Key Insights

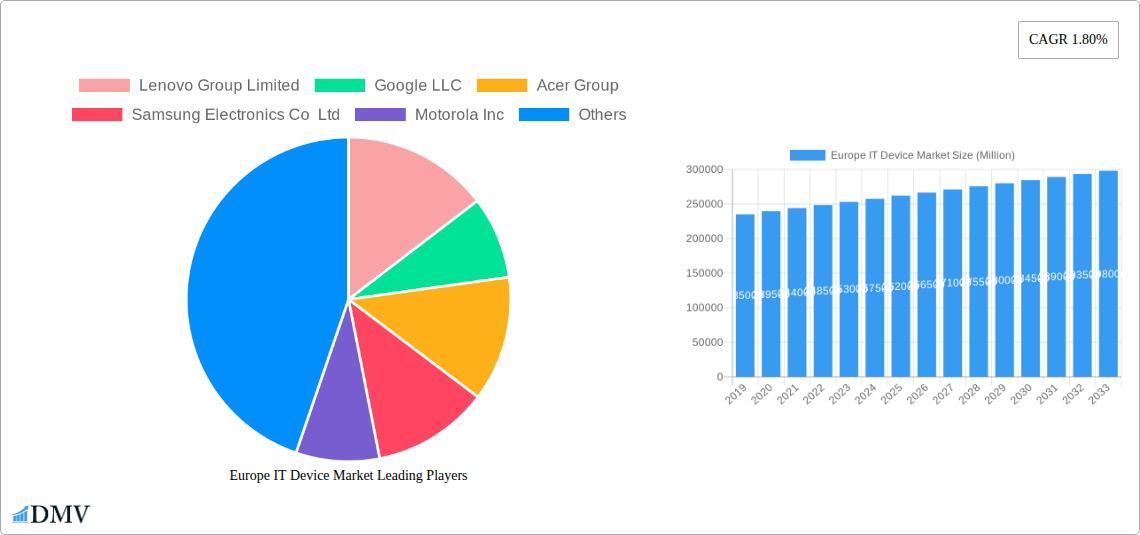

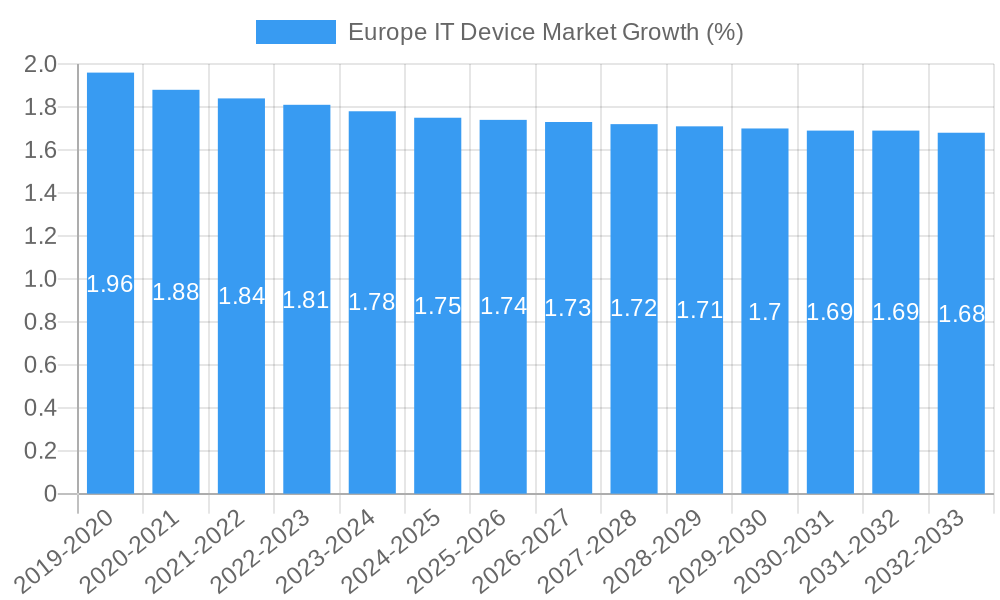

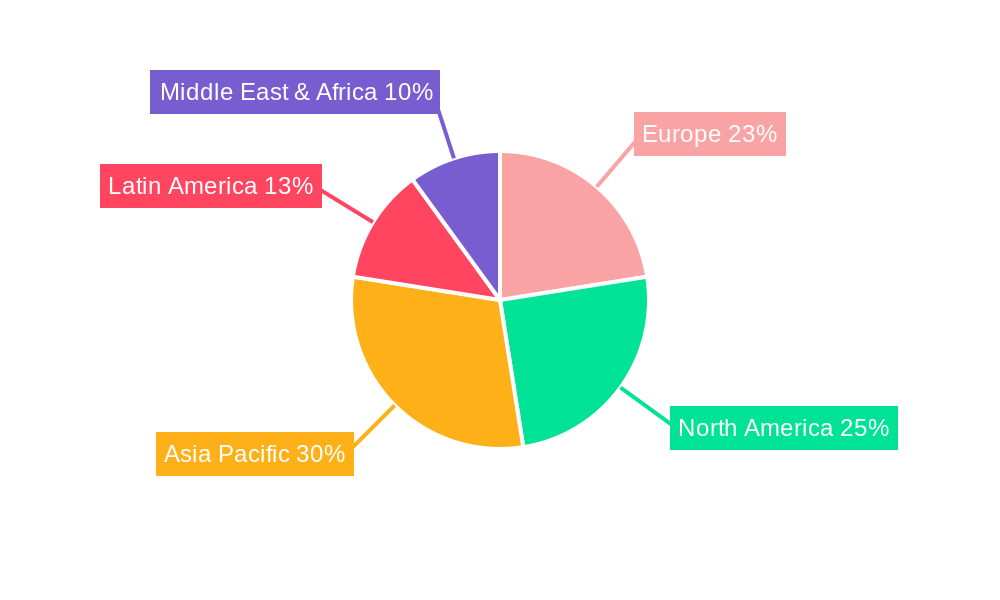

The European IT device market is projected to experience steady but moderate growth, with an estimated market size of approximately $250,000 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 1.80% through 2033. This segment, encompassing a wide array of devices from personal computers, including laptops, desktop PCs, and tablets, to various phone types such as landline phones, smartphones, and feature phones, represents a mature yet essential sector. Key growth drivers for this market include the ongoing demand for digital transformation across businesses, the persistent need for consumer electronics for both productivity and entertainment, and the continuous innovation in device capabilities, such as improved processing power, enhanced battery life, and integrated AI features. Emerging trends like the increasing adoption of hybrid work models, which necessitate robust and versatile computing solutions, and the growing integration of smart technologies within everyday devices are also fueling market expansion. Furthermore, the refresh cycle of existing devices, driven by technological obsolescence and the desire for upgraded features, continues to contribute to sustained demand.

Despite the overall positive outlook, the European IT device market faces certain restraints. Economic uncertainties, coupled with inflationary pressures, can impact consumer and business spending on discretionary IT purchases. Supply chain disruptions, though potentially easing, can still affect the availability and pricing of components, thereby influencing market dynamics. Intense competition among major players like Lenovo, Samsung, Apple, HP, and Microsoft, along with a plethora of other significant companies, leads to price sensitivity and necessitates continuous product innovation and competitive pricing strategies to maintain market share. Geographically, Europe presents a diverse landscape for IT devices, with countries like Germany, the United Kingdom, and France demonstrating substantial market activity. The "Rest of Europe" category also holds significant potential, reflecting varying levels of economic development and technology adoption across the region. The market's trajectory will largely depend on the ability of manufacturers and vendors to navigate these challenges while capitalizing on evolving consumer and enterprise needs for advanced, reliable, and cost-effective IT solutions.

Gain unparalleled insights into the dynamic Europe IT Device Market with this in-depth report. Spanning from 2019 to 2033, with a detailed focus on the Base Year 2025 and Forecast Period 2025–2033, this analysis delves into the intricate landscape of PCs and Phones. Explore market concentration, regulatory shifts, technological innovation, and the strategic maneuvers of industry giants such as Lenovo Group Limited, Google LLC, Acer Group, Samsung Electronics Co Ltd, Motorola Inc, HP Inc, Microsoft Corporation, Xiaomi Corporation, Huawei Technologies Co Ltd, Nokia Corporation, ASUSTek Computer Inc, Guangdong Oppo Mobile Telecommunications Corp Ltd, Apple Inc, Sony Corporation, LG Corporation, and Dell Technologies. Essential for stakeholders, investors, and strategic planners seeking to capitalize on the evolving European technology market.

Europe IT Device Market Market Composition & Trends

The Europe IT Device Market exhibits a moderate to high level of market concentration, with key players like Apple Inc., Samsung Electronics Co Ltd, and Lenovo Group Limited holding significant shares across PC and smartphone segments. Innovation is primarily driven by advancements in processing power, display technology, and battery life for laptops, desktop PCs, and smartphones. The regulatory landscape is increasingly influenced by data privacy laws (e.g., GDPR) and environmental sustainability initiatives, impacting device design and manufacturing. Substitute products, such as the increasing integration of advanced functionalities into wearable devices, pose a growing challenge, particularly for feature phones. End-user profiles are diverse, ranging from enterprise deployments demanding robust business laptops and desktop PCs to consumer segments prioritizing portable tablets and feature-rich smartphones. Mergers and acquisitions (M&A) activities, while not overtly dominant, are strategic, focusing on niche technologies or market access, with estimated deal values in the hundreds of Millions of Euros. The market is characterized by continuous product refresh cycles and a strong emphasis on ecosystem integration.

Europe IT Device Market Industry Evolution

The Europe IT Device Market has undergone a significant transformation over the historical period 2019–2024, driven by rapid technological advancements and shifting consumer demands, and is poised for substantial growth throughout the Forecast Period 2025–2033. The trajectory has been marked by the increasing commoditization of basic computing devices, leading to a heightened focus on premium features and integrated services. The widespread adoption of 5G technology has been a primary catalyst for innovation in the smartphones segment, encouraging manufacturers to develop devices with enhanced connectivity, superior camera capabilities, and advanced processing power for seamless multimedia experiences. Simultaneously, the PC market has witnessed a resurgence, fueled by the hybrid work model and the demand for powerful laptops and versatile tablets for both productivity and entertainment. Growth rates in the smartphones segment, while maturing, are expected to remain steady, driven by replacement cycles and the adoption of higher-tier devices. The PC segment, including laptops and desktop PCs, is projected to experience moderate but consistent growth, particularly in the enterprise sector. Adoption metrics for 5G-enabled devices have surpassed 60% in many Western European nations, while tablet penetration continues to be strong across educational and professional sectors. The introduction of foldable screen technology and advancements in sustainable materials are further shaping the industry's evolution, promising enhanced user experiences and a reduced environmental footprint.

Leading Regions, Countries, or Segments in Europe IT Device Market

Within the Europe IT Device Market, the smartphones segment, particularly within Western European countries like Germany, the United Kingdom, and France, consistently demonstrates dominant market presence and growth potential. This dominance is driven by a confluence of factors including high disposable incomes, a strong appetite for cutting-edge technology, and a well-established digital infrastructure supporting advanced mobile services. Investment trends in this region are heavily skewed towards research and development in AI-powered mobile features, advanced camera systems, and longer-lasting battery solutions for smartphones. Regulatory support, while primarily focused on consumer protection and data privacy, indirectly encourages manufacturers to innovate by setting high standards for device performance and security.

- Dominance Factors for Smartphones in Western Europe:

- High Consumer Spending Power: Affluent populations readily invest in premium smartphones, driving demand for high-end models.

- Advanced Digital Ecosystem: Robust 5G networks and a mature app development landscape enhance the utility and appeal of smartphones.

- Brand Loyalty and Innovation Adoption: Consumers in these regions are often early adopters of new technologies and demonstrate strong loyalty to established and innovative brands.

- Enterprise Mobility Solutions: The increasing adoption of mobile-first strategies in businesses further boosts the demand for reliable and secure smartphones.

While smartphones lead, the laptops segment within the PC category also shows significant strength, particularly in the corporate and educational sectors across the same key nations. The demand for powerful and portable laptops has been sustained by remote work trends and digital transformation initiatives.

Europe IT Device Market Product Innovations

Product innovations in the Europe IT Device Market are increasingly focused on enhancing user experience through advanced AI integration, superior display technologies, and sustainable design. Smartphones are seeing advancements in computational photography, foldable screen technology, and faster charging capabilities, leading to improved performance metrics in camera quality and battery life. Laptops are benefiting from lighter and more durable materials, extended battery life, and powerful, energy-efficient processors. The integration of augmented reality (AR) and virtual reality (VR) capabilities into devices like tablets and specialized PCs is expanding application potential across gaming, education, and professional visualization. Unique selling propositions often revolve around seamless ecosystem integration and enhanced data security features.

Propelling Factors for Europe IT Device Market Growth

The Europe IT Device Market is propelled by several key factors. Technological advancements, particularly in 5G connectivity and AI integration, are driving demand for newer, more capable devices. The ongoing digital transformation across industries, coupled with the sustained adoption of hybrid work models, fuels the need for robust PCs and versatile mobile devices. Favorable economic conditions in certain European nations, characterized by rising disposable incomes, enable consumers to invest in premium IT devices. Furthermore, government initiatives promoting digital literacy and infrastructure development indirectly support market growth. Specific examples include the widespread rollout of 5G networks across major European countries and the increasing enterprise investment in cloud-based solutions requiring powerful endpoint devices.

Obstacles in the Europe IT Device Market Market

Despite strong growth prospects, the Europe IT Device Market faces several obstacles. Regulatory challenges, including stringent data privacy laws and evolving environmental standards, can increase compliance costs and slow down product development cycles. Global supply chain disruptions, exacerbated by geopolitical tensions and component shortages, continue to impact production and lead times. Intense competitive pressures among major players, leading to price wars and thinner profit margins, also pose a significant restraint. Furthermore, economic downturns and inflation can dampen consumer spending on discretionary IT devices. The increasing cost of raw materials and advanced components further contributes to the overall increase in device prices, potentially impacting affordability for a segment of the market.

Future Opportunities in Europe IT Device Market

Emerging opportunities in the Europe IT Device Market are abundant. The growing demand for sustainable and eco-friendly devices presents a significant avenue for innovation and market differentiation. The expansion of the Internet of Things (IoT) ecosystem will drive the need for interconnected IT devices with enhanced processing capabilities and robust security features. Advancements in foldable technology and AR/VR integration are opening new product categories and use cases, particularly in the consumer electronics and enterprise solution spaces. Furthermore, the untapped potential within emerging markets in Eastern Europe offers significant growth prospects for various IT device segments.

Major Players in the Europe IT Device Market Ecosystem

- Lenovo Group Limited

- Google LLC

- Acer Group

- Samsung Electronics Co Ltd

- Motorola Inc

- HP Inc

- Microsoft Corporation

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- Nokia Corporation

- ASUSTek Computer Inc

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Apple Inc

- Sony Corporation

- LG Corporation

- Dell Technologies

Key Developments in Europe IT Device Market Industry

- September 2022: Apple announced its decision to implement significant pricing hikes for its in-app purchases and apps from Europe to Asia, safeguarding its profits when key currencies fell against the US dollar. Apple has been more cautious as it deals with a stuttering economy, even if it is doing better than some of its industry counterparts. This move highlights the strategic financial adjustments companies are making in response to global economic fluctuations and currency volatility impacting the Europe IT Device Market.

- October 2022: Nokia announced the launch of the X30 5G in the United Kingdom and other European markets in September 2022. The starting price for this phone in Europe and the UK is EUR 519 (USD 548) and GBP 399 (USD 489). The business intends to introduce the product in India before the end of this year with a price tag of approximately INR 40,000 (USD 489). This launch signifies Nokia's renewed focus on the mid-range smartphone segment in Europe, catering to price-sensitive yet technologically aware consumers, and signals global product rollout strategies within the IT Device Market.

Strategic Europe IT Device Market Market Forecast

The Europe IT Device Market is projected for robust growth, driven by continuous technological innovation and evolving consumer preferences for interconnected and intelligent devices. The strategic focus on 5G integration, AI-powered features, and enhanced user experiences will be paramount. Opportunities in sustainable product design and the burgeoning IoT sector present significant avenues for expansion. Key players will likely leverage M&A and strategic partnerships to enhance their market position and expand their product portfolios. The market's future trajectory will be shaped by its ability to adapt to evolving regulatory landscapes and to consistently deliver value through innovative and cost-effective IT solutions.

Europe IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

Europe IT Device Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand for Smart Phones; Rapid Roll-Out of 5G Across the Region

- 3.3. Market Restrains

- 3.3.1. Rising Inflation Reducing the Purchasing Power

- 3.4. Market Trends

- 3.4.1. Smartphone Demand Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lenovo Group Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Google LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Acer Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Motorola Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 HP Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Microsoft Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xiaomi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Huawei Technologies Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nokia Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 ASUSTek Computer Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Apple Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Sony Corporation

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 LG Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Dell Technologies

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Europe IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: Europe IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe IT Device Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe IT Device Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe IT Device Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe IT Device Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Germany Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: France Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Europe IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Europe IT Device Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: Europe IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe IT Device Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Germany Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: France Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Italy Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Spain Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IT Device Market?

The projected CAGR is approximately 1.80%.

2. Which companies are prominent players in the Europe IT Device Market?

Key companies in the market include Lenovo Group Limited, Google LLC, Acer Group, Samsung Electronics Co Ltd, Motorola Inc, HP Inc, Microsoft Corporation, Xiaomi Corporation, Huawei Technologies Co Ltd, Nokia Corporation, ASUSTek Computer Inc, Guangdong Oppo Mobile Telecommunications Corp Ltd, Apple Inc, Sony Corporation, LG Corporation, Dell Technologies.

3. What are the main segments of the Europe IT Device Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand for Smart Phones; Rapid Roll-Out of 5G Across the Region.

6. What are the notable trends driving market growth?

Smartphone Demand Boosting the Market.

7. Are there any restraints impacting market growth?

Rising Inflation Reducing the Purchasing Power.

8. Can you provide examples of recent developments in the market?

September 2022: Apple announced its decision to implement significant pricing hikes for its in-app purchases and apps from Europe to Asia, safeguarding its profits when key currencies fell against the US dollar. Apple has been more cautious as it deals with a stuttering economy, even if it is doing better than some of its industry counterparts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IT Device Market?

To stay informed about further developments, trends, and reports in the Europe IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence