Key Insights

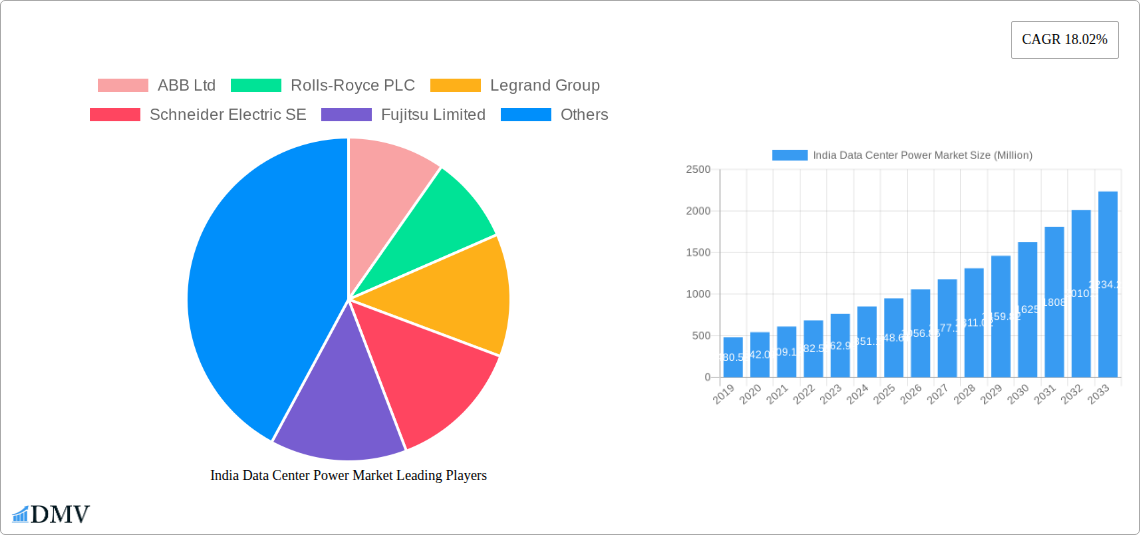

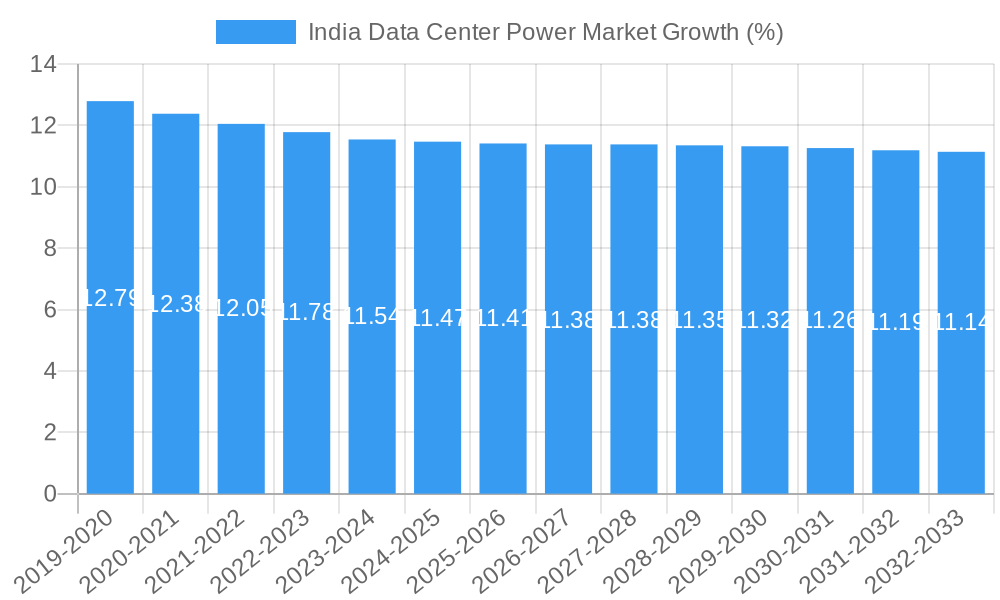

The Indian data center power market is poised for robust expansion, with an estimated market size of USD 0.84 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 18.02% through 2033. This impressive growth trajectory is fueled by a confluence of factors, including the accelerating digital transformation across various sectors, the burgeoning demand for cloud computing services, and the government's push for digital infrastructure development, as exemplified by initiatives like "Digital India." The increasing adoption of advanced technologies such as AI, IoT, and Big Data analytics necessitates greater processing power and, consequently, enhanced and reliable power solutions for data centers. The critical need for uninterrupted operations and data integrity underscores the importance of robust power infrastructure, including UPS systems, generators, and advanced power distribution solutions. The market is witnessing significant investments in building new hyperscale data centers and upgrading existing facilities to meet the escalating demand for data storage and processing.

The market segmentation reveals a strong emphasis on Power Infrastructure, particularly within Electrical Solutions encompassing UPS Systems, Generators, and a comprehensive range of Power Distribution Solutions like PDUs, Switchgear, and Transfer Switches. The Service segment is also expected to grow substantially as data center operators increasingly seek specialized support for installation, maintenance, and management of their power systems. Key end-users driving this demand include the IT & Telecommunication sector, BFSI (Banking, Financial Services, and Insurance), Government, and Media & Entertainment, all of which rely heavily on data center operations for their core business functions. Leading global and domestic players such as ABB Ltd, Schneider Electric SE, Cummins Inc, and Vertiv Group Corp are actively competing and innovating within this dynamic Indian market. The focus on energy efficiency, redundancy, and advanced monitoring systems will continue to shape the competitive landscape, ensuring the reliable and sustainable operation of India's rapidly expanding data center ecosystem.

India Data Center Power Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report delivers a critical analysis of the India Data Center Power Market, providing actionable insights for stakeholders navigating this rapidly evolving landscape. Spanning the historical period of 2019–2024 and extending to a forecast period of 2025–2033, with a base and estimated year of 2025, this research meticulously dissects market dynamics, technological advancements, and emerging trends. Understand the critical role of power infrastructure solutions, including UPS systems, generators, and power distribution solutions like PDUs, switchgear, and transfer switches, in supporting India's burgeoning IT & Telecommunication, BFSI, and Government sectors. With projected market growth driven by increasing data consumption, digital transformation initiatives, and the expansion of hyperscale and colocation data centers, this report is essential for strategic planning and investment decisions.

India Data Center Power Market Market Composition & Trends

The India Data Center Power Market exhibits a dynamic composition shaped by robust innovation and evolving regulatory frameworks. Market concentration, while significant, allows for competitive innovation fueled by companies like ABB Ltd, Rolls-Royce PLC, and Schneider Electric SE. Key trends include the increasing demand for energy-efficient power solutions, driven by environmental concerns and operational cost reduction. The power distribution solutions segment, encompassing PDUs, switchgear, and critical power distribution components, is a focal point for technological advancements. The regulatory landscape, while still developing, is increasingly favoring sustainable and reliable power, influencing investment decisions. Substitute products, while present, struggle to match the integrated reliability and efficiency offered by specialized data center power solutions. End-user profiles are diverse, with IT & Telecommunication and BFSI sectors being primary adopters, followed by Government and Media & Entertainment. Mergers and acquisitions (M&A) activity is expected to increase as larger players consolidate their market presence and acquire innovative technologies. For instance, recent M&A deals are estimated to be in the range of $500 Million to $1 Billion, reflecting strategic consolidation. Market share distribution shows a significant portion held by Power Infrastructure: Electrical Solution, estimated at 65%, followed by Service at 25%, and Other Power Distribution Solutions at 10%.

- Market Concentration: Fragmented with key players holding substantial influence.

- Innovation Catalysts: Growing data demands, cloud adoption, and edge computing.

- Regulatory Landscapes: Focus on energy efficiency and grid stability.

- Substitute Products: Traditional power solutions, less efficient alternatives.

- End-User Profiles: Predominantly IT, BFSI, Government.

- M&A Activities: Expected to accelerate for technology acquisition and market expansion.

India Data Center Power Market Industry Evolution

The India Data Center Power Market has witnessed a remarkable evolution over the historical period of 2019–2024, driven by rapid digitalization and a substantial increase in data generation and processing needs. This period saw foundational investments in power infrastructure, particularly in UPS systems and generators, to ensure uninterrupted operations for critical data centers. The growth rate of the market during this period averaged 15% annually, a testament to the burgeoning demand. Technological advancements have been a constant, with manufacturers progressively introducing more energy-efficient and intelligent power distribution solutions. The adoption of Power Distribution Units (PDUs), switchgear, and critical power distribution systems has surged, directly correlating with the expansion of hyperscale and enterprise data centers across the country. Shifting consumer demands for faster data access, seamless online services, and robust cloud platforms have further propelled the need for resilient and scalable power architectures. For example, the adoption of advanced transfer switches and remote power panels has increased by approximately 20% year-on-year as operators focus on redundancy and proactive management. The focus has gradually shifted from mere power supply to intelligent power management, predictive maintenance, and integration with broader data center infrastructure management (DCIM) systems. This evolution is supported by significant investments, with an estimated $20 Billion poured into data center infrastructure development between 2019 and 2024, a substantial portion of which was allocated to power solutions. The market's trajectory is indicative of its critical role in supporting India's digital economy.

Leading Regions, Countries, or Segments in India Data Center Power Market

Within the India Data Center Power Market, the Power Infrastructure: Electrical Solution segment stands as the dominant force, driven by the fundamental need for reliable and robust power systems. This segment is projected to command an estimated 65% of the market share throughout the forecast period of 2025–2033. The dominance is propelled by the continuous expansion of data center capacity, necessitating substantial investments in UPS Systems to ensure uninterrupted power supply, Generators for backup power, and a comprehensive array of Power Distribution Solutions. Specifically, UPS Systems are expected to witness a Compound Annual Growth Rate (CAGR) of 12.5%, while Generators will see a CAGR of 9.8%. The sub-segment of Power Distribution Solutions is further segmented, with PDU adoption rising due to the need for granular power monitoring and control, and Switchgear being essential for safe and efficient power distribution within data center facilities. The increasing complexity of data center designs also fuels demand for advanced solutions like Critical Power Distribution, Transfer Switches, and Remote Power Panels, ensuring high availability and fault tolerance.

Key Drivers for Dominance:

- Investment Trends: Significant FDI and domestic investment in new data center builds and expansions. An estimated $15 Billion in new data center investments are anticipated between 2025 and 2033.

- Regulatory Support: Government initiatives promoting digital infrastructure and data localization policies.

- Technological Advancements: Introduction of modular and scalable power solutions catering to diverse data center needs.

- Demand from End Users: Unprecedented growth in IT & Telecommunication and BFSI sectors, driving the demand for high-capacity and reliable data center power.

The IT & Telecommunication sector alone is expected to contribute over 40% of the market demand, followed by the BFSI sector at approximately 30%. The Government sector, with its increasing adoption of e-governance and digital initiatives, represents a growing segment, projected to account for 15% of the demand. The continued reliance on digital services, coupled with the projected growth of cloud computing and AI, solidifies the preeminence of power infrastructure solutions within the Indian data center ecosystem.

India Data Center Power Market Product Innovations

Product innovations in the India Data Center Power Market are sharply focused on enhancing efficiency, reliability, and sustainability. Manufacturers are introducing next-generation UPS systems with higher power densities and improved energy recovery features, aiming to reduce operational costs and carbon footprints. Advanced power distribution solutions, including intelligent PDUs with sophisticated monitoring capabilities and customizable switchgear configurations, are enabling granular control and proactive fault detection. The integration of IoT and AI in power management systems allows for predictive maintenance and optimized energy consumption. For instance, the latest transfer switches offer near-instantaneous failover, minimizing downtime during grid disruptions. These innovations are crucial for supporting the increasingly complex and power-intensive demands of modern data centers.

Propelling Factors for India Data Center Power Market Growth

The India Data Center Power Market is experiencing robust growth propelled by several interconnected factors. Foremost is the relentless surge in data consumption and digital transformation across all sectors, necessitating an expansion of data center capacity. Government initiatives like "Digital India" and the push for data localization further accelerate this trend. Technological advancements, including the rise of cloud computing, AI, and edge computing, are creating a sustained demand for more powerful and reliable data center infrastructure. Economic growth and increased internet penetration are also key drivers, expanding the user base for digital services. The BFSI and IT & Telecommunication sectors, in particular, are making substantial investments to upgrade their IT infrastructure and enhance their digital offerings, directly fueling the demand for advanced power solutions. The CAGR for the market is projected to be around 13% during the forecast period.

Obstacles in the India Data Center Power Market Market

Despite its promising growth trajectory, the India Data Center Power Market faces several obstacles. High capital expenditure required for setting up and upgrading data center power infrastructure can be a significant barrier for some investors. Furthermore, the availability of reliable and high-quality grid power in certain regions can be inconsistent, necessitating robust and often costly backup power solutions. Stringent regulatory compliance related to environmental impact and power quality can also pose challenges. Supply chain disruptions, exacerbated by global events, can lead to delays in equipment procurement and increased costs for components like UPS systems and generators. Finally, the escalating cost of electricity and the increasing focus on sustainability create pressure to adopt highly energy-efficient solutions, which may involve higher upfront investments.

Future Opportunities in India Data Center Power Market

The India Data Center Power Market presents numerous future opportunities. The expansion of 5G networks will drive the demand for smaller, distributed edge data centers, requiring specialized and compact power solutions. The burgeoning IoT ecosystem and the increasing adoption of AI and machine learning will necessitate more powerful computing capabilities, translating into higher power demands for data centers. The growing focus on green data centers opens opportunities for renewable energy integration and highly efficient power management systems. Furthermore, the government's continued emphasis on digital infrastructure development and data security will foster ongoing investment in the sector, creating a sustained demand for advanced power distribution solutions and services. The increasing adoption of modular data centers also presents a significant opportunity for scalable power solutions.

Major Players in the India Data Center Power Market Ecosystem

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Developments in India Data Center Power Market Industry

- 2023/Q4: Launch of advanced, modular UPS systems by Vertiv Group Corp, designed for enhanced scalability and energy efficiency in enterprise data centers.

- 2023/Q3: Eaton Corporation announces significant expansion of its power distribution solutions portfolio, focusing on intelligent PDUs for hyperscale facilities.

- 2023/Q2: Schneider Electric SE secures a major contract for supplying comprehensive power infrastructure for a new hyperscale data center in Mumbai.

- 2022/Q4: ABB Ltd introduces new high-efficiency generators tailored for the growing colocation data center market in India.

- 2022/Q3: Rolls-Royce PLC expands its service offerings for critical power solutions, emphasizing predictive maintenance and remote monitoring for data centers.

- 2022/Q1: Legrand Group enhances its range of transfer switches, focusing on faster failover times and increased reliability for critical power applications.

Strategic India Data Center Power Market Market Forecast

The India Data Center Power Market is poised for substantial growth, driven by the synergistic forces of digital transformation, increasing data volumes, and supportive government policies. The ongoing expansion of hyperscale and colocation facilities, coupled with the emergence of edge computing, will fuel a consistent demand for advanced power infrastructure solutions. Innovations in energy efficiency and smart grid integration will be critical for sustainability and operational cost optimization. The projected CAGR of 13% highlights the market's significant potential, making it an attractive landscape for both established players and new entrants seeking to capitalize on India's digital future. Strategic focus on reliable UPS systems, robust generators, and intelligent power distribution solutions will be paramount for success.

India Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Other Power Distribution Solutions

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

India Data Center Power Market Segmentation By Geography

- 1. India

India Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. The IT & Telecom Segment is Expected to Have Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Other Power Distribution Solutions

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. North India India Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rolls-Royce PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Legrand Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fujitsu Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Caterpillar Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rittal GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Systems Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cummins Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vertiv Group Corp

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Eaton Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: India Data Center Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Data Center Power Market Share (%) by Company 2024

List of Tables

- Table 1: India Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 3: India Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 11: India Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Power Market?

The projected CAGR is approximately 18.02%.

2. Which companies are prominent players in the India Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the India Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

The IT & Telecom Segment is Expected to Have Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Power Market?

To stay informed about further developments, trends, and reports in the India Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence