Key Insights

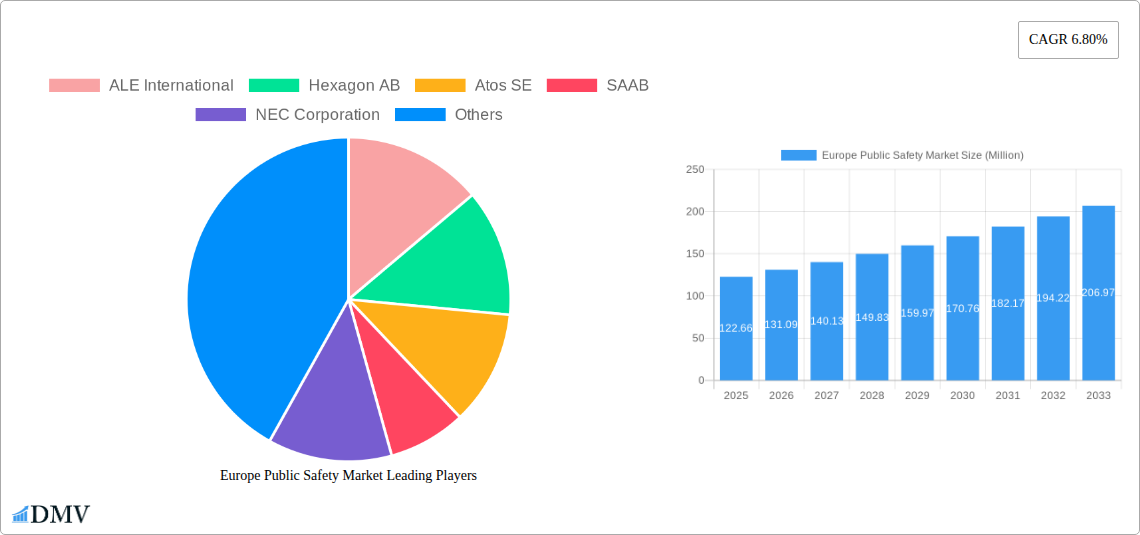

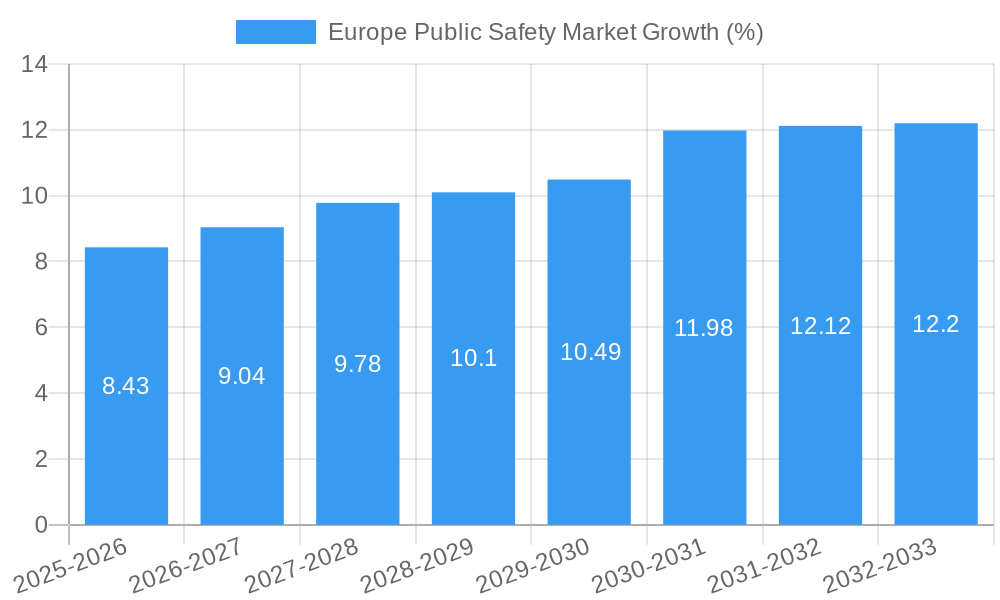

The European Public Safety market, valued at €122.66 million in 2025, is projected to experience robust growth, driven by increasing government investments in advanced technologies for crime prevention and emergency response. A Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033 indicates a significant market expansion. Key drivers include the rising adoption of AI-powered surveillance systems, improved data analytics for predictive policing, and the increasing demand for integrated communication networks enhancing inter-agency collaboration. The market is segmented by technology (e.g., video surveillance, communication systems, biometrics), application (e.g., law enforcement, emergency services, border security), and deployment (e.g., cloud-based, on-premise). Leading players like ALE International, Hexagon AB, and others are actively investing in R&D and strategic partnerships to capture market share. Challenges include data privacy concerns, cybersecurity threats, and the need for standardized interoperability across different systems.

Growth in the European Public Safety market is further fueled by the increasing prevalence of cross-border crime and the need for enhanced security measures, particularly in the wake of recent global events. The market's expansion is also shaped by the growing demand for improved citizen safety and the need for efficient and effective emergency response systems. Technological advancements in areas such as predictive analytics, facial recognition, and drone technology are contributing to the adoption of advanced solutions. However, restraints include the high initial investment costs associated with implementing new technologies, integration complexities, and regulatory compliance requirements. The market is expected to see increased consolidation as larger companies acquire smaller players to expand their product portfolios and geographical reach, shaping the competitive landscape in the coming years.

Europe Public Safety Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Public Safety Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The estimated market value in 2025 is projected at XX Million, demonstrating significant potential for growth.

Europe Public Safety Market Composition & Trends

This section delves into the intricate composition of the Europe Public Safety market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated landscape, with key players holding significant market share. However, the emergence of innovative solutions and agile startups is fostering competition.

- Market Share Distribution: While precise figures require in-depth analysis within the full report, preliminary estimates suggest that the top 5 players control approximately XX% of the market, with a long tail of smaller, specialized firms competing in niche segments.

- Innovation Catalysts: Advancements in artificial intelligence (AI), big data analytics, and Internet of Things (IoT) technologies are driving significant innovation, enabling improved surveillance, predictive policing, and emergency response capabilities.

- Regulatory Landscape: Stringent data privacy regulations (GDPR) and cybersecurity standards significantly influence market dynamics, demanding robust security measures and compliance frameworks from vendors.

- Substitute Products: Limited direct substitutes exist, but open-source software and alternative technologies represent potential challenges to established players.

- End-User Profiles: The market caters primarily to government agencies (police, fire departments, emergency medical services), but also includes private security firms and critical infrastructure providers.

- M&A Activities: The market witnessed XX Million in M&A deal values during the historical period (2019-2024), indicating consolidation and strategic expansion within the sector. Examples include the August 2023 acquisition of SSS Public Safety Ltd by NECSWS.

Europe Public Safety Market Industry Evolution

The Europe Public Safety market has witnessed significant evolution over the past few years. Driven by increasing security concerns, technological advancements, and changing consumer demands, the market is experiencing robust growth. The historical period (2019-2024) saw an average annual growth rate (CAGR) of approximately XX%, while the forecast period (2025-2033) projects a CAGR of XX%. This growth is fueled by several factors, including the rising adoption of advanced technologies like AI-powered video analytics, improved cybersecurity solutions, and the growing demand for integrated public safety systems. Furthermore, increased government investments in public safety infrastructure and initiatives to improve interoperability between agencies are boosting market expansion. The shift towards cloud-based solutions and the adoption of predictive policing models are also shaping the market landscape. The integration of IoT devices and the use of big data analytics for crime prevention are key trends enhancing market growth. Furthermore, the ongoing evolution towards smarter cities fuels demand for integrated solutions.

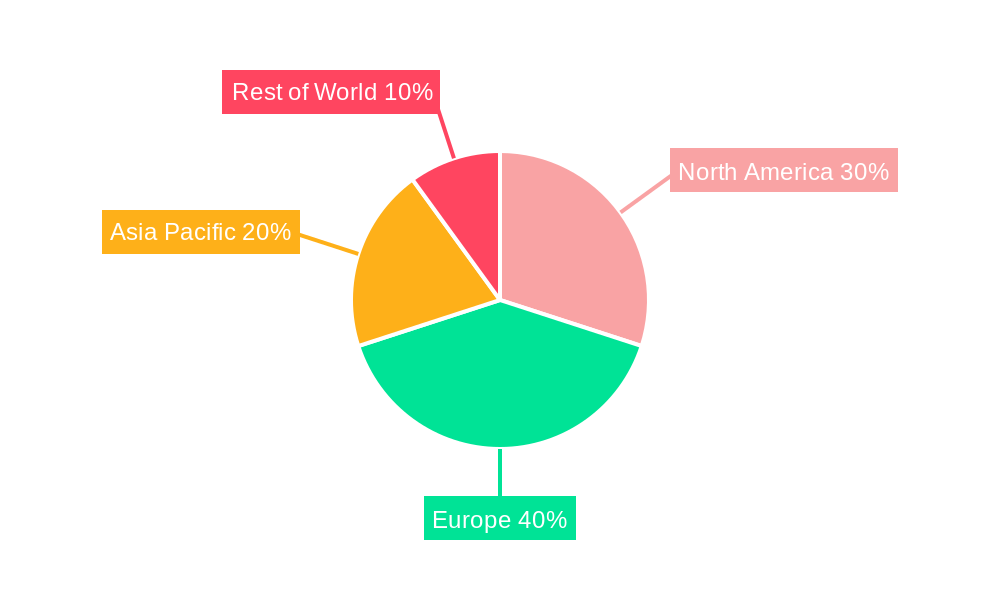

Leading Regions, Countries, or Segments in Europe Public Safety Market

While a detailed breakdown is available in the full report, preliminary analysis suggests that Western Europe, particularly countries like the United Kingdom, Germany, and France, currently dominate the market due to higher investments in public safety infrastructure and advanced technological adoption. The dominance is further driven by:

- High Government Spending: Significant budgetary allocations towards public safety initiatives, particularly in response to rising crime rates and security threats.

- Strong Regulatory Support: Favorable regulatory frameworks encouraging the adoption of innovative technologies and fostering competition.

- Technological Advancement: Early adoption of cutting-edge technologies and a strong focus on R&D within the public safety sector.

Europe Public Safety Market Product Innovations

Recent product innovations center on AI-driven solutions like predictive policing algorithms, facial recognition systems, and improved video analytics for threat detection. These innovations enhance situational awareness, improve response times, and optimize resource allocation. The integration of IoT devices for real-time monitoring and data collection further enhances the capabilities of public safety systems. These solutions offer unique selling propositions focusing on efficiency, accuracy, and improved public safety outcomes.

Propelling Factors for Europe Public Safety Market Growth

Several factors are fueling the growth of the Europe Public Safety Market. Technological advancements like AI, IoT, and big data analytics are transforming the sector, enabling more efficient and effective public safety operations. Government initiatives focusing on enhancing security and improving interoperability among agencies are also driving market expansion. Economic factors like rising disposable income and increased awareness about personal safety are contributing to the growth, as private security firms augment public safety efforts.

Obstacles in the Europe Public Safety Market

Despite significant opportunities, challenges exist. Data privacy regulations and cybersecurity concerns necessitate robust solutions, adding complexity and cost. Supply chain disruptions, particularly for specialized components, can impact availability and pricing. Intense competition among established players and emerging technologies also poses a challenge for market participants.

Future Opportunities in Europe Public Safety Market

Future opportunities lie in expanding into new market segments, such as smart city initiatives and private sector applications. Advancements in drone technology, blockchain for secure data management, and the development of more sophisticated AI algorithms present significant growth potentials. Addressing the evolving needs of cybersecurity and data privacy, alongside increased government investments, will open further opportunities for innovative solutions.

Major Players in the Europe Public Safety Market Ecosystem

- ALE International

- Hexagon AB

- Atos SE

- SAAB

- NEC Corporation

- Cisco Systems Inc

- Motorola Solutions Inc

- L3Harris Technologies Inc

- BAE Systems

- Telefonaktiebolaget LM Ericsson

- Elbit Systems Ltd

- CGI Inc

- Honeywell International Inc

- Thales Group

- Idemia

- Kroll LL

Key Developments in Europe Public Safety Market Industry

- November 2023: The Governing Council of the European Central Bank (ECB) rescheduled the launch of the Eurosystem Collateral Management System to November 2024. This impacts the financial infrastructure supporting public safety operations, potentially delaying some related investments.

- August 2023: NECSWS (NEC Software Solutions) acquired SSS Public Safety Ltd, strengthening its position in the UK public safety technology market and potentially impacting competitive dynamics.

Strategic Europe Public Safety Market Forecast

The Europe Public Safety Market is poised for sustained growth, driven by technological innovation, increased government spending, and evolving security needs. Emerging technologies like AI, IoT, and blockchain will continue to transform the sector, creating new opportunities for market participants. The market's potential is significant, indicating strong prospects for investment and expansion in the coming years.

Europe Public Safety Market Segmentation

-

1. Component

-

1.1. Software

- 1.1.1. Location Management

- 1.1.2. Record Management

- 1.1.3. Investigation Management

- 1.1.4. Crime Analysis

- 1.1.5. Criminal Intelligence

- 1.1.6. Other Software

- 1.2. Services

-

1.1. Software

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. Medical

- 3.2. Transportation

- 3.3. Law Enforcement

- 3.4. Firefighting

- 3.5. Other End-user Industries

Europe Public Safety Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Public Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Adoption of Biometric Methods such as Fingerprint

- 3.2.2 Facial

- 3.2.3 and Iris Recognition in Security Systems; Public Safety Agencies Increasing Investments in Cybersecurity Technologies to Protect Sensitive Data; Supportive Government Outlook Toward the Adoption of Advanced Technology for Safety and Security

- 3.3. Market Restrains

- 3.3.1 The Adoption of Biometric Methods such as Fingerprint

- 3.3.2 Facial

- 3.3.3 and Iris Recognition in Security Systems; Public Safety Agencies Increasing Investments in Cybersecurity Technologies to Protect Sensitive Data; Supportive Government Outlook Toward the Adoption of Advanced Technology for Safety and Security

- 3.4. Market Trends

- 3.4.1. Law Enforcement to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Public Safety Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.1.1. Location Management

- 5.1.1.2. Record Management

- 5.1.1.3. Investigation Management

- 5.1.1.4. Crime Analysis

- 5.1.1.5. Criminal Intelligence

- 5.1.1.6. Other Software

- 5.1.2. Services

- 5.1.1. Software

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Medical

- 5.3.2. Transportation

- 5.3.3. Law Enforcement

- 5.3.4. Firefighting

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ALE International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hexagon AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atos SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAAB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NEC Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Motorola Solutions Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 L3Harris Technologies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Telefonaktiebolaget LM Ericsson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Elbit Systems Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CGI Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Thales Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Idemia

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kroll LL

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 ALE International

List of Figures

- Figure 1: Europe Public Safety Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Public Safety Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Europe Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Europe Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 6: Europe Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 7: Europe Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Europe Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Europe Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Europe Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Europe Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 13: Europe Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 14: Europe Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 15: Europe Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Europe Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Public Safety Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Public Safety Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: France Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Spain Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Netherlands Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Netherlands Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Belgium Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Belgium Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Sweden Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Sweden Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Norway Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Poland Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Poland Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Denmark Europe Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Denmark Europe Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Public Safety Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Europe Public Safety Market?

Key companies in the market include ALE International, Hexagon AB, Atos SE, SAAB, NEC Corporation, Cisco Systems Inc, Motorola Solutions Inc, L3Harris Technologies Inc, BAE Systems, Telefonaktiebolaget LM Ericsson, Elbit Systems Ltd, CGI Inc, Honeywell International Inc, Thales Group, Idemia, Kroll LL.

3. What are the main segments of the Europe Public Safety Market?

The market segments include Component, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The Adoption of Biometric Methods such as Fingerprint. Facial. and Iris Recognition in Security Systems; Public Safety Agencies Increasing Investments in Cybersecurity Technologies to Protect Sensitive Data; Supportive Government Outlook Toward the Adoption of Advanced Technology for Safety and Security.

6. What are the notable trends driving market growth?

Law Enforcement to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

The Adoption of Biometric Methods such as Fingerprint. Facial. and Iris Recognition in Security Systems; Public Safety Agencies Increasing Investments in Cybersecurity Technologies to Protect Sensitive Data; Supportive Government Outlook Toward the Adoption of Advanced Technology for Safety and Security.

8. Can you provide examples of recent developments in the market?

November 2023: The Governing Council of the European Central Bank (ECB) rescheduled the launch of the Eurosystem Collateral Management System to November 2024 to facilitate a smooth migration to the new platform. This unified system for managing assets used as collateral in Eurosystem credit operations will replace the existing systems used by the national central banks of the countries in the euro area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Public Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Public Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Public Safety Market?

To stay informed about further developments, trends, and reports in the Europe Public Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence