Key Insights

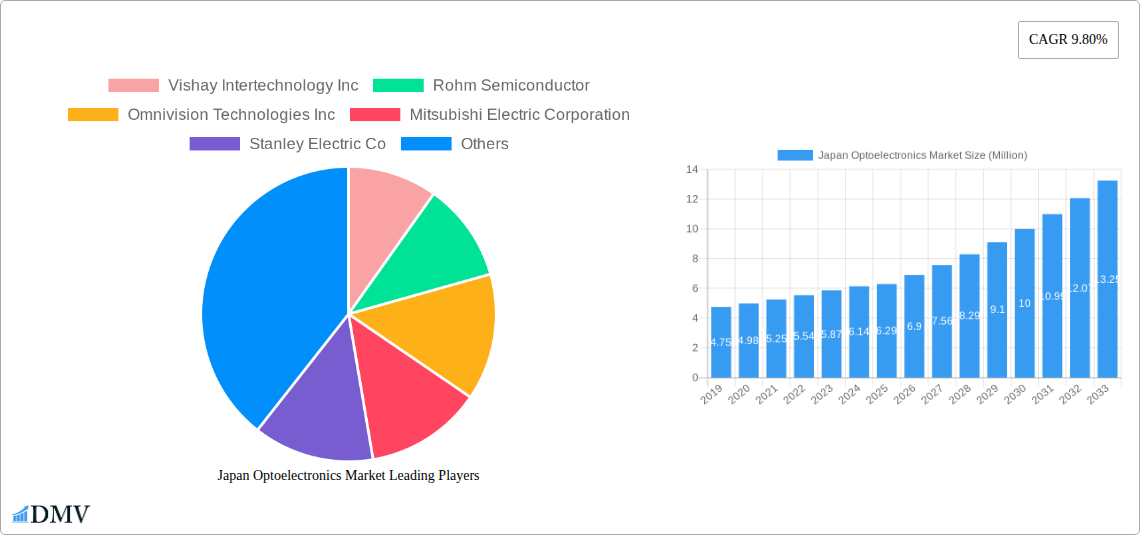

The Japanese optoelectronics market is poised for robust growth, projected to expand from a significant base of approximately USD 6.29 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 9.80% through 2033. This expansion is fueled by a confluence of dynamic market drivers and evolving technological trends. Key among these drivers is the escalating demand for advanced display technologies in consumer electronics and the burgeoning automotive sector's adoption of optoelectronic components for sophisticated driver-assistance systems and advanced lighting solutions. The increasing integration of optoelectronics in healthcare devices for diagnostics and monitoring, coupled with the relentless pursuit of energy efficiency and miniaturization across all industries, further propels market expansion. Japan's strong technological prowess and commitment to innovation in areas like high-resolution displays, advanced sensors, and laser technologies position it as a leader in this dynamic sector.

Japan Optoelectronics Market Market Size (In Million)

The market's trajectory is also shaped by the diverse application segments. The "Component type" segmentation highlights the growing importance of LED and Laser Diode technologies, driven by their widespread use in lighting, communication, and industrial applications. Image sensors are experiencing a surge in demand due to their critical role in automotive safety and advanced digital imaging. Conversely, while optocouplers and photovoltaic cells remain crucial, their growth might be more tempered compared to newer, rapidly evolving segments. In terms of "End-user industry," the automotive sector stands out as a major growth engine, alongside the ever-expanding consumer electronics and information technology sectors. Healthcare and industrial applications also represent significant and growing markets, leveraging the precision and efficiency offered by optoelectronic solutions. Emerging trends like the development of flexible and transparent optoelectronics, along with advancements in optical communication technologies, are expected to unlock new market opportunities.

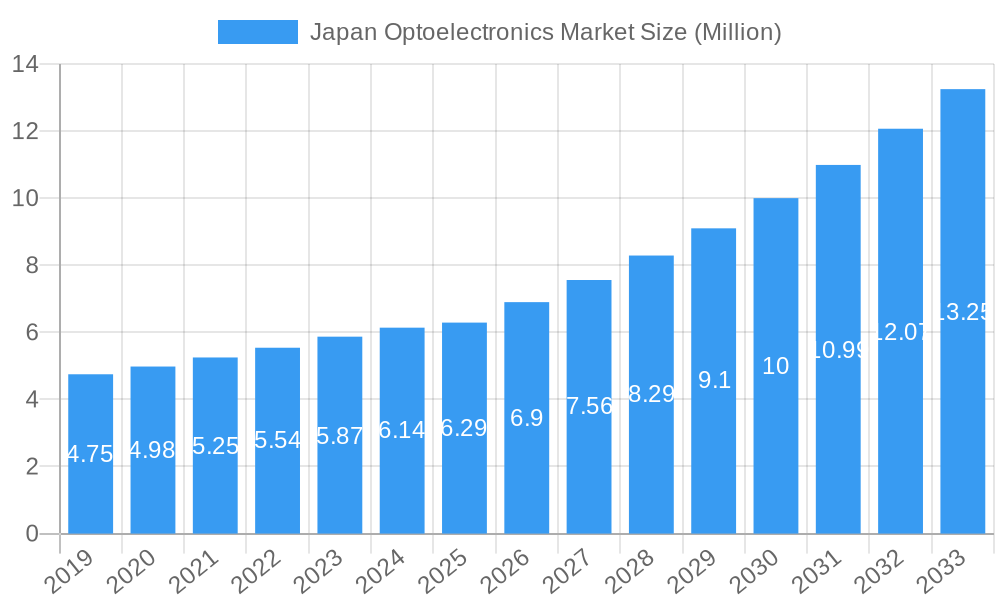

Japan Optoelectronics Market Company Market Share

Japan Optoelectronics Market Market Composition & Trends

The Japan Optoelectronics Market is characterized by a dynamic interplay of established giants and emerging innovators, shaping its competitive landscape. While specific market share distributions are detailed within the report, key players like Sony Corporation, Panasonic Corporation, and Mitsubishi Electric Corporation hold significant sway, driven by their robust product portfolios and extensive R&D investments. The market's concentration is influenced by the continuous evolution of LED technology, the growing demand for high-performance image sensors, and the critical role of laser diodes in advanced manufacturing and telecommunications. Innovation is primarily fueled by substantial R&D spending from leading companies, focusing on energy efficiency, miniaturization, and enhanced functionality across various optoelectronic components. The regulatory environment, though generally supportive of technological advancement, includes stringent quality and safety standards that companies must navigate. Substitute products, while present in some applications (e.g., alternative display technologies), are increasingly being outperformed by the superior capabilities of advanced optoelectronics. End-user profiles are diverse, spanning from high-volume consumer electronics and automotive applications to niche sectors like aerospace & defense and healthcare. Merger and acquisition (M&A) activities, while not always high-profile, are strategically aimed at acquiring novel technologies or expanding market reach. For instance, a hypothetical acquisition in the image sensor space could be valued in the hundreds of Million to secure intellectual property related to next-generation AI-enabled imaging. The market exhibits a moderate to high concentration, with a healthy degree of competition pushing innovation.

Japan Optoelectronics Market Industry Evolution

The Japan Optoelectronics Market has undergone a significant transformation, evolving from foundational technologies to encompass highly sophisticated and integrated solutions. Historically, the market's growth was propelled by the widespread adoption of LED lighting, revolutionizing energy efficiency and design possibilities in both residential and commercial settings. This foundational growth laid the groundwork for advancements in other optoelectronic components. The subsequent explosion in digital imaging, particularly fueled by the proliferation of smartphones and digital cameras, propelled the demand for advanced image sensors. Manufacturers have continuously pushed the boundaries of resolution, low-light performance, and frame rates, directly impacting the quality and capabilities of consumer electronics and professional imaging equipment. Simultaneously, the burgeoning automotive industry has become a major catalyst, with optoelectronics playing a crucial role in advanced driver-assistance systems (ADAS), in-car infotainment, and innovative lighting solutions. The increasing sophistication of autonomous driving technologies necessitates high-performance laser diodes for LiDAR systems and advanced image sensors for real-time environmental perception.

The IT sector, with its relentless pursuit of faster data transmission and higher processing speeds, also represents a significant growth trajectory. Laser diodes are indispensable in fiber optic communication networks, enabling the high-bandwidth connectivity essential for cloud computing, AI, and the Internet of Things (IoT). Furthermore, the healthcare sector is increasingly leveraging optoelectronics for diagnostic imaging (e.g., CT scans, MRI), minimally invasive surgical tools, and advanced biosensors. The development of compact and highly sensitive LEDs and image sensors is critical for portable medical devices and point-of-care diagnostics. Emerging applications in areas like augmented reality (AR) and virtual reality (VR) are also driving demand for specialized optoelectronic components, particularly advanced display technologies and tracking sensors. The overall market growth trajectory has been consistently positive, with projected annual growth rates of XX% during the forecast period (2025-2033). Shifting consumer demands towards smarter, more connected, and energy-efficient devices are continuously reshaping the product development landscape, compelling manufacturers to innovate at an accelerated pace. This evolution is further supported by ongoing investments in research and development, aiming to unlock new functionalities and applications for optoelectronic technologies.

Leading Regions, Countries, or Segments in Japan Optoelectronics Market

Within the Japan Optoelectronics Market, the Consumer Electronics end-user industry stands out as a dominant force, driven by the nation's strong heritage in electronics manufacturing and a discerning consumer base demanding cutting-edge technology. This dominance is further amplified by the significant contribution of Image Sensors as a key component type, intrinsically linked to the vast and ever-evolving consumer electronics ecosystem.

Dominant End-User Industry: Consumer Electronics

- Market Size: The consumer electronics segment is projected to account for over XX% of the total market revenue by 2033, with an estimated market value of XX Million in 2025.

- Key Drivers:

- High Consumer Demand for Innovation: Japanese consumers are early adopters of new technologies, constantly seeking the latest advancements in smartphones, cameras, televisions, and gaming consoles.

- Robust Domestic Manufacturing Base: Japan boasts world-leading manufacturers of consumer electronics, fostering a strong demand for domestically produced optoelectronic components.

- Technological Sophistication: The integration of AI, advanced imaging capabilities, and immersive display technologies in consumer devices directly fuels the demand for high-performance optoelectronic components.

- Growing Wearable Technology Market: The increasing popularity of smartwatches, fitness trackers, and AR/VR headsets creates new avenues for optoelectronic innovation.

Dominant Component Type: Image Sensors

- Market Share: Image sensors are expected to capture approximately XX% of the total optoelectronics market value by 2033.

- Factors Driving Dominance:

- Ubiquity in Smartphones: The smartphone remains the primary driver for image sensor demand, with advancements in computational photography and multi-camera systems requiring increasingly sophisticated sensors.

- High-Resolution and Low-Light Performance: Consumers expect superior image quality, pushing manufacturers to develop sensors with higher resolutions, better dynamic range, and exceptional low-light sensitivity.

- AI Integration: The integration of AI in image processing, from object recognition to facial detection, necessitates advanced image sensors capable of capturing detailed and accurate data.

- Emerging Applications: Beyond traditional photography, image sensors are finding critical applications in automotive safety (ADAS), industrial automation, medical imaging, and security surveillance, further solidifying their market dominance.

- Technological Advancements: Continuous innovation in sensor architecture, pixel technology (e.g., stacked CMOS), and on-chip processing capabilities allows for smaller, more power-efficient, and higher-performing image sensors.

The symbiotic relationship between the consumer electronics industry and image sensor technology creates a powerful growth engine within the Japan Optoelectronics Market. As consumer appetite for richer visual experiences and data-driven insights grows, the demand for advanced image sensors will continue to expand, further solidifying their position as a leading segment. While other segments like LEDs for lighting and displays, and laser diodes for industrial and communication applications, are also significant, the sheer volume and rapid innovation cycles within consumer electronics, powered by sophisticated image sensors, place them at the forefront of market influence and growth.

Japan Optoelectronics Market Product Innovations

The Japan Optoelectronics Market is a hotbed of innovation, constantly pushing the boundaries of performance and functionality. Recent advancements in LED technology include the development of micro-LEDs offering superior brightness, contrast, and energy efficiency for next-generation displays, while research into quantum dot LEDs promises enhanced color accuracy and wider color gamuts. In the realm of image sensors, breakthroughs in backside-illuminated (BSI) CMOS technology and stacked architectures are enabling significantly improved low-light performance, faster readout speeds, and reduced noise, critical for advanced imaging applications in smartphones and autonomous vehicles. Laser diodes are witnessing innovations in high-power efficiency and miniaturization, catering to the growing demand for LiDAR in automotive and industrial automation, as well as for advanced sensing and communication systems.

Propelling Factors for Japan Optoelectronics Market Growth

The growth of the Japan Optoelectronics Market is propelled by several key factors. The relentless advancement in LED technology, driven by the demand for energy-efficient lighting and high-resolution displays, continues to fuel market expansion. The burgeoning automotive sector, with its increasing reliance on advanced driver-assistance systems (ADAS) and autonomous driving features, is a significant driver, necessitating sophisticated image sensors and laser diodes for sensing and safety. Furthermore, the thriving consumer electronics industry, particularly the demand for high-quality cameras in smartphones and the growth of AR/VR devices, provides a consistent demand for innovative image sensors and associated optoelectronic components. Government initiatives supporting the semiconductor industry and digital transformation also play a crucial role in fostering innovation and investment.

Obstacles in the Japan Optoelectronics Market Market

Despite strong growth, the Japan Optoelectronics Market faces several obstacles. Intense global competition, particularly from manufacturers in other Asian countries, poses a significant challenge to market share. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can lead to production delays and increased costs. The high cost of research and development for cutting-edge optoelectronic technologies requires substantial investment, which can be a barrier for smaller companies. Furthermore, evolving regulatory standards and the need for continuous compliance can add complexity and cost to product development and market entry.

Future Opportunities in Japan Optoelectronics Market

The Japan Optoelectronics Market is ripe with future opportunities. The accelerating adoption of 5G and the expansion of the IoT ecosystem will drive demand for high-speed optical communication components, including advanced laser diodes and receivers. The growing demand for electric vehicles (EVs) and autonomous driving technology will continue to boost the market for automotive-grade image sensors and LiDAR systems. Furthermore, the increasing application of optoelectronics in healthcare, such as in advanced diagnostic imaging and minimally invasive surgical equipment, presents a significant growth avenue. The development of novel materials and integrated photonic devices also holds promise for groundbreaking applications in quantum computing and advanced sensing.

Major Players in the Japan Optoelectronics Market Ecosystem

- Vishay Intertechnology Inc

- Rohm Semiconductor

- Omnivision Technologies Inc

- Mitsubishi Electric Corporation

- Stanley Electric Co

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- General Electric Company

- Osram Licht AG

- Koninklijke Philips N V

- Panasonic Corporation

- Sony Corporation

Key Developments in Japan Optoelectronics Market Industry

- February 2024: Analog Devices and TSMC solidified a strategic agreement for wafer supply through TSMC's subsidiary, JASM, in Kumamoto Prefecture, Japan. This collaboration enhances Analog Devices' capacity for cutting-edge technology nodes crucial for sectors like wireless BMS (wBMS) and Gigabit Multimedia Serial Link (GMSL).

- February 2024: Qnami established a strategic commercial partnership with Quantum Design Japan and Quantum Design Korea to introduce its quantum platform for sensing applications to East Asia. This move aims to leverage NV-based quantum sensors in their ProteusQ nano-scale mapping microscope for materials science, navigation, and life sciences, contributing to sustainable future device development.

Strategic Japan Optoelectronics Market Market Forecast

The strategic forecast for the Japan Optoelectronics Market is overwhelmingly positive, driven by relentless technological innovation and expanding application frontiers. The continuous evolution of LED technology, particularly towards higher efficiency and novel form factors, will ensure its sustained demand across diverse sectors. The rapidly advancing automotive industry's transition to electric and autonomous vehicles represents a substantial opportunity for advanced image sensors and laser diodes. Furthermore, the increasing integration of AI and machine learning across industries will further amplify the need for sophisticated optoelectronic components that can capture and process visual data with unparalleled accuracy. The growing emphasis on digitalization and smart technologies across healthcare, industrial automation, and consumer electronics will create sustained demand, projecting robust growth for the Japan Optoelectronics Market throughout the forecast period.

Japan Optoelectronics Market Segmentation

-

1. Component type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Component Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential & Commercial

- 2.7. Industrial

- 2.8. Other End-user Industries

Japan Optoelectronics Market Segmentation By Geography

- 1. Japan

Japan Optoelectronics Market Regional Market Share

Geographic Coverage of Japan Optoelectronics Market

Japan Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Smart Consumer Electronics and Next Generation Technologies; Increasing Industrial Applications of the Technology

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Fabricating Costs

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential & Commercial

- 5.2.7. Industrial

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vishay Intertechnology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rohm Semiconductor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnivision Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Stanley Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Texas Instruments Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Osram Licht AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Koninklijke Philips N V

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sony Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Japan Optoelectronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Optoelectronics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 2: Japan Optoelectronics Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Japan Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 5: Japan Optoelectronics Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Japan Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Optoelectronics Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the Japan Optoelectronics Market?

Key companies in the market include Vishay Intertechnology Inc, Rohm Semiconductor, Omnivision Technologies Inc, Mitsubishi Electric Corporation, Stanley Electric Co, Texas Instruments Inc, Samsung Electronics Co Ltd, General Electric Company, Osram Licht AG, Koninklijke Philips N V, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Japan Optoelectronics Market?

The market segments include Component type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Smart Consumer Electronics and Next Generation Technologies; Increasing Industrial Applications of the Technology.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Manufacturing and Fabricating Costs.

8. Can you provide examples of recent developments in the market?

February 2024 - Analog Devices has struck a strategic deal with TSMC. Under this agreement, TSMC, a prominent semiconductor foundry, will provide Analog Devices with a steady supply of wafers through Japan Advanced Semiconductor Manufacturing (JASM), a manufacturing subsidiary majority-owned by TSMC, located in Kumamoto Prefecture, Japan. This collaboration, an extension of ADI's ongoing partnership with TSMC, bolsters ADI's capabilities in securing additional capacity for cutting-edge technology nodes. These nodes are crucial for ADI's diverse business applications, notably in wireless BMS (wBMS) and Gigabit Multimedia Serial Link (GMSL) sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Japan Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence