Key Insights

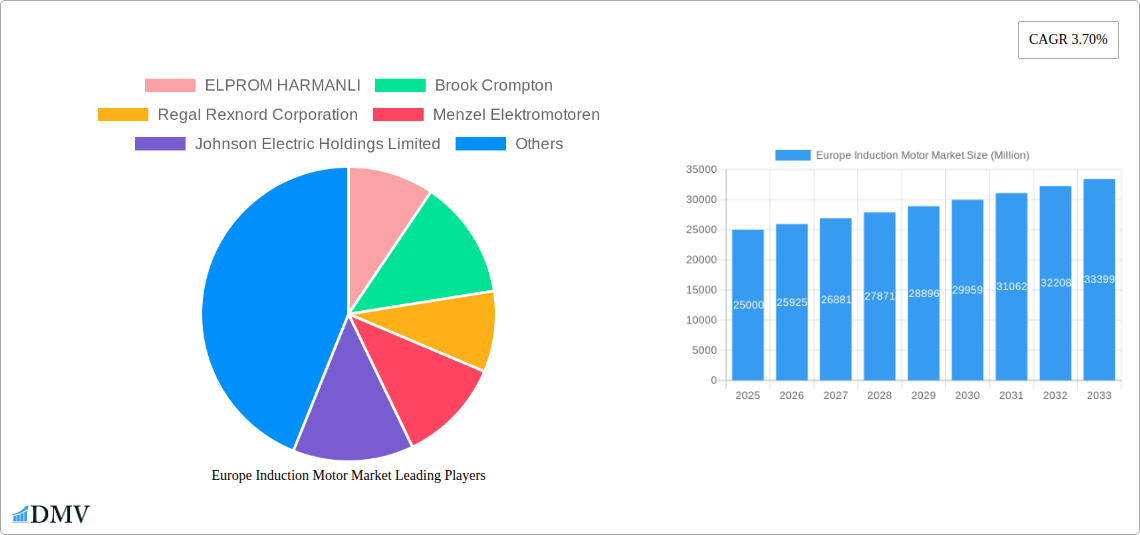

The European induction motor market is projected for robust growth, anticipating a market size of $24,652.8 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is propelled by significant demand from essential industries such as Power Generation, Oil & Gas, and Chemical & Petrochemical. These sectors leverage induction motors for operational efficiency and reliability in critical functions including pumping, compression, and material handling. Additionally, the escalating emphasis on energy efficiency and stringent European environmental regulations are driving industries to adopt advanced, energy-saving motor models, acting as a substantial growth catalyst. Discrete manufacturing sectors, including automotive and electronics, also contribute to this upward trend, fueled by automation and increasingly complex industrial processes.

Europe Induction Motor Market Market Size (In Billion)

However, market restraints include the substantial initial investment for advanced, energy-efficient induction motors and the availability of more economical, though less efficient, alternatives, particularly in price-sensitive market segments. Furthermore, the maturity of some European industrial sectors may result in slower adoption rates for new technologies. Despite these challenges, the move towards smart manufacturing and the integration of Industrial Internet of Things (IIoT) capabilities in industrial equipment present emerging opportunities. Companies are actively investing in developing sophisticated induction motors with enhanced monitoring, control, and predictive maintenance functionalities. Three-phase induction motors are expected to maintain market dominance due to their widespread use in heavy industries, while single-phase induction motors will continue to be in demand for smaller commercial and residential applications. Europe, with its strong industrial foundation and commitment to technological progress, is set to remain a key market for induction motors.

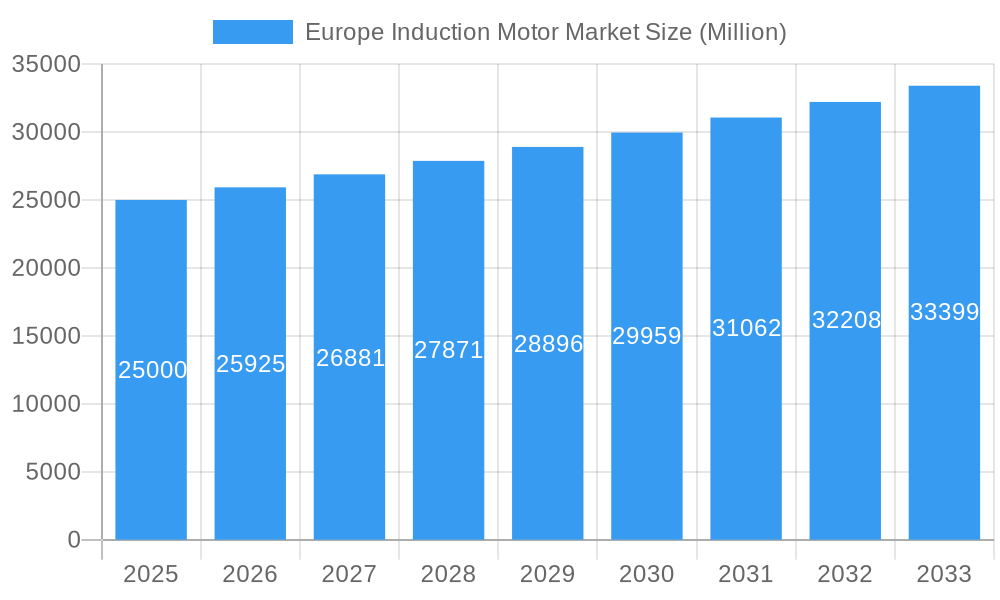

Europe Induction Motor Market Company Market Share

Europe Induction Motor Market: Comprehensive Insights & Future Outlook (2019-2033)

This detailed report provides a comprehensive analysis of the European Induction Motor Market, examining its dynamics, key players, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this study offers critical intelligence for stakeholders seeking to understand market composition, industry evolution, product innovations, growth drivers, potential obstacles, and emerging opportunities. Utilizing high-impact keywords such as "Europe induction motor market," "electric motors Europe," "three-phase induction motor," "single-phase induction motor," "energy-efficient motors," and "industrial automation," this report ensures maximum visibility and engagement for industry professionals, investors, and policymakers.

Europe Induction Motor Market Market Composition & Trends

The European Induction Motor Market exhibits a moderate to high concentration, with key players like ABB, Nidec Motor Corporation, and WEG holding significant market share. Innovation is primarily driven by the relentless pursuit of energy efficiency and sustainability, fueled by stringent EU regulations and increasing end-user demand for reduced operational costs. The regulatory landscape, particularly directives aimed at improving motor efficiency standards (e.g., IE3, IE4, IE5), acts as a significant catalyst for market growth and product development. Substitute products, such as DC motors and advanced permanent magnet motors, pose a growing challenge, particularly in niche applications demanding higher performance or specific control characteristics.

- Market Share Distribution: Major players collectively command an estimated 60-70% of the market.

- Innovation Catalysts:

- EU's Ecodesign Directive and Energy Labelling regulations.

- Growing demand for IE4 and IE5 efficiency class motors.

- Advancements in variable speed drives (VSDs) integration.

- Industry 4.0 adoption driving smart motor solutions.

- End-User Profiles: Diverse, ranging from heavy industries like Oil & Gas and Metal & Mining to discrete manufacturing and essential services like Water & Wastewater.

- M&A Activities: Limited but strategic, focusing on acquiring complementary technologies or expanding geographical reach. Deal values are estimated to range between XX Million to XXX Million.

- Regulatory Landscapes: Strict environmental and energy efficiency mandates are shaping product development and market entry.

- Substitute Products: Increasing adoption of permanent magnet synchronous motors (PMSMs) in specific high-performance applications.

Europe Induction Motor Market Industry Evolution

The evolution of the Europe Induction Motor Market is a testament to continuous technological advancement and a growing consciousness towards energy conservation. Over the historical period of 2019–2024, the market witnessed a steady expansion driven by industrial resurgence and increased automation across various sectors. The base year of 2025 marks a pivotal point where energy efficiency has become a paramount consideration, largely influenced by evolving regulatory frameworks and escalating energy costs. As we move into the forecast period of 2025–2033, the market is projected to experience a significant growth trajectory, estimated at a Compound Annual Growth Rate (CAGR) of approximately 5-7%. This growth is propelled by several key factors, including the imperative to upgrade older, less efficient motor systems to meet new energy standards, the burgeoning adoption of electric vehicles (EVs) and their associated infrastructure requiring robust electric motor solutions, and the increasing deployment of renewable energy sources like wind and solar power, which heavily rely on induction motors for their operation.

Technological advancements have been a cornerstone of this evolution. The development of IE4 and IE5 efficiency class motors has transitioned from a niche offering to a market standard, driven by both regulatory push and market pull. Furthermore, the integration of Variable Speed Drives (VSDs) with induction motors has revolutionized their application, enabling precise speed control, significant energy savings, and improved process performance across diverse industries such as Food & Beverage, Chemical & Petrochemical, and Discrete Industries. The adoption of smart technologies, including embedded sensors and connectivity features, is also on the rise, paving the way for predictive maintenance, remote monitoring, and enhanced operational efficiency, aligning with the broader Industry 4.0 revolution. Shifting consumer demands, especially in terms of reduced environmental impact and lower total cost of ownership, further underscore the importance of energy-efficient and high-performance induction motor solutions. The estimated market size in 2025 is approximately XX,XXX Million, with projections reaching XXX,XXX Million by 2033.

Leading Regions, Countries, or Segments in Europe Induction Motor Market

The European Induction Motor Market is characterized by distinct regional strengths and segment dominance. Among the types of induction motors, the Three-phase Induction Motor segment is the undisputed leader, accounting for an estimated 70-75% of the total market value. This dominance stems from their inherent efficiency, robustness, and suitability for a vast array of industrial applications requiring high power output and continuous operation. Single-phase induction motors, while crucial for smaller applications and residential use, represent a smaller, though stable, market share.

In terms of end-user industries, the Power Generation sector stands out as a significant driver of demand for high-performance induction motors, particularly for applications such as driving pumps, fans, and generators in both conventional and renewable energy facilities. The Chemical & Petrochemical industry also represents a substantial market, requiring explosion-proof and highly reliable motors for critical processes. The Water & Wastewater segment, driven by infrastructure upgrades and increasing population, also presents robust demand. Discrete Industries, encompassing automotive manufacturing and general machinery, are consistent contributors due to the widespread use of automated production lines.

Dominant Motor Type: Three-phase Induction Motor

- Key Drivers: Higher efficiency ratings (IE3, IE4, IE5), superior power-to-weight ratio, suitability for heavy-duty industrial machinery, widespread application in automation and manufacturing.

- Market Share: Estimated to be between 70-75% of the total induction motor market in Europe.

- Investment Trends: Continuous investment in advanced manufacturing processes to produce higher efficiency and more durable three-phase motors.

- Regulatory Support: EU regulations heavily favor the adoption of energy-efficient three-phase motor technologies.

Leading End-User Industries:

- Power Generation: Essential for turbines, pumps, and generators in both traditional and renewable energy sectors. Estimated market share: XX%.

- Chemical & Petrochemical: Demand for specialized, often explosion-proof, motors for hazardous environments. Estimated market share: XX%.

- Water & Wastewater: Driven by infrastructure development and environmental regulations. Estimated market share: XX%.

- Discrete Industries: Integral to automation, robotics, and manufacturing processes. Estimated market share: XX%.

- Metal & Mining: Requires robust and high-torque motors for heavy machinery. Estimated market share: XX%.

- Food & Beverage: Focus on hygienic and reliable motors for processing and packaging. Estimated market share: XX%.

Geographical Dominance: Germany, due to its strong industrial base and manufacturing prowess, is a leading country in terms of induction motor consumption and production within Europe. The Nordic countries also show strong adoption of energy-efficient motors, particularly in renewable energy applications.

Europe Induction Motor Market Product Innovations

The Europe Induction Motor Market is witnessing a surge in product innovations focused on enhancing energy efficiency, extending lifespan, and enabling intelligent functionalities. Manufacturers are increasingly developing motors that meet IE4 and IE5 efficiency standards, significantly reducing energy consumption for end-users. Innovations include advanced winding techniques, improved cooling systems, and the use of high-performance magnetic materials. Furthermore, the integration of sensors and connectivity features is enabling smart motors capable of real-time performance monitoring, predictive maintenance, and seamless integration with Industry 4.0 platforms. These advancements translate into substantial operational cost savings, reduced downtime, and optimized process control for applications across diverse sectors, from heavy industry to specialized manufacturing. The market is also seeing a trend towards modular designs and compact solutions, facilitating easier installation and maintenance.

Propelling Factors for Europe Induction Motor Market Growth

The Europe Induction Motor Market is propelled by a confluence of technological advancements, economic imperatives, and supportive regulatory frameworks. The primary growth driver is the increasing emphasis on energy efficiency and sustainability, mandated by EU directives and driven by rising energy costs. This is leading to a significant demand for higher efficiency class motors (IE4 and IE5). Technological advancements, particularly in materials science and motor design, are enabling the development of more powerful, compact, and reliable induction motors. The ongoing digitalization of industries, characterized by the adoption of Industry 4.0 principles, is also fueling demand for smart, connected motors with integrated diagnostics and control capabilities. Furthermore, the expansion of renewable energy sectors and the electrification of transport are creating new avenues for induction motor deployment.

- Technological Advancements: Development of IE4 and IE5 efficiency motors, advanced VSD integration, smart sensor technology.

- Economic Influences: Rising energy prices necessitate energy-efficient solutions to reduce operational costs. Industrial automation and modernization initiatives.

- Regulatory Support: EU's Ecodesign and Energy Labelling directives mandate minimum efficiency levels.

- Sectoral Growth: Expansion in renewable energy (wind, solar), electrification of transportation, and infrastructure development in water & wastewater.

Obstacles in the Europe Induction Motor Market Market

Despite robust growth prospects, the Europe Induction Motor Market faces several obstacles. High upfront costs associated with premium efficiency motors (IE4 and IE5) can be a deterrent for some small and medium-sized enterprises (SMEs), especially when compared to standard efficiency motors. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical raw materials and components, leading to price volatility and production delays. Intensifying competition from alternative motor technologies, such as permanent magnet synchronous motors (PMSMs), in specific high-performance applications poses a challenge. Furthermore, the complexities of retrofitting existing infrastructure with new, energy-efficient motor systems can be a significant barrier, requiring substantial investment and operational disruption.

- High Initial Investment: Premium efficiency motors command higher purchase prices.

- Supply Chain Volatility: Raw material shortages and geopolitical instability affecting component availability.

- Competition from Alternatives: Growing adoption of PMSMs for specialized high-performance needs.

- Retrofitting Challenges: Technical and financial hurdles in upgrading older industrial plants.

- Skilled Workforce Shortage: Lack of trained personnel for installation, maintenance, and integration of advanced motor systems.

Future Opportunities in Europe Induction Motor Market

The Europe Induction Motor Market is poised to capitalize on several emerging opportunities. The continued drive towards decarbonization and electrification across all sectors presents a significant growth avenue, particularly for advanced and highly efficient motor solutions. The expanding renewable energy infrastructure, including wind farms and solar power plants, will necessitate a consistent supply of robust induction motors. The ongoing digitalization of industrial processes and the widespread adoption of Industry 4.0 technologies will create demand for smart, connected motors with advanced diagnostic and predictive maintenance capabilities, valued at an estimated XX Million. Furthermore, the increasing focus on circular economy principles may drive opportunities for motor refurbishment and remanufacturing services. Emerging markets within Eastern Europe, with their growing industrialization, also represent untapped potential for market expansion.

- Electrification and Decarbonization: Powering electric vehicles, industrial machinery, and grid infrastructure.

- Renewable Energy Expansion: Demand for motors in wind turbines, solar tracking systems, and energy storage.

- Industry 4.0 Integration: Smart motors with IoT capabilities for predictive maintenance and optimized operations.

- Circular Economy Initiatives: Opportunities in motor refurbishment, remanufacturing, and recycling.

- Emerging Eastern European Markets: Growing industrialization and infrastructure development driving demand.

Major Players in the Europe Induction Motor Market Ecosystem

- ABB

- Nidec Motor Corporation

- WEG

- Regal Rexnord Corporation

- Brook Crompton

- Johnson Electric Holdings Limited

- Menzel Elektromotoren

- AC-MOTOREN GmbH

- CG Power & Industrial Solutions Ltd

- ELPROM HARMANLI

Key Developments in Europe Induction Motor Market Industry

- June 2022: ABB announced that its electric motors can achieve a prolonged operational life of up to 50,000 hours. The company is focusing on energy efficiency principles for all motor-driven applications, including heavy-duty construction machinery, and is actively pursuing zero-emission technology. Their first zero-emissions building project involves integrating an electric motor and drive, an energy management system, battery and charging solutions, and a power connection. ABB provides essential electric powertrain components and technical expertise.

- April 2022: Amidst rising energy costs, Nidec Motor Corp. launched its innovative SynRA motor, designed for exceptional energy efficiency in commercial pumping and HVAC equipment. Offering IE 4 and IE 5 efficiency ratings, SynRA provides significant operating benefits and suitability advantages. Its unique design allows for individual component replacement rather than the entire system, leading to reduced maintenance costs.

Strategic Europe Induction Motor Market Market Forecast

The strategic forecast for the Europe Induction Motor Market indicates robust and sustained growth driven by the imperative for energy efficiency, the ongoing industrial automation revolution, and the expansion of renewable energy sectors. The market is projected to benefit significantly from stricter environmental regulations that mandate higher efficiency standards, pushing demand towards IE4 and IE5 class motors. The increasing adoption of Variable Speed Drives (VSDs) alongside induction motors will unlock further energy savings and operational flexibility across various industries. The electrification of transportation and the continuous development of smart grids also represent substantial growth catalysts. With an estimated market size of XX,XXX Million in 2025, the market is poised for a significant expansion, reaching an estimated XXX,XXX Million by 2033, presenting a compelling investment and business development landscape.

Europe Induction Motor Market Segmentation

-

1. Type

- 1.1. Single-phase Induction Motor

- 1.2. Three-phase Induction Motor

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemical & Petrochemical

- 2.3. Power Generation

- 2.4. Water & Wastewater

- 2.5. Metal & Mining

- 2.6. Food & Beverage

- 2.7. Discrete Industries

- 2.8. Other End-user Industries

Europe Induction Motor Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Induction Motor Market Regional Market Share

Geographic Coverage of Europe Induction Motor Market

Europe Induction Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Energy-Efficient Motors Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Induction Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-phase Induction Motor

- 5.1.2. Three-phase Induction Motor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical & Petrochemical

- 5.2.3. Power Generation

- 5.2.4. Water & Wastewater

- 5.2.5. Metal & Mining

- 5.2.6. Food & Beverage

- 5.2.7. Discrete Industries

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ELPROM HARMANLI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brook Crompton

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Regal Rexnord Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Menzel Elektromotoren

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AC-MOTOREN GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CG Power & Industrial Solutions Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nidec Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ABB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ELPROM HARMANLI

List of Figures

- Figure 1: Europe Induction Motor Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Induction Motor Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Induction Motor Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Induction Motor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Induction Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Induction Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Induction Motor Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Induction Motor Market?

Key companies in the market include ELPROM HARMANLI, Brook Crompton, Regal Rexnord Corporation, Menzel Elektromotoren, Johnson Electric Holdings Limited, AC-MOTOREN GmbH, CG Power & Industrial Solutions Ltd, WEG, Nidec Motor Corporation, ABB.

3. What are the main segments of the Europe Induction Motor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24652.8 million as of 2022.

5. What are some drivers contributing to market growth?

Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles.

6. What are the notable trends driving market growth?

Energy-Efficient Motors Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

June 2022 - The electric motors from ABB can have a prolonged life of up to 50,000 hours. Energy efficiency principles can be applied to any motor-driven application, including heavy-duty construction machinery. The company is meeting future goals through zero-emission technology. The company's first zero-emissions building project includes fitting an electric motor and drive, an energy management system, a battery and charging solution, and a power connection. ABB supplies the electric powertrain components and provides technical advice.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Induction Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Induction Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Induction Motor Market?

To stay informed about further developments, trends, and reports in the Europe Induction Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence