report identifies distinct end-user segments based on demographics, income levels, and technological adoption rates.

- M&A Activities: We detail recent M&A activities, including deal sizes (e.g., XX Million deal in 2023), and analyze their impact on market consolidation and competition.

Latin America Consumer Electronic Industry Industry Evolution

This section analyzes the historical (2019-2024) and projected (2025-2033) growth trajectories of the Latin American consumer electronics market. We examine the influence of technological advancements (e.g., the rise of 5G technology, the increasing popularity of smart home solutions) and shifting consumer preferences (e.g., demand for premium products, growing preference for online channels). Data points include annual growth rates (e.g., average annual growth of XX% during 2019-2024), adoption rates of new technologies, and shifts in consumer spending patterns. The impact of economic fluctuations and government policies on market growth are also analyzed. Further details on macroeconomic factors and their influence on consumer spending are incorporated. The evolution of specific segments such as smartphones, televisions, and refrigerators will be explored, highlighting growth rates and key trends within each category.

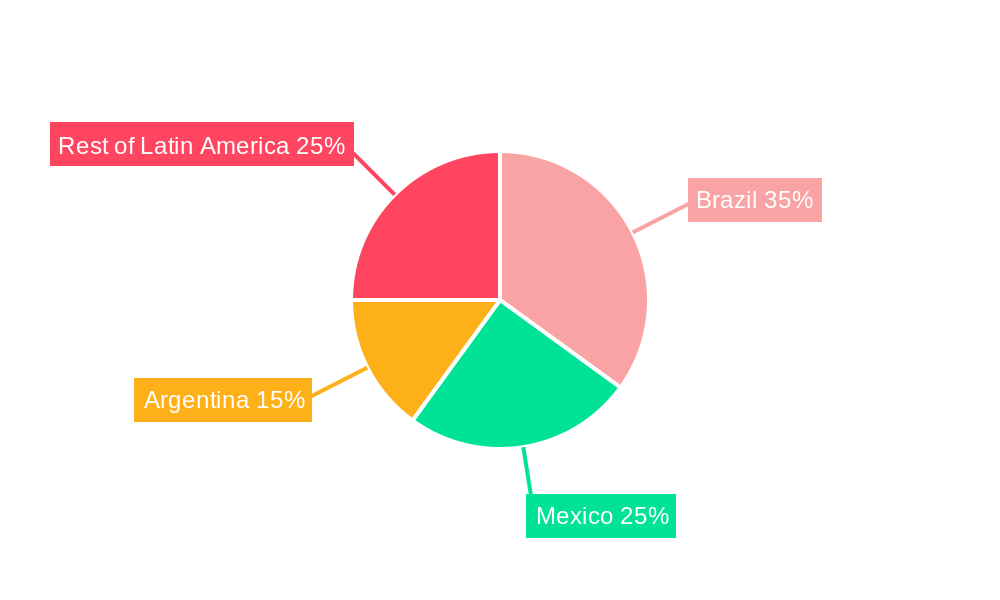

Leading Regions, Countries, or Segments in Latin America Consumer Electronic Industry

This section pinpoints the dominant regions, countries, and segments within the Latin American consumer electronics market. We identify the key drivers behind their dominance, including investment trends, regulatory support, and consumer behavior.

- Dominant Regions: Brazil consistently holds the largest market share due to its substantial population and relatively high consumer spending on electronics.

- Dominant Countries: Brazil, Mexico, and Argentina are the leading markets, although growth potential exists in other countries.

- Dominant Product Types: Smartphones, televisions, and refrigerators represent significant market segments.

- Dominant Sales Channels: The online sales channel exhibits robust growth, although offline retail remains crucial, particularly in certain segments.

- Key Drivers:

- Brazil’s large consumer base and expanding middle class contribute significantly to its market leadership.

- Government initiatives to promote digital inclusion in Mexico fuel online sales growth.

- Argentina’s fluctuating economy and currency impacts purchasing power, influencing consumer spending.

- The Rest of Latin America demonstrates notable growth potential due to increasing internet penetration and rising disposable incomes.

Latin America Consumer Electronic Industry Product Innovations

Recent years have witnessed significant product innovations in Latin America's consumer electronics sector. Manufacturers are focusing on energy-efficient appliances, incorporating smart features, and enhancing user interfaces. Key innovations include the introduction of foldable smartphones, advanced televisions with higher resolutions and HDR capabilities, and smart home devices with enhanced connectivity and AI features. These innovations cater to rising consumer demand for advanced functionality, seamless integration, and eco-friendly options. The market is also seeing innovative financing options and flexible payment plans to cater to wider customer demographics.

Propelling Factors for Latin America Consumer Electronic Industry Growth

Several factors contribute to the growth of Latin America's consumer electronics industry. Rising disposable incomes and increasing urbanization fuel consumer demand. Government initiatives promoting digital infrastructure development and favorable tax policies also stimulate market expansion. Furthermore, the growing penetration of the internet and mobile devices contributes significantly to this growth.

Obstacles in the Latin America Consumer Electronic Industry Market

The Latin American consumer electronics market faces several challenges. Economic volatility and fluctuating currency exchange rates impact consumer spending and import costs. Supply chain disruptions, particularly exacerbated by global events, can lead to product shortages and price increases. Intense competition from both domestic and international brands adds pressure on profit margins.

Future Opportunities in Latin America Consumer Electronic Industry

The Latin American consumer electronics market presents promising opportunities. The growing adoption of smart home technologies, rising demand for premium products, and increasing internet penetration create lucrative avenues for expansion. Focus on affordability and tailored payment schemes can further unlock market potential. Exploring niche markets and focusing on specific consumer needs can also lead to significant growth.

Major Players in the Latin America Consumer Electronic Industry Ecosystem

Key Developments in Latin America Consumer Electronic Industry Industry

- 2023 Q3: Samsung launched its new line of foldable smartphones in Brazil, experiencing high demand.

- 2022 Q4: A major merger between two regional appliance manufacturers resulted in increased market consolidation.

- 2021 Q2: Government incentives for smart home technology adoption boosted sales of related products.

- 2020 Q1: The COVID-19 pandemic temporarily disrupted supply chains, affecting product availability and pricing.

Strategic Latin America Consumer Electronic Industry Market Forecast

The Latin American consumer electronics market is poised for substantial growth over the forecast period (2025-2033). Driven by rising disposable incomes, expanding internet access, and increased adoption of smart technologies, the market is expected to exhibit robust expansion. Focusing on meeting the specific needs of diverse consumer segments and leveraging digital channels will be crucial for sustained success. Innovation and adaptation to the dynamic market conditions will be essential for capturing significant market share.

Latin America Consumer Electronic Industry Segmentation

-

1. Product Type

-

1.1. Electronic Devices

- 1.1.1. Smartphones

- 1.1.2. Tablets

- 1.1.3. Desktop PCs

- 1.1.4. Laptops/Notebooks

- 1.1.5. Television

- 1.1.6. Others

-

1.2. Household Appliances

- 1.2.1. Refrigerators

- 1.2.2. Air Conditioners

- 1.2.3. Washing Machines

-

1.1. Electronic Devices

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

Latin America Consumer Electronic Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Consumer Electronic Industry Regional Market Share

Geographic Coverage of Latin America Consumer Electronic Industry

Latin America Consumer Electronic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased access to the Internet; Growing inclination towards using smart appliances and devices

- 3.3. Market Restrains

- 3.3.1. Security concerns related to smart devices

- 3.4. Market Trends

- 3.4.1. Increasing smart device penetration in Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electronic Devices

- 5.1.1.1. Smartphones

- 5.1.1.2. Tablets

- 5.1.1.3. Desktop PCs

- 5.1.1.4. Laptops/Notebooks

- 5.1.1.5. Television

- 5.1.1.6. Others

- 5.1.2. Household Appliances

- 5.1.2.1. Refrigerators

- 5.1.2.2. Air Conditioners

- 5.1.2.3. Washing Machines

- 5.1.1. Electronic Devices

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Canon Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SEMP TCL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Acer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Whirlpool Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HP Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrolux AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Esmaltec*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Apple Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Samsung

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LG Electronics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Latin America Consumer Electronic Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Consumer Electronic Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Consumer Electronic Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Consumer Electronic Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Latin America Consumer Electronic Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Consumer Electronic Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Latin America Consumer Electronic Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Latin America Consumer Electronic Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Consumer Electronic Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the Latin America Consumer Electronic Industry?

Key companies in the market include Panasonic, Canon Inc, Lenovo Group Limited, SEMP TCL, Acer Inc, Whirlpool Corp, HP Inc, Dell Inc, Electrolux AB, Esmaltec*List Not Exhaustive, Apple Inc, Samsung, LG Electronics.

3. What are the main segments of the Latin America Consumer Electronic Industry?

The market segments include Product Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased access to the Internet; Growing inclination towards using smart appliances and devices.

6. What are the notable trends driving market growth?

Increasing smart device penetration in Latin America.

7. Are there any restraints impacting market growth?

Security concerns related to smart devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Consumer Electronic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Consumer Electronic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Consumer Electronic Industry?

To stay informed about further developments, trends, and reports in the Latin America Consumer Electronic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence