Key Insights

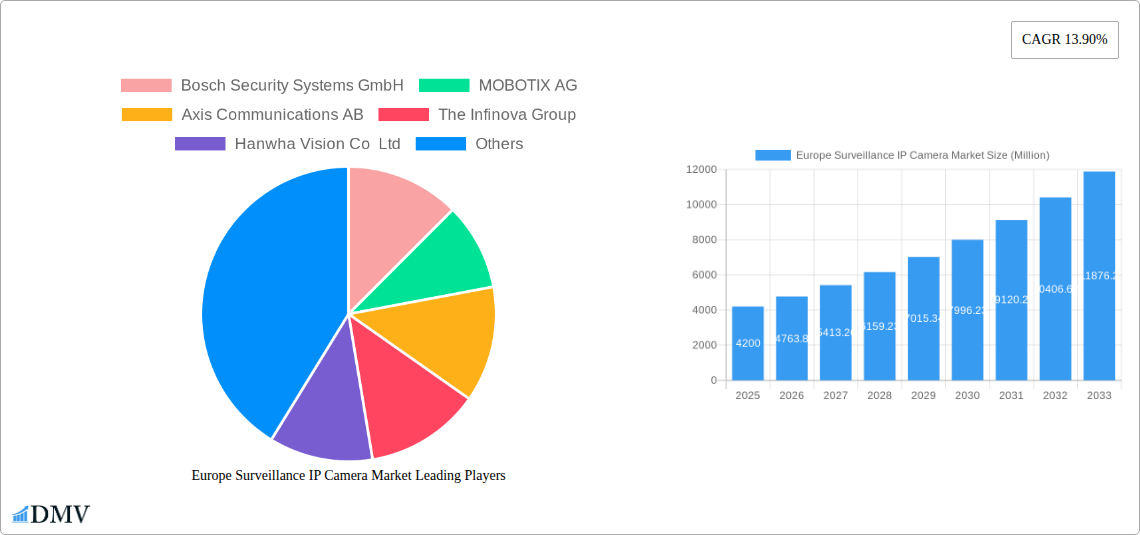

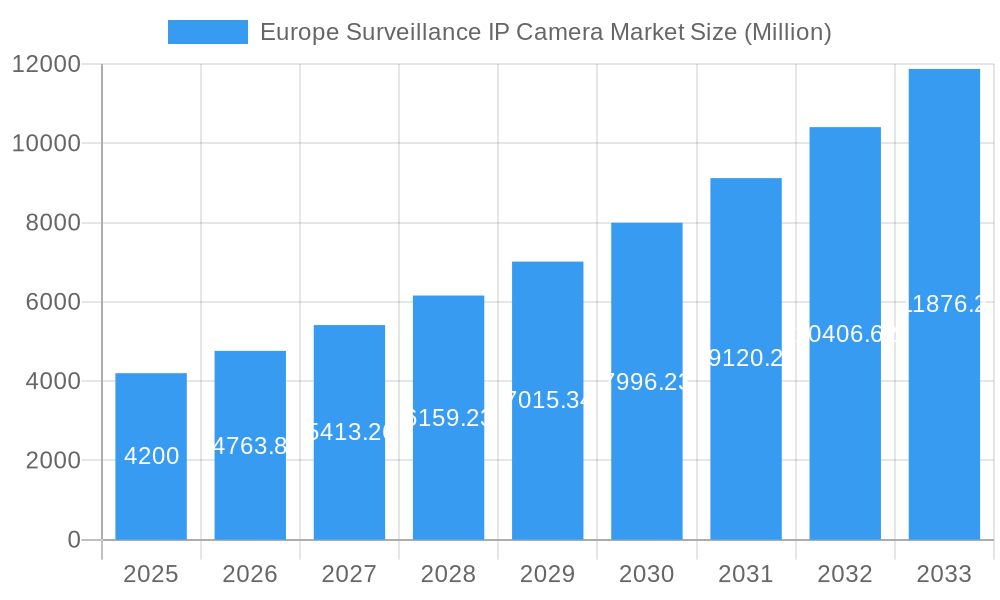

The European surveillance IP camera market is experiencing robust growth, projected to reach €4.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.90% from 2025 to 2033. This expansion is fueled by several key factors. Increased security concerns across various sectors, including residential, commercial, and governmental entities, drive significant demand for advanced surveillance solutions. The shift towards IP-based systems offers advantages like higher resolution, improved network integration, and remote monitoring capabilities, further bolstering market growth. Furthermore, technological advancements such as AI-powered analytics (e.g., facial recognition, object detection) and the increasing adoption of cloud-based storage solutions are contributing to market expansion. Government initiatives promoting smart city infrastructure and public safety also play a crucial role. Competitive pressures among established players like Bosch, Hikvision, and Axis, alongside the emergence of innovative smaller companies, are driving down prices and fostering innovation, thereby making these systems more accessible to a wider range of customers.

Europe Surveillance IP Camera Market Market Size (In Billion)

However, certain restraints exist. Data privacy regulations, like GDPR, necessitate careful implementation and data handling practices, potentially impacting adoption rates. The high initial investment cost for advanced systems can deter smaller businesses or individuals, particularly in economically challenged regions. Cybersecurity vulnerabilities and the potential for system breaches represent another concern. Despite these challenges, the long-term outlook for the European surveillance IP camera market remains positive, driven by sustained technological advancements and increasing demand for enhanced security measures across all sectors. The market segmentation is likely diversified across camera types (dome, bullet, PTZ), resolutions, and application areas (retail, transportation, healthcare). The competitive landscape is intense, with both established international players and regional companies vying for market share.

Europe Surveillance IP Camera Market Company Market Share

Europe Surveillance IP Camera Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Surveillance IP Camera Market, offering crucial data and projections for stakeholders seeking to understand market dynamics, competition, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously covers market trends, technological advancements, competitive landscapes, and key growth drivers, offering a holistic perspective for informed decision-making. The market is projected to reach xx Million by 2033, presenting significant investment and expansion possibilities.

Europe Surveillance IP Camera Market Composition & Trends

This section delves into the intricate composition of the European surveillance IP camera market, analyzing its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated landscape, with key players like Bosch, Hikvision, and Dahua holding significant market share. However, the presence of numerous smaller, specialized players fosters competition and innovation.

Market Share Distribution (Estimated 2025):

- Bosch Security Systems GmbH: xx%

- Hangzhou Hikvision Digital Technology Co Ltd: xx%

- Dahua Technology: xx%

- Axis Communications AB: xx%

- Others: xx%

Innovation Catalysts: The market is driven by technological advancements such as AI-powered analytics, improved image quality (e.g., 4K resolution), and the integration of IoT functionalities. Regulatory landscapes, particularly concerning data privacy (GDPR), significantly impact market developments. The emergence of alternative technologies like thermal imaging cameras presents a level of substitution but also expands overall market potential.

End-User Profiles: Key end-users include government agencies, commercial businesses (retail, banking, etc.), critical infrastructure operators, and residential consumers.

M&A Activities (2019-2024): While precise deal values are not publicly available for all transactions, the period witnessed a moderate level of M&A activity, primarily focused on smaller companies being acquired by larger players to expand product portfolios and market reach. Total M&A deal value for the period is estimated at xx Million.

Europe Surveillance IP Camera Market Industry Evolution

The European surveillance IP camera market has experienced consistent growth throughout the historical period (2019-2024), driven by factors such as increasing security concerns, technological advancements, and government initiatives. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. This growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements, including AI-powered video analytics, cloud-based solutions, and improved network capabilities, have significantly influenced market evolution. Consumer demands are shifting towards higher resolution cameras, enhanced cybersecurity features, and user-friendly interfaces. The market has also seen a growing adoption of smart home security solutions, incorporating IP cameras into broader connected home ecosystems.

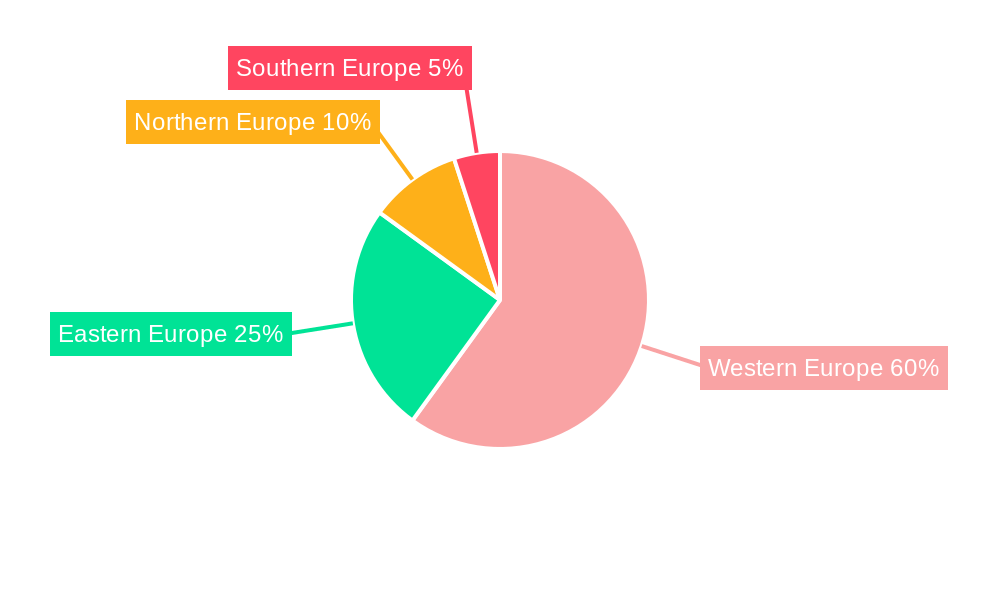

Leading Regions, Countries, or Segments in Europe Surveillance IP Camera Market

The Western European region, particularly Germany, UK, and France, currently dominates the European surveillance IP camera market due to higher adoption rates of advanced security solutions and robust regulatory frameworks.

Key Drivers for Western European Dominance:

- High Security Concerns: Increased instances of crime and terrorism have fueled demand for surveillance systems.

- Significant Investments in Public Safety: Government initiatives and funding for public safety infrastructure have promoted market growth.

- Stronger Regulatory Framework: Defined data privacy regulations and standards encourage the adoption of secure and compliant surveillance technologies.

- Advanced technological adoption: Higher adoption rates for advanced analytics and smart solutions

The dominance is further solidified by significant investments in advanced technologies, robust regulatory support, and high security concerns. Eastern European countries demonstrate promising growth potential, fueled by increasing urbanization and investment in smart city initiatives. However, the pace of adoption varies, influenced by economic conditions and technological infrastructure.

Europe Surveillance IP Camera Market Product Innovations

Recent innovations focus on enhanced image quality, AI-powered analytics (object detection, facial recognition), and seamless integration with cloud platforms. For instance, the AXIS Q9307-LV Dome Camera, launched in April 2024 by Axis Communications, showcases cutting-edge functionalities, including advanced audio analytics and LED indicators. These innovations deliver improved security, operational efficiency, and simplified user experiences, attracting a wider range of applications across various sectors.

Propelling Factors for Europe Surveillance IP Camera Market Growth

Several factors are driving the growth of the European surveillance IP camera market. These include:

- Growing security concerns: Terrorism, crime, and public safety anxieties are leading to increased demand for surveillance solutions.

- Technological advancements: AI-powered analytics, higher resolution imaging, and improved network technologies are enhancing product capabilities and value proposition.

- Government regulations and initiatives: Mandates for security and data protection push the deployment of advanced surveillance systems.

- Smart city initiatives: The development of smart city infrastructure significantly increases the demand for interconnected surveillance solutions.

Obstacles in the Europe Surveillance IP Camera Market

Despite significant growth potential, the market faces challenges, including:

- Data privacy regulations: The GDPR and other stringent data protection laws create complexities regarding data storage and usage, increasing compliance costs.

- Supply chain disruptions: Global events and geopolitical uncertainties can lead to shortages of components and increased production costs.

- Competitive pressures: A large number of established players and new entrants create intense competition, pressuring pricing and profitability. This competition also adds complexity to the sales cycle and market penetration.

Future Opportunities in Europe Surveillance IP Camera Market

Future opportunities lie in the expansion of AI capabilities, the integration of edge computing for enhanced analytics, and the growth of the smart home and smart city markets. Moreover, the increasing need for remote monitoring solutions and cybersecurity advancements presents significant opportunities for innovation and market expansion. Specific niche applications, particularly in healthcare and logistics, are also ripe for growth.

Major Players in the Europe Surveillance IP Camera Market Ecosystem

- Bosch Security Systems GmbH

- MOBOTIX AG

- Axis Communications AB

- The Infinova Group

- Hanwha Vision Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology

- Vivotek Inc (A Delta Group Company)

- Tyco (A Johnson Controls Brand)

- Honeywell Security (Honeywell International Inc)

- Sony Corporation

Key Developments in Europe Surveillance IP Camera Market Industry

- April 2024: Axis Communications launched the AXIS Q9307-LV Dome Camera, integrating high-definition video, two-way audio, actionable analytics, and LED indicators. This innovation significantly enhances safety, security, and operational efficiency.

- February 2024: Vivotek extended its warranty on network cameras and NVRs to five years globally, bolstering customer confidence and after-sales support.

Strategic Europe Surveillance IP Camera Market Forecast

The European surveillance IP camera market is poised for sustained growth, driven by technological advancements, increasing security demands, and the proliferation of smart city initiatives. The convergence of AI, IoT, and cloud technologies will reshape the market landscape, creating opportunities for innovative solutions and enhanced user experiences. The market is expected to experience strong growth in the forecast period, primarily driven by the adoption of advanced analytics and the expansion of network video recording systems.

Europe Surveillance IP Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others (

Europe Surveillance IP Camera Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Surveillance IP Camera Market Regional Market Share

Geographic Coverage of Europe Surveillance IP Camera Market

Europe Surveillance IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI

- 3.4. Market Trends

- 3.4.1. Transportation and Logistics End-User Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Surveillance IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bosch Security Systems GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MOBOTIX AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axis Communications AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Infinova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanwha Vision Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dahua Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vivotek Inc (A Delta Group Company)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tyco (A Johnson Controls Brand)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honeywell Security (Honeywell International Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sony Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bosch Security Systems GmbH

List of Figures

- Figure 1: Europe Surveillance IP Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Surveillance IP Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Europe Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Europe Surveillance IP Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Surveillance IP Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Europe Surveillance IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Surveillance IP Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Surveillance IP Camera Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the Europe Surveillance IP Camera Market?

Key companies in the market include Bosch Security Systems GmbH, MOBOTIX AG, Axis Communications AB, The Infinova Group, Hanwha Vision Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology, Vivotek Inc (A Delta Group Company), Tyco (A Johnson Controls Brand), Honeywell Security (Honeywell International Inc ), Sony Corporatio.

3. What are the main segments of the Europe Surveillance IP Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI.

6. What are the notable trends driving market growth?

Transportation and Logistics End-User Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI.

8. Can you provide examples of recent developments in the market?

April 2024: Axis Communications unveiled a versatile dome camera, integrating high-definition video, two-way audio, actionable analytics, and LED indicators. This innovative device enhances safety, security, and operational efficiency. It empowers users to streamline surveillance operations, enabling proactive resource allocation. For example, it can facilitate tele-sitting for patient monitoring in healthcare settings or aid in identifying and addressing loitering in retail spaces. The AXIS Q9307-LV Dome Camera is equipped with analytics for coughing fits and stressed voices, enhancing its capabilities for active incident management. It serves as an ideal tool for both remote monitoring and communication.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Surveillance IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Surveillance IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Surveillance IP Camera Market?

To stay informed about further developments, trends, and reports in the Europe Surveillance IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence